When receiving temporary disability benefits, the employee must understand that the payment comes not from the enterprise budget, but from the social insurance fund. It doesn't matter where a person works. If he pays taxes and contributions, he has every right to social support.

A certificate for 2 years for calculating disability payments, form 182N, is issued upon dismissal or in other cases, upon a written request from a citizen.

This document is filled out by the head of an organization or a separate division based on data received from the accounting department. A sample form of a salary certificate from a previous place of work for calculating sick leave is a document on three sheets, consisting of four sections.

Section 1

It is called “data about the policyholder,” that is, about the organization that made contributions to extra-budgetary funds.

This includes:

- Full legal name. Abbreviations or writing “brands” are unacceptable; if a person worked at Krasny Divan LLC as a salesperson, and the workplace was a “Buy Cheap” store, then it is necessary to write Krasny Divan LLC.

- In which territorial social insurance body was the citizen insured?

- Registration number of the enterprise in the social insurance system.

- Individual taxpayer number (TIN).

- Legal address. In the example given, the registration address of Krasny Divan LLC is written, and not the location of the store.

The document is intended to ensure that at a new job they can correctly calculate and accrue sick leave.

Section 2

In the second section, the certificate form for calculating sick leave from a previous place of work contains:

- Full name. It is unacceptable to write “A. B. Pribylny" instead of Anton Borisovich Pribylny.

- Full passport data - series, number, by whom and when issued.

- Address. It is not the address where the given citizen lives that is written, but the one written in the passport.

- SNILS – Insurance Number of the Individual Personal Account of a citizen of the Russian Federation in the compulsory pension insurance system. In order to avoid unnecessary bureaucracy, the social insurance system uses the identification of the pension system.

- Period of work at the enterprise. Since the calculation of temporary disability occurs based on the last two years, two lines are allocated for this.

Section 3

Information about the income that was received at this place of work over the past period, broken down by year. Several lines, in each of which the amount of the taxable base is written in words. Written in numbers and words.

At the same time, the upper limit is limited, since the amount is above 718 thousand rubles. not subject to payments

(data for 2020). Both a millionaire and an ordinary hard worker who received 800,000 rubles in a year will receive the same amount on sick leave.

Section 4

Number of days missed due to illness. The fact is that while a person is on sick leave, he is paid money from the insurance fund. These funds are not subject to insurance encumbrance. The number of days missed due to illness is indicated and a separate line indicates leave for pregnancy or raising a child. Each period has a start and end date.

The certificate is signed by the head of the company or individual entrepreneur, and the chief accountant also puts his signature. A round stamp is placed and the date is entered.

The document is prepared in printed form, or filled out with a blue ballpoint pen, free certificate 182N about the amount of wages can be

, officially it is called “Appendix No. 1 of April 30, 2013 No. 182n.”

Why do you need certificate No. 182N

The full title of the document consists of more than a hundred words, which a simple citizen cannot understand in principle; bureaucratic language for a normal person is not much different from bird language.

If you try to understand the name of the certificate for calculating sick leave from a previous place of work for an ordinary person and what it is used for, it will become clear that the document is intended to ensure that sick leave can be correctly accrued at a new job.

The law provides that payment for temporary disability is directly dependent on income for the last two years; the higher the income, the more money the insured person will receive.

Therefore, a rule has now been introduced according to which the employer is obliged to issue Form 182H upon dismissal, along with the work book and the final payment.

If the document has been lost, you must provide a duplicate of it, which is issued by the same company.

This is why certificate 182N is needed; a sample of filling out the form is not required, since it is impossible to make a mistake when writing it. You just have to take into account that you won’t be able to write it entirely by hand; it’s a titanic effort to rewrite the full title and note. It is much easier to print and fill out the form. ()

An individual entrepreneur has the right to conduct business without using a seal or involving the chief accountant; one signature will be enough.

https://youtu.be/jmybh7PybMw

Why do you need a 2-NDFL certificate for a new job?

When you leave your job and move to a new organization, you provide some documents for employment. The list of papers may also include a 2-NDFL certificate. It may be required by the accounting department. It is not always clear to employees why a new employer needs it.

The fact is that taxes are deducted for each employee. Personal income tax of 13% is deducted from your monthly earnings. The accounting department does this for you, and you receive in your hands the amount from which the obligatory payment to the tax office has already been deducted.

When paying personal income tax, there are certain deductions that reduce the tax base. That is, you have the right to pay tax not on the entire amount of earnings, but on the remainder after deduction. This discount is provided to some employees, and the amount depends on the preferential categories of citizens specified in the laws.

Deductions are calculated monthly until the amount of your earnings for the reporting year exceeds 350,000 rubles. As soon as this limit adds at least a ruble, deductions are no longer allowed. Then you will pay tax on all income.

In order for the accountant to figure out what deductions you used at your previous place of work and to view the total amount of your earnings for the reporting period, you must provide a 2-NDFL certificate. This way, the accounting department will be aware of your accruals and will be able to apply a deduction to you if it is due.

Calculation of average salary for two years

At first glance, everything is simple. The received salary is taken, divided by the number of working days, and the daily income is obtained. In practice, everything is somewhat more complicated.

Not working days are taken into account, but calendar days

. On weekends, the patient must also eat, and besides, there are different schedules, the watchman guards the garage on a daily basis, and the accountant works 5 days a week.

During periods of illness or child care, contributions are not paid. In this case, two full calendar years preceding the current one are taken into account.

Therefore, to calculate the average salary, the income received during the year is taken and divided by the number of calendar days, minus periods of incapacity for work. Although the amount received is called the average salary, this definition is not entirely correct, since additional types of earnings are also taken into account, such as bonuses, incentives and overtime.

How is a certificate prepared for calculating a temporary disability certificate? When and by whom is it issued, what to do if such a document is lost, and how to correctly calculate benefits.

Let's look at the basic rules that apply to these issues. Each company employee may experience a situation where he is temporarily unable to perform his duties at work.

The reasons may vary. But the most common situations are going on sick leave due to an illness, in which a person can also receive a certain amount. To do this, you need a certificate to calculate sick leave.

General information

What is sick leave, and when will you need a certificate to calculate disability certificates? – These are the main issues that workers and their employers should understand.

What it is?

A certificate for sick leave is the main document on the basis of which benefits for payments are calculated.

A sick leave certificate is a document that is evidence of an individual’s unfitness to perform work when the cause is injury or illness.

Sick leave gives you the right not to go to work until you have fully recovered. For the period when a person is disabled, he must receive compensation in monetary terms.

And to receive such funds you need a sick leave. In cases where the costs of paying benefits are not confirmed by the original sick leave certificate, the Social Insurance Fund does not recognize the costs.

As a result, you need to pay insurance premiums (). But a citizen has the right to challenge such a decision. To do this, you need accounting certificates for calculations for sick leave.

Cases of granting sick leave

A certificate of incapacity for work may be issued in cases where an individual cannot fulfill his work obligations:

- during pregnancy;

- due to illness;

- upon receipt of a work injury;

- during an operation (artificial termination of pregnancy, in vitro fertilization);

- if it is necessary to care for a sick person who is a family member;

- due to quarantine (for children under 7 years of age, when they cannot attend a child care facility, or for another disabled family member);

- for prosthetics according to doctor’s indications, which is carried out in a hospital;

- during follow-up treatment after a hospital, the premises of which are located within the territory of the Russian Federation.

If sick leave is issued in connection with quarantine, the terms will be determined taking into account the period of isolation of the sick person who has suffered an infectious disease or has come into contact with it.

An employee of a public catering, water supply or child care facility who has helminthiasis will be issued a certificate of incapacity for work for the entire duration of treatment.

If a citizen works part-time in several companies, he can receive temporary disability benefits for each place of work ().

To do this, you need to submit a separate certificate of incapacity to each company. But the form must indicate that the employee of the enterprise works part-time.

You will not be given sick leave when:

- there are no signs of the disease;

- the person undergoes examination, examination, treatment in a medical institution as directed by the military commissar;

- the person is under arrest;

- the person undergoes a periodic medical examination (also at the pathology prevention center);

- a person (also with chronic illnesses, when there is no deterioration in health) is examined or attends procedures in a clinic;

- Prosthetics are performed in the clinic.

One-time visits to a medical facility must be confirmed by certificates instead of a sick leave certificate.

The legislative framework

The issuance of a certificate of incapacity for work is carried out in accordance with the rules prescribed in.

Paragraph 67 states that sick leave benefits are calculated separately and attached to the ballots. But there is no regulated form of payment.

This means that such a certificate can be drawn up in any form. The certificate of incapacity for work is approved by law.

The form on the amount of earnings is established (form 182n).

What certificate must be provided to calculate sick leave?

Let's look at what the Russian legislation says about this.

Where can I get it?

The certificate form can be found on the Internet (at). This document can be issued by a doctor during an examination.

But you cannot receive benefits based on such a certificate. You will need a certificate from your place of work for sick leave for the last couple of years. The accounting department of the company where the citizen works enters information into the certificate and calculates benefits.

In some cases, the calculation will be made in accordance with the minimum wage established in the region. Eg:

- if the disease occurs while taking drugs, alcohol, toxic drugs;

- in case of violation of the hospital regime and such a circumstance is recorded;

- a person did not show up for an appointment with a doctor without good reason.

The doctor will record such violations on the disability sheet.

Sample document

Let's figure out what information is reflected in the certificate:

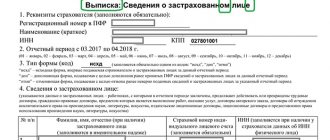

- In section 1, enter information about the name of the organization for sick leave.

- The second section contains data about the company employee for whom calculations are made.

- The third section is necessary to reflect data on payments with insurance transfers in favor of the employee who receives the document. All indicators are entered year by year in each column separately. Current information is also reflected.

- In the fourth section, enter the number of days when a company employee was on sick leave and his salary was kept without insurance accrual. These are the so-called excluded periods (according to).

The information in sections 3 and 4 must match.

Let's figure out how to fill out the certificate. All information on the form is written in black or blue ink. It is also possible to fill it out on a computer.

Excluded periods are reflected in separate columns. They write the start and end dates, indicate “temporary disability”, “pregnancy and childbirth”, etc.

The basis for compilation is data from the accounting and reporting of policyholders. It is necessary to put the company seal in such a way that the remaining details are readable. The signature is affixed by the director of the organization and the chief accountant.

If there are corrections in the document, it will be considered invalid. The certificate reflects the following information:

- what is the name of the certificate for calculating sick leave;

- type of benefit accrued;

- number and date when the certificate is drawn up, as well as when the sick leave is issued;

- Full name of the employee;

- Personnel Number;

- TIN, SNILS;

- position held;

- division of the company.

The document states:

- the period when the person was incapacitated;

- the number of days when the citizen was on sick leave;

- reasons for being on sick leave (codes are set);

- employee's length of service;

- the amount of compensation payments as a percentage;

- billing periods.

Information about the person's earnings:

- the amount of earnings paid for certain periods;

- maximum when calculating insurance amounts;

- funds that are taken into account when calculating compensation.

If an employee has been working for a company recently, then when determining the amount of benefits, data on the profit that was received from another employer in the billing period is needed.

Average daily earnings are also calculated:

- actual amount received;

- maximum average salary;

- salary indicator based on the minimum wage (if necessary);

- average salary for benefit calculations.

If the duration of the insurance period is no more than six months, the benefit will not exceed the minimum monthly wage (part 6 of article 7, part 3 of article 11 of act No. 255-FZ, paragraph 20 of the Regulations approved).

It is allowed to indicate the benefit with the deduction of personal income tax and separate tax indicators that are withheld from the benefit. Non-taxable payments are indicated in.

Established shelf life

An employee of a company can contact a regulatory authority, which has the right to bring the employer to administrative liability for.

It is worth knowing about some conditions for restoring a document if lost:

- Find out whether the sheets have been paid for or not.

- If the sick leave is lost before payment, then you should follow clause 1.14 of Instruction No. 455.

- If you lose the form, a medical institution employee will issue a duplicate certificate. The basis for this will be a document from the employer stating that no payments were made.

- If the certificate of incapacity for work is lost after payment due to force majeure situations, a duplicate will not be issued. But it is possible to restore primary documentation, which is related to sick pay. Restoration is possible in accordance with clause 6.10 of the Regulations on documentary support of accounting entries (Order No. 8 of May 24, 1995).

In accordance with the rules prescribed in legislative document No. 04-29-2541 dated November 26, 2007, the company must provide confirmation of the justification for payments on lost forms.

This is necessary in order not to return sick leave benefits to the Social Insurance Fund in case of violation of standards. The company should act like this:

- first, she receives documentation that will confirm the occurrence of force majeure. It could be:

- Document from housing and communal services.

- Certificates from the fire service.

- Judgment.

- Document from the regional body of the State Emergency Service, etc.

- Next, the primary documentation is restored, which was the basis for the accrual and payment of sick leave benefits. The company contacts the medical institution that issued the lost document.

- the company must restore all certificates that are related to accruals and payment of disability benefits. Otherwise, the company will be held liable for violations of laws. A representative of the organization contacts the FSS and receives photocopies of the lost certificates.

- if the person responsible for the loss is responsible, the certificate cannot be restored. Such an employee will reimburse funds that the employee received unreasonably.

If sick leave paid for using FSS funds is lost, the amount of the benefit is returned to the person responsible. The policyholder also:

- notifies the regional office of the Social Insurance Fund about the identification of errors;

- corrects errors in submitted reports.

If such actions are performed before the inspection, the company will not face a fine. Otherwise, fines will be assessed.

What is needed to calculate benefits

When making calculations, you should rely on the rules prescribed in Law No. 255-FZ of December 29, 2006. The calculation period is considered to be 2 years before the time when the citizen went on sick leave.

The following can receive benefits:

- company employees who fulfill their obligations in accordance with the employment contract;

- state and municipal employees, as well as persons holding public office;

- members of a production cooperative;

- persons who have been convicted and perform paid work.

The amount of the benefit will be determined taking into account the length of service:

How is the benefit itself calculated? They take into account earnings for the last 2 years with allowances, bonuses, coefficients and other payments.

The final indicator is divided by the number of days worked by the company employee in the billing period. The days of vacation and sick leave are reflected. The minimum amount should not be less than the minimum wage.

Let's derive the formula:

Let's give an example. In 2013, Ivanova A.A. works in Moscow. She filed a certificate of incapacity for work due to illness, which lasted 12 days. Citizenship experience - 9 years. In 2011, Ivanova was on sick leave for 20 days.

The payments were as follows:

| Year | Salary | Additional payment for experience | Sick leave | Vacation |

| 2011 | 240 thousand | 48 thousand | 10 thousand | 15 thousand |

| 2012 | 240 thousand | 48 thousand | 15 thousand | |

| Total | 480 thousand | 96 thousand | 10 thousand | 30 thousand |

Since the experience is more than 8 years, Volkova should receive 100%. Let's do the calculations.

Of all the amounts received, only sick leave will not be subject to insurance premiums. We summarize all other indicators:

Let's calculate the average daily earnings:

Number of days – 731 (2 years). From these it is worth subtracting the days when Ivanova was temporarily disabled (20 days).

Average salary per day:

Benefit amount:

A certificate for calculation is a document without which you will not receive benefits. Therefore, it is worth knowing all the nuances of issuing and filling it out. This way you will control the situation and receive the due amounts in a timely manner.

In view of recent changes in the current legislation on the issue of calculating average wages, there is an urgent need to change the reporting form.

For this reason, a certificate in form 4n was developed back in 2011, but soon some shortcomings were discovered in it.

This form did not have fields in which it would be possible to indicate periods of incapacity for work or absence from the workplace of citizens due to the birth or upbringing of children.

Thus, in April 2013, the Ministry of Labor of the Russian Federation approved a new form 182n

, in which these shortcomings were corrected.

Today, few people know how to obtain a certificate in form 182n. When is it not necessary to provide the original document? What to do if it is simply impossible to obtain this certificate?

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how to solve your specific problem

— contact a consultant:

(Moscow)

(Saint Petersburg)

(Regions)

It's fast and free

!

Form of income certificate for calculating sick leave

It should be noted that there is a certain form of certificate numbered 182 (formerly 4n), approved on April 30, 2013 by Order of the Ministry of Labor, which must be completed and issued to the employee, either at his personal request or due to dismissal.

If an individual leaves a certain workplace permanently, then when he is given a document on income for the last 2 years from his previous place of work, he has the opportunity to use it at a new job.

The responsibility for calculating and paying disability benefits lies with the employer.

If an employee has worked less than the period that is the basis for calculating benefits, then the employer needs to take the data somewhere. This is exactly what certificate 182n from your last place of work is used for.

Otherwise, in the absence of such a certificate, the calculation will be minimal. The accounting department will produce it, referring to the officially established minimum wage on the territory of the Russian Federation.

Find out whether sick leave is included in the calculation of vacation pay in our article.

The information that must be included in this certificate form is taken from documentary records that reflect information about all business transactions of the organization. If the company has a seal, it must be affixed.

A photocopied form of income certificate also has legal force, but only if it is certified by a notary or a person who has the authority to issue this document.

Purpose of this document

The approved form 182n fully fulfills the functions assigned to it in accordance with the Federal Law “On Compulsory Social Insurance due to Temporary Loss of Legal Capacity” No. 255 of December 2006.

According to the established norms of the law of the Russian Federation, the calculation of all types of benefits is carried out on the basis of the average salary

over the past few years preceding the year when there was an urgent need to determine the amount of benefits. For this reason, in the certificate on Form 182n you can see the total amount of all payments to the employee for this period.

It should be noted that the certificate indicates only those payments

, from which contributions to the Social Insurance Fund were withheld.

In addition to the average salary, to determine the amount of benefits, you also need to know the average salary for 1 day worked. If we take into account the fact that for benefits due to disability, the entire amount earned is divided into 730 days (2 years), then to determine the amount of maternity benefits, wages are divided by the number of days that were worked in a given period of time . For this reason, Form 182n indicates the days when the employee was on sick leave or on maternity leave.

The entire responsibility for calculating and paying benefits within the framework of the current Federal Law “On Compulsory Social Insurance due to Temporary Loss of Legal Capacity or Maternity” falls on the direct employer. If the employee worked less than the period required for calculation, then certificate 182n is the basis for the employer from the previous place of work.

Need for provision and responsibility

The list of attributes required to conclude an employment contract with a hired employee does not include a certificate from the previous place of work on accrued wages. Providing the document is more in the interests of the employee himself, since if he is absent, the new employer in the event of illness will not be able to take into account income for a given period above the minimum wage.

certificate for calculating sick leave 182n

The unified certificate for calculating sick leave 182n was approved by Order of the Ministry of Labor dated April 30, 2013 with the number contained in the document. It came into force on July 2, 2013, automatically canceling the previously valid form 4n. Legal entities and individuals are required to issue a form:

- upon dismissal along with the work book, form 2-NDFL on the last day of the employment relationship;

- at the request of the former employee within three working days from the date of application.

- How does an electronic sick leave work?

An employer, using a certificate for accruing sick leave issued by another organization, during inspections is responsible to the Social Insurance Fund for the correctness of the calculation. If social insurance, through its channels, recognizes the reflected information as unreliable, then non-acceptance of the amounts for credit and the imposition of financial sanctions will be carried out on the enterprise or entrepreneur that calculated and paid the benefits.

To check and be on the safe side, the fund’s management recommends two ways:

- Appeal to the Social Insurance Fund by drawing up a specially provided request in form No. 20n dated January 24, 2011. Confirmation removes responsibility from the applying legal entity or individual for the correct calculation of benefits.

- Drawing up a request in form No. 21n to the Pension Fund of the Russian Federation, including:

- an appeal from the insured person explaining the situation (inability to contact the management of the former employer, liquidation, reorganization, etc.);

- a request from a current employer to provide information about income, accompanied by a citizen’s appeal.

Filling rules

If you turn to the order of the Ministry of Labor, which approves the certificate in form 182n, then it contains brief instructions on how to fill it out.

This form includes several blocks

, namely:

- information about the direct employer (name of the enterprise, management initials, etc.);

- information about the employee himself (full name, position held, work experience, and so on);

- amount of payments by year;

- periods during which the employee was absent from the workplace due to or because of.

At every enterprise there is a person who is fully responsible for maintaining this reporting. It is he who fills out the certificate in form 182n, since it includes accounting information.

Basic rules for filling

it is generally accepted:

It is also necessary to take into account the fact that if a situation arises where an employee has worked for different employers for different periods of time over the past 2 years, a certificate must be issued from each place of work

.

Issuance procedure

According to the current legislation of the Russian Federation, this certificate must be issued to the employee on the day he resigns without any reminders to the employer.

If, for some reason, the employee was unable to pick up the certificate on the day of his dismissal, the enterprise where he worked can send it by mail in the form of a registered letter (in this case, the company initially sends a notification by mail about the need to pick up this document ). But this is only possible with the written consent of the recipient.

In the case when some period of time has already passed since the dismissal, and the former employee has an urgent need for this certificate, it is enough to contact the company and write an application requesting its provision.

It must be remembered that the employer does not have any legal grounds for refusing to provide this document. After submitting an application for a certificate, the employer has a maximum of 3 days to complete and provide this document to the applicant.

If the employer refuses to issue a document for any reason, the employee has every right to contact law enforcement authorities with a corresponding application.

Where is 2-NDFL issued?

If an accountant from a new place of duty requires you to bring a 2-NDFL certificate, you need to contact your former employer.

For these purposes you can:

- Leave a request by phone;

- Visit the accounting department in person.

The simplest option is when the employer and the head office for issuing certificates are located in the same city, or better yet, in the same building. In this case, you will not have any problems obtaining 2-NDFL.

It is prepared within three days and delivered to you. The validity period of the document is one month. If for some reason you did not have time to pick it up and provide it to a new accountant, it is considered overdue and is not subject to accounting. Then it will need to be issued again.

In large companies, certificates are often issued only at the head offices, which may be located in another region of the country. Here everything is much more complicated. To get a certificate, you need to go to the branch of your city and express your request to the manager. He will leave a request.

The certificate also takes three days to prepare, but it may arrive in a few weeks. It all depends on the speed of postal services. The main thing is to get it on time.

Some features of using the document

When to use only a copy

To calculate the amount of benefit that is assigned due to temporary loss of legal capacity, you can take into account not only the original, but also a copy of the certificate. This possibility is allowed by Article 13 of Federal Law No. 255 “On Compulsory Social Insurance”.

But in this case, the copy must be:

- certified by a notary authority;

- signed by the former employer, which confirms its authenticity.

In other cases, the copy will be considered invalid.

Unable to contact employer

What should you do if a situation arises when it is not possible to obtain this certificate from your former employer?

In this case, the future employer will be obliged to accrue benefits due to temporary disability based on the information that he currently has. This is provided for in Article 15 of Federal Law No. 255 and is confirmed by the FSS.

According to the above legislation, when determining the amount of benefits, it is necessary in this case to proceed from the amount that was established at the time the employee was absent from his workplace. This is due to the fact that the amount of the benefit itself cannot be less than the minimum wage, which is established for a specific region.

How else can you confirm your salary?

There are situations when a former employee simply forgot to get a certificate from his former job, but when there was an urgent need for it, it became known that the company was being liquidated.

In this case, the individual should write a letter to the employer notifying that there will be a request for this certificate to the territorial department of the Pension Fund

. After sending the notification, you will need to contact the Pension Fund at your place of residence and declare the need to obtain a certificate.

It is worth noting that such a document will be slightly different, since it will contain information on the total amount of payments for several years, and will not indicate the periods when the employee was on sick leave or on vacation.

The application itself is drawn up with a PF employee. The period for reviewing and issuing a certificate is no more than 10 calendar days.

As you can see, in any situation there is a way out. The main thing to remember is that it is better to make several copies at once, arrange everything legally correctly and then no problems will arise.

The rules for calculating hospital benefits based on certificate 182n are described in the following video:

A temporary disability certificate (or sick leave) is a document confirming the fact of illness or injury in a person and giving the right not to attend work until full recovery.

Upon returning to work, the employee receives monetary compensation, but one certificate of incapacity for work will not be enough for this.

Salary certificate from place of work

And here sometimes obstacles arise. You come to the accounting department with a request to give you a certificate of average salary , and they tell you, we have a lot of work, come back in a month. Come back a month later - the accountant is on sick leave, and they don’t even promise to give you a salary certificate. The accountant recovers, and your walks are repeated with different variations. Now the salary is being calculated, then the end of the year. Some workers even complain that they simply refuse to give them a certificate from their place of work about their salary, while such a certificate is needed urgently, for example, to receive subsidies or to the Pension Fund to calculate the amount of their pension. This is especially true for former employees of the enterprise; they are denied certificates of average wages especially often and without any reason.

Please note that Article 62 applies not only to those currently employed by the employer, but also to those who previously worked, regardless of how much time has passed since dismissal. So, either after 10 or 20 years, you can ask your employer for the certificates you need about your length of service and salary.

Why is it needed?

A certificate for calculating a certificate of incapacity for work is a document necessary for calculating benefits for the time the employee was on sick leave.

Compensation for temporary disability is calculated based on the average income for the two years preceding the year the insured event occurred.

If there is no such document, the payment will be calculated according to available information (for example, if part of the billing period has been worked out) or according to the “minimum wage” (minimum wage).

What should it contain?

Since 2013, a new method of calculating the average salary has been used. This indicator can be obtained by dividing the total income for the last two years by the number of days in this two-year period. Sick days, maternity leave and parental leave are not taken.

Thus, the formula for calculating the average daily wage will be as follows:

The total amount of income includes: salary and additional payments for which insurance transfers were made to the Pension Fund and the Social Insurance Fund. The total amount of income is calculated for the two years preceding maternity leave, illness or parental leave.

The number of calendar days is taken into account for the two-year period preceding the year in which:

- temporary disability leave has occurred;

- the employee quit or the job was terminated;

- the employee applied for a certificate of income.

Due to the fact that the method of calculating the average daily income was changed with the obligatory indication of the excluded period, from the spring of 2013 an updated form for a certificate of income for two calendar years began to be used. The certificate is issued in the form.

The new form differs from the old one in that the old copies did not indicate the periods to be excluded. The salary certificate was approved by Order of the Ministry of Labor of the Russian Federation dated April 30, 2013 No. 182n.

The structure of the new form includes four blocks of information:

| section No. 1 | Includes information about the organization that issued this certificate |

| section No. 2 | Includes information about the employee for whom the calculation is made |

| section No. 3 | Includes information about all payments with insurance transfers in favor of the employee receiving the document. All transfers are indicated by year, with information for each year entered in a separate column. Information about current transfers must also be reflected in the document |

| section No. 4 | Includes information about the number of days (for each year in a separate column) during which the employee was temporarily disabled while maintaining the average salary without insurance charges. These data are the “excluded periods” |

The information in the third and fourth sections should be identical by year.

Basic rules for drawing up a certificate:

| Filling method | Information on the salary certificate in form 182n is entered by hand in black or blue ink. The document can be filled out electronically using a computer. After this, the certificate is printed |

| Filling procedure | The third section of the certificate reflects only those incomes for which insurance transfers were made to the Social Insurance Fund and the Pension Fund. For each year, a certain limit is established within which insurance premiums are transferred. For this reason, you cannot reflect on the certificate an amount exceeding the maximum for that year. So, in 2011 this amount was 463,000 rubles , in 2012 - 512,000 rubles |

| Excluded periods | Each excluded period is reflected in a separate column. It must have a start date and an end date. The number of calendar days of a given period is recorded both in numbers and in words. It is necessary to indicate each excluded period: “temporary disability”, “maternity leave”, “parental leave” |

The certificate is drawn up on the basis of the accounting and reporting information of the policyholder. The document is affixed with a round, “wet” seal of the organization.

The seal should not interfere with reading the names of the persons who signed it. The certificate is signed by the manager and chief accountant.

Any adjustments or blots make the certificate invalid (Order of the Ministry of Labor of the Russian Federation dated April 30, 2013 No. 182n).

It is best to issue a certificate for calculating sick leave on the organization’s letterhead, which will indicate the official name and details (address, INN, KPP, OGRN, etc.).

In addition, you need to write down the name of the document (certificate of sick leave calculation). In the title you can indicate which benefit is accrued (for illness or for pregnancy and childbirth).

The form contains the number and date of the document, and also indicates the number and date of the certificate of incapacity for work, to which the certificate will be attached.

Then the following information is entered into the certificate:

- Full name of the employee;

- Personnel Number;

- TIN, SNILS;

- job title;

- department or structural unit.

The certificate contains the information necessary to calculate compensation:

- period of illness;

- number of days of incapacity;

- reason for disability (code 01 – illness, code 05 – maternity leave);

- insurance experience;

- amount of compensation as a percentage of salary (for example, 100%);

- billing period.

The document also reflects the following information on wages (by year):

- funds actually transferred during the billing period;

- the maximum amount of the base for calculating insurance payments;

- amounts taken into account for calculating compensation.

The certificate for calculating sick leave indicates the amount of benefits to be paid from the Social Insurance Fund.

Using its own money, the organization pays only for the first three days of illness; the entire remaining period is paid for by the Social Insurance Fund. Maternity benefits are paid entirely from the Social Insurance Fund.

The certificate may also indicate the amount of the benefit minus income tax or the tax amount separately. Maternity benefits are not subject to income tax for individuals.

Payment order

The certificate is required to pay for sick leave and benefits. Its main function is to determine the average daily earnings. Based on this, the cash security is calculated.

Calculation example

Rogozina S.F. began working at Rentcom LLC on February 5, 2020. A month later, she provided sick leave for a period of 14 days. Previously, she was issued a certificate of income from her previous place of work.

Specified data:

- total income for 2020 = 360 thousand rubles;

- total income for 2020 = 300 thousand rubles;

- There are no time intervals for absence from work due to sick leave.

Accordingly, to calculate average daily earnings you need:

- add up income for 2020 and 2020: 360,000 + 300,000 = 660,000;

- divide the received amount by 730 days: 660,000/730 = 904.11 rubles.

Now you can determine the amount of temporary disability benefits:

| Average daily earnings for the previous 2 reporting years | Percentage depending on length of service | Number of sick days | Amount of temporary disability benefit |

| RUB 904.11 | 100% | 14 | RUB 12,657.54 |

For all average cases, the calculation of the amount of sick leave is as follows:

Average daily earnings * number of days of temporary disability * percentage of payment coverage.

When is the minimum wage taken into account in the document?

If the employer does not have reliable information about the employee’s earnings for the previous 2 years before his employment, the minimum wage is taken into account when calculating benefits.

The minimum wage amount is taken as a basis not for the past period, but at the current moment in time.

When is sick leave paid 100 percent in 2020? Read in the article. How is sick leave paid for redundancy? See here.

Do they have the right to fire a pregnant woman? Find out here.

If the employee does not provide a certificate

If the employee does not provide a certificate for calculating the certificate of incapacity for work to the employer, then the accrual is made:

- based on available information from the employing enterprise;

- according to the minimum wage (the amount that is legally established at the time of the employee’s temporary disability is valid);

- based on information from the Pension Fund.

A citizen can officially contact the employer with an application to request information about his earnings for the previous 2 years from the Pension Fund.

In this case:

- the responsible employee sends the request to the Pension Fund (in electronic or paper form) within two days;

- The information received in the response message is used to calculate sick leave.

If the payment has already been made, and the employee did not make such a request, a recalculation must be made.

If the employee submitted after receiving benefits

If the employee’s accrual certificate was provided after the fact, it is necessary to recalculate:

- for the last period of temporary disability;

- for all periods of time the employee was absent due to illness during the previous 3 years.

The adjustment and payment of missing amounts is initiated by the employer and carried out by the Social Insurance Fund.

Certificate of income for external and internal part-time workers

When working part-time, there are several options for issuing an income certificate.

Depending on the period of work and the type of part-time job, obtaining a document occurs in different ways:

- An external part-time worker is issued a certificate at both the main and additional place of work.

- An internal part-time worker upon complete dismissal from the organization requires only 1 document with total income for each of 2 years.

- If an employee terminates an internal part-time job or remains only in this position, a certificate is signed for the liquidated workplace.

A new employer, if the employee has two income certificates for the 2 previous years, must sum up the amounts indicated in them for each year separately.

A certificate for calculating a certificate of incapacity for work is a mandatory document. Issued to an employee upon dismissal from his main or additional place of work on his last working day.

The former employee may also request it in writing. The document is necessary for calculating benefits. In its absence, payments are made on the basis of the minimum wage.

https://youtu.be/e7bmrGK77Mg

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions - 8 (800) 222-69-48

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Sick leave

Shelf life

According to Federal Law No. 212-FZ dated July 24, 2009, documents confirming the calculation and payment of insurance premiums must be preserved for six years.

A certificate of incapacity for work is the basis for the calculation and payment of temporary disability or maternity benefits to an employee.

It confirms the correctness of the due insurance amounts transferred to the Social Insurance Fund. Therefore, the storage period for sick leave is six years.

Since the certificate with the calculation of income is an attachment to the certificate of incapacity for work, it means that it needs to be kept for the same amount of time.

You can submit a certificate and issue a recalculation (additional accrual) within three years after the closure of sick leave

Sick leave or sick leave certificate

It must be remembered that payments for temporary incapacity for work are made only on a sheet of temporary incapacity for work (sick leave). It is prescribed by a doctor in the following cases:

- illness;

- injuries;

- pregnancy and childbirth;

- caring for a sick child or relative.

p>Instead of sick leave, a certificate is issued if, for example, an employee must undergo some kind of examination that will take a whole working day or most of it. Such a certificate is also issued by the doctor who referred the employee for examination and certified with his seal and signature. A sick certificate is not a basis for payment of benefits, only for legal failure to appear at the workplace at the time specified in the certificate.

ipinform.ru

Certificate from previous place of employment

According to the law, to calculate sick leave, the amount of his income for the previous two years is taken into account, even if the employee worked in another organization. That is why you need to get a certificate from your previous employer with the payments made.

If the employee does not have such a certificate, the accounting department will calculate sick leave at the “minimum wage” based on the minimum wage.

Providing a certificate from a previous place of work is not a mandatory condition; it is a right that an employee can use in order to increase payments (Federal Law No. 255-FZ).

The accountant can only inform the employee that the amount of payments with the certificate will be greater than without it, but he has no right to demand the document.

In addition, the employee himself does not have the right to demand that the accounting department recalculate sick leave on the basis of certificates not provided on time. The accountant will calculate the payment only on the basis of documents provided on time.

Can an employer refuse to issue a certificate?

The employer is deprived of the right to refuse an employee who has written a request for the issuance of such a certificate.

If the employer fails to comply with this requirement, the applicant may file a complaint with the labor inspectorate. The document is necessary when calculating temporary disability benefits, because the amount of payment will directly depend not only on the employee’s length of service, but also on his income. Therefore, when leaving or moving to a new place of work, it is better not to lose sight of the need to obtain certificate No. 182n. This will allow you to avoid possible misunderstandings in the future.

Upon dismissal

Upon dismissal, the organization can issue the employee three documents:

- work book;

- certificate of income in the form;

- a certificate of the amount of earnings for two years in form 182n.

Moreover, since January 2011, the Order of the Ministry of Health of the Russian Federation introduced a rule according to which a certificate of income for two years is provided to each employee upon dismissal.

A sample certificate can be found in the Order of the Ministry of Health in Appendix No. 1. This order states that every citizen has the right to receive a certificate for calculating sick leave within three days.

To receive compensation, you will need a sick leave certificate, and not a separate certificate. Only a certificate of incapacity for work is the basis for providing compensation.

Online magazine for accountants

If a newly hired employee plans to receive standard tax deductions from the new employer, then the new accounting department should have information about exactly what income the person has had since the beginning of the year. After all, deductions are provided only until the cumulative total income from the beginning of the year reaches the amount of 350,000 rubles. (Clause 1, Article 218 of the Tax Code of the Russian Federation). Help 2 – Personal Income Tax, in particular, allows the new accounting department to find out what income the employee has had since the beginning of the tax period. If the new employee does not submit a certificate, then the accounting department does not have the right to provide him with standard tax deductions.

We recommend reading: How to find out what a court debt is for by number

When you take out a mortgage, car loan or any other loan product, you may be asked to provide proof of income. We are used to this and are not surprised. However, when changing jobs, it happens that the new accounting department also asks for 2-NDFL from the previous place of work. In this case, we are talking about a certificate with information about income received for the period from the beginning of the current year until the day of dismissal (from the previous place of work).