Regime of joint property of spouses

(Clause 1, Article 33) defines the regime of joint ownership as the legal regime of the property of a husband and wife who are in an official marriage. If the spouses have not agreed to define a different property regime in the marriage contract, it is considered to be in force by default.

Spouses, in accordance with paragraph 1 of Art. 35 of the RF IC, have the right, by mutual consent, to own, use and dispose of common property.

In addition, on the basis of regulations and the Family Code of the Russian Federation, there is a presumption of consent of one of the spouses to the actions of the second in relation to the disposal of common property (clause 2 of article 35 of the RF IC and clause 2 of article 253 of the Civil Code of the Russian Federation). By default, it is generally accepted that, for example, the other spouse is aware of taking out a loan and fully approves of it.

Find out in more detail what joint property of spouses is.

What does a marriage contract contain?

The husband and wife agreement for a mortgage without the consent of one of the spouses must contain the following:

- information about the person taking out the loan (full name, passport details, place of residence);

- information about who will own the property;

- information about the amount of the down payment and its payer;

- information about who will make monthly payments;

- those responsible for violations of the marriage agreement are identified.

Recommended article: Housing rental with subsequent purchase - where to find and how to apply

Let's look at each point in more detail.

The first clauses of the agreement clearly and clearly define which of the spouses is the borrower and who will be the future owner of the home.

About mortgage payments

An important point in a prenuptial agreement when it is drawn up to take out a mortgage without the participation of a spouse is the down payment. After all, unless otherwise stated, all money in the family is considered joint. Therefore, it is important to indicate the source of the down payment.

The point about monthly payments is also very important. It must be indicated that such payments are part of the income of the future owner, and not joint family income.

About the norms of civil contract

A BD is an ordinary civil contract, in this case it decides the question of whether it is possible to take out a mortgage without the consent of the spouse. Therefore, in a situation where the clauses of the agreement of one of the parties are not fulfilled, the norms of the Civil Code of the Russian Federation apply. That is, the second party has the right to make demands for elimination of violations and even compensation for losses, as under any civil contract.

Termination of a marriage contract occurs in connection with the divorce of the spouses, unless other conditions are specified in the agreement

In each specific case, the agreement may contain information about the bank that issued the mortgage, the terms of this mortgage, or additional information about the property itself.

Legislation on the possibility of obtaining a mortgage during marriage

The process of taking out a mortgage loan is regulated by several legislative acts of the Russian Federation. First of all, this is the RF IC, Article 35 of which states that transactions involving state registration must have a notarization.

Also, according to Art. 20, a loan for the purchase of housing is a procedure that requires state registration, which means that it cannot be done without the consent of the second spouse.

Consent to conclude a mortgage lending agreement for the purchase of real estate by all its owners is a requirement regulated by Art. 7 Federal Law No. 102.

Rules for buying a home while married

Before purchasing real estate on credit, you need to consult with your other half. However, it is worth figuring out whether it is always necessary to obtain your spouse’s permission to purchase an apartment and what the consequences may be if this is not done.

When it comes to purchasing residential real estate without borrowing funds, you can do without the written consent of the second spouse:

- when buying a house or apartment by proxy, for third parties;

- if housing is purchased as shared ownership or as joint property, which is reflected in the documents;

- in case of purchasing a commercial property.

If you plan to take out a mortgage loan to purchase a home, you will not be able to avoid providing the bank with the notarized permission of the second spouse for the loan.

Joint purchase of housing

Real estate is always in demand on the market. Since not everyone can buy an apartment with one payment, most citizens take out a housing loan. If a person is married, before concluding a mortgage agreement, you should consult with your life partner. But is it necessary to obtain his consent?

When purchasing real estate without using borrowed funds, the spouse’s permission to purchase an apartment is not required:

- if the transaction is concluded by proxy;

- if housing is transferred into ownership on the basis of shared ownership or as joint ownership, both transactions are documented;

- in case of purchasing a commercial property.

Before issuing money, bank employees will request notarized permission from the second spouse. .

Do I need to get my spouse's consent for a mortgage?

When considering the issue of obtaining the approval of the second spouse to apply for a mortgage loan, it is worth proceeding from the possible subsequent division of property and loan debts.

Art. 30, 33 of the RF IC define debts on loans as general, unless a marriage contract is concluded establishing the conditions for obtaining a loan and its repayment.

According to judicial practice, when considering such cases, the fact is taken into account that if within a year the party declaring its disagreement has not challenged the actions of the husband or wife, then this confirms the spouse’s consent to the mortgage.

Moreover, most banks that issue loans for the purchase of housing require not only written consent, but also to make the other half a co-borrower, and therefore an equal defendant on debt obligations.

Spouse's consent to purchase an apartment: sample in 2021

It is especially important to draw up an agreement if funds from third parties are used to purchase an apartment. We are talking about a mortgage loan or other loan, even from familiar people. After all, the borrowed money will have to be repaid from common funds (Read also the article ⇒ Notarized consent of the spouse for the sale of an apartment: sample).

Such a procedure, of course, will not be easy, since it will be necessary to prove that a deliberate violation of the rights of the spouse was committed. However, since Article 35 of the RF IC can be interpreted differently, this can lead to certain risks for both the buyer and the seller.

We recommend reading: Refund of Money Through the Tax Office for an Apartment

Consent of the second spouse to pledge property

When planning to take out credit funds to purchase real estate, spouses often wonder not only whether the consent of the other half is needed to conclude such an agreement, but also try to solve other problems that arise.

According to the laws of the Russian Federation, in an official marriage, transactions with common property require notarial consent to a pledge from the spouse, regardless of his share in this property.

When a loan is taken out on the security of real estate already owned, then, in addition to a notarized permission to mortgage the property, the consent of the other half to the mortgage may also be required.

If we are talking about a pledge of the purchased apartment, then this action does not require additional consent to pledge the real estate.

The consent of the second spouse to take out a mortgage loan, as a rule, describes all the nuances associated with its registration. The document for registration of a mortgage must contain the consent of the second spouse, who often acts as a co-borrower or guarantor, that the housing purchased under this agreement acts as collateral. Therefore, the question that arises simultaneously with the decision to take out a mortgage loan is whether the spouse’s consent to the mortgage of real estate in the form of a separate document is necessary, in this case the answer is negative.

However, such a written, notarized document will definitely be required in situations where there is no marriage contract between spouses and the collateral property is common joint property acquired earlier.

The question of whether it is possible to mortgage an apartment without the consent of the spouse has the same negative answer.

Registration of notarized consent for a mortgage

Banks strive to minimize the risks of non-repayment of mortgage loans and do not allow situations where there is no firm certainty that a married borrower (husband or wife) is taking out a targeted loan with the knowledge and permission of the spouse. Therefore, the question of whether a husband can take out a mortgage without the consent of his wife has a negative answer - a mortgage loan will not be issued.

It is necessary to take care of the preparation of the relevant document in advance by drawing it up yourself or with a lawyer and having it certified by a notary.

What documents will be needed

To draw up an official consent to purchase an apartment with a mortgage, you can contact any notary office. Moreover, one of the spouses whose consent will be verified must certainly apply for this service, even if it is decided to issue a credit apartment for one spouse.

To obtain consent, the lawyer will require the following documents:

- passport (for the applicant’s identity card with a marriage registration stamp);

- marriage certificate (for the presence of the official seal of the civil registry office that registered the marriage).

If the documents are available and in the presence of the consenting spouse, the notary draws up a document indicating the consent of the husband or wife to the mortgage.

What should be contained in the text of the mortgage consent?

A sample of a spouse’s consent to pledge real estate, which is taking out a mortgage on a home, can be studied by contacting a notary’s office. It must contain the following information:

- Full name and full passport data of the spouse giving consent to the transaction;

- details of the document confirming the marriage (series, number, by whom it was issued);

- information about the property being purchased.

The applicant signs the document and has it certified by a notary in his presence.

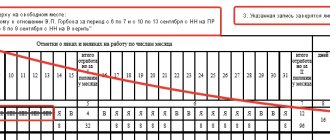

How long is mortgage approval valid?

All real estate transactions carried out during marriage and requiring official registration with government agencies require the consent of the second spouse in writing. As a rule, the document is drawn up before the conclusion of the contract and is presented along with other required papers.

Registration of consent to a pledge after signing an agreement is not practiced.

As a rule, the validity period of a spouse’s consent to a mortgage does not have a time frame. By default, it is considered that any document executed by a notary has a validity period of 3 years. After this time, the document becomes invalid due to limitation. Therefore, when drawing up the consent of the second spouse for a mortgage, you need to keep in mind how long this document is valid.

Cost of notary services

The service for obtaining the spouse’s official consent to obtain a mortgage depends on the regions of Russia and has different costs. The amount usually includes the preparation of the document and its notarization. This fee is established by the Federal Chamber of Notaries and is fixed.

On average, the cost of consent to purchase an apartment from a spouse is in the range of 1,500-2,000 rubles. If you draw up a consent yourself and apply only for certification of the document, the price for the service can be reduced. But in this case, the notary may refuse to certify the finished document due to its incorrect execution.

Is it possible to take out a mortgage without the consent of your spouse?

According to current legislation, all income of spouses during marriage is considered joint, and payments under the loan agreement, including the mortgage, will be made from the joint budget. If the question arises whether a husband can take out a mortgage without the consent of his wife, banks that provide lending clearly say no. A loan is a serious burden for any family and both husband and wife will have to bear it.

The bank must be sure that both spouses are fully aware of the responsibility for the emerging obligation. The execution of a loan agreement is subject to mandatory registration with government agencies; the second spouse’s permission to take out a mortgage must be formalized, i.e., notarized.

This requirement is imposed on spouses by all banking organizations that provide loans for the purchase of real estate. A mortgage without the consent of the spouse is impossible. If the consent of the second spouse is not included in the overall package of documents, the registration of real estate may be suspended until it is received.

We advise you to read:

- ✅ Spouse’s consent to sell an apartment: sample

- ✅ Can a wife claim her husband’s apartment purchased before marriage?

- ✅ Preliminary agreement for the purchase and sale of an apartment under a Sberbank mortgage

- ✅ How to sell an apartment with a mortgage: 4 proven ways

However, there is a situation when, for example, a woman took out a mortgage and got married. Does she need the consent of her future husband, and is he responsible for the loan when they enter into legal marriage? The question is complex and can be interpreted in two ways (which most often happens in divorces).

So, in such a situation, technically, the woman does not need the consent of her then-future spouse. But when citizens are married, both of them, as a rule, bear responsibility for the mortgage. And this can often cause conflicts, especially in divorces.

And this raises the next question: what to do if your spouse refuses to take out a mortgage? There are two ways. The first is to try to convince him. The second is to take on the mortgage entirely, indicating separately in the agreement that only this borrower bears the obligations. But here you will have to prove that your income level allows you to take out a loan in this way. Otherwise, if there is the slightest doubt about the citizen’s solvency, the bank will refuse to issue her a mortgage, since there is a high probability that the obligation to make payments will fall on both spouses.

The need for consent to refinance a mortgage

Citizens resort to mortgage refinancing (changing the terms of the agreement or concluding a new one to improve the terms of the loan for the client), pursuing various goals:

- reduction in monthly payments;

- changing the duration of the contract;

- reduction in interest rate.

For married persons, the relevant question is whether refinancing a mortgage loan requires the approval of the second spouse. Since we are talking about common property, and the loan will be repaid from common income, the bank will require from the second spouse:

- conclude a surety agreement;

- give notarized consent;

- become a co-borrower.

Thus, it will not be possible to avoid obtaining consent for refinancing from the second spouse. Of course, we are talking only about those cases when a marriage contract has not been concluded between the spouses.

If there is a contract, the questions of whether a mortgage can be issued only for the husband or only for the wife, as well as how and what actions to take with credit obligations, are not relevant - all situations, as a rule, are described in such an agreement.

Spouse's consent to a mortgage loan: questions and answers

- your expenses on loan obligations should not be more than 50% of your official income (if you have other current loans, this percentage is calculated in accordance with them);

- The balance of funds in addition to the monthly loan payment for monthly expenses per family member is approximately 10,000 rubles (depending on the region).

The law does not prohibit this, and the lending bank, as a rule, has its own requirements, the minimum of which is that you must be able to pay the monthly payment only from your own income. Some banks require a prenuptial agreement. In this case, contact the bank where you plan to take out a loan to obtain information about their conditions.

Is it possible to take out a mortgage without the participation of a spouse?

Due to various life situations, legally married persons are interested in under what circumstances it is possible to obtain a mortgage without obtaining the permission of the second spouse. Usually this is practically impossible.

However, there are options to avoid involving your husband or wife in the process of obtaining a mortgage loan:

- divorce;

- conclusion of a marriage contract.

If you decide to take the second path, the question arises of when you can take out a mortgage if the husband has signed the contract. In this case, a mortgage loan can be obtained and issued to the wife in a banking organization immediately after all the paperwork required by the bank has been completed. In this situation, the husband’s consent to draw up a mortgage agreement is not required.