To organize a decent funeral ceremony today requires significant financial costs. It is not surprising that many people of retirement age in Russia try to accumulate savings in advance for their burial, purchase land in a cemetery or a cell in a columbarium, in order to make the task easier for their loved ones in the future.

Unfortunately, not everyone knows that funeral expenses can be compensated by obtaining a funeral benefit and other financial payments, which can be quite large. But such a benefit is an opportunity to make a more dignified burial for a loved one.

Who is eligible to receive funeral benefits?

Any person can apply for a funeral benefit in 2020 if he or she incurred the financial costs of the burial and holding a farewell ceremony. It doesn’t matter whether this person is a close relative or just a friend, colleague who volunteered to help. There are exceptions to this rule. They relate to cases where we are talking about certain supplements to the standard benefit. Here there are already possible restrictions on the degree of relationship and other requirements that will have to be met.

All benefits are available for receipt only once. This right remains for six months from the date of death. If you make a request later, there is a high chance of being refused.

Comments and opinions

Secondly, it should be noted the difference between payments accrued in the general manner (for the example under consideration - wages for September) and accruals in the final calculation upon termination of employment with a deceased employee. In general, the day of termination of an employment contract is the last day of work of the employee (Article 84.1 of the Labor Code of the Russian Federation). The date of termination of the employment contract due to the death of the employee (clause 6, part 1, article 83 of the Labor Code of the Russian Federation) is the day of death. Payment of all amounts due to the employee from the employer is made on the day of dismissal (Article 140 of the Labor Code of the Russian Federation). Thus, it is on the day of death that payments are calculated in the final calculation, for example, wages for the period from October 1 to October 4 (5) and compensation for unused vacation.

As for personal income tax, it is paid by the taxpayer himself. A tax agent is an intermediary whose duty is to withhold the calculated amount of personal income tax directly from the taxpayer’s income upon actual payment and transfer this particular withheld amount to the budget system of the Russian Federation (clauses 4, 6 of Article 226 of the Tax Code of the Russian Federation). Consequently, the calculated amount of personal income tax cannot be transferred to the budget before it is withheld, before it is paid. This means that even if the tax agent recognized wages for September as income received on the last day of the month for which it was accrued - September 30 and calculated personal income tax, then withhold and transfer personal income tax to the budget system of the Russian Federation until the actual payment of wages (for the considered example - until October 10) he cannot. The employee who died on October 5 never received wages for September. At the same time, his obligation to pay tax is terminated from the date of death (subclause 3, clause 3, article 44 of the Tax Code of the Russian Federation). Therefore, the tax agent did not have the obligation to withhold personal income tax from wages for September accrued to an employee who died (letters of the Ministry of Finance of Russia dated April 24, 2020 No. 03-15-06 / 24374, dated October 6, 2020 No. 03- 04-05 /58142).

We recommend reading: Amount of Child Care Benefit for Children Under 3 Years of Age in 2020

What documents are required to receive benefits for the funeral of the deceased?

The first step on the path to funeral benefits is collecting all the documentation. First of all, you need to fill out the appropriate application. You can find the form and sample on the Internet and on the government services website. You need to have documents with you confirming that the person really died and you need money for his burial.

Also, do not forget to take your passport with you and find out your bank details in advance in order to receive money into your account. Another method of receipt is a money order, which is issued at the post office.

In some cases, it is necessary to prepare other documentation. For example, in order to receive a funeral benefit from the Moscow government, you need to confirm that the deceased person was registered in the capital and therefore has the right to an increased benefit.

Basic funeral benefit

The basic benefit amount in 2020 is 6124.86 . This is the minimum amount that every citizen of Russia is entitled to for burial, regardless of his type of activity and social status. This amount is indexed annually. In some regions, regional coefficients and surcharges for funerals from local authorities may be introduced. In Moscow and the Moscow region, residents can count on additional financial support in the amount of 11,616 rubles. and will amount to 17,740.86 rubles .

For many categories of citizens, increased benefits and funeral benefits are provided in addition to the benefit. To receive a basic payment for the funeral of a Russian citizen, you need to come to the social protection department with a pre-prepared package of papers.

How to receive benefits for the funeral of a pensioner?

Money for the funeral of pensioners who did not work or worked but received a “salary in an envelope” must be requested from the Pension Fund. This rule also applies to the burial of the indigenous peoples of the North.

You should apply for financial assistance at the same branch of the Pension Fund where the deceased last received his pension. In addition to the standard package of documentation indicated above, you need to take with you a document confirming the fact of relationship between the deceased and the applicant, as well as a document indicating the place of registration of the applicant at a given time.

List of documents

Each authority has its own nuances of the process. However, general requirements for documents can be identified:

- A statement indicating a request for payment of benefits.

- Identity document.

- Certificate confirming the fact of death.

- Confirmation of specific place of residence.

Important! In some cases, you will also need to prove the fact of relationship with the representative.

The procedure for obtaining funeral benefits from the employer of the deceased

If the deceased had an official place of work on the day of death, a request should be sent to his employer with a request to assign a death benefit to the employee. In this case, you can count on payment of the minimum basic benefit. However, be sure to look at the employment contract. If there was a provision for compensation for funeral expenses in excess of the minimum benefits established by the government, the final amount will be higher. Additional funds are paid from the Compulsory Social Insurance Fund.

Keep in mind that any payments from the employer are provided only for officially employed citizens. If the deceased person worked unofficially or under a civil contract, you should apply for benefits to the social protection authorities. There you will receive a basic benefit in the prescribed amount. The procedure for paying funeral benefits will be standard.

In some cases, relatives of the deceased may receive financial compensation from their employer. You can find information about the possibility of such payment in the collective agreement. Members of trade unions can also count on additional financial support, but in this case the degree of relationship for a person who wants to receive money for funeral expenses is often limited.

Financial assistance and insurance premiums in 2020-2020

For the purposes of calculating income tax, material assistance to employees does not reduce the tax base (clause 23, article 270 of the Tax Code of the Russian Federation). At the same time, the Russian Ministry of Finance allows the accounting of financial assistance paid for vacation as part of labor costs. For income tax purposes and under the simplified tax system:

- financial assistance paid for vacation is taken into account in labor costs if its payment is provided for in an employment (collective) agreement or local regulation and is related to the employee’s performance of his job duties (clause 25 of article 255 of the Tax Code of the Russian Federation, subclause 6, clause 1 , clause 2 of Article 346.16 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated September 2, 2014 No. 03-03-06/1/43912, dated October 22, 2013 No. 03-03-06/4/44144, dated September 24, 2012 No. 03- 11-06/2/129);

- financial assistance paid for other reasons is not taken into account in tax expenses (clause 23 of article 270, clause 2 of article 346.16 of the Tax Code of the Russian Federation).

Funeral benefit for a minor

And in this situation you will have to make a request to the employer. There are some nuances here: one of the parents must make a request to their employer. It is no coincidence that a death certificate is issued in one copy. This is done to eliminate the possibility of receiving money multiple times.

The calculation and processing of payment of benefits for the funeral of children occurs according to the principle described above: the base rate plus payments from the Compulsory Social Insurance Fund, if this is provided for in the collective labor agreement. If parents do not have an official place of work, they will have to contact the Social Protection Center. Here you can only count on the minimum amount of financial assistance for burial.

In both cases, in addition to the standard list of documentation, you will need to take with you the child’s birth certificate.

Calculation of premiums: features of filling out by policyholders - pilots

The Tax Service has updated its previous letter regarding the inclusion of employer expenses for payment of benefits in the calculation of insurance premiums. In particular, it was clarified in what cases policyholders participating in the Social Insurance Fund pilot project must fill out appendices 3 and 4 of the calculation.

Let us remind you that in relation to VNIM benefits, “pilots” do not fill out Annexes 3 “Expenses for compulsory insurance in case of temporary disability and in connection with maternity...” and 4 “Payments made from funds financed from the federal budget.” Indeed, within the framework of the pilot project, “sickness” benefits are paid to insured persons directly from the Fund.

10 Jun 2020 lawurist7 482

Share this post

- Related Posts

- Confiscation of Debts

- Unemployment in the world 2020 statistics

- Conditional early release under Article 228 Part 2 of the Criminal Code of the Russian Federation

- How Bailiffs Ensure the Safety of a Seized Car

Benefit for disabled people and participants of the Great Patriotic War

The largest supplements to the minimum benefit are provided for this category of citizens. In Moscow, the benefit can reach up to 38,400 rubles . With this money you can have a very decent burial. The principle of calculation is simple: the amount is equal to 35 minimum wages for the current calendar year. In this case, you can fully cover the funeral expenses.

There are no restrictions on the degree of relationship here. To receive a funeral payment, if you are dealing with this issue, you should contact the social security department.

Also, the funeral ceremony can be entirely organized by the War Memorial Institution, taking into account the wishes of the loved ones of the deceased person. No one will argue that WWII veterans have special services to the state. To pay tribute to the deceased, in addition to the standard list of ritual services and burial paraphernalia, it is planned to install an honorary sign or a worthy monument, the funeral ceremony takes place with an honor guard and orchestral accompaniment.

Benefits for military personnel

This category includes not only active military personnel, but also employees/veterans of internal affairs bodies and the penal system, fire and customs services.

If the deceased had the status of a military pensioner, the maximum benefit amount this year will be 27,016 rubles . Applicants have an alternative: instead of the base rate, they can receive an amount equal to the deceased’s pension for 3 months, and use this money to make a funeral.

If the deceased had the status of an active military personnel, members of his family have the right to receive insurance payment and a lump sum benefit in cases where the deceased died under the following circumstances:

- During military training;

- While performing military duties;

- Due to injury received during military service.

Among other things, you can receive partial or full compensation for the cost of a tombstone. The amount of this payment cannot exceed 20% of the total amount of money for burial.

Cost compensation mechanism

For six years, the pilot project “Direct Payments,” initiated by the Federal Social Insurance Fund of the Russian Federation, has been undergoing phased testing in the regions of the Russian Federation.

At the moment, there are already 39 regions among the participants in the FSS project (the full list can be clarified in paragraph 2 of the Decree of the Government of the Russian Federation No. 294 of April 21, 2011, as well as in the Decree of the Government of the Russian Federation No. 619 of May 30, 2018). The project will operate until 2020 inclusive. Under the offset mechanism, which until January 1, 2012 was in effect everywhere in all subjects of the country, the employer is obliged to independently calculate and pay to the insured person all provided types of social benefits, in addition, the insured enterprise is obliged to make monthly contributions to social insurance for temporary disability and in connection with with maternity (VNiM) for each employee from the amount of accrued wages for the month in favor of employees (the amount of insurance contributions is established by Chapter 34 of the Tax Code of the Russian Federation). In this regard, in order to avoid double taxation of contributions, the insured enterprise has the right to compensation for expenses incurred in paying social benefits to its employees (clause 2 of Article 431 of the Tax Code of the Russian Federation).

There are two ways to offset these costs:

Method 1: You can offset the costs incurred for the payment of benefits against the repayment of accrued social insurance contributions for the corresponding period.

For example, for June 2020, benefits were paid in favor of insured employees for a total amount of 20,653.74 rubles, and the total amount of insurance premiums accrued for June 2020 was 33,360.70 rubles, therefore, the employer for June is subject to payment of social insurance contributions for VNIM 12,706.96 rubles. (33,360.70 – 20,653.74);

Method 2: Alternatively, the enterprise can reimburse the amount of benefits from the Social Insurance Fund of the Russian Federation in cases where the costs incurred for the payment of benefits exceed the amount of accrued insurance premiums for the period (usually for a quarter or a calendar year).

Benefit for Chernobyl survivors

Additional benefits are provided for the burial of Chernobyl victims and those who took part in eliminating the consequences of the accident at the Chernobyl nuclear power plant, as well as at Mayak. You can count on an increased amount of benefits only if the deceased had a disability resulting from an accident at the specified facilities, or died as a result of a disease, the development of which was contributed to by the accident.

In addition to standard documents, you must provide a document that confirms the deceased’s right to receive social assistance for burial. The amount of the supplement to the funeral benefit in 2020 will be 11,848.75 rubles .

Who gets paid

An application for receiving funds must be written by the person who paid for all procedures related to the funeral . This mission is most often assigned to a close relative or acquaintance of the deceased.

It is they who will subsequently receive social benefits for burial. Today, such organizations are most often engaged in:

- husband or wife:

- other close blood relatives;

- the legal representative of the deceased, who was such during his lifetime;

- other persons. This group may include friends, acquaintances, colleagues or neighbors.

In 2020, the amount of the benefit directly depends on the region in which the deceased lived . The state pays a certain amount if the following person dies:

- pensioner;

- a person of pre-retirement age who worked officially;

- child under 16 years of age;

- unemployed citizen;

- a baby who was born dead.

All citizens of the country have burial benefits. Additionally, the state gives them a number of other guarantees:

- If a person did not have close relatives or acquaintances who would take responsibility for the burial, then all manipulations must be performed by a special service. In this case, their services will be paid from the state budget .

- The funerals of military personnel are also fully paid for by the state. At the same time, no attention is paid to the conditions under which death occurred.

- If a person’s death occurs in places of deprivation of liberty, then the Ministry of Justice of the Russian Federation will bear all costs.

- If death occurs due to the organization of a terrorist act, the costs will be repaid in full by government agencies. Additionally, it should be noted that releasing bodies to relatives or telling them about the burial place is strictly prohibited.

Benefits for foreigners

Few people know, but you can also count on benefits if the deceased is a citizen of another country. This is possible if several conditions are met:

- A foreign citizen died on the territory of the Russian Federation;

- The persons responsible for organizing the burial are blood or legal relatives of the deceased;

- The burial takes place on the territory of the Russian Federation.

Such requests for benefits are considered on a case-by-case basis. In addition to the standard list of documents, the applicant may be required to provide an explanatory note.

Benefit or free funeral

It is also useful to know about the possibility of organizing a burial not on your own and completely free of charge. This is available to the following categories of people:

- Children who were stillborn when the mother's gestational age was at least 154 days;

- WWII veterans;

- Officially unemployed persons, in particular pensioners;

- Disabled people of groups I, II and III;

- Deceased people who have no relatives (as well as when relatives refuse to organize a funeral).

If the deceased falls under one of the listed categories, his relatives have the right to choose: to conduct the burial at their own expense and benefits, or to request a free social burial. In the latter case, the citizen loses the right to receive benefits.

Do I need to prove funeral expenses?

Despite the fact that a receipt for payment for funeral services in many cases is not among the mandatory documentation that must be provided to those wishing to receive benefits, a payment document may be additionally requested from you at any time. That is why it is worth not only keeping all receipts, but also choosing a reliable funeral service that has state accreditation and can provide a cash receipt or form BO-13.

If you would like to clarify the possibility of receiving a funeral benefit and the procedure for processing the payment, please contact our funeral service staff. We provide comprehensive assistance in organizing the funeral and in resolving related issues.

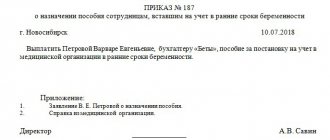

Financial assistance to relatives of a deceased employee - documents, accounting

Payment of financial assistance to the relatives of a deceased employee is documented with the following documents. If checkmate Assistance is paid from retained earnings of previous years, then its payment must be approved by the founders. For this purpose, the decision of the sole founder or the minutes of the meeting of founders is drawn up. If mat. Assistance is paid out of current profits, then the consent of the founders is not required. Next, an order from the manager for the payment of swearing is issued. help. The fact of payment of mat. assistance must also be documented. If you give money to relatives in cash, then such payment is formalized by an expenditure cash order. In accounting, this operation is recorded with the following entries:

We recommend reading: Cost of registering a car with the traffic police in 2020 without replacing license plates

No taxes or contributions were assessed on the amount of benefits and financial assistance. The accountant did not take these payments into account when calculating income tax. A permanent tax liability has been accrued in accounting (due to the difference in the recognition of expenses for the payment of financial assistance in accounting and tax accounting):