Is it possible to retire earlier than the standard retirement age? What to do if there is little left until retirement, but they are no longer hiring? What to do when you have no work experience at all? Have the basic rules for going on holiday in the Russian Federation changed in recent years?

The procedure for assigning payments to citizens of the Russian Federation is regulated by labor legislation and special laws. To receive payments from the Pension Fund of the Russian Federation, a person must have a certain insurance period.

In the absence of such a general period, the state does not leave a person to the mercy of fate by assigning a social pension, the amount of which is, of course, less than the minimum labor pension.

What is work experience for retirement?

The pension system of our state is constantly undergoing reform, and even with explanatory work with the population, future pensioners sometimes have difficulty imagining the size of their pension.

For all those who plan to rely on these savings in old age, it is useful to know that for calculating a large pension, only the size of the salary is not always important; the duration of its payment is also taken into account. This takes into account whether the worker had breaks from work and for how long, in what industries and in which regions of the country he worked, whether contributions were transferred to the Pension Fund, and so on. Depending on these conditions, a citizen’s entire work activity is covered by several types of length of service, which subsequently form the basis of his pension. These are general labor, special, continuous and insurance experience.

General insurance

A citizen’s general insurance period includes all time periods when employers or individual entrepreneurs paid insurance premiums to the Pension Fund of the Russian Federation for themselves, as well as periods that are equivalent to them:

- stay to care for a disabled child;

- serving a sentence in prison (with subsequent proof of innocence);

- child care up to 1.5 years old. The maximum duration of this period is 6 years;

- Military service;

- living in an area where there is no opportunity to find work;

- stay registered with the central registration center.

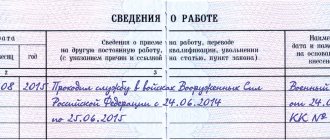

All information about a person’s insurance experience since 2002 is reflected in the computer personification system. To confirm data on the presence or absence of work experience in the 20th and early 21st centuries (before 2002), it is necessary to provide a work book or documents confirming the fact of work at the enterprise or organization.

Special pension experience for retirement

Benefits for receiving payments consist in the opportunity for certain categories to receive a pension earlier than the general period established by law.

Provided for the following reasons:

- work for a clearly defined minimum period in difficult working conditions (mines, hot shops and other facilities);

- length of service.

Continuous

Continuous work experience quite logically implies the absence of any breaks in a person’s work activity. Let's say a person got a job in January 1990 and works until today. This person’s insurance period is not interrupted.

If an individual was fired at least once (except for the case when he was accepted for a new job the next day after leaving the previous one), then the length of service will be interrupted.

If we talk about the insurance period, then this concept does not apply to it, that is, it develops according to the principle of accumulation.

How to increase your experience without working?

Before 2020, there were two main types of insurance periods taken into account for pensions:

- Staying on parental leave (women only). The maximum period of leave is 3 years, 1.5 for each of two children (until 2014).

- Military service (for men). During the stay in the Armed Forces, the state pays for the citizen to the Pension Fund.

According to the new pension legislation, both types of insurance periods are taken into account in the pension period. Moreover, the maximum duration of the insurance period for child care was expanded from 3 to 4.5 years (but not more than 1.5 years for each child).

The period of study at a university is no longer taken into account: it is believed that, having spent time on studying, a person with a higher education will make up for lost time due to higher wages. However, paid practical training, as well as training related to advanced training and retraining of an employee, should also be considered.

Finally, the easiest way to gain experience without working is to register with the labor exchange: the period of receiving unemployment benefits is also taken into account by the Pension Fund.

What length of service is taken into account when calculating the labor pension?

The length of service is calculated based on the work book entries.

At the same time, the law does not prohibit the use of several work books for persons working in two or more jobs at the same time. Such citizens need only one thing - to show increased care for the safety, correctness of maintenance and taking into account the number of these documents used, since upon retirement they must all be presented to a specialist who will be responsible for calculating the length of service.

What is included in the charge

According to the norms of the Federal Law “On Insurance Pensions”, the insurance period for a citizen when determining the possibility of receiving payment from the Pension Fund includes:

- official labor activity on the territory of the Russian Federation. Upon full registration, insurance premiums must be paid to the Pension Fund of the Russian Federation;

- work activity abroad. In this case, the citizen pays contributions to the Pension Fund on his own or they are transferred in accordance with the norms of international treaties of the Russian Federation with other countries.

The non-insurance periods indicated above are also included in the total length of service.

Experience under special working conditions

Special working conditions are established in production facilities that fall under special lists: No. 1 and No. 2. List No. 1 includes industries with particularly difficult conditions (for example, underground work). The conditions for early retirement for persons who worked in such industries are as follows:

- retirement age for men - 50 years, for women - 45 years;

- insurance experience – 20 and 15 years, respectively;

- the period of work in hazardous production cannot be less than 10 and 7.5 years, respectively.

List No. 2 includes less dangerous work (transport, tunnel construction, etc.). Here the conditions are:

- insurance experience of at least 25 years (men) and 20 years (women);

- retirement occurs at 55 and 50 years, respectively;

- the period of harmful work is at least 12.5 and 10 years, respectively.

Experience required to receive a labor pension

As part of the pension reform, not only the age for retirement has changed, but also the requirements for insurance coverage.

Reference! The insurance period, in contrast to labor or general service, includes periods when insurance contributions are deducted from wages or other income to the Pension Fund of the Russian Federation.

How much you need to work, as well as the requirements for the calculation procedure and calculation rules, confirmation of the working period are reflected in Chapter 3 of Federal Law No. 400 “On Insurance Pensions”. According to this legislative act, the length of service for granting a pension must be 15 years. But such a requirement will come into force only in 2023. During the transition period, which began in 2020, the criterion is increased by 1 year annually. However, even if there is a minimum output, a pension will not be assigned if the required number of pension points is not available, the calculation of which is also affected by the length of work.

This is interesting! How the duration of work affects the amount of pension payments is detailed in the material “Pension with a salary of 30,000 rubles: the amount of payments for different length of service.”

Table 1. Increase in length of service and PB by year

| Year | Minimum points | Minimum experience |

| 2018 | 13,8 | 9 |

| 2019 | 16,2 | 10 |

| 2020 | 18,6 | 11 |

| 2021 | 21 | 12 |

| 2022 | 23,4 | 13 |

| 2023 | 25,8 | 14 |

| 2025 | 28,2 | 15 |

| 2026 | 30 | 15 |

For those planning to retire in 2020, you must work for at least 10 years. (Author’s note. Here and below, the data is for 2020). If during this period the salary, or rather insurance contributions, allowed you to accumulate 16.2 points, you have no right to refuse a pension. Otherwise you can:

- Upon reaching 60.5 (hereinafter 65) for women and 65.5 (hereinafter 70) for men, apply for an insurance pension.

- Work the missing period to receive a labor pension after reaching retirement age: 55.5 years for women and 60.5 for men.

Material on topic! Increasing the pension to 20 thousand rubles, when it happens.

If you have a maximum total (working experience) of 37 years for women and 40 for men, the right to receive insurance payments arises, regardless of age.

How long do you need to work to qualify for early retirement?

Early retirement benefits are assigned based on social and professional indicators. At the same time, applicants may be required not only to have insurance experience, but also to the duration of work under certain conditions.

Experience for early retirement according to social criteria

According to social indicators, certain categories of Russians have the right to receive early insurance payments. But for this you need to work for a longer period than to obtain a minimum age pension.

Rice. 1. Mothers of many children were given the benefit of early retirement

Table 2. Duration of work to receive early benefits by social status

| Category of beneficiaries | Insurance experience | Early payment age | ||

| For women | For men | For women | For men | |

| Women who have given birth to 5 or more children, while raising up to 8 years of age | 15 | – | 50 | – |

| One of the parents of a disabled child | 15 | 20 | 50 | 55 |

| Guardian of a disabled person since childhood | 15 | 20 | Reduced by 1 year for every 1.5 years of guardianship, but not more than 5 years | |

| Disabled people with military trauma | 20 | 25 | 50 | 55 |

| Visually impaired, group I | 10 | 15 | 40 | 50 |

| Lilliputians and dwarfs | 15 | 20 | 40 | 45 |

Experience for northern pension

To obtain a preferential northern pension, special requirements are also put forward not only for the northern, but also for the general length of service.

Rice. 2. Working in the north is the basis for earlier retirement

Table 3. Required length of service to assign a northern pension

| Conditions | Northern experience | Insurance experience | Early payment age | |||

| For women | For men | For women | For men | For women | For men | |

| Women who have given birth to 2 or more children | – 12 in RKS; – 17 in equivalent areas | – | 20 | – | 50 | |

| Work in the conditions of RKS | 15 | 20 | 25 | 50 | 55 | |

| Work in the conditions of RKS | From 7.5 to 15 | 20 | 25 | Decreased by 4 months. for a full 1 year of work | ||

| Work in regions equivalent to RKS | 20 | 20 | 25 | 50 | 55 | |

| Mixed experience | 15 years, 1 year in areas equivalent to RKS = 9 months. in RKS | 20 | 25 | 50 | 55 | |

| Reindeer herders, fishermen, commercial hunters permanently residing in the RKS | 20 | 25 | 45 | 50 | ||

If the pensioner has northern experience, he receives a benefit not only for earlier retirement, but also for the appointment of an increased fixed payment, which remains, regardless of place of residence, after retirement, in contrast to the use of regional coefficients, which increase payments only by period of residence in northern and difficult to live areas.

Experience for early retirement pension according to professional criteria

When assigning an early insurance pension for certain professions, a requirement is put forward for professional and general work activity. In addition, the applicant must accumulate an individual coefficient of at least 30 points.

Rice. 3. Working in hazardous conditions

Table 4. Length of service for preferential pension

| Profession | Special experience | Insurance experience | Early payment age | |||

| For women | For men | For women | For men | For women | For men | |

| Professions in 1 grid | 7,5 | 10 | 15 | 20 | 45 | 50 |

| Professions on 2nd grid | 10 | 12,5 | 20 | 25 | 50 | 55 |

| Women tractor drivers, machinists | 15 | – | 20 | – | 50 | – |

| Women in the textile industry in difficult conditions | 20 | – | – | – | 50 | – |

| Workers in railway transport, subway, drivers in mines, mines | 10 | 12,5 | 20 | 25 | 50 | 55 |

| Field geological exploration, prospecting, geophysical and other survey work | 10 | 12,5 | 20 | 25 | 50 | 55 |

| Logging, rafting | 10 | 12,5 | 20 | 25 | 50 | 55 |

| Machine operators in ports during loading and unloading operations | 15 | 20 | 20 | 25 | 50 | 55 |

| River, marine, fishing industry fleet | 10 | 12,5 | 20 | 25 | 50 | 55 |

| Public transport drivers | 15 | 20 | 20 | 25 | 50 | 55 |

| Civil aviation pilots | 10 | 12,5 | 20 | 25 | 50 | 55 |

| Maintenance of civil aviation vessels | 15 | 20 | 20 | 25 | 50 | 55 |

| Workers and employees working with convicts | 15 | 20 | 20 | 25 | 50 | 55 |

| Government positions fire service | 25 | – | – | 50 | ||

When calculating preferential length of service for earlier periods, the rules provided for by the laws that were in force at the time the work was performed may be applied.

How long do you need to work to receive a long-service insurance pension?

Payments, which are usually called “according to length of service,” are in fact a preferential pension assigned regardless of age. Moreover, not only teachers and doctors can apply for such a benefit. The main condition for obtaining it is the presence of professional development in a certain field.

Rice. 4. A rural doctor must have worked for at least 25 years.

This benefit is provided:

- persons involved in open-pit and underground mining who have worked for 25 years;

- miners, miners, mining machine operators with a special experience of 20 years;

- civil aviation flight personnel: men at 25 years of service, women at 20; for health problems: 20 and 15 years, respectively;

- teachers with 25 years of teaching experience;

- for doctors who work in rural areas and urban areas – 25 years;

- for doctors working in cities or with mixed experience – 30 years.

Regardless of age, or upon reaching 50-55 years, payments are given to cultural workers who have worked in theaters or entertainment organizations for 15-30 years. After 40 years, or regardless of age, payments are assigned to rescuers who have worked for 15 years.

What periods are included in the insurance period?

When calculating the insurance period, the following periods are taken into account:

- work on the territory of Russia, when contributions were transferred from income;

- labor activity outside the Russian Federation when paying insurance premiums or under the terms of international treaties.

Note! The self-employed population and individual entrepreneurs can earn the required length of service by transferring a fixed amount to the Pension Fund. In addition, insurance periods may also be included when the applicant:

- served in the military;

- was on sick leave;

- was temporarily unemployed and registered with the employment center;

- was on maternity leave to care for a child up to 1.5 years old;

- cared for an elderly person over 80 years old, a disabled child or a disabled person of group I;

- served an unlawful sentence;

- was wrongfully removed from his position;

- lived as a spouse of a military personnel in an area where it was impossible to find a job (in total, no more than 5 years);

- spouses of employees of diplomatic, trade missions, consular offices abroad.

These periods are included in the insurance period if the applicant was employed before and/or after it.

Periods when contributions were transferred to another state, as well as periods taken into account when calculating long-service payments, are not included in the calculation.

Conditions of retirement

The state clearly establishes the norms and rules for assigning pensions for all categories of citizens. For this purpose, laws and regulations are developed and approved at both the federal and regional levels. Currently, this has led to the fact that pensioners in different regions find themselves in special conditions. So, everyone knows that the local government makes additional payments to pensioners in St. Petersburg and Moscow. In Chuvashia, the missing experience can now be purchased (no more than half of what is required), and retirement can be postponed in order to complete the time necessary to complete the experience.

Early retirement regardless of age and insurance period

In any case, when assigning a pension, the factor of age and the presence of a minimum certain insurance period are taken into account. The list of persons who have the right to a preferential pension is established by the norms of Art. 30 -32 Federal Law No. 400. The list is quite broad, so we see no point in listing it. In addition, it is possible to apply for a pension 2 years earlier under the following conditions:

- dismissals from the enterprise due to liquidation or downsizing;

- the citizen is registered with the Central Tax Service;

- There are no vacancies for which employment is possible.

In addition, representatives of the small peoples of the North have the right to a social pension, regardless of their work experience, upon reaching 55 (men) and 50 (women) years.

Social reasons for receiving a pension early

Early termination of work is quite reasonable for some citizens because:

- employees of production facilities on List No. 1 and No. 2 sharply deteriorate their health;

- It is very difficult for people of pre-retirement age to find work, because employers generally want to see a younger and more energetic team in their offices. People of this age who are registered with the Central Bank can apply for payment ahead of schedule;

- The state understands its social responsibility to mothers who have raised 5 or more children, as well as to disabled people with serious illnesses who, due to health reasons, are simply not able to work effectively in old age.

Financial assistance for pensioners

If for some reason at the time of retirement a person has not accumulated the required number of points and the required minimum length of service, he has the right to count on receiving a social pension, although the amount of payments is quite modest; it is added to the subsistence level thanks to regional allowances.

The unpleasant point is that you can receive “social benefits” only when women reach 60 years of age, and men - 65.

Citizens who, upon retirement, did not have the required amount of insurance experience and points, have the right to receive social assistance from the state. If you have the strength and desire, you can continue to work further, gradually increasing your experience. It is important to understand that working pensioners are not entitled to social security.

In addition, in order to receive a social pension, you need to permanently reside in Russia; when you leave its borders for permanent residence, payments stop. The amount of the social pension must be no less than the established minimum subsistence level. All pension payments are indexed annually.

For most elderly citizens, a pension is the most important, and often the only source of income. To receive decent security in old age, you need to take care of this from a young age, observing all the conditions for accumulating the minimum insurance period and the required number of points.

How many years do you need to work to receive a pension?

Laws establish minimum requirements for each category of citizens. Law No. 350-FZ came into force, defining new age limits for retirement starting in 2020. In general, the age increases by 5 years for both sexes. However, to reduce the stress load for those whose graduation date fell in 2019, a special scheme has been established. The law provides for a number of other innovations.

To establish old-age insurance benefits

Starting from 2020, the minimum length of service to receive an insurance pension in the Russian Federation will be 10 years. As is known, previously in almost all post-Soviet states, including the Russian Federation, this standard was practically minimal - 5 years.

The period of 10 years is not a limit, because according to the norms of the legislation of the Russian Federation, this threshold will increase and by 2025 it will be 15 years.

To assign a state pension

As you know, citizens who do not have the minimum length of service to receive a labor pension will receive a social benefit. This benefit will not be awarded immediately upon reaching retirement age. The person will be given 5 years to “get” the minimum length of service, which from 2020 will be 10 years. If this fails, then the Pension Fund of the Russian Federation will accrue a social pension.

Do you always have to wait until retirement age?

As we said above, as a general rule, men retire at 65, women at 60. But you don’t always have to wait until this age to receive a pension. To retire earlier, you need to be:

- A pilot on a civilian ship. He can retire at 50;

- A doctor or a teacher. To do this, you need to work in the village for 20 years or in the city for 30 years;

- An employee of the Ministry of Emergency Situations or the fire service. A man with 25 years of experience will be able to retire at 55, and a woman with 20 years of experience will be able to retire at 50;

- Employee of the textile industry. He has the right not to wait until retirement age if he has worked for 20 years;

- Miner. Men can rest from the age of 50. However, they need to work in the mine for at least 10 years, and the total experience must be 20 years. Women are entitled to a pension at the age of 45, but they need to work for 15 years, including at least 7.5 years as a miner;

- A mother who raised three or four children. She is entitled to a pension at age 57.

- A mother who has raised five or more children - at 50 years old.

In addition, northerners can count on early retirement (but they still need to work for 15 years). Men - at 60 years old, women at 55. However, if a worker has two or more children, she can go on vacation already at 50.

What should be the minimum length of service for an old-age pension?

The minimum working period is different for men and women. In addition, some categories of citizens have special benefits. Therefore, in accordance with the new pension legislation, pensioners for the transition period until 2025 will retire based on data from a government-approved table. So, for those who must leave work already in 2020, they must have at least 10 years of experience, which is 16.2 pension points.

Those who have not worked at all or have not earned the minimum length of service will receive a social old-age pension, the amount of which cannot be lower than the subsistence level.

How much experience does a woman need in Russia?

To receive pension payments, a woman in Russia must reach 55 years of age as of 2018. The insurance period cannot be less than 9 years. In 2020, no one will be able to count on receiving a pension if they have worked with contributions to the Pension Fund for less than 10 years. At the same time, a woman’s total work experience, taking into account non-insurance periods, is from 20 years.

How much experience does a man need?

If we talk about the purely insurance period, then its value in terms of the number of years at the moment is no different from the indicators established for women - 9 years, but there are some differences:

- the minimum retirement age is 5 years higher than for women;

- The minimum total work experience is 25 years.

What to expect from the amendments?

In 2020, the minimum length of service to qualify for an old-age pension is 11 years. In 2020, 10 years was enough. The state annually tightens the requirements for the minimum work experience for a pension by 1 year - this trend will continue until 2024, when a person counting on a pension will have to work 15 years in an official job.

It should be noted that even a sufficient minimum length of service for a pension in Russia is not a guarantee of a secure old age - since 2015, citizens have also been required to count pension points, the number of which depends on the level of income.

There is also a limitation: you cannot earn more than a certain number of points in 1 year. So far, this limitation is not significant - in 2020, by old age you need to score 18.6 points. However, over time it will become more important, because in 2025 30 points will be needed. Using pension points, the state links the size of the pension to the citizen’s income level.

The table of the required number of points and length of service for retirement will help you figure out:

| Year | Minimum length of service for calculating a pension |

| 2020 | 11 |

| 2021 | 12 |

| 2022 | 13 |

| 2023 | 14 |

| 2024 | 15 |

| Year | Minimum IPC value |

| 2019 | 16,2 |

| 2020 | 18,6 |

| 2021 | 21 |

| 2022 | 23,4 |

| 2023 | 25,8 |

| 2024 | 28,2 |

| 2025 | 30 |

The procedure for calculating length of service

Labor and insurance experience are similar but different concepts. The length of service takes into account the periods of work of a person at enterprises, institutions and organizations, as well as the implementation of other activities (study, child care, etc.) regardless of the payment of insurance premiums.

In understanding the TS, the concept of continuity is used. If a person quits the enterprise, then for continuity of service he must find a new job within 1 month. If this dismissal occurred due to the liquidation of the organization or staff reduction, 3 months are given for employment.

The insurance period in our country has been accrued since 2002 and is completely tied to the payment of contributions by employers for their employees.

The determination of the total length of the working period occurs by summing up all the stages that, according to the law, are included in the labor activity of a citizen.

Increasing coefficients

When calculating pensions in the Russian Federation, coefficients are established that determine the relationship between the size of the pension payment and the average salary in the country. The maximum standard ratio is 1.2, but there are also increased rates. For persons who have worked in the Far North and are applying for a “northern” pension, an increasing coefficient has been established in the range from 1.4 to 1.9.

What periods are not taken into account?

The pension period includes only those periods when the employee made contributions to the pension fund. Therefore, such periods will not be included in it:

- full-time training, regardless of the institution, as well as courses in personnel training or retraining;

- living in the occupied territories and besieged Leningrad during the Second World War;

- being in concentration camps during the Second World War;

- care for HIV-positive children under age;

- any leave without pay.

What is the minimum length of service for calculating a pension in Russia?

Pension issues concern not only citizens who are about to retire, but also everyone who cares about their own future.

One of the conditions for assigning an insurance pension is the presence of a minimum work experience.

In Russia, the pension system quite often undergoes significant changes, and it is necessary to constantly “keep your finger on the pulse” so as not to forget about all the changes.

Work experience is the total duration of work and other activities. For the payment of a pension, the insurance period is important, i.e. the periods of time when a person received income and the employer made contributions to the Pension Fund for the person. If it is less than established by law, then he will not be able to be assigned an old-age insurance pension.

The minimum period of work is not the only condition for assigning insurance pension payments. In the Russian Federation, the so-called point system is used.

A person needs to score a certain number of points (receive the appropriate individual pension coefficient (IPC)), otherwise, even if there is a required period for paying insurance premiums, he will not be assigned an old-age insurance pension.

It is also useful to read: How pension points are calculated

Important! Disabled people receive insurance pension payments provided they work at least 1 day.

The system with points and insurance (work) experience began to be used in 2020. Before this time period, different rules applied.

It is also useful to read: How to increase pension points

Russian legislation regulating pension payments actively uses the concept of seniority. But it is necessary to take into account that there are different types of it, each of which plays an important role in certain situations.

The following types of work experience are distinguished:

- General – takes into account the total duration of work or activity useful to society. Calculated on a calendar basis. Actively used until 2002.

- Insurance – the total duration of activity when insurance premiums were paid. This is what is used now when determining the possibility of assigning a pension.

- Special – periods when a person worked in a profession or under conditions that provided for the assignment of pension payments on preferential terms or in a special manner. Plays an important role in determining the start time of payments. It includes a significantly limited list of activities.

- Continuous – the duration of continuous work at 1 enterprise or in several organizations, if the transition period does not exceed the norms established by law. Currently, this concept has been completely eliminated in the pension system.

It is also useful to read: How to calculate total work experience

The most important factors for assigning pension payments are insurance and special service. The age at which a person can retire and various payment parameters directly depend on them.

Length of service refers to special length of service, but it in itself is a legal fact sufficient to assign a pension. If you have the required length of service, the person’s age and other parameters will not be important for assigning a pension.

Registration of old-age insurance benefits will be denied if the citizen does not have the minimum length of service for a pension and has not accumulated the necessary pension points. We will find out in the article what segments of professional activity are taken into account when calculating pensions and how much experience is needed for a pension in Russia.

In 2020, the age limit was raised to 60 for women and 65 for men who are entitled to an old-age pension.

But the fact of reaching the established age is not yet a sufficient basis to count on the accrual of an insurance pension.

In addition, the pensioner will have to accumulate the necessary work experience to calculate a pension and accumulate approved points in the form of an individual pension coefficient (IPC).

Minimum length of service for calculating an old-age pension:

- The minimum length of service is the same for everyone, regardless of the gender of the pensioner.

- The pension coefficient for a pensioner will be:

Disabled persons who have a work (insurance) length of service starting from one day and above are assigned an insurance pension. If a disabled person cannot prove his work experience, he will have to rely only on social benefits.

Before the pension reform of 2002, the size of the pension depended proportionally on the length and continuity of work experience and the average salary.

After the adoption of Federal Law No. 173, when calculating pension payments, only those periods in which the employer paid insurance payments for the citizen are taken into account.

This means that years of study and other periods when insurance premiums were not calculated will not be taken into account. To calculate the insurance period, the principle of continuity of work activity is no longer mandatory.

After 2002, the term “work experience” was replaced by a new one - “insurance experience”. However, Art.

30 Federal Law No. 173 establishes that citizens retiring will have their confirmed periods of work before 2002 taken into account when calculating their pension.

It is worth considering that “non-insurance” periods are included in the insurance period if the citizen worked between them and insurance contributions were paid for him.

A citizen is entitled to a social pension if the established number of years of insurance coverage is missing or the person has not been officially employed during his life. The only basis for calculating social pension is the achievement of the established age limit - 65 and 70 years. The length of service for a social pension in 2020 does not matter.

The Government of the Russian Federation also provides for a gradual transition to the payment of social pensions to this category of the population. In 2020, pensioners who have reached 60.5 and 65.5 years will receive social pensions. The age transition to old-age social benefits at 65 and 70 years old will be completed in 2024.

After the changes have been adopted to mitigate the consequences of the transition period, citizens who are entitled to a pension in 2020 according to the previously valid rule will receive a pension before the deadline over the next two years.

Pensioners will receive the due payment 6 months earlier than the new age pension qualification. In fact, in 2020, pensions will be granted to those whose ages are 55.5 and 60.5 years. This applies to the general rule of old age pension.

These categories of citizens have different conditions for retirement.

The calculation of pension payments to military personnel is regulated by Federal Law No. 4468-1. Lists of hazardous professions No. 1 and No. 2 establish lists of professions for which a preferential right to retire before the deadline is granted. In these categories, citizens have the right to receive an early pension by 5 years, and in some cases by 10 years.

The minimum working period is different for men and women. In addition, some categories of citizens have special benefits. Therefore, in accordance with the new pension legislation, pensioners for the transition period until 2025 will retire based on data from a government-approved table. So, for those who must leave work already in 2020, they must have at least 10 years of experience, which is 16.2 pension points.

To receive pension payments, a woman in Russia must reach 55 years of age as of 2018. The insurance period cannot be less than 9 years. In 2020, no one will be able to count on receiving a pension if they have worked with contributions to the Pension Fund for less than 10 years. At the same time, a woman’s total work experience, taking into account non-insurance periods, is from 20 years.

If we talk about the purely insurance period, then its value in terms of the number of years at the moment is no different from the indicators established for women - 9 years, but there are some differences:

- the minimum retirement age is 5 years higher than for women;

- The minimum total work experience is 25 years.

Pension in the absence of insurance experience

The state guaranteed payment to persons without work experience is assigned upon reaching 65 years of age for men and 60 years of age for women. For representatives of small nations of the North, the minimum age is reduced by 10 years.

To summarize, we can say that in order to receive decent financial assistance from the state in old age, you need to work for at least 20 years. There is also the possibility of receiving remuneration on preferential terms. The state takes care of all pensioners, so even if there is no standard age, a minimum level of income will be ensured.

How to calculate the length of work experience?

Until 2020, you only had to work for 5 years. After such work experience, you could well count on a pension. However, everything has changed. The government revised the law and decided from 2020 until 2024 to add one more year to the five-year length of service every year. For example, if your retirement age falls in 2020, then you need to work for 11 years.

Moreover, these rules apply to Russian citizens regardless of gender. There are no distinctions here, unlike the retirement age, which is:

- 65 years for men;

- 60 years for women.

If you retire after 2024, you will need to work for at least 15 years. In the case when you get legal rest earlier, you need less work experience.

The amount of your pension will depend not only on how much you worked, but also on the size of your “white” salary. Since the payment is formed from contributions that were made by the employer for you to the Pension Fund.

All calculations are made in points. To receive a pension, you need to accumulate at least 30. Naturally, the higher this figure, the more money will be transferred to you.

If the experience is not enough

For those who have not worked enough during their lives and do not have the required number of years of service, there are other rules for calculating pensions:

- You can enter your retirement pension 5 years later than the currently accepted retirement age (in 2020 it is 66.5 years for women and 71.5 years for men).

- You can purchase the missing experience. This right is available to those who have accumulated at least half of the minimum wage in the IPC (9.3) and length of service (5.5 years). Every year you can purchase additional experience and IPC by making voluntary contributions to the Pension Fund. Payments will have to be made once a year. This is convenient for those who quit their jobs, but were several months short of reaching the minimum values. Having paid, the citizen provides himself with a labor pension now, and does not wait 5 years for a small social allowance.

- You can continue to work. The IPC of pre-retirees accumulates somewhat faster than that of ordinary able-bodied people, and the length of service continues even after reaching the official retirement age. The length of service always increases as long as contributions are made to the Pension Fund for the employee.

Important! Additional voluntary contributions will not give the right to apply for an early pension. Do not buy teaching experience, northern, and others. Only the standard insurance period increases.

Who has the right to take early leave?

There are two reasons to retire earlier than your peers:

1. Occupation of positions, performance of work or employment in institutions that are included in a special government list approved by Cabinet Resolution No. 781 dated October 29, 2002. Among the potential “early leavers” are some categories of doctors and medical personnel, teachers, rescuers, people who worked in dangerous and harmful working conditions. 2. Work in the Far North and equivalent areas.

In both cases, to receive a pension, the employee’s age is of secondary importance; it is the length of service that is important. How long does a medical worker, for example, need to work to receive an early pension? If he worked in a rural area, then 25 years, if in an urban area - 30. In order to retire early, a teacher must have 25 years of experience, and a rescuer must have 15 years. Additional information about the requirements for duration of work for different professions can be read in Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”.

Preparing for old age in advance

Everyone has their own reason why they may not have enough experience. Usually this is either lack of work or unofficial employment. In order not to lose the opportunity to receive money from the Pension Fund in old age, officials offer two options.

The first is to form savings yourself. But you will have to pay for half the period provided for as the minimum length of service. For example, in 2018 the required minimum experience is 9 years. If it is not there, but the citizen voluntarily paid insurance premiums for 4 years and 6 months, he will be accrued and paid a pension, like other citizens who have worked the minimum. To receive a pension in 2020, you will need to already have either 10 years of official employment or receipts for voluntary payment of insurance premiums for 5 years.

If there is no way to pay, and you are already old (65 years old for men and 60 years old for women), you can apply for a social pension. This is the second option. After the April indexation, its size reached 5180 rubles 24 kopecks. This is less than the cost of living for a pensioner, which is set by the regions independently. Therefore, citizens should apply for a social supplement. An old-age pensioner is entitled to the same additional payment if the monthly amount accrued to him is below the subsistence level in the region.