Last updated 06/26/2019 In 2020, the government took a number of additional measures to support families with children. Starting this year, parents have the opportunity to receive additional benefits for their second child until he reaches one and a half years old from maternity capital funds.

In the new year 2020, families will receive additional financial support from the federal budget for the birth of a third child in 62 regional constituent entities of the Russian Federation, according to Decree No. 1747-r dated August 27, 2018. No new payments are expected in 2020.

Indexation of child benefits in 2020

In recent years, the indexation of social payments, including child benefits, has been carried out on February 1, according to Decree of the Government of the Russian Federation dated January 28, 2018 No. 42.

If before January 1, 2020, increases in benefits, compensation and other payments were carried out ahead of expected inflation, now payments are indexed based on actual inflation over the past year. In 2020, benefits are indexed from February 1.

In the government decree of January 24, 2020, the indexation coefficient for child benefits from February 1 is 1.043.

On February 1, 2020, the following manuals were indexed:

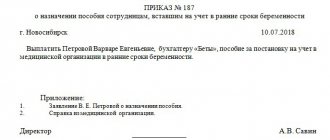

- One-time benefit for women registered before 12 weeks of pregnancy;

- One-time payments in connection with the birth of a child.

The child care benefit for children under 1.5 years of age increased from January 1, due to the fact that from January 1, 2020, the minimum wage (minimum wage) is equal to the subsistence level for the second quarter of 2020.

Benefit for working mother

Officially employed women are paid a monthly allowance for a child up to 1.5 years of age by the employer, and its amount directly depends on her salary at the time of going on maternity leave. The amount of the benefit is equal to 40% of the salary, but cannot exceed 100% of the salary received or the average earnings in the region. Since 2019, the benefit amount has increased to 26,152 rubles. The amount of the monthly child care benefit is calculated per child; if twins are born, the amount increases by 2 times, i.e. equal to 80% of earnings.

If you continue your childcare leave until the age of 3, you cannot count on a monthly childcare allowance. In this case, the mother can only be paid compensation in the amount of 50 rubles.

Child benefit for a working mother

The following should be said about what kind of monthly child benefit a working mother is entitled to: the amount of child benefit is on average 500 rubles, but it is paid only to those who really need it. As a rule, during the first 1.5 years of the mother’s maternity leave, it is paid, but the amount depends on whether the mother is officially married or raising the child alone. Single mothers can count on the maximum benefit amount.

Child care allowance up to 3 years old

A monthly compensation payment for up to 3 years is paid to one of the parents caring for the child. The amount of this benefit was established back in 1994 by Presidential Decree No. 1110 in the amount of 50 rubles.

The last time the issue of increasing this payment was discussed was in 2014, but in the end no decision was made.

The benefit amount will change from 2020

In 2020, there was finally talk of increasing benefits at a “high level.” The information that the payment will increase was confirmed by the Minister of Labor and Social Protection Maxim Topilin, as well as the President and Prime Minister of the Russian Federation.

All three announced that the amount of the benefit would be equal to the regional subsistence minimum per child, that is, more than 10,000 rubles. True, according to Dmitry Medvedev, only low-income families will receive benefits in this amount:

“It was decided to increase assistance to low-income families with children aged one and a half to three years. They will receive more than 10 thousand rubles per child monthly instead of the previous 50 rubles.”

It is not yet known how much the remaining families will receive.

In Russia, benefits for children under 3 years of age will be abolished

On November 26, 2020, a presidential decree appeared on the online legal information portal, which cancels the assignment of child benefits for child care from 1.5 to 3 years . The document comes into force on January 1, 2020. The size of this monthly payment was 50 rubles .

Let us remember that this measure of social support was introduced back in 1994 and has never changed since then.

Please note that the changes will only affect those recipients to whom these benefits have not yet been assigned . For those who received assistance before the adoption of the relevant legislation, payments will be calculated according to the old rules .

The Ministry of Labor has prepared changes to the payment of child benefits

From January 1, 2020, there will be some changes in the procedure for paying child benefits for low-income families for the first and second child, which will look like this:

- The income limit of the family that applies for payment will be increased. Starting next year, this figure will correspond to two subsistence minimums. In 2020, only those citizens whose income does not exceed 1.5 monthly income are entitled to benefits.

- Payments will be made until the child turns 3 years old (currently funds are paid for children under 1.5 years old). You can submit an application at any time.

- Registration will be divided into 3 periods: up to 1 year, from 1 year to 2 years, from 2 to 3 years. At each period, documents confirming the right to payment must be resubmitted. In 2020, the appointment takes place for a year, after which the documents are submitted again only once.

What will change in benefits for children under three years of age?

We have prepared a short guide for you on what will change in child benefits from January 1, 2020.

- The benefit of 50 rubles per child from 1.5 to 3 years old will remain unchanged.

- Putin's payments for the first and second children will change.

- For the third and subsequent child in the family there will be no Putin payments until the age of three - only 50 rubles.

- The payment is due only to those families in which a child was born since January 1, 2020.

- From January 1, 2020, the criterion of need will change - families whose average per capita income does not exceed two subsistence levels in the region will be able to apply for benefits.

- From January 1, 2020, Putin payments for the first and second child will be paid up to 3 years.

- The size of the benefit will remain unchanged - one subsistence minimum in the region.

- You can apply for benefits at any time until the child turns 3 years old.

- From 2020, the payment will be assigned not for a year, but until the child turns one year old. After which the application for benefits for up to 2 years and confirmation of income criteria will need to be submitted again. Once the child reaches 2 years old, you will have to apply for an appointment again.

- If your child was born before January 1, 2020, you are entitled to nothing!

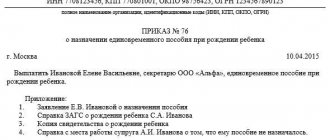

One-time benefit for the birth of a child

At the birth of a child, a woman has the right to three types of lump sum payment:

- For registration at the antenatal clinic for up to 12 weeks - 655.49 rubles.

- For pregnancy and childbirth. It is calculated based on the average earnings of a young mother over the past two years.

- One-time payment at the birth of a child - 17,328.73 rubles.

In addition to federal one-time payments, there are also regional additional payments. For example:

- In Moscow, a young family in which both spouses have not reached the age of 30 is entitled to a lump sum payment from Luzhkov. For the first child the amount is 5 subsistence minimums, for the second - 7, and for the third and subsequent ones - 10 subsistence minimums.

- in the Moscow region a one-time payment is provided to low-income families in the amount of 20 thousand rubles for the second child,

- in St. Petersburg - 28,700 rubles,

- in Voronezh - 20 thousand rubles for each child born,

- Kaliningrad residents, as well as students and single mothers from the Jewish Autonomous Region - 7 thousand each,

- in Kaluga - 22,326 for 2 children,

- in Khanta-Mansiysk - 10 thousand for the second child,

- In the Chukotka Autonomous Okrug, young parents - 10 thousand rubles,

Maternity payments

The right to maternity benefits for pregnancy and childbirth is granted to:

- officially employed and temporarily unemployed expectant mothers,

- military women,

- women who lost their jobs due to the liquidation of an enterprise,

- full-time students.

For working women, the payment is calculated based on the woman’s average official earnings for the last two years. If the average earnings during the specified period of time exceed the minimum wage, then the payment will be 100% of this amount. Otherwise, the woman is paid a fixed amount equal to the minimum wage, which from May 1, 2020 is 11,163 rubles.

Maximum and minimum amounts of maternity payments at the beginning of 2019:

| Duration of maternity leave in days | Minimum amount | Maximum amount |

| 140 (sick leave) | 51,919 rubles | 301,096.6 rubles |

| 156 (complicated childbirth) | 57,852.6 rubles | 335,507.64 rubles |

| 194 (multiple pregnancy) | 71,944.9 rubles | 417,233.86 rubles |

Who can apply for benefits

A subsidy of 50 rubles, which is paid until the child reaches 3 years of age, is assigned to the mother after childbirth and is registered at her place of employment or at the Social Security Administration. Paid to the following groups of women:

- those on parental leave and not fired during it;

- those in military service or working in military units in a civilian position;

- working at home or part-time;

- unemployed people laid off due to the closure of an enterprise;

- unemployed people undergoing retraining courses;

- students of correspondence universities;

- private entrepreneurs;

- caring for a disabled minor of group 1.

https://youtu.be/aM6Gbpqru8Y

Women laid off during maternity leave as a result of the liquidation of an enterprise receive payments from social security departments, but only if the mother is not registered with the employment center.

In addition to the mother, other citizens can make additional payments in her place. This:

- father;

- guardian;

- adoptive parent;

- grandmother grandfather;

- other close relatives who constantly look after the child.

If a woman plans to go to work and there is no place in the nursery, the benefit has the right to be reissued by the person who will look after the baby. Payments are also made monthly.

Child care allowance up to 1.5 years old

In addition, the father or mother, depending on who will care for the baby, have the right to receive child care benefits for up to 1.5 years. Unemployed parents also have the right to receive payments, but in a minimal amount.

An increase in benefits for the unemployed is expected only after February 1, 2019. Until this time, the amount of child care benefits is as follows:

- For officially employed parents, the amount is 40% of average earnings, but not more than 26,152.39 rubles and a minimum of 4,512 rubles for the first and 6,284.65 for the second child.

- The unemployed are paid 3,142.33 rubles for the first child, 6,284.65 rubles for the second and subsequent children.

To calculate maternity benefits, as well as child care benefits for children up to 1.5 years old, you can use the calculator on the official website of the Social Insurance Fund.

Termination of child benefit payments

If the following conditions occur, the payment of benefits stops on the next day.

So, the conditions for stopping payments:

- A woman returns from maternity leave and returns to work full time.

- If an unemployed mother starts receiving unemployment benefits

- If during maternity leave a woman goes on maternity leave

- If the mother quit of her own free will

- When transferring a child to full state support

- If parents have been deprived of parental rights

Important! The obligation to inform the employer (or the social security authority) that the above circumstances have occurred rests with the employee himself.

Payments for the second child

The birth of a second child in the family entitles parents to receive all the same payments that are due at the birth of their first child:

- maternity benefits

- lump sum payment

- child care allowance up to 1.5 years

- maternal capital

In 2020, in order to resolve the unfavorable demographic situation in the country, a number of incentive measures were taken:

- introduction of a monthly allowance for the second child until he reaches 1.5 years of age,

- extending the validity period of the maternity capital program and expanding the scope of its use,

- preferential mortgage with government subsidies for families with more than two children

- renovation and construction of new children's clinics

- eliminating queues at nurseries and kindergartens.

All payments due for the second child will remain in 2019, but the most significant assistance for the birth of a second child remains maternity capital.

What affects the type and amount of child benefit?

From the moment a child is born until he reaches the age of 3 years (and in some cases for a longer period), the state assumes the responsibility to support citizens with children. During these 3 years, various benefits and compensations are paid to parents (relatives, guardians and other persons) for the maintenance of the child. They can be regular or one-time. They can be provided under both federal, regional, and local legislation.

The type of benefits and payments for a child under 3 years of age is largely determined by his age (see the figure below):

But not only age determines the type and amount of payment. The assignment of individual benefits is made upon fulfillment of certain conditions related to the level of family income and/or the date of birth of the baby. For example, monthly payments from maternity capital until a child reaches the age of 1.5 years are not available to everyone. The figure below shows the conditions under which such a payment is possible:

Benefits for up to three years in 2020 may be assigned depending on the fulfillment of other conditions. For example, for large families, regional special payments for the third child are available, introduced in areas with low fertility rates.

Next, we will tell you in more detail about the amounts and types of benefits for a child under 3 years of age.

Payments for a third child

In 2020, no significant changes are expected in the case of the birth of a third child. Such a family has the right to receive one-time and monthly benefits, including as a low-income family, provided that the family’s average per capita income is below the subsistence level. In addition to federal ones, there are also regional payments for families with three children, and from 2020, families with three children from 60 regions will receive additional financial support from the federal budget.

At the same time, a family with three or more children receives the status of a large family, which gives it the right to a number of benefits and privileges, including additional payments.

What benefits are available to families with a third child:

- preferential mortgage without down payment for up to 30 years,

- Free land plot (this benefit is not available to Muscovites),

- 30% discount on utility bills and electricity,

- Free travel on public transport for one of the parents,

- Priority when enrolling in a preschool institution,

- Free meals at school,

- Annual compensation for the purchase of school uniforms and stationery.

A more detailed list of benefits that are available to large families can be found at the social protection authorities at the place of residence.

Benefits for military families

Financial assistance for military women or wives of military personnel is slightly different.

Maternity benefit for the wife of a serviceman

A one-time benefit to the wife of a military serviceman is provided to a citizen of the Russian Federation if the pregnancy period exceeds 180 days (6 months) . Its size is 28,732.85 rubles.

Financial assistance is processed at the social protection department. To complete this procedure you will need:

- Application for the need to receive benefits.

- Photocopy of marriage certificate.

- A certificate from a medical institution confirming registration in the first trimester.

- SNILS and TIN of the parent.

- Certificate confirming the status of a military personnel. Issued at the place of work.

The time period from the moment of submitting the application until the receipt of funds should not exceed 10 calendar days .

Also, the wife of a conscripted soldier is entitled to a monthly child care allowance.

Child care allowance up to 1.5 years old

Payments for the care of a military child are provided to wives whose husbands are serving in military service. Their amount is 12,314.07 rubles (previously 11,096.76 rubles) monthly . The registration process is carried out at the social protection department at the place of registration. To do this, you need to prepare a number of documents in advance:

- Photocopies of the birth of all children.

- Statement of need for benefits.

- A certificate from your place of employment containing the amounts of all payments for the last 3 months.

- A document issued by a representative of the military commissariat stating that the child’s father was called up for military service.

- A certificate confirming the child’s cohabitation with the parent. Issued at a children's clinic or housing office.

The application review period is 10 days .

Maternity capital in 2019

The amount of maternity capital in 2020 will remain at the same level and amount to 453,026 rubles. Regular indexation of maternity capital will resume only from 2020 and, as follows from the explanatory note to draft federal law No. 556363-7, the amount will increase:

- in 2020 - up to 470,241 rubles;

- in 2021 - up to 489,051 rubles.

The right to receive maternity capital appears in a family with the birth of a second child or subsequent ones, provided that the certificate was not previously received. Maternity capital can only be used for certain purposes:

- Improving living conditions,

- Children's education,

- formation of mother's pension,

- social adaptation of disabled children,

- monthly payments for the second child.

No one-time payments from maternity capital funds are provided.

According to the rules, maternity capital can be used only when the child for whom it was received reaches three years of age. But there are areas where the use of capital is possible immediately after the right to receive it:

- as down payment, interest or principal on a mortgage loan;

- payment for preschool education of children (including in private organizations);

- monthly allowance (the amount depends on the region of residence of the family);

- social adaptation of disabled children.

From 2020, funds from maternity capital can, in addition, be used to build a house on a garden plot. This became possible after the adoption of Law No. 217-FZ of July 29, 2017. From 2020, the pension fund will have 15 days, rather than a month, to make a decision on issuing maternity capital.

Read more about changes in maternity capital for 2020.

Presidential payments upon the birth of the first child

In 2020 V.V. Putin initiated a new payment for young families expecting their first child. The amount of the benefit depends on the cost of living of the region in which the young family lives. In 2019, along with other payments intended for families with children, the amount of the monthly benefit for the first child will be calculated taking into account annual indexation.

If two or three children are born at the same time, the payment is made to only one of them. For the second child, parents can write an application to the pension fund in order to pay a similar benefit from maternity capital funds.

The monthly allowance for the first child is essentially targeted assistance. To receive it, a family must meet two requirements:

- first child born after January 1, 2020;

- have a critical level of income.

The average payment amount in Russia is 10,836 rubles. In order to find out the exact amount, you need to focus on the cost of living in your region.

Let's sum it up

The increase in child benefits from January 1, 2020 under the new 2019 law does not affect everyone. At the same time, the allowance of 50 rubles has existed and will continue to exist. But the income of individual families with children aged 1.5 to 3 years will actually increase. The new law will have a positive impact on the following categories of citizens:

- families in which the mother continues to be on maternity leave after 1.5 years, but she is no longer paid benefits from the Social Insurance Fund. Undoubtedly, family income decreases when this payment stops. If previously a family might not have met the need criterion to receive benefits for up to 1.5 years, then perhaps after 1.5 years they will be given a payment. This will allow the family to avoid serious material losses;

- families in which the mother does not work, but takes care of the children and housework. For the first time, they can count on real assistance from the state for children over 1.5 years old;

Unfortunately, the new law will not affect the following categories of families:

- families in which the income per person exceeds the required criterion (regional subsistence level *2). If the income is at least 100 rubles more, then the benefit will not be assigned. However, such families may need benefits no less than others. The problem of “gray” wages in the country has not been resolved. Therefore, people with actual high income, but with low income according to documents, legally receive benefits. While citizens with official income may have a lower standard of living, and still not receive child benefits;

- large families. When the fourth, fifth and subsequent children appear, no new benefits are provided. For families with many children, other social support measures are provided.

You can download the text of the law on child benefits up to three years of age in 2020 here

Regional benefits for the third child

On August 24, 2020, the government of the Russian Federation approved regions of the Russian Federation in which, through co-financing from the federal budget, a special allowance will be paid for the third child until he reaches the age of three.

It is worth noting that this payment is not new and was created on the initiative of the President of the Russian Federation (decree dated 05/07/2012). In 2020, families from 50 regions could receive the payment; in 2020, 60 regions already participated in the program. Starting from 2020, the state will participate in financing payments for the third and subsequent children in 62 regions of the Russian Federation.

Regional benefits for the third and subsequent children until they reach the age of three are paid in the amount of the regional child subsistence minimum. In 2020, the average benefit amount was 10,181 rubles.

Since the start of this program, the demographic situation has improved in three regions: the Kaliningrad region, Sakhalin and Sevastopol. Officially, these regions are no longer included in the program, but co-financing here will remain until the children whose birth entitles the family to benefits turn three years old.

Benefits for military families

Financial assistance for military women or wives of military personnel is slightly different.

Maternity benefit for the wife of a serviceman

A one-time benefit to the wife of a military serviceman is provided to a citizen of the Russian Federation if the pregnancy period exceeds 180 days (6 months) . Its size is 28,732.85 rubles.

Financial assistance is processed at the social protection department. To complete this procedure you will need:

- Application for the need to receive benefits.

- Photocopy of marriage certificate.

- A certificate from a medical institution confirming registration in the first trimester.

- SNILS and TIN of the parent.

- Certificate confirming the status of a military personnel. Issued at the place of work.

The time period from the moment of submitting the application until the receipt of funds should not exceed 10 calendar days .

Also, the wife of a conscripted soldier is entitled to a monthly child care allowance.

Child care allowance up to 1.5 years old

Payments for the care of a military child are provided to wives whose husbands are serving in military service. Their amount is 12,314.07 rubles (previously 11,096.76 rubles) monthly . The registration process is carried out at the social protection department at the place of registration. To do this, you need to prepare a number of documents in advance:

- Photocopies of the birth of all children.

- Statement of need for benefits.

- A certificate from your place of employment containing the amounts of all payments for the last 3 months.

- A document issued by a representative of the military commissariat stating that the child’s father was called up for military service.

- A certificate confirming the child’s cohabitation with the parent. Issued at a children's clinic or housing office.

The application review period is 10 days .

Child benefits up to 18 years of age in 2020

From 2020, financial support for low-income families will be individual. Citizens whose average per capita income is below the subsistence level will be able to receive this benefit, provided they timely contact the social protection authorities and present a full package of documents.

It is too early to talk about the size of the benefit. The payment may be increased taking into account inflation over the past year, or it may remain at the same level.

You should not expect any new payments for children in 2020. Whether benefits will be increased and in what amount will become known only at the beginning of 2020.