Source:

1. The company paid the employee on the day of dismissal 2. The company paid the employee the day before the dismissal 3. The company withheld vacation pay upon dismissal 4. The company paid wages to the dismissed employee late 5. The company issued wages and benefits on the day of dismissal 6. The company upon dismissal paid severance pay 7. The company paid the dismissed employee on the last day of the reporting period 8. Several employees quit in the first quarter 9. The employee went on vacation with subsequent dismissal 10. The employee went on a business trip before dismissal

The company paid the employee on the day of dismissal

The company paid the employee on the day of dismissal - gave him a salary and compensation for unused vacation.

Upon dismissal, the employee receives income in the form of salary on the last working day (Clause 2 of Article 223 of the Tax Code of the Russian Federation).

Compensation for unused vacation days is not a salary. The date of receipt of income is the day of payment. Since the company paid the employee on the last working day, the dates in line 100 match. Tax on both payments must be withheld on the same day.

Compensation for unused vacation is not vacation pay. The deadline for transferring personal income tax on this amount is the day following the payment, as for salary. All three dates in lines 100–120 match. This means that compensation and salary should be reflected in one block of lines 100–140.

For example.

The employee resigned on June 16. On this day, the company gave him a salary for June - 28,000 rubles, and withheld personal income tax from it - 3,640 rubles. (RUB 28,000 × 13%). The company also transferred vacation compensation - 18,000 rubles, and withheld personal income tax - 2,340 rubles. (RUB 18,000 × 13%). The date of receipt of salary income is the last working day. That is June 16th. For vacation compensation - the day of payment. Also June 16th. The deadline for transfer is June 17. The dates on lines 100–120 are the same, so the company reported them together. The amount of income is 46,000 rubles. (28,000 + 18,000), personal income tax - 5980 rubles. (3640 + 2340). The company filled out Section 2 as in sample 84.

Sample 84. How to fill in the payment calculation on the day of dismissal:

Top

Dismissal in 6-NDFL - example of filling out 2020

Let us show with an example how section 2 is filled out when a specialist is dismissed. Let's say a company manager quits on December 5, 2019. The organization's accountant accrues due payments to him:

- Salary – 14,200 rubles.

- Compensation for 8 days of non-vacation – 21,900 rubles.

- Personal income tax withheld – 14200 x 13% + 21900 x 13% = 4693 rubles.

- To be paid “in hand” – (14200 + 21900) – 4693 = 31407 rubles.

Payments to a resigning employee must be reflected in a separate block in Section 2 of the report. Since the dates for payments to other employees will be shown in a different order. Below is an example of filling out a dismissal in 6-NDFL - suitable for both 2020 and 2020:

| Calculation line | date |

| 100 | 05.12.2019 |

| 110 | 05.12.2019 |

| 120 | 06.12.2019 |

| 130 | 36100 |

| 140 | 4693 |

Salary and compensation are recorded in the report at a time. The tax is withheld on the day of settlement with the employee. The deadline for transfer is the following day of payment of funds.

Note! If on the day of his dismissal (December 5) the employee was absent from work, the employer must give the individual money based on his application. Then the data will be reflected in the report at the time of payment of funds.

As for section 1, when filling it out, you need to reflect the information on an accrual basis. In our example, the employee quits in December. This means that data on the amounts of his remuneration, accrued and withheld tax will appear in the form for 2020.

Read: What is calculation using Form 6-NDFL

The company paid the employee the day before dismissal

The company issued wages and compensation for unused vacation days the day before dismissal. On the same day, the company withheld and transferred personal income tax from these payments.

The Code establishes a special date for receiving income in the form of wages in the event that an employee resigns. Personal income tax must be calculated on the last working day (clause 2 of Article 223 of the Tax Code of the Russian Federation). If the company issued the money earlier, then it withheld tax until the date the income was received.

In this case, in line 100, enter the date of receipt of income according to the code - the last working day. And in line 110 - the day of payment. The date on line 110 will be earlier than the date on line 100. But the program will skip this calculation.

There should be no problems with personal income tax. Inspectors allow tax to be withheld from wages issued before the date of receipt of income.

Compensation for unused vacation days is not a salary. The employee receives such income on the day of payment (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). This means that the dates in line 100 for salary and compensation will not match. Complete them in different blocks of lines 100–140.

For example

The employee resigns on June 16th. On June 15, the company gave the employee a salary and compensation for unused vacation. Compensation - 9000 rubles, personal income tax - 1170 rubles. (RUR 9,000 × 13%). Salary - 26,000 rubles, personal income tax - 3,380 rubles. (RUB 26,000 × 13%). The date of receipt of income for salary is 06.16.2016, for compensation - 06.15.2016. Therefore, the company completed two blocks of lines 100–140, as in sample 85.

Sample 85. How to fill in the payment calculation the day before dismissal:

Top

FAQ

When an employee is dismissed, he is paid compensation for unused vacation and salary. Do you need to reflect information from these payments separately in 6-NDFL?

If wages and vacation compensation are paid one-time and together, then in order to report, it is no longer advisable to break down these amounts. The employer is required by law to make full payment to the resigning person. And if the salary and compensation settlement parts are paid together, then the transfer to the tax account is also carried out in one day.

How to formulate in 6-NDFL the payment of disability benefits for a citizen (due to illness) on April 4 for January?

Since the benefit was paid in full in the 2nd quarter, it is not recommended to indicate the amount reimbursed for sick leave in calculations for the 1st quarter. This information must be reflected in annual reporting in lines 020, 040.

A legal entity rents work space from one of its employees under a contract. Rent is credited to the balance monthly, and it is reimbursed once per quarter until the 20th day of the month following the quarter. How to display this situation in the 6-NDFL report?

We invite you to read: Change in the subject and basis of the claim

https://www.youtube.com/watch?v=ytpolicyandsafetyru

Regardless of the frequency of accruals for rent repayments, the employee receives income once per quarter. And cash deductions coming to his account must be recorded according to their actual disbursement. That is, for example, for the period from April to June it is necessary to display payments for six months in the report. In subsequent periods, by analogy:

- pp. 100 – 20.06;

- pp. 110 – 20.06;

- pp. 120 – 21.06 (working day following payment - in it the withdrawn funds will go to the budget for personal income tax);

- line 130 – amount of quarterly rent payment;

- page 140 – quarterly tax deduction.

How to correctly fill out Section 2 of 6-NDFL?

Section 1 of the report records summary information in accordance with the established reporting period. Section 2 indicates the transactions of the last quarter of the reporting year. It defines:

- page 100 - the date of receipt of money by the taxpayer (for example, for an advance payment - this is the 20th day of the accounting month);

- page 110 – day of collection of the state personal income tax duty;

- page 120 – the date of transfer of tax funds to the state (following their nominal receipt by the employee);

- p. 130 – the totality of “dirty” profits (total tax shares);

- page 140 – the amount of the tax contribution.

What is the most correct way to process an employee’s 6-personal income tax allowance upon leaving the organization if it is 7,000 rubles more than three times the average salary?

Any amount exceeding the threshold must be recorded in both sections. Moreover, only the difference between the permissible maximum and the funds issued is indicated - 7,000 rubles. What is necessary for them is entered on pages 070, 140 (910 rubles are transferred to the state). Dates for transactions are entered as standard on pages 100, 110, 120.

Filling out information for the Federal Tax Service on dismissed personnel in 6-NDFL is simplified as much as possible. The forms contain only the necessary fields, leaving enough space for entering the necessary data. And the ability to optimize reporting preparation through 1C programs allows accountants to significantly reduce the amount of routine work.

Question No. 1. If a dismissed employee is required to pay compensation for unused vacation and salary, then does it become necessary to reflect information on these payments separately in Form 6-NDFL?

Answer. If the salary and compensation for unused vacation were issued to the employee at the same time, then there is no need to break down these amounts in the report. It is the employer's responsibility to fully pay the employee upon dismissal for all payments. Since the amounts of salary and compensation were issued at the same time, this means that personal income tax will also be transferred on the same day.

Question No. 2. How to reflect in the report the fact of payment of temporary disability benefits for September 2020 on October 2?

Answer. Since the benefit payment was made in the 4th quarter, the amount of sick leave should not be shown in the report for the 3rd quarter. This information will be reflected in the annual report on lines 020 and 040.

Question No. 3. A legal entity rents premises from its employee. Rent is calculated monthly and paid once a quarter by the 15th day of the month following the quarter. How to reflect these transactions in the report f.-6 personal income tax?

Page 100 – 04/15/2016

Page 110 – 04/15/2016

Page 120 – 04/16/2016 (the next working day after payment is the day of transfer of personal income tax to the budget)

Page 130 – rental income for the quarter

Page 140 – tax amount for the quarter.

Question No. 4. How to correctly fill out the second section of form 6-NDFL?

on page 100 – the day the taxpayer received income. For example, for wages - this is the last day of the reporting month;

on page 110 – the day the tax payment is withheld;

on page 120 – the day the tax payment is transferred to the budget (usually the next day after the money is issued to the employee);

on page 130 – the amount of income, including tax;

on page 140 – the amount of the tax payment.

Question No. 5. How to correctly reflect in f.-6 personal income tax severance pay when dismissing an employee, which is 5,000 rubles more than three times his salary.

Answer. The excess amount must be reflected in both the first and second sections. Three average salaries need not be indicated in this report, and the difference of 5,000 rubles should be reflected on lines 020 and 130. On lines 070 and 140, it is necessary to record the amount of excess tax (650.00 rubles), and on lines 100,110 and 120 - indicate the dates of receipt, issuance of income and transfer of tax.

The company withheld vacation pay upon dismissal

In the first quarter, the employee took his vacation in advance, and in the second quarter he quits. On the day of dismissal, the company withheld vacation pay from the salary for rest days that the employee did not work.

An employee can take vacation time in advance. But upon dismissal, the company has the right to withhold vacation pay for unworked rest days (Article 137 of the Labor Code of the Russian Federation). The company withholds personal income tax from vacation pay at the time of payment. Therefore, if an employee returns vacation pay, the tax must be recalculated.

In this case, personal income tax is not excessively withheld, because the company correctly calculated it on the date of issue of money. In addition, the employee will return only the amount he received, that is, minus personal income tax. This means that the company will not refund the tax to the employee.

The company will be overpaid for personal income tax. To get it back, some tax officials suggest applying for a refund. Others allow the next payment to the budget to be reduced by the recalculated tax. Do as your inspector recommends.

There is no error in the period when the company issued vacation pay. Therefore, do not specify the calculation for the previous quarter. In the current quarter, adjust section 1 - reduce income in line 020 for vacation pay. Reflect the calculated and withheld personal income tax minus the tax on excess vacation pay (letter of the Federal Tax Service of Russia dated May 24, 2016 No. BS-4-11/9248).

As for the salary upon dismissal in Section 2, the procedure for filling out depends on whether the employee returns vacation pay or the company withholds it itself from the last salary. If the employee returned the money to the cashier, show the salary in the amount in which it was accrued. If the company reduces wages for vacation pay, show the income minus the amount withheld. From the same amount, calculate and transfer personal income tax.

For example

The employee quits on April 15. On this day, the company gave him his salary for April. Accrued salary - 18,000 rubles. From this amount, the company withheld vacation pay - 3,000 rubles. (amount to be charged).

Section 1.

In line 020 for the first quarter, the company recorded the employee’s income including vacation pay - 160,000 rubles. Personal income tax in lines 040 and 070 - 20,800 rubles. (RUB 160,000 × 13%). In the second quarter, the company increased income in line 020 by salaries for April and decreased by withheld vacation pay - 175,000 rubles. (160,000 + 18,000 – 3000). Personal income tax - 22,750 rubles. (RUB 175,000 × 13%).

Section 2.

In fact, the company reduced the accrued salary for vacation pay. Therefore, she showed 15,000 rubles in the calculation. (18,000 - 3000). In line 140 I wrote down personal income tax on this amount - 1950 rubles. (RUB 15,000 × 13%). The date of receipt of income is 04/15/2016. The company filled out the calculation as in sample 86.

Sample 86. How to reflect the salary from which the company withheld vacation pay:

Top

Why was personal income tax-6 invented?

The taxpayer is obliged to submit to the Federal Tax Service a calculation of the personal income tax accrued and transferred to the budget f.-6. Such an obligation arose for him on January 1, 2020, as a supplement to the personal income tax-2 form already in force at that time, which must be submitted no later than the end of the first quarter of each year. In contrast to this form, personal income tax-6 must be submitted quarterly.

We invite you to read: Work injury payments and compensation 2020

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

The company paid the dismissed employee's salary late

The employee quit. The company gave him his salary only a few days after his dismissal.

Upon dismissal, the date of receipt of income in the form of salary is the last working day (clause 2 of Article 223 of the Tax Code of the Russian Federation). As of this date, the company calculates personal income tax. It doesn't matter when the company issues the money. In line 020 of section 1 of the calculation, include income in the period in which it was accrued. But the company will be able to withhold personal income tax only upon payment.

If the company did not withhold personal income tax in the reporting period. Reflect the income in line 020, and the calculated tax in line 040. Do not show the withheld tax in line 070, as well as in section 2 of the half-year calculation (letter of the Federal Tax Service of Russia dated May 16, 2016 No. BS-4-11/8609).

If the company withheld personal income tax in the reporting period. Reflect the income in line 020, the calculated personal income tax in line 040, and the withheld income in line 070. Reflect the payments in section 2. In line 100, write down the day the employee was dismissed. In line 110 - the date of payment, in line 120 - the next business day.

For example.

The employee resigned on May 16. On this day, the company calculated his salary for May - 34,000 rubles, and calculated personal income tax - 4,420 rubles. (RUB 34,000 × 13%). The company transferred the money only on June 1. On this day I withheld and transferred personal income tax. The date of receipt of income is 05/16/2016, personal income tax withholding is 06/01/2016. The company filled out the calculation as in sample 87

Sample 87. How to fill out a calculation if the company delayed wages upon dismissal:

Top

How to fill out 6-personal income tax when dismissing an employee, reflecting compensation, examples

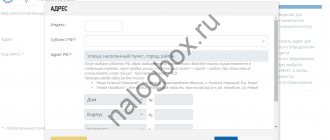

How to fill out cover page 6 of personal income tax

The first sheet of the form does not contain information about dismissed employees; it is filled out according to this sample and displays general information. You can take most of the information from existing documents, for example: code at the location of registration, TIN, KPP, code for the submission period, as well as the code for your activity according to OKTMO

All codes are in special classifiers operating throughout Russia. You cannot deviate from them. Please note that you need to fill out the TIN and KPP code on all pages of the forms at the very top, and also indicate the serial number of the page. Write down the name of your company, then indicate your contact number for communication. The number of sheets 6 personal income tax in all cases is two.

In the second part of the page, you only need to fill in the left area.

The company issued wages and benefits on the day of dismissal

The employee brought in sick leave, and a few days later he quit. The company provided the employee with salary and sick pay on the same day.

Upon dismissal, the employee receives income in the form of salary on the last working day (Clause 2 of Article 223 of the Tax Code of the Russian Federation). For benefits, the date of receipt of income is the day of payment (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Since the company issued benefits and wages on the day of dismissal, the dates in lines 100 match. The company withholds tax on the day of payment. But personal income tax from wages must be transferred no later than the next day. And from benefits - no later than the last day of the month in which the company issued the money (clause 6 of Article 226 of the Tax Code of the Russian Federation). The dates in lines 120 do not match. This means that payments should be filled out in two different blocks of lines 100–140.

For example

The employee resigned on May 24. On this day, the company gave the employee a salary for May - 29,000 rubles, personal income tax - 3,770 rubles. (29,000 rubles × 13%) and sickness benefits - 9,000 rubles, personal income tax - 1,170 rubles. (RUR 9,000 × 13%). The date of receipt of income and withholding of personal income tax for both payments is 05/24/2016. The deadline for transferring taxes from wages is 05.25.2016, from benefits - 05.31.2016. The company filled out payments in different blocks of lines 100–140, as in Sample 88.

Sample 88. How to reflect benefits and wages issued on the day of dismissal:

Top

We reflect the payment of dividends

Another difficult point that we will talk about is how to reflect the payment of dividends in 6-NDFL. They must be reflected separately in section 1. The rate for residents is set at 13%, therefore dividends paid to them are reflected in the same block with accruals to employees. But they are highlighted in line 025 of section 1.

The rate for non-residents is set at 15%. If the founder is a non-resident, then Section 1 must also be completed for dividends.

The procedure for withholding income tax for dividends has no special features: it must be withheld on the day of payment, and transferred no later than the next business day.

Using the conditions of the first example, let’s supplement it: on May 25, dividends were paid to the resident founder in the amount of 100,000 rubles.

The company paid severance pay upon dismissal

The employee resigned by agreement of the parties. Upon dismissal, the company provided severance pay.

Three average earnings upon dismissal are exempt from personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation). If the company issued compensation within these amounts, it has the right not to reflect them in 6-NDFL.

If the company issued more, reflect in the calculation only the amount that exceeds three average earnings. Write it down in line 020 of the calculation and line 130. The date of receipt of income and withholding of personal income tax is the day of payment. Reflect this date in lines 100 and 110. And in line 120 put the next day.

For example

The company fired the employee by agreement of the parties. On May 20, she paid him severance pay - 90,000 rubles. This is 20,000 rubles. higher than three times average earnings. The company withheld personal income tax from the difference - 2,600 rubles. (RUB 20,000 × 13%). The date of receipt of income is 05/20/2016. The next day, May 21, falls on a weekend, so the company reflected the nearest working day in line 120—05/23/2016. She filled out section 2 as in sample 89.

Sample 89. How to reflect severance pay upon dismissal in the calculation:

Top

What payments do we reflect in the report?

Since full payment to the employee is made on the last day of work, this is the date of actual receipt of income. How to fill out 6-NDFL upon dismissal? Only payments subject to personal income tax are reflected in 6-NDFL:

- salary;

- compensation for unused vacation.

Severance pay paid in the event of staff reduction, liquidation of an organization and in other cases established by law is not subject to personal income tax. Therefore, there is no need to enable it. The severance pay paid upon dismissal by agreement of the parties is taxed in excess of three months' average earnings. This excess and the tax on it are included in the report.

The company paid the dismissed employee on the last day of the reporting period

The employee resigned on the last day of the quarter—June 30. On this day, the company issued a calculation and withheld personal income tax.

The date of receipt of income in the form of salary is the day of dismissal (clause 2 of Article 223 of the Tax Code of the Russian Federation). And the deadline for tax transfer is the next working day (clause 6 of Article 226 of the Tax Code of the Russian Federation). The employee resigned on the last day of the quarter—June 30. This means that the deadline for transferring personal income tax fell on the next reporting period - July 1.

In section 2 of the 6-NDFL calculation, the payment must be reflected in the period in which the operation is completed. The Federal Tax Service clarified that the operation was completed in the period in which the deadline for personal income tax payment falls (letter of the Federal Tax Service of Russia dated October 24, 2016 No. BS-4-11 / [email protected] ). This means that section 2 should be completed in the reporting for nine months. In this case, reflect the salary in section 1 of the calculation for the six months.

For example

The company fired the employee on June 30. On this day, I paid out a salary - 76,000 rubles, calculated and withheld personal income tax - 9,880 rubles. (RUB 76,000 × 13%). The date of receipt of income and withholding of personal income tax is 06/30/2016. The deadline for tax payment is 07/01/2016. The company withheld tax in the second quarter, so it reflected the payment in section 2 of the calculation for nine months as in sample 90.

Sample 90. How to fill out section 2 if the personal income tax payment deadline falls in the next quarter:

Top

Date of receipt of income and transfer of tax for the dismissed employee

Questions when filling out Form 6 of personal income tax for dismissed employees often arise due to the fact that the timing of the transfer of income tax for them does not always coincide with the time of transfer of this payment for working employees. The day the employee is dismissed is the day the income is received and is reflected on line 100 of the reporting.

In accordance with the Labor Code of the Russian Federation, the employer is obliged to pay all amounts due to the employee on the day of his dismissal. If for any reason an employee does not show up for work on the day of dismissal, then the deadline for payment is the next day. Income tax for a dismissed employee is withheld on the day of his dismissal and receipt of the payment.

| Line number in the report | Intelligence |

| 100 | Date of dismissal of the employee (reflects the day he received income) |

| 110 | The date on which all payments were made must be indicated. |

| 120 | The tax payment deadline is the day following the day indicated on line 110. If the next day was a weekend, then you must indicate the first working day |

Several employees left in the first quarter

In March, several employees quit, whose income the company reflected in the calculation of 6-personal income tax for the first quarter.

The company fills out section 1 of the calculation with a cumulative total (clause 3.1 of the Procedure, approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] ). Including line 060, which counts the number of “physicists” who received income in the reporting period. Therefore, even if employees quit last quarter and no longer received income, they need to be counted in line 060 of the half-year calculation.

For example

In the calculations for the first quarter, the company reflected the income of 15 “physicists”. In line 020 I wrote down 600,000 rubles, in lines 040 and 070 the calculated and withheld personal income tax from this amount is 78,000 rubles. (RUB 600,000 × 13%). At the end of the first quarter, 5 employees left and were no longer receiving income from the company. For April, May and June, the company paid income to the 10 remaining employees - 450,000 rubles, calculated and withheld personal income tax - 58,500 rubles. (RUB 450,000 × 13%).

The company reflected income and personal income tax on an accrual basis. In line 020 - 1,050,000 rubles. (600,000 + 450,000), in lines 040 and 070 - 136,500 rubles. (78,000 + 58,500). In line 060, the company counted all the “physicists” to whom it accrued and paid income during the six months. In the first quarter, 15 employees received income, in the second, 10 employees out of the same 15 people. The second time, the company did not take into account the “physicists”, but included those laid off in the calculation. The company filled out Section 1 of the calculation as in sample 91.

Sample 91. How to reflect dismissed employees in the calculation:

Top

What is a 6-NDFL report: how to prepare it and when to submit it

According to Article 230 of the Tax Code of the Russian Federation, tax agents paying income to individuals and withholding personal income tax are required to provide to the Federal Tax Service at the place of their registration a calculation of the amounts of personal income tax calculated and withheld for:

- first quarter, half a year and 9 months - no later than the last day of the month following the reporting period;

- for the year - no later than March 1 of the following year.

If an organization has separate divisions, it submits a 6-NDFL report at the place of registration of each separate division in relation to income paid to employees.

The form was approved by Order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected]

It consists of a title page and two sections. The first section is intended to reflect the generalized amounts of income paid and personal income tax withheld. The second provides information about the dates and amounts of actual receipt of income, withholding and transfer of tax.

The employee went on vacation and was subsequently fired

The employee went on vacation and was subsequently fired. The company gave him a paycheck and vacation pay.

Upon dismissal, the employee receives salary income on the last working day for which the company accrued money (Clause 2 of Article 223 of the Tax Code of the Russian Federation). If an employee goes on vacation with subsequent dismissal, the date of termination of the contract is considered the last day of vacation (Part 2 of Article 127 of the Labor Code of the Russian Federation). But the company pays off and issues a work book before the vacation (Part 4 of Article 84.1 of the Labor Code of the Russian Federation). The last day for which the company calculates wages is the last working day before vacation. This means that this is the date of receipt of income.

No later than three calendar days before the start of the vacation, the company transfers vacation pay. On this day the employee receives income. The deadline for transferring tax on this payment is the last day of the month in which the company issued the money (letter of the Federal Tax Service of Russia dated May 11, 2016 No. BS-3-11 / [email protected] ). This day should be written on line 120.

For example

The employee went on vacation and was subsequently fired. The last working day before vacation is May 20. And the date of termination of the employment contract is June 10.

Vacation pay. On May 16, the company issued vacation pay - 32,000 rubles, personal income tax - 4,160 rubles. (RUB 32,000 × 13%). The deadline for transferring personal income tax from vacation pay is 05/31/2016.

Salary. The company paid the employee on the last working day before the vacation - May 20. I gave him a salary - 58,000 rubles, personal income tax - 7,540 rubles. (RUB 58,000 × 13%). The deadline for transferring personal income tax is May 21, which happened to be a weekend. Therefore, in line 120 the company wrote 05/23/2016.

In section 2, the company filled out payments as in sample 92.

Sample 92. How to fill out a calculation if an employee goes on vacation with subsequent dismissal:

Top

To whom and when to fill out and where to submit

6-NDFL must be submitted to persons who are designated as tax agents in accordance with the Tax Code of the Russian Federation:

- legal – factories, firms, factories, etc.;

- IP;

- non-departmental notaries, lawyers;

- other persons conducting private business activities.

The report contains data aggregated to all income for a specified period. They also include remuneration to employees in total with dividends and incentives, the provision of which must be fixed in a civil contract of employment or receipt of one-time services.

Income from the sale of personal (non-current) property is not subject to taxation.

The report for 6-NDFL is compiled and submitted to the tax authorities before the deadline of the month after the reporting quarter, 2-NDFL - before the beginning of April of the year succeeding the accounting one. An individual reports at the place of residence, a legal entity – in the region of registration.

The Tax Code of the Russian Federation provides for a number of exceptions, such as the transfer of documentation via mail or online report, if another option is not available to the taxpayer.

Particular attention must also be paid to the transmission of the report to the regulatory authority. Methods for filing 6-NDFL for 2020:

- Filling out the form in writing/on a PC. Afterwards it is handed over by the person (authorized representative) in person or by registered mail by Russian Post.

- Formation of data in a PC and sending through your personal account using an electronic signature. Most payers use this method because of convenience, but for legal entities with more than 25 employees, it is mandatory and the only one.

Purpose of the certificate

Starting from the 2020 report, taxpayers submit to the Federal Tax Service data on personal income tax-6 accrued and transferred to the budget in addition to the personal income tax-2 form in force at that time with a deadline of the end of the first quarter. The difference between 6NDFL and the existing certificate is the need to submit it every 3 months . Increasing the frequency of submission of primary information makes it possible to strengthen control over the correctness of calculations and timely payment of income tax by payers to the treasury.

Composition of taxable income

Individuals who earned money from the sale of property are exempt from the obligation to pay the levy. For all other types of income, reporting is prepared based on the results of the quarter and submitted to the inspectorate no later than the end of the next month, and the year - before April 1 of the following month. The dismissal of an employee is accompanied by the receipt of the following income from the employer:

- severance pay in case of reduction or liquidation of an enterprise;

- compensation for missed days of rest;

- earnings with bonuses provided for by the payment system;

- remuneration under civil contracts and dividends.

Tax on severance pay is levied only on the part that exceeds three times the average earnings of the dismissed employee. The excess amount is reflected on page 020 of the first section and line 130 of the second. Lines 070 and 140 show the calculated personal income tax based on the excess amount.

Deadlines and rules for filling out reports

Tax agents required to submit 6-NDFL include enterprises and organizations, individual entrepreneurs, private notaries, and other individuals with individual practice. There are several options for submitting the report: electronically using the same signature, filling it out on a computer or by hand and personally bringing it to the inspectorate, or sending it by mail.

Institutions with an average staff of ≥ 25 people submit the form electronically. The timing of tax transfers when an employee quits is not always identical to the timing of contributions for working specialists. The day of contract termination is the moment of receipt of income, reflected on line 100.

| Report line | Explanations |

| 100 | Date of dismissal - issuance of amounts due to the citizen |

| 110 | The date when the final payment of all money occurred |

| 120 | The time for tax transfer is the next day after the mark on line 110. If it is a day off, then indicate the first working day. |

When paying tax, they are guided by the order of the Federal Tax Service dated October 14, 2015 No. 11/450. The document sets out the general procedure for reflecting the 6-NDFL form approved by it, including cases of termination of the contract. Most often, when dismissing and calculating taxes, complications are caused by the following payments:

- vacation money issued upon subsequent departure from the enterprise;

- compensation for rest days that could not be used for their intended purpose.

https://youtu.be/PAyFe0-Q2WY

Depending on the type of income received by the employee and the time of its issuance, the timing of transferring withheld amounts to the budget changes. To avoid confusion when to pay 6 personal income taxes upon dismissal in 2017, the following table is offered .

| Type of income received | The fact that money was issued by an employee who left the company - page 100 | The standard period for making contributions to the treasury is via line 120 |

| Basic and incentive salary | Last day of activity in the organization | The next day after the money is issued |

| Vacation amounts | Payout episode | End date of the month in which income is accrued and received |

| Sick leave benefits | Same | Identical rule |

Each type of compensation and amount of tax is reflected in separate packages of the second section, grouped according to the time of issue and payment of the fee. The amount of the transferred personal income tax payment is indicated in line 140, payments - 130. For each item, the deadlines are set on the corresponding lines 100, 110, 120.