- one is handed over to the accounting department to the responsible accountant, on its basis the inventory items are written off from the MOL;

the second is stored in the structural unit where it was compiled (for example, in a warehouse, store, sales area);

act TORG-15 in Excel format (for 2020)

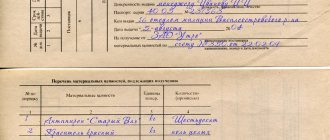

The TORG-15 header indicates the company, its legal address, and the name of the structural unit where the damaged goods were discovered.

Additionally, the supplier of the product in question, its address, and bank account details are specified. The number of the act, the date of its preparation, the signature of the head of the company and the date of approval of the document must be indicated. The tabular part consists of the following details:

- name of the product, its characteristics and code;

- unit of measurement (name and OKEI code);

- product article;

- grade or category of goods and materials;

- quantity of goods;

- discounted price in rubles;

- information about the markdown of goods;

- discount percentage;

- additional characteristics (cause of defect).

Below the table the cause of the defect is repeated and the culprit of the incident is indicated. Filling out the main details of the damage report is presented in the table:

| Props name | Explanations for filling |

| Name of goods and materials | It is advisable to indicate the name of inventory items in detail, with an article number. This is necessary to identify inventory items and clarify the type of product. Since the taxation procedure directly depends on the type of values and grounds for write-off. |

| Reason for markdown or write-off | When checking, tax authorities pay close attention to precisely the reason for writing off inventory items. Since this point is important when tax or legal disputes arise regarding compensation for losses in the presence of guilty parties. Trading companies should pay special attention to this detail. Based on clause 4 of Art. 5 of the Law “On the Protection of Consumer Rights”, the manufacturer must indicate expiration dates for food products, perfumes, medicines, household chemicals and other goods. After the expiration date, these types of valuables are considered unsuitable for their intended use and are subject to deregistration. A complete list of such goods is contained in the list prepared and approved by the government decree of the Russian Federation. |

| Product defects | In TORG-15, it is advisable to fully describe the identified defects of the product; their detailed description will serve as a powerful argument for confirming the fact of scrap or damage to goods and materials and for clarifying the fact whether the product has partially or completely lost its consumer properties. The last point is important for deciding the subsequent “fate” of the product: sell it at reduced prices or dispose of it. |

| Quantity, price before and after the markdown procedure | These indicators in accounting serve as the basis for making the necessary changes. If companies often encounter markdowns of inventory items, then it is more rational to develop and approve a special provision on the procedure for marking down goods. Since during an audit, tax authorities are often interested in the issues of the amount of markdown and the procedure for establishing it. If there is such a provision, it will reduce the risks of additional income tax charges. |

| Details of the person responsible for the damage | Completing this section is especially important if the reason for writing off inventory items was theft, violation of the rules for transporting goods, their acceptance or storage, or defects due to the fault of the supplier. If a product is written off due to the expiration date, then this detail is not filled in. |

| Details of persons included in the commission | To carry out the procedure for writing off valuables, a commission is formed, which includes, among other things, MOL, representatives of management and accounting. This commission determines the reasons for the impossibility of further use of assets, is responsible for filling out the TORG-15 act and establishes the possibility of subsequent use of damaged goods and materials at a lower price or its liquidation. |

| Document on write-off and disposal | If it is impossible to subsequently sell the goods (even at a lower price), the object is deregistered, using the TORG-16 act or another document, invoice, drawn up in any form as a basis. |

Errors in filling out TORG-15

The legislation does not require the mandatory completion of the TORG-15 standard form when identifying grounds for markdown or deregistration of goods. If desired, the company can use the unified form of the TORG-16 write-off act or draw up a document in its own form.

filling out the TORG-15 act in Excel format

If the standard form TORG-15 is taken as a basis, then it must be filled out correctly. Many corrections in the act are not allowed, as this will reduce the readability of the document. If there are a lot of errors, it is better not to correct them, but to fill out a new act.

The act must contain reliable information. This document is the primary one for the accountant to write off or reduce the value of goods; entries will be made based on the TORG-15 form, and therefore all amounts must be calculated correctly.

If a markdown is carried out, then you need to correctly calculate its percentage, that is, arithmetic errors in the act are not allowed.

Members of the commission drawing up the act must sign the completed document. With their signatures, each member confirms the correctness of completion. The accountant should also carefully check the specified quantitative and cost indicators and carry out the calculations correctly.

Errors in the TORG-15 act are unacceptable - the Federal Tax Service will not accept expenses as taxable profit unless there is correct documentary evidence. If the expenses are attributed to the guilty employees of the organization, then it is possible to demand compensation from them for damages only if the act is filled out correctly.

Source: https://kfin.pro/gde-primenyaetsya-akt-torg-15/

How to fill out the TORG-15 form correctly

The header indicates the organization, its address and the name of the structural unit where the damaged goods were found. Also indicated is the supplier organization whose goods are subject to markdown or write-off, its address and bank details (account), document number, date of its preparation, visa of the manager: signature, date of approval of the act. The tabular section states:

- the reason for writing off/devaluation of goods is damage, scrap, damage;

- name of the inventory, its code (if a coding system is used);

- units of measurement, article number, grade, etc.;

- if the product is subject to markdown, columns 10 to 14 are filled in;

- the cause of the defect is indicated.

Below the table, the cause of the defect is repeated, and the person responsible for the incident is also indicated.

Next, the act is signed by all members of the commission and the person responsible for storing inventory items.

The head of the organization, having familiarized himself with the drawn up act, makes a decision on further actions in relation to the product: write it off or discount it; and also determines which employee’s account to write off the losses incurred. The amount of damage incurred is indicated in words below.

If it is decided to post scrap (scrap) or the goods are subject to destruction, appropriate records are made about this. All this must be signed by the chief accountant.

Current samples, forms, document forms for 2019>>>

Scope of application of form OP-15

The standard interindustry form OP-15 - “Act on the removal of residues of products, semi-finished products and finished kitchen products” and Instructions for its use and completion were approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132 “On approval of unified forms of primary accounting documentation for accounting of trade operations” .

The form is used by catering organizations.

Since January 2013, this form, like most unified forms, is not mandatory for use, but those organizations that used it continue to do so. In this case, instructions on the use of this form should be contained in the accounting policies of the organization.

In addition, the organization can modify the form to suit its needs, then it will be a new form, which must also be approved by the manager, and an indication of which must be contained in the organization’s accounting policy (

The form is used in the kitchen and in other similar departments to record leftover products, semi-finished products, and unsold finished products.

Thanks to filling out this act, the organization always has data on the actual amount of unused products in the kitchen, the remains of semi-finished products and unsold products.

An act in the OP-15 form is drawn up during inventory, when changing the team in the case when the kitchen work is carried out in two or more shifts.

The act is drawn up and signed by the commission. This act is drawn up in two copies.

https://youtu.be/nKo-w-wTZP8

The basic rule when inventorying leftovers in the kitchen is that leftovers of semi-finished products and finished products must be converted into raw materials based on the standards contained in the recipes that were used when compiling calculations for semi-finished products and finished products.

The amount of raw materials (both unprocessed and newly counted) is indicated in column 11 of the form.

- The header of the form is filled out - the name of the organization and structural unit, the type of activity of the organization, as well as the number and date of drawing up the act are indicated.

- At the top of the act, the name of the remaining semi-finished and finished products is indicated - name, code (if available), unit of measurement (unit of measurement code) and the number of balances. This data is entered in lines 1-5.

- Next, the amount of products (raw materials) is indicated, both unconsumed and included in the finished dishes. Each line contains one name. If there is no data in the column, a dash is placed.

- For each item the following is indicated:

- Name

- Code (if available)

- Unit of measurement and its code

- Remaining raw materials

For ready-made dishes, the remaining raw materials are indicated at the rate for 1 serving and for the total quantity.

- The last three columns, united by the common name “Total Products,” indicate the price, quantity and amount for each item.

- At the end of the form, the total cost of the remaining products is indicated in the final line. The same amount is indicated below the table in words.

- The act is signed by the members of the commission. Their positions and transcripts of signatures must be indicated for them.

Let's look at an example of filling out the Act form OP-15

In the Solnyshko canteen, an inventory of food remains, semi-finished products and unsold food remains was carried out.

Detection of errors in the Report form OP-15

If errors are found in the act, they must be corrected according to the general rules in force in accounting. This provision is contained in paragraph 7 of Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”.

There are 2 options for fixing the error

Source: https://kfin.pro/sfera-primeneniya-formy-op-15/

Act on damage, damage, scrap of inventory items, form bargaining-15.

When transporting, storing and moving goods and material assets, the problem of unintentional damage, breakage or scrap of property often arises. In such cases, the fact of the event is recorded by drawing up a document of the TORG-15 form, which is called “Act of damage (damage, scrap) of goods and material assets (material assets).” In accordance with the OKUD classification, the document has a unified form with code 0330215. A sample of filling out the TORG-15 form The act is drawn up by the employee of the enterprise responsible for the safety of valuables in the presence of a special commission, the function of which is to confirm the fact of damage to goods or property. The composition of experts must be appointed by the head of the business organization by order. Where to find the form and sample of filling out TORG-15 Form TORG-15, although it is unified, is not required for use. Another thing is that the specified form is very convenient - after all, it takes into account all the nuances for documenting the situation with damage/crowbar/damage to goods and materials.

TORG-15 you can on our website. Download form TORG-15 And if you have difficulties completing this document, we recommend using the sample for filling it out on our website. TORG-15 Results The need to draw up an act in the TORG-15 form arises when damage to goods is detected.

Based on this act, the goods can be discounted or disposed of. It also indicates the amount of damage caused and the guilty person from whom this amount will need to be withheld, if such a person is identified.

Specification

- TORG-11. Product label

- TORG-12. Packing list

- TORG-13. Invoice for internal movement, transfer of goods, containers

- TORG-14.

Invoice for expenses and receipts (for small retail trade) - TORG-15. Act on damage, damage, scrap of inventory items

- TORG-16. Certificate of write-off of goods

- TORG-18. Journal of goods movement in the warehouse

- TORG-23. Product journal of a retail trade worker

- TORG-26. Order

- TORG-29. Commodity report

This form is used to register inventory items that arise due to damage, damage or scrap and are subject to markdown or write-off. Losses are written off to the account of the guilty employees. The act is approved by the head of the organization and drawn up in triplicate.

How to draw up a TORG-15 act: sample filling and rules

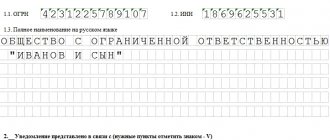

To draw up TORG-15, a special commission is created, composed of members approved by the director of the company. It must include a representative of the enterprise administration, a person financially responsible for the safety of goods, and, if necessary, a representative of the sanitary inspection.

The visa approval of the director of the company must be on the front side of the act. The TORG-15 act is filled out in 3 identical copies, one of which remains in the structural unit, the other is sent to the accountant for display in accounting and withholding the damage from the salary of the guilty employee, and the third is transferred to the person responsible for causing the damage.

When filling out TORG-15, you should pay attention to filling out some points. Thus, the code for the reason for damage/breakage/scrap may not be included in the report if the company does not use an internal coding system. The document must indicate the reason for writing off the damaged goods or marking them down.

For information on how you can organize accounting in trade, read the article “Trading goods with and without VAT (nuances).”

Spoiled (damaged) goods should be listed, indicating their name, main characteristics, quantity and accounting value before and after the markdown. The guilty person (if it is possible to identify him) and his position must also be named.

The final part of TORG-15 contains the text of the manager’s order on the further fate of damaged (damaged) inventory items. Thus, the need for their disposal may be indicated. In addition, you should provide the exact amount of damage and the details of the person at whose expense it will be compensated.

Where is the TORG-15 act applied?

Damage to inventory items usually occurs as a result of careless handling of goods, improper storage and transportation. To write off unsuitable goods, a special commission is appointed consisting of the head of the company, financially responsible persons, and sometimes a sanitary inspection officer. After clarifying the circumstances of the case, the commission members fill out the TORG-15 form in triplicate.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

The document indicates the full composition of the commission, the name of the missing or damaged goods, its quantity, cost, causes of losses, defects that have arisen and the possibility of further use of goods and materials. The last point may imply several options:

- sale of goods at actual cost;

- sale of commodity or material assets at a reduced price;

- complete destruction of the goods;

- removal of goods and materials to a landfill;

- transfer to livestock feed and so on.

If there is a partial loss of consumer properties, the product is discounted. Then the act indicates two prices: this is the cost of the valuables before and after the markdown, and the amount of the markdown is also indicated. If damage or loss of quality of valuables occurs, and the goods are not subject to subsequent sale, then an additional act TORG-16 is also drawn up in triplicate, which is signed by the head of the company and members of the created commission.

Errors in filling out TORG-15

The legislation does not require the mandatory completion of the TORG-15 standard form when identifying grounds for markdown or deregistration of goods. If desired, the company can use the unified form of the TORG-16 write-off act or draw up a document in its own form.

filling out the TORG-15 act in Excel format

If the standard form TORG-15 is taken as a basis, then it must be filled out correctly. Many corrections in the act are not allowed, as this will reduce the readability of the document. If there are a lot of errors, it is better not to correct them, but to fill out a new act.

The act must contain reliable information. This document is the primary one for the accountant to write off or reduce the value of goods; entries will be made based on the TORG-15 form, and therefore all amounts must be calculated correctly.

If a markdown is carried out, then you need to correctly calculate its percentage, that is, arithmetic errors in the act are not allowed.

Members of the commission drawing up the act must sign the completed document. With their signatures, each member confirms the correctness of completion. The accountant should also carefully check the specified quantitative and cost indicators and carry out the calculations correctly.

Errors in the TORG-15 act are unacceptable - the Federal Tax Service will not accept expenses as taxable profit unless there is correct documentary evidence. If the expenses are attributed to the guilty employees of the organization, then it is possible to demand compensation from them for damages only if the act is filled out correctly.

Who signs the completed act?

In conclusion, the TORG-15 act is signed by all members of the commission, including the employee responsible for storing inventory items. After reading the document, the head of the company signs his visa and decides on subsequent actions in relation to the product (write off or discount) and determines which employee is to blame for what happened.

As a rule, the loss of consumer properties of a product occurs due to mismanagement of employees, so damages are recovered from those responsible.

Registration of the TORG-15 act

The unified form is filled out in triplicate:

- one is handed over to the accounting department to the responsible accountant, on its basis the inventory items are written off from the MOL;

- the second is stored in the structural unit where it was compiled (for example, in a warehouse, store, sales area);

- the third is given to the person responsible for these values. In this case, the product being written off is removed from the account of this person.

The TORG-15 header indicates the company, its legal address, and the name of the structural unit where the damaged goods were discovered.

Additionally, the supplier of the product in question, its address, and bank account details are specified. The number of the act, the date of its preparation, the signature of the head of the company and the date of approval of the document must be indicated. The tabular part consists of the following details:

- name of the product, its characteristics and code;

- unit of measurement (name and OKEI code);

- product article;

- grade or category of goods and materials;

- quantity of goods;

- discounted price in rubles;

- information about the markdown of goods;

- discount percentage;

- additional characteristics (cause of defect).

Below the table the cause of the defect is repeated and the culprit of the incident is indicated. Filling out the main details of the damage report is presented in the table:

| Props name | Explanations for filling |

| Name of goods and materials | It is advisable to indicate the name of inventory items in detail, with an article number. This is necessary to identify inventory items and clarify the type of product. Since the taxation procedure directly depends on the type of values and grounds for write-off. |

| Reason for markdown or write-off | When checking, tax authorities pay close attention to precisely the reason for writing off inventory items. Since this point is important when tax or legal disputes arise regarding compensation for losses in the presence of guilty parties. Trading companies should pay special attention to this detail. Based on clause 4 of Art. 5 of the Law “On the Protection of Consumer Rights”, the manufacturer must indicate expiration dates for food products, perfumes, medicines, household chemicals and other goods. After the expiration date, these types of valuables are considered unsuitable for their intended use and are subject to deregistration. A complete list of such goods is contained in the list prepared and approved by the government decree of the Russian Federation. |

| Product defects | In TORG-15, it is advisable to fully describe the identified defects of the product; their detailed description will serve as a powerful argument for confirming the fact of scrap or damage to goods and materials and for clarifying the fact whether the product has partially or completely lost its consumer properties. The last point is important for deciding the subsequent “fate” of the product: sell it at reduced prices or dispose of it. |

| Quantity, price before and after the markdown procedure | These indicators in accounting serve as the basis for making the necessary changes. If companies often encounter markdowns of inventory items, then it is more rational to develop and approve a special provision on the procedure for marking down goods. Since during an audit, tax authorities are often interested in the issues of the amount of markdown and the procedure for establishing it. If there is such a provision, it will reduce the risks of additional income tax charges. |

| Details of the person responsible for the damage | Completing this section is especially important if the reason for writing off inventory items was theft, violation of the rules for transporting goods, their acceptance or storage, or defects due to the fault of the supplier. If a product is written off due to the expiration date, then this detail is not filled in. |

| Details of persons included in the commission | To carry out the procedure for writing off valuables, a commission is formed, which includes, among other things, MOL, representatives of management and accounting. This commission determines the reasons for the impossibility of further use of assets, is responsible for filling out the TORG-15 act and establishes the possibility of subsequent use of damaged goods and materials at a lower price or its liquidation. |

| Document on write-off and disposal | If it is impossible to subsequently sell the goods (even at a lower price), the object is deregistered, using the TORG-16 act or another document, invoice, drawn up in any form as a basis. |

Registration of a write-off act

If it is impossible to further use the goods, a write-off report is drawn up. The head of the enterprise issues an order defining the composition of the commission and its tasks. The act is filled out in printed form by one of the commission members and drawn up in triplicate (for the accounting department, for the structural unit, for the financially responsible person).

You can use the unified form TORG-16:

- name of the enterprise and its structural division;

- date of receipt of goods (from invoices - commodity TORG-12 or commodity transport 1-T);

- name of the product, its code;

Important! The document reflects complete information about the product and the reasons for its write-off.

The act is a primary accounting document, therefore corrections and errors in it are unacceptable. It is necessary to redo the document if it is drawn up incorrectly.

The document is signed by all members of the audit commission and the financially responsible person. Below, the manager writes a decision on how the goods will be written off:

- the guilty person indicating the last name, first name, patronymic and position;

- cost;

- profits, etc.