When is inventory taken?

First of all, the corresponding order is issued.

The methodology and frequency of the procedure are established by the management of the business entity. But in certain cases, the law requires an inventory of property:

- before the start of the formation of the annual balance sheet

if it is planned to transfer the property for rent, its sale or purchase- at the stage of transformation of the form of ownership (state or municipal)

- after theft, damage to property, abuse of property rights

- when changing personnel with financial responsibility

- after natural and man-made disasters

- at the stage of liquidation or reorganization of the company

Formation of an inventory commission

A commission is formed by a special order. It states:

- Inventory item

- Basics for the procedure (reasons)

- Time frames allocated for inventory

- Full name of the chairman of the commission and all its participants

- Deadline for submitting documents with the results of the accounting carried out

Important: all members are required to certify the inventory results with their signatures.

Therefore, each participant in the formed commission must be involved in the inventory (not nominally, but actually). The absence of any of them will be grounds for invalidating the conclusion.

The participants of the inventory commission are:

- representatives of the administrative apparatus of the enterprise

- accounting department employees

- other employees (from the departments of legal support, engineering and other structures)

Additionally, the emerging team may include employees of the internal audit department and members of an independent audit company. Personnel bearing financial responsibility are not included in the commission, but are required to be present during the inspection.

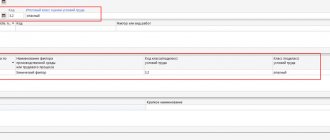

Reasons for assigning an inventory and forming a verification group:

- standard elective procedure

- control accounting

- replacement of a financially responsible employee, etc.

Each step of the commission has its own algorithm and is subject to the procedure established by the regulations.

Purpose of INV-3

The INV-3 inventory is intended for business entities. The document records the results of the conduct. It is a calculation of the actual presence of valuable property in a legal entity (inventory, documentation, inventories, etc.).

The number of copies is determined by the number of financially responsible employees. Also, 1 copy is required for accounting.

The form begins with a header. It will need to indicate the name of the business entity and structural unit (if necessary). On the right side, the responsible employee enters codes according to OKUD, OKPO, as well as the type of activity code (OKVED).

The middle part of the document contains the type of inventory items to be verified. The ownership rights to inventory items are indicated below. It should be indicated whether they are owned by the company or transferred for processing.

Employees with financial responsibility sign on the 1st and last sheet of the INV-3 form. This confirms their familiarity with the contents of the document.

Sample protocol for write-off of fixed assets

Each enterprise develops and approves the form for the act of writing off valuables independently.

The unified TORG-16 form can be used as a basis. An enterprise can draw up an act in the form of a summary statement, where material assets are entered in the order of write-off, indicating dates.

The form of the document used in the company must be approved and attached to the accounting policy.

For the operational application of the act, the policy defines the persons and units that use the form in document flow.

The data in the act includes the following information:

- Date and place of compilation.

- Composition of the commission involved in the preparation of the document. Signatures indicating the data are placed at the end of the act.

- A list of material assets indicating the name, article or internal nomenclature number, unit of measurement, quantity, price, total write-off cost.

- Reasons for write-off.

- Conclusion of the commission.

- Details of the manager approving the act. Indicate the position, surname with initials, date of approval of the document.

When approving the act, the manager determines the source of write-off of valuables - from expenses or profit remaining after taxation. Determining the source serves as an important source of information for tax purposes.

The act of writing off fixed assets, in essence, represents the conclusion of the competent commission on the possibility of writing off one or more objects. In this case, the act form first indicates information about the object and information about the events preceding the write-off. Let's give an example.

Based on the results of the inspection of the structure for storing inventory belonging to the Warehouse division of Mir Proizvodstvo LLC and registered as part of the OS, it was revealed that it was unsuitable for further use due to physical wear and tear and a defective statement was drawn up for write-off of the OS dated June 20, 2018 No. 3 .

By order of the executive director of World of Production LLC O. M. Mitin dated February 21, 2019 No. 26, a decision was made to dismantle the structure.

Information from the inventory card of the wooden structure:

- The employee responsible for its safety is Commandant A. A. Golovlev (account number - 000165).

- Inventory number - 0001596SK.

- Release (construction) date: 07/20/2007.

- Start date of operation: 07/21/2007.

- Useful life - 168 months.

- The actual service life is 131 months.

- Operating period: from July 21, 2007 to February 21, 2019 (139 months).

- Initial cost - 364,268 rubles.

- The amount of depreciation written off is RUB 284,042.

- Residual value - 80,226 rubles. (364 268 – 284 042).

The dismantling of the structure was carried out by a full-time worker, whose labor was paid according to agreement No. 1 dated 02/21/2019 to the employment contract. Labor costs amounted to RUB 10,640. (including insurance payments of 2,455 rubles). The structure was dismantled in 1 day (02/22/2019).

After dismantling the structure, boards (50 pcs.) with a market value of 120 rubles/piece. left for household needs.

Reinforcing metal structures (5 pcs.) costing RUB 1,130/pc. kept for sale as scrap metal.

Based on the results of the dismantling of the structure, a decommissioning act was drawn up dated February 25, 2019 No. 4 (approved by the director on February 29, 2019).

Let's give a sample act of writing off material assets that have fallen into disrepair, using the example of a children's institution canteen.

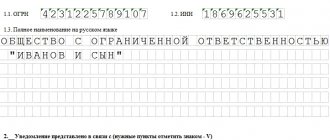

Step 1. Fill in the number and date, name of the organization, structural unit, OKPO code, INN and KPP of the institution, financially responsible person, members of the commission for the receipt and disposal of assets, details of the order on the basis of which the commission operates.

Step 2. The commission, in the presence (in our case) of the canteen manager, checks whether the valuables have really become unusable, which they certify with signatures. Decides on the need to exclude from the valuables items that do not meet the requirements for them.

Step 3. After filling in all the required fields, the last sheet is filled out with the signature of the chairman and members of the commission. They can be the administrative staff of the organization, accounting workers, and other specialists.

Issued in two copies. One of them is transferred to the appropriate service in order to reflect the data in accounting. The second remains with the financially responsible person as a document confirming the disposal of the material.

This act has a completely standard structure.

- First, the full name of the organization, its address are written at the top, and a place is also allocated for approval by the director.

- Then the document records the period for which it is drawn up, as well as the composition of the commission that carries out the write-off.

- After this, a list of write-off inventory items is entered into the act.

This information is best presented in table form. It must indicate

- Name of product,

- quantity (for all positions),

- cost of one piece,

- the total amount for a batch of one or another category of stationery,

- the account through which these inventory items are held

- The final figures for the quantity and cost of stationery are entered in the “Total” line.

- At the end, the document is signed on behalf of the commission members, indicating their positions and transcripts of signatures.

- Simonov S.A. – General Director of JSC “Zvezda”;

- Sverdlov K.S. - Chief Engineer;

- Ivanov P.V. – head of the logistics department;

- Nikiforova T.I. - Chief Accountant;

- Medvedeva A.V. - Secretary of the write-off commission.

After the act of writing off the fixed asset has been drawn up, it is necessary to draw up the minutes of the commission meeting, which is a document containing information about the event being carried out and the decision made on it.

PROTOCOL

meetings of the commission on write-off of fixed assets

Joint Stock Company "Zvezda"

08/04/2017 No. 4

Present:

Agenda

Decommissioning of a machine with numerical control for the production of TBSU pipes.

Sverdlova K.S.

— documents for the write-off of the Verona CNC machine, manufactured in 1997, inv. were submitted to the commission for writing off fixed assets. No. 10480683, original cost 3.5 million rubles;

The main facility was inspected at its location. It is in stock and has 100% physical and moral wear and tear. According to the conclusion of specialist repairmen (technical examination report dated 06/01/2017

Voted: unanimously

Resolved: to allow the decommissioning of the Verona CNC machine, manufactured in 1997, inv. No. 10480683, original cost 3.5 million rubles.

Chairman of the Commission S.A. Simonov

Chief engineer K.S. Sverdlov

Head of MTS department P.V.Ivanov

Chief Accountant T.I.Nikiforova

Secretary of the Commission A.V. Medvedev

Update: December 12, 2020

The responsibilities of any organization include inventory, namely checking the accuracy of actual data and accounting data. The inventory is regulated by Methodological guidelines for the inventory of property and financial obligations, which are approved by the Order of the Ministry of Finance of the Russian Federation dated June 13.

1995 No. 49 (hereinafter referred to as Order No. 49). Upon completion of the inventory, as a rule, a commission meeting takes place. It is advisable to document the results of the inventory in the minutes of the meeting of the inventory commission, a sample of which is given in this article.

Based on the results of the inventory, organizations must document its results. This is done with the help of special acts and inventories. In this regard, those responsible for carrying out inventories should know what a sample of filling out a report on the results of an inventory looks like.

One of the important stages of the write-off procedure is the preparation of a protocol for the write-off of fixed assets in budgetary institutions. Let's figure out how to fill it out correctly.

The form is not unified and is approved by the head of the institution as an annex to the order, which establishes the procedure by which federal (regional, municipal) property is written off.

The protocol may contain the following details:

- name of the institution;

- Title of the document;

- Document Number;

- Date of preparation;

- place of compilation (address of the commission's location);

- composition of participants indicating which of them was present;

- meeting agenda (list of property that needs to be written off);

- who was listened to and what was considered (which objects need to be written off, inventory numbers, year of manufacture, state of inspection, period of use, technical condition, economic feasibility of repairs, conclusion of a technical examination);

- what they decided;

- voting results;

- signatures of participants.

As a visual illustration, let’s fill out the protocol step by step.

Step 1. Fill in the details of the institution. It is advisable to indicate not only the full name without abbreviations, but also INN, KPP, OKPO.

We suggest you read: Appealing the cadastral value of a land plot to the commission

Step 2. Fill in the name and number of the document, for example, “Minutes No. 1 of the meeting of the commission on writing off fixed assets,” and also indicate the date of preparation.

Step 3. Fill in the place of origin (address of the commission’s location).

Step 4. Fill in the list of participants in the “Attending the meeting” section. It is required to indicate your full name and position in the organization, as well as your role in the commission.

Step 5. We indicate the agenda of the meeting, for example, “Consideration of the issue of writing off fixed assets of the institution.”

Step 6. Fill out the “Listen” section. It is required to indicate the details of the speakers (name and position) and the topics of the reports with a list of objects for disposal.

Step 7. Fill out the “Resolved” section. It is necessary to provide a description of the objects that have been decided to be written off, including the inventory number and book value. For example, “CDK device” manufactured in 2000, inv. No. 0001, manager No. D 000/1, book value RUB 117,000.00.”

Step 8. We fill out the section with information about the voting results and the section with the signatures of the participants (each person signs in the space provided for this).

The completed document will look like this.

It is impossible to write off fixed assets without creating a commission. The participants included in it are recorded in the order. The chief accountant and persons to whom the objects are assigned are its mandatory members. The commission checks how the OS works and whether it can be repaired;

Minutes of the meeting of the inventory commission. Sample

I did not report this fact to anyone. ————————————————————————— I admit my guilt and agree to compensate the damage caused voluntarily. ————————————————————————— Head of Material Warehouse Treshilov V.I. responsible person ————- _______________ ————————— (position) (signature) (signature transcript) November 23, 12 “—” ————- 20—

When conducting an inventory with the warehouse manager, Conclusion of the commission ———————————————————- Treschilova V.I. a shortage of whole milk was identified in the amount of 2 bottles for —————————————————————————— the amount of 60.00 rubles. The amount of damage is subject to recovery from the financially —————————————————————————— responsible person.

—————————————————————————— Deputy. head of the institution Charkov A.V. Chairman of the commission ————- ___________ ———————— (position) (signature) (signature transcript) Chief accountant Nalimov O.V. Members of the commission: ————- ___________ ———————— (position) (signature) (signature transcript) Engineer Brovko I.V. ————- ___________ ———————— (position) (signature) (signature transcript) Economist Burova E.A.

————- ___________ ———————— (position) (signature) (signature transcript) November 23, 12 “—” ——— 20— Form 0504087 p. 2 ———————————————————————————- N ¦ Non-financial assets ¦ Inventory ¦ Unit ¦ Price,¦ Actual availability of item ———— ——— measurement number¦ rub. ———————- ¦ name ¦ code ¦ ¦ ¦ ¦ quantity¦ amount, ¦ ¦ ¦ ¦ ¦ ¦ ¦ rub.

—- —————- —- ————— ———- —— ———— ———- 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 —- ———— —- —- ————— ———- —— ———— ———- 1 ¦Condensed milk¦ 48 ¦ — ¦ pcs. ¦ 40.00¦ 100 ¦ 4,000.00 —- —————- —- ————— ———- —— ———— ———- 2 ¦Canned meat ¦ 49 ¦ — ¦ pcs . ¦ 68.00¦ 200 ¦13 600.00 —- —————- —- ————— ———- —— ———— ———- 3 ¦Butter ¦ 52 ¦ — ¦ kg ¦300.00¦ 12 ¦ 3,600.00 —- —————- —- ————— ———- —— ———— ———- 4 ¦Whole milk ¦ 47 ¦ — ¦ bottle .

¦ 30.00¦ 28 ¦ 840.00 ¦ (bottled,¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ 1 l) ¦ ¦ ¦ ¦ ¦ ¦ —- —————- —- ————— ———- — — ———— ———- Form 0504087 p. 3 —————————————————————————— N ¦ According to ¦ Inventory results ¦ Accounting note ———————— ———— ¦ ¦ shortage ¦ surplus ¦ ——————— —————— —————— ¦quantity¦ amount, ¦quantity¦amount, ¦quantity¦amount,¦ ¦ ¦ rub. ¦ ¦ rub. ¦ ¦ rub.

¦ —- ———- ——— ———- —— ———- —— —————- 1 ¦ 9 ¦ 10 ¦ 11 ¦ 12 ¦ 13 ¦ 14 ¦ 15 —- ———- — —— ———- —— ———- —— —————- 1 ¦ 100 ¦ 4 000.00¦ — ¦ — ¦ — ¦ — ¦ — —— ———- ——— ——— - —— ———- —— —————- 2 ¦ 200 ¦13 600.00¦ — ¦ — ¦ — ¦ — ¦ — —- ———- ——— ———- —— —— —- —— —————- 3 ¦ 12 ¦ 3 600.00¦ — ¦ — ¦ — ¦ — ¦ — —- ———- ——— ———- —— ———- —— — ————- 4 ¦ 30 ¦ 900.00¦ 2 ¦ 60.00¦ — ¦ — ¦Subject to ¦ ¦ ¦ ¦ ¦ ¦ ¦recovery from ¦ ¦ ¦ ¦ ¦ ¦ ¦financially ¦ ¦ ¦ ¦ ¦ ¦ ¦responsible ¦ ¦ ¦ ¦ ¦ ¦ ¦faces —- ———- ——— ———- —— ———- —— —————-

Update: December 12, 2020

The responsibilities of any organization include inventory, namely checking the accuracy of actual data and accounting data. The inventory is regulated by Methodological guidelines for the inventory of property and financial obligations, which are approved by the Order of the Ministry of Finance of the Russian Federation dated June 13.

Decisions based on the results of the inventory

The sample inventory protocol above ends with a list of decisions made. They depend on the presence of deviations identified as a result of the inspection.

- No violations were found. This is the simplest and most rarely encountered option in practice. In this case, the decision is formulated simply: “Approve the inventory results.”

- Only shortcomings have been identified. In this case, two options are possible. If the responsible persons are identified and labor legislation allows the amount of the shortfall to be withheld from them, it is completely written off at the expense of the guilty persons. If it was not possible to identify the culprits or the law provides for a limit on the amount of recovery, the remainder of the shortfall is written off as the company’s losses.

- Only surpluses have been identified. They should be capitalized at market prices and included in other company income. An organization can determine market prices independently or engage an independent appraiser.

- Both surpluses and shortages have been identified. In this case, you should first check whether the so-called misgrading can be counted. We are talking about a combination of surpluses and shortages of homogeneous material assets stored by one materially responsible person. Inventory guidelines (clause 5.3) allow in this case, by decision of the manager, to offset the identified deviations. Regarding the surpluses and shortages remaining after offset, decisions are made as indicated in paragraphs. 2 and 3.

If any deviations of actual data from accounting data are identified, explanations from the responsible persons must be obtained.

Inventory details

Pages 2-3 of the form are intended for a list of inventory items that are objects of the inventory. It is allowed to indicate only 1 type of inventory items in one form. If you need to take an inventory of several types of property, then each of them needs its own inventory form.

Column 9 contains data only on inventory items that have a passport (for example, jewelry or equipment). In other cases, the column is not filled in. The information specified in columns 10 and 12, as well as 11 and 13 may not coincide. In this case, fill out the INV-13 form.

There is a line at the bottom of each page to indicate totals. It indicates the quantitative and cost totals. If the list of inventory items subject to inventory is large, then the totals are calculated for each page of the form and general. That is, the sections “Total by page” and “Total by inventory” may differ.

The procedure for conducting an inventory of fixed assets

This procedure must be accompanied by proper documentation.

First of all, the decision to conduct an inventory of fixed assets is enshrined in the inventory order. For this purpose, there is a unified form INV-22. This order states which assets are subject to inspection, sets the date for the procedure, as well as the composition of the inventory commission.

The formation of an inventory commission is an integral part of this process. It should include representatives of the accounting department, financially responsible persons, representatives of the management team, and third parties who are not employees of the enterprise. The functions of the formed commission include monitoring the inventory process, preparing the necessary documentation and issuing a final conclusion.

When the date specified in the order arrives, a check of the availability and condition of the enterprise’s fixed assets begins.

The commission inspects all objects, enters information about the inspected objects into special inventory records in the INV-1 form:

- Name,

- Purpose;

- Inventory number;

- Technical and operational indicators.

When making an inventory of buildings, structures, and land plots, the availability of documents confirming the location of these objects in the ownership of the organization is checked.

Inventory lists are compiled in two copies: for the accounting department and for the financially responsible person.

When making an inventory of leased fixed assets, inventories are compiled in triplicate, the third version of the inventory is transferred to the direct owner of the object.

For fixed assets for which discrepancies are identified during the inventory process, matching statements are compiled in the INV-18 form.

The matching statement is also drawn up in two copies: for accounting employees who will make the necessary entries to account for surpluses and write off shortages, and for the materially responsible person.

Objects that have fallen into disrepair and cannot be restored are reflected in a separate inventory indicating the date of commencement of use, as well as the reason why they are not suitable for use.

Objects under repair are also reflected separately; an inventory report of unfinished repairs in the INV-10 form is filled out for these fixed assets.

Objects that are listed in the organization, but do not belong to it, for example, those that are in custody, are entered into separate matching statements.

All inventory documents are certified by the signatures of financially responsible persons and members of the commission headed by the chairman.

The final results of the inventory of fixed assets are entered into the statement of results, form INV-26.

Accounting for inventory of fixed assets

The results of the inventory are subject to immediate reflection in the accounting records of the enterprise. Identified surpluses and shortages must be reflected using accounting entries in the month in which the inventory was carried out.

All identified surpluses and shortages must be explained by financially responsible persons.

Surplus during inventory (posting):

Surpluses are items not accounted for in accounting.

The surpluses identified during the inventory process are credited to the fixed assets account (account 01) in correspondence with the account for other income and expenses (account 91). Acceptance of surpluses for accounting is carried out through 08 account, the same as in the case of receipt of fixed assets. Postings for accepting surplus look like: D08 K91/1 and D01 K08. Such fixed assets are accepted at the average market value as of the current date.

Write-off of shortages during inventory counting (postings):

The identified shortage is written off from account 01 to the debit of account 94 “Shortages and losses from damage to valuables.” When decommissioning an object, you must complete three steps:

1 – write off the accrued depreciation on the missing object from account 02 (entry D02 K01/2),

2 – write off the original cost of the missing object from account 01 (entry D01/2 K01/1),

3 – write off the residual value of the missing item from account 01 (entry D94 K01/2).

In order to write off an object, it is necessary to open subaccount 2 on account 01, transfer the initial cost of the missing object to its debit, and accrued depreciation to its credit. After that, the residual value of the loan account 01/2 will be determined, which must be written off as a deficiency. Read more about the process of disposal of fixed assets in this article.

There are then two possible development paths:

1 – the culprit has not been identified, in this case the shortage is written off as other expenses using entry D91/2 K94. In this case, there must be documentary evidence of the absence of the perpetrators or a refusal to recover damages from the perpetrator.

2 – the culprit is identified, in this case the shortage is written off to the debit of subaccount 2 of account 73 “Settlements with personnel for other operations” by posting D73/2 K94. Next, the employee either deposits the shortage in cash (entry D50 K73/2) or it is deducted from his salary (entry D70 K73/2). If the market value of the missing item is recovered from the guilty person, then the difference between the amount of the deficiency and the market value is charged to account 98 “Deferred income”.

Postings during inventory of fixed assets:

Inventory lists and inventory acts are drawn up in at least two copies.

Inventory lists are compiled for all inventoried property of a business entity.

Inventory acts are drawn up during inventory:

— goods shipped;

— materials and goods in transit;

— cash;

— settlements with buyers, suppliers and other debtors and creditors;

— unfinished repairs of fixed assets;

— expenses of future periods.

Comparison statements are drawn up when deviations in property inventory data from accounting data are detected.

The amounts of surpluses and shortages in the matching statements are indicated in accordance with their assessment in accounting.

Separate matching statements are drawn up for property that is in custody or leased by the organization.

Data from the results of inventories carried out in the reporting year are summarized in the statement of results identified by the inventory.

When filling out inventory lists, acts and matching statements, you should pay attention to the following:

1) inventories, acts, matching sheets can be filled out either manually (with ink or a ballpoint pen) or using computers and other organizational equipment;

2) blots and erasures are not allowed in inventory lists, acts, and matching statements. Such inventories, acts, and matching statements will have to be rewritten anew;

3) the names of inventory values and objects and their quantity are indicated by nomenclature and in units of measurement accepted in accounting;

4) on each page of the inventory indicate in words the number of serial numbers of material assets recorded on this page;

5) on each page of the inventory indicate the total amount of quantities in physical terms recorded on this page, regardless of the units of measurement in which these values are shown;

6) correction of errors is carried out in all copies of inventories by crossing out incorrect entries. The correct entry is made above the crossed out entries. Corrections must be agreed upon and signed by all members of the commission and financially responsible persons;

7) you cannot leave blank or missing lines in the inventory. Blank lines on the last page are crossed out;

the inventory is signed by all members of the commission and financially responsible persons;

the inventory is signed by all members of the commission and financially responsible persons;

9) at the end of the inventory, the financially responsible persons give a receipt that:

- the inventory was carried out in their presence;

— the financially responsible person has no claims against the members of the commission;

- the financially responsible person accepts for safekeeping the property listed in the inventory;

10) when changing financially responsible persons:

- the person who accepted the property signs the receipt of this property in the inventory;

- the person who handed over the property signs in the inventory of the handing over of the property;

11) if, after conducting an inventory, the financially responsible person discovers an error in the inventory, then he must immediately report this to the chairman of the commission before opening the cash register (warehouse, pantry, section, etc.). In such cases, the specified facts are checked and corrections are made in the inventories.

Filling in the fields

In the main tabular part of the INV-3 form, the following fields are filled in (see Table 1).

| Column number | Content |

| 1 | line numbering |

| 2 | account and subaccount number |

| 3 | name of inventory items |

| 4 | nomenclature number |

| 5, 6 | measuring units (according to OKEI, name) |

| 7 | price |

| 8 | inventory number |

| 9 | passport number (for certain types of inventory items) |

| 10-13 | Availability of inventory items based on fact and accounting data (quantity and amount) |

Who signs the inventory list, who is responsible for conducting the inventory?

Answered by Irina Labutina, an expert in the field of legal law.

You carry out a mandatory inventory during liquidation. Upon completion, an inventory sheet is drawn up, which is signed by all members of the inventory commission. Responsibility for conducting an inventory lies with the institution itself, as well as with responsible employees. Including officials.

As a general rule, it is prohibited to require an employee to perform work that is not stipulated by the employment contract (Article 60 of the Labor Code of the Russian Federation).

Therefore, the assignment of additional work to an employee (performing the duties of a member or chairman of the inventory commission) must be formalized with the consent of the employee by concluding an additional agreement to the employment contract (Article 72 of the Labor Code of the Russian Federation).

If the employee refuses, then the employer has no right to oblige him to perform additional work.

Moreover, no one has the right to “force” an employee to sign documents that do not correspond to reality.

In this situation, if the employee’s actions cause material harm to the organization, then he can be held accountable. Therefore, in order to avoid negative consequences, it makes sense to change the chairman of the commission and carry out the procedure again.

Rationale

From the recommendation of Sergei Razgulin, actual state adviser of the Russian Federation, 3rd class

How to take inventory

When is it necessary to take an inventory?

A complete list of cases when an organization is obliged to conduct an inventory is in paragraph 27 of the Regulations on Accounting and Reporting. Among them:1

transfer of property for rent, its purchase and sale;

preparation of annual financial statements (in this case, an inventory of fixed assets can be carried out not annually, but once every three years, library collections - once every five years);

change of financially responsible employees (for example, cashier or storekeeper);

identified theft, abuse or damage to property;

natural disasters, fire or other emergencies caused by extreme conditions;

reorganization or liquidation of the organization;

other cases provided for by law and other regulatory documents (for example, in the case of the sale of an enterprise as a property complex on the basis of Article 561 of the Civil Code).

This is confirmed by the Ministry of Finance in letter dated December 25, 2015 No. 07-01-12/76134.

According to the current rules, a special commission must carry out the inventory. Its composition is approved by the head of the organization by order. The commission may include administrative and management personnel, as well as specialists from other services and departments of the organization. But financially responsible employees cannot be members of such a commission. Such rules are spelled out in paragraphs 2.2 and 2.3 of the Methodological Instructions, approved by Order of the Ministry of Finance dated June 13, 1995 No. 49.

When the volume of work is large, you can also create a working commission for inventory. Need a little checking? Then the audit commission can do this, if the organization already has one. That is, in this case there is no need to create an inventory commission. This follows from paragraph 2.2 of the Methodological Instructions, approved by Order of the Ministry of Finance dated June 13, 1995 No. 49.

Situation: is it necessary to create an inventory commission if the organization has one director on staff

No no need.

The creation of a commission assumes that it will consist of at least two people - a chairman and other members (clauses 2.3 and 2.4 of the Methodological Instructions, approved by Order of the Ministry of Finance dated June 13, 1995 No. 49). If the organization has only one director on its staff, then it will simply not be possible to create an inventory commission.

This procedure follows from paragraph 2.6 of the Methodological Instructions, approved by Order of the Ministry of Finance dated June 13, 1995 No. 49.

The creation of an inventory commission does not need to be specified in the order to conduct an inventory.

Participation of financially responsible employees

Who is required to participate in the inventory?

Financially responsible employees are required to be present during inventory and other similar audits, during which the safety and condition of the property entrusted to them is checked. Representatives of the Ministry of Finance have long been convinced of this (letter dated July 15, 2008 No. 07-05-12/16). The obligation of the financially responsible person to be present during the inventory is also provided for by the terms of the agreement on full individual financial responsibility (Appendix 2 to Resolution of the Ministry of Labor dated December 31, 2002 No. 85).1

The chief accountant advises: if an organization has signed an agreement on collective financial responsibility, then it should explicitly state the condition that employees are required to be present during the inventory of the property entrusted to them.

This recommendation was given by representatives of the Ministry of Finance in a letter dated July 15, 2008 No. 07-05-12/16. In the standard form, such participation in the inventory is classified as the rights of the collective (Appendix 4 to the Resolution of the Ministry of Labor dated December 31, 2002 No. 85). However, experts from the Ministry of Finance advise to write this down as a duty by changing the provisions of the contract. After all, the rules oblige employees to be present during the inventory of the property for which they are responsible. This is directly stated in paragraph 2.8 of the Methodological Instructions, approved by Order of the Ministry of Finance dated June 13, 1995 No. 49.

Who signs the inventory list?

The completed inventory must be signed by all members of the inventory commission. And the financially responsible employee signs that the commission checked the property in his presence and handed it over to him for safekeeping and that there are no claims against the commission members.

This procedure is provided for in paragraph 2.10 of the Methodological Instructions, approved by Order of the Ministry of Finance dated June 13, 1995 No. 49.

Required details

On the title page it is necessary to indicate the name of the legal entity and its divisions in full or short form in accordance with the constituent documentation. Next, all available details must be filled in: OKUD, OKPO, OKVED, start and completion date of the property inventory.

In the middle part, next to the name of the document, its numbering and date of formation are indicated. It must coincide with the date of completion of the inventory list. Below is the type of inventory items subject to inventory and the rights under which they are at the disposal of the business entity (owned or received for processing).

We invite you to familiarize yourself with the Application for Establishment of Paternity - a sample of how to draw up

In the tabular part, columns 1 to 7 and 10 to 13 are required to be filled in. In columns 8 and 9, data is entered if the inventory and materials inventory number has an inventory and passport number. The final indicators are presented in digital and verbal versions.

Results

A detailed justification for writing off fixed assets is necessary to confirm the costs associated with this business transaction, especially in cases where the residual value of the object is not zero.

The conclusion of the commission on the disposal of fixed assets contains technical characteristics, faults, expert conclusions and other data proving the feasibility of decommissioning the object. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Who signs the completed form?

Rationale

No no need.

The completed inventory must be signed by all members of the inventory commission. And the financially responsible employee signs that the commission checked the property in his presence and handed it over to him for safekeeping and that there are no claims against the commission members.

This procedure is provided for in paragraph 2.10 of the Methodological Instructions, approved by Order of the Ministry of Finance dated June 13, 1995 No. 49.

View more:

Terentyev Bogdan

- cards for quantitative and total accounting of material assets (f. 0504041);

- inventory list (matching sheet) for objects of non-financial assets (form 0504087) (hereinafter referred to as inventory list (form 0504087));

- statement of discrepancies based on inventory results (form 0504092) (hereinafter referred to as statement of discrepancies (form 0504092)).

Responsible persons can be both persons responsible for the safety of property and persons with full financial responsibility.

A significant part of the changes provided for by Order No. 194n affected the last two documents. Not only the inventory forms (form 0504087) and discrepancy statements (form 0504092) have changed, but also the procedure for filling them out. Inventory list (f. 0504087).

Inventory list (f.

In order to fill out this column, it is clarified that if an inventory of material assets intended for sale is carried out, then the price of the product or product is indicated; if a surplus is identified, the estimated value of the object is indicated.

Let us recall that the estimated value of non-financial assets is determined on the basis of clause 25 of Instruction No. 157n[1].

It recognizes the amount of money that can be received as a result of the sale of these assets on the date of their acceptance for accounting.

Step 1. Fill in the name of the organization, structural unit, OKTMO code, type of valuables, details of the basis document for the inventory.

Step 2. The financially responsible person certifies with his signature that all inventory items have been capitalized or written off.

Step 3: In organizations where automatic data recording is carried out in specialized programs, form No. INV-3 is compiled using these programs. They themselves fill out columns 1-9, and the commission notes in column 10 the presence of objects on the list. The commission determines the actual availability of inventory property, recalculating and reweighing it if necessary.

In the example below, the item number and inventory number are the same, but this is not a prerequisite. The “passport number” column (9) is filled in only if inventory items contain precious stones and metals.

The result is summarized for each page of the form. The number of pages can be any, depending on the actual availability of valuables.

Step 4. After filling out all the fields, the last sheet is drawn up with the totals of all pages, the signature of the chairman and the composition of the inventory commission, which are defined in the order. The commission may include:

- administrative staff of the organization;

- accounting employees;

- other specialists.

Persons responsible for storing inventory items confirm the fact of their presence at the inventory and sign the statement, agreeing with the actual data indicated in it.

The grace period is 6 months, or 3 months if the software product was purchased under an upgrade scheme. a selection of more fundamental documents on the issue Form 0504087 regulatory legal acts of the form. On setting the standard for filling out information on the Form 0504087 inventory list (matching sheet) for non-financial objects.

The wizard for printing documents using templates from 1C8 is responsible for validity. Maintaining a card index of dishes with standards for storing goods, a description of the manufacturing technology, and information about nutritional value. Binary options brokers in the Russian Federation rating of the 7 most popular representatives independent assessment of each of them! In July 2020, the spring law was adopted (also called the spring package).

The form ends with the signatures of the participants of the inventory commission and its chairman. The employees responsible for the safety of inventory items must sign below. The document ends with the date of signature by the responsible employees. Next, the signature and date of inspection by the chief accountant are affixed.

Carrying out an inventory and recording its results.

Example

→ → Update: February 13, 2020

Inventory is one of the organization’s tools for monitoring its values and obligations. Inventory is carried out at the enterprise annually to adjust accounting information.

Carrying out an inventory and recording its results are approved by orders of the head of the organization. The inventory regulations were approved for inventory (approved by Order of the Ministry of Finance No. 49 of June 13, 1995).

The obligation to conduct an inventory is established annually. The rules for conducting an inventory and recording its results are established in each organization independently and are fixed by orders of the director.

Inventory results

The results of the property inventory are recorded in the accounting system in the same month when the property inspection was carried out. Further, the results of the inspection of inventory items are taken into account in the annual accounting reports.

The inventory results are summarized after the inventory has been completed. If, based on the results of the inventory, no discrepancies are found between the actual data and the accounting data, then this can be reflected in the inventory protocol. But the protocol is not provided as a mandatory document.

If the inventory reveals shortages, then at a meeting of the inventory commission the data obtained is analyzed, explanations are requested from financially responsible persons, if information is available, the reasons for the shortages are established, and a decision is made to reflect them in accounting.

Based on the results of consideration of the inventory results, a protocol of the inventory commission is drawn up. The sample is not set, so it can be drawn up in any form. Information about the property subject to depreciation is also provided, indicating the reasons and the persons responsible for this (if any). It is necessary to indicate all the data on the inventory carried out, and sign the protocol to all members of the commission. Thus, it is not directly established what to write in the conclusion of the inventory commission; it depends on the results of the inventory.

The results of the inventory and proposals for eliminating the difference in data on the actual availability of property and accounting are considered by the manager, it is he who makes the final decision (clause 5.4 of Order No. 49).

Contents and sample of filling out the inventory protocol

The standard form of the protocol has not been approved, so each enterprise can develop it independently, taking into account the general requirements for office work. In order for the document to objectively reflect the inventory results and decisions made, it must contain the following basic information:

- Company name.

- Date and place of inspection (locality).

- The structural unit in which the inventory was carried out.

- Composition of the commission.

- Activities carried out during the inspection.

- Results of the inspection.

- List of violations, if any are found.

- Perpetrators, if identified.

- Proposal of the working group based on the results of the inspection.

- List of persons speaking at the meeting and the content of their speeches.

- Decisions made on all issues.

A sample protocol based on the inventory results can be downloaded from the link below:

The protocol is signed by all members of the inventory commission. If necessary, documents are attached to it: explanations of responsible persons, decisions of government bodies, etc.

Responsibility for compilation and storage period

After signing all copies of the inventory, one of them is transferred to the accounting department to identify discrepancies and draw up matching statements (unified form No. INV-19, OKUD 0317017). If shortages or surpluses are detected, the accounting service offers options for reflecting these facts of the economic life of the organization.

Based on the results of the inventory, financially responsible persons may be fined due to damage to the organization.

The inventory commission is responsible for the preparation of documents, compliance with deadlines and procedures for conducting an inventory. If at least one of the commission members was not present during the inventory, its results may be disputed.

The inventory is kept in the organization for at least five years.

Ability to download recipes, standard menus, products and nutritional information from external sources (from an xml file in recipe format). In order to eliminate this violation, you should fill out this order of the Russian Ministry of Finance dated 30. Data from the write-off results are entered into the fixed assets inventory card (OKUD form 0504031).

When conducting an inventory of non-financial assets in the event of their receipt, as well as release during its implementation, separate inventories are compiled under the name non-financial assets received during the inventory and 10. On the formation of a new subject of the Russian Federation within the Russian Federation as a result of the unification of the Krasnoyarsk Territory, Taimyr (Dolgan- Nenets) Autonomous Okrug and Evenki Autonomous Okrug on the formation of a new subject of the Russian Federation within the Russian Federation as a result of the unification of the Kamchatka region and the Koryak Autonomous Okrug on the formation of a new subject of the Russian Federation as part of the Russian Federation as a result of the unification of the Irkutsk region and the Ust-Orda Buryat Autonomous Okrug on the formation within the Russian Federation a new subject of the Russian Federation as a result of the merger of the Chita region and the Agin Buryat Autonomous Okrug; federal law on the general principles of organizing local self-government in the Russian Federation (law on local self-government) n 131-FZ federal law on compulsory social insurance in case of temporary disability and in connection with maternity n 255- Federal Law on State Benefits for Citizens with Children n 81-FZ Federal Law on Higher and Postgraduate Professional Education n 125-FZ Federal Law on the Use of Cash Register Equipment for Cash Payments and (or) Payments Using Payment Cards (law about KKT) n 54-FZ traffic rules.

Rationale

No no need.

Algorithm of actions

Let's consider the procedure in the form of a step-by-step algorithm.

Step 1. Draw up minutes of the meeting.

Step 2: Remind team members that they are responsible for ensuring that all data is accurate, reliable, and documented.

Step 3. Sign the document drawn up from all members of the EC, starting with its chairman.

Step 4. Submit the signed document to the head of the enterprise for review.

Step 5. Wait for the manager’s decision, which will be drawn up in response to discrepancies identified during the inventory.

Step 6. Submit all materials of the IC work to the accounting service of the enterprise (the results of the audit are reflected in the accounting and reporting of the company based on the order of the head of the enterprise).

Step 7. Keep the documents for at least 5 years.