Legislative norms on social support for families with disabled children

The main legislative acts regulating the provision of guarantees and benefits to families with special children in Russia are:

- Federal Law, approved by the State Duma on December 23, 2013 under No. 442, on basic measures of social services for Russians;

- Presidential Decree on guaranteeing additional legal, social and economic support for persons with disabilities - No. 774/May 13, 2008;

- Presidential Decree No. 175, dated February 2, 2013, on payments to persons caring for children with disabilities and childhood disabilities;

- Law of the Russian Federation No. 178/17.07.1999 on granting the right to parents and guardians to receive a set of social services for their disabled children (clause 9 of article 6.1);

- Federal Law No. 181 of November 24, 1995 on the right of families with disabled children to improved living conditions and a 50% discount on housing and communal services.

Tax benefits for parents of disabled children are allocated in accordance with the provisions of the Tax Code (Tax Code) of the country - its article 218. The preference is carried out by deducting a certain amount not subject to personal income tax from the salary of working parents (guardians).

Amount of child deduction in 2019

The child tax deduction in 2020 is still determined in the Tax Code and is provided under the same conditions as before. No changes have been made in this area.

When determining the amount of the deduction, you must take into account the total number of children of the employee whose income is taxed. The order in which children were born is important. This means that when the oldest child becomes an adult and loses benefits, all younger children continue to receive their benefits at the same rate. The amount of benefits cannot be recalculated.

For example, an employee has 3 children. The eldest turned 18 and lost benefits. However, the amount of 1,400 rubles will still be provided for the middle child, and 3,000 rubles for the youngest child.

Benefits for children are set in the following amounts:

- 1400 rubles - for the child who was born first (code 126).

- 1400 rubles - for a child born second (code 127).

- 3000 rubles - for the third born child and all subsequent ones (code 128).

- 12,000 rubles – deduction for a disabled child of the 1st or 2nd group (code 129).

Attention! However, for the benefit for a disabled person, it matters whether the child is his own child or adopted. In the second case, the deduction is reduced to 6,000 rubles. If parents received a benefit for a disabled person, then it was previously prohibited to add it to the standard deduction. Now the Ministry of Finance has determined in letter No. 03-04-06/15803 dated March 20, 2017 that such deductions can still be summed up.

You might be interested in:

Work injury: classification, severity, compensation, employer liability

For example, the child is the third in the family and has a disability. Parents will now be entitled to a deduction in the amount of 12,000 + 3,000 = 15,000 rubles.

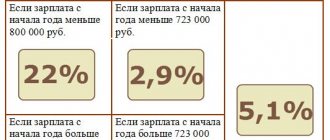

The standard deduction only applies until the employee's income reaches a certain limit. After this, from the month of excess, he is deprived of this right. The maximum amount of deductions per child in 2020 has not changed compared to previous years.

Limits on the use of the child deduction:

| 2017 | 2018 | 2019 |

| RUB 350,000.00 | RUB 350,000.00 | RUB 350,000.00 |

Peculiarities of accrual of ST for guardians and parents of disabled children

Providing this type of deduction refers to receiving a claim-type benefit. The deduction from the taxable amount of earnings when determining personal income tax continues until the date when the earnings of an individual equal the amount of 350,000 rubles. The preference is renewed from the beginning of next year.

The benefit applies not only to families with minors with disabilities, but also to full-time students in the 1st and 2nd groups (graduate students, cadets, residents, interns) until they reach 24 years of age. Measures to support families are provided from the federal budget.

Nuances of obtaining a deduction for a disabled child’s education at a university

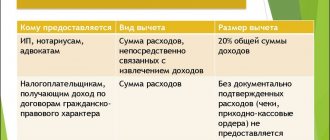

A deduction for the education of a disabled child belonging to a social type is provided by the state in parallel with receiving a standard deduction for personal income tax. The preference is the ability of one of the parents to return previously paid personal income tax from the amounts spent on paying for their offspring’s education at a university.

The disabled person himself can apply for the deduction if he is employed. The norm is regulated by Art. 219 of the Tax Code of Russia.

Currently, tax benefits for parents of disabled children who are studying at a university can be received monthly, without waiting for the end of the year, as was the case before 01/01/2016.

In this case, you need to contact your employer. But you will still have to go to the tax office for notification of the right to receive a deduction.

The maximum amount of expenses for educating one's children (foster children, foster children) is taken to be 50 thousand rubles/year. That is, the return of funds spent on education is made (maximum) in the amount of 6,500 rubles: 50,000 x 13%. If the cost of training exceeds the permissible 50 thousand rubles in the calculation, the deduction will not be large.

Examples of applying the deduction for children

If you rent out an apartment, garage, or other property and report income to the tax office, you can also claim your right to a deduction.

Other changes to Art. 218 of the Tax Code of the Russian Federation is not expected in the near future. The procedure for calculating and applying tax deductions has also been preserved. As before, everything depends on the number of children, the status of the parents in relation to the child and the presence/absence of the child’s disability.

These amounts are added to the usual benefits depending on the priority of the baby (clause 14 of the Review, approved by the Presidium of the Supreme Court of the Russian Federation on October 21, 2020, letter of the Ministry of Finance of Russia dated March 20, 2020 No. 03-04-06/15803).

That is, if a disabled child is the third born, then his parents can receive a deduction of either 3,000 rubles, as for a third child, or 12,000 rubles, as for a disabled child. There are disputes on this score among both lawyers and financiers, because the Tax Code does not directly indicate this: sum up the benefits or choose the largest of them.

An employee can receive a standard tax deduction for a child only from a tax agent, i.e. at your employer. There is no need to apply to the Federal Tax Service for such a deduction.

Documentation

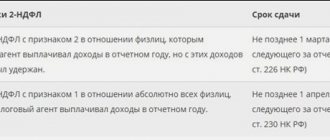

To receive a child tax deduction, first of all, an individual will need to fill out documents such as a declaration (filled out in accordance with the 3-NDFL form), a certificate with information about income (issued by the employer and filled out according to the 2-NDFL sample), an application containing a request for personal income tax return and bank card details, as well as make a copy of the birth certificate.

How are tax deductions processed?

A standard deduction for personal income tax for a disabled child is most often issued by the employer after submitting the appropriate application and the necessary documents. Subject to compliance with the law, the taxable amount of earnings of each working parent is reduced. The family will eventually have more income.

You can count on a social tax deduction for education if you study at not every university. Such a right appears when an educational institution (including abroad) has the appropriate license. In this case, the contract for receiving paid education must be drawn up in the name of the parent of a child with a disability, as well as documents on payment.

Personal income tax deductions for children in 2020. What is the deduction limit for children in 2020?

An employee has the right to receive a deduction:

- from the month of birth

- from the month of adoption of the child;

- from the month of establishment of guardianship/trusteeship;

- from the month of concluding the agreement on the transfer of the child to a family for upbringing.

The child deduction is provided monthly throughout the calendar year until the employee’s income reaches a certain limit. In 2020, personal income tax deductions for children are provided until the employee’s income reaches the limit of 350,000 rubles.

Important! The limit for personal income tax deduction in 2020 is RUB 350,000.

This means that once income reaches this amount, the employer no longer provides a deduction for the child or children. This limit does not depend on the number of children in the family. It is the same for all employees.

Personal income tax deductions for children in 2020. How to get a double deduction for personal income tax in 2020

A double deduction can be received by:

- sole parent, adoptive parent, guardian or trustee;

Divorce of marriage is not the basis for the emergence of the right to a double deduction on the basis of a single parent. For such a right to arise, the second parent must be declared dead or declared missing.

- one of the parents (adoptive parents), if the other refuses the deduction in his favor.

There is a list of situations when the second parent cannot refuse the deduction in favor of the second:

- If he or she is not working;

- If she is on maternity leave;

- If he or she is on parental leave for up to 1.5 years;

- If he or she is registered with the employment center.

How to fill out form 3-NDFL to receive tax benefits and deductions.

The form of the document and the procedure for filling out the declaration are established in the order of the tax service dated December 24, 2014 No. МММВ-7-11/ [email protected] (as amended according to the order of the Federal Tax Service No. МММВ-7-11/ [email protected] ). The unified KND form 1151020 can be downloaded from the resources of specialized institutions and on helper sites.

In the current year 2020, by declaring to the tax service their intention to receive a deduction for paying for their children’s education in 2020, the parent also has the right to return the tax for both 2020 and 2020. You need to prepare a separate declaration for each year. To correctly fill out the fields, you must use the 2-NDFL certificate.

To complete the declaration you need to fill out:

- Personal data of the declarant. This includes information from the passport - full name, registration address, as well as codes - the local tax authority and an eleven-digit code - according to OKTMO. You can find out these digital values by calling the tax office. After completing each page, you must save it;

- Next, fill in information about the type of income, most often it is salary. Its size is taken from the 2-NDFL certificate provided by the employer’s accounting department. The name of the company, its tax identification number, checkpoint and OKTMO code are also taken from this certificate and entered in the appropriate field;

- In the line “Total amount of income for the year” the figure from clause 5.1 of form 2-NDFL is entered;

- Line “Total amount of income for the year” - this data must be taken from paragraph 5.1 of the 2-NDFL certificate;

- Data on the taxable amount of income is entered in the next line, and is also taken from certificate 2-NDFL (clause 5.2);

- The withheld tax amount is transferred from clause 5. 4 of the certificate to the next declaration period.

After filling out the section of the declaration containing information about income, you must enter the requested information in the section on standard and social deductions.

Here you need to select the appropriate item “Children’s education expenses” and indicate their amount.

Completing each sheet of the declaration with a personal signature indicates the completeness and accuracy of the information.

Where should the declaration be submitted and within what time frame?

You can receive a social tax deduction from your employer if you paid for your training in the current year. If a parent wants to return part of their income for a year or several years, they need to contact the tax authority. In this case, the deduction can be provided to the parent for a period not exceeding 3 years.

It is necessary to apply for a deduction for the education of children at the tax office at the place of residence by April 30 following the reporting year.

To apply to the tax authority for a refund of part (13%) of the funds spent on training, you must submit to the inspector:

- Statement;

- Original and copy of passport;

- Declaration 3-NDFL for the year in which the payment was made;

- A certificate from the employer confirming the amount of taxes withheld;

- Agreement with the university on the provision of paid educational services;

- A certificate confirming that the child is studying at a specific university;

- A copy of the license of the university, academy, institute.

Confirmation of the fact of payment are the original payment documents. Copies of these are also provided. The declaration and scanned copies of documents can be delivered in person, using the Internet or postal services.

Ways to compensate for deductions

When applying for a deduction for training from an employer, previously paid income tax is not returned through the company cash desk directly to the mother or father.

Having received a notification from the tax office, a parent’s application and payment documents confirming the expenses incurred for their children’s education, the accounting department will withhold a monthly reduced amount of tax from current earnings, taking into account the required deduction.

Examples of applying the deduction for children

For one child

The employee receives a salary of 36 thousand rubles per month and she has one child. The calculation will be as follows (36,000 -1,400)*13% = 4,498 rubles, without applying the deduction she will pay 4,680 rubles in personal income tax. Thus, the savings will be 182 rubles per month and 1638 rubles per year. But the lower the salary level, the stronger the impact of applying the deduction.

For one disabled child

If there is a disabled child in the family, then the amount of the deduction will be larger - 12,000 rubles if he is a natural child and not an adopted child, plus 1,400 standard deduction. In this case, we will receive (36,000 – 12,000-1,400)*13% = 2,938 rubles of income tax. Without applying the deduction it would be 4,680 rubles. The savings per month are already 1,742 rubles, and over the year it will be 15,678 rubles.

What if parents are divorced

Some experts believe that if the parents are divorced, then the one with whom the child is may qualify for a double deduction. However, this is not true. A double deduction means that the child does not have a second parent, and this situation does not arise during a divorce.

This position was voiced by the Ministry of Finance in its letter dated May 12, 2020. It explains that the concept of “sole parent” means his complete absence due to death, missing, declared dead, etc.

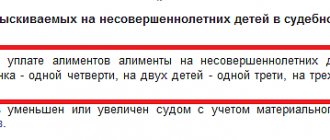

In a divorce, both parents are healthy. Therefore, each of them has the right to apply for a standard deduction. However, the one who lives separately must provide confirmation that he is participating in the maintenance of the child. This usually involves paying alimony. Thus, when submitting documents, you must provide a copy of the child’s certificate and a document confirming the payment of child support.

At the same time, the second parent has the right to refuse his deduction in favor of the first. Then the latter will, in fact, receive a double deduction.