Insurance premiums accrued (accounting entry)

Insurance premiums are a tax paid by the employer for its employees. They have a social orientation, while insurance premiums are calculated into four funds:

- Social insurance – percentage 2.9;

- Pension insurance – percentage 22%;

- Compulsory health insurance – percentage 5.1%;

- Social insurance against industrial accidents and occupational diseases is established by the fund individually depending on the hazard class of the main type of economic activity.

Insurance premiums have been accrued - posting these transactions in accounting confirms the existence of expenses for withholding contributions from employee salaries. This article provides information about accounting entries when calculating and paying insurance premiums.

Why are extra-budgetary funds needed?

Calculation of insurance premiums to extra-budgetary funds

Postings when calculating insurance premiums

Contributions listed: what kind of postings are made?

Accounts with personnel are an integral part of the work of any organization if at least 1 employee is hired. But in addition to issuing wages, the employer needs to formalize other transactions and reflect them in accounting. For example, the calculation of insurance premiums, the entries for which form the necessary amounts to be paid to the funds.

After calculating wages, insurance premiums must be calculated. Their number and volume depend on the type of activity of the economic entity, the applied taxation system, and the amount of payments. Insurance premiums include the following payments:

- Transfers to pension insurance - 22% (the rate is valid until the end of 2020).

- Payments for compulsory health insurance - 5.1%.

- Social security contributions - 2.9%.

- Contributions to the Social Insurance Fund for insurance against accidents at work - from 0.2% to 8.5%.

Above are the basic payroll insurance rates. However, rates may vary depending on the type of activity of the employer.

Organizations and individual entrepreneurs who are on the simplified tax system and are employed in a certain production sector, as well as in the field of healthcare, construction, sports development and others can apply for preferential payments in a reduced amount.

In addition, it is allowed to charge contributions in a reduced amount for payers whose activities meet the criteria of Art. 427 Tax Code of the Russian Federation. We are talking about entities working in technological, scientific fields and others.

Typical wiring

Let's consider the key algorithm for calculating CBs and reflecting them in accounting using a specific example.

VESNA LLC is an OSNO company that applies generally established tariffs for insurance coverage for citizens. The contribution rate for injuries is 0.2%. In September 2020, salaries of key personnel were accrued in the amount of 1,000,000 rubles. The accountant recorded the following actions:

| Operation | Amount, in rubles | Note | ||

| Salaries of key personnel accrued | Basis document: salary slips for September | |||

| Insurance premiums accrued, posting for VNiM | (1 000 000 × 2,9 %) | |||

| Accrual of SV on OPS | (1 000 000 × 22 %) | |||

| SV reflected on compulsory medical insurance | (1 000 000 × 5,1 %) | |||

| SV accrued for injuries (NS and PP) | (1 000 000 × 0,2 %) | |||

| Insurance premiums listed, posting: | ||||

| Basis document: payment orders, extract from a banking organization on the status of the current account | ||||

In September 2020, VESNA LLC received from the Federal Tax Service a requirement to pay arrears in the amount of 5,000 rubles and a penalty in the amount of 135.55 rubles. The accountant made the following entries:

| Operation | Amount, rub. | A document base | |

| Postings for calculating penalties on insurance premiums | 99 or 91 (depending on the method specified in the accounting policy) | ||

| Penalty payment reflected | 69 (according to the corresponding subaccount) | Payment order | |

| Accrual of arrears on insurance premiums (postings) | 20 - if the arrears were accrued for the current year 91.2 - if the arrears were billed for previous reporting periods | 69 (according to the corresponding subaccount) | Requirement of the Federal Tax Service |

| Payment of arrears | 69 (sub-account) | Payment order |

Accounting

To account for insurance premiums, account 69 is used, which has several sub-accounts delimiting the areas of insurance payments:

- 69.1 – accounting for social insurance payments. This subaccount has two subaccounts of the second order, which is associated with the division of social insurance into two types: compulsory social insurance and social insurance against industrial accidents and occupational diseases;

- 69.2 – accounting of payments for compulsory pension insurance;

- 69.3 – accounting for payments for compulsory health insurance.

The credit of this account shows the accrual of insurance premiums, and the debit shows their payment.

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 20, 25, 26, 44 | 70 | 267 800,00 | Employees of the company received wages | Payroll |

| 20, 25, 26, 44 | 69-1/1 | 7 766,20 | of 267,800.00 * 2.9% = 7,766.20 rubles were accrued to the wage fund | Payroll |

| 20, 25, 26, 44 | 69-2 | 58 916,00 | of 267,800.00 * 22% = 58,916.00 rubles were accrued to the wage fund | Payroll |

| 20, 25, 26, 44 | 69-3 | 13 657,80 | 267,800.00 * 5.1% = RUB 13,657.80 were accrued to the wage fund | Payroll |

| 20, 25, 26, 44 | 69-1/2 | 535,60 | Accident contributions of 267,800.00 * 0.2% = 535.60 rubles were accrued to the wage fund. | Payroll |

| 69-1/1 | 51 (50) | 7 766,20 | Social insurance contributions have been paid | Payment order, bank statement |

| 69-2 | 51 (50) | 58 916,00 | Pension contributions have been paid | Payment order, bank statement |

| 69-3 | 51 (50) | 13 657,80 | Compulsory health insurance premiums have been paid | Payment order, bank statement |

| 69-1/2 | 51 (50) | 535,60 | Accident premiums have been paid | Payment order, bank statement |

All employers pay insurance contributions for pension, health and social insurance.

Part of the contributions (pension, medical and social benefits in case of illness and maternity) is paid in different payments to the tax office.

And only social contributions for social insurance against accidents and occupational diseases are still transferred to the Social Insurance Fund. In this article we will tell you how to calculate contributions, what transactions to create and how to take them into account in tax accounting.

Insurance premiums in accounting are calculated by employing organizations in the month to which the contributions relate. Insurance premiums from vacation pay are calculated along with them.

According to the Labor Code of the Russian Federation, vacation pay must be issued to the employee no later than three days before the start of the vacation.

This means that insurance premiums for the entire amount of vacation pay must be accrued simultaneously with vacation pay, even if the vacation began in one reporting period (billing period) and ended in another.

To account for insurance premiums, the chart of accounts has 69 accounts and subaccounts to it.

Debit 20 (25, 26, 44 ...) Credit 69 sub-account “OPS” - pension contributions have been accrued;

Debit 20 (25, 26, 44 ...) Credit 69 subaccount “Calculations for medical contributions” - contributions for medical insurance have been accrued;

Debit 20 (25, 26, 44 ...) Credit 69 subaccount “Calculations for contributions in case of temporary disability and maternity” - contributions in case of temporary disability and maternity have been accrued;

Debit 20 (25, 26, 44 ...) Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions from accidents and occupational diseases” - insurance premiums to the Social Insurance Fund of the Russian Federation for accidents at work have been accrued.

Debit 69 sub-account “OPS” Credit 51 “Current account” - contributions to the insurance part of the pension have been paid;

https://youtu.be/pajSvpLr8KQ

Debit 69 subaccount “Calculations for medical contributions” Credit 51 “Current account” - medical contributions have been paid;

Debit 69 “Settlements with the Social Insurance Fund for contributions from accidents and occupational diseases” Credit 51 “Current account” - insurance premiums were paid to the Social Insurance Fund of the Russian Federation for accidents at work.

If you work for OSNO, then expenses in the form of insurance contributions for compulsory pension, social and health insurance are taken into account as part of other expenses. The same applies to contributions accrued for payments that are not included in the expenses for corporate income tax on OSNO.

Since 2020, insurance premiums have been divided in relation to the legislative norms establishing the rules for working with them:

- the bulk of contributions (for compulsory health insurance, compulsory medical insurance, compulsory health insurance for disability and maternity) began to be subject to the Tax Code of the Russian Federation and the requirements that apply to tax payments;

- contributions for injuries remained under the provisions of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ.

However, the requirements for their payment have remained unchanged: insurance premiums must be paid by the payer on time and in full. If due to any circumstances they are not paid or not paid in full, not only the arrears are collected from the payer, but also a sanction for late payment, which is called a penalty.

Please note that arrears in contributions cannot be repaid using overpayments incurred before 2020. A return of the overpayment to the current account is possible only after the arrears have been repaid.

For more details, see “Offsetting overpayments on contributions for periods before 2017 is not possible.”

The basis for payment of penalties (if they are not paid voluntarily) are the requirements presented to the payer by the body supervising the relevant contributions (IFTS or Social Insurance Fund). Thus, penalties are the estimated amount that must be paid by a payer who has violated the deadline for paying contributions. They are calculated as a percentage for each day of delay, starting from the day following the payment deadline, which is established by law.

You can calculate penalties using our calculator.

Read about the specifics of calculating penalties from October 1, 2017 in the material “Increased penalties are not always paid.”

Read about the proposed changes in the calculation of penalties in the article “Tax Penalties: Changes in Payment.”

If the payer has neglected the opportunity to voluntarily fulfill the requirement to pay penalties, they are collected using the following methods:

- sending a collection order to the payer’s bank;

To learn about which accounts penalties can be collected, read the article “From which accounts can tax authorities collect penalties?”

- recovery from property.

In addition, if the terms and completeness of payment of insurance premiums are violated, we are talking not only about sanctions, but also about a violation of the pension rights of the insured persons.

We invite you to read: Reinsurance company accepting reinsurance risk

The negative consequences of non-payment of contributions are:

- reducing the possibility of obtaining investment income from investing pension savings;

- reduction in the amount of pension savings when indexing them.

Read about the consequences of non-payment of insurance premiums due to their failure to be reflected in the calculation in the article “What is the liability for non-payment of insurance premiums?”

Clause 7 of PBU 1/2008 states that the enterprise itself has the opportunity to choose the method of reflecting expenses in accounting, if it is not expressly established by law. PBU 10/99 does not specifically specify the reflection of penalties for taxes and fees; it only indicates penalties for violation of the terms of contracts.

Dt 26 (44) Kt 69.

Read more about the latest point of view of the Ministry of Finance in the material “Tax Penalties and Fines - What is the Accounting Account?”

In earlier recommendations, the Ministry of Finance proposed using account 99 to reflect penalties (letter dated February 15, 2006 No. 07-05-06/31).

In the instructions for using the chart of accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, account 99 is used to reflect tax sanctions. Penalties do not apply to tax sanctions, but the instructions say that account 99 can also be used to reflect penalties for violation of deadlines for paying contributions in correspondence with account 69.

Dt 91 Kt 69.

The amount of the listed penalties is reflected by the posting: Dt 69 Kt 51.

We also emphasize that the amount of penalties on contributions is not involved in calculating the income tax base (clause 2 of Article 270 of the Tax Code of the Russian Federation), therefore, in relation to them, permanent differences arise between accounting and tax accounting (clause 4 of PBU 18/02). These differences correspond to permanent tax liabilities accrued by posting: Dt 99 Kt 68.

When reflecting in accounting the operation of calculating penalties on insurance premiums, account 69 “Calculations for social insurance and security” corresponds with account 99 “Profits and losses”.

You will find an example of transactions for calculating penalties in the Pension Fund and transferring them to the budget in.

Payments to employees is one of the main responsibilities of every employer. But in addition to the management of companies and enterprises, they are obliged to make other contributions and payments with their subsequent reflection in accounting. One of these types are contributions to the Social Insurance Fund and the Pension Fund. Therefore, every accountant should know how to record the accrual of insurance premiums on wages.

After calculating payment for labor, the accounting department must do. The amount of such payments directly depends on the type of activity of companies or enterprises, as well as the type of taxation. In addition, insurance premiums consist of the following types of payments:

- Charges to the social insurance fund for accidents at the enterprise – 0.2-8.5%

- FSS – 2.9%

- Contribution to the Pension Fund of the Russian Federation – 22%

- Transfer for compulsory medical insurance – 5.1%

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 69.1 | Insurance premiums paid to the Social Insurance Fund | 7536,35 | Payroll T-51 | |

| 69.2 | Contributions to the Pension Fund have been accrued | 57 172, | Payroll T-51 | |

| 69.3 | Contributions to the FFOMS have been accrued | 13 253,57 | Payroll T-51 | |

| Tax contributions accrued | 519,75 | Payroll T-51 | ||

| Materials transferred to production | 100 318 | Payroll T-51 | ||

| 69.1 |

Organization of accounting of calculations for social contributions

Organization of accounting of calculations regarding insurance deductions is the responsibility of all employers, regardless of the taxation system applied. The billing period is the calendar year, and the reporting period is the first quarter, six months, 9 months, and a year. According to the approved procedure, the employer must record:

- accrued, transferred social contributions, pennies, fines;

- excess insurance deductions, penalties, penalties subject to refund, including interest;

- settlements with Social Insurance for social insurance funds due to maternity and illness at the place of registration of the policyholder (including amounts from the Social Insurance Fund);

- insurance costs.

Cost accounting for deductions for insurance coverage carried out by the policyholder is represented by social cash benefits (for disability, when registering in early pregnancy, at the birth of a child, for child care (every month), etc.). This also includes cash payments in excess of the established amounts and in amounts taken into account when counting into the insurance period periods that are not subject to compulsory insurance (applies to cash assistance for temporary disability due to illness and due to maternity).

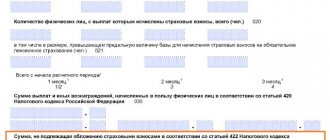

Accounting for the amounts of calculated payments is carried out based on the results of each month by the policyholders during the billing (reporting) period for all employees. The basis is the amount of cash payments and material incentives credited from the beginning of this period to the end of the month, as well as the rates of the insurance contributions themselves. In this case, mandatory payments in relation to the individual in whose favor the cash payments were made are excluded. Regressive rates are no longer in effect.

When the maximum amount is reached, accruals (Government Decree No. 974 of November 24, 2011) are terminated, with the exception of pension insurance. The calculation for the Pension Fund does not stop, but only the tariff is reduced. The policyholder can obtain background information on the status of settlements regarding contributions, penalties or fines through a request to the territorial fund authority within 5 days.

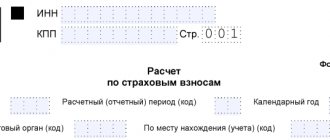

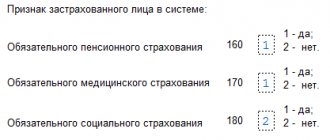

The payer prepares and submits a declaration on social contributions for pension insurance, as well as calculations of advance payments under the Unified Social Tax (for those who make cash payments to individuals). Reporting is prepared and submitted in accordance with forms 4-FSS and RSV-1 Pension Fund of the Russian Federation. Form 4-FSS has been filled out since 2020, taking into account the new rules established by FSS Order No. 59. It is mandatory for all those entrepreneurs who use hired labor. The proposed form contains information about accrued and paid insurance premiums and is submitted quarterly. It has nothing to do with entrepreneurs who cover Social Insurance contributions for themselves.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Insurance premiums listed: posting

When calculating insurance premiums, accounting makes entries only for strictly defined accounts. Contribution amounts are debited to the same accounts as salary expenses.

In addition to account 20, accounts 23, 25, 26, 29 and 44 can be used to calculate wages and contributions. If the payer uses more than one account to account for expenses, then insurance premiums will be distributed among them in full accordance with the distribution of wages. Just for the loan, account 69 will be included in the posting. This will be discussed below.

Since 2014, new tariff norms have been introduced for contribution payers. Thus, for employers who are engaged in underground work, have hazardous workshops and did not carry out certification of workplaces before the specified year or did so with violations, an additional 9% tariff was introduced.

A slightly lower additional tariff, 6%, is provided for organizations that perform the work specified in paragraphs. 2–18 h.

ATTENTION! The size of the additional tariff is not constant: the rate may change depending on the results of a special assessment of production conditions. The assigned rate will be valid for the entire billing period, since the base threshold for setting the tariff is not limited by law.

When insurance contributions to extra-budgetary funds are accrued, the accompanying entries will be of the following type: Dt 20 Kt 69.1.

As you can see, the posting was made for contributions to the Social Insurance Fund. For other funds, the loan subaccount will be different. For debit, as mentioned above regarding the patch, other (except for the 20th) accounts can be used: 23, 25, 26, 29 and 44.

Policyholders have strict deadlines for transferring contributions to the funds. This operation must be completed before the 15th day inclusive of the month following the month of calculation of contributions (clause 5 of Article 15 of Law No. 212-FZ).

The transfer of funds to each fund is issued in separate payments or receipts if payment is made in cash through the bank's cash desk (this is allowed for individual entrepreneurs). Late payment inevitably entails the accrual of penalties, which begin to count the next day after the deadline for making contributions.

The amount of the penalty is calculated based on 1/300 of the refinancing rate for each day of delay.

Failure to submit payment of contributions within the prescribed period will result in at least a 5% fine. It is assigned for each overdue month (even if it is not full), and the calculation is based on the amount of insurance premiums calculated for the previous 3 months. The law also establishes the scope of the fine. It cannot exceed 30% of the amount of contributions and cannot be less than 1,000 rubles.

IMPORTANT! Whatever fine you have to pay, this amount cannot be written off as expenses.

When the insurance premiums are transferred, the posting will look like this: Dt 69.1 Kt 51.

When recording assigned penalties and fines by debit, account 91 is used, into which other income and expenses are entered. For the loan, a subaccount of account 69 is used, corresponding to a specific fund. For example, for penalties on contributions detained in the Pension Fund, the entry will be as follows: Dt 91.2 Kt 69.2.

Note that the use of count 91 is not a dogma. It is quite acceptable to use account 99. It all depends on the chosen accounting method, which is enshrined in the company’s accounting policy.

Insurance premiums are transferred monthly no later than the 15th day of the month following the month of accrual (Clause 5, Article 15 of Law No. 212-FZ).

When transferring funds to pay contributions, indicate the subaccount number of the corresponding fund in debit, and account 51 in credit, which reflects the current accounts of the company. The entry for payment of contributions (using the example of a pension fund) is as follows: Dt 69.

2 Kt 51. Postings are made similarly for other subaccounts of each fund.

Transfer of insurance premiums for each fund must be carried out in separate payment orders (Clause 8, Article 15 of Law No. 212-FZ).

When paying contributions to funds, you need to pay special attention to the timing of their payment. For late payment of insurance premiums, organizations are charged penalties.

The amount of the penalty interest is taken at the rate of 1,300 of the Central Bank refinancing rate (clause 6 of Article 25 of Law No. 212-FZ).

Since 2020, the refinancing rate has been equal to the key rate, and its value has become larger.

If the organization has not also provided a calculation of contributions to the relevant fund, then an additional fine will be issued. It will be 5% (clause 1 of Article 46 of Law No. 212-FZ) for each month of delay. It is calculated from the amount of accrued contributions for the last 3 months. The maximum fine is 30% of this amount, the minimum is 1,000 rubles.

The material “Basic entries when paying penalties on insurance premiums” will help you figure out which account should be used to calculate penalties on insurance premiums.

Accrued penalties and fines do not reduce taxable profit (clause 2 of Article 270 of the Tax Code of the Russian Federation).

For information on what sanctions and fines are provided for non-payment of premiums, see the material “What is the responsibility for non-payment of insurance premiums?”

We suggest you read: How much does unlimited car insurance cost?

When an accountant needs to calculate temporary disability benefits from the social insurance fund, they use the entry: Dt 69.1.1 Kt 70 (for regular sick leave) or Dt 69.1.2 (69.11) Kt 70 (for benefits due to an industrial injury).

Since 2011, the procedure for calculating this benefit has changed. The first 3 days are paid for by the organization, the rest - by the Social Insurance Fund. For the calculation, data on earnings for 2 years before the occurrence of the insured event is used. The benefit amount for a calendar month should not be less than the minimum wage (RUB 6,204 in 2020).

The amounts transferred to the Social Insurance Fund by the company can be reduced by payment costs:

- benefits for temporary disability at the expense of the Social Insurance Fund;

- vouchers for the treatment of workers employed in harmful or dangerous working conditions.

How are contributions to extra-budgetary funds calculated?

Due to accounting specifics, insurance premiums are charged on the wages of hired personnel and income paid to attracted employees. The amount of contributions ultimately depends on the following factors:

- amount of income;

the rate established for this type of insurance premium;

features of the application of this rate.

If contributions are accrued in the wrong amount, paid late or not transferred at all, the legislation provides for sanctions in the form of penalties and fines.

The amount of contributions for the Social Insurance Fund may change downward. To do this, according to the order of the Ministry of Labor and Social Protection of the Russian Federation dated December 10, 2012 No. 580n, it is necessary to obtain permission from the territorial division of the Social Insurance Fund. If the arguments prove convincing, the organization will be allowed to spend part of the contributions on its stated goals.

Transactions on all insurance contributions must be reflected in accounting. In this case, each fund has its own sub-account, namely:

- FSS - subaccount 69.1;

- FFOMS - 69.3.

In addition, for a more detailed reflection, it is recommended to use additional accounts. For example, subaccount 69.1 for the Social Insurance Fund can be divided into account 69.1.1, to which you can record transactions on insurance in case of temporary disability, and account 69.1.2 for conducting transactions on “traumatic” insurance. It is not forbidden to enter a separate account, for example 69.11. Some programs use it to account for injury contributions.

Until 2014, the practice was to create additional accounts for subaccounts 69.2 and 69.3. However, then the legislation changed, and such a division was considered inappropriate.

The described actions allow the organization to rationally organize the accounting of the flow of insurance premiums across funds. It should be noted that the Pension Fund receives contributions not only as part of pension provision, but also for the Federal Compulsory Medical Insurance Fund. This equipment is produced in accordance with the norms of paragraph 1 of Art. 3 of Law No. 212-FZ. The pension fund notifies the health insurance company, which does not have control functions, of all receipts. Payers submit reports in form RSV-1, which reflects the completeness of accrual/payment of both contributions.

In turn, the FFOMS also shares information with the Pension Fund within its competence.

Moreover, the tax authorities also check the correctness of the reflection of insurance premiums as part of their control activities. They necessarily compare data from the following sources: account 69, cards in which contributions are calculated, the general ledger and, finally, RSV-1.

Calculation of insurance premiums: postings

After accruing wages to the employees of the enterprise, its owner or accountant calculates and accrues insurance premiums for them, the amount of which is calculated on the basis of the rules established by law.

Most often, account 69 is used for these purposes, on the basis of which a number of auxiliary sub-accounts are opened, corresponding to a separate type of payment. When setting the amount of deductions, cost accounts must be taken into account. They can be designated by numbers from 20 to 26 and 44.

The company accrued a salary of 550 thousand rubles for December 2020, including 300 thousand rubles for production workers. and for the management department - 150 thousand rubles.

According to the above conditions, transfers were made for social needs with a total value of 80 thousand rubles to the Pension Fund of the Russian Federation, including for workers in production - 60 thousand rubles and for the management department - 30 thousand rubles. Additionally, the social insurance fund amounted to 4200 and 2100 rubles.

As a result, insurance premiums were calculated, the posting of which shows the expenses for each department of the company:

- Dt 20 - Kt 69.01 - 60 thousand in the Pension Fund of the Russian Federation for workers in the production workshop

- Dt 26 - Kt 69.01 - 30 thousand in the Pension Fund of the Russian Federation for the salary of the management department

- Dt 20 - Kt 69.01 - 4200 transfers for injuries and danger to persons working in production

- Debit 26 - Credit 69.11 - 2100 transfers for injuries to employees of the company management department

- Debit 69.01 - Credit 51 - 90 thousand insurance payments are transferred to the state budget, the total amount to be transferred to the Pension Fund is reflected in the accounting documentation

- Debit 69.11 - Credit 51 - 6300 insurance transfers are transferred to the state budget, the posting reflects the amount of accruals to the Social Insurance Fund.

The company produces lumber, applies a simplified taxation system and enjoys preferential rates on insurance premiums.

The accrual of insurance premiums is reflected in credit 69 of the account. Each type of insurance has its own subaccount. By debit 69, the account corresponds with cost accounts: 20, 25,26, 44.

Postings for calculating contributions:

- Debit 20 (...) Credit 69.1 (FSS) - accrual to the Social Insurance Fund.

- Debit 20 (...) Credit 69.2 (PFR) - accrual Pension Fund.

- Debit 20 (...) Credit 69.3 (FFOMS) - accrual to the Medical Insurance Fund.

- Debit 20 (...) Credit 69.11 (NS) - accrual to the Social Insurance Fund for accident insurance.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 20.01 | 69.1 | Insurance premiums paid to the Social Insurance Fund | 7536,35 | Payroll T-51 |

| 20.01 | 69.2 | Contributions to the Pension Fund have been accrued | 57 172,28 | Payroll T-51 |

| 20.01 | 69.3 | Contributions to the FFOMS have been accrued | 13 253,57 | Payroll T-51 |

| 20.01 | 69.11 | Tax contributions accrued | 519,75 | Payroll T-51 |

| 20.01 | 10.01 | Materials transferred to production | 100 318 | Payroll T-51 |

| 69.1 | 51 | Social Insurance contributions paid | 7536,35 | Payment order |

| 69.2 | 51 | Pension Fund contributions paid | 57 172,28 | Payment order |

| 69.3 | 51 | FFOMS contributions paid | 13 253,57 | Payment order |

| 69.11 | 51 | Tax contributions paid | 519,75 | Payment order |

Accounting for payment of contributions is regulated by two documents:

- for calculations of contributions for compulsory social insurance in connection with disability and maternity, the rules established by order of the Ministry of Health and Social Development of the Russian Federation dated November 18, 2009 No. 908n apply;

- in relation to calculations for other contributions, the requirements of the Instructions for the chart of accounts, approved. by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, since there are no specific legislative norms in this area.

Based on the current chart of accounts, an account should be used to reflect transactions for calculating contributions. 69. This point must also be indicated in the accounting policy, which is enshrined in clause 4 of PBU 1/2008 (approved by order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n).

To break down by area when accounting for calculations of insurance premiums, you need to add to your account. 69 subaccounts. In practice, this breakdown may have the following implementation:

- 1 - for calculations of contributions for compulsory social insurance in connection with disability and maternity;

- 2 - for calculations of contributions to compulsory pension insurance;

- 3 - for calculations of contributions for compulsory health insurance;

- 11 - for calculations of contributions for injuries.

Subaccounts may be different; we have given the most common approach to the breakdown by analytics.

Dt 20, 23, 26, 44, 91-2 Kt 69 (by subaccounts).

Postings for transfer of contributions

If the deadlines are ignored, the payer is subject to a penalty, and in some cases additional penalties. Payment is made through the company's account, and when closing the debt, the accounting documents indicate: Debit 69 Credit 51.

For employees, the main work of the accounting departments of enterprises. To accurately record all possible transactions, it is important for specialists to know the main aspects of payroll posting.

Write your question in the form below

Accounting account 69 is used to reflect generalized information about the amounts of insurance premiums paid by the employing organization from employee salaries. We will talk about the features of organizing accounting for transactions with insurance premiums, as well as about typical entries for account 69 in our article.

An enterprise that makes payments to employees in accordance with concluded employment contracts is obliged to record the accrual of insurance premiums for their subsequent transfer to an extra-budgetary fund. The law provides for compulsory medical, social and pension insurance for employees. The employer must also ensure payment of insurance premiums in case of occupational diseases and accidents at work.

To reflect the amounts of accrued and paid contributions to extra-budgetary funds, account 69 is used. To analyze and control the amounts of contributions, the organization can open sub-accounts in accordance with the types of transfers made.

Regulatory documents provide that account 69 can be used to reflect the following transactions:

- payment of the amount of contributions (fines, penalties);

- reflection of expenses for contributions to extra-budgetary funds.

It should be noted that on account 69 not only the amounts of obligations to the funds are recorded, but also credits coming from the Social Insurance Fund are made.

Dt 69 - Kt 51 - insurance premiums are listed, posting uses the corresponding subaccounts.

Insurance contributions to the Funds: Pension, Medical Insurance and Social Insurance are calculated from the salaries of the company's employees. For entrepreneurs with employees and who are not employers, a fixed amount of contributions from the Pension Fund and the Federal Compulsory Medical Insurance Fund is established.

Reflection of transactions with extra-budgetary funds in accounting

To record transactions on contributions to extra-budgetary funds, account 69 is used. A separate sub-account is created for each of the social protection bodies (Pension Fund, FSS for social insurance contributions, FFOMS).

Let's look at typical transactions for accruals and transfers to extra-budgetary funds using examples.

Social contributions from payments under employment contracts

Marker LLC in August 2020 accrued payments in favor of employees: salary - 1,350,000 rubles, sick leave benefits - 54,500 rubles. (including 2,700 rubles for the first 3 days at the expense of the organization).

The amount of social contributions was calculated:

- Pension fund - RUB 1,350,000. * 22% = 297,000 rub.

- FSS - 1,350,000 rubles. * 2.9% = 39,150 rub.

- FFOMS - 1,350,000 rubles. * 5.1% = 68,850 rub.

The accountant of Marker LLC made the following entries:

| Dt | CT | Description | Sum | Document |

| 44 | Payroll | RUB 1,350,000 | ||

| 44 | for the first 3 days at the expense of Marker LLC | 2,700 rub. | Sick leave | |

| 69 FSS | Accrual of sick leave at the expense of the Social Insurance Fund (RUB 54,500 - RUB 2,700) | 800 rub. | Sick leave | |

| 44 | 69 Pension Fund | Calculation of contributions to the Pension Fund | RUB 297,000 | Payroll sheet |

| 44 | 69 FSS | Calculation of contributions to the Social Insurance Fund | RUB 39,150 | Payroll sheet |

| 44 | 69 FFOMS | Calculation of contributions to the FFOMS | RUB 68,850 | Payroll sheet |

The expenses of Marker LLC for social insurance amounted to 800 rubles, which is more than the accrued amount of contributions for August (39,150 rubles). For this reason, Marker LLC did not make any transfers to the Social Insurance Fund in August 2020. Part of the uncovered expenses (800 rubles - 39,150 rubles = 12,650 rubles) was taken into account in September 2020.

Social contributions from payments under a contract

Between Globus LLC and Yu.P. Kondratenko a contract was concluded for the amount of 000 rubles. (construction and installation works). According to the terms of the agreement, Kondratenko was paid an advance in the amount of 10% of the cost of the work (4,300 rubles). The balance of funds was paid upon completion of the work (RUB 38,700).

The following entries were made in the accounting of Globus LLC:

| Dt | CT | Description | Sum | Document |

| 76 | Transfer of advance payment to Kondratenko under the contract | 4,300 rub. | Payment order, contract |

Insurance premiums accrued - posting

on accounts is done in order to record the fact of accrual of such contributions to the income of hired personnel and the sending of funds to the desired address. Our article provides information about the nature of accounting entries in related circumstances.

Calculation of insurance premiums: postings

The basis for calculating the amount of insurance premiums is the amount of remuneration that is paid to the employee according to the employment contract. The amount of accrual of contributions is carried out according to Kt 69, transfers to extra-budgetary funds are reflected in Dt 69. Also, according to Kt 69 the amount of receipts of contributions credited from extra-budgetary funds in favor of the organization can be carried out.

On January 31, 2016, Start LLC made a payment to K.R. Sazonov, an employee of the economic department:

- salary - 41,300 rubles;

- sickness benefit - 7,500 rubles. (including for the first 2 days at the expense of the organization - 2,350 rubles).

When paying Sazonov’s salary, the accountant at Start LLC calculated the amount of insurance premiums:

- Pension Fund for the insurance part of the labor pension: 41,300 rubles. x 14.0% = RUB 5,782;

- Pension Fund for the funded part of the labor pension: 41,300 rubles. x 6.0% = 2478 rub.;

- FSS for insurance premiums: 41,300 rubles. x 2.9% = 1198 rub.;

- Social Insurance Fund for contributions to insurance against accidents and occupational diseases: 41,300 rubles. x 0.2% = 83 rub.;

- FFOMS: 41,300 rub. x 1.1% = 454 rubles;

- TFOMS: 41,300 rub. x 2.0% = 826 rub.

We suggest you read: Is it possible to insure a child’s accident?

| Dt | CT | Description | Sum | Document |

| 91.2 | The salary of K.R. Sazonov has been accrued. | RUB 41,300 | Payroll | |

| 91.2 | Sickness benefits accrued (at the expense of Start LLC) | RUB 2,350 | Payroll | |

| Sickness benefit accrued (at the expense of the state) | RUB 5,150 | Payroll | ||

| 91.2 | The amount of insurance contributions to the Social Insurance Fund has been calculated | 1198 RUR | Payroll | |

| 91.2 | The amount of insurance premiums accrued (accidents and occupational diseases) | 83 rub. | Payroll | |

| 91.2 |

For late submission of reports or submission of accounting information, for example, when opening a current account, or payment of taxes later than the due date, penalties are imposed, the amount of which is regulated by the relevant articles of the Tax Code.

A penalty is something other than penalties. It is a kind of security that encourages the timely fulfillment of their obligations regarding the payment of relevant taxes and fees.

The amount of the accrued penalty is regulated by Article 75 of the Tax Code of Russia, which states that it is accrued from the day following the payment deadline and ends on the day the arrears are repaid.

According to this article of the Tax Code, the amount of the penalty depends on three parameters:

- Overdue amount;

- Number of days overdue;

- From the refinancing interest rate of the Central Bank of Russia.

To display the accrued penalty, it is recommended to use account 99, which allows you to avoid a permanent tax liability, since when generating an income tax return, the accrued penalty on insurance premiums is not included in the calculation of the tax base. It is recommended to consolidate the use of account 99 in the accounting policy of the enterprise.

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 20 (25, 26, 29, 44) | 69-2 | 10 000,00 | Insurance premiums paid to the Pension Fund | Payroll |

| 20 (25, 26, 29, 44) | 69-1 | 2 000,00 | Contributions to the Social Insurance Fund have been accrued | Payroll |

| 20 (25, 26, 29, 44) | 69-3 | 3 000,00 | Contributions to the Compulsory Medical Insurance Fund have been accrued | Payroll |

| 69-2 | 51 | 10 000,00 | Payment of insurance premiums to the Pension Fund | Bank statement |

| 91 (99) | 69-1,69-3 | 3,67 | Postings for calculating penalties for late insurance premiums. Overdue period – 2 days; Overdue amount – RUB 5,000.00; Refinancing rate – 11%. P = 5,000.00 * 2 days. * 11% * 1/300 = 3.67 rub. | Accounting information |

| 69-1, 69-3 | 51 | 5 000,00 | Payment of debt on insurance contributions to the Social Insurance Fund and the Compulsory Medical Insurance Fund | Payment order |

| 69-1, 69-3 | 51 | 3,67 | Accounting certificate, payment order | |

| 99-2 | 68-4 (68-2, 68-1) | 475,17 | A penalty was accrued for non-payment of tax in the amount of RUB 78,540.00. The delay was 22 days. Refinancing rate – 8.25%.P = 78540 * 22 days. * 8.25% * 1/300 = 475.17 | Accounting information |

| 68-4 (68-2, 68-1) | 51 | 78 540,00 | The amount of tax debt has been paid | Payment order |

| 68-4 (68-2, 68-1) | 51 | 475,17 | The accrued penalty was paid to the budget | Payment order |

Organizations and individual entrepreneurs who are on the simplified tax system and are employed in a certain production sector, as well as in the field of healthcare, construction, sports development and others can apply for preferential payments in a reduced amount.

In addition, it is allowed to charge contributions in a reduced amount for payers whose activities meet the criteria of Art. 427 Tax Code of the Russian Federation. We are talking about entities working in technological, scientific fields and others.

In case of untimely repayment of outstanding contributions, the organization will have to pay the amount of penalties received. And here some nuances already appear. Indeed, in the case when insurance premiums are accrued, the posting takes the form - Dt cost account - Kt 69.

If it is discovered that insurance premiums have not been transferred in full, in addition to penalties, the amount of arrears is also collected from the payer. If the amounts were initially calculated incorrectly, the arrears of insurance premiums should be calculated; the entries are identical in this case to the usual calculation of payments: Dt expense account - Kt 69.

In order for the state to coordinate cash flows in certain social areas, several insurance funds were created. The most famous of them are the Pension Fund, the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund.

The peculiarity of these 3 state formations is that money is deposited into their accounts without fail by all organizations and individual entrepreneurs paying income to citizens of the Russian Federation. In the future, these funds are distributed according to social programs: for the issuance of pensions, maternity capital, payment of sick leave, etc.

The activities of the funds are regulated by the legislation of the Russian Federation, in particular:

- Budget Code of the Russian Federation dated July 31, 1998 No. 145-FZ;

Federal Law “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” dated July 24, 2009 No. 212-FZ.

Lyubov Kotova answers,

The day the debt is transferred is not taken into account in the non-payment period used to calculate the amount of the fine. According to Law No. 212-FZ, the obligation is considered fulfilled:

- from the moment a transaction related to the transfer of money to the relevant authorities is reflected in the enterprise’s account;

- from the date of presentation to the bank of a properly executed payment order;

- from the date of the supervisory authority’s decision to set off previously overpaid amounts;

- from the moment of depositing cash into the bank's cash desk, the administration to repay the debt to the relevant fund.

That is, if an organization transfers money for March 2020 on April 18, the accounting service should send to extra-budgetary funds an amount equal to mandatory contributions increased by the amount of the penalty. In this case, the amount of sanctions will be calculated taking into account 2 days of delay - April 16 and 17.

The amount of sanctions is calculated as a percentage of the amount of contributions payable. This indicator is equal to 1/300 of the refinancing rate of the Central Bank of Russia in effect on the date of delay. From January 1, 2020, it is 11%.

C - the amount of contributions to be paid;

D - number of calendar days of delay;

SR - refinancing rate.

Amounts that the company was unable to transfer for good reason are excluded from the calculations. Such situations include:

- suspension by court decision of all banking operations of the company;

- seizure of property belonging to the enterprise.

- Debit 20 (...) Credit 69.1 (FSS) - accrual to the Social Insurance Fund.

- Debit 20 (...) Credit 69.2 (PFR) - accrual Pension Fund.

- Debit 20 (...) Credit 69.3 (FFOMS) - accrual to the Medical Insurance Fund.

- Debit 20 (...) Credit (NS) - accrual to the Social Insurance Fund for accident insurance.

- FFOMS = 259,874 x 5.1% = 13,253.57

- Social Insurance Fund = 259,874 x 2.9% = 7536.35

- NS = 259,874 x 0.2% = 519.75

Extra-budgetary funds: functions

In order for the state to coordinate cash flows in certain social areas, several insurance funds were created. The most famous of them are the Pension Fund, the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund.

The peculiarity of these 3 state formations is that money is deposited into their accounts without fail by all organizations and individual entrepreneurs paying income to citizens of the Russian Federation. In the future, these funds are distributed according to social programs: for the issuance of pensions, maternity capital, payment of sick leave, etc.

The activities of the funds are regulated by the legislation of the Russian Federation, in particular:

- Budget Code of the Russian Federation dated July 31, 1998 No. 145-FZ;

Federal Law “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” dated July 24, 2009 No. 212-FZ.

Salary insurance premiums accrued: posting

Wage expenses are written off against the cost of production or goods, therefore the following accounts correspond to account 70:

- for a manufacturing enterprise - 20 account “Main production” or 23 account “Auxiliary production”, 25 “General production expenses”, 26 “General (administrative) expenses”, 29 “Servicing production and facilities”;

- for a trading enterprise - account 44 “Sales expenses”.

D20 (44.26,…) K70

Business lawyer {amp}gt; Accounting{amp}gt; Accounting and reporting {amp}gt; What does the posting of payroll insurance premiums look like?

Payments to employees is one of the main responsibilities of every employer.

But in addition to paying wages, the management of companies and enterprises is obliged to make other contributions and payments and then reflect them in accounting.

One of these types are contributions to the Social Insurance Fund and the Pension Fund. Therefore, every accountant should know how to record the accrual of insurance premiums on wages.

Salary contributions

After calculating payment for labor, the accounting department must make a transfer of insurance premiums. The amount of such payments directly depends on the type of activity of companies or enterprises, as well as the type of taxation. In addition, insurance premiums consist of the following types of payments:

- Are on the simplified tax system

- They work in the defense industry, medicine, construction of social facilities and others.

- Engaged in scientific activities and development of new technologies

In general, benefits on insurance premiums are granted to those employers who fall under Article No. 427 of the Tax Code of the Russian Federation. Additionally, contributions to the Social Insurance Fund depend on the level of harmfulness and danger at work. The higher these indicators, the higher the size of transfers.