According to the country's legislation, each retail outlet must be equipped with an online cash register. Legislators have provided a benefit for individual entrepreneurs on a patent. It consists of a tax deduction for the amount of costs for purchasing the device.

In some cases, products are brought to a retail outlet for secondary sale. The trade worker is obliged to formalize the acceptance of the goods and return the money spent by the citizen. Therefore, trade workers should know for what reasons the goods can be returned by the consumer, the registration procedure and the period for transferring money.

Reimbursement of expenses via online checkout

What to do if a check is entered incorrectly

Unlike conventional cash register equipment, online cash registers are equipped with a fiscal drive for storing information. Its purpose is to send daily information about the proceeds to the tax authority through the fiscal data operator.

If the cashier made a mistake on the check, refer to the provisions of Federal Law No. 54 “On the use of cash register equipment.”

Important! To make corrections to a financial transaction that has already been completed, you must issue a return of receipt or a correction check.

Incorrect information in a cash receipt is corrected if:

- Inaccuracy that contributed to the shortage.

- The cashier made a mistake, which led to extra money being processed through the online cash register, and he wants to fix it.

- Malfunctions resulting in malfunctions of cash register equipment.

An adjustment is made if the cashier punches a check through the online cash register for the wrong amount or the check is not punched out and the sale is not taken into account. The correct cash document is issued when discrepancies are identified.

If the cashier himself discovers an erroneous receipt at the online cash register, he must act according to the following algorithm:

- Draw up a paper - a memo. It indicates the date and time of the error that caused unaccounted revenue.

- The correction check indicates the number assigned during registration and the date the memo was drawn up. The sign of settlement is also determined: independent operation or receipt.

- The adjusted check is punched. It is sent by the OFD to the tax authority. After completing the steps described above, you need to contact the Federal Tax Service to notify you that an error has been detected and corrected.

A difficult situation may arise - the operator discovered his mistake when the buyer had already left. It is impossible to issue another cash document. For example: a person bought a hairdryer for 2000 rubles, and the cashier punched the receipt for 200 rubles and did not notice it. To ensure that excess funds are accounted for correctly in the cash register, perform the following actions:

- Punching a correction check.

- Save the corrected receipt in a separate folder.

- An explanatory note regarding this cash document is attached.

The information will be sent to the Federal Tax Service through the fiscal data operator with whom the company has entered into a contract. If the Federal Tax Service requests a saved document, it will be presented.

Carrying out a return

The procedure is carried out in different ways. It all depends on the reason for which you need to make a return.

On the day of purchase (seller's error)

How to make a return via online checkout after purchase? Sometimes sellers make mistakes when selling goods. The receipt may indicate an incorrect number of product units. It is also possible that the prices on the receipt and the price tag may not match. To eliminate the mistake, the cashier knocks out “Return of Receipt”. The salesperson issues a receipt with the correct quantity of product and its price. This document is handed over to the buyer along with the overpaid money. The buyer will not need any other papers.

Fiscal authorities will need to provide documentation confirming the legality of cost reimbursement. The seller needs to write a memo explaining which check was issued incorrectly (the erroneous document must be attached to the note). The fact of generating 2 supplementary checks (“Return of receipt” and a new cash receipt) is recorded in the document.

If a consumer contacts a store to resell purchased products, the procedure on the day of purchase is no different from the return process several days after the purchase and sale transaction. A similar rule applies to the transfer of an advance payment (prepayment) for goods to the buyer.

Not on the day of purchase

In some situations, customers bring goods to the store demanding a full refund. There are many reasons for this. The day a citizen applies for compensation does not matter. He may demand a refund immediately or after a certain period. At the online checkout, costs are reimbursed equally in both situations.

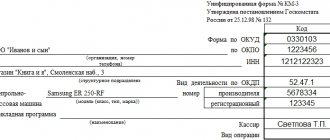

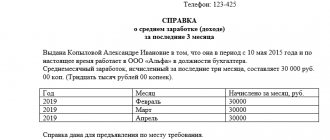

Example of an invoice

You should go to the store to transfer goods for secondary sale with a receipt and passport. On the spot, you must write an application in any form with the obligatory indication of the above information. Some retail outlets have developed forms for such cases to simplify and speed up the process.

Next, the seller creates an invoice for returning the goods. There is no single form of this paper. Authorized persons create the form on their own. The invoice is drawn up in 2 copies. Each of them is certified by the seller and the buyer.

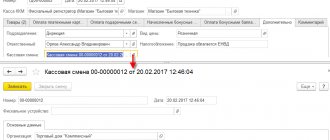

At the next stage, the trade employee creates a refund check. It differs from the original check in the sign of settlement. In this block, instead of the word “Parish” there is the phrase “Return of arrival”. The program creates a document with the following information:

- the name of the purchase for which reimbursement will be required;

- its cost;

- payment method (cash, non-cash);

- date, time of the operation, its barcode, etc.

Return check example

Refund to the buyer (the buyer returns the goods)

After issuing a return check in KKM online and signing the necessary documentation, the seller returns the money paid by the buyer in whole or in part. A partial refund is provided when several units of goods from different groups are purchased (for example, bread, saucepan and sausage, but only the saucepan is subject to a monetary refund). In both cases, the procedure for transferring cash is the same.

https://youtu.be/F3tQ6Grt-gg

Is it necessary to notify the tax office?

Taxpayers are required to transmit to the tax authority information in electronic form about the use of cash register equipment.

Important! Law No. 54 “On the use of cash registers” does not oblige users of online cash registers to inform the Federal Tax Service about the independent execution of a correction check.

All fiscal documentation, including adjustments, is submitted to the tax authority by the fiscal data operator. The norm is prescribed in Art. 1 of Federal Law No. 54. The tax authority, monitoring the information received, identifies violations. Owners of cash register equipment are sent instructions for execution or prosecution. If a check is entered incorrectly, it is better to correct the error immediately so that it does not become visible to the tax authorities.

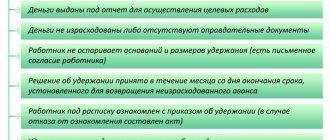

What to do if there is no money at the checkout when returning goods

If the buyer returns the goods, the store has the right to delay payment of funds for no more than 10 days.

If the buyer has expressed a desire to return an item that was paid for in cash, and there is no money in the cash register, the cashier can refer to legislative norms (this information is specified in Article 22 of the Law on the Protection of Consumer Rights ).

Important! If the delay in payment is exceeded, for each day of delay the store will be charged a fine equal to 1% of the cost of the returned goods.

How to correct a check entered by mistake

A correction is made when, before the end of the shift, there was more revenue in the cash register than there should be. In addition to the explanatory note, the cashier must draw up an act to explain to the Federal Tax Service the reasons for the adjustment and prove that the excess money ended up in the cash register by accident. In this situation, it is impossible to issue a refund check.

Features of returns via online cash register for non-cash payments

The buyer may request reimbursement of costs for goods to a bank card. For example, if they were paid with “plastic”. Legislators have not established a special refund methodology for such situations. Therefore, the buyer is recommended to indicate the need for cashless payment in the application. You will also need to indicate the card details in it.

The salesperson gives the return receipt to the consumer. It states that the money is transferred to a plastic card. Generating the document will eliminate the shortage in the cash register when creating a report before the end of the shift.

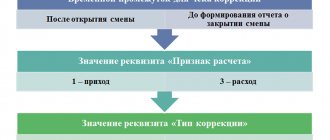

In what cases is adjustment needed?

A correction check is issued when it is necessary to correct an error made by the cashier, or problems have arisen in the operation of the online cash register.

Common mistakes made by transaction operators are:

- Punching a receipt return check instead of adjusting.

- The check was not cleared for the amount transferred by the buyer for the goods.

- The check turned out to be punched for a larger amount than the buyer paid, and the error was discovered at the end of the shift.

Failures in the online operation of the cash register may be due to its overheating and failure, or to a power outage in the store.

The details of the correction check are the same as for a regular check: cash register number, tax identification number, fiscal attribute and others. Their distinctive feature is that the corrected receipt does not indicate the product range, its volume and cost, since it is not issued to the buyer. The correction is needed by the fiscal data operator to send to the tax authority. Such a cash document does not require a breakdown by item. Only the total amount of the adjustment is indicated.

The difference between a correction check and a refund check

There are situations when, at the time of settlement with the buyer, the seller does not punch the check. This may be due to human factors, and, for example, due to a technical problem. As a result, there is a shortage at the cash register, which somehow needs to be explained. In this case, the cashier will be helped by a correction check.

The correction check is created strictly on the basis of some explanatory document (memo on the fact of the shortage, explanatory note, etc.).

A correction check is a fiscal document and a strict reporting form; it will definitely be submitted to the tax office, which in turn may request clarification on the fact that the correction was created.

Accordingly, an entrepreneur should keep all documents on the basis of which such checks are created.

Important! To avoid a fine, an entrepreneur must inform the tax service about the adjustment before the tax office learns about it from other sources.

If we are talking about a return, a correction check is not needed; it is enough to issue a regular check, in which the payment indicator will be indicated as “return of goods”.

Those. A correction check is created if an error was made that resulted in a shortage of funds and this somehow needs to be corrected. And at the time of return there are no cashier errors, and nothing needs to be corrected.

Procedure for issuing a check

The following documents must be submitted to the Federal Tax Service:

- Corrected check.

- Report on the discovery of surplus funds.

- An explanatory note about the error drawn up by the cashier.

Important! Copies of these documents are transferred to the tax authority. Keep the originals with you.

Step-by-step algorithm for correcting a check with an error:

- Drawing up a report on the discovery of excess money with a correction check.

- Drawing up an explanatory note by the cashier with a full description of the reason for the error.

- Written notification to the Federal Tax Service about the adjustment made.

Important! The letter should be sent before the tax service detects the violation. Otherwise, the organization will be fined in the amount of 30,000 rubles in accordance with the provisions of the Code of Administrative Offenses (Article 14.5, paragraph 2).

The explanatory note and act must be kept by the cashier if the tax office requires an explanation of the reason for the adjustment.

The best offers in price and quality

Tax deduction for cash registers: frequently asked questions

Is a tax deduction possible for an online cash register for individual entrepreneurs using the simplified tax system?

Only in the case when the individual entrepreneur combines the simplified tax system and UTII / PSN. Then you can offset the costs of those cash desks that are used for imputation or patent. Companies and entrepreneurs using a simplified system are not provided with a cash deduction.

How to get a full tax deduction for online cash registers?

The full amount of the deduction established by law is 18,000 rubles for each cash register. It will not be possible to return money beyond this amount, even if the CCP was more expensive.

How to void a bad check

If the cashier enters an incorrect receipt at the online cash register, it can be cancelled.

Canceling a check using cash register technology means canceling the operation of accepting cash from the buyer and further actions with the check. At online checkouts, the check will be canceled if it is not punched. Online cash register software makes it possible to cancel an incorrect receipt before it is printed and submitted to the fiscal data operator. If the cash register is flashed with the Evotor OFD, you can return to the process of entering goods into the cash document, as well as adjust the goods or cancel the receipt.

When a cash document is knocked out, it is impossible to cancel it due to amendments to Federal Law No. 54 “On the use of cash register systems.” Such an error can only be corrected by correcting the check.

In online cash register equipment there is a “receipt return” sign. Calculations can be adjusted in the presence of the buyer. If an incorrectly stamped check is detected, the client who made the payment at the cash desk is issued a new document for the same amount with the calculation sign “receipt return”. This check will have a fiscal indication that it is erroneous. The cashier-operator in his own way cancels an incorrectly stamped document. The buyer gets a new one for the correct amount.

Reasons for return

The seller can accept sold products at the online checkout if the following conditions are met:

- 14 days have not passed since the date of sale of the goods;

- During an external inspection, no signs of use of the product should be detected;

- the returned goods must be suitable for further sale (presence of seals, labels, etc.);

- Availability of a cash receipt for products sold.

The consumer can bring goods to the store. The reasons for transferring them to the seller for re-sale may be the following factors:

- presence of defects, breakdowns;

- non-compliance with the requirements for operation;

- mismatch in configuration, color, size, etc.

In the absence of a cash receipt due to its damage or loss, the buyer may bring witnesses. They must confirm that they purchased the product.

Note! The seller cannot refuse to return the consumer in the absence of a cash document. Information on product sales is included in the sales register. The cashier can generate a duplicate check.

Based on the standards of domestic legislation, the money is transferred to the buyer within 10 days. But most often they are returned on the day when the citizen brings the purchased products for resale after filling out the necessary documentation.

If you need to return a large item that requires delivery, you can do one of the following:

- Contact the store to arrange delivery of large items to the store.

- Personally arrange delivery and then request reimbursement in writing. To confirm them, documentation confirming expenses must be attached to the application.

Cost reimbursement

How to issue a return

A seller's refund receipt alone is not enough. For tax accounting, this operation must also be documented. Previously, for this purpose, an act was formed in the KM-3 form; today, the following must be attached to the reporting documents:

- consumer statement about the need for a return;

- invoice with the necessary details.

These papers will act as the legal basis for the return. Let's talk in more detail about the features of their formation.

Buyer's Statement

This document can be compiled in free form. At the same time, it must contain the following information:

- Buyer's personal information. These include last name, first name and patronymic, as well as passport information.

- Grounds for returning the product (defect, unsuitability of the model itself, etc.).

- Amount of funds to be returned.

- Date of application and personal signature of the consumer with transcript.

You can attach a receipt confirming the fact of the initial payment to the received application. As permission to return payment to an individual, this document must be endorsed by the signature of the head of the enterprise or branch, or the store manager.

This kind of document, such as a statement of the need for a return, has a serious practical purpose . Firstly: it confirms the consumer’s direct contact with the store, which will help avoid controversial situations with tax and supervisory authorities. Secondly: not all checks can be withdrawn upon return, which means that if the next day a second return request is received using the same payment document, the store will be protected from such fraudulent actions.

Accounting registration

In addition to the return application, endorsed by the manager, it is necessary to draw up two copies of the invoice with all the necessary details. They are considered valid only if signed by the buyer. The first copy is given to the consumer along with the money and receipt, and the second is attached to the financial statements.

Additionally, in order to protect the seller from repeatedly returning goods using the same check, it is recommended to draw up a cash receipt order , which must also contain the buyer’s signature. Information about cash register services is entered into the Cash Book. It is worth noting that the norms that prescribed the use of expense orders are still relevant today, which means this document will never be superfluous. As for the accounting entries that are used when returning goods, there are no changes here.

Online cash registers: return of receipts

Based on the requirements of paragraph 1 of Art. 4.7 of Law No. 54-FZ, a check generated by an online cash register must contain a number of mandatory details, and one of them is a payment indicator, i.e. an indicator of the nature of the operation being carried out. There are only four signs:

- “receipt”, meaning the receipt of funds from sales;

- “return of receipt” - return to the buyer of money previously received from him;

- “expense” - issuing money to the client for goods or - the return by the client of funds received by him earlier.

Thus, when selling a product/service, the receipt indicates the “receipt” attribute. Accordingly, when performing other transactions, checks with a characteristic feature are generated.

About the refund application

Despite the fact that regulations do not require writing an application, it is better to fill it out. The document will protect the buyer from a second request for payment. In addition, the application will confirm the legality of the online cash register return operation for the tax authorities, and the invoice will serve as an additional accounting document for inventory items. What is recommended to be included in the document:

- applicant's passport details;

- a list of returned goods indicating the reasons;

- the total value to be transferred back;

- date of compilation;

The application is endorsed by the buyer's signature. If necessary, bank details for transferring non-cash funds are also indicated here.