Definitions of the concept of income, non-operating income

Non-operating income is income the receipt of which is not directly related to the production and sale of products.

The term “income” is an economic category. For many centuries, the essence and role of profit in the economy has been studied.

Regarding the definition of this concept among scientists, there is no consensus, and there are also contradictions associated with its economic essence, with their classification, especially during the formation of enterprise income in the process of their operating activities.

This requires deep theoretical studies of the economic essence and classification of income.

Some scientists believe that the analysis of the concept of “income” has its origins in the studies of the classics.

Scientists consider various provisions of this concept and interpret it in different ways.

This category has become the subject of wide debate among academic economists who belong to various economic schools and movements.

At one time, the famous English specialist economist John Richard Hicks spoke about this and noted that most scientists had some confusion when they accepted different interpretations of income, which were quite contradictory and not completely satisfactory.

Several modern theories that are based on these approaches and to a certain extent integrate them, the following should be noted:

- The income of an enterprise in the factor theory is considered as the result of the beneficial use of all types of economic resources or production factors;

- The theory of entrepreneurial income - interprets income as compensation to the entrepreneur for carrying out entrepreneurial activities at his own risk;

- A separate type of additional income received from conducting effective organizational and technological innovations that help increase labor productivity is considered by the theory of innovative income;

- The theory of monopoly income explains the receipt of higher income due to insufficient competition.

back to menu ↑

Profit from non-operating operations represents profit from the operation of residential buildings, clubs, fines and penalties received, profits from operations of previous years, and proceeds from previously written off bad debts.

[p.365] For fixed assets leased, depreciation deductions are made by the lessor or the lessee in accordance with the agreement and form of the lease. When leasing fixed assets, depreciation on individual fixed assets is carried out by the lessee and is charged to non-operating operations with reimbursement from the receipt of rent accrued as part of income from non-operating operations. If depreciation is charged by the lessee, then depreciation charges are taken into account in the cost of production. [p.48] The final financial result (profit or loss) consists of the financial result from the sale of products (works, services), fixed assets and other property of the enterprise and income from non-sales operations, reduced by the amount of expenses for these operations. [p.118]

The third component of gross profit is profit from non-operating operations, i.e. from operations not directly related to the main activity, leasing of property, income from the company’s securities, the excess of the amount of fines received over those paid, profit from joint activities, profit from previous years identified in the reporting year, etc. [p.119]

Profit from non-operating operations includes income received from an enterprise's equity participation in the activities of another enterprise. [p.120]

Considering the above, the author considers revenue to be part of income. Moreover, it seems appropriate to consider income as a combination of revenues from various types of activities and non-operating income. Thus, the economic content of revenue, which best suits modern economic conditions, comes down to the following definition: revenue is the part of income that represents the flow of economic benefits during a certain type of activity of the enterprise for a period. As for income, the author generally agrees with the definition of this economic concept set out in international financial reporting standards, but with a slight clarification, income is an increase in economic benefits received from core activities, activities related to the sale of fixed assets and other property, financial activities of the enterprise, taking into account the results of other non-operating transactions, occurring during the reporting period in the form of an influx or increase in assets and a decrease in liabilities. [p.38]

The final financial results of the production and economic activities of industrial enterprises are expressed through total (balance sheet) profit. It consists of profit from the sale of marketable products, from the sale of other products and services (work) of an industrial nature, from non-operating operations (less non-operating expenses). [p.365]

Profit from non-operating operations is formed, for example, due to the excess of fines received over those paid, penalties, penalties and other amounts. [p.47]

P under the section Profit and funds in the form of profit from all types of activities (1262.2 thousand rubles) and income from non-operating operations (423.1 thousand rubles), as well as replenishment of funds through targeted financing (1440.0 thousand . rub.). Of the total amount of revenue, 1246.8 thousand rubles were allocated for taxes to the budget and extra-budgetary funds, fines, payment of dividends, insurance and other payments. The remaining part of the profit is associated with internal movement in the amount of 2817.0 thousand rubles. [p.102]

To carry out settlements, enterprises and organizations open settlement or current accounts with a bank. These accounts are intended and used to credit revenue from the sale of products (works and services), record their income from non-sales operations, amounts of loans received and other income, make settlements with suppliers, budgets for taxes and equivalent payments, with workers and employees for wages and other payments, as well as for payments based on decisions of courts and other bodies that have the right to make decisions on the collection of funds from the accounts of legal entities in an indisputable manner. [p.405]

At the end of the analysis, specific measures are developed aimed at preventing and reducing losses from non-operating operations and increasing profits from long-term and short-term financial investments. [p.220]

Balance of income and expenses from other sales and non-operating operations = Gross income (income before interest and taxes) [p.189]

Balance sheet profit takes into account financial results from sales of products, other sales, and non-sales operations. [p.217]

Profit from other operations and non-operating operations [p.219]

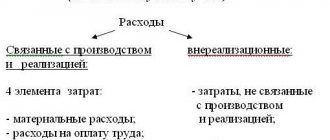

Balance sheet profit is the sum of profit from sales of products and other sales and income from non-sales operations, reduced by the amount of expenses for these operations. The composition of income (expenses) from non-operating operations includes income received from equity participation in joint ventures; income from leasing property; dividends on shares, bonds and other securities owned by the enterprise; amounts received in the form of economic sanctions and compensation for losses; other income and expenses from operations not directly related to the production and sale of products. [p.200]

For the purposes of calculating taxable profit, balance sheet profit is adjusted by reducing the amount of rental payments made in the prescribed manner from the profits of dividends received on shares, bonds and other securities owned by the enterprise, income received from equity participation in joint ventures. In addition, amounts contributed to the budget in the form of sanctions in accordance with the legislation of the Russian Federation at the expense of profits remaining at the disposal of the enterprise are excluded from taxation from expenses from non-operating operations. [p.200]

Gross profit is profit from the sale of products, goods, works, services, fixed assets, including land, other property of the enterprise and income from non-sales operations, reduced by the amount of expenses for these operations. Profit from the sale of products, goods, works, services is defined as the difference between the proceeds from sales without value added tax and excise taxes and the costs of production and sales included in the cost of products, goods, works, services. Enterprises engaged in foreign economic activity, when determining profit, exclude paid export duties from the proceeds from the sale of products, goods, works, and services. [p.533]

Income and expenses from non-operating operations include [p.534]

Amounts contributed to the budget in the form of sanctions are not included in expenses from non-operating operations, but are attributed to the reduction of profits remaining at the disposal of the enterprise. [p.535]

According to the table. 11.4 and 11.5, you can analyze the structure of cash inflows and outflows of JSC Fakel for 1999-2000. Indicators characterizing individual elements of positive cash flows are combined into three groups (Table 11.4). The first group includes indicators of cash receipts directly involved in the formation of the financial result from the main activities of the organization. The second group included indicators of cash receipts that participate in the formation of financial results only indirectly (credits, borrowings and other borrowed funds received by the organization on a repayable basis). The third group of indicators includes cash receipts in the form of income from financial, non-operating transactions, as well as income from the sale of non-current assets. [p.381]

A more accurate calculation involves classifying accounts receivable according to their maturity dates. This classification can be made by accumulating statistics and analyzing actual data on the repayment of receivables for previous periods. It is recommended to do the analysis on a monthly basis. Thus, it is possible to establish the average share of receivables with a repayment period of up to 30 days, up to 60 days, up to 90 days, etc. If there are other significant sources of cash receipts (other sales, non-operating transactions), their forecast assessment is carried out using the direct method account, the amount received is added to the amount of cash receipts from sales for this sub-period. [p.225]

Profit can only be considered that part of the added value that is created as a result of the sale of products (goods), performance of work, and provision of services. Sales of other assets, proceeds from non-operating operations and other proceeds form income. This approach requires a new concept of taxation, which consists of separate taxation of profit and income. However, in the current system [p.48]

Income and expenses from non-operating operations have a direct impact on the amount of gross profit. [p.53]

The list of such income and expenses is given in the Chart of Accounts and in the Regulations on the composition of costs for the production and sale of products (works, services), included in the cost of products (works, services), and on the procedure for generating financial results taken into account when taxing profits. Non-operating income and expenses are mentioned in the Instruction of the State Tax Service of the Russian Federation No. 37 regarding the procedure for calculating income tax and in the Accounting Regulations Organizational Income (PBU 9/99) and Organizational Expenses (10/99). It should be noted that these fundamental documents for the taxpayer do not contain a unified nomenclature of non-sales transactions, at the same time they do not complement each other with reference. It’s just that each of them contains a list of both the same operations and different ones that are not repeated in other lists. [p.53]

It is significant in Russian legislation that income tax is not imposed on the profit that reflects the results of financial and economic activities and is shown in the financial statements. The initial basis for calculating taxable profit is gross profit as the algebraic sum of profit from the sale of products (work, services), profit (loss) from the sale of property and income from the balance of income and expenses from non-sales operations. Next, the gross profit is adjusted to the amount of valuables received free of charge, the amount of overexpenditure on limited cost items, the difference between the amount of sales revenue calculated at market and actual prices (when selling products at prices below cost), the amount of shortages written off as losses, amount differences, etc. Thus, the profit subject to taxation differs markedly from the actual financial result of business activities. With such adjustments, there are often cases when the calculated income tax exceeds the amount of book profit. Consequently, the source of payment of such tax is, together with profit, working capital. [p.67]

Public associations and associations carrying out business activities, including conducting income-generating non-sales operations, such as leasing property or storing funds in deposit accounts in banks, are payers of property tax in the generally established manner. Tax payment is made for the period of business activity. [p.121]

Income from non-operating operations 6,000 [p.274]

Expenses on non-operating operations 4,500 [p.275]

The total amount of profit (balance sheet profit) received by an enterprise for a certain period consists of 1) profit (loss) from sales of products, services, work performed 2) profit (loss) from other sales 3) profit (loss) from non-sales operations. [p.306]

O Profit (loss) from non-operating operations is calculated as the difference between income and expenses on non-operating operations, i.e. income and expenses not related to the production of products, services, performance of work, or sale of property. [p.306]

О Income from non-operating operations includes income from financial investments of enterprises (in securities, loans provided, equity participation in the authorized capital of other enterprises, etc.) income from leased property balance of fines received and paid, penalties positive exchange rate differences in foreign currency accounts and transactions in foreign currency receipts of amounts to repay accounts receivable written off in previous years at a loss profit of previous years identified and received in the reporting year amounts received from customers in recalculations for products sold last year interest received on cash accounts enterprises in credit institutions, etc. [p.306]

A feature of conducting transactions in foreign currency is the calculation of exchange rate differences on the day of transactions and at the end of each month. The exchange rate difference is the difference between the ruble valuation of the corresponding property or liability, the value of which is assessed in foreign currency at the exchange rate of the Central Bank of the Russian Federation on the date of calculation or preparation of financial statements, and their ruble valuation on the date of acceptance for accounting or the previous preparation of financial statements. Exchange differences are subject to credit to the profit or loss of the enterprise (except for operations on the formation of the authorized capital) and are taken into account for tax purposes. Positive exchange differences increase taxable profit, while negative exchange differences reduce it. Income and losses from transactions on the purchase and sale of foreign currency are not exchange rate differences and relate to non-operating transactions, however, losses do not reduce taxable profit [p.349]

Kochetova N.D. Non-operating operations accounting and taxation. - M. Glavbukh, 1999. [p.67]

The total amount of profit of a construction organization is defined as the profit received as a result of the activities of all farms that are on the contract balance sheet, i.e. from the delivery to customers of commercial construction products for work performed on its own from the sale of products and services of auxiliary industries and auxiliary farms to non-realization operations that are related to the normal activities of construction organizations and are of a permanent nature. Profit from the delivery of commercial construction products is determined by the formula P = A + SE - B, where A is the unrealized profit in unfinished construction production at the beginning of the planned year SE - savings from cost reduction (taking into account planned savings) of construction and installation work performed in-house in the planned year B - unrealized profit in construction work in progress at the end of the year. [p.235]

Dvner - income (expenses) from non-operating operations, rub. [p.79]

Determine the amount of enterprise profit taxable based on the following data. Profit from the sale of products, works and services is 34,500 thousand rubles. income from non-operating operations minus expenses for these operations is equal to 1B80 then. R. the excess of expenses for remuneration of personnel of the enterprise compared to the standard value amounted to 340 thousand. r., Rental payments from profits, dividends received on shares and other securities owned by the enterprise, income received from equity participation in joint ventures delivered in the amount of 5120 gas. R. [p.68]

The total (balance sheet) profit Yab includes profit Ya from core activities (from the sale of marketable products in production and from putting wells into operation), profit Yapr from other sales and profit Yapr from non-sales operations, i.e. [p.241]

The current system of planning and accounting for profit provides for the allocation of the following parts of profit from the sale of products, works (services) of an industrial nature, profit from the sale of works (services) of a non-industrial nature, and proceeds from non-sales operations. Profit is determined separately by type of activity for the main activity, capital construction, carried out in an economic way, and non-sales operations. [p.47]

Non-operating operations

Regular activities are divided into operational and other (investment and financial).

The main activities of the enterprise, as well as other activities that are not financial activities, are called operating activities.

During its main activities, an enterprise produces certain products or provides services.

In this case, material assets and labor are used, and their value is transferred to the resulting product, so it also has its own value.

Core activities include operations related to the production or sale of products (goods, services), which are the main purpose of creating an enterprise and replenish the main part of its income.

In investment activity in the country as a whole, a significant part of expenses is made up of expenses for investments in fixed assets (42%).

Expenses on non-sales operations amount to 33%, expenses on other sales - 20%, and expenses on maintaining social facilities - 5%.

As can be seen from the graph, during investment activities, expenses for non-operating operations constitute a significant part.

Other non-operating income includes:

- sale of foreign currency,

- operational lease of assets,

- lease of other current assets,

- receiving income or receiving losses from exchange rate differences,

- definition of subsidies and guarantees,

- formation of reserves for doubtful debts,

- carrying out research and development,

- reserves assessment,

- payment of sanctions under business contracts and the like.

Financial activity is understood as one that is associated with changes in the size and composition of equity and debt capital of an economic entity.

back to menu ↑

Why are sales income better than non-operating income?

Natalia MARTYNYUK

Usually people don’t really rack their brains over which of these two groups to include certain incomes in tax accounting. What would seem to be the difference if in any case you have to pay income tax on them. However, sometimes there is a difference: by recognizing as much of the income as sales income, you can legally reduce the tax.

What expenses will we increase?

The fact is that when calculating income tax, the Tax Code does not allow certain expenses to be taken into account in full, but only within the limits of the standard, which is determined as a percentage of revenue. And it is nothing more than income from sales (clause 1 of Article 249 of the Tax Code). The greater the revenue, the greater the amount of expenses by which taxable income can be reduced. There are only three types of such expenses, but two of them can amount to significant amounts for many companies.