When an employee quits or his employment contract is terminated, a calculation note is drawn up to calculate the payment necessary in this situation (salary or compensation for unspent vacation days, etc.).

There is a special uniform form T-61, which is used in this case. The specialists responsible for preparing this document are a personnel officer and an accountant. The HR employee enters general information about the employee, information about dismissal and the fact of termination of the contract (on the front side of the document). On the other side, the accountant calculates the amount of payment due to him.

You may find the form for a note-calculation on granting leave (Form T-60) useful.

Part 1. Information about the employee

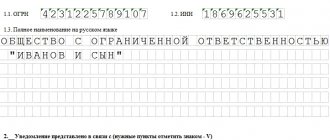

- The first part of the calculation note in form T-61 is filled out by the personnel officer and includes information about the company in which the employee worked, with its full name and mandatory indication of the organizational and legal status (IP, LLC, CJSC). Here you need to enter the date of preparation and document number for internal document flow.

- Next, you need to enter information relating to the employee personally, that is, his full name, position, structural unit or department in which he worked, as well as the personnel number assigned to him when he was hired.

- Then you should enter in the form the date of termination of the employment contract and the basis on which the employee was dismissed (this data must correspond to the order of the head of the organization, as well as the entries in the employee’s work book).

- The last part in this section concerns vacation periods, namely the number of days of remaining unused vacation and, if there was a fact of using vacation “in advance,” fixing the number of “extra” vacation days. In the second case, the amount paid to the employee for vacation previously provided “in advance” is deducted from the final calculations.

- As a final step at this stage, you need to put in this part the date of filling out the document and the signature of the personnel specialist.

Form and sample

The document has a single approved form and is used universally by any organizations:

- IP;

- small companies;

- large trading and manufacturing enterprises of any form of ownership;

- public associations;

- religious organizations.

The only exception is budgetary organizations of any level (schools, hospitals, local, federal authorities, the Ministry of Internal Affairs and many others). They do not keep records using Form T-61.

The form approved by the State Statistics Committee of Russia is given below.

And here is a ready-made example of filling that can be used as a sample.

https://youtu.be/BXzcMcg9umY

Part 2. Calculation of vacation pay

This section is completed by an employee of the accounting department .

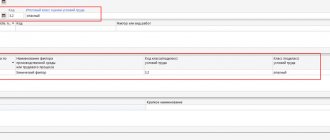

To calculate compensation for unspent vacation days, you must enter the necessary information in all columns of this section according to the algorithm below.

Next comes the column number in numbers and a description for it.

- — the year is entered here (necessary for calculating the average monthly salary of an employee);

- — months are indicated here (before the date of dismissal);

- — here you need to write the employee’s income for each of the months taken into account;

- — the number of days (according to the calendar) in the period taken as the calculation period;

- — is issued only for hourly wages of the employee;

- — the calculated amount of the average daily wage is indicated here;

- — the number of vacation days that were taken in advance;

- — unspent vacation days;

- - the final amount of money due to be paid to the employee for the specified number of unused vacation days. The calculation is made as follows: (from the data in column 8 you need to subtract the data in column 7) multiply the result by the data from column 6.

What is it for?

By receiving a payslip upon dismissal, an employee can find out all the components of his salary and the total amount that the employer will pay him upon payment on the last working day.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

By detailing all accruals and deductions, the employee has the opportunity to determine whether there are any discrepancies in the payments indicated in the form with those that are due to him in accordance with the employment contract and the norms of the Labor Code of the Russian Federation.

A payslip allows you to make the relationship between employer and employee regarding remuneration as transparent as possible. If an employee identifies shortcomings in payments, he or she can recover the missing amount from the employer, and the employer, in the event of unlawful claims regarding accruals made, can prove that he is right by presenting a payslip.

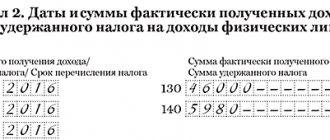

Part 3. Calculation of payments due to the employee

Here, too, everything needs to be filled out step by step, taking into account all the information from payment and settlement documents. In columns 10 to 19, data is entered to calculate the amount that must be paid to the employee.

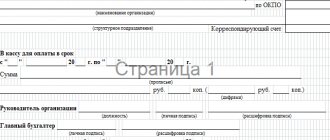

Attention! The final amount of payments due to the employee upon dismissal must be entered at the end of the T-61 form, both in numerical form and in words. Here you also need to enter payroll data, which serves as justification for the issuance of cash from the organization’s cash desk.

After completing the last section, the accountant who filled out the document must put his signature under it with a transcript and the date of completion.

After the entire procedure described above for drawing up the T-61 calculation note, it is necessary to make a corresponding entry in the employee’s work book about the termination of the employment contract. To properly maintain personnel records, the necessary mark must be placed on the personal card of the resigned employee.

The procedure for using a settlement note upon dismissal

Termination of an employment relationship can occur for various reasons: both at the initiative of the employee and the employer. In each case, there are different deadlines within which a decision is made, and then a dismissal order is issued.

As soon as an order to terminate the contract is issued, on its basis the personnel service issues a settlement note, for which form T-61 is used. You just need to take into account that the employee must calculate the amounts and pay them on the day of dismissal.

When filling out a calculation note, it is very important to reflect whether the employee has vacation days due to him for which he needs to be compensated, or whether he has already taken them off. A situation may arise that an employee has already been granted annual leave according to the approved vacation schedule. As a result, he incurs debt for unworked rest time.

To calculate how many vacation days an employee is entitled to, you need to take into account his length of service. To do this, you need to look at previous leave orders or the employee’s personal card (if appropriate entries were made there), where the time of work for which the employee was already granted it is recorded. Next, the vacation days upon dismissal are calculated.

The law establishes that for each month of work an employee is provided with 2.33 days of rest. In this case, the period before the 15th is not taken into account, and after the 15th is considered as a full month.

Having filled out his page of the notice-calculation upon dismissal, the HR inspector endorses it and transfers it to the accounting department for further processing.

The accountant selects data from payroll statements for the previous 12 months, and fills in information about salaries with a breakdown of them monthly, and the number of calendar days in the selected period. The calculation takes into account the accrued time-based or piece-rate salary with allowances and additional payments with bonuses (if they are not one-time).

It is necessary to exclude from this sample all amounts for the calculation of which average earnings, sick leave benefits, financial assistance, etc. were used. When calculating calendar days for each month of work, 29.3 is taken, and for partially - calendar days falling on the period work divided by the total number of jobs per month and multiplied by 29.3.

Based on these data, the average daily earnings are determined and compensation for unused vacation upon dismissal is calculated.

Here the accountant fills in information about wages for days worked, other accruals, as well as deductions and the amount to be paid. Based on the calculation, payment documents for payment or transfers are issued.

The calculation note is endorsed by the accountant and attached to the rest of the payroll documents for the current month.

Are they required to issue?

The payslip contains all the information about charges. Are they obliged to issue it - yes. It should reflect the following information:

- about the exact amount of salary that the employee will receive upon dismissal. This paragraph should also take into account payment in non-monetary form, if the enterprise has one;

- about the interest rate;

- about bonuses, if any are provided for by the collective agreement or regulations of the organization;

- about bonus payments that are awarded as a reward to an employee for the work done;

- on compensation and additional payments;

- on contributions to various funds.

The documents must reflect all payments that will be accrued to the employee, as well as for what period the accrual is made. This information must be contained even if funds are issued in cash.

The document plays the role of an accounting form on which an employee can see what his salary and the final amount of money given upon dismissal are made up of. Any shortcomings may allow the employee to go to court, by which decision the employer may be required to pay monetary compensation to the employee.

By law, a payslip is required. It is issued to all employees, regardless of the type of contract concluded and its duration. This is done so that the employer cannot make payments of an unaccountable type, as well as for transparency of operations, including for the employee. In addition, if during the calculation the employee does not agree with the amount of payment, the employer will be able to prove his case using a payslip.

The payroll must be drawn up by an accounting employee who has full access to data on the employee’s salary and other required payments. After preparing the document, it does not need to be signed by the responsible employee and manager, or certified with the organization’s seal, due to the fact that this sheet is for informational purposes only and does not confirm the fact that the employee has received funds. At the same time, after receiving the sheet, the employee must sign the form, which will confirm the fact that the document was provided to him.

Does the employee need to be given a pay slip?

Article 136 part 1 of the Civil Code of the Russian Federation.

Article 136 part 1 of the Civil Code of the Russian Federation states that when issuing wages, the employer is obliged to notify the employee in writing:

- about the components of his earnings for the established period;

- about other accruals, including monetary compensation due as a result of the director’s violation of salary payment deadlines, vacation pay, severance pay, etc.;

- about the total amount of accruals;

- about the amount and reasons for deductions from wages;

- on the amount of funds to be paid.

The information listed is contained in the pay slip, so the employer is required to provide it. It does not matter how the salary is paid - in cash or transferred to a bank card.

We invite you to familiarize yourself with the dismissal of the director of an LLC - what is the procedure

There is no unified form of pay slip, so the organization creates it independently. The order of their issuance is determined by the order of the head.

Typically, information about accruals and deductions is printed on paper, but can also be in electronic form. Upon dismissal, a pay slip is issued on the last working day. For untimely issuance or absence at all, a fine is provided for employers.

| For officials | From 10 to 20 thousand rubles. |

| For individual entrepreneurs | From 1 to 5 thousand rubles |

| For legal entities | From 30 to 50 thousand rubles. |

Instead of a fine, the activities of individuals and legal entities may be suspended for up to 90 days.

Filling rules

A unified form of the document is not established by law, therefore each employer can develop its own form of the form and establish the procedure for its issuance, taking into account the norms of the Labor Code of the Russian Federation. The issuance procedure is fixed in the local regulations of the organization, indicating the persons responsible for the issuance.

This is important to know: Is it possible to fire a disabled person of group 2 at the initiative of the employer?

The legislation does not say in what form the document should be issued. This can be a standard A4 sheet or company letterhead. The sheet can be filled out either handwritten or printed. The pay slip must not contain typos or false information, otherwise the document will be declared invalid.

An accounting department employee is appointed responsible for the formation of the payslip, since he has access to information about payroll for each employee. Since the payslip is only an information document, it does not require the signature of the manager and the seal of the enterprise.

You can hand over a payment document to an employee with or without a signature (what papers must the employee sign?). The first option is more reliable, since the employer can document the receipt by the employee of the sheet at any time. To implement it, choose one of the following methods:

- tear-off spine - upon receipt, the employee puts a personal signature on the tear-off part of the form, after which the spine remains with the employer;

- keeping a journal - upon receipt of a document, employees sign in the journal for issuing pay slips;

- an additional column in payment documents or a separate form where employees sign upon receipt of the document.

An employer may fulfill its obligation to inform staff, but not document this fact. This applies to the following cases:

- employees are informed about the issuance of pay slips, but they apply for the document themselves when necessary, for example, upon dismissal;

- information is provided by sending data by email;

- information is posted in the employee’s personal account on the corporate website (in case of dismissal, it may not be applied due to the employee’s access being blocked).

Accounting entries

Upon termination of the employment agreement based on the completed settlement note, Form T-61, the accountant creates the following entries:

- Dt20 - Kt70 - remuneration and compensation payments due to the main personnel of the company have been accrued;

- Dt23 - Kt70 - remuneration and compensation payments due to the company’s support staff have been accrued;

- Dt25 - Kt70 - remuneration and compensation payments due to general production personnel of the company have been accrued;

- Dt26 - Kt70 - remuneration and compensation payments due to administrative personnel have been accrued;

- Dt44 - Kt70 - remuneration and compensation payments due to personnel involved in the sale of the company’s goods have been accrued;

- Dt91 - K70 - remuneration and compensation payments due to company personnel engaged in other operations have been accrued.

- Dt70 - Kt68 - personal income tax was deducted from the accrued amounts to the employee;

- Dt70 - Kt76 - other deductions were made from accrued wages (for example, according to writs of execution).

- Dt70 - Kt50 - the amounts due upon dismissal were issued to the employee in cash.

- Dt70 - Kt51 - the amounts due upon dismissal were issued to the employee by bank transfer.

How long before dismissal should you write a note?

The legislation does not regulate the period of time during which a settlement note must be drawn up. The norms of the acts only establish the obligation to pay all money due upon dismissal to the employee either on the final day of work, or, if the salary is transferred to the card, then on the next day.

The deadline for its formation is the final working day of the resigning employee. If the employee terminates the contract on his own initiative, then according to the general rules he submits an application two weeks before this date.

This is important to know: Transferring a part-time worker to the main job without dismissal

Therefore, you can issue a dismissal order and draw up a settlement note from the moment you receive the dismissal application. However, you must also remember the employee’s right to withdraw the application before the end of the notice period. Therefore, the dismissal order and the note may have to be canceled.