Source/official document: attachment to letters No. AD-30-26/16030, 17-03-10/08–473 dated 12/09/2014 Submission method: paper or electronically Penalty for late submission: 200 rubles. for each employee

Document name: Card for individual accounting of amounts of accrued payments and other remunerations and amounts of accrued insurance premiums Format: xls Size: 134 kb

Print Preview Bookmark

Save to yourself:

Since 01/01/2017, payments to the Pension Fund of Russia, Social Insurance Fund and Compulsory Medical Insurance Fund are administered by the Tax Service of Russia. The Tax Code of the Russian Federation has a special chapter No. 34 dedicated to insurance premiums. The innovation abolished the previous Federal Law No. 212. Do enterprises need to monitor payments in the form of a Personal Account Card in 2020?

Card for individual accounting of amounts of payments and insurance premiums: what is it?

In 2020, Federal Law No. 212 of July 24, 2009 stated that accounting for insurance and social contributions for an employee is mandatory at the enterprise. From 01/01/2017, payments are regulated on the basis of Ch. 34 Tax Code of the Russian Federation. Article clause 4 art. 431 of the Code almost completely repeats Art. 15, 28 Federal Law No. 212. Accordingly, the employer’s obligation to keep records for each employee has not been canceled.

To simplify accounting, the FSS and the PRF of Russia recommended a card form as an attachment to letters No. AD-30-26/16030, 17-03-10/08–473 dated 12/09/2014 This is not a mandatory form : an enterprise can develop it independently with taking into account the specifics of its activities, for example, hazardous production or the presence of employees who were Chernobyl victims.

After the changes that took place, the new recommended form has not yet been approved. You can use the card form developed in 2014, with minor adjustments. It is necessary to replace outdated references to Federal Law No. 212 with current excerpts from the Tax Code, correct the old names of insurance premiums with new ones, and indicate the current payment limits.

Information about additional fees

A special section has appeared on the card to reflect information about additional contributions depending on the class of special assessment of working conditions (page 2 of the card).

We remind you that since 2013, an additional tariff of insurance premiums has been introduced for employers who have jobs in hazardous and hazardous industries. Moreover, since 2014, differentiation of these tariffs has been established depending on the results of a special assessment of working conditions (Part 2.1, Article 58.3 of Law No. 212-FZ). A special assessment of working conditions is carried out in accordance with Federal Law No. 426-FZ “On the special assessment of working conditions”.

The card contains separate lines for payments and additional contributions, depending on whether a special assessment of working conditions of workplaces was carried out, as well as by classes of working conditions (O4 - dangerous, B3.4 - harmful 3.4, B3.3 - harmful 3.3, B3.2 - harmful 3.2, B3.1 - harmful 3.1).

Who hands over the Card and in what cases

Payers must keep records of insurance, pension and social contributions for each employee separately from the first day of his work. This is mandatory for all legal entities and individual entrepreneurs who employ at least one person. The full list of payers is given in Art. 419 of the Tax Code of the Russian Federation.

Records are kept in the form of a card, which is issued for each employee on his first paid day. It is filled out once a month based on the results of the previous month with a cumulative total, calculated for the calendar year. If an employee got a job, for example, in March, dashes are added for January–February.

Unlike other forms of insurance reporting (SZV-M, RSV-1), there is no need to specifically submit the card to funds and departments. It is required only for on-site and desk audits by the tax service and various funds, as well as for reconciling payment amounts at the end of the year. Thus, the Pension Fund of Russia requests cards in accordance with the Order of the Pension Fund of Russia No. 34R dated 02/03/2011.

About tariffs

A small table on the right side of the card displays information about the insurance premium rate applied by the organization.

Tariff code

The first line of this plate indicates the tariff code, which can be found in the Directory of tariff codes for insurance premium payers.

In 2010, institutions paying insurance premiums according to the basic tariff indicate code 01.

Agricultural producers, organizations of folk arts and crafts, family communities of indigenous peoples of the North engaged in traditional sectors of the economy indicate tariff code 02.

Tariff code 03 indicates:

Organizations and individual entrepreneurs that have resident status in the technology-innovation special economic zone (TVOEZ) and make payments to individuals working in the territory of TVOEZ;

Public organizations of disabled people (including those created as unions of public organizations of disabled people), among whose members disabled people and their legal representatives make up at least 80 percent;

Organizations whose authorized capital consists entirely of contributions from public organizations of disabled people and in which the average number of disabled people is at least 50 percent, and the share of wages of disabled people in the wage fund is at least 25 percent;

Institutions created to achieve educational, cultural, medical and recreational, physical culture, sports, scientific, information and other social goals, as well as to provide legal and other assistance to people with disabilities, disabled children and their parents (other legal representatives), the sole owners of property which are public organizations of disabled people, with the exception of payers of insurance premiums engaged in the production and (or) sale of excisable goods, mineral raw materials, other minerals, as well as other goods in accordance with the list approved by the Government of the Russian Federation on the proposal of all-Russian public organizations of disabled people.

Organizations and individual entrepreneurs paying the Unified Agricultural Tax use tariff code 04.

Organizations and individual entrepreneurs using the simplified tax system, as well as organizations and individual entrepreneurs paying only UTII, use tariff code 05 (but since 2011 they have been paying insurance premiums at the basic tariff).

Tariff size

The “%” column indicates the amount of the insurance premium rate. Basic tariff of insurance premiums in 2010:

Pension fund - 20 percent;

Social Insurance Fund - 2.9 percent;

Federal Compulsory Health Insurance Fund - 1.1 percent;

Territorial compulsory health insurance funds - 2 percent.

For compulsory pension insurance (OPI), the tariff for the insurance part, the funded part and additional deductions is indicated. Pension insurance is carried out taking into account the employee’s year of birth. The main insurance rate for compulsory insurance in 2010:

To finance the insurance part of the labor pension for persons born in 1966 and older - 20 percent, for persons born in 1967 and younger - 14 percent;

To finance the funded part of the labor pension for persons born in 1967 and younger - 6 percent.

For compulsory health insurance (CHI), tariffs are also indicated with a breakdown into federal and territorial funds - 1.1 and 2 percent, respectively.

Providing a card

The card is necessary to confirm the fact of keeping records of payments and contributions at the enterprise during audits. The Tax Code of the Russian Federation does not specify the form for maintaining this accounting. Accordingly, you can fill it out electronically (in 1C or Excel) or download a form for an individual accounting card for payments and insurance premiums and fill it out by hand on paper.

If the company’s accounting department works with 1C, the card is printed annually to verify the amount of contributions to funds for each employee or, as necessary, during audits. The form is found in section 1C “Payroll calculation by organizations”, subsections “Taxes and contributions”, “Card”. You should select the employee’s full name, print out the generated form, certify it with the signature of the chief accountant and a blue seal.

It is also recommended to make a paper version of the card at the beginning of the year for the previous period. The document requires the signature of the chief accountant and the seal of the organization. The final and intermediate forms should be kept.

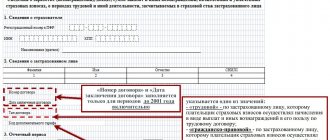

A cap

In the title of the card you must indicate for what year it was compiled, as well as put down the page numbers. The pages are numbered through, that is, in a continuous manner.

The first line of the header reflects information about the payer of insurance premiums, his tax identification number and checkpoint.

It is necessary, as before, to indicate the insurance number, citizenship and date of birth of the employee. At the same time, an indicator such as an individual’s Taxpayer Identification Number (TIN) has been added to the new card. However, it may not be filled out if the organization does not have information about the taxpayer identification number.

The recommended card does not require indicating the number and series of the employee’s passport, his gender, place of residence, position, type and number of the contract, as well as the date of appointment to the position. These indicators were considered insignificant and excluded from the new form of the document.

But information about disability remains mandatory. If the employee is disabled, then it is enough to indicate the validity period of the certificate (date of issue and expiration date), but there is no need to indicate the certificate number.

For your information. The form of the card can be found on the official website of the FSS of the Russian Federation (www.fss.ru) in the “Enterprises and Organizations” section.

Penalty for late delivery

Failure to provide a card at the request of the inspection authorities will be regarded as failure to keep records of insurance and other payments and contributions. This threatens the employer with tax liability under clause 1 of Art. 126 of the Tax Code of the Russian Federation: a fine of 200 rubles. for each employee. So, an enterprise with a staff of 40 people will pay 200 * 40 = 8000 (rubles).

It must be remembered that the storage period for accounting documents is 5 years (Article 29 of Federal Law No. 402 of December 6, 2011). The requirement to provide cards for an earlier period is illegal.

Responsibility for incorrectly filling out the card

Despite the fact that the form of the card is of a recommendatory nature, its maintenance is mandatory. The absence of this register or systematic errors in filling it out will be considered gross violations of the rules for accounting for taxable items, liability for which comes under Art. 120 Tax Code of the Russian Federation.

This responsibility is expressed in fines, which will amount to:

- 10,000 or 30,000 rub. depending on the number of billing periods associated with the error, which did not lead to an underestimation of the base for calculating contributions;

- 20% of unpaid contributions, but not less than 40,000 rubles, if the basis for calculating contributions turned out to be underestimated.

Shape and structure

The card required to record insurance premiums must contain certain information:

- The name of the institution that is the insured must be indicated. His checkpoint and taxpayer identification number are marked next to him.

- The following is information about the person subject to insurance. His last name, first name, patronymic, citizenship, and presence of disability are indicated. You can confirm the employment relationship using the name and characteristics of the contract, with a note on the date of its conclusion and registration number. The date when the person began to occupy this position may also be stated. In the absence of citizenship or belonging to another state, the status of the employee is noted.

- The column records the amounts that were paid to the person as income. Separate lines reflect the funds from which insurance premiums will and will not be deducted.

- The insurance bases from which funds are transferred to each fund are separately indicated. The amounts to be transferred to the Pension Fund, Social and Compulsory Health Insurance Funds are noted here.

- For each type of insurance, the amounts that were accrued are indicated separately. When prescribing pension contributions, it is important to note those that do not exceed the established limit and values in excess of the norm.

- The funds that were to be paid to employees are noted next to them. Benefits are provided in the event of temporary disability, pregnancy, or child care. This also includes payments for damage resulting from occupational diseases and work-related injuries. Full details of payments are noted on the third page.

It is important to remember that the dimensions are indicated twice. One amount is noted for a specific month. Another number is needed to determine the running total.

Additional fees may be noted on the card.

They are reflected for:

- flight crew members;

- coal industry workers;

- persons working in harmful and dangerous working conditions.

This data is written on the second page of the document.

Form of insurance premium registration card in 2020:

Sample filling

Let's fill out the developed form with information using a conditional example.

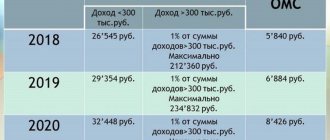

LLC "Company" pays insurance premiums at regular rates to employee Semenov S.S. disability has not been established. The monthly salary is 100,000 rubles. During the year, accrued remuneration reached the maximum bases for calculating insurance premiums. Let us remind you that the maximum payment amounts for calculating social contributions in 2020 are:

- for OPS - RUB 1,021,000.00;

- at VNiM - RUB 815,000.00.

Please note that data on accrued remuneration and social insurance payments must be provided in rubles and kopecks. This is due to the fact that social contributions are calculated with an accuracy of kopecks (clause 5 of Article 431 of the Tax Code of the Russian Federation).

Employers must keep records of payments and other remunerations accrued in favor of their employees, as well as the amounts of insurance premiums calculated from them. To maintain such records in 2020, the Pension Fund of the Russian Federation and the Social Insurance Fund of Russia recommend using an individual card form for recording the amounts of accrued payments and other remunerations and the amounts of accrued insurance contributions. The form of the card is given in the Appendix to the letter of the Pension Fund of the Russian Federation No. AD-30-26/16030, FSS of the Russian Federation No. 17-03-10/08/47380 dated December 9, 2014.

This form is not mandatory, therefore regulatory agencies do not establish any strict requirements for the form and procedure for its maintenance. Accordingly, you can make changes to it - add the necessary columns (rows) and delete unnecessary ones. In addition, it is not prohibited to keep records in another form, which the policyholder will develop independently based on the specifics of the activity, and use the recommended form of an individual card for recording the amounts of accrued payments as a sample. The main goal of this document is to reflect complete and reliable information on accrued payments to employees in kind and cash and calculated insurance premiums, as well as social expenses.