The state is trying to actively support citizens of the Russian Federation financially, creating a system of certain payments for specific cases. It strives in every possible way to improve the demographic situation in the country. Therefore, both benefits were created, issued to all citizens, and to those who carry out labor activities.

The benefit that will be discussed in this article is issued to persons who are employed. Both the mother, who works in a specific organization, and, if she does not have a job, the father of the child can count on receiving it. Payments are transferred on the occasion of the birth of a baby. Funds are transferred for each child. The amount does not depend on the position, financial status, or income of the person submitting the application. That is, it is a constant.

document

Download as .doc/.pdf Save this document in a convenient format. It's free.

Limited Liability Company "Leto"

Order N 37-k

Moscow July 2, 2009

I order:

1. Provide the sales department manager O.I. Zvonareva maternity leave from July 2, 2009 to November 18, 2009

2. Pay O.I. Zvonareva:

— maternity benefit for the period of maternity leave;

— a one-time benefit for women who registered in the early stages of pregnancy.

Base:

1. Statement by O.I. Zvonareva dated 07/02/2009.

2. Certificate of temporary incapacity for work dated 07/02/2009.

3. Certificate from the antenatal clinic dated 07/02/2009 N 148.

Sukhov General Director —— N.A. Sukhov Zvonareva Sales Department Manager has been familiarized with the order ——— O.I. Zvonareva 07/02/2009 Print LLC "Leto"

Download as .doc/.pdfSave this document now. It will come in handy.

Documents first

Before applying for benefits, you need to receive from the employee a set of documents required by law. Without the papers required in such a situation, there can be no talk of issuing money. Therefore, an employee counting on receiving child benefits must bring the following documents to the employer (accounting or personnel department):

- application requesting child support;

- a certificate from the registry office about the birth of a baby (if the child was born abroad, the certificate is replaced by the corresponding document issued by the consulate);

- a certificate from the work of the second parent, confirming the non-receipt of this benefit from another employer (if the second parent is not employed, then such a certificate will be issued by the Social Security Service. The presence of this document will relieve liability from the company paying the money).

This is important to know: Lump sum payment at the birth of a child: when and how much is paid, how to apply

Who is considered a young specialist in Russia

The term presupposes, first of all, a certain age.

As a rule, the limit is 35 years. It is before this that specialists are considered young.

Sometimes, for example, to obtain a mortgage loan, the age of 30 years is used. But the first age limit is still more common.

A young specialist in Russia is considered to be a graduate of a university or secondary educational institution who:

- graduated from an educational institution with state accreditation;

- studied full-time on a budgetary basis;

- received a standard diploma;

- gets a job in the first year after graduation;

- is employed for the first time in the acquired specialty (direction);

- I chose a budget organization as my place of work.

Only if all these conditions are met can you count on receiving various social payments, primarily allowances. An older graduate who received education through correspondence or on a commercial basis will not be able to apply for them.

for free

The benefit is paid at the place of work/service of one of the parents. However, this rule applies only to spouses. If the child’s parents are divorced, then the benefit is received by the parent with whom the child lives, at his place of work or at the social security agency (if he is unemployed). If the father and mother of a newborn do not work, then the benefit is paid by the social security authority at the place of residence of one of them (according to a passport, temporary certificate or place of actual residence).

Sample order for payment of a lump sum benefit upon the birth of a child

Start-up companies will find it extremely useful to know what a sample order for the payment of a lump sum benefit upon the birth of a child looks like. The presence of a woman in a team means that sooner or later this knowledge will come in handy. The principle of receipt and complete information about this type of payment are also interesting. This article contains the latest information at the moment.

Introduction

The state is trying to actively support citizens of the Russian Federation financially, creating a system of certain payments for specific cases. It strives in every possible way to improve the demographic situation in the country. Therefore, both benefits were created, issued to all citizens, and to those who carry out labor activities.

The benefit that will be discussed in this article is issued to persons who are employed.

Funds are transferred for each child. The amount does not depend on the position, financial status, or income of the person submitting the application. That is, it is a constant.

Where to submit the document

The next most important issue is the choice of the place where this benefit will be issued. In the case where both parents or at least one is working, he should submit papers in his organization

Otherwise, go to the address of the department for the protection of citizens of a social nature, which is located at the place of residence of the family.

Amendments were made in 2011. Since then, most regions have been using a new system for receiving funds. More precisely, another source. Now this is a question for the territorial body of the Social Insurance Fund for Citizens. Moreover, the appeal must occur directly. If citizens are employed, then there are no changes for them - a package of documents should be handed over to employers.

What you need

Of course, there are differences in documents depending on whether a citizen has a place of work. First of all, let’s look at the case when the papers are handed over by a citizen who is employed. In this case you will need:

- A single document of a citizen of the Russian Federation or its analogues confirming identity.

- Request to start benefit payments.

- Documents confirming the birth of the baby and relationship.

- Confirmation that the spouse did not receive payments in connection with child care. Of course, it is needed if both parents are employed.

- When the spouse is unemployed, a document from the Social Protection Administration is required, which also confirms that no payments were received.

- If this is a single mother, you will need a document from the registry office. It must contain information that the baby’s father was entered according to the mother’s words.

USEFUL INFORMATION: How to write a statement to bailiffs about arrears of alimony

In the case where the parents are not employed citizens, in addition to the standard set, the following papers are required:

- Work activity books, in which there is a record that they were fired from their jobs.

- If the parents are students or simply unemployed citizens, then a diploma/certificate or other document is required to prove that they have not previously worked.

- When this is a single mother, a document from the registry office is necessary. It must contain information that the baby’s father was entered according to the mother’s words.

Another group of people has an additional document. This is when, for example, the baby’s mother is an individual entrepreneur. In this case, a document from the Social Insurance Fund will be required. This paper must confirm that no one received benefits for this child.

A little about the timing and the order itself

It is necessary to submit documents to a specific institution as early as possible. The deadline is when the child reaches six months. That is, the parent has six months left. After the deadline, submitting an application will be problematic, and the likelihood of refusal is high. A valid reason is required for such a delay.

The benefit will be credited in approximately ten days. They will be counted from the moment the parent has provided the necessary documents and the relevant authority has confirmed that all the papers are in place. But the transfer of funds should be expected no earlier than the end of next month.

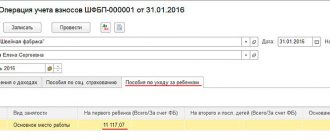

And finally, I would like to provide a sample order for the payment of a lump sum benefit upon the birth of a child. This document looks like this:

Having all the information that in one way or another relates to this manual, it is almost impossible to make a mistake when preparing it. You should also periodically check the legislation on this topic for possible amendments.

Amount of benefits and subtleties when applying for a job

The lump sum payment is one of the fastest growing benefits. It is indexed to inflation, although recently its growth has exceeded the rate of inflation. So, for example, in 2011 its size was 11,700 rubles, and from the beginning of February 2020 it will be 16,870 rubles.

A common question is whether an order is needed to pay a lump sum benefit for the birth of a child? This document regulates budget processes and allows you to receive cash benefits from work, the state then compensates the employer for this amount.

What are the requirements for the order in this case:

- The order form is proprietary, that is, the name of the enterprise is indicated on it.

- The order is assigned a unique number.

- The form contains all the basic data of the company, including the address.

- The dates for drawing up and signing the order must be indicated.

- A list of documents from the applicant is attached to the order.

There should be no confusion, because the basic form is the same for all enterprises, the only differences are in the specified details and signatures.

For several years, the requirements for the form have not changed, so the sample order for the payment of a lump sum benefit upon the birth of a child in 2020 will be no different from last year. [Total votes: 0 Average: 0/5]

Order for payment of a lump sum benefit upon the birth of a child

A parent who applies for a one-time child benefit with his employer must present the following package of papers:

- A freely drawn up application outlining the essence of the request - to assign the payment indicated in the article due to the birth of a son or daughter, indicating information about the newborn (date of birth, first name, last name).

- A certificate of a standard form received from the registry office in connection with the birth of a child; you must contact the nearest registry office office to obtain the document.

- Paper confirmation of the fact that the specified benefit was not assigned or issued to the second parent if the applicant is in a registered marriage. This paper takes the form of a certificate that can be obtained at the place of work (if there is one), at the place of service or at the social security authority at the address of residence; the last place to obtain the certificate is possible in the absence of an official employer.

Having considered the issue, we came to the following conclusion:

To pay an employee a lump sum benefit in connection with the birth of a child, drawing up an order from the employer is not mandatory.

Rationale for the conclusion:

In accordance with Art. 11 of Federal Law No. 81-FZ of May 19, 1995 “On state benefits for citizens with children” (hereinafter referred to as Law No. 81-FZ), one of the parents or a person replacing him has the right to a lump sum benefit upon the birth of a child.

The procedure and conditions for the appointment and payment of state benefits to citizens with children were approved by Order of the Ministry of Health and Social Development of Russia dated December 23, 2009 N 1012n (hereinafter referred to as the Procedure). To assign and pay an employee a one-time benefit upon the birth of a child, he must submit the following documents at his place of work, listed in clause 28 of the Procedure:

— application for granting benefits;

— a child’s birth certificate issued by the civil registry office;

- a certificate from the place of work (service, study, social protection authority at the child’s place of residence) of the other parent stating that this benefit was not assigned to him.

When accepting an application, the employer’s representative is obliged to issue a receipt notification of acceptance (registration) of the application (and when sending the application by mail, send a notice of the date of receipt (registration) of the application within 5 days from the date of its receipt (registration) (clause 8 of the Procedure ).

The employer’s obligation to issue an order on the assignment of benefits is not provided for by law.

Thus, the employee’s right to a one-time benefit in connection with the birth of a child does not depend on the employer issuing an order to pay such a benefit.

In addition, as follows from the List of documents that must be submitted by the policyholder for the territorial body of the Social Insurance Fund of the Russian Federation to make a decision on the allocation of the necessary funds for the payment of insurance coverage (approved by order of the Ministry of Health and Social Development of the Russian Federation of December 4, 2009 N 951n), the employer, when applying for reimbursement of funds paid as benefits is not required to submit to the Federal Social Insurance Fund of the Russian Federation an order for the payment of benefits of funds paid as benefits. Documents confirming the validity and correctness of the employer’s expenses for paying the employee a one-time benefit for the birth of a child, according to clause 3 of the List, are only a certificate of birth of a child in the established form, issued by the civil registry authorities, and a certificate from the other parent’s place of work about non-receipt of benefits.

At the same time, the main administrative document by which the employer’s decisions are formalized is an order. In our opinion, the employer has the right (but is not obligated) to issue an order to assign benefits to the employee in connection with the birth of a child in any form (since there is no unified form for such an order).

Information legal support GARANT

https://www.garant.ru

One-time benefit for the birth of a child

Who at the enterprise signs the order for payment of benefits? The order form must contain the signatures of the following persons:

- The head of the company - the signature approves the document and puts it into effect;

- The employee in whose favor the benefit is assigned - the signature is for informational purposes only and confirms that the employee is aware of the assignment of social benefits to him in connection with the documents submitted by him;

- An employee who is entrusted with accrual and payment, this may be an accountant, cashier;

- The person who is entrusted with control over the execution of the order - the signature is also of an introductory type, confirms that the employee is informed of the duties assigned to him.

What documents are needed to fill out an order? The procedure for assigning benefits and registering its receipt is regulated at the legislative level.

How to issue an order for the birth of a child 2020

It is this regulatory document that must be studied in order to smoothly receive a lump sum payment. During the preparation of the document in question, it is necessary to pay attention to some important nuances that may become the main reason for declaring the order invalid.

One-time benefit for the birth of a child: sample order for the appointment of payment in 2020

- A certificate confirming the fact of birth in form 24. It is issued simultaneously with the entire package of documents in the maternity hospital and reissued at the registry office upon receipt of the birth certificate. If the certificate is lost, you must contact the medical institution again for a duplicate.

- A certificate certifying that the second parent did not receive a lump sum payment. It is issued by the accounting department at the place of work or by social security if there is an unemployed person in the family.

Deadlines for payment of child benefits Payment of funds must be made within ten days from the date of receipt of the relevant papers from the parent of the newborn or the person replacing him. It is important that the employer is obliged to calculate and issue benefits only if documents are received no later than six months from the date of birth of the baby.

How should an order to pay allowances to a young specialist be drawn up, sample

Calculation of lifting payments is carried out on the basis of an order. The employer must draw it up independently and notify the employee. The employee needs to sign the order only after reviewing it. An application, a copy of the diploma and a copy of the work book (the date of registration for work is noted in it), certified by a notary, is attached to the order. Documents for calculating financial assistance:

- An order drawn up by the employer. It approves Appendix 1 “On the procedure and conditions for additional payments to an employee without work experience,” as well as Appendix 2. At the end of the order, the date and signature of the head of the department are placed.

- The order is supported by Appendix 1 “On the procedure and conditions for additional payments to an employee without work experience.” Contains general provisions, appointment procedure and amount of payments.

- Appendix 2 to the order is an application for financial assistance written by a young employee.

Reasons for drawing up an order and who is involved in it

Each document drawn up at the enterprise must have certain grounds, and also not contradict legal norms. In the case of receiving benefits, such a basis will be the package of documentation provided by the citizen when submitting the application. When forming an order, you must remember that all papers must be recorded as attachments.

USEFUL INFORMATION: Is it possible to get a divorce in one day?

The list of attached documentation includes:

- An application on behalf of a woman requesting benefits.

- A copy of the baby's birth certificate.

- A certificate from the place of employment of the employee’s husband that he did not apply for leave or benefits.

The document must be drawn up on behalf of the head of the company, however, the director himself is not required to draw up such an order. He can entrust this matter to his secretary or HR employee

It is important that the employee involved in the formation of the order has an idea of how such documents are correctly drawn up. After preparation, the paper is submitted to the manager for signature

Errors when drawing up an order

Due to errors, the resolution is not valid. In such cases, a new order should be prepared from the existing template. Most often, the errors are as follows:

- There is no signature of the manager - this means that the document is not valid.

- There are no signatures of other persons.

- Components of the details are missing, for example, name, position number, etc.

- There is no list of attachments - at the end the details and attached papers are indicated on the basis of which benefits are assigned.

Recommendations for filling out an order for payment of child benefits

The designated document does not have a standard or recommended format; each employer prepares an order independently, taking into account the basic requirements for the preparation of administrative documentation. For registration, a company letterhead is usually used - that is, a sheet of paper on which the company logo is indicated, as well as the main details of the company. Using a company letterhead will eliminate the need to manually specify the characteristics of the enterprise.

The structure of the order for the payment of a lump sum benefit is represented by the following components:

| Component of the order | Explanations for filling |

| Header part | It is located at the top of the order and includes:

|

| Justification for issuing the order | It usually begins with the words “in connection with..”, followed by an explanation of the reason for preparing the order. |

| Administrative part | The main part of the order, directly containing the instructions of the manager:

|

| Application | This part of the order sequentially lists all those papers that are attached to the employee’s application. |

| Signatures | Signatures are placed under the text of the order:

|

Sample design

The order can be issued on the organization’s letterhead. As a standard, this document must include the date, number, title, heading, text and signature of the manager.

Attention should be paid to the text, which is broken down into the reason for preparing the document and the manager’s orders. The reason is the need to calculate and pay a lump sum benefit upon the birth of a child.

The order is expressed in the form of the word “I order” and a list of the orders themselves:

- the accounting department is given an order to accrue benefits for the birth of a child;

- The cashier is given an order to pay this benefit.

Indicate the employee's full name, as well as his position and the department where he works. A list of documents handed over to them is also provided; their list is indicated above.

The order should also appoint a responsible person who will monitor the execution of orders.

The order form must contain an approving signature, as well as information from interested parties.

An example of placing an order can be downloaded below.

Where to submit the document

The next most important issue is the choice of the place where this benefit will be issued. In the case where both parents or at least one is working, he should submit papers in his organization

Otherwise, go to the address of the department for the protection of citizens of a social nature, which is located at the place of residence of the family.

A little about the timing and the order itself

It is necessary to submit documents to a specific institution as early as possible. The deadline is when the child reaches six months. That is, the parent has six months left. After the deadline, submitting an application will be problematic, and the likelihood of refusal is high. A valid reason is required for such a delay.

The benefit will be credited in approximately ten days. They will be counted from the moment the parent has provided the necessary documents and the relevant authority has confirmed that all the papers are in place. But the transfer of funds should be expected no earlier than the end of next month.

And finally, I would like to provide a sample order for the payment of a lump sum benefit upon the birth of a child. This document looks like this:

Having all the information that in one way or another relates to this manual, it is almost impossible to make a mistake when preparing it. You should also periodically check the legislation on this topic for possible amendments.

Sample order for payment of a lump sum benefit upon the birth of a child

- instructions to an accounting employee;

- the authorized person is issued an order regarding control over the execution of the approved order. Management may reserve this right

Appendix In this section of the order, it is necessary to list sequentially all the documentation that was provided by the employee to calculate the payment. Signature After specifying the basic information, the document must be signed:

- manager - approves the drawn up order;

- an accountant, as well as a cashier and other authorized persons who were indicated in the administrative section;

- a hired employee to whom a lump sum payment will be made

By following these generally accepted rules, you can eliminate the possibility of entering erroneous or unreliable information in the sample order in question.

How to apply for a one-time benefit at the birth of a child

- ID card of father and mother;

- child's birth certificate;

- a certificate of birth of a child from the registry office, which is issued at the time of registration;

- marriage certificate;

- divorce certificate if parents are divorced;

- certificate from the second parent’s place of work. If he is not officially employed, he needs to contact the social protection authorities and request such a certificate there.

A one-time benefit for the birth of a child is provided to one of the parents. The payment can be provided to both the mother and the father.

If the parents are officially employed, then the application can be written at the place of work of any of them, and you will need to provide a certificate from the work of the other that he did not receive the payment. If one of them does not work, then a lump sum benefit is paid at the place of employment of the working parent.

If both father and mother are not officially employed, the payment is made through the Social Insurance Fund.

One-time benefit for the birth of a child

- Adoptive parents, guardians. An extract from the decision to transfer custody of a child to a specific person is required. Copies of documents should be provided (court decision on adoption (if it enters into legal force, agreement on the transfer of children to a foster family).

- Expats provide a copy of their temporary residence permit from December 31, 2006.

- Parents are divorced. In this case, the applicant is required to provide a copy of the divorce certificate.

If a lump sum benefit for the birth of a child is assigned at the place of residence or work of the parent with whom the baby lives, a document will be required that confirms the fact that the baby lives together with one of the parents in the territory of the Russian Federation.

We recommend reading: Ministry of Internal Affairs veteran labor benefits

The entire package of documents must be prepared and submitted no later than 6 months from the date of birth of the child. An application for payment of benefits is written in the name of the employer. A package of necessary documents should be attached to it and submitted to the HR department of the enterprise.

Amount of lump sum payments in 2020

There are no changes in 2020 regarding raise payments for budget employees. The amounts of all material benefits are established at the federal or regional level and are not subject to indexation. They can increase only due to an increase in the worker’s salary itself.

Payments to young employees are calculated once a year for 3 years. In Novosibirsk, Ufa and Nizhny Novgorod, the first payment is 40 thousand rubles, the second - 35 thousand rubles, and the third - 30 thousand rubles. In large cities, St. Petersburg and Moscow, the amount of accruals is much larger, since the standard of living and average earnings are higher.

In what cases is an order required?

The order is not considered a mandatory and necessary document that is required to receive benefits, since this right is assigned to a young mother at the legislative level, and must be carried out automatically at any enterprise without making any additional decisions or drawing up orders.

At the same time, in many large enterprises this document is necessary and must be drawn up. In essence, the paper confirms that the employee has grounds for receiving financial support and clearly establishes the timing of the provision of benefits. In the future, the document allows you to avoid confusion and conduct office work at the enterprise more efficiently.

What you need

Of course, there are differences in documents depending on whether a citizen has a place of work. First of all, let’s look at the case when the papers are handed over by a citizen who is employed. In this case you will need:

- A single document of a citizen of the Russian Federation or its analogues confirming identity.

- Request to start benefit payments.

- Documents confirming the birth of the baby and relationship.

- Confirmation that the spouse did not receive payments in connection with child care. Of course, it is needed if both parents are employed.

- When the spouse is unemployed, a document from the Social Protection Administration is required, which also confirms that no payments were received.

- If this is a single mother, you will need a document from the registry office. It must contain information that the baby’s father was entered according to the mother’s words.

USEFUL INFORMATION: Will they provide maternity capital if the first child is 18 years old?

In the case where the parents are not employed citizens, in addition to the standard set, the following papers are required:

- Work activity books, in which there is a record that they were fired from their jobs.

- If the parents are students or simply unemployed citizens, then a diploma/certificate or other document is required to prove that they have not previously worked.

- When this is a single mother, a document from the registry office is necessary. It must contain information that the baby’s father was entered according to the mother’s words.

Another group of people has an additional document. This is when, for example, the baby’s mother is an individual entrepreneur. In this case, a document from the Social Insurance Fund will be required. This paper must confirm that no one received benefits for this child.

Order on the appointment and payment of benefits up to 15 years of 2020

The administrative document does not have a unified form and is drawn up in any form. However, an order for a one-time benefit at the birth of a child must contain the following data:

- surname, position, structural unit, personnel number of the employee to whom payments will be made;

- basis (application, birth certificate of a child issued by the registry office, etc.);

- amount of payments.

The order for the payment of a lump sum benefit upon the birth of a child is signed by the head of the organization. The employee must be familiarized with the document against signature. A one-time benefit is assigned and paid no later than 10 days from the date of receipt (registration) of the application with all the necessary documents.

With the birth of each baby, the family receives a one-time subsidy in addition to other types of assistance. Its provision for most citizens is regulated by the order for the payment of a lump sum benefit upon the birth of a child.

Legislation

Legislation is trying in various ways to ease the burden of financial pressure on new parents. For example, the maternity capital program has been operating for more than ten years, and it has proven itself well. Since 2007, when the start was given, the amount of capital has almost doubled, and now it already exceeds 450 thousand rubles.

Go to What payments are due to employees from the company when they receive an occupational disease?

For each child born in a family, a child birth benefit is assigned.

The uniqueness of this subsidy is that it is not intended for the mother, it is addressed specifically to the child, and either parent can receive it once.

Such a one-time payment is available to absolutely any family and is paid after drawing up an order according to a pre-established sample and registering the necessary documents.

True, there is some difference in the registration process between the situations if the parents are unemployed, both are working, or one is employed and the other is not.

If both parents do not work, or if a certificate will be submitted by a non-working parent, then you should contact the social security office in your area of residence, and in some cases you can apply for a subsidy at your place of residence. To obtain it you will need the following package of documents:

- Original passports of both parents.

- SNILS of both parents.

- Work books for unemployed citizens.

- A certificate from the accounting department from the place of work of the working parent that he did not receive this payment.

- Certificate from the labor exchange for a non-working person (registered or not).

- Birth certificate or a completed child certificate.

- Application requesting payment of the subsidy.

Depending on regional specifics and situations, additional information may be required. For example, if the child’s father is serving in the army due to conscription.

This is a separate case, and for this reason it will be necessary to provide the social protection authorities with a certificate from the military unit where the man is stationed.

By the way, a greatly increased one-time payment has been established for children of conscripted military personnel. At the moment, it is almost nine thousand rubles more than the standard one.

- Your passport.

- A certificate issued at the maternity hospital at birth, or a completed certificate.

- Statement.

Is it possible to reduce the VAT base by the amount of the specified services?

News from our partners

- Section on IT components

- Disk shelf HP D2600 SAS/SATA AJ940A storage

- Server hp proliant dl360 g7.

To receive a government service, the applicant must submit a number of documents to the territorial body of the FSS of Russia, including: Documents: Federal Law of December 29, 2006

Of course, it is needed if both parents are employed. In the case where the parents are not employed citizens, in addition to the standard set, the following papers are required: The following persons can receive government services: After one and a half years, the parent has the right to continue on parental leave until the age of three, but he will no longer be able to receive benefits. All funds paid by the employer as benefits are fully compensated by the Social Insurance Fund.

Is it necessary to write an order? An order is not mandatory, since the receipt of child care benefits for a child up to 1.5 years by every woman who has given birth is enshrined in the legislation of the Russian Federation and should be carried out automatically.

It is this regulatory document that must be studied in order to smoothly receive a lump sum payment. During the preparation of the document in question, it is necessary to pay attention to some important nuances that may become the main reason for declaring the order invalid.

Go to Features of payment of unemployment benefits in the regions of the Russian Federation

Let's consider the basic rules for drawing up an Order on the appointment of a lump sum payment on the occasion of the birth of a child in the family. The Order in question does not have a standard or recommended form.

In order to draw up an Order and accrue birth benefits to the father (or mother), it is necessary to use a letterhead that displays the organization’s logo, including the basic details of the company - this belongs to the category of reporting documentation.

Payments due to young professionals

In the Russian Federation, young professionals can count on a number of benefits.

For example, when employed in the first year after admission, a probationary period is not established for them. Of course, if they found a job in their specialty. But this is an intangible benefit.

Graduates can also count on various cash payments. For example, salaries in some industries, in the same education, include an additional payment for higher education. For holders of “red” diplomas, it has an increased size.

The collective agreement of an organization or enterprise may establish other allowances, benefits or other types of financial assistance for young specialists.

Regional youth support programs provide one-time payments to young professionals upon employment - the so-called “lifting benefits”. Their employer pays them in the first month after concluding an employment contract. For him, such benefits are quite profitable, since they are not subject to taxes.

In addition, the payment of allowances may be associated with the simultaneous obligation of young personnel to work in their specialty for a certain period of time, usually 3-5 years.

If a young specialist gets a job in a different area than where he lives, then in addition to the allowance, he has the right to receive:

- compensation for relocation (especially to rural areas);

- payment of expenses for transportation of furniture and other furnishings;

- compensation for travel expenses for yourself and your entire family;

- daily allowance for each day on the road (as on a business trip);

- average salary for the same period.

Lifting benefits can be paid only once, or can be assigned as annual payments for three years. But every year the amount will decrease. You can check specific conditions with your employer or local administration.

How and where to get lifting tickets

What is the size of the lifting payments?

The amount of payments to young professionals is determined by regional social support programs. And it can range from one salary to very substantial amounts. The size of lifts in rural areas is especially large.

Let's give a few examples.

Since 2010, the Zemsky Doctor program has been in effect.

According to it, medical specialists can receive up to 1 million rubles:

- with completed higher education;

- not older than 50 years;

- those who moved to the countryside;

- who have entered into an employment contract for at least 5 years.

Nurses and paramedics are not eligible for this program. The doctor must complete his internship and be ready for completely autonomous and independent work. The benefit received can be spent on building or purchasing your own home.

Beginning teachers have the right to receive from 20 to 100 thousand allowances when applying for a job in public secondary schools.

Moscow teachers traditionally receive the maximum payments - about 100,000 rubles. for St. Petersburg this amount will be approximately half as much. In addition, teachers receive a 40% bonus for having a higher education. For those who received a diploma with honors, it will be 50%.

Features of drawing up an order

To correctly draw up such an order, you need to read the tips below and get acquainted with a sample document

First of all, it is necessary to pay attention to the essence of the order, since a unified form does not exist today, and many employers draw up such an order in any form

A standard order is drawn up on a sheet of paper in F4 format, however, it is allowed to write the document by hand or print it on a computer. The paper should not contain errors or inaccuracies, and the order itself must be certified by the manager. A seal is required only if this condition is stated in the statutory documents of the enterprise.

The text must contain: the name of the document, organization, as well as the date and place of drawing up the paper. The main part indicates the reason for issuing the form and the full details of the employee. At the end of the order, the attached documents are listed and the director’s signature is affixed.