Return period

The employee must report on the amounts received for reporting no later than three working days after the expiration of the period for which these amounts were issued.

To do this, he needs to present to the chief accountant or accountant, and in their absence, to the manager, an advance report with attached supporting documents (clause 6.3 of the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U). From what date this period is to be counted depends on the purpose for which the employee was given accountable money. If an employee received money on account for business needs, then he must report for it within three days from the end of the period for which it was issued to him (clause 6.3 of the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U).

If the money is issued on account of travel expenses, then the employee must report for them within three working days after returning from a business trip (clause 26 of the regulation approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

Checking the advance report, its approval by the manager and the final settlement on it are carried out within the time period established by the manager (clause 6.3 of the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U). That is, the employee must return the unspent amounts within the period set by the manager.

Situation: when must an employee report on amounts received on account for business needs if the deadline for their return has not been established?

On the day you receive them.

The employee must report on the amounts received for reporting no later than three working days after the expiration of the period for which these amounts were issued (clause 6.3 of the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U). The question of how to report on accountable amounts if the return period has not been established is not stated in the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U. According to the tax department, in such a situation the employee must report on accountable money on the same day on which he received it (letter of the Federal Tax Service of Russia dated January 24, 2005 No. 04-1-02/704).

Advice: due to the ambiguity of the issue, it is better for the organization to establish the period for which accountable amounts are issued for business needs. This will help avoid possible disagreements with regulatory agencies.

An example of calculating the period during which an employee must report on amounts received for reporting for business needs

April 8 Secretary E.V. Ivanova received money to buy stationery (paper, staplers, pens, etc.) for the organization. She completed the task without spending the entire amount received for the report.

The organization does not set a period for which employees receive accountable amounts for business needs. Therefore, no later than April 8, Ivanova must submit an advance report.

Situation: from what date should I calculate the reporting period for amounts issued for travel expenses - from the end date of the business trip specified in the order, or from the day when the employee actually returned to his place of permanent work?

From the day when the employee actually returned to his place of permanent work.

The deadline for an employee’s report on travel expenses is three working days from the date of his return from a business trip (clause 26 of the regulation approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749). Therefore, regardless of what date is indicated in the manager’s order to send an employee on a business trip, the countdown must be carried out from the moment when the employee actually returned to the place of work (paragraph 2, paragraph 4 of the regulation, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749). When traveling within the country, this day is determined on the basis of travel documents (clause 7 of the regulations approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749). When traveling abroad - according to the mark in the international passport (paragraph 2, clause 18 of the regulation approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

How to return funds from the account if an employee no longer works for you

In a situation where the employee did not return the accountable money and quit, you can do the following:

- If the employee has not yet been paid, then the debt can be withheld from his salary, subject to the decision of the manager and the consent of the employee. In this case, the withholding should not exceed 20% of the salary (Article 138 of the Labor Code of the Russian Federation).

- If all settlements with the employee are terminated or he does not agree with the amount of withheld amounts, the debt can only be collected through legal proceedings.

To find out whether it is possible to delay the payment of funds due to an employee upon dismissal if he has not returned the accountable amounts, read the material “Calculation upon dismissal of one’s own free will - 2017”.

Refunds of accountable amounts can be made both in cash and in non-cash form. To minimize the risks of disputes with tax authorities, the possibility of returning funds in non-cash form should be fixed in internal regulations.

Be the first to know about important tax changes

Have questions? Get quick answers on our forum!

Deposit at the cash register

The employee must deposit unspent accountable money into the organization's cash desk. In this case, you need to issue a cash receipt order. This conclusion follows from the instructions approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

This also applies to employees to whom accountable amounts were transferred to a bank card. In this case, the employee has the right to withdraw money from the card and return the remaining unused amounts to the organization’s cash desk in cash or transfer them by bank transfer. After all, the instructions of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U regulate only the issuance of cash on account.

How to properly return accountable money to the organization’s account?

These days, almost every employee has a salary card. It is to this card that money can be transferred to the account. It is more convenient for an individual to return the balance of unused funds to the organization’s account from the same card through online banking.

How to do this in practice?

Firstly, the possibility of issuing and returning accountable money through a current account to or from employee salary cards or bank cards of persons involved under civil law contracts must be enshrined in a local act of the enterprise - for example, draw up a Regulation on settlements with accountable persons or include it in the Accounting Policy .

Secondly, it is necessary to return accountable funds to the current account by making an entry “return of unused accountable amounts” in the “payment name” field. This entry will allow you to avoid problems with the tax authorities and not include the amounts received in the tax base for profit tax, VAT and income when applying the simplified tax system. If, when making a payment, the accountant did not indicate that the money transferred is a return of the unused amount, it is better to formalize this with an explanatory note to the payment.

Cash register receipt

Situation: is it necessary to issue a cash receipt for the amount of unspent accountable money that the employee returns to the organization?

Answer: no, it is not necessary.

Cash register systems must be used when receiving cash for goods sold, work performed or services provided (Clause 1, Article 2 of Law No. 54-FZ of May 22, 2003). The return by an employee of the balance of the amount given to him on account does not apply to such operations. Therefore, there is no need to issue a cash receipt for the accountable amount that the employee returned to the organization. This conclusion is confirmed by the Russian Ministry of Finance in letter dated November 30, 2004 No. 03-01-20/2-47.

An example of reflecting in accounting the return of unspent accountable amounts

On April 11, Secretary of Alpha LLC E.V. Ivanova received 2000 rubles. for the purchase of office supplies (paper, staplers, pens, etc.) for the organization. The cost of the goods she purchased was 1,500 rubles. (the purchase was not subject to VAT, since the seller applies a simplification). The deadline set by the manager for the return of accountable amounts is April 14.

On April 14, the head of Alpha approved Ivanova’s advance report. On the same day, she returned the unspent balance of accountable money in the amount of 500 rubles to the organization’s cash desk. (2000 rub. – 1500 rub.).

In accounting, Alpha's accountant made the following entries.

11 April:

Debit 71 Credit 50 – 2000 rub. – money was issued against Ivanova’s report.

14th of April:

Debit 10 Credit 71 – 1500 rub. – stationery purchased by the employee has been received;

Debit 50 Credit 71 – 500 rub. – the balance of unspent accountable amounts is entered into the cash register.

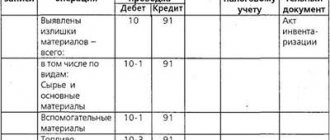

Accounting for accountable amounts using specific examples

To purchase stationery, the secretary of the Prokopyevskaya Village Hospital, A. I. Altufeva, was given 3,500 rubles from the cash register. The funds are allocated from the institution’s own income. The purchased stationery will be used in the activities of the institution, not subject to VAT. The total purchase price is RUB 2,900. (including VAT - 442 rubles 37 kopecks), costs for courier delivery of stationery - 200 rubles. (including VAT - 30 rubles 50 kopecks).

Operations for the purchase of stationery will be reflected in the institution’s accounting records:

| Debit | Credit | Amount, rubles | Contents of operation |

| 2 208 34 560 | 2 201 34 610 | 3 500 | Funds were issued against the report for the purchase of stationery |

| 2 106 34 340 | 2 208 34 660 | 2 900 | Costs for purchasing stationery are taken into account |

| 2 106 34 340 | 2 208 34 660 | 200 | The cost of courier delivery of office supplies to the institution is written off as an increase in their cost (including “input” VAT) |

| 2 105 36 340 | 2 106 34 340 | 3 100 (2 900 + 200) | Purchased stationery items are included in materials |

| 2 109 80 272 | 2 105 36 440 | 3 100 | The cost of stationery put into operation has been written off |

| 2 201 34 510 | 2 208 34 660 | 400 | Accountable funds were returned to the institution's cash desk |

Postings on the advance report for a business trip

Business trip expense write-off accounts depend on the company's area of activity and the purpose of the trip. In this case, the account is credited. 71 in correspondence with account. 20 (if expenses relate to core activities), inc. 26 (for general business expenses, including postal expenses in the advance report), inc. 44 (for expenses associated with the sale of products).

In addition, it is necessary to take into account that the costs listed in the advance report (for example, the cost of travel tickets or a hotel room) include VAT, which must be allocated.

The purpose of preparing a report is to organize costs and determine their actual amount. If it coincides with the amount of the advance payment issued, then 71 accounts are closed, the balance of funds on the advance report indicates the need to deposit it in the company’s cash desk, and overspending indicates the employee’s own expenses incurred, which, after approval of the advance report, are returned to him from the company’s cash desk or by transfer to map. The overexpenditure is reflected in the advance report by posting: D/t 71 – K/t 50, 51.

Accounting entries accompanying the acceptance of costs on the advance report:

| Operations | D/t | K/t |

| The expense report has been approved and the travel expenses have been written off by posting: | ||

| - in a trading company (if its goal was to promote the product) | 44 | 71 |

| — in a manufacturing enterprise (work-related trips) | 20 | 71 |

| - general business purposes, such as postage | 26 | 71 |

| Assets or materials purchased during the trip | 08,10 60 | 60 71 |

| VAT has been deducted from the cost amount | 19 | 71 |

| VAT is accepted for deduction | 68 | 19 |

| The balance of unused travel expenses is returned to the cashier, to the current account or deducted from the payment with the consent of the employee | 50, 51, 70 | 71 |

| Cost overrun paid to employee | 71 | 50 |

Let's illustrate accounting for business travel costs with examples.

Example 1:

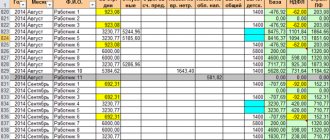

Employee of Troya LLC, engineer Deryabin A.Yu. in April 2020, I received an advance on a business trip for a period of 5 days in the amount of 160,000 rubles. to travel to another region. The purpose of the trip was to purchase filter equipment for production. Deryabin A.Yu. departed by plane on April 15, and returned on April 19 by supplier’s transport, accompanying the purchased equipment. On April 23, 2019, they were provided with an advance report listing the expenses:

- the cost of “there” tickets is 18,000 rubles. (including VAT – 3000 rub.);

- The cost of a hotel room is 21,600 rubles. (including VAT - 3600 rub.) for 3 days;

- daily allowance - 3500 rub. (700 x 5 days);

- payment for consulting services of the equipment manufacturer – 15,000 rubles;

- purchase of the installation – 108,000 rubles. (including VAT 18,000 rubles).

The engineer attached all documents confirming expenses to the advance report. In the final line of the report, the amount of expenses is 166,100 rubles, i.e. there was an overexpenditure of issued funds. The accountant checked the report and approved the expenses incurred. According to the advance report, the following accounting entries were made:

| date | Operations | D/t | K/t | Sum |

| 15.04 | An advance payment for a business trip is transferred to the employee’s card | 71 | 51 | 160 000 |

| 23.04 | Accepted expense report, approval transactions and write-off of costs: | |||

| - daily allowance | 20 | 71 | 3500 | |

| — for hotel accommodation | 20 | 71 | 18 000 | |

| VAT on hotel account | 19 | 71 | 3600 | |

| — for travel (air ticket) | 20 | 71 | 15 000 | |

| VAT on air ticket | 19 | 71 | 3000 | |

| Consultation on the use of equipment | 08 | 60 | 15 000 | |

| Installation cost | 08 | 60 | 90 000 | |

| VAT on installation cost | 19 | 71 | 18 000 | |

| Expenses for the purchase of the installation are written off from accountable amounts | 60 | 71 | 105 000 | |

| Accepted for VAT deduction (3600 + 3000 + 18,000) | 68 | 19 | 24 600 | |

| Deryabin A. Yu. was issued an overexpenditure on the advance report (166,100 – 160,000) | 71 | 50 | 6100 |

In the example, the amount of overexpenditure according to the advance report (posting D/t 71 - K/t 50) was issued from the cash register. Depending on the company’s system of settlements with personnel, money could be transferred to his card by posting D/t 71 K/t 51. As a result, the account. 71 for the accountable amount issued to Deryabin A.Yu. closed.

Example 2:

PC operator Minina I.I. 04/15/2019 sent on a business trip for 2 days to improve professional training and attend a seminar. The advance amount was 13,400 rubles. Travel tickets were pre-ordered by the company and issued to them along with the amount of travel allowance. 04/17/2019 Minina I.I. returned and submitted an advance report for approval, where she listed the expenses and confirmed them with documents:

- daily allowance 1400 rub. (700 x 2 days);

- hotel accommodation fee 3360 rub. (VAT 560 rub.);

- travel 6000 rub.:

- payment for participation in the seminar is 5000 rubles.

A total of 15,760 rubles.

Postings:

| date | Operations | D/t | K/t | Sum |

| 15.04 | An advance was issued from the company's cash desk for a business trip | 71 | 50 | 13 400 |

| Tickets for the passage of I.I. Minina have arrived at the box office. | 50/3 | 76 | 6000 | |

| Travel documents were issued by I.I. Minina. | 71 | 50/3 | 6000 | |

| 17.04 | The advance report for the business trip has been approved and the following write-off entries have been made: | |||

| - daily allowance | 20 | 71 | 1400 | |

| - for accommodation | 20 | 71 | 2800 | |

| VAT on hotel account | 19 | 71 | 560 | |

| — for travel | 20 | 71 | 6000 | |

| — for participation in the seminar | 20 | 71 | 5000 | |

| The balance of the unused advance is 3640 rubles. (13,400 + 6000 – 1400 – 3360 – 6000 – 5000) returned to the cashier | 50 | 71 | 3640 |

We learn to draw up expense reports using examples (1C: Accounting 8.3, edition 3.0)

2016-12-08T12:30:37+00:00

In my observation, for novice accountants, preparing expense reports is a significant challenge at first.

Today we will look at the basics of this matter, as well as the most popular cases from life. We will perform all experiments in 1C: Accounting 8.3 (edition 3.0).

So, let's begin

It’s not for me to tell you that 71 accounts are responsible for settlements with accountable persons in the accounting department:

The issuance of assets is reflected to the employee as a debit to this account, and write-offs are reflected as a credit.

Well, for example, they gave out 5000 against a report from the cash register:

Dt 71 Kt 50 5000

The employee reported on the use of these funds, for example, to pay for general business expenses... well, for example, for electricity:

Dt 26 Kt 71 5000

Why did I say assets? This is because we can give the employee:

- Cash (from the cash register through cash register)

- Non-cash funds (transfer from the organization's current account to the employee's card account)

- Financial documents (for example, plane tickets for a business trip)

Let's look at each of the examples listed above.

How is the amount of return of funds taken into account reflected in accounting?

The company, having received accountable amounts from the employee, reflects the following entries in accounting:

- Dt 50 Kt 71 - return of cash to the cash desk;

- Dt 51 Kt 71 - return of accountable amounts to the ruble bank account of the enterprise;

- Dt 52 Kt 71 - return of the sub-report to the company’s foreign currency account;

- Dt 94 Kt 71 - reflection of the debt of the accountable in case of non-repayment of the amounts issued by him.

For information on what to do if an employee does not have enough accountable funds, read the article “ What to do if an accountable person has spent his money? "