Inventory of fixed assets.

- •

- •Section 1. Non-current assets

- •Topic 1.1. Fixed Asset Accounting

- •1. Concept, classification and valuation of fixed assets.

- •2. Accounting for the movement of fixed assets.

- •Receipt of fixed assets into the organization.

- •Disposal of fixed assets from the organization.

- •3. Accounting for depreciation of fixed assets.

- •4. Accounting for repairs of fixed assets.

- •5. Accounting for leased fixed assets.

- •Accounting for leased fixed assets from the lessor.

- •Accounting for leased fixed assets from the tenant.

- •6. Inventory of fixed assets.

- •Topic 1.2. Accounting for intangible assets.

- •1. Concept, classification and valuation of intangible assets.

- •1. Exclusive rights of the patent holder to inventions, industrial designs, utility models and breeding achievements:

- •2. Exclusive copyright for computer programs and databases:

- •3. The exclusive rights of the owner to the trademark and service mark, the name of the place of origin of goods:

- •4. Business reputation of the organization, organizational expenses:

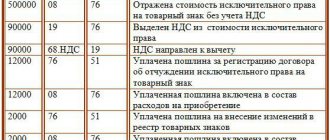

- •2. Accounting for the movement of intangible assets.

- •Admission

- •04 "Nma"

- •Accounting for the acquisition of intangible assets for a fee.

- •Accounting for the creation of intangible assets by an organization.

- •Accounting for the receipt of intangible assets as a contribution to the authorized capital.

- •Accounting for gratuitous receipt of intangible assets.

- •Accounting for receipt of intangible assets under an exchange agreement.

- •Business reputation of the organization.

- •3. Accounting for amortization of intangible assets.

- •Topic 1.3. Accounting for long-term investments.

- •1. The concept of long-term investment.

- •2. An economic way of long-term investment.

- •3. Contracting method of long-term investment.

- •Topic 1.4. Accounting for financial investments.

- •1. Concept, classification and assessment of financial investments.

- •2. Accounting for contributions to the authorized capital of other organizations.

- •3. Accounting for financial investments in securities.

- •4. Accounting for financial investments in loans.

- •5. Impairment of financial investments

- •6. Inventory of financial investments.

- •Section 2. Current assets.

- •Topic 2.1. Accounting for industrial inventories.

- •1. Concept, classification and assessment of inventories.

- •2. Accounting for the movement of inventories.

- •Accounting for the receipt of inventories.

- •Features of accounting and evaluation of materials when using accounts 15 and 16.

- •3. Accounting for transportation and procurement costs.

- •4. Inventory of industrial stocks.

- •Topic 2.2. Accounting for production costs.

- •1. Concept, composition and classification of costs.

- •Types of calculations

- •Classification of production costs

- •2. Costing methods. Standard method of cost calculation.

- •Custom costing method.

- •Lateral method of cost calculation.

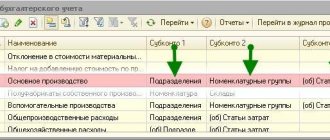

- •3. System of accounts for recording production costs. Main production cost accounting

- •Accounting for auxiliary production costs

- •Accounting for work in progress

- •1. In mass and serial production:

- •Accounting for overhead costs

- •Accounting for general business expenses

- •Accounting for unproductive expenses and losses

- •Accounting for deferred expenses and reserved expenses

- •Topic 2.3. Accounting for finished products and goods.

- •1. Accounting for finished products. Concept and evaluation of finished products (works, services).

- •Accounting for the release of finished products (works, services).

- •Options for synthetic accounting of finished products

- •Shipment (release) of products, works and services to buyers and customers.

- •26 “General business expenses”

- •Accounting for sales expenses

- •Accounting for goods shipped

- •2. Accounting for goods and trade margins.

- •Topic 2.4. Cash accounting.

- •1. Accounting for cash transactions.

- •2. Accounting for transactions on current accounts.

- •3. Accounting for transactions on foreign currency accounts.

- •4. Accounting for funds in special accounts.

- •5. Accounting for transfers en route.

- •Topic 2.5. Accounts receivable accounting.

- •2. Accounting with buyers and customers.

- •3. Accounting with different debtors.

https://youtu.be/TT6yxHqJzZs

Carrying out an inventory of goods and materials, fixed assets and intangible assets

To ensure the safety of inventory items and control over their accounting, an inventory is carried out at least once a year. Surplus materials identified during the inventory are accounted for on the basis of a matching statement of the results of the inventory of inventory items (Form No. INV-19) and a receipt order (Form No. M-4) to account 10, and this amount is credited to the financial results. The shortage of material assets is written off to account 94 “Shortages and losses from damage to valuables” at the actual cost, and for partially damaged materials - in the amount of established losses.

When liquidating material assets due to emergency situations, an entry is made in the debit of account 99 on the basis of a collation sheet of the results of the inventory of inventory items - form No. INV-19 (Table 5).

Table 5

Entries in accounting accounts of the results of inventory, theft and damage to material assets

| Business transaction | Debit | Credit |

| Material assets discovered during inventory were capitalized | 10 | 91-1 |

| Shortages and losses of material assets discovered during inventory, theft and damage to material assets | 94 | 10 |

| Write-off of shortages: a) within the limits of natural loss rates - to the accounts of production or distribution costs; b) in excess of the norms of natural loss and theft, when the perpetrators are identified; c) in excess of the norms of natural loss and theft, when the perpetrators have not been identified, or when the court refuses to recover damages due to the unfoundedness of the claims | 20, 25, etc. 73-2 91-2 | 94 94 94 |

Since January 1, 2006, a different procedure for assessing materials received from dismantling and capitalized as surplus during the inventory has been in effect.

Federal Law No. 58-FZ, paragraph 2 of Article 254 of the Tax Code of the Russian Federation, is supplemented by a paragraph that establishes that the cost of inventories in the form of surpluses identified during the inventory and (or) property obtained during the dismantling or disassembly of fixed assets being decommissioned, is defined as the amount of tax calculated on the income provided for in paragraphs 13 and 20 of part two of Article 250 of the Tax Code of the Russian Federation. That is, upon subsequent acceptance of such inventories for tax accounting, the tax base will not be reduced by the market value of the capitalized materials, but only by the amount of tax paid on this value.

For example, as a result of an inventory, excess inventories were identified for a total amount (at market value) of 10 thousand rubles. Tax rate – 24%. The following entries will be made in accounting:

DEBIT account 10 “Materials” CREDIT account 91 “Other income and expenses” subaccount “Other income”

— 10 thousand rubles. – the amount of the market value of excess materials.

The tax base will also be increased by 10 thousand rubles. The tax amount will be reflected in accounting by posting:

DEBIT of account 99 “Profits and losses” CREDIT of account 68 “Calculations for taxes and fees” subaccount “Income Tax”

— 2400 rub. (10,000 ∙ 24%).

If subsequently capitalized materials are used in the production of products, performance of work or provision of services, the following entry will be recorded in accounting:

DEBIT account 20 “Main production” CREDIT account 10

— 10 thousand rubles. – the amount of the book value of written-off materials.

The tax base for income tax will be reduced by only 2,400 rubles. (in accordance with the requirement of the newly introduced norm of paragraph 2 of Article 254 of the Tax Code of the Russian Federation).

Thus, conditions have actually been created under which the capitalization of surplus inventories, as well as materials from the dismantling of fixed assets, becomes impractical - the organization will not receive any benefit in terms of taxes. At the same time, when selling products (works, services) manufactured (performed, provided) using such materials, the size of the tax base for income tax will practically be artificially inflated (compared to the tax base formed when using purchased inventories ).

An accounting statement of income in the form of surplus inventories may have the following form (Table 6).

Table 6

Form of accounting certificate No. 4/3/-NPR on income in the form of surplus inventories

The results of the inventory of finished products and goods are recorded in the inventory list of inventory items (Form No. INV-3), goods shipped (Form No. INV-4), items handed over (accepted) for safekeeping (Form No. INV-5), in the comparison statements of inventory results of inventory items (form No. INV-19).

Inventory of fixed assets

Fixed assets for the purpose of calculating income tax are part of the property used as means of labor for the production and sale of goods (performing work, providing services) or for managing an organization.

Before the inventory of fixed assets begins, the following are checked: the presence and condition of inventory cards, inventory books, inventories and other analytical accounting registers, technical passports or other technical documentation; availability of documents for fixed assets leased or accepted by organizations for storage and storage. If documents are missing, it is necessary to ensure their receipt or execution.

When making an inventory of fixed assets, the commission inspects the objects and enters their full name, purpose, inventory numbers and main technical and operational indicators into the inventory records. When making an inventory of buildings, structures and other real estate, the commission checks the availability of documents confirming the location of these objects in the ownership of the organization.

When identifying objects that have not been registered, as well as objects that are missing from the accounting registers or have incorrect data indicated on them, the commission must include correct information on these objects in the inventory.

Unaccounted for objects identified by the inventory are valued at market prices, depreciation is determined based on the actual technical condition of the objects, with information about the valuation and depreciation recorded in the relevant acts.

Fixed assets are entered into inventory records by name in accordance with the main purpose of the object. If an object has undergone restoration, reconstruction, expansion or re-equipment and, as a result, its main purpose has changed, it is included in the inventory under the name corresponding to the new purpose.

If the commission establishes that work of a capital nature (adding floors, adding new premises, etc.) or partial liquidation of buildings and structures (destruction of individual structural elements) is not reflected in the accounting, it is necessary to determine the amount of increase or decrease in the book value of the object using the relevant documents and provide In the inventory there is information about the changes made.

Machinery, equipment and vehicles are entered into the inventory individually, indicating the factory inventory number according to the technical passport of the manufacturer, year of manufacture, purpose, capacity. Similar items of household equipment, tools, machines and others of the same value, received simultaneously in one of the structural divisions of the organization and recorded on a standard group accounting inventory card, are indicated in the inventories by name and number of items.

For fixed assets that cannot be restored, the commission draws up a separate inventory indicating the time of commissioning and the reasons that led to their unsuitability (damage, complete physical wear and tear, etc.).

For leased properties, separate inventories are also compiled, which indicate information about the lessor and the lease period.

Discrepancies between the actual amount of property and accounting data identified during the inventory are regulated by the relevant regulatory documents.

Surplus property

is accounted for at market value on the date of the inventory, the corresponding amount is credited to the financial results:

Debit account 01

"Fixed assets"

Credit account 91

"Other income and expenses."

In case of shortage or damage to objects

The following entries are made:

Debit account 02

"Depreciation of fixed assets"

Credit account 01

“Fixed assets” – for the amount of accumulated depreciation;

Debit account 94

“Shortages and losses from damage to valuables”

Credit account 01

“Fixed assets” – for the residual value of the object.

When identifying specific culprits

missing or damaged objects are valued at market prices and documented by posting:

Debit account 73

“Settlements with personnel for other operations”

Credit account 94

"Shortages and losses from damage to valuables."

If the perpetrators are not identified

or the court refused to recover losses from them, the shortage of property and its damage are written off to the financial results of the organization:

Debit account 91-9

"Balance of income and expenses"

Credit account 94

“Shortages and losses from damage to valuables”;

At the same time a recording is made:

Debit account 99

"Other income and expenses"

Credit account 91-9

"Balance of income and expenses."

When inventorying intangible assets

pay attention to the availability of documents confirming the organization’s right to use them, as well as the correctness and timeliness of reflecting intangible assets in accounting and balance sheets.

The procedure for accounting for surpluses and shortages of intangible assets discovered during inventory is similar to the procedure for accounting for these transactions for fixed assets.

The Tax Code of the Russian Federation does not establish a special procedure for accounting for excess depreciable property

(for example, it seems that it would be more correct to include such property in Income gradually - in the amount of accrued depreciation or according to other similar schemes).

However, the absence of references to a special procedure for recording such property can indicate only one thing - the cost of excess fixed assets, unfinished construction, intangible assets and other investments in non-current assets identified during the inventory is included in the income tax base at a time in full - at the market

the value of surplus assets (talk about residual value is inappropriate here, since the very fact of identifying surplus indicates that for such objects it is impossible to document either the replacement cost or accrued depreciation).

Accounting statements for this type of non-operating income - depending on the type of assets and liabilities - may have the following form (numerical examples are not given, since the inventory is carried out, as a rule, at the end of the calendar year - the tax period) (Tables 7 and 8).

Table 7

Form of accounting certificate No. 2/3/ -NPR on income in the form of surplus fixed assets and intangible assets

Table 8

Form of accounting certificate No. 7/1/-NPR on income in the form of surpluses of other non-current assets

Contents of the inventory process of intangible assets

As follows from paragraph 5 of PBU 14/2007, the object of intangible assets is:

- or a simple object (a right confirmed by a document for the possibility of using a copyright object);

- or a complex object (the right to use several copyright objects simultaneously).

Such objects, as a rule, are:

- works of science, literature and art;

- computer programs;

- various databases;

- musical phonograms;

- inventions, etc.

To have an idea of the procedure for regulatory regulation of copyrights, it is necessary to familiarize yourself with the norms of part four of the Civil Code of the Russian Federation.

It must be taken into account that the possibility of using a copyrighted object and the possibility of using its material carrier are not identical.

During the inventory of intangible assets, the following documents are subject to verification, in particular:

- patents for inventions;

- certificates of registration of computer programs;

- copyright agreements and agreements on the transfer of exclusive rights;

- licensing agreements, etc.;

- documents confirming state registration of ownership of the intangible asset (if necessary).

During the inventory of intangible assets, you should check not only the presence of the asset itself, but also the accuracy of the reflection of intangible assets in analytical accounting (inventory cards).

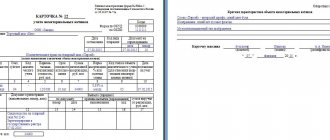

Synthetic accounting of intangible assets should be analyzed in order journals 10, 13 and in intangible assets accounting sheet No. 17.

In addition, you should analyze the information in accounting about the depreciation of the relevant intangible assets. It is important to take into account that the depreciation method is subject to annual clarification. This is necessary in order to make the calculation of depreciation for accounting and the calculation for tax accounting as identical as possible. Such clarification of the method of calculating depreciation should be carried out before preparing financial statements.

As a rule, the procedure for inventorying intangible assets can be divided into three stages:

- determination of the composition of the inventory commission, the period for carrying out the inventory and the reasons for its implementation. All these components must be included in one document - the manager’s order to conduct an inventory;

- establishing the fact of the presence of intangible assets. This stage includes identifying and verifying supporting documents;

- comparison of the information established as a result of the above verification procedure with the information contained in the accounting.

The inventory commission determines whether the information included in the inventory cards for the relevant intangible assets is reliable, and whether such cards have been created for all of the specified assets.

Inventory procedure for intangible assets

When checking the availability of intangible assets, the commission should determine the actual presence of the intangible asset itself, as well as monitor the correctness of their reflection in analytical and synthetic accounting, check the presence of inventory cards and the correctness of their execution. Memorial orders No. 10, 13, 17 are also subject to verification. Also, the commission’s tasks during the audit of intangible assets include checking the accounting for depreciation of the corresponding intangible assets.

After the audit, the inventory committee determines whether accounting is being kept legally, whether the information specified in the accounting is reliable and whether there are inventory cards for each of the intangible assets. After the inspection, it is necessary to document the inventory of intangible assets.

Documentation of inventory of intangible assets

Based on the results of the inspection under consideration, the inventory commission draws up a statement in the INV-1a form.

Each person responsible for the safety of supporting documents for intangible assets must sign the header of the inventory list.

If unaccounted for assets were identified during the audit, they must also be included in the inventory.

The inventory is printed in two copies (one for the accounting department, the second for the person responsible for storing documents).

This document must be signed by each member of the inventory commission.

In addition, a matching statement is drawn up (form INV-18). It is designed to take into account discrepancies between actual data (i.e. inventory data) and accounting data.

This document is also printed in two copies.

The results of the inventory of intangible assets must be accepted for accounting.

Surpluses are included in the financial result and are taken into account at market value. Deficiencies are recovered at the expense of the financially responsible persons at fault or are also written off to the financial result.

Please note that starting from 2013, it is not necessary to use unified forms. In order to take into account the results of the inventory, the organization has the right to develop and approve its own forms of documentation indicating all the details necessary for this operation. After this, the organization has the right to complete the OS inventory using its own documentation forms.

Instructions for carrying out

The inventory is carried out by a commission approved by the order of the organization. This is a permanent body. Its composition can only change in accordance with a new order. The inventory procedure is determined by order of the Ministry of Finance. The instructions look like this:

- An organization order is issued.

- Before starting the inventory, the commission must familiarize itself with documents confirming the presence of intangible assets and ownership.

- The procedure is carried out in the presence of a financially responsible person.

- During this process, the actual presence of assets and their physical and quantitative expression are compared with the inventory.

- The results of the reconciliation are documented.

Responsible persons

To carry out actual control over the safety of intangible assets, an inventory is carried out. The following are responsible for conducting the audit:

- The head of the company , who must provide the conditions for carrying out this procedure, the commission’s access to the intangible assets necessary to carry out the technical support reconciliation.

- Inventory commission (permanent) in its entirety, approved by order of the organization.

- The person (or persons) financially responsible who are required to be personally present during the inventory.

Documenting

When conducting an inventory, intangible assets accounting documents are checked:

- Acceptance certificate.

- Account card.

- Write-off act.

If a surplus or deficiency is detected, the INV-18 matching sheet appears. The document looks like this:

- The first page indicates: organization, division (department, workshop), order number, beginning and end of the inspection.

- On the second page there is a table where identified surpluses or shortages of assets are entered with their description and cost.

This document is signed by:

- It was compiled by an employee of the company's accounting department.

- The person(s) financially responsible for the safety.

If the commission has not identified any violations in asset accounting, an inventory list is filled out (for intangible assets, this is the INV form - 1a).

Procedure

Conducts an inventory of intangible assets at the end of each year. Inventory commission, which should include:

- Deputy Director (Chairman of the Commission).

- Accountant.

- Representative of the engineering and operational service.

Conducted a reconciliation of the actual availability of assets with their accounting cards, checking:

- Availability of inventory cards.

- Availability of intangible assets themselves and their compliance with accounting.

- Presence of ownership documentation in the company.

The commission discovered a shortage of intangible assets. The reason for the loss of the asset was the refusal to produce an outdated model and the transition to a new one. This shortage was classified as a production loss, so it was reflected in the residual value of the object.

Inventory report

The commission reflected the results of its activities in the Act on the results of the inventory. This act states the following:

- Name of the institution.

- Last name of the person responsible for the safety of intangible assets.

- Composition of the commission.

- Number and date of the order for her appointment.

- Audit deadlines.

- Inventory object (INA).

- Inventory number and date of its preparation.

- Audit results.

- Availability of a statement of discrepancies.

- The act must be signed by all members of the commission, and approved by the head of the company.

Accounting for results

Federal legislation requires the company to provide reliable information about the availability of intangible assets. Therefore, the results of the inventory must be taken into account by the company in its:

- Analytical accounting (in inventory cards for assets).

- Synthetic accounting (that is, in monetary terms, carried out through accounting).

In the first case, the accounting cards must be brought into line with the actual availability of assets. In synthetic accounting, the following happens:

- Surplus intangible assets are accounted for at the market price at the time of the audit.

- The shortage is compensated by the culprit of the incident; if one is not found, then it is written off to the results of the company’s economic activities.

Frequency of inventory of intangible assets

The timing and frequency of the inventory are set by the manager. It is mandatory to audit assets in the 4th quarter before preparing annual reports. In other cases, the need for control measures is determined by the head of the enterprise.

Let's consider cases that require checking the status of intangible assets in the table below.

| Inventory frequency | Reasons for need |

| Once a year | Preparation of data for annual reporting |

| Once every six months | Checking the status of intangible assets and documents in accounting for semi-annual and annual balances |

| Several times, as necessary (except for cases of mandatory inventory) | Change of the financially responsible person whose responsibilities include accounting and storage of intangible assets, or dismissal of more than half of the group of responsible persons |

| Changing the structure of an enterprise - merger, liquidation, change of owner | |

| Revaluation of assets at market value | |

| Detection of theft or damage to an asset | |

| The occurrence of a force majeure circumstance - fire, flooding, leading to complete or partial loss of property |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Accounting entries

Based on the results of the audit, surpluses or shortages of assets may be identified. Therefore, if they are available, after a complete inventory of intangible assets has been carried out, synthetic accounting entries are reflected accordingly.

Table. Postings for reflecting surpluses and shortages of intangible assets.

| Business transaction | Debit | Credit |

| Capitalization of surplus into other income | 04 | 91 |

| Write-off of shortfalls for other expenses | 91 | 04 |

According to legislative norms, the head of the enterprise has the right to independently establish the period and frequency with which the inventory of intangible assets will be carried out; entries, accordingly, will also be reflected with the same frequency. For example, management has decided to conduct an inventory every quarter before reporting, so the identified discrepancies must be reflected in the quarterly reports.

In addition to the inventory carried out for the purpose of generating accounting documentation for the reporting period, checking the availability of intangible assets is carried out when revaluing assets, when identifying theft, when changing the MOL, as well as in the event of force majeure situations that lead to damage or liquidation of assets.

Similar articles

- Inventory of intangible assets

- How to take an inventory and document it

- Inventory list of intangible assets (sample)

- Inventory list of intangible assets (sample)

- Inventory tasks

What data is checked?

During the verification process, it will be necessary to check whether the asset corresponds to the concept of intangible asset. Intangible assets must have documentary evidence of the intangible asset itself and exclusive rights to it. The inventory process confirms the presence of a patent, a certificate of copyright or trademark, an agreement for the acquisition of an exclusive right and other documents.

One of the main criteria for classifying an asset as an intangible asset is its exclusivity, when determining which it is necessary to take into account:

- In the absence of exclusive rights, the object does not belong to intangible assets and the costs of its acquisition or creation are expensed.

- The requirement applies to intangible assets created after 2001.

- Previously, the condition for classifying an asset as an intangible asset was the right arising from other types of contracts.

Contracts for intangible assets identified during the inspection before 2001 with expired contracts for the transfer of non-exclusive objects, their description is included in the inventory. Based on the compiled materials, objects are written off from the off-balance sheet account.

Registration of inventory results

During the inventory process, the commission checks the primary accounting documents provided by the responsible persons. Based on the results of the inspection, the data obtained is entered into the inventory list. For accounting, use form No. INV-1a or a self-developed form. The inventory is included in the audit materials.

Features of the inventory design:

- Filling out is done manually or typewritten with the document certified by original signatures.

- Line gaps are not allowed. Lines that are not filled in with text are crossed out.

- The name of objects is indicated in the units and nomenclature adopted in accounting.

- Each page must be numbered. The page displays the total of the specified objects in natural units.

Inventory indicators are used for comparison with accounting data in a special statement to determine compliance or discrepancies. The comparison sheet of inventory results (form No. INV-18) contains information about data deviations.

The inventory and statement are drawn up in at least 2 copies, which are signed by material persons. The forms are valid if all signatures are present on the documents. One copy is sent to the accounting department to confirm accounting data or make adjustments. The second copy remains with the commission and is subject to storage in the inventory materials file or with the financially responsible person.

What is important to remember

- The inventory can be filled out either by hand or on the computer. In the first case there should be no blots.

- The document is drawn up in 2 copies. The first is transferred to the accounting department, and the second remains with the employee who is responsible for the safety of documents for the right to intangible assets.

- If a factual error is found in the document, it is corrected by notifying all persons involved in the inventory. Incorrect information is crossed out and the correct option is written on top. All participants in the procedure put their signatures.

- Inventory records must be stored in the organization for 5 years.

Measures taken based on the results of the inspection

Upon completion of the inspection, the materials are transferred to the manager for approval. The end date of the inspection is the day the documents are signed by the head of the enterprise. The data obtained serves as the basis for making decisions based on the results of the inventory.

| Data identified during the audit | Measures taken |

| Indicators of full compliance of the audit results with the records were obtained | No action taken |

| An asset created or acquired after 2001 does not meet the exclusivity requirement | Attribute costs to current expenses or account 97 “Deferred expenses” if the asset is expected to be used for a long time |

| An asset not included in the accounting data was identified | Information from the inventory and statement serves as the basis for registering an intangible asset |

| An object received on temporary basis with an expired contract was identified | A write-off act is issued |

| An intangible asset with obsolescence has been identified | |

| A shortage of intangible assets resulting from the actions or inactions of the guilty parties has been identified | After documentary confirmation of those responsible for the shortage, the loss is written off at the expense of the responsible persons. |

| A shortage of intangible assets has been identified, the perpetrators of which have not been identified | The shortfall is written off to financial results |

The organization includes intangible assets accepted for accounting as part of its property. In accordance with Art. 12 of the Federal Law “On Accounting”, in order to ensure reliable accounting data and financial statements, organizations are required to conduct an inventory of property and liabilities. During the inventory, their presence, condition and assessment are checked and documented.

The head of the organization determines the procedure and timing of the inventory, except for cases when the inventory is mandatory.

During the inventory of intangible assets, one should be guided by the Methodological Guidelines for the Inventory of Property and Financial Liabilities, approved by Order of the Ministry of Finance of the Russian Federation dated July 13, 1995 No. 49. A permanent inventory commission, the composition of which is approved by order (instruction) of the head of the organization, checks the availability of documents confirming the organization’s rights to use intangible assets, the accuracy and timeliness of their reflection in the balance sheet.

To prepare inventory data for intangible assets, an inventory list of intangible assets is used (standard form No. INV-la). The inventory is drawn up by the commission in one copy. Inventory records record the actual presence of intangible assets by name and purpose.

To reflect the results of the inventory of intangible assets for which deviations from the accounting data are identified, a Comparison Statement of the Results of the Inventory of Fixed Assets is compiled (standard form No. INV-18). The form of this comparison sheet is used because a standard form for reflecting the results of the inventory of intangible assets has not been developed. The matching statement is compiled by the organization's accountant in one copy and stored in the accounting department.

Discrepancies identified during the inventory between the actual availability of intangible assets and accounting data are reflected in the accounting accounts in the following order:

- surplus intangible assets are accounted for at market value on the date of inventory, and the corresponding amount is credited to financial results. At the same time, it becomes clear when and by whose order unaccounted for intangible assets were acquired and where the corresponding expenses were written off;

- the shortage of intangible assets is at the expense of the guilty persons.

If the perpetrators have not been identified or the court has refused to recover damages from them, then losses from the shortage of intangible assets are written off to the financial results of the organization.

Excess intangible assets identified during the inventory are taken into account as part of non-operating income and are reflected by posting:

Dt 04 “Intangible assets” Kt 91 “Other income and expenses”, subaccount “Other income”.

For missing intangible assets, the amount of accumulated depreciation is written off:

D-t 05 “Amortization of intangible assets” D-t 04 “Intangible assets”.

Then the shortage of intangible assets is written off at their residual value:

D-t 94 “Shortages and losses from damage to valuables” K-t 04 “Intangible assets”.

If the guilty person is identified and admits his guilt, the amount of the shortfall is credited to the account of this guilty person according to the residual value of the object. For these purposes, accounting uses account 73 “Settlements with personnel for other operations”, subaccount “Settlements for compensation of material damage”. This operation is reflected by the entry:

D-t 73 “Settlements with personnel for other operations”, sub-account “Settlements for compensation of material damage” K-t 94 “Shortages and losses from damage to valuables”.

The difference between the market and book value of the missing item of intangible assets is also attributed to the account of the guilty person and at the same time this amount is reflected in the future income of the organization on account 98 “Deferred income”, on the sub-account “Difference between the amount to be recovered from the guilty persons and the balance sheet value based on shortages of valuables":

D-t 73 “Settlements with personnel for other operations”, sub-account “Settlements for compensation of material damage” K-t 98 “Deferred income”, sub-account “The difference between the amount to be recovered from the guilty parties and the book value for shortages of valuables” .

To repay the damage caused, the guilty person can deposit funds into the organization’s cash desk, into the organization’s bank account, or these amounts can be deducted from his salary:

D-t 50 “Cash”, 51 “Cash accounts”, 70 “Settlements with personnel for wages” D-t 73 “Settlements with personnel for other operations”, sub-account “Settlements for compensation of material damage”.

At the same time, the amount of future income in the part proportional to the received payment is included in the other income of the organization:

D-t 98 “Deferred income”, sub-account “The difference between the amount to be recovered from the guilty parties and the book value for shortages of valuables” K-t 91 “Other income and expenses”, sub-account “Other income”.

If there is no culprit, the shortage is written off as non-operating expenses:

D-t 91 “Other income and expenses”, sub-account “Other expenses” D-t 94 “Shortages and losses from damage to valuables”.

The amount of damage caused by the shortage of intangible assets is written off as losses:

D-t 99 “Profits and losses” D-t 91 “Other income and expenses”, subaccount “Balance of other income and expenses”.

The amount of non-operating income received as a result of compensation by the employee for the amount of the shortfall is written off:

Dt 91 “Other income and expenses”, subaccount “Balance of other income and expenses” Kt 99 “Profits and losses”.

Checking intangible assets for impairment. Example

Enterprises often initiate an inventory count before revaluing intangible assets or a group of assets. The basis for revaluation is the discrepancy between the valuation of assets and the real market value. After revaluation, assets are carried at fair value. The initial cost and accrued depreciation of intangible assets are subject to revaluation. As a result of revaluation, assets are revalued or devalued.

The possibility of revaluation is approved in the accounting policy. Enterprises conducting revaluations are required to carry them out regularly in the future. The change in value and depreciation accrued as of the date is made using a coefficient derived from a comparison of prices. Intangible assets of a unique nature (patents, trademarks and analogues) are not subject to revaluation due to the lack of comparative samples.

Example of asset revaluation after inventory

Let's consider an example of revaluation of an asset after an inventory, during which an expert assessment of the market value of the asset was considered.

The organization Concord LLC carried out an inventory of intangible assets, based on the results of which a decision was made to re-evaluate the value of the Iskra object - registered software. The revaluation was carried out for the first time; there are no other objects on the balance sheet. The residual value of the object at the time of revaluation is 50,000 rubles with accrued depreciation of 5,000 rubles. The market value is estimated at 60,000 rubles (coefficient 1.2).

| Action | Calculation | Wiring |

| Revaluation of original cost | 55,000 x 1.2 = 66,000 rubles | |

| Revaluation of cost | 66,000 – 55,000 = 11,000 rubles | Dt 04 Kt 83 – 11 000 |

| Revaluation of depreciation | 5,000 x 1.2 = 6,000 rubles | |

| Overestimation of depreciation | 6,000 – 5,000 = 1,000 rubles | Dt 83 Kt 05 – 1 000 |

| Calculation of residual value | 66,000 – 6,000 = 60,000 rubles |

The revalued residual value is reflected in the balance sheet. Read also: → account 04 in accounting (postings, example)

Features of identifying shortages during inventory of intangible assets. Postings

Determining the shortage of intangible assets is quite difficult. If title documents are lost, the forms are restored by obtaining duplicates. Another option arises when the object itself is lost, for example, a program or development.

Let's consider an example with a shortage identified during an inventory. Conducted an inventory of intangible assets in preparation for annual reporting. The commission identified a shortage of the “Program” object, reflecting the results in the inventory. The loss of the asset occurred due to the fault of the responsible person K., who caused damage to the storage equipment of the facility. Based on the results of the inspection, the manager decides to write off the object at a residual value of 150,000 rubles.

Debit 94 Credit 04 – the shortage of an intangible asset in the amount of 150,000 rubles is written off.

Debit 73.2 Credit 94 – transferring the amount of damage of 150,000 rubles to the account of the person who caused the damage (the loss was recognized by the person at fault).

Debit 50 Credit 73.2 – receipt of amounts to the cash desk to repay the damage.

In the absence of the consent of the guilty person to voluntarily repay the damage, the amount is recovered by court decision.

Postings

This is done with the following wiring:

- Dt04/Kt91 – acceptance of the surplus discovered during the audit into accounting as non-operating income.

- Dt94/Kt04 – write-off of the shortage in intangible assets at the expense of the culprit at the residual value.

- Dt91/Kt94 – write-off if the culprit is not found (as non-operating expenses).

- Dt99/Kt91 – write-off to the loss account.

- Dt05/Kt04 – writing off depreciation from undetected intangible assets.

This video will tell you about such an inventory:

Answers to frequently asked questions about inventory of intangible assets

Here are the answers to frequently asked questions:

Question No. 1. Do financially responsible persons have the right to express disagreement with the inventory of intangible assets.

Financially responsible persons make an entry at the end of the inventory list. The text indicates that the check was carried out in their presence. The text may indicate objections to the actions of persons from the commission.

Question No. 2. Are corrections of incorrect entries in inventory materials allowed?

Corrections made when filling out the inventory are corrected with the certification of the new entry by all members of the commission. Corrections are made in all copies.

Question No. 3. How many inventories are compiled as a result of an inventory of intangible assets?

When checking the status of intangible assets, data is generated separately for own objects received temporarily for safekeeping and leased.

Question No. 4. What objects are excluded from the composition of intangible assets during the inventory as those that did not produce results?

During the audit of intangible assets, the commission must allocate funds that are not subject to accounting as intangible assets. R&D developments that did not produce results, scientific developments that did not receive documentation, and financial investments in ineffective developments are excluded.

Question No. 5. Is an inventory of assets prepared for disposal by write-off carried out?

Intangible assets listed at the time of the start of the inventory are subject to verification, as well as other funds on the balance sheet. To account for retiring assets, a separate inventory is drawn up indicating the reasons for write-off.

Rate the quality of the article. We want to become better for you: If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓ Legal Consultation free Moscow, Moscow region call

One-click call St. Petersburg, Leningrad region call: +7 (812) 317-60-16

Call in one click From other regions of the Russian Federation, call

One-click call

AccountingWeb

Before starting the inventory, it is recommended to check:

the presence and condition of inventory cards, inventories and other analytical accounting registers, as well as technical passports or other technical documentation;

availability of documents for fixed assets leased or accepted by the organization for storage. If documents are missing, it is necessary to ensure their receipt or execution. Need a sculpture for a grave gs-best.ru.

If discrepancies and inaccuracies are detected in the accounting registers or technical documentation, appropriate corrections and clarifications must be made.

When making an inventory of fixed assets, non-produced and intangible assets, the commission inspects the objects and enters their full name, purpose, inventory numbers and main technical or operational indicators into the inventory records.

When making an inventory of buildings, structures and other real estate, the commission checks the availability of documents confirming that the objects are owned by the organization.

The availability of documents for land plots, reservoirs and other natural resource objects owned by the organization is also checked.

When identifying objects that have not been registered, as well as objects for which there is no data in the accounting registers or incorrect data characterizing them is indicated, the commission must include in the inventory the correct information and technical indicators for these objects.

The assessment of unaccounted for objects identified by the inventory must be made taking into account market prices, and depreciation is determined based on the actual technical condition of the objects, with information about the assessment and depreciation recorded in the relevant acts.

Fixed assets are included in the inventory under the name in accordance with the main purpose of the object. If an object has undergone restoration, reconstruction, expansion or re-equipment and, as a result, its main purpose has changed, it is entered into the inventory under the name corresponding to the new purpose.

If the commission establishes that work of a capital nature (adding floors, adding new premises, etc.) or partial liquidation of buildings and structures (demolition of individual structural elements) is not reflected in the accounting records, it is necessary to determine the amount of increase or decrease in the book value of the object using the relevant documents and provide information about the changes made in the inventory.

Machinery, equipment and vehicles are entered into the inventory individually, indicating the factory inventory number, manufacturer, year of manufacture, purpose, capacity, etc.

Fixed assets that, at the time of inventory, are located outside the location of the organization (on long-distance voyages, sea and river vessels, railway rolling stock, vehicles; machinery and equipment sent for major repairs, etc.) are inventoried until their temporary disposal.

For fixed assets that cannot be restored, the inventory commission draws up a separate inventory indicating the time of commissioning and the reasons that led to the unsuitability of these objects (damage, complete wear and tear, etc.).

Simultaneously with the inventory of own fixed assets, fixed assets in custody and leased are checked.

For these objects, a separate inventory is drawn up, which provides a link to documents confirming the acceptance of these objects for safekeeping or rental.

To reflect the results of the inventory of non-financial asset objects, an inventory list (matching sheet) for non-financial asset objects is used.

In this form of document, the actual availability of property is compared with budget accounting data and discrepancies are identified. The inventory reflects: the number of the order (instruction) to carry out the inventory; place and date of the inventory; decision of the head of the institution with signature, transcript of signature, date; receipt of the financially responsible person (issued before the start of the inventory) indicating the position, signature, transcript of the signature, date; confirmation by the financially responsible person of the correctness of entering into the act the values in his custody; name and code of non-financial assets, inventory number; unit of measurement; price; information about actual availability (quantity, amount); information according to budget accounting data (quantity, amount); information on inventory results (for shortages and surpluses - quantity, amount); if necessary, notes. Explanation of the reasons for surpluses or shortages, conclusion of the commission.

Pages: 1

see also

Purchase of currency from individual clients at the expense of a credit organization. The operation is carried out on the basis of the client’s application for the sale of currency in the form established by the credit organization, and is formalized by direct posting between the client’s foreign currency and ruble accounts: Dt val ...

The procedure for opening and maintaining personal accounts is Federal Law dated 02.12.1990 N 395-1 “On banks and banking activities” (Article 30) established that clients have the right to open the number of settlement, deposit and other accounts they need...

Summary Currently, the International Standards Committee has approved more than 40 standards that define the rules for reflecting resources, financial transactions and business facts in financial accounting...

Frequency and procedure for conducting an inventory of intangible assets, recording the results

October 5, 2020 Intangible assets

Intangible assets (intangible assets) of an enterprise are considered to be property objects operated by the copyright holder for a long time (more than a year), contributing to the generation of profit (economic benefit), which do not have a physical embodiment (material expression).

Intangible assets of an organization belong to the category of non-current assets and, as is known, require proper accounting.

Such objects are often products of intellectual activity or, alternatively, means of unambiguous individualization of their copyright holder.

Such assets appear in a company as a result of purposeful actions of an interested party to create, transfer/receive or acquire them.

The main feature of all these activities is that the enterprise has an exclusive right to the beneficial use of the corresponding intangible asset.

In order to reliably determine (clarify) the presence of intangible assets, their condition and the degree of obsolescence, it is necessary to regularly conduct an inventory (audit, verification) of the relevant assets in the company.

It is important for specialized specialists to know what such an inventory is, how often it should be carried out, in what order it is carried out, what documents are used to document its results, and how its accounting is carried out.

The specifics of appropriate accounting actions based on the results of an inventory carried out for certain intangible assets are determined by the result that was obtained - full compliance with accounting information or identification of a shortage/surplus.

It should be noted, however, that some aspects of the conduct and execution of such an audit are specifically regulated by regulatory requirements that are generally binding.

What is a concept

The accounting information for intangible assets, verified and confirmed by the corresponding inventory, is used by the accountants of the copyright holder enterprise.

Based on the information, annual financial statements and all interim balance sheets are compiled.

Periodic checking of the presence and condition of such assets helps to monitor their safety and increase the efficiency (profitability) of their practical use.

The inventory of certain intangible assets may result in one of the following results:

- The results of the audit performed completely coincide with the accounting data.

- Identification of assets not recorded in accounting at the start date of the audit. The detected intangible material is included in the inventory list and registered.

- Damage, loss, and other force majeure circumstances determined the absence of intangible assets, which, however, were registered by the copyright holder enterprise. The fact that there is no documentary justification for the intangible asset is recorded in the inventory act indicating the guilty party.

As a rule, an inventory of existing intangible assets is assigned for individual situations (cases), prompting the company's management to check the actual status of these assets on a certain date.

How often is it carried out for NMA?

In principle, the management of the copyright holder organization usually independently regulates the frequency, frequency and specific timing of the inventory of intangible objects.

However, it must be carried out in the fourth quarter of the reporting year - immediately before the preparation and preparation of annual financial statements.

In all other situations (cases), the feasibility and necessity of such an event are determined at the discretion of management.

Thus, in order to collect the necessary information for the preparation of annual financial statements, it will be enough to audit intangible assets once during the year.

To check the presence of intangible assets at the enterprise, assess their actual condition, and also clarify the reliability of the relevant accounting documents, you can perform an inventory of these assets no more than once per six-month period.

Except for those cases when inventory activities are carried out at the enterprise without fail, inventory of intangible assets can be carried out more often, that is, as necessary/expedient, in the following situations:

- the occurrence of force majeure circumstances that led to partial/complete loss of assets (flooding, fire, etc.);

- establishing facts of damage, theft, and other malicious actions committed in relation to the organization’s assets;

- the assets of the enterprise are revalued by specialists at current market prices;

- the structure of the organization is modified (the owner changes, the company is liquidated, it is merged);

- more than 50% of the group of responsible entities of the copyright holder enterprise is subject to release (dismissal);

- a materially responsible entity is replaced at the enterprise, whose competence includes ensuring the safety and accounting of objects;

- other circumstances.

Order of conduct

Inventory of intangible assets at an enterprise is usually carried out by special commissions - one-time or regularly operating.

As a rule, such a commission includes at least three people - the chairman and ordinary participants.

The start of the inventory procedure is formalized by an appropriate order from management (form INV-22).

If the inventory commission operates at the enterprise permanently, the execution of an administrative act of management is not in this case a necessary condition for starting a mandatory inventory.

If such an order is nevertheless issued, it is registered in the accounting book compiled according to the INV-23 standard.

A mandatory requirement when performing the next audit of intangible assets is the direct participation in this procedure of entities that are personally responsible for the safety and proper accounting of the relevant assets.

Responsible entities draw up the necessary receipts, which are included by the commission in the inventory documentation package.

Such papers (receipts) clearly confirm the following facts:

- Intangible assets are written off by the enterprise according to the time limits regulated for disposal;

- objects at the disposal of responsible entities are accounted for and registered;

- documents recording the receipt, movement, movement and disposal of intangible assets are transferred to authorized persons for the purpose of performing checks.

If responsible entities were previously issued accountable funds for the acquisition (purchase) of an intangible asset, and a documentary report on these amounts was never transferred to the accounting department, a receipt must be drawn up indicating the existence of such circumstances.

An asset inventory, first of all, should clarify whether a specific property item is an intangible asset.

In other words, does this asset meet the regulatory requirements for intangible assets?

In addition, it is necessary to check the availability of documentary evidence of the intangible asset, and also find out whether the owner of the company has an exclusive right to it.

You should check whether the organization that owns the right has patent documentation, copyright certificates, registration paper for a trademark, an agreement on obtaining an exclusive right, and other documents.

Documenting

Carrying out an inventory of an enterprise by the commission involves checking by specialists the primary accounting documents provided by the responsible entities.

Based on the results of such an audit, the information obtained is indicated by the commission in the appropriate inventory.

For accounting actions, the INV-1a standard form or, alternatively, a form independently developed by the enterprise’s specialists can be used.

The generated inventory is added to the package of documentation drawn up during the inspection.

The inventory data is subsequently used for comparison (comparison, juxtaposition) with the accounting information of accounting registers.

A special comparison statement is drawn up, through which the correspondence of the compared data is established or a discrepancy between them is identified.

The matching statement and inventory list are drawn up in at least two copies.

These papers are signed by all responsible entities, which is an official confirmation of their validity.

The first copy is sent directly to the accounting department of the enterprise in order to confirm accounting information or make the necessary changes.

The second copy should be left at the disposal of the commission; it is stored in the inventory archive or, alternatively, with the responsible entity.

Accounting for results: surplus, shortage

The results of the audit of intangible assets are reflected in accounting as follows:

| Operation (description) | Debit | Credit |

| Detected surplus intangible assets are recorded and taken into account | 04 | 91 (according to the subaccount of other income) |

| Write-off of accumulated depreciation for identified shortages of intangible assets | 05 | 04 |

| Write-off of detected shortages of intangible assets at the residual value | 94 | 04 |

| Attribution of the residual value of the shortage to the account of the guilty entity | 73 (according to subaccount) | 94 |

| Attribution of the difference between the market price and the book value of the shortage to the account of the guilty entity while simultaneously reflecting it in future income | 73 (according to subaccount) | 98 (according to subaccount) |

| Payment of monetary compensation to the enterprise by the entity responsible for the shortage | 70,51,50 | 73 (according to subaccount) |

| The amount of future income upon compensation of the shortfall by the guilty entity is transferred to other income | 98 (according to subaccount) | 91 (according to subaccount) |

| Attribution of the detected shortage to non-operating costs if the culprit is absent | 91 (for subaccount of other expenses) | 94 |

| Damage caused to an enterprise by a detected shortage of intangible assets is classified as losses | 99 | 91 (according to the subaccount of the balance of other income/expenses) |

| If the culprit reimburses the company for the amount of the detected shortage, it is taken into account as non-operating income | 91 (according to the subaccount of the balance of other income/expenses) | 99 |

Fresh materials

- Certificate of non-admission to the apartment, sample EVERYTHING THAT CONCERNES THE COMPANY BURMISTR.RU CRM system APARTMENT.BURMISTR.RU SERVICE FOR REQUESTING EXTRACTS FROM ROSSREESTR AND CONDUCTING…

- Balance sheet of JSC Accounting (financial) statements of enterprises 39,149.84 billion rubles — JSC VTB CAPITAL 4,892.93 billion…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Exemption from VAT Notification of the use of the right to exemption from VAT Notification of the use of the right to exemption from VAT...