Is there a difference when calculating personal income tax on vacation pay and sick leave?

The 6-NDFL report includes the amounts of monthly employee salaries, vacation money and sick leave, and also indicates the specific dates for their transfer.

Salaries are calculated every 15 days at least (Article 136 of the Labor Code of the Russian Federation). Money for annual leave and sick leave (sick leave) is paid within the following periods:

- vacation pay - no later than 3 days before the annual vacation;

- on sick leave - within 10 days after receiving a certificate of incapacity for work from the employee. The above amounts are transferred together with the next monthly salary (clause 1 of article 15 of Federal Law No. 255 of December 29, 2006).

In addition to the differences in terms, for payments for vacation and sick leave, according to Art. 223, 226 of the Tax Code of the Russian Federation establish the following indicators:

- date of recognition of monthly income that is subject to personal income tax. This day corresponds to a specific payment deadline for the monthly salary;

- the day of transfer to the Federal Tax Service of a certain amount of personal income tax. This date is considered to be the 28th, 30th or 31st of the month in which the monthly salary is calculated.

Important! Personal income tax from vacation pay and sick leave is withheld no later than the last day of the month in which such payments were made (clause 6 of Article 226 of the Tax Code of the Russian Federation). In cases where the last day of the period falls on a day recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday, the end of the period is considered to be the next working day following it (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). In Section 2 of the 6-NDFL report, this money is reflected not together with the salary, but in a new separate line.

Article 136 of the Labor Code of the Russian Federation “Procedure, place and timing of payment of wages”

Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

Article 223 of the Tax Code of the Russian Federation “Date of actual receipt of income”

Article 226 of the Tax Code of the Russian Federation “Features of tax calculation by tax agents. Procedure and deadlines for tax payment by tax agents"

Responsibilities of a tax agent

Article 226 of the Tax Code of the Russian Federation obliges organizations and individual entrepreneurs from which an individual received income to withhold and transfer income tax to the budget. Vacation payments are subject to personal income tax at the same rate as wages:

- 13% of income if the worker is recognized as a Russian resident (stayed in the Russian Federation for at least 183 calendar days for 12 consecutive months)

- 30% of income if the employee is a non-resident.

In general, the tax agent transfers the income tax withheld from an individual to the Federal Tax Service at the place of his registration. If an organization has a separate division, then the tax withheld from its employees is transferred to the location of the OP. Individual entrepreneurs who are payers of UTII and PSN transfer personal income tax on the income of individuals at the place of conduct of the relevant activity. This follows from paragraph 7 of Article 226 of the Tax Code of the Russian Federation.

Important: for violation of the tax agent’s obligation to withhold and transfer income tax from wages, vacation pay and other payments, a fine is imposed under Article 123 of the Tax Code of the Russian Federation. The amount of recovery is 20% of the unwithheld or not transferred personal income tax amount.

https://youtu.be/jDwPD6Qr5oA

Deadlines for payment and calculation of personal income tax on vacation money

For income that is subject to personal income tax, specific dates are established for the calculation of income tax, its withholding and further transfer to the Federal Tax Service of the Russian Federation. Such a tax payment is calculated and then transferred to the inspectorate no later than the last day of the month in which these payments were made.

Read also: Daily allowance for a business trip in 2020

When transferring a certain amount of income tax for individuals, they take into account the fact in which month the day of payment of vacation money falls. This is also done when “rolling” annual leaves arise, which are opened in one specific month and closed in another.

On a note! Vacation pay for January 2020, which was transferred to the salary card in December 2020, was indicated in section 1 of the 6-NDFL calculation form for 2020. So, if vacation pay was paid to the employee on December 30, then in the calculation of 6-NDFL for the year this operation had to be indicated only in section 1. And in section 2 this payment is reflected when filling out the calculation for the first quarter of the current year. A similar procedure is in the letter of the Federal Tax Service dated 04/05/17 No. BS-4-11/ [email protected]

Order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ [email protected] “On approval of the form for calculating the amounts of personal income tax calculated and withheld by the tax agent (Form 6-NDFL), the procedure for its completion and submission, as well as the format for presenting the calculation of tax amounts on the income of individuals calculated and withheld by a tax agent in electronic form"

Calculation

The deadline for transferring tax to 6-NDFL is counted from the moment the income is received. This is the day:

- receipt of payment by transferring money to a bank account or in cash;

- issuance of income in the form of goods and services;

- purchases of securities;

- when the counterclaims were offset;

- writing off bad debts from the balance sheet;

- the last day of the month of approval of the advance report upon the employee’s return from a business trip;

- the last day of the month during the loan term.

The agent must write off the calculated amount from the payer’s income upon payment of funds.

When will money be transferred for vacation in 2020?

According to Art. 136 of the Labor Code of the Russian Federation, vacation pay is paid a maximum of 3 days before the start of annual leave.

Example

The merchandiser of Lenta LLC went on vacation on August 20. The accountant of this company set the deadline for payment of money for vacation - August 17, 18 and 19.

An employee of the accounting department counted 3 calendar days without taking into account the start dates of vacation and the day of transfer of funds. As a result, this money was transferred to the merchandiser’s card on August 16.

How to calculate insurance premiums

Employers pay insurance premiums for employees. They go toward free healthcare, pensions, and in case of work-related injuries.

The contribution amount is 30% of the salaries of all employees. Contributions are not withheld from wages as personal income tax; they are paid by the employer.

They are distributed like this:

- pension insurance - 22%;

- compulsory health insurance - 5.1%;

- social insurance - 2.9%.

In addition to these 30%, they also pay contributions in case of injuries and occupational diseases - from 0.2% to 8.5%.

All contributions, except contributions for injuries, are transferred to the tax office. Injuries are listed in social insurance.

If an employee goes on vacation, insurance premiums are paid as usual - only vacation pay is added to the salary.

spent 3 million on employee benefits in March. Of these, 2.5 million are for salaries, and 500,000 rubles are for vacation pay. It turns out that in March “Salmon” will pay 30% of contributions from salaries and vacation pay.

3,000,000 - the amount of salaries and vacation pay of Salmon employees for March.

We calculate pension contributions: 3,000,000 x 22% = 669,000 rubles.

Now contributions for compulsory medical insurance: 3,000,000 x 5.1% = 153,000 rubles.

Now for social insurance: 3,000,000 x 2.9% = 87,000 rubles.

And finally, we calculate contributions for injuries at the basic rate: 3,000,000 x 0.2% = 6,000 rubles.

Salmon's accountant will enter these figures into the payment slips - one for each type of contribution.

Reflection of money for vacation in the calculation of 6 personal income taxes

Vacation pay is not considered salary or other monetary remuneration for work.

The date of receipt of such income is considered the day on which the worker is paid such money in fact - transferred to a card or given through a cash register (letter of the Ministry of Finance of the Russian Federation No. 2187 dated January 26, 2020, Article 223 of the Tax Code of the Russian Federation). At the same time, personal income tax is withheld from vacation money. This is done before the end of a certain month by paying a specific amount of vacation pay (Article 226 of the Tax Code of the Russian Federation).

When preparing a unified calculation of 6-NDFL in Section 1 of this document, the accrued specific amount of vacation pay is combined with other monthly income. In Section 2, money for vacation is separated from salaries (clause 4.2 of Appendix No. 2 from Order of the Federal Tax Service of the Russian Federation No. 450 of October 14, 2020). In this situation, additional lines are allocated and then filled in separately for each payment.

Vacation benefits are paid regardless of the date of payroll. This money is reflected in separate specific lines of Section 2 of form 6-NDFL. This is done for reasons:

- due to a discrepancy between the specific date of accrual of annual vacation pay and monthly salary;

- when applying a separate procedure for transferring income tax amounts from money for vacation on one of these days - the 28th, 30th or 31st of the month.

Money for annual leave is paid along with the monthly salary. This is done when specific calendar days coincide or, in particular, when paying annual leave with the subsequent dismissal of an employee.

Letter of the Ministry of Finance dated January 26, 2015 No. 03-04-06/2187 “On determining the date of receipt of income in the form of vacation pay for personal income tax purposes”

Read also: Taxes for third parties

Example

Money for vacation and salary was transferred to the worker’s salary card on March 31. The date of transfer of this money and the day of personal income tax deduction coincided.

In this situation, a specific amount of tax from the monthly salary is paid on working Monday or another next day, and money for vacation is issued on March 31. Then, in the unified form 6-NDFL, the payment period for a certain amount of vacation pay and wages is indicated in separate specific lines of Section 2.

How to fill out a payment order

Payment of personal income tax on vacation pay is indicated in a separate payment order. This document is filled out according to the rules from the order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013 and on the form according to form 0401060. In field 101 indicate code 02. In field 104 the following BCC is written - 182 1 0100 110.

Attention! The specific KBK code is found in the service from the Glavbukh System - on the website www.1gl.ru/about/.

Field 106 indicates the type of payment, and field 107 indicates the period for which personal income tax is paid. For example, when transferring to the tax office a specific amount of tax from vacation money for January 2020, the following entry is made in field 107 - MS.01.2020.

Fields 109 and 108 are filled with zeros. Field 110 is left blank.

Sample of filling out a payment order

Form 0401060

Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation”

How and where are carryover vacation pay reflected and their amounts after recalculation?

The 6-NDFL calculation reflects all types of annual vacation pay, including those that transfer to another specific month. This is done this way:

- First, vacation pay and the specific amount of personal income tax are calculated. This is done in accordance with certain dates for accrual and payment of this money in fact;

- The amounts received are recorded in Section 1 of the calculation;

- They reflect the payment of money for vacation in Section 2. In this place, indicate the date of transfer of this money and the deadline for paying a specific amount of personal income tax on it.

Recalculation of annual vacation pay is performed in 2 situations:

- when you provide incorrect information. In this situation, an updated (additional) 6-NDFL report is drawn up, in which reliable information on money for vacation is entered;

- upon dismissal or recall from annual leave, as well as upon untimely transfer of specific amounts of vacation pay. Changes in the amount of such payments and the tax on them are entered into specific calculation lines for the month in which the recalculation is made.

Important! According to the letter of the Federal Tax Service of Russia No. 9248 dated May 24, 2020, the amount of carryover vacation pay is indicated in form 6-NDFL upon the fact of their payment, and not according to the period in which they are accrued.

Letter of the Federal Tax Service dated May 24, 2020 No. BS-4-11/9248 “On the issue of filling out form 6-NDFL”

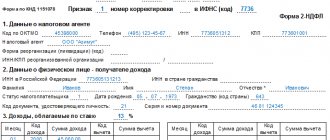

An example of form 6 personal income tax

Below is an example of how to correctly fill out the 6-NDFL calculation with vacation pay.

At Titan LLC, 2 workers were paid the following money for annual leave:

- August 15 - 17 thousand rubles. At the same time, personal income tax was charged in the amount of 2,210 rubles;

- August 22 - 23 thousand rubles. In this situation, income tax is 2990 rubles.

In 9 months paid 2 million rubles. salaries, applied deductions of 50 thousand rubles. Also, during this period, personal income tax was charged in the amount of 253,500 rubles, and withheld 230,500 rubles. tax

In this situation, in Section 1 of the unified form 6-NDFL, 2 workers entered vacation payments and the above salaries on line 020 (2 million rubles + 23 thousand rubles + 17 thousand rubles = 2 million 40 thousand rubles .).

Read also: What do you pay when you resign at your own request?

The amount of a certain accrued personal income tax was indicated on line 040 (2,990 rubles + 2,210 rubles + 253,500 rubles = 258,700 rubles), and the amount of such tax withheld was indicated on line 070 (2,990 rubles + 2,210 rubles. + 230,050 rub.) = 235,700 rub.).

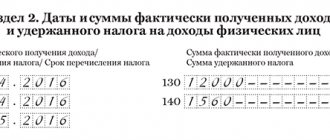

In Section 2 of the report, the corresponding entries were made in the lines below:

- pp. 100, 130 - indicated the date of payment of annual vacation pay to workers (08/15/2016), and their amount (RUB 17,000);

- pp. 110, 140 - entered information about the day of withholding of accrued income tax (08/15/2016) and its amount (2210 rubles);

- page 120 - indicated the date of transfer of a certain amount of tax to the INFS (08/31/2016).

In the same way, fill out the lines for the second accrued specific personal income tax amount:

- pp. 100, 130 - indicated the date of payment of vacation money to the second employee (08/22/2016) and their amount (23,000 rubles);

- pp. 110, 140 - date of withholding (08/22/2016) and the amount of personal income tax (RUB 2990);

- page 120 - date of personal income tax payment (08/31/2016).

Attention! If the unified form 6-NDFL is correctly completed, the specific amount of vacation pay along with the monthly salary is prescribed in Section 1. In Section 2 of this document, vacation payments are separated from other various incomes.

Example 1

From January 19 to January 25, 2020, the employee was on vacation. Vacation pay was on January 17 in the amount of 10 thousand rubles. The employee's salary is 45 thousand rubles. For January, in which he worked for 10 days, 30 thousand rubles were accrued. (4515*10). Salary deductions are not provided.

On the date of payment of vacation pay, personal income tax should be withheld: 10 * 0.13 = 1.3 thousand rubles.

The deadline for transferring personal income tax from vacation pay is February 1 (since January 31 is a day off).

Personal income tax from salary: 30 * 0.13 = 3.9 thousand rubles.

Personal income tax should be calculated on January 31, withheld when paying income, and transferred the next day.

The company gave bonuses to employees for a month. The tax from them was transferred at the end of the month - on the day the employees were paid. The Federal Tax Service may regard these actions as a violation of the deadlines for transferring taxes.

The argument may be that a bonus is a separate type of remuneration for work. It is not subject to the standard deadline for transferring personal income tax from wages. You can defend your point of view only through the court. As confirmation, you can provide a Labor Code, which states that a bonus is an incentive for high-quality and conscientious work, which stimulates productivity. This payment is considered part of the salary. Taxation of income is carried out according to general rules.

Example No. 1. In a company, all employees are given vacation time: 2 weeks in the first half of the year and 2 weeks in the second. Employee Sokovnin A.M. went on vacation for 14 days from August 8 to August 21, 2020.

In accordance with the Labor Code, the employer is obliged to transfer money to the employee’s card 3 days before the start of the vacation. August 8 is Wednesday, and August 5 (3 days before the start) is Sunday. In this case, the law requires the employer to transfer money on the eve of the weekend (paragraph 8 of article 136 of the Labor Code of the Russian Federation).

Example No. 2. Employee Vorontsova A.K. went on vacation on June 1, 2020 for 28 days. The end date of the holiday is June 28. The money was transferred to her on May 29.

In this case, the deadline for paying personal income tax on vacation pay in 2020 falls in May. When Vorontsova A.K. paid the money with the tax already calculated, the employer is obliged to make a payment to the Federal Tax Service before May 31, otherwise he will delay the period of fulfillment of his duties, which may lead to the imposition of sanctions on him.

Example No. 3. Employee Maltsov R.A. asked in the application to divide his vacation, where 3 weeks of rest fall in July, and the last 7 days in September. Payment must be made proportionally: in July - for the 3 weeks used, and in September the balances are transferred to the card.

The organization transferred the money to the employee’s card on September 10. Then the deadline for paying personal income tax on vacation pay (for the balance) also falls in September. The month ends on the 30th, which falls on a Sunday.

Personal income tax for compensation for missed vacation

When a certain employee is officially dismissed from a specific position, he is paid compensation for unused (missed) vacation (Article 127 of the Labor Code of the Russian Federation).

The deadline for receiving such money is considered the day it is received in fact - on a card or through a cash register. Such payments are also subject to personal income tax. Important! Compensation for missed vacation is transferred along with the monthly salary (Article 140 of the Labor Code of the Russian Federation). Personal income tax on compensation payments is paid to the Federal Tax Service of the Russian Federation on the day following the deadline for transferring this money.

Compensation is also indicated in the unified form 6-NDFL. In Section 1 of this document, the compensation amount is added to line 020, and the personal income tax for this payment is added to lines 070 and 040.

In section 2 of the report, vacation compensation is indicated along with the employee’s monthly salary, which is paid on the same day. Moreover, separate additional lines (100 and 140) are not created.

Article 127 of the Labor Code of the Russian Federation “Exercising the right to leave upon dismissal of an employee”

Article 140 of the Labor Code of the Russian Federation “Terms of calculation upon dismissal”

Fines

If the deadline for transferring personal income tax to 6-NDFL was violated or the wrong amount was calculated, then the tax agent is subject to a fine of 20% of the amount to be transferred. An additional penalty is charged for each day of late payment, starting from the day following the statutory day.

It is calculated as a percentage of 1300 of the rate of the Central Bank of the Russian Federation. The deadline for transferring personal income tax may be missed not only due to lack of funds. If the organization did not correctly indicate OKATO in the payment order, then the tax will be considered unpaid.

We suggest you read: What to do if you don’t repay the debt without a receipt

Employer's liability for late tax payment

In case of untimely or partial transfer of personal income tax to the tax office, various tax sanctions are applied to the employer, and the guilty officials are brought to administrative or criminal liability.

According to Art. 123 of the Tax Code of the Russian Federation, tax agents are fined the same amount - 20% of the tax, which is subject to withholding and (or) transfer. If, in case of violation of the rules for calculating personal income tax, 10% or more of a similar payment was not withheld from vacation pay, then the chief accountant will be fined 5,000–10,000 rubles.

The manager is held administratively liable in the following situations:

- with independent accounting;

- when transferring accounting to a third-party specialized organization - after concluding an outsourcing agreement;

- when signing a written order on accounting by the chief accountant.

Attention! When employees of the Federal Tax Service of the Russian Federation establish facts of deliberate non-payment of personal income tax on vacation pay, the guilty officials are brought to criminal liability (Article 199.1 of the Criminal Code of the Russian Federation).

Article 123 of the Tax Code of the Russian Federation “Failure of a tax agent to fulfill the obligation to withhold and (or) transfer taxes”

Article 199.1 of the Criminal Code of the Russian Federation “Failure to fulfill the duties of a tax agent”

Are vacation pay subject to personal income tax?

All employee income paid to them by an organization or individual entrepreneur must be subject to personal income tax. Cash paid as vacation pay is also counted as income. They are not included in the list of income exempt from taxation. Consequently, vacation pay is subject to personal income tax. The employer acts as a tax agent and is obliged to withhold personal income tax and transfer it to the budget.

Materials from a special section of our website will help you understand the nuances of vacation.

When vacation pay is paid on the last day of the month

If an employee received vacation pay on the last day of the month, then the tax must be paid on the same day. The legislator does not provide for deferred payments in such situations.

Example

Due to various circumstances, an employer may make a mistake and, for example, delay the payment of vacation pay. And in such cases, the day of payment plays a decisive role.

Example

The deadline for transferring personal income tax from vacation pay in 2020, as well as the established rules for making payments, will remain unchanged.

Let us remind you that other deadlines have been established for paying tax on compensation for unused vacation. Tax legislation considers this payment as income on the employee’s last day of work, and determines the deadline for personal income tax payment no later than the next day. That is, payment of tax on compensation can be made on the last day of work or the next.