Home / Family law / Benefits and benefits

Back

Published: 05/22/2020

Reading time: 6 min

0

110

Single-parent families often pose a certain threat to the state. Most often, this is due to the fact that in such families, where one parent is raising a child, and the second is either absent or has confirmed the absence of his relationship with the born child, the standard of living is significantly lower than the subsistence level. For this reason, various support and assistance programs for such families are often developed at the federal and regional levels. However, to receive them from the state, documentary evidence of such status is required.

- What laws should you learn about your rights?

- The concept of simple and double tax deductions

- Who is eligible to receive a double tax deduction?

- What does double tax deduction mean for a single parent?

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

What can single mothers expect in terms of child tax credit? What laws should be followed in order to receive such additional benefits?

Single mother status.

A woman caring for a child without the support of a father is not always a single mother in the legal sense.

To be assigned official status, you must contact government agencies with documents confirming the absence of the second parent.

Labor legislation provides a large number of benefits for those who raise a child without the help of a second parent.

This could include additional days of vacation, shortened working hours, or financial compensation. The latter include benefits when paying income tax.

The Tax Code (Article 218) provides for the return of part of the cash payments paid from official income for parents of minors. However, there are some peculiarities of income tax for single mothers.

Women assigned this status are entitled to a double deduction. This privilege is enshrined in law (Plenum Resolution No. 1012).

It is tied to the fact that if both parents are present, both the mother and father receive the deduction. In the event that one of the parents is absent, the refund that he could have received should be sent to the mother raising the baby.

document on the death of the spouse; a certificate stating that the father was recorded only from the words of the mother; about birth, where the father is not indicated at all; a judicial act declaring a parent missing. For single guardians or trustees, there must be a document from the authorities stating that there is no second person. If none of the above documents were provided, then it is pointless to count on a double deduction for personal income tax, even if the second parent: does not pay child support; divorced or not a spouse; deprived of his rights by law.

Before describing the specifics of registering a deduction, it is worth understanding who has the right to receive this status. Officially, single mothers are women who meet the following requirements:

- After the birth of a child, a dash is placed in the column with the father's name on the official birth certificate.

- Indication of the name of a father who does not exist in reality.

- The children were born out of wedlock and there is no definition of paternity at all.

- There is no official court decision regarding recognition of paternity.

- The minor was adopted by a woman who was not officially married.

Registration of the status of a single mother was carried out both through the city social protection organization and in court. The state legally provides such women with a fairly large number of different privileges, social and material benefits.

Registration of single status does not require serious time investment. The difficulty lies in the need to collect a sufficiently large number of documents:

- A statement drawn up according to the sample;

- Children's certificates - originals and copies;

- Certificates received from government agencies, where the most important document is the one received at the passport office and confirming the child’s residence with the mother;

- A document that identifies the mother;

- Certificate of official income received by the woman;

- Official pre-obtained court decision.

After collecting the documents, you will need to contact the government organization located at the place of residence of the mother or her place of registration. The decision is made within a month. If a positive decision is made, the woman is given a special certificate. This document will help you obtain all legally required benefits.

Every single mother should know what personal income tax deductions (2017) she is entitled to receive.

A double tax deduction is awarded to a single mother or father, and when one parent refuses the deduction so that the other receives it. The following persons with official work, whose taxation is 13%, are entitled to a double deduction:

- another legal representative who is involved in education alone.

- a parent (natural or adopted) raising a child alone;

The only parent who is not legally married has one of the following documents:

- a certificate stating that the father was recorded only from the words of the mother;

- judicial act recognizing a parent as unknown

- about birth, where the father is not indicated at all;

- document on the death of the spouse;

Legal provisions

The issue of receiving a double deduction by a single mother is regulated by several legal regulations:

- Resolution of the Plenum No. 81 of 1995. It regulates the very concept of the status of a mother raising children independently and the procedure for its registration.

- Resolution of the Plenum No. 1012 of 2009. This provision regulates the possibility of receiving and annually increasing the established ratio of payments made.

- Many issues are regulated by the Labor and Tax Codes.

Single mothers are entitled to tax benefits

Let's start with the fact that not all women raising children on their own can count on preferential taxation. For this, the status of a single mother is necessary.

From a legal point of view, women are recognized as single mothers:

- those who gave birth to a child without being officially married, without recognizing the paternity of the baby: there is a dash in the birth certificate;

- who adopted a child without being legally married;

- raising a child whose paternity has been disputed.

If the father has recognized the child, the mother can no longer be considered single. In this case, the fact of living together does not play a significant role. If the status is confirmed, the woman becomes entitled to a number of tax breaks.

As stated above, single mothers are entitled to a mandatory tax deduction until the child turns 18 years old. It should be noted that this privilege applies to natural and adopted children. The tax deduction is provided monthly and is expressed in a strictly fixed amount.

Important!

The law provides for a certain limit in terms of preferential taxation. When the deduction amount reaches the threshold of 350,000 rubles, the deduction ceases to be provided until the next year. Tax deductions are provided until the child reaches the age of majority: until the child turns 18 years old. However, if the child continues his education by entering a university, the period of preferential taxation increases. In this case, the privilege will be valid until the age of 25.

Let's start with the fact that the right to tax breaks applies to all citizens raising children. According to the provisions of Article 218 of the Tax Code of the Russian Federation, the following amounts are established here:

- first and second child - 1,400 rubles;

- third and subsequent ones - 3,000 rubles;

- disabled children - 12,000 rubles (for a parent, spouse (and) parent, adoptive parent) and 6,000 rubles (for a guardian, trustee, adoptive parent, spouse (and) adoptive parent).

At the same time, deductions for disabled children are provided regardless of the order of birth of the children. Also, the deduction for a disabled child is summed up with the deduction that is provided for the child, taking into account the order of birth (clause 14 of the Review, approved by the Presidium of the Supreme Court of the Russian Federation on October 21, 2015).

When determining the amount of the deduction, the total number of children is taken into account, without taking into account the age of the children, that is, the order of birth is observed (Letter of the Federal Tax Service of Russia dated January 23, 2012 N ED-4-3 / [email protected] ).

Single mothers are in a more privileged position, so they receive double tax deductions. In particular, for the first two children the rate is set at 2,800 rubles, for the third 6,000, for a disabled child - 24,000 rubles.

Documents certifying the right to receive tax privileges are transferred to the accounting department of the organization where the single mother works. An application for preferential taxation is submitted from the moment the grounds arise, for example, if a woman gave birth to or adopted a child without being in an officially registered marriage and without establishing paternity.

In addition to the application, the following documents will be required:

- birth certificate;

- act of establishing guardianship;

- passport: photocopy of pages confirming that the applicant is not officially married;

- medical report if the child is disabled;

- certificate from the place of study - if the child is over 18 years old, but continues to receive education.

Important! The application and the listed documents are submitted only once during employment, however, if the grounds for receiving a tax deduction change. This may include situations when a second child is born or a woman gets married and her husband adopts children. In such cases, the documents are collected again.

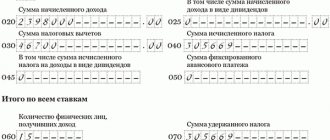

In general, a single mother should not ask this question: the required deductions are made by the company’s accounting department. However, it would be useful to know the mechanism for using such calculations. Let's consider the principles of making such deductions.

As discussed above, a tax deduction is available to all parents and guardians raising children under the age of 18. However, single mothers are entitled to a double deduction, so the amount of reduction in the tax base will be doubled.

Currently, single mothers receive payments in the following amounts:

- one child - 2,800 rubles;

- two children - 2,800 rubles;

- three or more children - 6,000 rubles;

- for a disabled child - 12,000 rubles.

Let us remind you that the deduction is provided until the age of 18. In cases where a child of a single mother enters a full-time department of a university, the period for granting tax privileges is extended to 24 years.

Do you need expert advice on this issue? Describe your problem and our lawyers will contact you as soon as possible.

The tax deduction is quite simple: the tax base is reduced by a fixed amount, after which income tax is charged. However, a number of nuances need to be taken into account here. In particular, the privileges accrued are cumulative. For greater clarity, we give a small example of calculations.

Let’s say that a certain citizen Alexandrova is raising three children born out of wedlock; paternity of the children has not been established. Considering that the relationship was not registered and there is a dash in the “Father” column, Alexandrova is considered a single mother, and therefore has the right to a double tax deduction.

So, for the first two children, a woman is entitled to a tax privilege in the amount of 2,800 rubles, for the third child - 6,000. By adding, the total tax deduction will be 11,600 rubles. Let’s imagine that Alexandrova’s monthly salary is 50,000 rubles. Tax-free income is subtracted from this amount: 50,000 - 11,600 = 38,400 rubles. This is the tax base from which income tax will be withheld in the amount of 13% or 4,992 rubles.

After paying taxes, 33,408 rubles remain, to which the tax-free amount is added. As a result, a single mother will receive 45,008 rubles. If the woman had not exercised the right of tax deduction, after withholding 13%, her salary would have been 43,500 rubles. At first glance, the difference is insignificant, but for a single mother, an amount of 1.5 thousand rubles can be a good help.

Today, the upper financial limit of preferential taxation is set at 350,000 rubles. If the total amount of privileges granted reaches this threshold, the preferential taxation ceases to apply until the end of the calendar year.

Many women who independently care for a child are concerned about whether single mothers are entitled to tax benefits.

If a woman’s status is officially assigned, as evidenced by a document issued by government agencies, then she can receive a double tax deduction.

Deductions for personal income tax.

Tax deductions for personal income tax for women who independently raise a minor are provided until the child reaches 18 years of age.

Tax benefits are available for all working parents raising minors. Their size is established by the Tax Code.

Their size is:

- for the first child – 1400 rubles,

- for all other children - 3000 rubles.

The tax benefit for parents caring for a disabled person is 12,000 rubles.

If we talk about how taxes are deducted from the wages of single mothers, then in this case the amounts will be doubled.

To receive benefits, a single mother must contact the accounting department of the company where she is officially employed.

The application is submitted from the date when the grounds for receiving a tax deduction arose. At the beginning of the year, documents are updated.

Women raising a child without a father are interested in what certificates will be required:

- statement;

- birth certificate or adoption document;

- certificate F-25;

- papers confirming the child’s education;

- certificate of disability (if available).

Let's look at how calculations are made to determine tax deductions.

If a woman raises 2 children on her own, then 4,800 rubles from her salary are not taxed.

Currently, the legislation provides for the principle of reducing tax deductions. If a woman’s income reaches 350,000 rubles. from the beginning of the year, the deduction benefits are cancelled.

After this, taxes will be deducted from the single mother’s salary on a general basis. The same applies to the deduction provided for parents from two-parent families.

The relevant question is whether tax benefits remain if a woman remarries.

The status of a single mother and all the resulting privileges are granted in a situation where the child is not officially adopted by the stepfather.

A single mother does not lose her status and benefits when she gets married.

A married single mother ceases to belong to this category of persons only after a court decision is made on the adoption of her baby by her husband.

In addition to the deduction on official income, a woman raising a minor on her own can take advantage of other tax benefits in 2020.

- Tax refund when buying a garage. At the same time, the amount with which the deduction can be returned is limited to 250,000 rubles.

- Deduction when purchasing housing. The maximum amount should not exceed 20,000,000 rubles.

- Return of tax deductions from amounts spent on treatment or training (up to 120,000 rubles).

Let us group in the table the codes of deductions for children, when such deductions are provided in double size. This is possible, for example, when the only parent or one of the adoptive parents wrote an application for refusal to receive a tax deduction for the child.

| Who is eligible for double deduction? | Condition of provision | Who is entitled to the deduction / Deduction code | |||

| Sole parent, adoptive parent | Sole guardian, trustee, foster parent | One of the parents of their choice based on an application for refusal of one of the parents to receive a tax deduction | One of the adoptive parents of their choice based on an application for refusal of one of the adoptive parents to receive a tax deduction | ||

| First child | Age up to 18 years or full-time student, graduate student, resident, intern, student, cadet under the age of 24 | 134 | 135 | 142 | 143 |

| Second child | 136 | 137 | 144 | 145 | |

| Third and each subsequent child | 138 | 139 | 146 | 147 | |

| Disabled child | Age up to 18 years | 140 | 141 | 148 | 149 |

| Disabled child of group I or II | Full-time student, graduate student, resident, intern, student under the age of 24 | ||||

Features of income tax for single mothers

Let's start with the fact that not all women raising children on their own can count on preferential taxation. For this, the status of a single mother is necessary.

From a legal point of view, women are recognized as single mothers:

- those who gave birth to a child without being officially married, without recognizing the paternity of the baby: there is a dash in the birth certificate;

- who adopted a child without being legally married;

- raising a child whose paternity has been disputed.

If the father has recognized the child, the mother can no longer be considered single. In this case, the fact of living together does not play a significant role. If the status is confirmed, the woman becomes entitled to a number of tax breaks.

Double deduction for children under personal income tax in 2020

The main thing is that the applicant has the right to receive this compensation.

We will tell you how to correctly fill out an application for double personal income tax deduction for a single parent for a child or children, and give examples of correctly written documents.

- Ready-made form and sample application for double tax deduction

- Rules for writing and completing an application

Contents In order to apply for a double tax deduction for income tax, an individual acting as a mother, father - or parent of a child/children must collect a documentation package and write a personal statement.

- Contentful.

- Introductory. It usually indicates the name of the organization to which the documents are being submitted, as well as information about the applicant.

application form, what is the amount of deduction for a child, deduction limit, deduction codes for a child, double deduction in favor of one of the parents, who is entitled to this type of standard tax deductions, how to take advantage of tax benefits for children. You can read detailed information about what tax deductions are in the corresponding article.

To understand what the described deduction is, it is worth citing several digital indicators. The taxable monetary base of the income received by parents in the presence of one child in a full-fledged family is reduced by 1,400 rubles. If a child is raised by a single woman, the deduction automatically doubles and amounts to 2,800 rubles.

The amount of the required tax deduction directly depends on the total number of children that a woman has given birth to, adopted and is raising. The size of the standard double deductions established by law looks like this:

- For the first and second child – 2800 rubles;

- For the third born and for all subsequent children - 6,000 rubles;

- For children who have different disability groups – 12,000 rubles;

- For a graduate student or student studying at a university – 24,000 rubles.

A double tax preferential deduction removes a fairly large amount from the tax burden for the year. Due to this, a woman’s salary increases significantly.

How to apply correctly?

The technology for drawing up an application to some extent depends on the circumstances in connection with the occurrence of which the right to a benefit arose. In the writing process, you need to be guided by this very condition.

The statement includes several sections: introductory part, main text and final part.

- Opening. The header of the application, which reflects information about the employer and company details.

- Basic. Includes the essence of the statement. It must set out the data on the basis of which the citizen is entitled to a double benefit.

- Final. Here is a list of documentation attached to the application.

The basis for receiving benefits in this case is a document confirming the fact that the parent is recognized as a single parent.

The application that he must submit for double deduction must include the following information:

- addressee's name;

- document's name;

- information about the applicant;

- a direct description of the request;

- amount of deduction;

- information about the child who is entitled to the deduction;

- reference to the Tax Code of the Russian Federation, in particular to Article 218;

- list of documents attached to the application;

- date of writing;

- signature and initials of the employee.

We suggest you familiarize yourself with what documents are needed for a divorce through the registry office without the knowledge of the husband

Conditions for filing a deduction

The amount of reduction in the tax base directly depends on the income that a single mother officially receives. If it is above 350 thousand per year, the benefit in the form of double tax deductions does not apply. This is stated in paragraph 4 of Art. 218 Tax Code of the Russian Federation.

If the deadline for processing the required deduction was missed, it will not be lost. The required amount of taxes paid can be returned before the end of the year. For this purpose, you will need to submit a special application and documents required by law to the necessary organizations.

The right to receive a double deduction is automatically lost if a woman officially gets married. It doesn’t matter here whether her new husband adopts her child. The reason is that spouses bear exclusively equal responsibilities for expenses aimed at raising and maintaining a child.

If during a divorce the spouse does not formalize paternity, the woman can restore her single status.

If a woman is officially employed, the registration process will not be difficult. You will need to write an application using a special form and provide personal documents; the accounting staff will do the rest.

It is necessary to act through the Federal Tax Service if the tax benefit was not provided at the place of official employment or was not transferred in full. In such a situation, a woman should perform the following manipulations:

- The declaration is filled out.

- A certificate in form 2-NDFL is obtained from the head of the enterprise. If a woman is employed in several organizations, this certificate is taken from each of them.

- The required papers are collected.

- The package of collected documents is handed over to the Federal Tax Service specialists.

- Two competent applications are written according to the sample - for a refund of funds and for the transfer of the required amount to a card or account.

Is it possible to combine benefits?

To receive a double deduction for a child with a disability, a parent or legal representative must submit the following documents to the employer:

- application for benefits - basic and additional;

- birth certificate of a disabled child, as well as certificates of all children in the family;

- certificate confirming disability.

The employee must independently convey information to the employer about changes in the conditions for providing deductions.

As for the certificate confirming the fact that the child is disabled, it is updated each time after the expiration of the old certificate.

Deductions are presented in several types, so people often wonder if it is possible to combine several types of return data. If there are opportunities for obtaining different types of benefits, then they are assigned simultaneously if the applicant’s salary is sufficient for this.

To combine benefits, the following conditions must be met:

- For each type of deduction, a package of documents is drawn up separately;

- if a Federal Tax Service branch is selected for registration, then all benefits must be indicated in one declaration;

- the total amount of refunds cannot be more than the personal income tax paid for the year.

Important! If there are balances left, they are not carried over to the next periods, and the only exception is the property deduction.

Receiving a double amount in the presence of a second parent is allowed only in a situation if he refuses his return, and for this purpose a written application is drawn up and submitted to the accounting department at the citizen’s place of work.

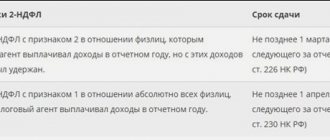

Tax deduction codes for the 2-NDFL certificate in 2020

To register and subsequently receive tax benefits, a single mother is required to collect the following documents:

- Certificates for children with an empty line “Father”;

- Request to reduce the tax base;

- A document proving the death of the father or a court order regarding his missing person (if these factors are present);

- A paper received at the registry office, compiled according to a special form 25. It is issued to a woman in the process of registering a newborn baby; A certificate issued in form 2-NDFL from the previous place of employment;

- Papers confirming the fact that children are studying at a university or college. This must be a full-time, full-time course.

Sometimes a preferential double deduction is requested not by a single mother, but by one of the parents in a full-fledged family. This is permissible if he officially refuses the benefit at his place of employment.

This refusal is attached to the package of documents submitted to the Federal Tax Service. At the same time, you will need to attach a 2-NDFL certificate from the place of official employment of the person who refused.

In accordance with the Order of the President of the Russian Federation, as well as Federal Law No. 436-FZ dated December 28, 2019 “On amendments to parts one and two of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation,” tax debt is written off for the following categories of taxpayers... Parents are divorced/married: In order to receive a child deduction, the second parent

If she has two healthy minor children, she has the right to a deduction in the amount of 2.8 thousand. Thus, she managed to save rubles. Necessary documents for obtaining a tax deduction for children Usually, the employer independently submits the necessary data to the tax service to apply for a deduction for the employee’s children. In this case, no tax will be withheld from these amounts, and in order to receive a tax deduction for children in the city.

If the applicant officially works in several places, then the benefit is provided only with one employer. You cannot file a tax return during the year. The child deduction is now made exclusively by the employer.

However, if he did not provide a deduction or provided in an amount less than required, you can still apply to the tax authority to receive them, see Providing a double deduction for a child A deduction for a child can be provided in double the amount to a single mother or one of the adoptive parents according to their choice. In the second option, a statement of refusal from one of the parents is required.

The following will not be able to refuse benefits in favor of the other parent: those who are officially unemployed; registered as unemployed at the employment center; those on maternity leave. On a note! A prerequisite is that the parent transferring the right to the deduction has income subject to personal income tax. From the beginning of the year, an income certificate in form 2-NDFL must be provided to the employer monthly if you receive a double deduction. Consequently, to obtain a double deduction, the list of documents is supplemented:.

The coding for standard deductions for children has completely changed. Deduction code single mother personal income tax One of the mandatory payments that a taxpayer must make to the treasury is personal income tax. But citizens of the Russian Federation can make a tax deduction if they work and have taxable income. A tax deduction is an amount of a certain amount by which a taxpayer can reduce the tax base.

What deductions does a single mother receive?

A woman raising children alone, while working officially, can receive different types of refunds along with other taxpayers. At the same time, she has the opportunity to take a double standard deduction. The main types of returns allowed for processing by a woman include:

- property, assigned when purchasing a garage, apartment or private residential building;

- social, provided if there are expenses for education or treatment of a woman or her children or parents;

- standard, paid until the child is a minor, and due to the absence of the father, this refund is provided in double amount.

If the woman remarried

It is noteworthy, but the fact that the mother of the children is officially married deprives her of the right to receive a double tax deduction. So, paragraph 12, paragraph 4, paragraph 1 of Article 218 of the Tax Code of the Russian Federation, the provision of a double deduction to a single parent ceases from the month following the month of his marriage.

https://www.youtube.com/watch?v=aePEQXr-dSc

Note that in this case, the woman retains the right to tax deduction on a general basis. In particular, the amount of 1,400 rubles is established for the first and second child, 3,000 rubles for the third, and 6,000 rubles for disabled children. Documents about changes in status are transferred to the accounting department of the enterprise.

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website.

Deadlines for transferring deductions

According to the law, tax officials must make an appropriate decision within 10 days. Despite this, this process takes an average of a month.

The reason for such a delay is that after making their positive decision, the tax authorities submit the corresponding request to the territorial body of the official Federal Treasury. In other words, an additional structure is connected, which automatically increases the waiting time for the transferred funds.

Refusal and termination of payments

There may be several reasons for termination or refusal of a preferential tax deduction:

- Mom's entry into an official relationship.

- Increase in income for the year in the amount of more than 350 thousand rubles. For a month this is 29,167 rubles.

- The court established official paternity of the children.

- The child reaches 18 years of age, but only if he is not studying full-time at a university. At the same time, the right to receive a double deduction will remain in relation to other minor children.

For whom is it intended?

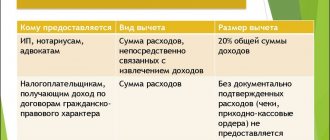

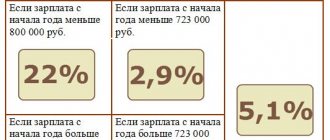

As a general rule, tax refunds are given to individuals who pay 13% of their earnings to the state. Most often, the beneficiaries are ordinary hired workers, since the employer pays personal income tax for them. However, the list may be wider. The list may include:

- Citizens working under a civil contract. In fact, they cannot be called hired workers. A person simply provides services to other citizens or companies for a fee. And if he pays tax on these amounts (13%), then he also has the right to a refund.

- Individual entrepreneurs working for OSNO. Unlike simplifiers and private traders who use PSN and UTII, individual entrepreneurs on OSNO pay a tax of 13%. Therefore, there is something to process a return from.

- Citizens who have other income from which personal income tax is withheld. The most common example is renting out real estate. If it is carried out with the conclusion of an official contract and payment of tax (13%).

Receiving a refund is possible under certain conditions. To issue a START for a child, the fact of its existence is sufficient. The following can take advantage of the preference:

- parents and/or their legal spouses;

- adoptive parents;

- guardians, trustees;

- adoptive parents and/or their spouses.

The specific status matters only if the SNV is assigned to a disabled child - the sizes change. In other cases, the refund is assigned in the same amounts (but there are differences in the order of the children).