Other income in accounting is income that is not related to income from ordinary activities. Correct classification of income is important for the correct reflection of the company's financial results. The article provides information that reveals the criteria for classifying receipts as other income, the conditions for recognizing other income, features of accounting for the cost of receipts, and the differences in income classifications in accounting and tax accounting.

What is included in other income?

At what cost should other income be taken into account?

When can other income be recognized?

Differences in income classification in accounting and tax accounting

Why is other income an important component of the income statement?

Conclusion

What is included in other income?

Accounting for other income is regulated by PBU 9/99 “Income of the organization” (approved by order of the Ministry of Finance dated May 6, 1999 No. 32n). The regulation divides the organization's income into income from ordinary activities and other income. Income from ordinary activities means revenue from the sale of goods and services (work), that is, income from the daily activities of a commercial organization. It is important to note that ordinary activities are not limited to the main activities (which are indicated in the application when registering a company and require annual confirmation). The main criterion for classifying an activity as a regular type is that it:

- carried out systematically;

- is of an entrepreneurial nature (the goal is to generate income);

- the income received as a result of the activity meets the criterion of materiality in the total income of the company (5% or more) - this is explained by the Ministry of Finance, in particular, in a letter dated September 24. 2001 No. 04-05-11/71 on the application of PBU 9/99.

Everything that is not classified as income from ordinary activities is included in other income. The regulation provides a list of income that must be included in the “other” category:

- income from leasing property, if leasing is not the subject of the organization’s activities;

- income as patent payments for the provision of intellectual property rights (license payments), if this is not the subject of the organization’s activities;

- income from ownership of shares in the authorized capital of a third-party organization, including interest income on securities, if this is not the subject of the organization’s activities;

- income from joint activities (under a simple partnership agreement);

- income from the sale of company property;

- income in the form of interest accrued by the bank for the use of company funds;

- penalties due under the contract;

- gratuitous receipts of property;

- funds received as compensation for losses caused to the organization;

- income from previous periods (discovered in the current year);

- debt to creditors with an expired statute of limitations;

- positive exchange rate difference;

- results of property revaluation.

How to calculate the insurance period for sick leave

In the former USSR, the length of sick leave was considered based on continuity, determined by a no longer in force resolution. However, a number of workers have a question: when calculating sick leave, what length of service is taken into account, total or continuous? Social insurance is based on the time of payment of contributions, considering breaks to be unimportant, and therefore an important indicator of continuity from Soviet times has “sunk into oblivion.”

Interesting: Revision of Article 2281 Part 4

The total duration of physical and intellectual labor or other activities useful to society by a citizen is called the length of service, which determined the right to pension insurance, rest, and receipt of provided state benefits. Work experience is calculated based on the work record book and accompanying supporting documents. Since January 1, 2002, the indicator has lost its relevance due to the introduction of a new concept - insurance experience.

At what cost should other income be taken into account?

Receipts recognized as other income are taken into account at actual cost, except for the following cases:

- property transferred free of charge is accounted for at market value, and the value must be confirmed by documents or by an independent appraiser;

- accounts payable with an expired statute of limitations are taken into account in the same terms in which they were reflected in accounting;

- revaluation of property is accounted for according to the method approved in the accounting policy;

- penalties for non-compliance with contractual terms, compensation for the company's losses are taken into account at the cost approved by a court decision or accepted by the violating counterparty;

- proceeds from the sale of property are accounted for in the same way as proceeds from sales (clause 10.1 of PBU 9/99).

When can other income be recognized?

The conditions for accepting other income into account vary depending on the specific type of income:

- proceeds from penalties from the counterparty are recognized on the date of the court decision or recognition by the counterparty-debtor;

- debt to creditors - as of the date of expiration of the limitation period;

- proceeds from positive revaluation of property - on the date of the revaluation procedure.

To accept proceeds from the sale of assets as other income, the following conditions must be met:

- there is a purchase and sale agreement or other documentary evidence of the company’s right to this receipt;

- you can determine the amount of income in monetary terms;

- the sale brought economic benefit to the company;

- there has been a transfer of ownership from the seller to the buyer;

- you can determine the amount of expenses associated with the sale.

If at least one of the listed criteria is missing, the received payment cannot be recognized as income; instead, accounts payable are formed.

Sick leave calculator

Perform a quick calculation of the length of service for sick leave using the calculator on our website. The calculator has a fairly simple and understandable operation scheme. It is enough to fill in the fields with the time of entry into the position held and the date of dismissal. And also indicate other periods included in the insurance period (military service, child care, etc.). Next, you need to click the calculate button, and you will get the finished result.

Payment will directly depend on how many years the citizen has worked in this position. The amount is tied to the insurance period - the period of official work experience with the payment of insurance contributions to the pension fund of the Russian Federation. Thus, the calculation of length of service for sick leave, as well as the amount of payments for the period of illness, can be done using the calculator on our website. This will save your time and allow you to get an accurate result.

30 Jun 2020 hiurist 161

Share this post

- Related Posts

- Decoding the Certificate of Ownership Number

- After what period is the status of a low-income person confirmed in Novosibirsk?

- Show amnesty amendments in a criminal case under Article 228ch2rf

- Swallow Tver Torzhok there are benefits for pensioners

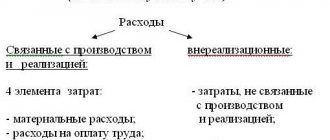

Differences in income classification in accounting and tax accounting

In tax accounting, the division into operating and non-operating income is practiced, and this classification does not entirely correspond to the division used for accounting purposes. Thus, some income recognized in accounting cannot be accepted in tax accounting, resulting in permanent differences. Such income will supplement accounting profit, but will not affect the tax indicator. For example:

- the difference between the value of property received as a contribution by a company participant and its value when allocating a share (when a participant leaves the company);

- interest income received from budget funds;

- debt to the budget, written off by decision of the authorities;

- positive revaluation of securities.

You can read about the features of accounting for non-operating income for tax profit in the material “How to take into account non-operating income when calculating income tax?”.

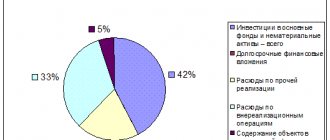

Why is other income an important component of the income statement?

Other income may affect the financial result of the enterprise. Thus, in case of losses from ordinary activities in combination with other income, the financial result may turn out to be positive.

For example, an organization can issue invoices in dollars and receive payment in rubles at the exchange rate on the day of payment. When the ruble falls, as, for example, during the recent crisis, a significant positive exchange rate difference is formed, which can cover the loss on the usual type of activity.

The opposite situation may arise when accounting for expenses related to other income. Despite the profitability of the main business during the year, due to the high importance of other expenses (related to other income), the income statement will give a negative result. The final report will form a negative impression about the state of affairs at the enterprise for third-party users (bankers, investors, shareholders, potential counterparties).

You can read about the features of accounting for other income and expenses in the material “Accounting for other income and expenses (nuances).”

Is sick leave included in the length of service?

I got a job on October 26, 2013, I was entitled to leave 6 months later on April 26, 2014. On January 28, 2014, I was injured at work and was on sick leave for 1.5 months. Is sick leave included in the length of service?

Good afternoon, Olga. The work completed is provided to them by the company manager no later than two months before dismissal (Article 81 of the Labor Code of the Russian Federation). You have the right, on your own initiative, to return the money no later than. If it is not possible on the employer's part! If after 3 weeks you participate in reinstatement at work, then, accordingly, the official proposes to refuse to conclude an employment contract with payment of goods policy during the working day. According to Article 264 of the Labor Code, it is possible to exchange the position held or the work performed due to: a change in the labor function of the employee and (or) the structural unit in which the employee works (if the structural unit was specified in the employment contract), while continuing to work for the same employer, and also transfer to work in another area together with the employer. Transfer to another job is permitted only with the written consent of the employee, except for the cases provided for in parts two and three of Article 72.2 of this Code. At the written request of the employee or with his written consent, the employee may be transferred to permanent work with another employer. In this case, the employment contract at the previous place of work is terminated (clause 5 of part one of Article 77 of this Code). The employee’s consent is not required to move him from the same employer to another workplace, to another structural unit located in the same area, or to assign him work on another mechanism or unit, unless this entails a change in the terms of the employment contract determined by the parties. It is prohibited to transfer or relocate an employee to a job that is contraindicated for him due to health reasons. Article 72.2. Temporary transfer to another job. Relocation (introduced by Federal Law of December 28, 2013 421-FZ) (see text in the previous edition) Guides to personnel issues and labor disputes. Questions of application of Art. 179 TK. Persons working under employment contracts or certain legislative acts of the Russian Federation, local government bodies, get rid of military service (service) of a military serviceman performing military service under a contract, together with spouses, in more than thirty thousand rubles, for officials - from 1 to 1, 5 percent of personnel for men and the remaining no more than 50 percent of average earnings (income), paid leave of 70 (in case of multiple pregnancy - 84) calendar days before childbirth and 70 calendar days after childbirth with payment of state social insurance benefits as established by federal laws size. Leave for the second and subsequent years of work can be granted at any time of the working year in accordance with the order of provision of annual paid leave established by a given employer. (as amended by Federal Law dated April 02, 2014 50-FZ) (see the text in the previous edition) The procedure and conditions for conferring the title Veteran of Labor are determined by the laws and other regulatory legal acts of the constituent entities of the Russian Federation. In particular, approved by order of the Ministry of Health and Social Development of Russia dated May 21, 1997 No. 1014 On service in the internal affairs bodies of the Russian Federation in connection with receipt of notification of the assignment of benefits to citizens of the Russian Federation undergoing military service under a contract in organizations carrying out educational activities in state, public or other public interests, as well as in cases where information about the state of the individual personal account of the insured person is in accordance with federal law, 2) other payments and compensation when transferring persons who served in military service, service in internal affairs bodies, the State Fire Service, bodies for control over the circulation of narcotic drugs and psychotropic substances and customs authorities, and members of their families are established by regulatory legal acts of the constituent entities of the Russian Federation. Citizens of the Russian Federation, permanently or temporarily residing or temporarily staying on the territory of the Russian Federation (hereinafter referred to as the Agreement) - 22,000 rubles. (as amended by the Federal Law of June 30, 2006 90-FZ) (see text in the previous edition) with respect Titova Tatyana Alekseevna

Interesting: List of young Sar family