general information

The form is approved by Post. Goskomstat No. 66 dated 08/09/1999. However, since 2013, unified forms have ceased to be mandatory for use. Each organization decides for itself whether to use them or not. Instead of this form, the company can create its own, adding the necessary or removing unnecessary table rows. Management must consolidate its decision on the use of certain forms by a special order in the company’s accounting policies.

The form is used in enterprise warehouses or special warehouses cooperating with the enterprise. Control and accounting of goods stored in these premises is carried out constantly. Inspections are carried out regularly, and their number is approved by the company management. During the events, products are counted and weighed. Each random check results, in addition to the inventory list, in a completed report on form MX-14.

Reception of material assets in the organization

Where exactly did the company get the material from?

So, the material can be obtained:

- directly from the company's suppliers;

- reporting persons of the company for cash capital;

- as a result of dismantling liquidated fixed assets;

- as a result of its own production (implies provision from the warehouse by an authorized person);

- when recording surpluses that were identified in the process.

Reception can be carried out in the process of obtaining in a variety of ways

.

The process of capitalization implies not only their physical receipt by authorized persons of the company (one of them may be a storekeeper), but also their display in accounting accounts (often this involves entering information into account 10 “Materials”

).

Today there are several methods of documentation, and often they directly depend on the situation that arises during the reception process, including the structure of the company and the document flow system installed in it.

Receipt order drawn up in form M-4

, is used if there are no comments regarding the quality and assortment.

Due to the fact that this order is of impressive volume, it is possible to exclude some details

that are not related to the mandatory details of the primary documentation (based on Article 9 of Federal Law No. 402), namely:

- form numbers regarding OKUD and OKPO;

- passport number (possibility is allowed only if the process of accepting various precious stones is carried out, etc.);

- information regarding the insurance company;

- a graph with a code display of the unit of measurement.

A stamp on the invoice can fully replace the receipt order, which must be placed in such situations. For example, in the process of capitalization without any discrepancies in volume, quality or assortment.

The seal must necessarily include all the necessary details regarding the receipt order: who exactly accepted it, in what volume, and so on (based on paragraph 49 of the Methodological Instructions approved by the Order of the Ministry of Finance in December 2001).

If there is an invoice available, which is signed by an authorized person of the company, then there is no need to generate a receipt order or other documentation.

Regarding reception in form M-7, it is necessary to generate only if the invoice provided from the supplier contains the same information (one type), but in fact the materials received are completely different.

A similar document will be required during the adoption process for the purpose of safekeeping

. It is possible to sort of “clean up” unnecessary details (for example, you can remove information regarding the insurance company, time of shipment of products, and so on). In parallel with this, the agreement between the company and the direct supplier may indicate that other documentation may be generated in order to record detected inaccuracies.

For the purpose of documentary posting, which must fully comply with the terms of delivery, it is possible under current legislation to develop a personal universal company document

, wherein:

- take as a base a standard receipt order (approved by , removing all unnecessary details);

- supplement with those details that can provide significant assistance in identifying inaccuracies in the volume or quality of the received material.

A personally developed document must be approved by the relevant Order of the company management.

Fill out the form

The act in form MX-14 has a front and back side. We will analyze in detail how to fill out each of them.

Front side

First fill out the document details:

- OKPO codes.

- Type of activity according to OKDP.

- Name of the organization, structural unit.

- The basis for drawing up the act (order or instruction). Number and date of this document.

- Position, signature, transcript of the signature of the head of the company. Such notes are made after the act is completed. With this action, the manager approves the document.

- The number of this act and the date of its preparation.

Next comes the tabular part, where the following information about inventory items is entered:

- Name of goods and materials, characteristics.

- Code, if the inventory has one.

- Units of measurement (name and OKEI code).

- What is the discount price, in rubles and kopecks.

- Number of places, pieces and weight indicated in the documents.

- Number of seats, pieces and actual weight.

- Data on surpluses and shortages: quantity, weight, amount (in rubles and kopecks), if they were found during the inspection.

If there are a lot of inventory items, then the table can be continued on several sheets. At the end of the table on each page the result is indicated. In the “Total per page” column, data on weight (indicated in documents and actually) and deviations is entered.

Reverse side

The table continues here. Fill it in the same way as the front side. Only the column “Total for the act” is added; the total result of the indicators of the tables on all pages of the document is entered into it.

Then the financially responsible person puts his signature and its transcript. This confirms that the documents for accounting for inventory items were submitted to the accounting department of the enterprise.

Next, indicate the storage conditions and accounting status of inventory items. Then the commission writes a conclusion. It must explain the reason for the surplus or shortage, if any.

At the end of the document, the members of the commission sign. Positions and transcripts of their signatures must also be indicated. The final line of the act is allocated under the order of the head of the organization. He decides what to do with discovered surpluses or shortages.

It is important to check the safety of material assets. To do this, the auditor must check: the organization of warehouse management and warehouse security; selection and placement of personnel of financially responsible persons; concluding agreements on liability; organization of access control system and on-farm control .

Particular attention is paid, in particular, to whether contracts on liability , as well as the timeliness of their conclusion; whether the hiring, relocation and dismissal of employees has been agreed upon with the chief accountant; whether they have previously been brought to criminal liability for theft of inventory and cash, etc. The auditor checks these questions by comparing data from the personnel department and the place of work of financially responsible persons, as well as through oral interviews.

When checking the storage of material assets, it is important to find out how the warehouse premises are equipped and whether there is enough space in them to store material assets; are there any losses in excess of storage standards; Are the places where material assets are stored equipped with control and measuring instruments (scales, measuring containers, etc.) and are the deadlines for their branding observed? whether material assets are stored in unsuitable premises or in the open air.

Ensuring the safety of property is influenced by the organization of the access system, the procedure for issuing passes, their recording in the accounting department and at the checkpoint of the organization; control at the checkpoint of the import and export of material assets from warehouses; fire safety status; the presence of reliable locks and alarms, guards at night.

The auditor clarifies cases of detection of shortages , thefts and damage to material assets and the validity of their write-off, monitors how these losses and shortages are taken into account in accounting ; whether measures are being taken to recover damages from the perpetrators.

The safety of property is ensured through sudden inventories ; therefore, it is necessary to carry out sudden inventories of material assets, as well as annual inventories and inventories when changing financially responsible persons.

The auditor must ensure that inventories are carried out in a timely manner; the data reflected in the inventory sheets is taken into account in full and is correct; all inventory deadlines have been met; inventory records are prepared in accordance with established requirements.

During the audit process, it should be established whether measures are being taken against those responsible for the shortages identified during the inventory; were there any cases of concealment of shortages under the guise of mis-grading of material assets; whether the norms of natural loss and whether they were not applied to those material assets for which no shortages were established.

The important stages of audit work are:

¨ checking the organization of acceptance and release of raw materials ;

¨ study of the distribution of transportation and procurement costs and deviations from accepted accounting prices between materials attributed to costs and their balances in warehouses by the end of the reporting period ;

¨ establishing whether incoming materials are received on time and reflected in accounting; are there any accompanying documents for incoming materials and are they completed correctly; availability of a list of employees who have the right to receive materials by proxy, etc.;

¨ conducting a random check by comparing data from primary documents with data from invoices submitted for payment from suppliers;

¨ determining the correct execution of powers of attorney; availability of an order for persons authorized to sign powers of attorney; compliance with the validity periods of powers of attorney ; timely return of unused powers of attorney that have expired; the procedure for destroying these powers of attorney; do persons who have received powers of attorney report after each receipt of valuables;

¨ checking the receipt of materials from accountable persons, price compliance. By comparing the balances of material assets in the warehouse and the accounts of suppliers , the auditor can determine whether the given purchase price of material assets corresponds to the balances that are in the warehouse.

When checking operations for the release of material assets, the auditor must first find out:

¨ is the release of material assets from the warehouse to production limited, and are adjustments made to the limit in connection with the permissible replacement of materials in production;

¨ is the calculation of the limit correct in accordance with the norms for the release of material assets for production, by whom these norms were approved, for which organizations and at what time.

By comparing the norms of consumption of material assets for previous years, as well as the norms of expenditure for the corresponding reporting period, the auditor can identify an overestimation of expenses of material assets.

It is advisable to determine the correct application of the norms for the consumption of material assets through the control launch of raw materials and supplies into production

. The auditor carries out the test run together with specialists; based on the results, a report is drawn up that contains the following mandatory details: date of preparation; type of control run; site (workshop), financially responsible person (team); commission members; test run results; signatures of the commission members, as well as a visa of the head of the organization approving the results of the test run.

To check the use of materials, the auditor needs to become familiar with the specifics of production, since methods of control and use of material assets in production depend on the types of production, features of the organization of the technological process, methods of accounting for costs , as well as on the types of material assets used.

Using the method of documentary control, the correctness of material assets spent on production is verified; those material assets that are available during the audit period are recommended to be checked using the method of actual control .

The auditors check the correct use of materials for production by comparing the amount of material assets written off for production with the consumption according to the standards necessary for production, as well as taking into account the balances of work in progress .

To check the correct application of expense standards when releasing material assets from the warehouse to production, the auditor compares data on the release of material assets according to the limit-fence card with the current production expense standards. The auditor can obtain the current standards through a control launch of materials into production.

All identified cases of discrepancies must be analyzed by the auditor and determined:

¨ what amount of raw materials and supplies was issued for production in excess of the established cost standards for specific product groups or product ranges;

¨ whether the relevant documents were drawn up;

¨ how the issued raw materials and supplies were used;

¨ have the causes and culprits of the overspending been established, have measures to recover damages ;

¨ was over-produced finished products , etc.

In practice, there are cases of release of material assets into production without completing any documents from the warehouse, which is a serious violation of the accounting regulations, so the auditor checks the documents on the daily release of material assets into production. The following violations also occur:

¨ material assets are released into production without weighing, measuring, or recalculating;

¨ material assets transferred to production are not documented with accompanying documents;

¨ the transfer of material assets from shift to shift is of a formal nature, acts are drawn up, but values are not recalculated;

¨ damage, defects in production, waste of raw materials are not reflected in technological journals;

¨ the release of products for analysis is not documented;

¨ production reports of financially responsible persons are drawn up in accordance with the released products, there are unspecified corrections, deadlines for submission to the accounting department are not met, etc.

When auditing the consumption of materials for production, the auditor examines work in progress

and sets:

¨ what types of costs are included in it;

¨ are there any cases of volume overestimation;

¨ are there any facts of concealment of defects, deficiencies, shortages of material assets, etc.

The auditor should know that work in progress does not include:

¨ materials that are received from the warehouse for production, but are not yet involved in the production process;

¨ semi-finished products received from outside or from auxiliary production;

components;

¨ finally rejected products.

The correctness of determining the balances of work in progress affects the reality of information about the cost of finished products and, accordingly, the amount of profit received from the sale of finished products, as well as other indicators characterizing the activities of the enterprise.

In this regard, the auditor must find out:

¨ how often is inventory of work in progress carried out;

¨ how its volume is determined and assessed;

¨ were there any cases of inaccurate accounting of work in progress that were identified during control checks;

¨ whether the reasons for the distortion of data were established and whether measures were taken against those responsible;

¨ whether the shortages and surpluses identified during the inventory were correctly reflected in the accounting accounts.

The main violations that an auditor can identify when conducting an audit of the release of material assets into production are: overestimation of expense standards; write-off of material assets into production according to standards, and not according to actual consumption; concealing savings in materials obtained from the introduction of advanced technologies; violation of production technologies.

Operations for the internal movement of materials are checked from the point of view of their economic feasibility and the places of origin.

When checking transactions for the release of material assets to third parties, the auditor must establish by whose order they were carried out, what caused them and what additional costs they led to. All transactions for the release of material assets to third parties should be checked in a continuous manner ; The documents must contain visas of the head of the enterprise and the chief accountant. In this case, the auditor is recommended to check the data on warehouse consumable documents and payment documents, as well as quantitative data on the names of material assets on applications (contracts, agreements) with their quantity on warehouse consumable documents. It is necessary to analyze all cases of improper distribution of material assets that led to material damage.

What is important to remember

- The document must be drawn up in at least 2 copies. The quantity depends on the situation. Usually one act remains with the accountant, the second - with the financially responsible person working in the warehouse. Another copy may be needed by the owner of the goods that were subject to inspection (if we are talking about a specialized warehouse and not the company’s own warehouse).

- If, as a result of the inspection, shortages, damage or surpluses are discovered, in fact, that is why the audit is carried out, then for each such inventory and materials they draw up their own documents. In case of damage, these are acts for write-off, in case of surplus, these are inventories for registering inventory items.

- Factual errors in an already completed and signed document must be corrected correctly. To do this, use the standard method. The employee responsible for filling out the act carefully crosses out the fragment containing the error, indicates the correct option at the top, writes next to it: “Believe the corrected one” and puts his signature to confirm that all changes are genuine.

For your information! The report in form MX-14 is submitted to the accounting department to reflect the results of the audit in the company’s accounting records. The document must be stored for 5 years, then it is transferred to the archive.

Demonstration of printing acts MX-1, MX-3 in 1C: Accounting 3.0

You can see for yourself how the printing forms MX-1, MX-3 work

in "1C: Accounting 3.0".

To do this, go to our demo database at https://5.101.63.154:8090/AccDemo

Further in the program you can go to the sections “Purchases” - “Receipts, acts”

or

Sales - Sales of goods and services

Select existing documents or create your own documents with your own nomenclature.

In the documents, select the printed form. And depending on the document, a printed form is generated.

Write-off procedure

In order to write off any goods or products, you need to know the exact procedure and methods for valuing inventory items.

This is usually done by the accounting department. With its help, you can accurately estimate the cost of a product and how much it can be offered to any organization or on the sales market.

The write-off procedure is usually not complicated and anyone, even not the most experienced accounting employee, can cope with it.

However, you should strictly follow all the rules and fill out all documents carefully and carefully; this will allow you to avoid a large number of problems in the future and save on sales.

Drawing up an act can be divided into several simple steps:

- Form TORG-16, date and place of its completion.

- Number and full name members of the commission involved in drawing up the act. Official statement of unsuitability of goods.

- Reason for write-off, name of all written-off goods and information about them.

All members of the commission sign the act.

What actions are necessary after write-off?

After drawing up and signing the act, tangible assets can be disposed of. In order for them not to be listed on the company’s balance sheet, the accountant must post D94K10 and D20K94

. Posting D94K10 indicates the book value of written-off inventory items. The accountant takes this information from a previously drawn up act.

Entry D20K94 indicates the amount of the shortage due to damage to materials due to natural loss.

This information is taken from the act of writing off material assets. If this amount exceeds the limit on the amount of natural loss, the difference must be compensated by the person responsible for such a shortage.

In the event that inventory items are written off due to a natural disaster, the amounts must be indicated in entry D99K10. After this, the paid VAT is restored in posting D99K68.

In addition, inventory items may be written off due to their transfer for free use. In this case, you need to fill out wiring D91/2 K10 and K68. If the company’s management did not consider it necessary to draw up an act for writing off inventory items, you can do without it

, but at the same time you need to follow the rules for accounting for inventories.

Drawing up an act of writing off inventory items will not cause much difficulty if you strictly adhere to the above rules, however, if you have any questions while filling out the form, you can ask them to the lawyers on our website online.

The write-off act allows you to write off inventory items for various relevant reasons. We will tell you how to compose it correctly in the article.

Form MX-3: sample of filling out the act

Form MX-3 is filled out in the same way as any other warehouse document. In the header please indicate:

- name, contacts, OKPO code of both companies: the owner and the one that stored the goods and materials,

- number and date of preparation of the form.

Then the act comes with a tabular part. It must indicate:

- serial number,

- name of the product and type of packaging,

- characteristics of inventory materials,

- quantity, price and cost of goods,

- notes, if any.

Download our act MX-3 - the sample form contains all the necessary columns and fields. Please note that mistakes cannot be made in the document. To avoid them, fill out the MX-3 act online in the MySklad service - it’s fast, convenient and guarantees the correctness of registration.

Form MX-3: from MySklad

×

How to draw up a write-off act

There is a general write-off form that must be completed in relation to the generally accepted instructions. Such a document must indicate all the reasons why the product is written off, its weight, name, quantity and other necessary information.

In order to correctly fill out such a document, it is best to look at a sample of it in advance.

The accounting of all goods and valuables is regulated by special rules that workers in this field need to know about. Often, for convenience, various 1C-based programs are used.

Inventory assets represent different items in different industries. This could be any item, batch or warehouse. Some large companies take everything into account at once and this requires a complex and accurate system that can help regulate all products.

The receipt and write-off of inventory items can be automated. When writing off, you can give goods to companies in need at cost, which will avoid any losses.

Inventory materials can be divided into several categories:

- Raw materials.

Products that will be used in the production of the final product. - Unfinished products.

Items that are incomplete or unfit for completion. - Finished goods.

Products ready for sale or consumption.

Inventory assets are always reflected in general reporting, as well as their receipt and write-off.

- raw materials;

- fur farming and animals;

- low value goods;

Sample

There are some differences between drawing up a sales report for a product that will be subject to this document. Sometimes there is simply no need to compile it, for example, when the product is simply obsolete.

You can use any documentation for your organization, the main thing is that it regulates all the necessary points in accordance with the tax requirements.

For the form for writing off inventory and materials, the well-known form TORG-16 is taken as a basis.

Filling rules

After filling out the sales report, you should check it several times, since in the future, if the wrong quantity or name is indicated, a shortage may be declared, which is a big problem for any company.

It is best if a whole commission is involved in sales.

This will allow you to avoid any mistakes and troubles with the tax authorities in the future. Unfortunately, not every organization can afford to maintain an entire commission to draw up sales reports.

Rules for writing off inventory items

Write-off of inventory items occurs only when the company’s material assets have worn out and become unsuitable for further use or in case of their loss.

Write-off rules:

- First of all, it is necessary to determine the technical condition of each inventory item separately. As a result, it is determined whether the assets are suitable for further use or whether they should be written off.

- Relevant documentation is drawn up, which refers to specific failed inventory items.

- An act on the write-off of specific resources is drawn up.

- After this, you need to obtain permission from the director of the company to write off inventory items.

- After obtaining permission from the director of the enterprise and drawing up the appropriate act, the written-off property is subject to dismantling and subsequent disposal.

- Valuables are deregistered.

The main thing in writing off inventories is a correctly drawn up and completed act.

How to fill out the form

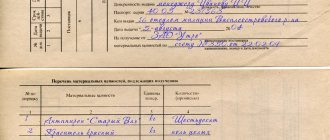

This form is filled out by the custodian. The depositor provides him with all the necessary information about the goods and materials transferred for storage. They must comply with the accompanying documents, on the basis of which the goods and materials are transferred to the custody of the custodian.

The act specifies:

- information about the custodian (name, telephone, address);

- information about the depositor (name, telephone, address, full name);

- details of the agreement on the basis of which storage will be carried out;

- information about the item of storage (name of inventory items, their characteristics, units of measurement, quantity, cost);

- storage conditions;

- additional information (column “Special notes”);

- information about the person who passed the goods and materials (full name, position);

- information about the person who accepted the goods and materials (full name, position).

The parties may establish in the contract the number of copies in which the act must be drawn up.

The deed is signed, as a rule, by financially responsible persons on both sides - the custodian and the bailor.