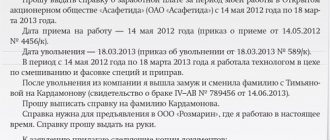

An example of calculating the number of days in a billing period

Sales Manager Kiseleva A.N.

wrote an application for maternity leave in February 2019. The calculation period for determining benefits is 2017-2018. During these 2 years, she had periods of temporary disability: in 2020 - 16 calendar days, in 2020 - 34 calendar days. These are the excluded periods when calculating sick leave in 2019. Therefore, the number of days in the employee’s pay period will be 680 calendar days (365 days, 365 days – 16 days – 34 days).

https://youtu.be/xVzS80BslqM

Example of calculating maternity benefits

P = SDZ × Kdb × %O,

P - amount of benefit;

SDZ - average daily earnings of an employee;

Kdb - number of days of sick leave;

%О is the percentage of payment determined based on the employee’s insurance experience.

At the same time, the algorithm for calculating SDZ in case of illness and sick leave for pregnancy and childbirth (B&C) is different:

- When determining SDZ by disease, the formula is used:

SDZ = D / 730,

D - the amount of income for 2 calendar years preceding the occurrence of the insured event (SS);

730 – constant number of days in the billing period.

For an example of how sick leave benefits are calculated, see here.

- The calculation of SDZ for BiR is carried out according to a similar formula, but the indicator 730 is dynamic:

SDZ (B&R) = D / (730 (or 731 or 732) – ID),

ID - excluded days for calculating sick leave.

The list of excluded periods is given in clause 3.1 of Art. 14 of the Law “On Compulsory Insurance” dated December 29, 2006 No. 255-FZ. This:

- time of illness, child care, pregnancy and childbirth;

- the period of release of a person from work, when he retained a full or partial salary, provided that contributions to the Social Insurance Fund were not accrued from this earnings.

730 (731 or 732) — number of days in the billing period. This indicator is determined on the basis of the employee’s application to change the years for calculating benefits.

For an example of determining the number of days of the billing period for sick leave according to BiR, see the article “How to correctly calculate maternity leave in 2017-2018?”

We invite you to familiarize yourself with: Calculation of work experience: rules, formula, supporting documents

https://youtu.be/RJ7r7gz61oQ

What does the legislation say?

From the moment of employment, each employee is already automatically insured against temporary disability in accordance with the norms of the Federal Law of July 16, 1999 N 165-FZ.

At the same time, insurance consists not only of nominal registration, but also of monthly transfer of contributions to the Social Insurance Fund, which was created with the purpose of accumulating funds to compensate for sick days in the amount specified by law. Federal Law of July 16, 1999 N 165-FZ

Thus, the main regulatory act regulating the procedure for paying for periods of incapacity is Federal Law No. 255, which specifies not only the categories of persons entitled to payment for sick days, but also the rules for calculating length of service, the period that is accepted for calculation and the conditions for assigning benefits, along with with other nuances.

Federal Law of December 29, 2006 N 255-FZ

Also, the procedure for assigning compensation for sick days also depends on the norms of Order No. 624 N, according to which a citizen who seeks help from a medical institution has the right to apply for sick leave, the procedure for issuing which also has its own characteristics.

Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n

Exception Features

The accountant must correctly set the excluded days for calculating sick leave. It is important to have two basic aspects in mind:

- None of the days of illness are excluded from the calculation;

- In the formula for calculating sick leave benefits, 730 of them always appear (for 2 years).

In this case, the type of sick leave does not matter. The calculations will always include 730 days, as required by paragraph 3 of Article 14 of Law of 2006 No. 255-FZ {amp}lt;On compulsory social insurance for illnesses and maternity˃. Even if there is:

- sick leave to look after a child;

- misfortune during the labor process;

- injury sustained during off-duty hours;

- the illness occurred within 30 calendar days after the final departure from the enterprise.

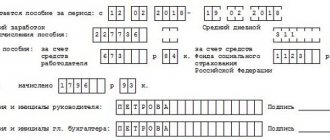

| Amount of daily benefit = Employee’s earnings for the last 2 years (subject to contributions to the Social Insurance Fund / 730 X 100, at 80 or 60 (depending on length of service) |

To be more precise, let’s say which periods are excluded when calculating sick leave in 2020. Thus, when calculating the required benefit, those periods when wages were not accrued are not taken into account. After all, the policyholder did not deduct contributions from her.

Payment for common illness

Performed during illness or injury, including:

- termination of pregnancy;

- in vitro fertilization.

In these cases, the FSS issues compensation starting from the 4th day of illness. From 1st to 3rd costs are borne by the company. When calculating payments, the insurance period is taken into account. This is the period of time during which insurance premiums were paid for the employee. How accruals depend on the number of years of experience is shown below.

| Number of years of experience | Percent | Base |

| Up to 5 | 60% | SDZ |

| 5-8 | 80% | SDZ |

| After 8 | 100% | SDZ |

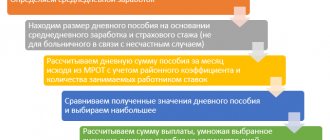

The calculation of sick leave benefits is carried out in accordance with an algorithm by which the values are multiplied:

- SDZ.

- Percentage of experience.

- Calendar days during incapacity.

| ★ Best-selling book “Calculating sick leave and insurance premiums in 2018” for dummies (understand how to calculate insurance premiums in 72 hours) 3000+ books purchased |

An example of calculating the number of days in a billing period

If the employee(s)'s billing period used to calculate maternity, child care, or sickness benefits includes maternity leave or parental leave, then, upon application, one or both years of that billing period may be replaced by earlier ones. But this is only possible if such a replacement of years leads to an increase in the amount of benefits (Part 1 of Article 14 of the Law of December 29, 2006 No. 255-FZ).

Based on paragraph 1 of Art. 14 of Law No. 255-FZ, the employee has the right to replace one or two years taken into account when calculating sick leave payments with other previous periods. This can be done in the case when, in the years used for calculation, she was on labor and employment leave and/or on maternity leave. At the same time, replacing the years for calculating sick leave in 2017-2018 should lead to an increase in the amount of the calculated benefit.

We suggest you read: Divorce from a disabled person consequences

The employer can change the years only on the basis of a corresponding application from the employee.

NOTE! If, as a result of replacing years, 1 leap year falls into the calculation period, then 731 calendar days are taken into account when calculating benefits for the BiR; if there are 2 leap years, then 732 days are included in the calculation.

Paying for family care

Sick leave is also paid when caring for family members of the employee. Below are the nuances that relate to the number of paid days.

| Who cares for | How to treat | Sick days | Total days per year |

| Children under 7 years old | outpatient; together in hospital | Not limited | No more than 60 |

| including, in case of illness from List No. 84n* | outpatient; hospital | Not limited | No more than 90 |

| Children from 7 to 15 years old | outpatient; hospital | No more than 15 | No more than 45 |

| Disabled children up to 15 years old | outpatient; hospital | Not limited | No more than 120 |

| HIV-infected up to 15 l | hospital | Not limited | Not limited |

| Children under 15 liters with: with post-vaccination complications; for malignant tumors | outpatient; hospital | Not limited | Not limited |

| Other diseases | outpatient | No more than 7 | No more than 30 |

*List of the Ministry of Health and Social Development dated February 20, 2008 No. 84.

There are differences in the amount of benefits depending on the age of the patient and the type of treatment.

| Category | Type of treatment | Paid days and % |

| Children under 15 years old | outpatient | 10 days – 100%; other days – 50% |

| Children after 15 years | stationary | All the time - 100% |

| Adults | outpatient | All the time - 100% |

There are a number of restrictions when calculating payments for caring for relatives, but there are no exceptions for determining the PPA. All days are paid by the Social Insurance Fund. Read also the article: → “Sick leave to care for a sick relative: how to get it.”

Excluded periods: list

However, there are still excluded periods when calculating sick leave in 2020. Provided that we are talking about basic maternity benefits. When calculating them, they do not take into account the periods during which:

- temporary illness;

- pregnancy and its outcome;

- babysitting;

- release of the employee from performing his labor functions while retaining his position.

The latter case is usually associated with the performance of state or public duties. For example, as an assessor in court, a witness, an expert, a translator, a member of an election commission, etc.

EXAMPLE

Accountant Lobanova submitted an application requesting maternity leave from March 2020. The estimated time for determining her benefits is the period 2020 and 2020. Over the course of these two years, she had moments when she took sick leave:

- in 2020 – 12 calendar days;

- in 2020 – 23.

These days should not be taken into account when calculating benefits in 2020. As a result, the number of days in the employee’s pay period will be: 365,365 – 12 – 23 = 695.

P = SDZ × Kdb × %O,

P - amount of benefit;

SDZ = D / 730,

What you need to know when calculating sick leave

FLN = SZ × KST × KO,

FLN - actual compensation for the certificate of incapacity for work;

SZ - average earnings;

KST - coefficient depending on length of service;

KO - the number of paid sick days.

Each of the formula indicators is determined within the framework of a rather complex algorithm.

In addition, the result of the calculation using the above formula depends on establishing:

- minimum and maximum compensation for a certificate of incapacity for work;

- some limits taken into account when calculating sick leave;

- payments that should not be included in the calculation of sick leave.

These procedures are carried out by an accountant in all scenarios for calculating the amount of compensation for a certificate of incapacity for work.

When determining the amount of payments made to an employee and his length of service, the following should be fundamentally excluded from the calculations:

- days when an employee is on leave at his own expense, for study, for child care;

- days on which the employee did not work due to downtime (if he got sick during the downtime period);

- days of added leave if the employee went on paid sick leave during the days of paid leave due to the need to care for a child or other relative.

Moreover, if the employee himself gets sick, the employer provides him with days of added vacation and pays for them in the amount determined by the FLN formula.

There are 2 blocks of main points that you need to know before starting the calculation.

1st block - initial calculation parameters

1. Who pays for sick leave:

- for illness and injury (non-occupational):

- the first 3 days - by the employer;

- subsequent days - from the FSS budget;

- for the entire period - from the FSS budget.

2. Who is paid sick leave:

- employees under an employment contract;

- recipients of funds from which contributions to the Social Insurance Fund are paid.

IMPORTANT! Foreign citizens temporarily staying in Russia and working in Russian organizations are also entitled to sick pay if they have an employment contract and the employer (insurer) has paid contributions for the foreigner to the Social Insurance Fund for 6 months prior to the month in which the incapacity occurred (Article 2 of the law “ On compulsory social insurance in case of temporary disability and in connection with maternity" dated December 29, 2006 No. 255-FZ).

3. How sick leave is paid.

Calendar days of incapacity for work (indicated on the sick leave certificate) are paid. The exceptions (under Article 9 of the Law “On Mandatory Social Insurance...” dated December 29, 2006 No. 255-FZ) are the periods:

- downtime;

- suspension from work;

- other exemption from work with full or partial compensation, except for annual basic leave;

- the employee’s stay in custody or arrest;

- conducting forensic and medical examinations.

2nd block - indicators for calculation

| Working experience (during which insurance premiums were paid), in years | Percentage of average earnings limiting sick leave payment, in % |

| Up to 5 | 60 |

| From 5 to 8 | 80 |

| From 8 | 100 |

NOTE! If the incapacity for work occurs as a result of an occupational disease or an emergency at work, 100% of earnings are immediately taken into account. In this case, the maximum payment for sick leave is limited to 4 times the monthly insurance payment in the Social Insurance Fund (Article 9 of the Law “On Compulsory Social Insurance against Industrial Accidents and Occupational Diseases” dated July 24, 1998 No. 125-FZ).

Restrictions on payments based on length of service do not apply to sick pay for maternity leave.

Read about calculating sick leave for pregnancy and childbirth here.

2. Calculation period. It is 2 years before the year of sick leave. Includes all payments from which contributions to the Social Insurance Fund were calculated, including from other employers (Article 14 of Law No. 255-FZ).

3. Divider to obtain the average daily earnings. For sick leave, the figure of 730 is always used. An exception here would be calculations related to maternity benefits. For them, the formula (if we are not talking about determining the minimum or maximum benefit amount) takes the actual number of days in the calculation period, from which the duration of certain periods must be subtracted.

For more information about the features of recording the number of days in a period for sick leave for pregnancy and childbirth, see the material “When you give sick leave for pregnancy and childbirth.”

The employee was hired by the organization under an employment contract on July 1, 2017. This is her first place of work. The employee's salary is 28,000 rubles. In December, she was paid a year-end bonus in the amount of her salary. On January 14, 2019, the employee went on maternity leave.

To calculate sick leave for pregnancy and childbirth, you need to calculate the following values:

- Average earnings for 2 years (January - December 2020 January - December 2020) amounted to 296,000 rubles. This means that the average daily earnings are 405.48 rubles. (296,000 / 730).

- Let's determine how much the average daily wage is according to the minimum wage:

11,280 × 24 / 730 = 370.85 rubles.

No minimum wage calculations were needed. We take as a basis the calculation option that is more beneficial for the employee based on the amount of earnings over the last 2 years.

IMPORTANT! If the length of service is less than 6 months, the calculation is made only according to the minimum wage.

- Compare the average daily cost with the maximum:

RUB 405.48 {amp}lt; RUB 2,150.68

It is less than the maximum amount of sick leave in 2020 according to the maximum value of the insurance premium base (RUB 2,150.68).

We invite you to familiarize yourself with the Order on additional payment up to the minimum wage - sample 2019

140 (calendar days) × 405.48 = 56,767.20 rubles.

For more examples of calculating sick leave, see here.

In 2020, when calculating a certificate of incapacity for work, the calculation period is considered to be 2 calendar years preceding the year:

- onset of the disease;

- maternity leave;

- parental leave.

To calculate a more favorable average salary, periods at the employee’s request can be replaced by previous calendar years (year). But only in a situation if this ultimately leads to an increase in the amount of benefits.

According to paragraph 1 of Art. 14 of Law No. 255-FZ, the periods for calculating sick leave can be replaced if the employee has had no income for 2 years due to maternity or child care leave. Social Insurance, in a letter dated November 30, 2015 No. 02-09-11/15-23247, explained that it is possible to replace the years for calculation only with the years immediately preceding maternity leave.

It should be borne in mind that this procedure for calculating sick leave is not the responsibility of the employer, but the right of the insured person. Therefore, it is important to receive a statement from the employee, which will indicate his will and an indication of those years that will relate to the new billing period. As a result, sick leave benefits in the current period should increase, otherwise this calculation procedure cannot be used.

The Social Insurance Fund also indicates the right to choose the year that was not fully worked (this could be the year of leaving maternity leave or the year in which maternity leave began). Non-consecutive years can also be used as a calculation period if, for example, the employee worked during the year between 2 maternity leave.

Example

The employee was on maternity leave from March 2020 to November 2019, after which she returned to work. In May 2020, she goes on sick leave. For previous years her income was as follows:

- 2015 - 115,000 rubles. (full year worked);

- 2016 - 379,000 rubles. (full year worked);

- 2017 (before going on maternity leave) - 84,000 rubles;

- 2018 - no income;

- 2019 (after leaving maternity leave) - 34,000 rubles.

The employee understood that if her earnings in 2020 and 2020 were taken to calculate her benefits, then as a result she would receive sick pay based on the minimum wage. Therefore, she compared her earnings for the years preceding her maternity leave, combining them in different combinations.

NOTE! When calculating the average earnings for temporary disability benefits, we always divide the salary for the billing period by 730. No periods are excluded from the calculation, and the denominator does not change, including if there were leap years (Part 3 of Article 14 of Law No. 255- Federal Law).

| Period | Calculation of average earnings | Average earnings amount |

| 2015 and 2020 | (115 000 379 000) / 730 | RUB 676.71 |

| 2016 and 2020 | (379 000 84 000) / 730 | RUB 634.25 |

| 2017 and 2020 | (84 000 34 000) / 730 | 161.64 rub. |

Having found out that the highest average earnings would be received if 2020 and 2020 were used as the calculation period, the employee wrote a statement indicating this particular period.

To learn about the nuances when calculating average earnings, read the article “Average daily earnings for calculating sick leave.”

Are weekends included in sick pay?

The question of whether weekends are included in sick leave can be answered unequivocally: yes, these days are paid in the same way as workers included in sick leave. The calculation of average earnings is the same for them, however, there are periods during which sick days are not paid (neither workdays nor weekends). According to Art. 9 of Law No. 255-FZ, such time periods include:

- detention of an employee;

- vacation at your own expense;

- administrative arrest;

- downtime, if the illness occurred during this period;

- period of forensic medical examination;

- the period of suspension of an employee from work, provided that no salary was accrued to him.

The FSS explains: “Should I pay benefits if a person gets sick on vacation at his own expense?”

Is it necessary to adjust the average earnings for part-time employment?

An employee hired under an employment agreement in the event of a period of temporary incapacity for work can count on payment for this time according to the rules established by law. The source of funding for sick leave payments is from the employer and the Social Insurance Fund. To calculate disability benefits, it is very convenient to use the sick leave calculator in 2020.

Online calculator: make calculations quickly and correctly

For the rules for calculating sick leave in 2020, see Federal Law No. 255-FZ dated December 29, 2006. According to the rules of the law, it follows that the amount of benefits for temporary disability and maternity leave is determined by multiplying the amount of the daily benefit by the number of calendar days that fall during the period of temporary disability and maternity leave.

Only payments from which contributions to the Fund were paid can be taken into account. If an employee joined your organization less than two years ago, you will have to obtain a certificate of income from the previous place of work, or request it from the Pension Fund.

It is worth noting that under the simplified tax system, only that part of the benefits that is not reimbursed by the Social Insurance Fund can be taken into account. In other words, this is only a benefit due to temporary disability for the first three days of illness. Therefore, the amount for these days can be included in the tax base under the simplified tax system. If the object is “income minus expenses”, then it is included in the expenses of the “simplified”, and if the object is “income”, then in the tax deduction line. This is approved by Article No. 346.16, paragraph 1, subparagraph 6 and Article 346.21, paragraph 3.1 of the Tax Code of the Russian Federation.

Maximum amount of disability benefit

Even if a person worked under an employment contract, but an unscrupulous employer did not pay insurance premiums for him, this work time is also not included and is excluded from the calculation. In this case, the worker may demand payment for a certificate of incapacity for work. In the absence of a positive response from the manager, he will have the right to apply to the court, the prosecutor's office or the labor inspectorate for the protection of his violated rights and legitimate interests.

In the process of determining wages, the full 12 months of service are taken into account. In other words, the salary is divided by 12, and then divided by another 29.3. The second indicator is the average number of calendar days per year. The resulting average salary is divided by the total number of working days. In this case, the schedule of a standard six-day week is taken as a basis.

If there are 0 such days, then vacation pay will not be accrued. The legislation of our country states that while on leave due to pregnancy, the employer is obliged to count the length of service and provide paid leave.

Conclusions for 2020

The excluded periods when calculating sick leave in 2020 should not be confused with:

- restriction by law on the days of payment (as a rule, these are cases of long-term care for children with complex diagnoses, after-care in sanatorium conditions);

- periods that are not subject to insurance premiums (for example, release from office for public purposes, detention, arrest, partly downtime).

We invite you to familiarize yourself with: Rules for drawing up a gift agreement

The calculation period for calculating benefits for temporary disability, maternity and child care benefits is the same: the calculation period is two calendar years preceding the year of temporary disability, maternity leave, parental leave up to one and a half years ( Part 1 Art.

When calculating average earnings to pay for maternity leave and parental leave, the following periods must be excluded from the calculation period (Part 3.1 of Article 14 of Law No. 255-FZ):

- temporary disability;

- maternity leave;

- maternity leave;

- releasing an employee from work while maintaining wages, if they were not subject to insurance contributions for VNiM.

When calculating average earnings for sick pay, there is no need to exclude any periods from the calculation period.

If the employee(s)'s billing period used to calculate maternity, child care, or sickness benefits includes maternity leave or parental leave, then, upon application, one or both years of that billing period may be replaced by earlier ones. But this is only possible if such a replacement of years leads to an increase in the amount of benefits (Part 1 of Article 14 of the Law of December 29, 2006 No. 255-FZ).

If you find an error, please highlight a piece of text and press Ctrl Enter.

Monthly assistance provided when caring for a child up to 1.5 years old

Paid to any family member actually caring for the child. Its size is 40% of the NW.

The benefit is calculated according to the following algorithm:

SDZ is calculated. SZ for 2 years is divided by the number of calendar days, excluding periods of stay:

- on a sick leave;

- on maternity leave;

- on vacation with a child under 1.5 years old;

- during the period of release from work while maintaining payment.

SDZ is multiplied by 30.4 and 40%.

Example 3. Manager Kolesnikova I.K. planning leave to care for a child up to 1.5 years old in May 2020. Her working career began in December 2014. In 2020, she was on maternity leave.

- The sum of days for calculation is 365+366 = 731. 140 days must be subtracted from this period. 731 – 140 = 591

- Earnings 2020 – 425,000.55 rubles, 2020 – 331,551.76 rubles.

- 425000.55 + 331551.76 = 765552.31 rub.

- SDZ = 756552.31: 591 = 1280.12*60% = 768.07 rub.

- The benefit is equal to: 768.07 x 30.4 x 40%. = 9339.73 rub.

When calculating the SDZ for child care benefits up to 1.5 years old, the days that fell on maternity leave were subtracted from the number of people actually worked. The entire benefit amount comes from social insurance.

How to get the maximum maternity benefit without large salaries?

Important!

Strictly

Those. You need to first calculate maternity benefits on a calculator. And if the benefit is greater than that calculated according to the minimum wage, then the maternity leaver must write a statement indicating the periods that need to be taken when calculating 2020.

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

Note: Keep in mind that the calculation takes into account the real payments that were then, which are not indexed in any way.

Example: Employee of OJSC Gazprom V.S. Vyakhereva. goes on maternity leave in April 2014. In June 2013, she returned from another maternity leave, which she had been on since March 2010. The maternity maid has been working at this magical OJSC since March 2007. Thus, 2012 is “empty” for her, and 2013 is “half empty”.

Note: This is the only exception to the general rule. In all other cases, benefits must be calculated based on earnings for the last two calendar years.

Another example of calculating maternity benefits in a situation from maternity leave to maternity leave. The woman worked in the organization from 2010-2011, and in May 2012 she went on maternity leave. He is on maternity leave until June 2015 to care for a child under 3 years old. In May 2020, the date for the second maternity leave is due. Do I need to go back to work or immediately apply for maternity leave?

No, it is not necessary, since you can replace the calculation period for 2011 and 2012 by submitting an appropriate application without interrupting your child care leave. Even if you go out for 1 day, they should still, according to your application, take the 2 years of work you indicated - 2010 and 2011. Because you have no earnings for the previous 2 years. Replacing a period is an exception to the rule in a situation “from maternity leave to maternity leave.”

How to get the maximum maternity benefit without large salaries?

In 2020, the employee had sick leave under the BiR, then vacation for up to 1.5 years. In 2020 until August, vacation continuation up to 1.5 years, then vacation up to 3 years. At the beginning of 2020, she again goes on leave for the BiR. Thus, her accounting years are 2020 and 2020:

- 2015 = 0

- 2016 - the employee interrupts her vacation for several days and goes to work part-time, earns an average daily salary of more than 1,700 and again goes on maternity leave.

Thus, it turns out that all the time she is either on sick leave or on maternity leave and these days are excluded from the calculation of average daily earnings.

Calculation of maternity benefits:

2015= 0/(365-365)=0

2016 = 6000/(365-363) = 3000 rubles, which is more than the maximum average daily earnings.

So, any (even small) amount received with a zero number of days taken into account leads to the maximum benefit!!!

2015= 0/(365-365)=0

2016 = 6000/(365-363) = 3000 rubles, which is more than the maximum average daily earnings.

So, any (even small) amount received with a zero number of days taken into account leads to the maximum benefit!!!

Important!

Strictly

https://www.youtube.com/watch?v=ytadvertiseru

2015= 0/(365-365)=0

Common Mistakes

Despite fairly clear legal provisions for calculating sick leave, some employees still make mistakes.

In particular, the most common are:

- taking into account the actual number of calendar days in two years, taking into account the leap year, while by virtue of Resolution No. 375 only the coefficient of 730 should be applied;

- payment for sick leave, which, in fact, are a continuation of each other, taking into account the norms of Article 3 of Federal Law No. 255 at the expense of the employer for both leaves, while the disease is still considered one and, accordingly, the company pays only three days for the first sick leave , and not according to subsequent ones;

- payment for periods of incapacity over the limit of days per year specified in Article 6 of Federal Law No. 255;

- calculation of sick leave for a dismissed employee in an amount proportional to the length of service worked, and not at the level of 60% established by Federal Law No. 255;

- Sick leave is paid to a part-time worker only if he has been employed by the same employer for at least two years; if the worker has worked in several companies for less than the specified period, sick leave is paid only at the main place of employment.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions - 8 (800) 222-69-48

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Sick leave