New formula for calculating the share of income on the simplified tax system for a reduced tariff

From January 1, 2020, Law No. 335-FZ dated November 27, 2017 (hereinafter referred to as Law No. 335-FZ), with amendments to the Tax Code of the Russian Federation, obliged some simplified organizations to count the share of income in a new way for applying a reduced tariff of insurance premiums. These changes in insurance premiums from 2020 have adjusted the rules for calculating the share of income to recognize the type of activity of an organization as the main one (clause 6 of Article 427 of the Tax Code of the Russian Federation as amended). It is still necessary to divide the amount of such income by the total amount of income. But an important clarification has been made: the total amount of income (i.e., the denominator of the calculation formula) must include income that is provided for in Art. 251 Tax Code of the Russian Federation. That is, they do not form the tax base.

It is not yet clear whether they can be included in income from a preferential type of activity (i.e., in the numerator of the calculation formula). This question arises, for example, among medical organizations when taking into account fees for services under compulsory medical insurance.

It is important that these amendments apply to 2020 and for some companies they will be worse. This means that these changes do not have retroactive effect for them. They should only be applied from the 2020 period.

Clarifying the formula for calculating the share of income may worsen the situation of simplifiers in the following situations:

1. There are incomes that are named in Art. 251 of the Tax Code of the Russian Federation, but they are not related to preferential activities (for example, a loan was received) and were not previously taken into account in the calculation formula. According to the new rules, the calculation of insurance premiums will have to be clarified. In addition, the share of income may not reach 70%, and contributions will have to be recalculated at the general rate.

2. There are incomes that are named in Art. 251 of the Tax Code of the Russian Federation, they relate to a preferential type of activity and are taken into account in the numerator and denominator of the calculation formula. If we interpret the changes literally, income from the specified item must be given only in the denominator (although the Ministry of Finance allowed them to be taken into account in both the numerator and the denominator - letter dated October 10, 2017 No. 03-15-06/66041).

Also see “Changes to the simplified tax system in 2020.”

When is it necessary to submit an updated calculation?

The payer is obliged to make the necessary changes and submit an updated calculation to the tax authority in the manner prescribed by Art. Tax Code of the Russian Federation, if the following facts are discovered in the calculation submitted by it (clause 1.2 of the Procedure for filling out calculations for insurance premiums, approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11 / [email protected] , hereinafter - the Procedure):

- non-reflection or incomplete reflection of information;

- errors that lead to an underestimation of the amount of insurance premiums payable;

- as well as recalculation of the base for the previous period towards a decrease, such explanations are given by the Federal Tax Service in a letter dated 08/24/2017 No. BS-4-11/ [email protected]

If the base for calculating insurance premiums for previous reporting periods is adjusted, the payer submits an updated calculation for this period. The calculation for the current reporting period does not reflect the amount of recalculation made for the previous period. When filling out calculation line indicators, negative values are not provided (section II “General requirements for the procedure for filling out the Calculation” of the Procedure).

Beginning with 9-month reporting, files containing negative amounts will be considered inconsistent with the format. Such changes were made by the Federal Tax Service to the xml file schema. And those who submitted calculations for the first half of the year with negative amounts will have to submit an updated calculation for the first quarter (the tax authorities are sending out the relevant requirements).

Let’s say that in July they recalculated vacation pay for June to an employee who quit. The result was a negative basis and assessed contributions. It is necessary to submit to the Federal Tax Service an updated calculation for the six months with reduced amounts, and in the calculation for 9 months, take this into account in the columns “Total from the beginning of the billing period.”

Changes to the Labor Code of the Russian Federation, personal income tax and wages. Watch the reports of representatives of regulatory authorities at Kontur.Conference-2018

To learn more

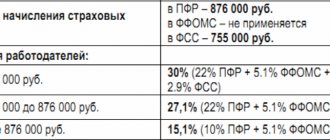

Increasing the marginal base

Decree of the Government of the Russian Federation of November 15, 2020 No. 1378 increased the maximum bases of insurance premiums for 2020.

For sick leave and maternity, the limit for calculating contributions has increased from 01/01/2018 from 755 to 815 thousand rubles. And for contributions to compulsory health insurance – from 876 thousand to 1 million 21 thousand rubles.

Three main rules for limit bases:

1. Contributions for illness and maternity are not accrued if the base limit has been reached.

2. Contributions to compulsory pension insurance when the limit is reached are charged at a reduced rate - 10 instead of 22%.

3. There is no base limit for contributions to compulsory medical insurance from 2020. They are accrued regardless of the size of payments from the beginning of the year.

For more information about this, see “The maximum value of the base for calculating insurance premiums for 2018.”

The procedure for submitting a single calculation to the tax control authorities

The provision of a single calculation for insurance premiums (the form can be downloaded from the link below) is carried out at the end of each quarter, no later than the 30th day of the month following the expired reporting period. Accordingly, you will need to submit a form for calculating insurance premiums from 2020 to the Federal Tax Service inspection 4 times: for 2017, for the 1st quarter of 2020, half a year and 9 months. Reporting for 2020 is required by January 30, 2020.

A sample of filling out the form “Calculation of insurance premiums” is provided by policyholders to the territorial fiscal control authorities. It is typical for organizations to submit a report to the Federal Tax Service at the place of actual registration, while individual entrepreneurs submit the reporting document to the tax authorities at the place of registration.

If an inspection by tax officials reveals irregularities in the preparation of a document, they contact the policyholder with a request for clarification. Updated forms for calculating insurance premiums for 2020 must reflect correct information, as well as the serial number of the update contained on the title page of the document.

You can generate a report in either paper or electronic format. For companies with more than 25 employees, only transfer of the document through TKS is allowed.

Failure to pay contributions: new grounds

Law No. 335-FZ from January 1, 2020 introduced paragraph 2 of clause 7 of Art. 431 of the Tax Code of the Russian Federation, new grounds for recognizing a single payment for contributions as not submitted. There will be a fine if for each insured person there are errors in the following lines of Section 3, which is devoted to detailing the amounts of payments and contributions accrued on them:

| Line | Index |

| 210 | The amount of payments and other remuneration for each of the last 3 months of the reporting or billing period |

| 220 | The base for contributions to compulsory pension insurance within the limits for the same months |

| 240 | Calculated contributions to compulsory social security within the limits for the same months |

| 250 | Result for lines 210, 220 and 240 |

| 280 | Base for calculating pension contributions at the additional tariff for each of the last 3 months of the reporting or billing period |

| 290 | The amount of calculated pension contributions at the additional tariff for the same months |

| 300 | Result on lines 280 and 290 |

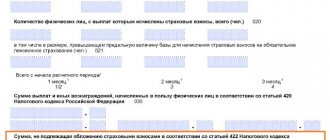

Here are these graphs in the form of the calculation itself:

Please note that the total indicators in the listed lines for all individuals must correspond to the summary data in Subsections 1.1 and 1.3 of the calculation of contributions.

Also see “Submission of calculations for insurance premiums in 2020: deadlines.”

Report “Calculation of insurance premiums” 2020: contents

The universal 24-page document consists of:

- title;

- 1st section, combining information about the obligation to pay contributions;

- 2nd section, including information on the obligations of heads of peasant farms;

- Section 3, containing personal data for each insured person.

Depending on the status of the policyholder and the type of activity of the company, a certain set of pages is filled in, which are then numbered consecutively. For example, all legal entities and individual entrepreneurs (except for heads of peasant farms) are required to prepare the following pages in the calculation:

- title page;

- section 1 with subsections 1.1 and 1.2, appendices No. 1, No. 2, No. 3;

- section 3.

If the payer uses preferential/additional tariffs, then the list of DAM pages is supplemented by the design of subsections 1.3.1, 1.3.2, 1.4, appendices No. 5-10 to section 1, paying benefits to the liquidators of the Chernobyl nuclear power plant - appendix No. 4, paying sick leave and maternity benefits and childbirth - Appendix No. 3.

The control ratios of the indicators for the unified calculation of contributions have been supplemented

The supplemented control ratios, which the Federal Tax Service approved by letter No. GD-4-11/25417 dated December 13, 2020, will help you avoid errors in the calculation of contributions and check the correctness of its completion. Their update is associated with the expansion of the list of grounds for non-acceptance of settlements.

The fact is that from 01/01/2018, when accepting an initial or updated calculation of insurance premiums, tax authorities control not only the discrepancy in information about the calculated amounts of contributions to compulsory health insurance, but also the discrepancy:

- amounts of payments and other remuneration in favor of individuals;

- bases for calculating contributions to compulsory pension insurance within the established limit;

- bases for calculating contributions to compulsory health insurance at an additional tariff;

- amounts of contributions to compulsory health insurance at an additional tariff.

For this reason, the Federal Tax Service also expanded the functionality of the program for preparing reports - “Taxpayer Legal Entities”.

For more information, see “New control ratios for calculating insurance premiums from 2018.”

Control ratios for calculation of insurance premiums 2020

Having filled out the DAM, you should make sure that the information entered is correct, and for this you need to compare the calculation information for different sections, checking their compliance with each other.

For example, the amount of contributions for compulsory health insurance specified in subsection 1.1 (page 061) must correspond to the summed value of lines 220, 230 and 240 of section 3 for all insured persons. In our example, this is 47,520 rubles. The breakdown by type of deductions should be consistent with the following line data:

- 030 section 1 and 060 subsection 1.1 – contributions for compulsory pension insurance;

- 050 section 1 and 060 subsection 1.2 – compulsory medical insurance contributions;

- 110 section 1 and 060 appendix 2 – contributions for VNIM.

In addition, you should check whether the number of insured persons is indicated correctly and recalculate the amount of contributions, comparing with the total amount accrued to the payroll specified in section 1.

You can read more about control ratios here.

Changes to the payment form for contributions

Apparently, starting from 2020, insurance premium payments will have to be submitted on an updated form. Let's say right away that these adjustments are mainly not related to changes in tax legislation. The Federal Tax Service of Russia simply decided to finalize some calculation indicators, as well as clarify its electronic version.

We list the main innovations in the calculation of contributions since 2018 and the rules for filling it out:

- Section 3 with personalized data about the insured received a new attribute “Type of adjustment” by analogy with SZV-M: primary/changing/cancelling;

- in order to fill out the calculation, the tax authorities prescribed that there cannot be negative indicators;

- the column “Payer tariff code” was added to Appendix 2 to Section 1;

- in Section 2 “Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity”, columns 051 to 054 were excluded and two new fields were introduced: 001 “Payer tariff code” and 015 “Number of individuals , from whose payments insurance premiums are calculated";

- in the Sheet “Information about an individual who is not an individual entrepreneur” there is no longer a field for indicating the place of residence in Russia;

- participants of the FSS pilot project “Direct Payments” no longer need to fill out Appendices No. 3 and No. 4 to Section 1;

- the procedure for breaking down indicators by month for some subsections and applications has been clarified;

- excluded The application that needs to inform tax authorities about how the reduced tariff valid until 2018 is applied.

How to fill out the calculation of insurance premiums in the Federal Tax Service 2018

The procedure for filling out the DAM is given in Appendix 2 to the order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11 / [email protected] When drawing up the document, the requirements generally accepted for such forms are adhered to - if there are no values in the lines, dashes are added, and value indicators are filled with zeros. Corrections, printing on the reverse side of the sheet, or stapled documents are prohibited.

We will indicate some nuances that should be taken into account when drawing up the report, giving brief explanations of the lines of the document using the example of a company that provides accounting support to companies and fills out the DAM for the 2nd quarter of 2020.

Example

To simplify the problem, let’s assume that Bukhservice LLC has been operating since October 2020, has 2 people (men) on its staff - a director and a specialist, who did not issue sick leave certificates for the time worked.

Based on the results of the 2nd quarter, salary payments amounted to:

- Director Sviridov R.V. – 120,000 rub. (40,000 rubles monthly)

- Specialist A.I. Kochnev – 96,000 rub. (RUB 32,000 monthly)

So, filling out begins with the title page, which indicates all the information about the payer - TIN, KPP, reporting period codes (21), Federal Tax Service Inspectorate (7404), place of registration of the company (214), full name of the company, type of activity corresponding to the OKVED code, phone number (with spaces after 8 and area code). In addition, indicate who submits the form - the payer (code 1) or his authorized representative (code 2). After filling out all the sheets, returning to the title sheet, indicate the number of pages actually filled out and numbered in continuous order.

In the 1st section, the BCC is indicated for each type of payment (mandatory and additional), the amount of accrued contributions - with a monthly breakdown.

The section takes up several pages, each of them signed and dated.

Appendix No. 1 to Section 1 calculates insurance contributions, separately indicating the amounts of payments for all types of insurance and the number of insured persons in each month. In the same vein, subsection 1.2 is filled in, where compulsory medical insurance payments are calculated. In Appendix No. 1 of the calculation of insurance premiums 2020, indicate the tariff code - an encrypted value indicating which tariff is applied in the company. In our example, code 01 is used, i.e. the main one for deductions from the payer to OSNO. The decoding of the codes is presented in the 5th appendix to the order MMV-7-11/ [email protected]

In Appendix No. 2 to Section 1, deductions for VNIM are calculated, indicating information about the amounts calculated for the quarter and the method of payment - directly or by offset, filling in the line “payment attribute” in the calculation of insurance premiums. Code 1 corresponds to direct payments, 2 to the offset payment system. In the same section, the amount reimbursed by the Social Insurance Fund, as well as the amount due for payment, is noted.

Section 3 contains information about insured personnel. For each employee, a separate sheet is filled out, where all the basic data is entered - passport number, TIN, category code of the insured. This is where filling out the RSV ends; the suggested example of filling out the form will tell you what it looks like.

Individual entrepreneurs’ contributions were “untied” from the minimum wage

Starting from 2020, the amounts of insurance premiums for individual entrepreneurs are not related to the minimum wage and the tariff rate. Now, in the new version of Article 430 of the Tax Code of the Russian Federation, specific ruble amounts of contributions to compulsory health insurance are given (amendments were made by Law No. 335-FZ):

- if the income of an individual entrepreneur without staff does not exceed 300,000 rubles, contributions to compulsory pension insurance will amount to 26,545 rubles, and to compulsory medical insurance – 5,840 rubles;

- if the businessman’s annual income is from 300,000 rubles, as before, additional pension contributions must be made at a rate of 1%.

The amount of fixed contributions for peasant farms is similar and, since 2018, also does not depend on the minimum wage and tariff rate. Only the number of participants in the farm, including the head, matters.

Also see “Insurance premiums of individual entrepreneurs for themselves in 2020: how to calculate and pay.”

The procedure for filling out the unified ERSV calculation

Tax calculations for SV are compiled according to the type of declaration. Consequently, the document has a title page, as well as sections for calculating the base for assessing contributions and reflecting charges. There is no data on incoming/outgoing balances and amounts paid, as was the case in 4-FSS. General requirements for the reflection of all information are given in Appendix 2 to Order No. ММВ-7-11/ [email protected] Let's consider common questions when drawing up the ERSV:

- How to indicate the sign of payments in the calculation of insurance premiums 2020 - the corresponding code (1 or 2) is given on page 001 Appendix. Section 2 1 to indicate the method of settlements with citizens. For the direct system, 1 is indicated, for the credit system, 2.

- Is it necessary to reflect dividends in the calculation of insurance premiums for 2018 - since such amounts are not included in the base for taxation of SV according to stat. 420, as well as are not mentioned in non-taxable amounts according to the norms of stat. 422, this type of remuneration to citizens is not required to be indicated in the ERSV.

- How to designate the tariff code in the calculation of insurance premiums for 2020 - the meaning of this code in terms of the tariff applied by the payer is given on page 001 of the Appendix. 1 to section 1. And according to page 270 section. 3. The current coding is given in Appendix 5 to the Order. For example, for payers of contributions at the basic tariff and in the general mode, code 01 is intended, and for simplifiers - 02, etc. If during the period the company used different tariffs, it is required to create the number of sheets of Appendix 1 according to the number of tariffs applied.

- Should the calculation of insurance premiums for 2020 contain Appendix 3 - these sheets are generated only in situations where the employer incurs VNIM costs. In other cases, this section is not submitted.

How to fill out calculations for insurance premiums 2018

Postponement of the deadline for payment of individual entrepreneur contributions to compulsory pension insurance from large incomes

New edition of clause 2 of Art. 432 of the Tax Code of the Russian Federation (Law No. 335-FZ) establishes a new deadline for the transfer of pension contributions to individual entrepreneurs without staff and private practice specialists with incomes of 300,000 rubles.

Previously, this deadline was no later than April 1 of the following year. But it was postponed from reporting for 2020 to July 1.

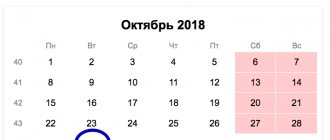

Thus, contributions from the excess amount for 2020 must be paid no later than July 2, 2020. The fact is that 07/01/2018 is Sunday, so the transfer rule applies:

For more information about this, see “Deadline for payment of individual entrepreneur insurance premiums for 2020.”

Discrepancies between the DAM and accounting

Practice has shown that many accountants doubt whether they correctly filled out lines 080 and 090 of Appendix 2 to Section 1 of the RSV for the 1st quarter of 2020. Doubts arise because line 090, filled out according to the above formula, does not reflect the actual balance of calculations for social insurance contributions. In other words, according to accounting data there is one figure, and according to the DAM data - another.

Let’s say right away: this state of affairs does not mean at all that an error has crept into the RSV. The reason for the discrepancy is that in the insurance premium calculation form there are no fields intended for opening and closing balances. Because of this, the amount of excess of paid benefits over contributions that arose in 2020 does not fall into the DAM for the 1st quarter of 2020. And if compensation from the Social Insurance Fund in the specified amount was received in the first quarter, then the calculation does not reflect the connection between the compensation received and “last year’s” excess.

Example

In 2020, the excess of benefits paid over contributions amounted to RUB 25,000. This value was reflected in the DAM for 2020 on line 090 of Appendix 2 to Section 1 with the attribute “2”. The balance on the debit of account 69 subaccount “Social insurance settlements” as of December 31, 2020 amounted to 25,000 rubles.

In January 2020, the FSS transferred compensation in the amount of 25,000 rubles to the policyholder. However, in the first quarter there were no accrued contributions or paid benefits. The balance on account 69 subaccount “Social Insurance Settlements” as of March 31, 2020 was zero.

In Appendix 2 to Section 1 of the DAM for the 1st quarter of 2020, the policyholder indicated the following data:

- on line 080 - 25 000

- on line 090 - 25,000 with sign “1”.

Thus, the balance according to accounting data is zero, and the DAM for the 1st quarter shows that the policyholder owes the budget 25,000 rubles. However, the calculation is completed correctly.

The range of payments within the framework of the World Cup, which are exempt from contributions, has been reduced

Since 2020, payments to foreign citizens and stateless persons who took part in the preparation and holding of the World Cup are exempt from insurance premiums. But this is a general rule.

Law No. 303-FZ of October 30, 2020 shortened the wording of paragraph 7 of Art. 420 Tax Code of the Russian Federation. From January 1, 2020, there will be no contributions if these persons signed an employment or civil contract directly with FIFA.

And so payments to them are still subject to contributions if they go through:

- FIFA subsidiaries;

- organizing committee "Russia-2018";

- subsidiaries of this organizing committee.

Legal basis and general filling rules

Let us remind you that from 2020, all mandatory insurance contributions (except for the Social Insurance Fund for injuries) of individual entrepreneurs and companies acting as policyholders are reported to their tax office, and not to the Pension Fund of the Russian Federation.

This is due to the transfer of the function of administering these payments to tax authorities. The exception is contributions for injuries. They remained under the control of the Social Insurance Fund.

Also see “Control bodies over the payment of insurance premiums since 2017”.

The official name of the form for calculating premiums is “Calculation of insurance premiums”. And the prefix “single” appeared by itself. Accountants use it. This formulation is due to the fact that the report provides data on almost all types of contributions.

Also see “Overview of changes in insurance premiums since 2018.”

Since 2020, contributions to extra-budgetary funds are controlled by the tax authorities. In this regard, a new reporting form has appeared, submitted to the Federal Tax Service quarterly - calculation of insurance premiums (DAM). We can say that it is a kind of “hybrid” of the RSV-1 report, which was previously submitted to the Pension Fund and forms 4-FSS.

The new report became effective in the 1st quarter of 2020. But his form was, naturally, approved in advance - by order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. MMV-7-11/551. The same document also approved the procedure for filling out the DAM (hereinafter referred to as the Procedure).

All employers, both legal entities and individuals, are required to fill out the DAM. The latter include not only entrepreneurs, but also those who use the services of hired workers (lawyers, notaries, heads of peasant farms). The report must be submitted even if no activity was carried out during the reporting period and wages were not accrued.

The minimum composition of the report looks like this:

- Title page.

- Sec. 1, containing general information about accrued insurance premiums. There are 10 applications for it, each of which is dedicated to a specific payment calculation option. Only the Appendix must be completed. 1 (subsections 1.1 and 1.2), as well as App. 2 and 3, which relate to the basic options for calculating contributions.

- Sec. 3, which contains personal data of all income recipients.

All other sheets of the report must be completed if they correspond to the status of the employer or the types of payments that it makes.

We will consider the rules for filling out not by numbering the sheets, but in the order of “mandatory” - first the sheets common to all, and then the rest.

A sample of the DAM registration for the 2nd quarter of 2020 can be seen here.

Download (XLS, 409KB)

The object of taxation of contributions in terms of intellectual property has been expanded

Insurance premiums will have to be calculated more often in 2020. Law No. 335-FZ adjusted the composition of objects subject to insurance premiums (clauses 1 and 4 of Article 420 of the Tax Code of the Russian Federation).

The amendments clarified the list of agreements on the alienation of the exclusive right to the results of intellectual activity and licensing agreements on the granting of the right to use, payments for which are subject to insurance premiums. Now the Tax Code of the Russian Federation refers to subparagraphs 1 to 12 of paragraph 1 of Art. 1225 of the Civil Code of the Russian Federation. And this:

- works of science, literature and art;

- computer programs;

- Database;

- execution;

- phonograms;

- messages on the air or via cable radio or television programs (broadcasting);

- inventions;

- utility models;

- industrial designs;

- selection achievements;

- topologies of integrated circuits;

- know-how.

Until 2020, the Ministry of Finance believed that remuneration for the alienation of the exclusive right to a computer program was not subject to insurance premiums (letter dated 06/09/2017 No. 03-15-05/36269). The explanation was this: it does not refer to works of science, literature and art, but a separately identified result of intellectual activity.

ERSV in the Pension Fund of Russia – personalized data of employees

The ERSV form appeared in 2020. Its presence is explained simply - from this year, control over the accrual and payment of SV is entrusted to the Federal Tax Service. There is only one exception left. It refers to the SV for injuries, which were left to the FSS.

Calculations RSV-1...3, 4-FSS replaced ERSV on a new form. Its main difference is that the form is drawn up on the principle of a tax return. This means that it contains exclusively information that relates only to accrual amounts for the reporting period of time. The form does not include the following indicators:

- amount of paid CBs;

- debt balances – incoming and outgoing.

Important! Although the supervisory function for SV passed to the tax authorities, there was no automatic elimination of reporting to extra-budgetary funds. This applies to the SZV-Experience form.

One of the ERSV sections (the third) must be filled in with personal data about the insured persons. Correct information is entered within the framework of contracts:

- labor;

- civil law.

Personalized data is:

- TIN and SNILS;

- date of birth and full name;

- nationality and gender;

- series and number of the identity document and its code.

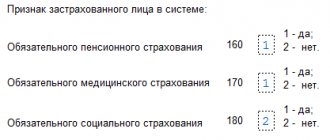

It also indicates whether the employee has compulsory insurance - medical, pension, social.

There is no longer a need to record the following data in the ERSV form:

- work period;

- the amount of insurance experience;

- working conditions.

KBK

Thanks to budget classification codes (BCC), information about all payments, as well as the correctness of the transfer of funds, will not be lost. The KBK for payment of insurance premiums to the Federal Tax Service, which indicate payment slips in details 104, determines the type of tax. Due to the transfer of administration of payments to tax authorities, the manager’s BCC has changed from code 392, 393 to 182. Now the classification code when funds are credited before January 1, 2020 remains the same, but contributions that are transferred after this date are classified according to the new BCC.