The legislation clearly states that every employee must receive a salary at least twice a month, i.e. every two weeks. If the employer has the desire, he can pay his subordinates more often - even every day at the end of the shift.

It is impossible to issue salaries less than twice a month: violation of this rule threatens enterprises and organizations with serious sanctions from supervisory structures.

At the same time, exactly how the wages will be divided: equal shares or not – is at the discretion of the employer.

From October 3, 2020, legislators determined the exact day by which wages should be transferred to employees - this is the 15th of the current month. If the enterprise previously established deadlines that did not comply with this rule (for example, “finishing” for the previous month was paid on the 16th or later), it is necessary to issue an order to postpone the payment of wages.

This procedure should also include written notification to all employees of the enterprise about upcoming changes in the timing of salary payments at least two months before the event itself.

Articles on the topic (click to view)

- Are maternity payments income?

- Are maternity payments taken into account when calculating Putin’s income?

- Conditions for appointment and payment of temporary disability benefits

- Are unemployment benefits and maternity benefits available to non-working mothers?

- What payments are due to pensioners in case of staff reduction?

- How to pay child support if you quit your job

- How are wages paid when a company goes bankrupt?

If the employee does not agree with the innovation, according to Art. 74, clause 7, part 1, art. 77, art. 178 of the Labor Code of the Russian Federation, the employer has the right to fire him.

It should be noted that if the dates of payment of wages in fact comply with the norms of the Labor Code of the Russian Federation, but are not documented anywhere, this may also subject the company and its director to administrative fines: from 30 tr. rub. up to 50 tr. rub.. – for the company itself and from 1t. R. rub. up to 5t. R. rub. - for its leader.

What punishment will the organization suffer?

The right to receive payment for work is stated not only in the Labor Code, but also in Article 37. Constitution. For violating this right, the employer may face:

- Disciplinary liability (under Article 192 of the Civil Code). According to this article, guilty persons may be temporarily suspended from official duties or even dismissed;

- Administrative punishment (fine);

- Criminal liability (under Article 145 of the Criminal Code).

Responsibility for delays in wages to employees is prescribed in Art. 142 Labor Code of the Russian Federation . According to this article, the degree of punishment will depend on the timing of non-payment of salary, the amount of debt, and the reasons for the delay.

Administrative measures

Article 5 of the Code of Administrative Offenses talks about administrative punishment for delayed wages. Liability under this article depends not only on the size of the debt and the timing of non-payment, but also on the form of business and the frequency of violations. If the law was violated for the first time, the fine will be :

- 50 thousand rubles. from the company;

- 20 thousand rubles. personally from the guilty person;

- Up to 5 thousand rubles. with IP.

If the delay in wages was repeated, the amount of the fine will increase to:

You can read more about fines for late wages in a special article prepared by our editors.

These measures are intended to encourage management to make payments on time and in full. Administrative fines can be issued by GIT employees and the court. That is, in order for management to be punished, the employee will need to write a statement to the judicial or supervisory authorities.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

An appeal to the labor inspectorate can be submitted in the form of a collective complaint. To do this, the document must describe all the circumstances of the violation and sign all the applicants.

After considering the complaint, an inspection is carried out at the enterprise, based on the results of which a fine is issued . If the violation is serious and a fine alone is not enough, the case is sent to law enforcement agencies for further investigation, and possibly the initiation of a criminal case.

Criminal sanctions

The employer is criminally liable for delayed wages under Article 145 of the Criminal Code. The severity of the punishment will depend on the reasons and timing of the delay, the employer’s motives for committing the crime, and the amount of debt (whether partial payments were made or wages were not transferred in full).

An employer may face a criminal charge only if the money intended for salary payments was spent for other purposes for personal gain.

The punishment may be more serious (up to 5 years in prison). The period will increase if it is proven that the delay in wages caused harm to the health, life of the employee or his loved ones. For example, it was not possible to buy medicine on time, an employee committed suicide due to debts that there was no way to pay off, etc.

The issue of criminal liability for non-payment of wages is discussed in detail in a separate material. Recommended reading.

Employees of the Investigative Committee (should apply first) or the Ministry of Internal Affairs can accept a statement from an injured employee. A complaint to the labor inspectorate may also result in the initiation of a criminal case. Although GIT employees do not have the authority to independently open cases under the Criminal Code, they can transfer information to law enforcement agencies for further investigation.

This is important to know: Conditions for the appointment and payment of temporary disability benefits

How to register a general director without paying wages?

The criterion for a major transaction in an LLC is 25 percent or more of the asset balance sheet of the company for the last reporting period preceding the day the decision was made to carry out such a transaction, in this case, the day the director’s salary was established (Article 46 of Federal Law No. 14-FZ dated 02/08/1998 ). Is it possible not to accrue the director’s salary? Naturally, the director’s salary may not be accrued if he does not work (for example, he is on leave without pay). In other cases, non-payment of wages is a violation of labor legislation, threatening the employer with a fine and payment of monetary compensation to the employee. Therefore, at a minimum, the minimum wage must be accrued to the employee for a full month. If the month is not fully worked out, the monthly salary may be lower than the minimum wage. The same applies to the case when the director works part-time, i.e. the General Director has the right to sign an employment contract “with himself” if he is the sole founder of the company, since this is not prohibited by current labor legislation. On the other hand, the formula for signing an employment contract “with yourself” is not entirely logical.

Moreover, according to Art. 56 of the Labor Code of the Russian Federation, an employment contract is concluded between an employee and an employer. In a situation where the general director is the sole founder of the company in relation to the general director, there is no employer.

In this situation, the Federal Service for Labor and Employment in Letter dated December 28, 2006 N 2262-6-1 recommends not signing an employment contract in the case where the general director of the company is its sole founder.

From the point of view of labor legislation, the head of an organization (director, general director) is the same employee who performs his duties on the basis of an employment contract, but has broader functionality and responsibilities. And he is subject to all the rights and obligations provided for by the Labor Code of the Russian Federation in relation to employees.

We’ll talk about issues related to the CEO’s salary in our material. Director's salary The salary of the general director, like other employees, consists of 3 main elements:

- remuneration for work;

- compensation payments;

- incentive payments.

At the same time, for a full month worked, the director’s salary cannot be less than the minimum wage (Part.

3 tbsp. 133 Labor Code of the Russian Federation). The amount of the “minimum wage” from 01.07.2016 minimum wage is set at 7,500 rubles per month (Article Question We are a commercial organization. Can we issue an order not to accrue wages to the director? And for what period can this be done? If this is not possible, then how to justify?The director is hired, he is not a founder. Answer Answer to the question: No, you cannot issue an order not to accrue salaries to the director. In relation to the organization, the director is the same employee as everyone else, and has the same rights, including including the right to wages. Moreover, the employer’s obligation to pay an employee’s salary does not depend on whether the organization conducts any activities and whether it has revenue. Even if an employee writes a statement about his voluntary desire not to receive a salary, the labor inspectorate will not recognize such a statement can bring the organization to justice (parts 1 and 4 of article 5.27 of the Code of Administrative Offenses of the Russian Federation, article 145.1 of the Criminal Code of the Russian Federation, article 192 of the Labor Code of the Russian Federation).

How to write an order correctly

Today there is no standard uniform template for all orders on the timing of payment of wages, so employers can write it in any form. In some cases, enterprises use internal document templates approved in the company's accounting policies. But, regardless of which path is chosen, the order must include a number of mandatory information. These include:

- Date of preparation,

- Name of the organization,

- the essence of the order, i.e. exact dates of payment of wages,

- the basis for its writing,

- persons responsible for its execution, indicating their positions and full names.

If any additional papers are attached to the document, they must be noted in a separate paragraph.

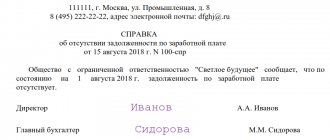

Principle of documentation

The state has not established a standard form for the order, so organizations are free to submit it. You can use any convenient method. The only requirement is that it must clearly follow from the text what, when and by whom it is put into effect. Check that the text includes:

- information about the company;

- Date of preparation;

- effective date;

- signature of the person authorized to sign.

https://youtu.be/J1ZE1GbZqBc

Thus, a sample order for approval of the regulations on remuneration of employees can be drawn up on a standard form for both internal and external documentation. You don’t have to use the form at all, but be sure to provide brief information about the organization (at a minimum, full name and Taxpayer Identification Number).

As for the content, it must indicate:

- what is being asserted;

- justification for innovation;

- effective date;

- information about the need to familiarize all employees with innovations or changes under signature;

- who is responsible for execution.

Previously, the Labor Code of the Russian Federation did not consider the timing of payment of wages. However, in two thousand and sixteen, this provision was revised. According to the decree of October 3, salary payment must be made by the fifteenth day of each month. In this regard, many organizations where payment of wages is carried out later must draw up a report on changes in payment terms. The order on the timing of payment of wages in accordance with the established procedure must contain the exact date of payment.

According to the new resolution, documents such as the Regulations on Remuneration, the employment contract and internal regulations must indicate specific deadlines for issuing payment. If this documentation does not contain a clearly established framework, then the above documents need to be completely redone.

“Closed Joint Stock Company “Pyramid” INN 0000000000 Marketing department employee D.B. Potapov

CJSC "Pyramid" brings to your attention that according to the current rules of legislation, based on changes dated October 3, 2016 under Article No. 136 of the Labor Code, the data of the employment agreement (dated March 23, 2020 No. 90- Labor Contract) has been corrected. From October 1, 2020, clause 6.4 of the Employment Agreement will be amended as follows: “The advance payment is issued on the 21st of the current month. Payments are made on the 7th day of the month following the previous one.”

Chief: I.T. Mikhailov Acquainted: D.B. Potapov."

https://youtu.be/EPErJ9cTq7E

Salary for the first half of the month

This payment procedure causes difficulties, because... in accordance with the Tax Code and the position of the Ministry of Finance, personal income tax must be calculated based on monthly results, taking into account the provision of standard deductions. In addition, other deductions (for example, alimony) are also calculated from the salary for the entire month. Therefore, it turns out that if you make payments for the first half of the month according to the time actually worked, but without taking into account deductions from your salary, then the salary for the second half of the month will be less, because When calculating, you will need to take into account salary deductions for the entire month.

Therefore, most accountants calculate salaries for the first half of the month in the form of an advance: they set each employee an amount that is approximately half of the amount payable for the month (including deductions) and pay it without dividing it into specific additional payments, allowances and without withholding income tax. And after the end of the month, all types of accruals and deductions are calculated, the total amount payable for the month is determined and the advance payment already paid is subtracted from it. This is the salary for the second half.

Approach each employee individually. If an employee was on vacation for the entire first half of the month, he does not need to pay an advance, because he has already received vacation pay for this period. If the employee did not work for some reason or worked less time, then the amount of the advance must be reduced.

Sample order for non-payment of wages to the general director

In this case, it is necessary to decide who will provide periodic reports to the funds, participate in planned activities for state supervision, transfer mandatory monthly payments, etc. This conclusion follows from Articles 128, 274 of the Labor Code of the Russian Federation.

Documentation What documents need to be prepared to apply for leave without pay? Regardless of whether the leave is mandatory or not, to provide it, the employee must write an application (Article 128 of the Labor Code of the Russian Federation). Based on the application, issue an order for granting leave (using Form No. T-6 or a self-developed form). The order must be signed by the head of the organization, the employee must be familiarized with the order for signature. Do not fill out a calculation note for the provision of leave (for example, according to form No. T-60). If one of the parties is absent, the contract cannot be concluded. Therefore, if the founder and manager are the same person, there is no need to conclude an employment contract. The possibility of not concluding an employment contract was confirmed by the Ministry of Finance of Russia in its letter dated February 19, 2015 No. 03-11-06/2/7790. The department also believes that the director cannot sign an employment contract with himself. And since there is no contract, then there are no grounds for paying wages. In our opinion, there cannot be a violation of the law if the general director works, but there is no employment contract, since the duties of the director are one thing, and the labor relationship with the employee is another. The General Director is obliged to act on behalf of the organization on the basis of the Charter; for this he does not have to enter into an employment relationship with his company.

We are trying to get payment

Most regulatory and human rights organizations have a complaint procedure. That is, before writing a statement to the Ministry of Internal Affairs, the Investigative Committee or the court, you should try to resolve the problem directly with the employer.

is sent to the general director of the enterprise demanding payment of wages and compensation for the delay . Most often, a conflict situation is resolved at this stage, because not a single boss is interested in conducting inspections at his company.

Let's learn how to file a claim against an employer for non-payment of wages by reading this article.

The standard period for consideration of a claim is 10 days. If after this period no measures are taken to eliminate violations of the law, the employee should forward complaints to other authorities to protect his interests.

Where should I complain?

Where to file a wage arrears complaint first depends on the complainant's goals. Each authority has its own powers; with the help of one appeal you can punish the employer, with another – to achieve payment of the debt and compensation.

An application to the State Tax Inspectorate may result in management issuing a fine and an order to eliminate violations. Among these instructions, most likely, will be the payment of wage arrears. If the case takes a more serious turn (fraud or money fraud is discovered), the information will be sent to other departments.

Contacting the labor inspectorate does not imply a mandatory claim procedure. The application can be submitted simultaneously with the letter to the enterprise.

Law enforcement agencies should be contacted in case of gross violation of the law. An application to the Investigative Committee or the Ministry of Internal Affairs will allow the unscrupulous employer to be punished according to the law, perhaps even depriving him of his position. The court will help collect arrears of wages. In addition to the debt, the employee has the opportunity to demand payment of moral damages, lost profits and compensation for delays.

Special material has been prepared on the topic of how to write an application to the prosecutor’s office against an employer; we recommend that you read it.

Salary compensation and its calculation

As mentioned above, financial liability is provided for violating the terms of salary payments. This means that from the first day of delay, the employer must charge, in addition to funds for wages, compensation, the amount of which is currently equal to 1/150 of the Central Bank rate .

For clarity, let’s look at an example of calculating the amount of compensation. Given:

- Salary delay period = 17 days.

- Central Bank rate = 7.25%.

That is, in addition to the main debt, management is obliged to transfer compensation to the employee in the amount of 246.5 rubles. In this case, the amount of compensation was insignificant, but, as a rule, wages are delayed for longer periods, and accordingly, the amount of the penalty will be greater.

You may find the following information interesting: how to calculate compensation for delayed wages?

Order to change wages

The conditions of remuneration for work are established not only in the Regulations on Remuneration. Information about this is also indicated in the contract that the employee signs with the employer. Therefore, a change in the calculation system is also a change in the terms of the employment contract. And changing the terms of the contract is allowed only with the consent of the employees.

New payment terms may be introduced at the initiative of the employer. But the reason for this must be a change in technological or organizational working conditions. There is an indication of this in Art. 74 Labor Code of the Russian Federation.

The calculation system can be changed at the request of the employee. For example, if he decided to switch from a time-based payment system to a piece-rate system.

Be that as it may, this should be reflected in the supplement. agreement to the contract with each employee. After the parties sign this document, the director of the enterprise issues an order to change wages.

In case of bankruptcy of a company

If a company is on the verge of bankruptcy, management is obliged to warn all its employees and the employment center (employment center) about this 2 months before laying off staff.

The employer will need to make all the same payments to employees as during layoffs. Despite the fact that during bankruptcy the organization has debts to creditors, the priority requires first making payments in favor of employees .

Debts to employees are divided into 2 types:

- Registered. Debts incurred before a business filed for bankruptcy.

- Current. Debt obligations arising after the commencement of bankruptcy proceedings.

Is it possible to pay before the due date?

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

In contrast to delays in the provision of wages, transferring funds to a bank account or issuing cash at the cash desk earlier than the regulated period is not punishable by law. This fact takes into account the linking of transactions for transferring funds to employee cards to banking days.

This is important to know: Are maternity payments taken into account when calculating Putin’s income?

For this reason, banks transfer salaries to company employees not on Saturday or Sunday, but on Friday, since the last two days of the week are not banking days.

And if the payment is made on Monday, it will be possible to talk about a delay, which will mean additional expenses for employers.

Also, an employee can receive a salary ahead of schedule

- when going on vacation;

- under special circumstances in the life of the employee himself;

- ahead of the long holiday period;

- before a long business trip.

Payment of wages under the Labor Code in 2019

In a situation where the terms for payment of wages are contained in the employment contract, the employer will have to enter into an additional agreement to the employment contract with each employee (Article 72 of the Labor Code of the Russian Federation).

If the salary payment period in employment contracts meets the requirements of the law under comment, then nothing needs to be done. However, it is possible that employment contracts allow for the payment of wages after the 15th of the next month (for example, the 17th). Or, it is possible that the salary payment period is set, for example, from the 5th to the 12th.

Employee remuneration involves three types of payments:

- payments in monetary or non-monetary form for quality work done in accordance with the employment contract,

- incentive payments (production bonuses, valuable gifts),

- compensation payments (for special working conditions or a special climate, for night work, overtime work, for work on a weekend or holiday, etc.).

We invite you to familiarize yourself with: Statute of limitations for violations of the Labor Code. There have been no changes to the deadlines for payment of wages since 2020. The salary payment rules still establish the payment of earnings to employees at least once every six months: first an advance is issued, then the final payment is made. You can transfer money to staff more often, but usually employers adhere to the general procedure.

When should salaries be paid?

The legislation clearly states that every employee must receive a salary at least twice a month, i.e.

every two weeks. If the employer has the desire, he can pay his subordinates more often - even every day at the end of the shift. It is impossible to issue salaries less than twice a month: violation of this rule threatens enterprises and organizations with serious sanctions from supervisory structures.

https://youtu.be/d9vZ9A5xBNI

At the same time, exactly how the wages will be divided: equal shares or not – is at the discretion of the employer.

From October 3, 2020, legislators determined the exact day by which wages should be transferred to employees - this is the 15th of the current month. If the enterprise previously established deadlines that did not comply with this rule (for example, “finishing” for the previous month was paid on the 16th or later), it is necessary to issue an order to postpone the payment of wages.

This procedure should also include written notification to all employees of the enterprise about upcoming changes in the timing of salary payments at least two months before the event itself.

If the employee does not agree with the innovation, according to Art. 74, clause 7, part 1, art. 77, art. 178 of the Labor Code of the Russian Federation, the employer has the right to fire him.

It should be noted that if the dates of payment of wages in fact comply with the norms of the Labor Code of the Russian Federation, but are not documented anywhere, this may also subject the company and its director to administrative fines: from 30 tr. rub. up to 50 tr. rub.. – for the company itself and from 1t. R. rub. up to 5t. R. rub. - for its leader.

When should salaries be paid?

From October 3, 2016, the content of Article 136 of the Labor Code of the Russian Federation was adjusted, requiring the employer to designate the days of payment of wages in two amounts up to and including the 15th day from the end of the period for which the wages were calculated. At the same time, there is a rule according to which the minimum interval between payment dates is established - half a month.

Taking both requirements into account simultaneously leads to the following procedure for establishing payment deadlines:

- For the first part of the month, the payment date is up to and including the 30th day of this month;

- For the second part – until the 15th day inclusive of the next month.

The employee will receive part of the earnings in the current month, the rest in the next month. The first part of the month is the first 15 calendar days, respectively, the second part of the month is the remaining days.

Is it possible to set deadlines using an order?

Part 6 of Article 136 of the Labor Code of the Russian Federation clearly states with the help of which documents you can set the deadline for issuing earned funds:

- Internal Labor Regulations (ILR);

- Collective agreement;

- Employment agreements with each individual employee.

The specified list does not include an order, and therefore it is not permissible to use it as a document establishing the timing of the issuance of funds to personnel.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

How to correctly approve the timing of salary payments

To set deadlines, you need to specify specific dates in the PVTR, collective or labor agreement.

The first local act is the most preferable and convenient for setting deadlines for the enterprise as a whole. In addition, it is easier to make changes to the PVTR - this is an internal local act of the company, the rules in which the employer sets independently without coordination with anyone. The main thing is to take into account the provisions of labor laws. It is convenient to set terms in an employment contract that differ from those in force for the enterprise as a whole, when special dates for the issuance of funds are determined for individual employees. Changing the content of an employment contract, and especially a collective one, is more difficult and takes longer, and therefore this method of setting deadlines is less common in practice.

What should be displayed in the order when there has been an increase in salary or a decrease in salary?

The specifics of paying wages at an enterprise can be established by various documents - local regulations (Regulations on wages, Regulations on bonuses, Collective agreement and other documents). Also, the procedure for paying wages can be specified in the employment contract of each individual employee.

When a person is hired, an employment contract is drawn up, and a contract is drawn up and concluded. Along with these documents, an order from the management of the enterprise is simultaneously issued, the second copy is transferred to the accounting department.

A personal card is filled out based on the order itself, and then a personal account is opened directly for each employee and, accordingly, an entry is made in the work book.

Management is obliged to correctly calculate wages and accrue them in a timely manner by issuing an order for the accrual of wages. In relation to Art.

Since there is no standard pay slip form, it is allowed to draw it up in any form, and then coordinate it with the relevant and representative bodies of workers (if there are any at the enterprise).

Payslips should be generated only once a month when the 2nd part of the finances is accrued (as a rule, this should happen at the end of the month).

The pay slip contains the following information:

- the total amount to be paid;

- components of wages due to a specialist;

- salary accruals (deductions).

For violation of the rules for issuing or drawing up pay slips, an organization can be brought to administrative liability.

Please note that the days for payment of wages are established by labor and collective agreements, as well as internal labor regulations.

Application for maternity leave Prepared by experts Sample form of a regulation on a video surveillance system in an organization Prepared by experts Sample form of an agreement for the installation of a video surveillance system Prepared by experts Terms of reference for the installation of a video surveillance system Prepared by experts Form No. 401/u “Certificate for donor on examination” Order of the USSR Ministry of Health dated August 7, 1985

Moreover, each of these options is completely legal and correct. Nevertheless, in most enterprises, for this purpose, a separate order is issued on the timing of payment of wages, a sample of which you can draw up yourself. To do this, such a document must contain the following necessary information:

- date of creation of the order;

- its registration number;

- location and name of the enterprise;

- Title of the document;

- the reason for its publication;

- article of the Labor Code, which serves as the basis for issuing such an order;

- the main content of the document, which indicates clear dates for payments made;

- the additional part must indicate the person responsible for familiarizing all employees with this document;

- position, full name

There are several options when salary recalculation can be carried out. You should also take into account some possible changes that may affect the change in salary amount.

An order on the terms of payment of wages is not drawn up at every enterprise, since these terms are established by other documents, for example, an employment contract or internal labor regulations.

Initially, accountants need to check whether the current standards comply with the updated requirements of the Labor Code. If everything is in order, then there is no need to make changes. And if inconsistencies are found, then it is necessary to prepare an order to set new dates. Before setting specific dates, it is recommended to clarify the views of employees. If the organization has a trade union, then consent will be sufficient. Usually they try to pay wages at the beginning of the month, before the 5th.

According to Art. 57 and 136 of the Labor Code, the employer has no obligation to indicate specific days for payment of wages in the employment contract. He has the right to prescribe them in the internal regulations of the enterprise or a collective agreement.

The procedure for postponing the date of payment of wages directly depends on which document specifies the specific deadlines.

| The date of receipt of wages is fixed in the document | Procedure for rescheduling |

| Internal regulations (IVR) | The transfer of dates occurs on the basis of an order issued by the enterprise. After the changes, every employed citizen must be familiarized with them against signature. Since PVRs are local regulatory documents, decisions on changes are made by the employer without the consent of employees. If there is a trade union in the company, its opinion must be taken into account when making changes. |

| Collective agreements | If the collective agreement does not contain a clause regarding the procedure for making changes to it, then they are implemented through negotiations. Typically, a special commission is created to amend such agreements. It should include representatives of both parties: the employer and the employees. The results are recorded in a special additional agreement. It contains a free form, but must include new deadlines for receiving payment for work. The additional agreement is sent to the territorial labor authority for registration no later than seven days after signing. The document comes into force from the moment of its publication, not registration. |

| Employment contracts | According to Art. 72 of the Labor Code of the Russian Federation, when the date of salary payment changes, it is carried out by concluding an additional agreement with each employee. If a person does not agree with the change in the terms of the contract, the organization will have to settle it with payment of severance pay in the amount of two weeks’ earnings. With this option, it is imperative to notify employees of the upcoming changes two months in writing. The notification must contain not only the new dates for payment of wages, but also the reasons for the changes being introduced and explanations why the previous deadlines cannot be maintained. |

If dates are recorded in two or three documents at the same time, then changes will have to be made to each of them.

For example, when the date is specified in the rules of procedure and employment contracts, an order is issued and notices are sent to employees two months in advance.

After which additional agreements to the employment contracts are concluded.

An organization is obliged to notify staff about the transfer of wages for work only if a specific payment period is specified in the employment contracts.

Written notices are sent to employees no later than two months in advance.

When the deadlines for receiving payment for labor are agreed upon by the PVR, there is no need to ask the employees for consent; changes are made by order.

However, the employer is obliged to familiarize all personnel with the order.

The way changes are made is influenced by the way the organization sets deadlines. The procedure for each case is summarized in the table.

| Regulatory document that sets deadlines | Procedure for making changes |

| PVTR | The procedure is quite simple:

|

| Collective agreement | The following steps are performed:

|

| Employment contract | The procedure is complicated by the fact that you need to work with each employee separately. For each agreement to which you need to make changes, you must perform the following steps:

|

The order contains:

- Organization details;

- Publication date and number;

- Title;

- The basis for preparing the order is the content of Article 136 of the Labor Code of the Russian Federation;

- An order obliging to make updates to the current Rules, a new wording of the paragraph of the Rules is provided, where the deadlines are prescribed;

- Moment of entry into force of the changes;

- An order to monitor the execution of the order and familiarize employees with the new deadlines;

- Instructing the chief accountant to make payments within the specified time frame;

- Approval signature of the manager.

At their core, these two concepts are close and quite similar - they both relate to the economic component of the employee’s labor. But there are also significant differences between them.

Salary is considered to be the unchanged base part of the salary, which is prescribed in the employment contract or an additional agreement to it.

Wages are a whole series of various accruals: salary, allowances for hazardous production, percentage of sales, bonuses, bonuses, etc. minus insurance payments to extra-budgetary funds. When wages increase, all parts of wages increase simultaneously.

The employer has the right to independently determine employees worthy of a salary increase. Usually the choice falls on those employees who have distinguished themselves in some way: for example, they exceed production standards, produce good sales figures, etc. Increases can occur with a certain regularity and for different amounts - in this sense, they are limited only by the financial capabilities of the organization.

Rules for issuing an advance