Purpose, procedure for specifying UIN

UIN is a digital code that was introduced in order to track all fees coming into the country’s budget system from individuals and legal entities. It is part of the State Information System (on state municipal payments) (GIS GMP).

The UIN is established for all types of payment for funds that are redirected to state income. Thanks to the UIN, cash payments are identified by the GIS and are received at their destination.

The rules approved by the relevant order of the Ministry of Finance and prescribing how data must be designated in the structure of payment orders sending money to the country’s budget came into force on February 4, 2014.

One of the requirements is that the UIN code must be indicated in payment documents.

By the beginning of April 2014, it was placed in a cell marked with the words “Purpose of payment.” Then, to this day, all UIN numbers are entered in the “Code” field, conventionally designated by the number 22. Since last year, there has been an order according to which the UIN code must be indicated in payment orders. Without it, it is impossible to transfer funds to institutions that are financed from the budget.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Search for accruals by UIN

What is UIN

UIN is a unique accrual identifier in the State Information System on state and municipal payments; with its help, you can pay off any debts and fines to the state, and using the UIN number you can easily pay various fees for services provided by state and municipal bodies.

Due to the fact that information about all payments made is centrally transmitted and stored in the GIS GMP, it becomes available immediately after the fact of payment is transferred to the system, and payers are relieved of the need to provide any supporting documents.

What can you pay using your UIN?

Payment by UIN is a simple and convenient tool for making payments for any state and municipal services. With the help of this service, paying debts, fines and various duties has become much easier and no longer requires even leaving home. With us you can make payments for services such as:

- administrative fines, in particular, for ticketless travel and traffic violations;

- fee for obtaining a civil and foreign passport from the State Administration for Migration Issues of the Ministry of Internal Affairs of the Russian Federation (formerly the Federal Migration Service);

- educational services - payment for kindergartens and schools, replenishment of personal accounts in various payment systems for passage and meals;

- state duties for the provision of hunting and fishing licenses, as well as permits for trading and other activities.

How to pay a fine using your UIN number

In order to pay for any service, you must indicate the UIN number, consisting of 20 or 25 digits (it is indicated in the notice, receipt, or issued when ordering the service on one of the state portals) and click the “Search” button. If the specified accrual is found in the GIS GMP, then all the necessary details will be entered automatically.

Payment, for example, of a fine by UIN number online is available regardless of the region where the service is received and ordered or the accrual is paid. You can pay off debts or make any other payments throughout Russia, including in the following regions:

- Moscow and Moscow region,

- St. Petersburg and Leningrad region,

- Krasnodar region,

- Novosibirsk region,

- Ekaterinburg and Sverdlovsk region,

- Sevastopol and the Republic of Crimea.

How and where to get a UIN - step-by-step instructions

To pay the required amount and indicate the UIN in the payment document, an enterprise or individual entrepreneur must:

| Steps | Content |

| 1. | Receive an official request from the relevant organization, which indicates the need to pay a penalty, fine or arrears |

| 2. | Find the UIN in the document |

| 3. | Carefully transfer all the numbers to the payment slip: cell 22 “Code”. The corresponding field is located at the bottom of the payment document |

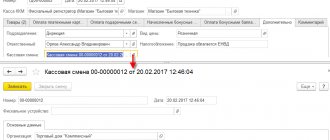

Each field of the payment slip is assigned a conditional numeric number. In the excerpt from the payment slip below, they are highlighted in black. The UIN field is marked in red. The corresponding part of the payment order looks like this:

| PAYMENT ORDER No. | |||||||||||||||

| Type of payment | (18) | Payment due date | (19) | ||||||||||||

| Payment name | (20) | Sequence of payments | (21) | ||||||||||||

| Recipient (16) | Code | 22 | R. field | (23) | |||||||||||

| (104) | (105) | (106) | (107) | (108) | (109) | (110) | |||||||||

Important! The UIN code cannot be found in any table or directory. There are no lists where it is indicated. The name of the code indicates that the UIN is unique. This means that it is not repeated and each specific payment is assigned its own set of numbers.

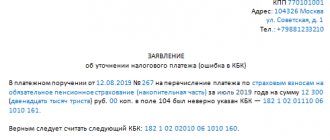

The UIN is contained in the payment request, which comes from a certain regulatory authority. Thus, to determine the UIN, you must carefully study the receipt or notice; the code must be present in this document.

What is indicated in field number 22

There are only two options:

- If the request received from certain authorities contains a UIN, it must be transferred number by number to the payment slip (field 22).

- When the UIN is missing, the number 0 (without quotes) is entered in field 22.

If there is a UIN on the payment:

- the money will go exactly to the specified address;

- recipients of the payment will be able to correctly identify it and record it in the relevant documentation.

If the payer is an ordinary person, and his payment is not related to business, it is enough to present a notice to the operator at the bank, deposit the specified amount and receive a receipt confirming its payment.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Conclusions for 2019-2020 about UIN

In field 22 of the payment slip, indicate the UIN (unique accrual identifier), if you know it (for example, indicated in the inspection request for tax payment). It consists of 20 or 25 characters, and all of them cannot have the value “0” at the same time.

https://www.youtube.com/watch?v=ytcreatorsen-GB

In other cases, put “0” (zero) in field 22 (clause 12 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n, Explanations of the Federal Tax Service of Russia), including:

- when paying current tax payments;

- when transferring arrears not at the request of the inspection;

- if the request does not indicate the UIN.

If you find an error, please highlight a piece of text and press Ctrl Enter.

UIN in a payment order, sample

In the sample payment below, the UIN is located in cell 22, where it should be.

Sample of filling out a payment order:

| PAYMENT ORDER No. 520 | 18.10.2016 | 03 |

| date | Payment type |

| Suma in cuirsive | Twenty thousand rubles 00 kopecks | ||||||||||

| TIN 8203183654 | Gearbox 8202230822 | Sum | 20 000,00 | ||||||||

| LLC "Sladkoezhka" | |||||||||||

| Account No. | 40125600000802156877 | ||||||||||

| Payer | |||||||||||

| Bank "Ogonyok" | BIC | 048321658 | |||||||||

| Account No. | 30101018060000007586 | ||||||||||

| Payer's bank | |||||||||||

| Department 4 Yekaterinburg | BIC | 048385002 | |||||||||

| Account No. | 10501832100000023584 | ||||||||||

| payee's bank | |||||||||||

| TIN 7785687879 | Gearbox 778680203 | Account No. | |||||||||

| UFK for the city of Yekaterinburg (Inspectorate of the Federal Tax Service of Russia No. 25 for the city of Yekaterinburg) | |||||||||||

| Type of payment | 02 | Payment deadline. | |||||||||

| Purpose of payment | Next pl. | 5 | |||||||||

| Recipient | Code | 18210102012211001457 | R. field | ||||||||

| 18201204561459654873 | 45331478 | TP | MS.09.2016 | 0 | 0 | ||||||

| Tax penalty on request No. 55 dated October 17, 2016 | |||||||||||

The sample payment slip shows that the UIN occupies two lines, since it does not fit in one. The Bank of the Russian Federation allowed this way to fill out the document. The font can be reduced so that all twenty digits of the UIN fit in the cell.

As noted above, in the absence of a resolution or decision, payment can be made independently. In cell 22 you must enter the number 0. The payment will be sent to the address and will not get lost in the ocean of other documents.

Important! Field 22 cannot be left empty (unfilled). It must contain either 20 digits of the UIN or a zero (0).

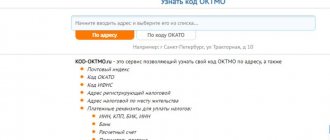

How to find out the UIN of an organization when paying taxes by an individual

etc. - all these documents relate to the grounds for the emergence of property rights. The rights to own, use and dispose of an apartment or other real estate can be fully realized only after state registration of the right.

Confirmation of payment of the state fee for registering ownership of real estate is necessary for registering rights to real estate in Rosreestr.

Before making a direct payment, the system prompts you to check all the details again.

- Low-income, status must be documented;

- Representatives of local authorities.

The receipt in this case is a document that confirms the fact of payment and is submitted to the relevant authority along with all documents.

You can choose any convenient method, but when filling out the receipt you need to be especially careful, since it directly affects the speed of the transaction. At the moment, payment of the fee is carried out using:

- to a division of Rosreestr (registration chamber);

- in the MFC;

- an application with the required documents can be sent by mail (with a list of the contents and declared value);

- through the Rosreestr website or the government services portal.

The application must be supported by the basis for registering the object.

Taxes can be paid in cash through a deposit with a credit institution.

When filling out a notice (payment document) in form N PD-4sb (tax) by an individual at a credit institution (for example, Sberbank), the UIN and document index are not indicated. Other information identifying an individual is indicated:

- Full Name;

- payer's TIN;

- address of registration or place of residence (if the individual does not have a registered address).

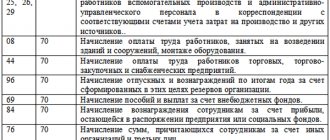

Decoding the code in the UIN data

The UIN contains four parts:

| Code numbers | Decoding |

| From 1 to 3 | Indicates the recipient of the payment: the administrator of budget revenues, the executive authority. For example, for the tax office – 182 |

| 4 | This code number is not yet used. For this reason, a zero is placed in place of the fourth digit |

| From 5 to 19 | A specific payment number is hidden under fifteen digits. They act as a document index |

| 20 | This is a control number calculated using a special algorithm |

Important! The UIN and index are identical only when the latter contains 20 digits.

Obtaining a UIN to pay a fine from the traffic police

When paying a fine to the State Road Safety Inspectorate, you can specify the identification number in the resolution, thanks to which the above-mentioned authority will hold you administratively liable.

Those areas of the document where the UIN is indicated are highlighted in red.

In this case, the number you are interested in will be generated automatically, namely:

- according to the date on which the protocol was drawn up;

- by protocol serial number.

If you received a receipt for payment of a fine, according to the scheme described above, study its upper part and find the index you need there.

Is it possible to use the same UIN for different payments?

But when you pick up the decree, don’t be alarmed, it won’t be there. In this case, the UIN is reflected as a resolution number . Pay attention to the header of the application. There is a barcode there, and underneath it is the sequence of numbers that interests us.

We recommend that you read an article on the topic - If the license is expired, what is the fine: what affects the size of the fine and how can it be reduced?

Where and in what cases is the UIN indicated?

The code should be indicated when filling out payment orders for transferring funds to budget organizations. A whole field is allocated for the UIN in the payment document, designated conventionally as “22”. With the help of the UIN, payments of business entities and ordinary citizens, directed to the country’s budget, are recorded.

This year, the code is required in a payment order for payment made at the request of the Federal Tax Service, the Pension Fund of the Russian Federation, the Social Insurance Fund, and the State Traffic Safety Inspectorate:

- Arrears.

- Peni.

- Fine.

- State duties.

What to do if the UIN is unknown

Many payers are also often interested in the question “what to do if the UIN is unknown?” Most organizations that independently pay tax payments do not use the UIN when processing payment orders. For such organizations, the unique identifier is KBK. As for individual payers, the TIN number is used as the UIN. This applies to both individuals and individual entrepreneurs. Legal entities use checkpoint as this code.

If an entrepreneur planning to make a payment to the tax authority works according to the “simplified” system, when generating a payment order, he must indicate a zero UIN value. In this case, in field 104 you should indicate the code in accordance with the current KBK directory.

To summarize, it must be said that in the absence of a tax notice, the field that is intended to write a unique identifier always has a zero value. In this case, it is necessary to indicate a zero value or identifier in the field as required by the Federal Tax Service. Payments with an empty field for entering a unique identifier are considered invalid.