Terms of payment for work performed according to the law

Answered by the lawyer - S.O. Koroleva: Hello Alexey! According to Art. 190 of the Civil Code of the Russian Federation, there are several ways to determine deadlines in civil law: - by a period of time; — indication of the calendar date; - an indication of an event that must inevitably occur. In this situation, the term under the contract is determined by a period of time, but counted from the moment, which is determined by an indication of the event (receipt of a positive conclusion from the state examination of the project). According to Art. 758 of the Civil Code of the Russian Federation, under a contract for design and survey work, the contractor (designer, surveyor) undertakes, on the customer’s instructions, to develop technical documentation and (or) perform survey work, and the customer undertakes to accept and pay for their result. According to paragraph 2 of Art. 702 of the Civil Code of the Russian Federation to certain types of contract (household contract, construction contract, contract for design and survey work, contract work for state needs), the provisions provided for in paragraph 1 of Chapter 37 of the Civil Code of the Russian Federation apply, unless otherwise established by the rules of the Civil Code of the Russian Federation on these types of contracts. According to paragraph 1 of Art. 708 of the Civil Code of the Russian Federation, the contract indicates the initial and final deadlines for the work. According to paragraph 1 of Art. 711 of the Civil Code of the Russian Federation, if the contract does not provide for advance payment for the work performed or its individual stages, the customer is obliged to pay the contractor the agreed price after the final delivery of the work results, provided that the work is completed properly and on time, or with the customer’s consent ahead of schedule. According to Art. 762 of the Civil Code of the Russian Federation, under a contract for design and survey work, the customer is obliged, among other things (unless otherwise provided by the contract) to pay the contractor the established price in full after completion of all work or to pay it in installments after completion of individual stages of work. That is, in this situation, a period for payment is provided, connected by a period of time with the moment that, in the opinion of the parties, should confirm the fact of the final completion of the work, namely the moment of receiving a positive conclusion from the state examination of the project. Thus, the event “receiving a positive conclusion from the state examination” will have two meanings for this contract: 1) the moment of final delivery of the work, i.e. proper performance of the obligation by the contractor; 2) the starting point for counting the time period that determines the payment period under the contract. Thus, the fact of proper fulfillment of the obligation and the payment deadline are made dependent on the fact of receiving a positive expert opinion. Meanwhile, this fact does not have the obligatory sign of the inevitability of the occurrence, since a positive conclusion of the state examination may not be issued at all or may not be issued within the period expected by the customer and the contractor, being reasonable and conscientious, since the positive conclusion of the examination is given by a state body that is a third person for the parties to the contract. According to the Determination of the Supreme Arbitration Court of the Russian Federation dated March 21, 2012 N VAS-17519/11 in case N A45-19833/2010, a period made dependent on the actions of third parties is considered not to have any sign of inevitability. The very coincidence of the fact of delivery of work with the initial moment of counting the period of time for payment contradicts Art. 190 of the Civil Code of the Russian Federation, because the fact of delivery of work depends on the will of the parties to the contract, and the occurrence of an inevitable event cannot depend on the will of the subjects of law. Accordingly, the occurrence of an event that depends on the will of the parties or third parties is not inevitable and does not comply with Art. 190 Civil Code of the Russian Federation. The same opinion is shared by the courts in similar situations: Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 18, 2011 N 11659/10 in case N A40-76599/09-159-650; Resolution of the Federal Antimonopoly Service of the West Siberian District dated 07/09/2014 in case No. A45-19115/2013. In addition to direct violation of paragraph. 2 tbsp. 190 of the Civil Code of the Russian Federation, the wording of the payment period in this way makes payment dependent on the actions of a third party. Consequently, the moment of final delivery of work established in this way does not depend on the will of the contractor, which may prevent receiving payment for properly completed design and survey work. Thus, the term of the contract, which establishes the rule regarding the payment period as a period of time from the moment of receiving a positive conclusion from the state examination, contradicts Art. 190 of the Civil Code of the Russian Federation, and its implementation by the customer in certain situations will contradict Art. 762 of the Civil Code of the Russian Federation. Based on the foregoing, we can conclude that the wording of the condition on the deadline for payment for the result of the work after receiving a positive expert opinion cannot be considered a condition on the deadline for the obligation to occur, since it does not correspond to the signs of an event that must inevitably occur, and the customer’s fulfillment of this condition will be contrary to the law.

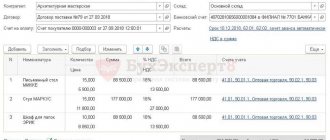

Features of accounting for a contract

Accounting is an important part of the contract.

The monetary value of completed work is taken into account by the organization as an expense for simple types of labor activity.

Cash costs for repair work in office premises are reflected in accordance with the debit of the established account in full compliance with the credit of the main account.

Insurance contributions, which are calculated on the entire amount of remuneration transferred to the contractor, are part of the expenses associated with the ordinary activities of the enterprise. A debit entry to the main cash account appears in the accounting data.

The costs of an organization that are associated with the calculation of wages to an individual who is not an employee of a company or enterprise for carrying out labor activities under a contract are taken into account as part of the costs arising from cash payments to employees on the basis of the Tax Code of the Russian Federation.

Depending on the method of transferring funds, costs associated with remuneration for labor activities are taken into account on a monthly basis, taking into account the transferred amount. Insurance contributions transferred by the organization to the contractor are considered part of the total costs associated with the development and production at the time of their transfer.

Sometimes situations arise when the conclusion of an agreement occurs between an organization and its own employee. Then the amount of money will be reflected according to the credit of the main account.

If a contract has been concluded with a specific employee who is a member of the organization’s staff, then work under this contract can be carried out during non-working hours.

Contract agreement: advantages and disadvantages

It is important to distinguish between an employment contract and a work contract.

This agreement is one of the main objects of attention for tax authorities. Representatives of tax services are able to recognize the document as a work document, which is why the organization can subsequently expect a large fine.

Article number 15 of the Labor Code of the Russian Federation does not provide for the conclusion of civil law contracts, which are actually responsible for regulating labor relations between an employee of an organization and his employer.

The minimum cost of a fine is usually five thousand rubles.

In addition, you will need to pay certain amounts of money to the company employee, for example, vacation pay.

There are some differences between a contract and an employment contract. For example, the main purpose of an employment contract is the implementation by the employee of specific functions determined for his status.

A work contract implies the achievement by a person acting as a contractor of specific results, as well as the transfer of finished work within a specified time frame. The transfer of salary under an employment contract occurs every month, regardless of the final result.

In a contract agreement, payment for work activities is carried out in accordance with the final result.

According to the rules of the employment contract, the employee is subject to the rules of the internal organizational work schedule. The contract indicates that the contractor can independently determine the methods for carrying out the task assigned to him by the customer.

If property rights are taken into account, then in an employment contract, the property produced by the employee is the property of the employer. The work contract states that the item created by the contractor is his property before the property is transferred to the customer.

Positive characteristics of the contract for the customer:

- most of the terms of the official agreement, as well as the specifics of financing, are interpreted rather loosely;

- payment of contributions for monetary rewards will not be required;

- There is no need to pay sick leave or vacations.

The positive features of a contract for the contractor are the reduction of the tax base by the total cost of real expenses associated with the implementation of contractual obligations. Costs must be confirmed by official documents of the appropriate type.

The certificate of completion and the invoice are issued with different dates: how critical is this?

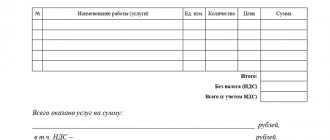

In current business practice, the package of documents accompanying the transaction includes an invoice, an invoice and a certificate of completion of work. The accounting department files this set of papers after the work has been accepted by the customer and the necessary accounting operations have been completed.

The question arises: if all three documents relate to one transaction, should they be issued on the same date or can they diverge in time? And if so, how critical is this discrepancy?

The legislation does not require that the dates in the work completion certificate and the invoice coincide. And the date of issuance of such a document as an invoice is not regulated by any regulatory act. This is explained by the fact that the invoice is not recognized as a primary document in accounting, and for tax accounting it has no significance. The contractor delivers it to the customer at his own discretion or within the time limits specified in the contract. That is, a coincidence in the dates of the invoice, invoice and certificate of completion of work is acceptable, but not necessary.

What needs to be taken into account in a situation where the act and invoice are issued on different dates?

The date in the work completion certificate is an important element that affects the reliability of the formation of information in accounting. On this date, the customer’s accounting recognizes expenses in the amount of the cost of work performed, agreed upon by the parties. In the contractor's accounting on the same date, revenue from the implementation of work is reflected and expenses associated with the fulfillment of obligations under the contract are recognized.

The date of the invoice affects the timeliness of the customer receiving the VAT deduction for the work. It is determined according to the norms of paragraph 3 of Art. 168 of the Tax Code of the Russian Federation and is selected from a segment of 5 calendar days, counted from the moment:

- performing work, providing services or shipping goods and products;

- receiving an advance;

- changes in the volume of work performed (quantity or price of goods shipped).

It turns out that the discrepancy in dates is a normal situation limited by time frames.

What happens if you violate the 5-day deadline or issue a non-advance invoice before the work is completed and accepted by the customer? Such calendar leapfrog, if it occurs at the border of tax periods, can cause claims from controllers and become a reason for a fine. But in general, the Ministry of Finance is not inclined to consider later issuance of an invoice as a basis for refusing a deduction to the buyer.

We talk about possible fines for violating the deadline for issuing an invoice in this material.

Results

The invoice date is not regulated by law and is determined independently by the contractor or specified in the contract.

The invoice and the certificate of completion of work can be issued on the same date. It is acceptable to issue an invoice on dates different from the date of the primary document (act). In this case, the difference in dates should not exceed 5 calendar days. In order not to get confused about dates and optimize document flow, you can replace the act and invoice with one universal transfer document (UDD). You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

How to get rid of calendar confusion

In order not to make mistakes with the dates in the act and invoice, you can optimize the procedure for preparing these two documents, namely, combine them in one universal transfer document (UDD). Accordingly, such a document will have only one date. The reason for discrepancies in dates will disappear, and the risks of claims from controllers will be minimized.

The transition to using UPD requires preliminary preparation:

- It is necessary, based on the UPD form recommended by tax authorities, to develop a form that allows you to combine information from the invoice and the work completion certificate. It is important that this form contains all the details required for the primary document and invoice.

- Approve the UPD form and the possibility of its use in the accounting policy.

- Agree with counterparties on the terms of application of the UPD.

General recommendations for preparing UPD are given in the letter of the Federal Tax Service of Russia dated October 21, 2013 No. MMB-20-3/ [email protected]

We tell you more about the algorithm for switching to UPD here.