Who should pay income tax

The payment of income tax, as well as advance payments on it, is regulated by Chapter. 25 Tax Code of the Russian Federation. According to it, taxpayers include Russian organizations and foreign enterprises operating through representative offices in the Russian Federation. Exemption from paying this tax is available to those who apply special tax regimes, such as the simplified tax system, unified agricultural tax, UTII, or pay tax on the gambling business. Some tax regimes can be combined, for example UTII and OSNO. In this case, the taxpayer must keep separate records of income and expenses for activities subject to different taxes. Individual entrepreneurs can also apply OSNO, however, in this case they do not pay income tax, but personal income tax, so our article does not apply to individual entrepreneurs.

If the organization has separate divisions, then income tax and advances on it are paid separately at the place of registration. If there are several separate divisions, you can choose one main one and pay tax at the place of its registration for all divisions, notifying the Federal Tax Service accordingly.

How to fill out

So, let’s look at those payment options that accountants have the most difficulty filling out.

Field 5 called “Type of Payment”. This line should be filled out as prescribed by the bank. First, you should ask your banking institution whether it is necessary to fill out this field somehow. When the need for filling is confirmed, then here, at the bank, you should find out which code to enter in this field.

Detail 15 with the account number of the banking institution. When transferring tax payments, this section is not filled in in any way because of this? that the recipient of the funds is not a credit institution.

Field 21 called “Payment order”. If personal income tax is paid, the order of payment is indicated. For example, the number 3 indicates collection taxes. The number 5, in turn, indicates independent payment of taxes.

Field 22 called “Code”. In this field, as mentioned above, the UIN identifier is entered, which consists of 20 or 25 digits.

Field 24 called “Purpose of payment”. This section contains the information that will be needed to identify the payment. Therefore, data such as the name of the tax paid on income, the time for which the tax is paid, as well as the level of the budget where the payment is transferred are entered here.

Field 101 called “Payer Status”. If the company pays taxes for itself, the code “01” is entered. In the same case, when a company pays tax as a tax agent, code “02” is entered.

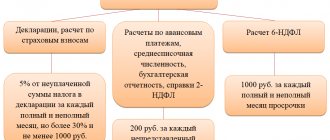

When should you pay tax?

Income tax is paid once a year based on the results of the tax period, which is a calendar year. Advance payments must be made during this year. There are several ways to calculate down payments. They can be calculated and paid monthly or quarterly. There are two calculation options for monthly payments: based on the actual profit received or monthly with an additional payment based on the results of the quarter. Organizations whose average quarterly income for the previous four quarters is less than 15 million rubles pay advances quarterly.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

The deadline for paying income tax is the 28th of the month. Monthly advances are paid by the 28th day of each current month or the next one after the reporting month, depending on the method of calculating the advance. Quarterly advances are paid by the 28th day of the month following the reporting quarter. Income tax is due by March 28 of the year following the reporting year.

If this date is a holiday or weekend, then payment can be postponed to the next working day after that.

How to pay income tax

To pay corporate income tax, you must issue a payment order on paper and take it to the bank or do it via the Internet in the Client-Bank system.

How to upload a payment from 1C to the client bank, read here.

Recently, the law of November 30, 2016 No. 401-FZ allows third parties to pay taxes for the organization.

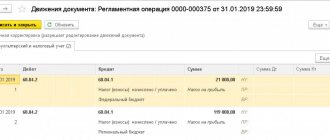

There is no difference in the methods of paying income tax and advances on it. The peculiarity of transferring these payments is that it is necessary to issue two payment orders. Income tax is distributed to two different budgets: the federal and the budget of the constituent entity of the Russian Federation. For each of these budgets there is its own BCC, therefore there should be two payments.

Read more about the main BCCs of income tax in 2019-2020 for organizations in our other article.

The main income tax rates are 17% (subject of the Russian Federation) and 3% (federal budget), established for 2017–2020. However, rates may vary for certain categories of taxpayers depending on the region or type of activity.

Income tax is paid without taking into account kopecks. The amount is rounded according to mathematical rules to the nearest ruble.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

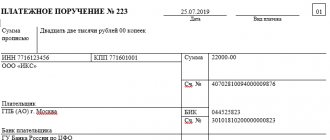

Sample payment order for payment of income tax

Let's look at a sample payment order for income tax in 2019-2020 and look at the most significant fields.

Example

Let Principle LLC be registered in Moscow and pay an advance on income tax in the amount of 10,000.00 rubles based on the results of 9 months of 2020, of which 8,500.00 rubles. falls into the budget of a constituent entity of the Russian Federation, and 1500.00 rubles. - to the federal budget. Advances are calculated quarterly. The accountant fills out two payment orders.

Payment to the regional budget:

Payment to the federal budget:

In these samples, the data of the taxpayer organization is highlighted in blue.

Green - details of the tax office where the payment must be transferred.

In red are the details of the payment itself to the budget.

KBK

By the way, this year minor changes were made to the KBK for payment of contributions and taxes. The table below shows all the codes that will be needed in order to correctly fill out the payment slip this year. Changes that occurred this year are highlighted with an asterisk.

Field 104 called “KBK” must be filled out correctly. So, this code consists of 20 digits, which should be entered in this field. If we talk about current payments, then for them the BCC has not changed at all this year:

- If the funds go to the federal budget (the rate is 2%), then code 182 1 0100 110 is entered.

- When we are talking about the regional budget and the rate from 13.5 to 18%, then the code is 182 1 0100 110.

This year, only the BCC has changed to the KIC, about which Order No. 90 was issued. For such payments it is now written as 182 1 0100 110.

It is also worth entering field 105 “OKTMO” correctly. This code consists of 8 or 11 digits.

How to determine how many numbers to enter? In the event that the tax is credited to the federal budget - 8. The same number will be if the tax is sent to the municipal budget. But if personal income tax is distributed between several divisions at once, which are part of the municipality, then the code will be 11.

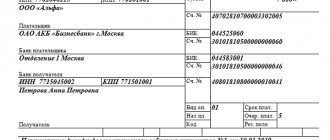

Decoding the fields of a payment order to the budget

Let's take a closer look at filling out a sample payment tax bill for 2019-2020 in the part related to fields 101–109:

- The upper right field 101 determines the payer status. For income tax, set 01 - legal entity paying taxes.

- Field 104 - KBK, the value of which is the same for all payers. It is this that differs when making payments to the federal (KBK - 18210101011011000110) and regional (KBK - 18210101012021000110) budgets. In all other respects (except for the payment amount), the payment slips are filled out identically.

- Field 105 - OKTMO of the organization. Determined by territorial location and taken from the company’s statistical data.

- Field 106 - basis of payment. The full list of grounds is given in the order of the Ministry of Finance dated November 12, 2013 No. 107n. To pay a regular advance or tax, we use the TP code - current year payments. The remaining codes are provided for paying various types of debts.

- Field 107 - tax period. Information about the tax period for which payment occurs is encrypted here. The first fields are filled in with letters indicating the period: month, quarter or year. The next fields are the period number, that is, 1st quarter, 2nd month, and so on. Next is a year. When making non-current payments, it is possible to specify a specific date.

- Field 108 - document number. This refers to the document according to which the payment is made, for example a tax demand. For current payments, set to 0.

- Field 109 - document date. This reflects the date of signing the tax return or the date of the demand and other enforcement documents.

- The purpose of payment should indicate in words what tax is paid and for what period.

Read more about filling out these fields in the material “Sample of filling out a payment order in 2020 - 2020”

Changes in details in payment orders from October 2, 2020

From October 2, new rules for filling out field 101 “Payer Status” of a payment order are in effect (Order of the Ministry of Finance of Russia dated April 5, 2020 No. 58). In payment orders, the following must be indicated in a new way: – the payer’s status in field 101. The payer’s status is indicated by a two-digit code in accordance with Appendix 5 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013; – payment type; - taxable period. The changes apply to credit institutions, Russian Post, and companies receiving international mail. The Ministry of Finance introduced two new payer statuses from October 2 (Order of the Ministry of Finance of Russia dated April 5, 2017 No. 58n): – 27 – credit organizations (branches) that issued an order for the transfer of funds transferred from the budget, not credited and subject to return to the budget; – 28 – participant in foreign economic activity – recipient of international mail. Officials also clarified how to fill out field 107 “Tax period”. In this field you must indicate the period for which you are transferring the tax. For customs VAT, fees and duties, the rules are different. In field 107 you should enter an eight-character customs code (letter of the Russian Treasury dated August 10, 2017 No. 07-04-05/05-660). In field 110 “Payment type” you now need to enter code 1 if you are transferring money to individuals from the budget. For example, salaries for state employees. Using the code in field 110, the bank will check if the recipient has a “Mir” card (directive of the Central Bank dated July 5, 2017 No. 4449-U). More at the seminar “All changes in reporting for 2020: federal standards, accounting policies, income tax, VAT, contributions and personal income tax. New in the Labor Code of the Russian Federation": https://www.sba-consult.ru/event/nds1

Sign up for our seminars and courses

- Seminar Income Tax

- Tax seminars on VAT for accountants

- Accounting 2018-2020

- Wage

- USN and UTII

- Online cash register seminar, cash register equipment (CCT)

- Accounting in non-profit organizations

- Seminar Fixed Asset Accounting

- Accounting in construction

- Tax planning

- Tax audits

- Tax control

- Seminar IFRS (International Financial Reporting Standards)

- Holding management

- Tax seminars

- Seminars for accountants