Z-report online cash register

In order to competently organize the operation of existing cash register equipment, you will need not only to pre-register the device with the Federal Tax Service, but also to understand the intricacies of document flow.

The Z-report, along with the X-report, are considered the main types of cashier documents. The difference between them is that the second form (X-report) is used for intermediate reading of cash register indicators, that is, up to several times a day without resetting the counter values.

And the first (Z-report) is issued to take the final indicators at the end of the shift, followed by resetting the counters.

The main purpose of the Z-report is to provide the Federal Tax Service with information about the revenue received per day in order to ensure tax authorities control over the entrepreneur. The document is generated only at the end of the day. In this case, all data is entered into the fiscal memory of the device, and the RAM is reset to zero.

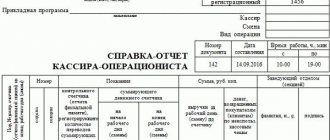

After this, the cashier can transfer the money for collection, entering the final information (number and date of the report, the amount of savings at the beginning/end of the day, the amount of revenue for his shift, if any, returns and non-cash payments) in the journal of the cashier-operator KM-4.

Then a cashier’s certificate is drawn up, which is submitted to the accounting department and serves as the basis for filling out the individual entrepreneur’s cash book.

Types of Z-reports:

- The main document is the cashier’s main document, which must be removed every day at the end of the shift. Removing the report allows you to reset the device counters and clear the registers. If the cashier forgets and does not remove the Z-report, the machine will be blocked and will not work.

- By cashiers - this document is intended to summarize data separately for cashiers and shows how much revenue a particular responsible employee generated. When withdrawing, the cashier's information is also reset to zero.

- By department – allows you to determine how much revenue each department earned.

Accumulations of counters are also reset when the report is taken, but this is not necessary to do every day. - By goods - this type of reports is available if the device is programmed to collect data on a database of goods or services.

Important! Removing a Z-report ALWAYS resets the data on the cash register in the current operating mode.

In addition, resetting occurs in the event of re-registration of equipment; during repairs or after replacing fiscal memory.

Zet report in the online cash register - procedure for drawing up

Each document is numbered in chronological order. When discharged, the form contains the following information:

- Number and date.

- Information on counters (starting and ending).

- Summary data on revenue received per day.

- Total amount of refunds.

- Summary information on the discounts provided.

- Number of canceled checks.

The data entered in the cashier's journal must match the data in the Z-report. When identifying discrepancies up/down, it is necessary to establish and justify their reasons.

If the cashier forgot to remove the Z-report at the end of the day, what to do and how to fix it? In fact, a one-time removal of the document at the beginning of the next shift is allowed, because there can be various problems - from power outages to breakdowns, etc.

But regular violation of regulatory requirements threatens with sanctions from regulatory authorities due to late posting of cash proceeds, which is especially important for entrepreneurs using the simplified tax system.

Source: https://raszp.ru/onlayn-kassa/z-otchet-onlayn-kassa.html

Cash documents used in online cash registers

The document was displayed once a day (at the end of each shift), that is, it is necessary to prepare a report for each shift. Generating a Z-report seems to be a simple operation depending on the specific cash register.

However, there were the following restrictions:

- on weekends there was no need to reset the cash register

- on weekdays, in the absence of cash transactions, the Z-report was taken with zero indicators, and cashier reports were also compiled on its basis.

Z-reports, which were supposed to be stored for 5 years, lost their essence when using an online cash register.

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

It is allowed to capitalize the proceeds the next day after the fiscal report is issued, for example, when the operating hours of the company (from 12.00 to 24.00) and the administration (from 10.00 to 19.00) do not coincide.

Expert of the Legal Consulting Service GARANT, professional accountant

I. Bashkirova

Sample

Not all entrepreneurs are required to use cash register equipment in their business activities, but if such a device is properly registered with the INFS, then when using it, cash discipline must be strictly observed in order to avoid serious fines.

One of the mandatory elements of a cashier-operator’s job is the preparation of a Z-report. What kind of document is this, what is it for, what to do if it is lost, and what sanctions entrepreneurs may be subject to for incorrect Z-reporting - all in detail below.

What is a z-report

Z-report (“Z-report”, also known as a canceled report) is the final cash receipt, which must be printed within 24 hours.

It means completing the cash register shift, handing over the proceeds and resetting the cash register RAM. All data from the previous moment of cancellation remains in the fiscal memory of the cash register and on the EKLZ tape.

FOR YOUR INFORMATION! In the cash register there is a control tape (EKLZ - “electronic control tape protected”), on which all indicators from the meters are recorded. In cases where information on reports is lost for some reason, EKLZ is the only way to restore it.

From this document you can track:

- money counter data at the beginning and end of the shift;

- the total amount of proceeds until cancellation;

- the amount of refunds, if any;

- the amount of discounts provided;

- amount for canceled checks.

The printed check with the final report must be pinned or glued to the “Cashier-operator’s certificate-report”. The following information is entered into the cash register as a separate line:

- date of each document;

- his number;

- gross total (sum at the beginning and at the end of the shift);

- amounts of sales, returns, discounts, etc.

Together with the recorded revenue, the cash register at the end of the shift (working day) is handed over to the senior cashier, to the accounting department or personally to the manager (depending on how this is established by the internal procedure of the organization).

The collected Z-reports, as well as used EKLZ, must be stored for at least 5 years; the manager is responsible for the timing and safety.

IMPORTANT! Take care of these documents, do not lose or throw away the taken Z-reports, even if they were carried out by a foreman when setting up the cash register, contain zero indicators, or were taken as a test. Absolutely all canceled reports must be recorded in a journal.

“Zetka” is a document of strict financial reporting.

It must be removed after a shift or working day, but at least once every 24 hours. If this is not done, the cash register will be blocked.

All cash registers, as required by law, are equipped with an automatic locking system when a 24-hour shift is exceeded.

Until the Z-report is removed, the cash desk will not be able to perform any operations.

The SFSU letter dated February 10, 2015 clarified that zero reports do not need to be printed if not a single cash transaction has been completed within 24 hours.

However, often internal documents of an enterprise require opening and closing a shift, regardless of the passage through the cash register.

Until legislators have clarified this issue completely, it is better to print the Z-report daily and register it in the cash book, even if it is zero, to avoid troubles.

- Each cancellation report has its own serial number, so there should be no gaps in the cashier’s journal.

- It cannot be removed or canceled again, since it is recorded in the fiscal memory of the device and on the control tape.

- If no cash transactions were made within 24 hours, you can issue a zero Z-report.

- During a shift or working day, you can take any number of Z-reports; each must be issued separately and filed with the operator’s certificate.

- After printing the Z-report a second time, it cannot be withdrawn until any cash transaction is carried out.

NOTE! The very first report with cancellation, taken to the INFS when registering the cash register, will remain there: its absence will not in any way affect the correctness of the cash register. But with all the subsequent ones you should be especially careful.

In life, anything can happen, and even an irreplaceable report with cancellation may, for some reason, not be documented in the journal as it should be. This most often happens:

- with inexperienced employees who unknowingly throw away such an important check;

- due to the repair of the device, when the report is punched out by the master for verification, they do not always think to save it;

- if the receipt was not printed due to a breakdown of the cash register, problems with the ribbon or paper, or a power outage;

- if the check is lost;

- when the document is torn, worn out, flooded, or damaged in some other way.

The absence of a Z-report threatens the company with large fines. To avoid them, you need to immediately follow the procedures prescribed by law when you discover the loss of the socket.

- Draw up an act of loss of the Z-report (it must be signed by the shift cashier, the senior cashier, if there is one, the company’s accountant and a representative of the administration).

- Oblige the cashier to provide an explanatory note, which will highlight the time and circumstances of the loss of the report, as well as the reasons why the required information was not entered in the cash register.

- Achieve receipt of a fiscal receipt according to EKLZ data, confirming revenue for a shift with a lost Z-report. To do this, you will have to call a technician from the KKM service center.

- The fiscal report taken for the required period should be drawn up in the cashier's journal instead of the lost Z-report.

IMPORTANT! The manager has the right to impose punishment on the cashier guilty of losing a strict reporting document, if he deems it necessary based on the results of his explanatory note. There is no dismissal for such an offense, but a reprimand or verbal warning is quite likely.

At the end of the shift, they didn’t remove the cap, but performed this action at the beginning of the next day? This often happens, however, this is a violation that, once caught, the tax authorities will not skimp on fines. The reason will be that, according to the documents, the proceeds will be untimely capitalized.

You should not rely on the fact that the tax office will not compare the dates of reports and the posting of money to the cash desk. It may well happen that a violation “comes to light” as a result of servicing representatives of a legal entity.

Having received a check for a product or service stamped on a certain date, he can submit it to the accounting department of his organization for a report on the finances spent.

A counter-check is quite possible, as a result of which it will become clear that the money received according to the presented check was capitalized not on the day of receipt, but later.

There is a special situation with entrepreneurs using the simplified tax system, who are required to show revenue in KUDIR on the exact date when it ended up in the cash register.

If a check for a purchase or service is issued today, and the Z-report on it is going to be taken out only tomorrow, then in KUDIR there will be a discrepancy: you will have to indicate today’s check against a “z” that has not yet been taken out, according to which the checks will already be from yesterday.

NOTE! Isolated cases of untimely withdrawal of a canceled report can go unpunished: after all, they can also be caused by technical problems, this can be reflected in the explanatory note. It is important not to allow such cases to become a regular practice.

Violations of Z-reporting identified by a tax audit are fraught with serious fines for the organization’s management.

The absence of one or more “zokes” is a violation of Article 19.

7 of the Code of Administrative Offenses of the Russian Federation, since in fact this is a failure to provide representatives of state bodies with the information they require.

For this, officials can be fined in the amount of 300 to 500 rubles, and legal entities - tenfold.

Once or twice a day, cashiers submit a Z-report. What kind of reporting form is this, and how does it differ from others? What are the features and difficulties encountered in preparing such reports? This is what we will talk about now.

Why do you need a Z-report for the cash register?

The Z-report is collected at the end of each cashier's work shift. This operation is necessary:

- to monitor the work of cashiers;

- for rapid revenue assessment;

- to hand over the proceeds to collectors;

- for reporting to the tax office.

There is also an X-report, which is executed as needed, but does not reset the amounts. And after the Z-report is removed, everything that was entered at this cash register during the cashier’s working day is reset to zero.

Cash after this operation is collected. The received data is entered into the cashier-operator's journal: document number and date of its execution; savings at the beginning and end of the working day; revenue per shift; as well as data on refunds and non-cash payments.

| for officials | 4000 – 5000 rubles |

| for individual entrepreneurs or legal entities | 40,000 – 50,000 rubles |

https://youtu.be/imCiInK6xmw

New cash registers are removed and the report for the shift is taken or how the accountant finds out the revenue

If this report is removed, the cashiers' savings will be reset to zero.

- Z - report on goods - this report shows how many goods were sold if a database of goods (or services) is programmed in the cash register.

Accumulations in the Z report Accumulations in the report are the total amount of all money entered for the entire period of operation of the cash register. Sometimes savings may be reset, for example in the following cases:

- re-registration of a cash register

- replacing fiscal memory

- other cash register repairs

The amount of savings itself does not mean anything in a legal sense. That is, the tax inspectorate cannot and does not have any claims regarding savings. But out of old habit, when resetting savings, some tax inspectors ask to fill out the KM-2 form.

Do I need a z-report when using an online cash register?

Home Newsletter R Z-report the next day Fill in all fields The letter is sent on April 27, 2017 Often in practice a situation arises when the z-report is removed the next day, for example, for technical reasons or due to a seller’s error.

In this case, it is necessary to generate a z - report for the previous day before opening a new cash register shift; make two entries in the cashier-operator’s journal, dated the same date; reflect two separate receipt orders in the cash book.

In addition, you should take written explanations from the cashier regarding the reasons for this situation.

Removal of the report the next day may be regarded by the inspection authorities as a violation of the rules for working with cash register equipment.

Detailed instructions for working with the cash register program can be read here!

Z - report is a report on the cash register, which the cashier makes at the end of his shift in order to collect the cash register and transfer all the cash to the administrator (if there is one). This report is needed exclusively by tax authorities to monitor entrepreneurs. From a business point of view, this is completely pointless.

Why Z is a pointless report, read at the end of the page. But you still have to describe what it is and what it is eaten with. After withdrawing the Z-report, the cashier collects cash from the cash register and enters the data from the Z-report into the cashier-operator’s journal.

The following data is entered into the journal: Z-report number, accumulation at the beginning of the working day, accumulation at the end of the working day, revenue for the shift, date of the report, returns, non-cash payments. After this, the cashier fills out the cashier's certificate and gives it to the accounting department, which fills out the cash book.

Z - report (report with cancellation, osg, shift closing report)

7 of the Law of July 3, 2020 No. 290-FZ.

News

On old and current cash registers, the Z-report is a daily report of the cash register with information being reset in RAM and entering it into fiscal memory, while new machines immediately write everything into fiscal memory. Therefore, with the introduction of online cash registers, cashier-operator logs will become a thing of the past, and there will be no need to store Z-reports. After all, the online cash register will quickly transmit data to tax authorities via the Internet.

Important: In new machines, before the cash register starts making payments, a report on the opening of a shift will be generated, and upon completion of payments, a report on the closure of a shift.

At the same time, a cash receipt cannot be generated later than 24 hours from the moment the report on the opening of the shift is generated. Let me remind you about the stages of transition to online cash registers: 1) from July 15, 2020, according to paragraph.

5 tbsp. 7 of the Law of July 3, 2020

Z-report: online cash register

Source: https://advokatdokin.ru/novye-kassy-snimaetsya-zet-otchet-za-smenu-ili-kak-buhgalter-uznaet-vyruchku/

What is a z-report

Z-report ( “Z-report” , also known as a cancellation report ) is the final cash receipt, which must be printed within 24 hours. It means completing the cash register shift, handing over the proceeds and resetting the cash register RAM. All data from the previous moment of cancellation remains in the fiscal memory of the cash register and on the EKLZ tape.

FOR YOUR INFORMATION! In the cash register there is a control tape (EKLZ - “electronic control tape protected”), on which all indicators from the meters are recorded. In cases where information on reports is lost for some reason, EKLZ is the only way to restore it.

From this document you can track:

- money counter data at the beginning and end of the shift;

- the total amount of proceeds until cancellation;

- the amount of refunds, if any;

- the amount of discounts provided;

- amount for canceled checks.

Report on the opening and closing of a shift at the online cash register when registering cash transactions

Cash transactions must be carried out in strict accordance with the law. One of the conditions for complying with such standards is the correct documentation of such operations. What are its conditions? What forms of documents should be used by the user of cash register equipment?

What operations can be performed at the checkout?

An online cash register is a device designed for fiscalization (reflection in fiscal registers - those that are then transferred in the prescribed manner to the Federal Tax Service or verified by the department) of revenue (in some cases, expenses) of an economic entity.

As is obvious from the name of the innovative device, it is used at the cash desk of an enterprise - the place where the receipt and issuance of funds is carried out (and documented in the manner prescribed by law).

At the same time, documenting transactions at the cash register (in a broad sense) forms 2 legally independent (but at the same time related) procedures:

- documentation using accounting documents - in all cases;

- documentation using fiscal documents - if an online cash register is used at the checkout.

Cash desk - in a broad sense (not as an object equipped for the work of a cashier, but as any place where cash is received and issued), involves the following:

They are documented using unified accounting documents - cash receipt orders. These orders can, in particular, be drawn up on the basis of fiscal documents - checks, reports. This is the relationship between accounting and fiscal documents - the former can be compiled on the basis of the latter.

They are documented using cash receipts. Cash receipts can also be the primary source for filling them out - but, again, this will be a special case of using the primary document, which in this scenario is a fiscal receipt.

- Operations for consolidated accounting of receipts and expenses at the cash register.

The main one of these operations is the reflection of information on all cash registers and cash registers in the Cash Book.

In all of these 3 types of transactions, only cash is taken into account. Acquiring is not taken into account - since transactions there are carried out not at the cash register, but according to the current account of the business entity. On a current account, accounting is carried out according to completely different principles.

Cash transactions are regulated by the following main regulations:

- Directive of the Bank of Russia dated October 7, 2013 No. 3073-U (LINK);

Source: https://onlain-kassy.ru/normativ/buhgalteriya/kassovye-operatsii/pri-ispolzovanii-kkt.html

Monitoring every day

What is a ZET cash register report? We have already clarified this a little. But they did not explain that removing it every 24 hours is a very important aspect. If the work proceeds normally, then everything is clear, no problems. But if the activity was frozen and the point did not actually carry out a single operation, everything becomes more complicated. Theoretically, comments from tax authorities indicate that in this case there is no need to carry out manipulations. There is always a chance to receive reasonable sanctions. It is also unclear that during the opening period there is almost always a certain amount of financial resources in the cash register. That is, one operation - reading the balance at the time of opening - must already be completed. It has already been completed automatically. Therefore, it is still recommended to carry out the procedure every 24 hours, even without activity.

Do I need to store Z-reports for online cash registers according to the new rules? — Information Center Iskra

Z-report (z-report) - a synonym for the word “Report with cancellation” - which is printed - withdrawn at the cash register (cash register) daily, at least once every 24 hours (in the language of cashiers, compiling a Z-report is equal to “repay, reset, close cash desk"). If 24 hours are exceeded, the cash register is blocked and an error message is issued indicating that the current work shift has been exceeded.

https://www.youtube.com/watch?v=16VX1VxkOFg

Thus, before the introduction of online cash registers, the Z-report is a report on the cash register that the cashier makes at the end of his shift in order to collect the cash register. This report is needed exclusively by the tax authorities to control revenue.

After removing the Z-report, the cashier collects cash from the cash register, enters the data from the Z-report into the cashier-operator’s journal, fills out the cashier-operator’s certificate and submits it to the accounting department to fill out the cash book.

On old and current cash registers, the Z-report is a daily report of the cash register with information being reset in RAM and entering it into fiscal memory, while new machines immediately write everything into fiscal memory. Therefore, with the introduction of online cash registers, cashier-operator logs will become a thing of the past, and there will be no need to store Z-reports.

After all, the online cash register will quickly transmit data to tax authorities via the Internet. In new machines, before the cash register starts making payments, a report on the opening of a shift will be generated, and upon completion of payments, a report on the closure of a shift.

At the same time, a cash receipt cannot be generated later than 24 hours from the moment the report on the opening of the shift is generated.

Let me remind you about the stages of transition to online cash registers:

1) from July 15, 2020 in accordance with clause 5 of Art. 7 of Law No. 290-FZ of July 3, 2016 – voluntary transition to online cash registers (optional);

2) from February 1, 2020 in accordance with paragraphs 3, 7 and 8 of Art. 7 of Law No. 290-FZ of July 3, 2020 - only online cash registers are connected to the Federal Tax Service.

At the same time, old devices that were purchased before February 1, 2017 can be used until July 1, 2020.

The exception is organizations and entrepreneurs on UTII; entrepreneurs using the patent tax system; organizations and entrepreneurs when providing services to the population;

3) from July 1, 2020 - all businesses will have to switch to online cash registers;

4) from July 1, 2020 - UTII and patent taxpayers will be required to use online cash register systems, although today they can do without a cash register at all on the basis of Art. 7 of the Law of July 3, 2020 No. 290-FZ.

Head of the column: Svetlana PENTEGOVA, professional tax consultant, practicing accountant

Source: https://ic-iskra.ru/news/1101-nuzhno-li-khranit-z-otchety-po-onlayn-kasse-po-novym-pravilam

Z-report on the cash register: what is it?

Z-report (with blanking) is a report taken from the cash register at the end of the shift and containing all operations performed during the working day. It is formed no later than 24 hours from the start of work on the device. Even if the cashier hasn’t processed a single check for the whole day, it is still withdrawn.

There is a mandatory requirement for the document: all data is transferred to the Federal Tax Service. They are stored in the device’s memory for 30 days, so if the Internet fails, the information is transmitted automatically when the connection is restored. If the tax service does not receive data within a month, the FN is blocked.

Z-report: online cash register

There is a special document to record revenue when using cash registers. This document is the “online cash register” Z-report. It is a control tape that is formed at the end of a work shift or day. For more information about why it is needed and how it is formed, read this article.

For the qualified organization of the operation of a cash register, it is necessary not only to register the cash register with the tax service, but also to understand the nuances of the circulation of documents on it.

Reports on Form Z and X are one of the main reports of a cashier.

The difference between them is that the report in Form X is used for the purpose of intermediately removing cash register data, that is, this form is used several times a day without resetting counter data.

A Z-report in the online cash register is compiled to record the final values at the end of the day. This resets the counter data.

The key purpose of the Form Z report is to provide the tax service with information about the profit received for the day. This is necessary in order to ensure control by the Federal Tax Service over individual entrepreneurs.

The report is compiled only at the end of the work shift. In this case, all information is entered onto the fiscal medium of the cash register, and the RAM data is reset.

After this, the cashier can transfer the cash for collection, while entering the final information (serial number and date of generation of the report; amount of cash in the cash register at the beginning and end of the shift; amount of profit received for the shift; payments and returns made by non-cash method - if any) to the cashier-operator’s journal in the KM-4 form.

After this, a certificate from the cashier is generated, which is sent to the accounting department. It is the basis for filling out the cash register.

Classification of reports according to form Z

“Online cash register” Z-reports come in four types:

- The main one is the main document of the cashier, which must be generated at the end of each day. Thanks to the generation of such a report, it is possible to reset the cash register counters and clear the registers. If the cashier forgets to take this report, the cash register will stop functioning.

- By cashiers – such a report is intended to summarize information separately for cashiers. It reflects how much profit a particular cashier employee received.

- By department - thanks to this report, you can find out how much profit each department of the company received.

- By goods - this type of report will be available only if the cash register device is programmed to collect information on a database of services or goods.

It is worth noting that removing any of these types of reports always resets the information on the cash register in the current operating mode.

Report generation procedure

Each of the z-reports in the online cash register must be numbered in chronological order. It should include the following information:

- Sequential number and date of formation;

- Starting and ending data on counters;

- Summary information on revenue received per shift;

- Total amount of returns;

- Summary information on discounts provided;

- Number of checks that were voided.

The information entered into the cashier-operator's journal must fully comply with the information in the Z-report. If inconsistencies are found, their reasons must be identified and justified.

Source: https://okbuh.ru/kassy-onlajn/z-otchet

Cash discipline when using an online cash register

For organizations and individual entrepreneurs, Rules for working with cash registers are formed regarding the movement of funds, their storage and work with cash registers in general.

The order sets a balance limit for organizations, the rest is handed over to the bank (if there is no order, then the limit = 0), the individual entrepreneur can store cash in as much as necessary. Exceeding the limit is allowed on paydays, weekends and holidays.

For cash payments to organizations and individual entrepreneurs, a limit of 100,000 rubles is established; there are no restrictions for individuals.

When introducing online cash registers, the use of forms No. KM-4 and No. KM-6 is not necessary.

Online cash register z report how many times can you withdraw

How to make a z cash register report

› Making a z-report is a mandatory procedure and one of the foundations of cash discipline. A sample document, its purpose and other important points - about this right now. Contents This document represents the main final receipt, which each cashier handing over a shift must withdraw from the cash register.

Therefore, if you need to measure current readings, then a so-called x-report is taken, which is essentially no different from z, but it does not lead to zeroing. Thus, its main purpose is as follows: 1. It is the main source of information on the shift, which the cashier always records in the cash book.

Online cash registers – 2020 in questions and answers

At webinars and conferences for small businesses, experts from the “” and “” services answer many questions about the transition to online cash registers, the choice of equipment and the rules for its use. Today Buhonline presents you with a selection of their answers to the most common questions. From July 1, 2020, the use of cash registers is mandatory for the following entities:

- Individual entrepreneurs on UTII who have employees and are engaged in retail or catering.

- LLC on UTII, which are engaged in retail trade or provide catering services.

- Individual entrepreneurs on PSN who are engaged in retail and catering.

Also see about the timing of application of CCP for other segments of trade and services.

Legal entities and individual entrepreneurs can work without a cash register until July 1, 2020, if they provide services to the public (except for catering services).

Is it necessary to store Z-reports of an online cash register?

The Z-report (today called the shift closing report) is a daily report on the operation of the cash register, carried out at the end of the cashier’s shift (it is not reset to zero in online cash registers). The use of online cash registers in work is aimed at reducing paper reporting and exchanging information between the entrepreneur and the Federal Tax Service in electronic format.

Today, entrepreneurs, regardless of the applicable tax regime, are required to switch to online cash registers, but conducting cash register transactions directly on site remains the same.

How to store checks with cancellation online at cash desks

/ / 04/20/2018 605 Views It is impossible to issue a copy of SZV-M to a resigning employee. According to the law on personal accounting, when dismissing an employee, the employer is obliged to give him copies of personalized reports (in particular, SZV-M and SZV-STAZH).

Do I need a z-report when using an online cash register?

The online cash register does not generate a Z-report. It is intended:

- reflection of refunds and discounts, cancellation of checks;

- recording data on sales results in fiscal memory;

- summarizing revenue per shift;

- substantiation of information entered into the cashier's reporting on the cash register for posting to the operating cash desk (certificate report and journal of the cashier-operator).

- to reset sales data for a shift;

A Z-report at old-style cash registers had to be generated at least every 24 hours (otherwise the cash register operation would be blocked) and had to be printed out.

Online cash registers 2018

Source: https://domhelpers.ru/onlajn-kassa-z-otchet-skolko-raz-mozhno-snimat-59535/

Daily control

“Zetka” is a document of strict financial reporting.

It must be removed after a shift or working day, but at least once every 24 hours. If this is not done, the cash register will be blocked. All cash registers, as required by law, are equipped with an automatic locking system when a 24-hour shift is exceeded. Until the Z-report is removed, the cash desk will not be able to perform any operations.

What if there were no operations?

The SFSU letter dated February 10, 2015 clarified that zero reports do not need to be printed if not a single cash transaction has been completed within 24 hours. However, often internal documents of an enterprise require opening and closing a shift, regardless of the passage through the cash register. In addition, in practice, small money is most often stored in the machine, and this is also finance that must be carried out daily through the cash register (“service deposit”), and this is an operation that will be reflected in the Z-report.

Until legislators have clarified this issue completely, it is better to print the Z-report daily and register it in the cash book, even if it is zero, to avoid troubles.

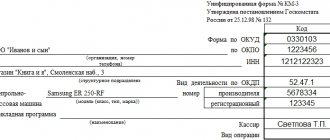

54-FZ: REQUIREMENTS FOR THE REPORT ON THE CLOSING OF A SHIFT (Z-REPORT)

Changes in Federal Law 54-FZ regulate not only the new procedure for using cash registers, but also contain a list of mandatory details of a cash receipt, a strict reporting form and a z-report.

Shift closing report (z-report)

In accordance with 54-FZ, the z-report must contain:

Features of printing details in the shift closing report (z-report)

Which details will be printed in the z-report depends on the model and settings of the cash register. Let's look at an example of a Viki Print z-report.

CCP:

- The name of the document and its number is “Shift Closing Report (Z)” No. 0000.

- Date and time of the operation - date in the format 00.00.0000. and the exact time the report was taken.

- Details of the point of sale - these include: full name of the organization, TIN, place of payment.

- Factory cash register number (ZVD No.) is the cash register number assigned by the manufacturer. Not a required requirement.

- KKT registration number (KKT No.) is the cash register number that is issued by the Federal Tax Service when registering a KKT.

FN:

- Serial number (FN No.) - the number of the fiscal drive, which is assigned by the manufacturer;

- Fiscal document number (FD No.) - each check has a serial number of the fiscal document, starting with the cash register registration report.

- Fiscal attribute of the document (FPD No.) - a fiscal attribute that is generated by the FN to verify the authenticity of the sent check;

Accounting system:

- Cash desk number, position and surname of the employee taking the report.

- Shift number is the serial number of the cash register shift.

- Form of payment - cash and/or electronic money and the amount of payment in each method.

- Sign of calculation - at the beginning of the cash register, receipt, return of receipt, deposit, withdrawal, amount in the cash register, correction.

- Issued checks - data on checks received, returned, canceled, deposited, withdrawn, service documents.

- Amounts received and returned at the beginning of the shift.

- Documents not confirmed - the number of documents not sent to the OFD (queue of documents awaiting dispatch).

- The number and date of the first unsent document in the queue waiting to be sent.

All details contained in the z-report must be clear and easy to read within 6 months from the date of printing on paper.

With the exception of: settlements by users who are not VAT payers or are exempt from performing the duties of a VAT payer, as well as payments for goods, works, services exempt from VAT.

Source: https://SBIS.ru/help/ofd/54fz_z_otchet

X and Z report - what they are, what they look like and how they differ

When operating any enterprise, there is a constant need to generate reports and other documents. Before Federal Law 54 “On the use of cash registers” came into force, everyone used old-style cash registers.

When the working day ended, they used them to generate a document closing the shift. It was called Z-reporting. The introduction of cash register and online solutions has changed the process a little. The new document does not reset the data, but sends the results of the work directly to the tax office.

This material will discuss the concept of a Z-report, what it is, what it looks like and how to generate it.

What is a Z-report

A canceled report is a special report that is taken from the cash register at the end of each shift. It contains all transactions performed during the working day. Its formation occurs no later than 24 hours from the moment you start working on the device. The document is removed even if the cashier has not entered a single check for the whole day.

KKT has stepped far forward in its development

A mandatory requirement for the document is that it is submitted to the Federal Tax Service.

Storage in the cash register memory occurs for a period of no more than one month, therefore, in case of various errors and communication failures, documents are sent automatically when the Internet is restored.

The tax office blocks the fiscal accumulator if it does not receive reports within a month.

Important! With the advent of innovations, the need to keep a cashier's journal disappeared. Only the registration of cash receipts and cash receipts remains mandatory.

A cash book is also maintained, which can be in several forms:

- Digital with printing option;

- Digital with the ability to view on a computer;

- Paper, which must be numbered and filed without fail.

Modern cash registers allow you to print the necessary documents at any time

What is an X report

There is another report called the uncancelled report. What an X report is will be discussed in this section.

X report without cancellation is another document generated by the cash register device. It contains information about all the cash that was processed on it during the shift. This document can be generated at any time, it is not recorded anywhere and does not require sending to the Federal Tax Service.

Its other names are: morning reporting or zero check. It is called that way because previously the tax office required its removal at the very beginning of the shift, that is, in the morning.

This was done in order to make sure that there was no cash in the cash register and to show that revenue at the beginning of the shift was zero.

Today, this document is not required to be withdrawn every morning, since all the necessary information can now be stored in a secure electronic cash tape.

Difference between Z and X

Despite the fact that these two reports are similar, they have significant differences. The difference between these two documents is that the first is designed to close the shift and reset the sales registers, increasing the shift counter by one point. After all these steps, the cash register is ready for the next cashier to work.

The second document opens the shift and shows the amount of cash and revenue from the moment of its opening, recording this in the fiscal registrar. It can be printed as many times as you like to verify the amount of money in the cash register.

Another difference is in the list of details contained in each of them, but more on that in the next section.

The X-report helps to determine the correctness of entering information into CCP, as well as to analyze trade turnover, both in general and specifically for a specific product.

https://youtu.be/tZk_Djurws0

KKM PORT DPG 55 ФKZ

How do they look

Both of these documents look like checks printed by cash register machines. The only difference is in the data and details provided.

For the z-report, the order of the Federal Tax Service of the Russian Federation approved the following list of details, the presence of which is mandatory in the report:

- The name of the organization or the full name of its founder;

- Taxpayer identification number;

- Legal address of location;

- Full name of the cashier operating the device;

- Name and number of the document;

- The sum of all settlements for various operations;

- Receipt and return amounts;

- Number of checks printed per day;

- Information about the cash register: registration number and serial number;

- Fiscal storage number;

- Shift number, date and time;

- Fiscal sign.

Important! There is an optional field “Individual Entrepreneur Revenue Amount”, but some cash register companies have it and can fill it out. You can find out detailed information about this on the websites of fiscal data operators.

The X report provides the following data:

- Date and time;

- Number of checks printed;

- Total sales amount;

- Amount of cash in the cash register;

- Information on returns;

- Number of sales for the current shift;

- Type of payment: cash or non-cash.

It will not be possible to obtain this data for other shifts electronically, since the X-report makes it possible to take readings only of the current shift and record them on paper.

How to make Z-report and X-report

After it has become clear what an X report is, you can move on to considering withdrawals. Reporting on cash register equipment is generated automatically. The cashier does not have to enter any data himself. All that is needed is to perform a certain manipulation, which consists of pressing buttons in the desired sequence.

X-report on Agat 1K

Which buttons should be pressed depends directly on the type of device, its model and manufacturer.

First of all, it is recommended that you read the instructions for using the specific device.

After its removal, the printed receipt is sewn by the cashier working that shift into the book “Cashier Operator's Certificate Report.” The following information can be entered separately into the cash journal from the report:

X-report on Alpha-400K

- Date and time of withdrawal;

- Check number;

- The amount of cash at the beginning and end of the shift, called the gross total;

- Amount of discounts and returns.

It is necessary to take into account that the X report is generated only before the Z report.

Z is printed once a day, while X is generated by each cashier when depositing proceeds. The X-report is generated in a similar way using certain combinations with the keys of the device, on which this sequence and the type of the final report in electronic and paper form will depend.

Below are several images of the X-report decoding on different cash registers

X-report on Kasbi 02 MK

Important! In both cases, the cash register at the end of the shift, along with the posted revenue, must be handed over to the senior cashier, accountant or manager. It depends on the internal order of the organization adopted by its founder.

Types of Z-reports

Z-reports are not very diverse, but they come in several types:

- Basic. The main document removed at the end of the shift. He clears all registers of the cash register, that is, he resets the revenue for the working day and ends the shift. It must be carried out, otherwise the cash register will be blocked;

- By department. The paper shows everything the same, but specifically for each sales department. The report resets the department accumulation counter to zero. It is not necessary to withdraw every day;

- By cashiers. Determines the amount of money entered by one or another cashier. Removing it means that cashier savings will be reset to zero;

- By goods. Displays the number of products sold if the device contains a database of all products.

Types of X-reports

In addition to daily and aggregated data, you can also receive documents based on narrower indicators. They are not much different from the types of Z-reports discussed earlier and include:

- Basic paperwork for checks and cash. It reflects the number of receipts per shift and the amount of cash in the cash drawer;

- By cashiers. All revenue data is grouped for each individual cashier;

- By department. Similar to the grouping by cashiers, the information reflects the grouping of the main document by sales departments;

- By goods. Used to control inventory balances and group data by product;

- Checking sales activity. Sales analytics are performed over time to determine the highest buyer activity.

How to make a Z-report and X-report at the cash desk

The general algorithm for generating a report is as follows:

Generated and printed Z-report

- The opening of a shift can occur automatically depending on the cash register.

Before starting work and making the first sale, the new cashier should check whether the amount of cash matches the amount in the cash register system. To do this, you need to remove the X-report; - Next, the change, that is, the initial balance, is deposited into the cash register. This is done in the case when the previous changer did not leave the exchange;

- The third step is to remove the X-report without blanking the interval.

This operation is performed to check the cash register, for example, in case of conflicts with clients regarding the denominations of banknotes; - The last thing to do is close the shift, which consists of several stages.

First of all, the responsible person takes out the X-report and recalculates the cash register. After this, if necessary, a small amount of money is left in the machine, and the rest is withdrawn using the “Payment from the cash register” operation. - The very last stage is the generation of a Z-report with blanking.

It resets the sales and returns registers for the current working day and increases the shift counter by one point. After all these actions, the cash register is considered closed and is ready to accept the next employee for a new shift.

Thus, after reading it should be clear what this is - an X-report and a Z-report for an online cash register. The introduction of online cash registers made it possible to simplify the work of cashiers who might have forgotten to perform certain operations.

How to store acquiring checks: legal norms and bank requirements

In this article we will look at how to properly store acquiring receipts. Let's find out what slip checks are needed for and how long they need to be stored, according to the law. We have prepared step-by-step instructions for you on how to transfer checks to the bank and have collected recommendations on how to properly store slips.

Is a check required for acquiring?

Disputes about whether a fiscal receipt is needed when paying online, as well as whether it is necessary to save it, have been going on since 2003.

At this time, Law No. 54-FZ was adopted, which defines the use of cash registers (KKM) when paying for goods or services with a bank card or cash.

But this act did not take into account the improvement of technology and the emergence of the possibility of online payment. Until July 2020, this law could be interpreted as follows:

Today this opinion is not correct. Federal Law No. 290, issued on July 3, 2020, clearly states that a fiscal document is required for any payment method, including:

- sale of goods and services;

- payment of winnings from lottery tickets;

- electronic payments (for example, to a mobile phone account or for housing and communal services through the application);

- receiving paid content (applications, games, books, software, etc.);

- and others.

Therefore, the answer to the question of whether checks are needed for acquiring is clear: yes, they are needed. However, they must be stored for a certain period of time. Let's look at how long you need to save receipts in 2018.

How long to store acquiring checks

All documents that fall into the category of primary cash registers must be retained by law for 5 years. This rule was approved by Decree of the Government of the Russian Federation No. 470 of June 23, 2007.

However, the law provides an exception for copies of sales receipts and used cash receipts. The storage period for these two documents is 10 days. The storage of acquiring receipts and other similar documents is carried out by the financially responsible person. At the same time, Z-reports from cash registers (including from POS terminals) refer to primary documents, the shelf life of which is 5 years.

As a rule, the acquiring agreement provides for a period of storage of checks and other documents confirming the fact of a transaction or expenses. It is equal to three years. In this case, checks (slips) are transferred to the bank no later than within three days from the date of receipt of the request from the bank.

Now let’s look at why and how to store receipts.

Why do you need to save receipts?

First of all, the presence of saved receipts is due to the need for the enterprise itself:

- To avoid a fine from the tax office (for example, if a Z-report is lost) and for correct accounting (different sections of the cash register are allocated for cash and non-cash payments, which avoids double taxation).

- To resolve disputes with clients.

- For a refund.

- In some cases, to check the payment status.

In addition to these cases, the bank with which the acquiring agreement is concluded has the right to demand that all slips for a certain period or a specific date be sent to its office. If checks are stored correctly, providing the required information will take less time than the three days established by the contract.

Let's figure out how to properly store acquiring receipts. Modern cash registers print receipts, usually on thermal tape. The data printed on such a tape fades completely over time. No special storage conditions can affect this process. But receipts from acquiring companies must be kept for a certain period of time. But how to do this if in a few months all the information disappears?

There is no need to file receipts (slips) with any cash register documents. It is optimal to put them in a certain place, for convenience, separating them with bookmarks by day or month. A low box or lid from a package of photocopier paper is suitable for these purposes.

The question arises: what to do with unclaimed checks? Slips that have expired are either stored in an archive or disposed of.

Transfer of slip checks to the bank

Reconciliation of results from the POS terminal occurs daily. All information on completed transactions goes to the acquiring bank. Evidence of this is the closing report on the terminal. However, sometimes the bank sends a request to provide a slip check and clarify the details of the operation. This is done in many cases, in particular, to prevent fraudulent activities on the part of buyers.

In order to correctly provide the bank with all the necessary information, please read the step-by-step instructions:

| No. | Algorithm of actions |

| 1. | Receiving a request from a bank to provide slip(s) for a certain period. |

| 2. | It is necessary to find checks for the period indicated by the bank. |

| 3. | Slip checks (+ their certified photocopies, if the checks have faded) and the explanations required by the bank are described, i.e., an inventory of documents is compiled. |

| 4. | Documents are packaged in a package or folder. The description is attached to the package. |

| 5. | The documents are sent to the bank by courier (yours or from the bank). You can take the package yourself to the bank office. |

| 6. | A note is placed on the inventory indicating that the documents were accepted by the responsible person (bank employee or courier). |

(1

Source: https://rko-bank.ru/stati/hranenie-chekov-po-ekvajringu.html