Terms of payment upon dismissal of an employee

As a general rule, the final payment to the employee is made on the day of dismissal. This period is regulated by Article 140 of the Labor Code of the Russian Federation. Typically, the day of dismissal is the last working day for the terminated employee.

The amount of the amounts can be appealed to the labor inspectorate or in court, but in this case the date of final payment is postponed indefinitely - until a decision is made by the labor inspector or judge.

The reason for dismissal does not in any way affect the timing of the final payment. When stopping work on his own initiative, the employee warns the employer in writing 14 calendar days in advance. After this period, he must be issued:

- a work book issued by the HR department with the date of dismissal and details of the order;

- payments required by law: wages for days worked;

- compensation for unused vacation.

For seasonal workers and employees hired for a probationary period, the two-week notice does not apply. In this case, the dismissal procedure is carried out within three days. At the same time, payment of funds, as well as the issuance of a work book, is carried out as standard - on the day of dismissal.

Crediting to the account or issuing cash in hand is carried out on the day of termination of the employment relationship, which is also the last working day. If the employee was on vacation or sick leave at that time, and all payments in the organization are made in cash, then the accrued amounts are issued no later than the next day after the employee applies for payments.

If these deadlines are violated, the employee has the right to claim compensation for late payments. According to Art. 236 of the Labor Code of the Russian Federation, the penalty will be 1/150 of the rate of the Central Bank of the Russian Federation for each day, including the day of the actual transfer of funds.

The employer's refusal can be appealed to the labor inspectorate or court. In this case, in accordance with Part 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, an offender may be subject to administrative punishment in the form of a fine:

- up to 5 thousand rubles – per entrepreneur;

- up to 20 thousand rubles – per official;

- up to 50 thousand rubles – for organization.

Absolutely all employees are paid a salary for the time worked on the day of dismissal, as well as vacation pay compensation for annual leave not taken.

In addition to these mandatory payments, the employer may provide additional ones - various compensations, severance pay.

Legislation

Legislative acts governing and regulating the aspects discussed in the article are as follows:

- Art. 140 Labor Code of the Russian Federation.

- Art. 81 Labor Code of the Russian Federation.

- Art. 236 Labor Code of the Russian Federation.

- Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Any labor relations between the parties are based on the norms of the Labor Code of the Russian Federation. The employer’s obligation to make a final settlement with the dismissed employee is regulated by Article 140 of the Labor Code of the Russian Federation. Additionally, you should pay attention to Chapter 23 of the Labor Code of the Russian Federation, which provides for the concept of guarantees and compensation, as well as cases of their provision to a dismissed employee.

Definitions

https://youtu.be/gXAUMelo9as

Final settlement is a mandatory procedure during which the employee is paid the amounts due, depending on the grounds for termination of the employment contract.

An employee has the right to count on the following types of payments:

- wages for a period worked but not paid;

- compensation for days of unused vacation;

- severance pay in case of dismissal of an employee at the initiative of the employer;

- other compensations and payments provided for by the employment or collective agreement.

basic information

According to the Labor Code of the Russian Federation, settlement upon dismissal is the accrual of all due payments to an employee upon termination of his employment contract.

Regardless of the grounds on which the employment contract was terminated, the employer undertakes to settle accounts with the employee on the last working day and pay the amounts due to him.

The types of payments and their size may differ depending on the reason for which the employee was dismissed. A correct understanding of labor laws will make it possible to oblige the employer to pay all monies due.

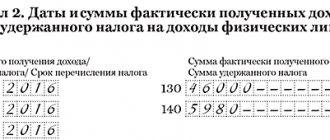

Calculation of personal income tax for compensation due to dismissal

The amounts of the final calculation are subject to taxation - the employer is obliged to transfer personal income tax from them, guided by the following algorithm:

- Calculation of tax due.

- Withholding tax from accrued income.

- Transfer of personal income tax on the day following the termination of the employment relationship.

- Filing a tax return in form 2-NDFL at the end of the calendar year.

We invite you to familiarize yourself with what documents are needed to inherit a land plot: list

According to Art. 225 of the Tax Code of the Russian Federation, personal income tax is 13% of the tax base, which is calculated as the monetary expression of income minus tax deductions. Monthly tax deductions are presented in the table.

| Basis of deduction | Amount of deduction, rub. |

| Disabled person status during WWII | 3000 |

| Title of Hero of the Russian Federation | 500 |

| Parents of one or two children | 1400 each |

| Parents of three or more children | 3000 each |

The tax legislation of the Russian Federation stipulates that compensation and severance benefits are not subject to taxation, except for payments to the employee for unused vacation days.

Compensation for unused vacation

The final settlement involves the accrual and payment of:

- wages for the last month of work;

- compensation for unused annual paid leave;

- severance pay - the grounds for calculating this payment are specified in the second paragraph of the first part of Article 81 of the Labor Code of the Russian Federation.

The tax legislation of the Russian Federation stipulates that compensation and severance benefits are not subject to taxation, except for payments to the employee for unused vacation days.

In addition to payment for days actually worked, the dismissed employee must receive compensation for unused vacation or, conversely, compensate the employer himself for a certain amount. Such a refund occurs when a person has already taken vacation for the current calendar year and then decides to quit. So, depending on the situation, the payment of vacation pay upon dismissal occurs as follows:

- if the working year has not been completed and vacation has not been taken, then its days are calculated in proportion to the months worked;

- if compensation must be paid for previous years, then the calculation is carried out on the basis of 28 days of vacation per year;

- if the dismissal occurs before the end of the period for which the person has already received vacation, then the days will have to be calculated proportionally and the paid vacation pay will have to be withheld on the basis of Article 137 of the Labor Code of the Russian Federation.

It is important to remember that the payment required by law in these situations is considered not based on actual earnings, but on the basis of average earnings for vacations in accordance with Decree of the Government of the Russian Federation No. 922 of December 24, 2007 (as amended on December 10, 2016). The online calculator for calculating vacation pay compensation on our website will help you figure out how to calculate vacation pay upon dismissal - use it to calculate the amount of compensation.

According to the provisions of Article 115 of the Labor Code of the Russian Federation, annual paid leave is provided to all Russian employed citizens for a duration of 28 calendar days per year of work. There are categories of citizens for whom additional paid time is legally established by virtue of Article 116 of the Labor Code of the Russian Federation.

These, in particular, include workers with a special nature of work, workers with irregular working hours, persons working in the Far North and equivalent areas, and other persons, in cases expressly provided for by the Labor Code and other federal laws. For such categories of persons, the calculation formula does not change, but it should take into account not 28 calendar days, but the rest period due to a specific employee.

We invite you to familiarize yourself with the Calculation of fees for single electricity supply

It is important to take into account that there are features of calculating the number of months that a citizen worked for a particular employer; they are formulated in the rules approved by the People's Commissar of the USSR on April 30, 1930 N 169. For example, if less than half a month has passed from the beginning of the month to the date of dismissal, then this month is calculated from excluded, and if a person managed to work half or more, then this month is taken into account when calculating vacation pay as a whole month. That is, there is no need to divide vacation days for one month in proportion to days worked.

According to the provisions of Article 217 of the Tax Code of the Russian Federation, the amount of compensation for unused vacation is subject to personal income tax in full. The employer transfers the withheld tax to the budget no later than the day following the day of payment to the employee.

Employee's desire

Often, legal relations with the employer are terminated precisely on the initiative of the employee. The starting point for terminating an employment relationship is the employee submitting an appropriate application, which indicates the desired date of dismissal. The document must be submitted to the manager for registration at least two weeks before the actual date of departure.

By agreement with the employer, the above period may not be worked out, in this case the legislation provides for such cases. when the employee is generally released from this obligation.

Situations when processing is not required:

- employee enrollment for training;

- retirement;

- the emergence of circumstances that require care for a minor child or close relatives;

- in case of detection of a violation by the employer of the current norms of labor legislation in relation to the employee.

If the above circumstances occur, the employee is not required to notify the employer in advance and work for 2 weeks. It should be noted that even after submitting a letter of resignation, the employee has the right to withdraw it at any time. An exception is the case in which the employer has already offered a vacancy to a new employee in writing.

If the participants in the labor relationship have not reached mutual understanding, the employer may invite the employee to write a letter of resignation of his own free will. The parties cannot always reach agreement on this issue, and in such cases the dismissal procedure at the initiative of the employer cannot be avoided.

If a discrepancy is detected for the position held, the employer has the right to initiate the creation of an attestation commission that will check the employee’s professional suitability. The person being inspected undertakes to perform one or a number of tasks related to his direct work responsibilities.

If, based on the results of the inspection, it is determined that the employee is not able to properly perform his job duties, then the employer has all the legal reasons to dismiss him on the basis of the document drawn up by the certification commission.

Systematic failure to fulfill official duties is also grounds for termination of employment relationships. Each fact of violation of labor discipline must be properly recorded, and in accordance with Article 193 of the Labor Code of the Russian Federation, the employee is obliged to provide written explanations. It is impossible to dismiss an unscrupulous employee without applying disciplinary measures to him in the form of a warning or reprimand.

Dismissal due to the employee’s absence from the workplace or due to systematic tardiness is regulated by paragraph 6 of Article 181 of the Labor Code of the Russian Federation. An employee who is absent from the workplace during a work shift or for 4 hours must provide the employer with a written justification for the reasons why he could not be at work or begin performing his job duties on time.

Words alone will not be enough, and the employer must provide documentary evidence of the valid reason for absence.

We suggest you read: Is it possible to fire a pregnant woman under fraud?

Article 181 contains a complete list of grounds on which an unscrupulous employee may be dismissed at the initiative of the employer.

An employee’s own desire to leave the organization can be initiated on any day of work.

To complete the procedure, it is enough for the worker to write an application in free form and submit it in advance to the responsible person. Notice periods are 2 weeks for all employees except managers. For the latter, the period increases to 1 month.

After the required time period has expired, the employer carries out a number of mandatory dismissal procedures:

- issues an order;

- fills out a personal card and work book;

- calculates due payments;

- pays the full amount;

- issues the necessary certificates and documents to the employee.

https://youtu.be/jjvAGdngxE4

The basis in the form of one’s own desire for dismissal is enshrined in clause 3 of Article 77 of the Labor Code of the Russian Federation; this article is referenced in the order and work book.

The employee is not obliged to explain the reasons for termination of the employment relationship; he must only give notice within the prescribed period and work for the allotted time before dismissal.

He has the right to receive a full payment on the last day of work in the organization. Any delays entail a violation of labor laws and liability for the employer.

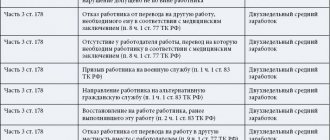

Severance pay

In some cases, employers, in accordance with Article 178 of the Labor Code of the Russian Federation, must include severance pay in the calculation. It varies in size and depends on the reasons for termination of the employment contract and the category of employees. In particular, persons who were fired due to:

- inability to continue working due to health reasons;

- conscription for military or alternative civilian service;

- reinstatement of the employee who previously performed this work;

- a person’s refusal to transfer due to the organization’s relocation to another location.

In the amount of average monthly earnings, severance pay will have to be paid:

- upon dismissal due to liquidation of the organization;

- when reducing the number or staff of employees.

In addition, such employees have the right to receive compensation in the amount of average monthly earnings for the period of employment for a maximum of two months from the date of dismissal. But these amounts are not included in the calculation upon dismissal, since they are paid later.

This payment is issued to an employee in cases where dismissal occurs due to:

- due to illness that does not allow the citizen to continue working;

- upon refusal to transfer to another position;

- in case of disability;

- in case of changes in working conditions;

- when conscripted into the army;

- in a situation where dismissal is carried out due to layoffs or in connection with the liquidation of the company.

How are payments calculated in 2019?

Calculation of payments due to an employee upon leaving at his own request is made in accordance with established rules. The calculation procedure depends on the type of income paid.

Wages are calculated in accordance with the established remuneration system for the employee; this point is always specified in the employment contract.

Vacation compensation is calculated on the basis of average earnings for vacation pay, the calculation rules of which are prescribed in the Regulation of the Government of the Russian Federation No. 922 dated December 24, 2007, as amended. from 12/10/2016.

Online calculator of average daily earnings for compensation upon dismissal.

The required amounts are calculated by an accountant, and the calculation note T-61 is filled out. This document reflects all accruals and deductions from employee payments, as well as the total amount to be paid.

The rules for determining an employee’s salary are included in the terms of the employment contract. A remuneration system is established for the worker; the contract specifies the salary, tariff rate or piece rates, as well as all components of the salary.

In addition to payment at a salary, tariff or rate, wages may also include additional incentive compensation and bonuses.

Upon dismissal, all days worked for which the employee did not receive a salary or advance payment are subject to payment. Wages must also be calculated for the last working day, since it is also paid.

The calculation period for calculating wages is a calendar month. The amount of wages is calculated based on salary, tariff or piece rates on the date of dismissal. If an advance has already been paid for this month, then its amount must be subtracted from the total accrual for the month.

Below are examples of the procedure for calculating wages upon dismissal under various remuneration systems.

Termination of TD, counting rules

If on the day of dismissal of an employee he was not paid the required remuneration, the employer will have to compensate for this. The fine is 1/300 of the refinancing rate established by the Central Bank of Russia.

Also, if the final amount of the final payment after calculating severance pay to the dismissed employee exceeds the amount of his salary three times, then income tax will be withheld from this amount.

The employer is obligated to make final payments to the dismissed employee on the last working day. For violation of the deadlines for providing due compensation and payment of wages, the employer may be held administratively liable.

We invite you to familiarize yourself with Eviction without provision of other living quarters: conditions and grounds under the Housing Code of the Russian Federation || Eviction without provision of other residential premises, grounds, procedure and terms

Agreement of the parties

The employer has the right to invite the employee to terminate cooperation by mutual agreement. If dismissal cannot be avoided anyway, then this form of termination of employment relations is not the worst for the employee. Upon termination of an employment contract by mutual agreement of the parties, the employer undertakes to pay the employee at least 2 average monthly earnings in addition to wages and compensation for unused vacation.

We invite you to familiarize yourself with the Head of ventilation and air conditioning official

You should not agree with the employer’s offer to resign of your own free will if it becomes known about the impending liquidation of the enterprise, since in this case the employee loses part of the mandatory payments and can only count on receiving wages, as well as compensation for unused vacation days.

Compensation for unused vacation

A certain amount of money may be withheld from some payments. In particular, this applies to annual leave on which the employee took part-time leave. In such a situation, a recalculation occurs, and compensation is paid only for unused rest days.

This occurs in situations where the severance of employment relations with a citizen is carried out on the basis of a reduction in the number of employees or during the liquidation of the company.

Compensation payment for unused vacation days is calculated as follows:

- Annual paid leave is 28 days. This value is divided by the number of months in a year and multiplied only by the number of months worked. For example, 5.

28 / 12 * 5 = 2.33 * 5 = 11.65 – unused vacation days

- The resulting value is multiplied by the employee’s average salary for one day. For example, it is one thousand rubles.

11.65 * 1000 = 11,650 rubles.

- Personal income tax is withheld from the compensation, and the amount received is given to the citizen as compensation.

11,650 * 0.87 (personal income tax - 13%) = 10,135.50 rubles.

Deduction from compensation for unused vacation, calculated by the actual period worked by the citizen, cannot be made if:

- Liquidation of the company.

- Reducing the number of employees.

- Severance of labor relations due to the impossibility of further work due to illness.

- Prizes for compulsory military service.

- In case of disability.

- Reinstatement to position based on a verdict of a judicial authority.

- Dismissal that occurs due to other circumstances beyond the control of either the employee or the employer.

conclusions

The employer must pay the employee who resigns at his own request within the prescribed period. We need to pay wages and vacation compensation. Other payments are possible only if the employer wishes.

The calculation is made on the last working day. Violation of this rule entails significant fines for the company, as well as additional compensation for delay.

| The article describes typical situations. To solve your problem, write to our consultant or call for free: 7 Moscow — CALL 7 St. Petersburg — CALL 8 ext.849 – Other regions – CALL It's fast and free! |

What is the liability for late payments?

Violation of payments when calculating in connection with dismissal entails the employer being held liable in the form of a fine, which is 1/300 of the Central Bank refinancing rate for each day of failure to fulfill the obligation.

An employee who has not received his due payments on time has the right to submit a written application to the labor inspectorate. If the issued order from the worker protection service is also ignored by the management of the enterprise, then the dismissed employee has every reason to file a claim in court to recover the payments due to him.

Even if there are compelling grounds for filing a claim, it is not recommended to initiate legal proceedings without first consulting with specialists in the field of labor disputes. Additionally, it should be noted that the help of specialists will allow you to recover not only the amounts due, but also compensation for moral damage and other types of penalties.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Shift of deadlines

The payment of dismissal payments and the terms are clearly regulated by the Labor Code of the Russian Federation.

The date of final payment upon termination of employment relationships may be shifted in the following cases:

- if the employee retained the position, the employee did not actually perform job duties;

- if we are fired and was on vacation.

Shifting the timing of the final payment can only be applied in cases of dismissal of an employee at his own request, since the law prohibits the employer from terminating employment relationships with employees on sick leave or on vacation.

Reasons

Article 140 of the Labor Code of the Russian Federation states that all due payments to an employee must be given to him directly on the last day of work. Depending on the reason for which the employment relationship is broken, the set of compensation due may differ.

Dismissal can occur at the citizen’s own request and at the initiative of the employer, as well as due to circumstances beyond the control of both parties. Most often, the procedure is carried out by mutual agreement. If there is an agreement, final payment to the employee can be made even after the day of termination of the employment relationship.

Note-calculation

The calculation note in form T-61 is filled out by employees of the personnel department, and then the accounting department. On the front side of the document, the days of used and unused vacation are counted, as well as the number of advance vacation pay.

On the back of the note, the accounting employee calculates the payments due to the employee. The document is drawn up in the presence of a dismissal order, about which a corresponding note is made.

A budget organization or commercial enterprise can transfer funds through a bank or pay by hand.

https://youtu.be/SKq1hUmZum0

Documentation

In addition to paying the required remuneration, the manager of the dismissed employee is obliged to provide him with the following package of documentation:

- certificate of income received in form 2-NDFL;

- certificate of summarized income - used to calculate benefits;

- work book with a record of termination of the working relationship;

In addition, upon the corresponding application of the employee, he will also have to issue:

- a copy of the hiring and dismissal order;

- a certificate of wages received for a certain period of time;

- a certificate of contributions made to the pension insurance fund.

In order to calculate and pay all amounts due to the employee, it is necessary to prepare the following documents:

- dismissal order;

- settlement note upon termination of an employment agreement (contract) with an employee;

- income certificate in form 2-NDFL for the current year.

Section 1. Title page, on which you should indicate all the data about the person, the period of his work, the date and reasons for dismissal.

Section 2. Calculation of vacation pay (reverse side). Here the entire period of work for which vacation was not used is calculated.

Please note that the title page is signed by a human resources specialist, and the reverse side is signed by the accountant of the organization who made the calculation.