General trends of change

In 2020 The main taxpayers who must pay this type of contribution are:

- persons making payments and other amounts of remuneration to individuals;

- IP.

If an individual entrepreneur has hired persons and employees under civil contracts, it is necessary to make contributions not only for yourself, but also for them.

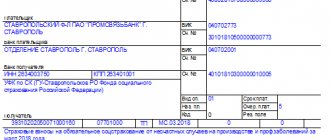

A sample declaration of insurance premiums is presented in the appendix to the work.

Direction of insurance premiums in 2020

In 2020 These contributions can be sent to:

- for pension insurance OPS;

- for compulsory medical insurance;

- for insurance in case of illness, pregnancy and maternity (VNiM).

In 2020 Amounts for injuries are also paid to the Social Insurance Fund (Federal Law No. 125-FZ dated July 24, 1998).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Basics of calculation

Calculation of contributions for 2020 carried out by combining the following elements:

- amounts of payments to individuals;

- restrictions on the tax base;

- rates.

The amount of amounts not subject to contribution is specified in Article 422 of the Tax Code of the Russian Federation.

Important! Changes in 2020 did not affect the taxable base. It can still be defined as the amount of payments corresponding to paragraph 1 of Art. 420 Tax Code of the Russian Federation. The amount received is reduced by the amount of non-taxable amounts specified in Art. 422 of the Tax Code of the Russian Federation. Example: state aid, financial assistance up to 4,000 rubles.

Tariffs for legal entities in 2020

In 2020 the tariff rate also remains at 30% in the event, with the exception of the situation when the company uses preferential tariffs (Article 426 of the Tax Code of the Russian Federation).

Size fear. tariffs in 2020: (click to expand)

- on general pension fund – 22%, + 10% after exceeding the payment base;

- for compulsory medical insurance – 5.1%, without base restrictions;

- on the Social Insurance Fund – 2.9%, without base restrictions.

These tariffs apply to:

- residents of the Russian Federation;

- temporarily residing foreign guests, except for a group of highly qualified specialists (HQS);

- citizens of the EAEU.

The table shows data on tariffs for legal entities for payments to individuals

| View | Base in 2020 (maximum), rubles | Base limit rate in 2020 | Bet when limits are exceeded |

| OPF | 1 150 000 | 22 | 10 |

| FSS | 865 000 | 2,9 | 0 |

| Compulsory medical insurance | No | 5,1 | – |

Important! Previously, the government provided for an increase in the tariff for compulsory medical insurance from 2021 to 26%. But from January 1, 2020, this tariff was documented at a fixed rate of 22% without specifying a deadline (No. 306-FZ dated August 3, 2020).

The rate has not changed, but the limit base has increased. The change in the size of the base is reflected in clauses 3 and 6 of Art. 421 Tax Code of the Russian Federation. That is, if the employee’s income for the year exceeds the specified amounts, the employer must calculate 10% in the OPF (Clause 1, Article 426 of the Tax Code of the Russian Federation).

The table shows data on increasing contribution limits

| Year | OPS limit | FSS limit |

| 2017 | 876 000 | 755 000 |

| 2020 | 1 021 000 | 815 000 |

| 2020 | 1 150 000 | 865 000 |

Important! There is no limit on compulsory medical insurance contributions. These contributions in any situation are paid in the amount of 5.1% of the amount of income.

What happened before

Since 2010, after the abolition of the unified social tax, the concept of a maximum size has been defined. This is the basis for calculating insurance premiums at the established rate for the Pension Fund and the Social Insurance Fund. For the Compulsory Medical Insurance Fund there is no limit on the size of the base.

For the Pension Fund of the Russian Federation and the Social Insurance Fund, a maximum size of the base has been established for 2020, based on the average salary in the country, increased by 12 times, taking into account increasing factors compared to the previous year 2020 (clause 5 of Article 421 of the Tax Code of the Russian Federation) and for the Pension Fund of the Russian Federation the amount is 1,021,000 rubles . and for the Social Insurance Fund - 815,000 rubles. The same article of the Tax Code of the Russian Federation provides for increasing coefficients for 2019-2021. For the self-employed population (including individual entrepreneurs, lawyers, notaries) from 2010 to 2020, the base for calculating insurance premiums was the size of 1 minimum wage, depending on its size at the beginning of the year and the formula: 1 minimum wage x 26% x 12 months, the size of the fixed amount was calculated payment for the year, where 26% is the tariff for employers established by Article 425 of the Tax Code of the Russian Federation (previously the tariff in Law No. 212-FZ) on a general basis (until 2020, the general tariff is 22% of Article 426 of the Tax Code of the Russian Federation).

But from 2018-2019, in connection with the increase in the minimum wage to the level of the subsistence level in the country, the size of the financial contribution for individual entrepreneurs and other persons in this category was “untied” and the clarified Article 431 of the Tax Code of the Russian Federation established a specific maximum contribution amount for this category for 2018-2020. G. no more than 8 times the established fixed payment amount. Tariffs and procedure for payment/accounting of current insurance contributions to the Federal Tax Service in 2017-2018. for various categories of payers.

The basic rate of insurance contributions for employers is set at 34%, where 26% is for compulsory insurance in the Pension Fund of the Russian Federation within the established amount of the base for calculating insurance premiums, 2.9% is for compulsory social insurance in the Social Insurance Fund within the established amount of the contribution base, 5.1% - for compulsory medical insurance in the Compulsory Medical Insurance Fund without establishing the specified limit (Article 425 of the Tax Code), but until 2020 Article 426 of the Tax Code is in force, where:

- for the Pension Fund of the Russian Federation for compulsory security the general tariff is 22% plus 10% if the maximum size of the base is exceeded;

- for the Compulsory Medical Insurance Fund - for compulsory medical insurance the tariff is 5.1% without establishing a maximum base size;

- for the Social Insurance Fund - for compulsory social insurance in case of temporary disability and in connection with maternity within the established limit of the base for calculating insurance premiums for this type of insurance - 2.9% and compulsory social insurance in case of temporary disability in relation to payments and other remunerations in favor of foreign citizens and stateless persons temporarily staying in the Russian Federation (with the exception of highly qualified specialists), within the established maximum base for calculating insurance premiums for this type of insurance - 1.8%.

Reduced tariffs are established by art. 427 of the Tax Code of the Russian Federation (confirmation according to the new edition of OKVED). Additional tariffs are established by art. 428 of the Tax Code of the Russian Federation, depending on the hazard class determined based on the results of the special assessment of working conditions (special assessment of working conditions carried out in accordance with Law No. 426-FZ no later than December 31, 2018 by all employers (for class 4 - dangerous - 8.0%, for class 3 - harmful from 2% to 7% depending on the subclass, for class 2 - permissible and class 1 - optimal - 0%) Before the SOUT, based on the results of certification of workplaces of the same article of the Tax Code of the Russian Federation, a tariff of 6% or 9 is established % depending on the hazard class.

Calculation of contributions for maternity and disability for changes in 2020.

From payments up to 865,000 rubles per year it is necessary to calculate:

- 2.9% when applying general tariffs;

- 1.8% for payments for temporary foreigners, with the exception of those who have HQS status;

- reduced rates when the company applies benefits.

Important! If the maximum base is exceeded, social contributions for this insurance are not calculated.

Example No. 1. To change conditions in 2020.

Initial data:

- the company uses general tariffs;

- the employee's salary is 100,000 rubles;

- The limit on pension payments is 1,150,000 rubles. It will be exhausted in November 2020;

- The limit on social payments (865,000 rubles) will be exhausted in September.

The calculation is presented in the table below.

| Month | Base, rub. | OPS, rub. | VNBiM, rub. | Compulsory medical insurance, rub. |

| January | 100 000 | 22 000 | 2 900 | 5 100 |

| February | 100 000 | 22 000 | 2 900 | 5 100 |

| March | 100 000 | 22 000 | 2 900 | 5 100 |

| April | 100 000 | 22 000 | 2 900 | 5 100 |

| May | 100 000 | 22 000 | 2 900 | 5 100 |

| June | 100 000 | 22 000 | 2 900 | 5 100 |

| July | 100 000 | 22 000 | 2 900 | 5 100 |

| August | 100 000 | 22 000 | 2 900 | 5 100 |

| September | 100 000 | 22 000 | 1 885 | 5 100 |

| October | 100 000 | 22 000 | 0 | 5 100 |

| November | 100 000 | 22 000 | 0 | 5 100 |

| December | 100 000 | 11 000 | 0 | 5 100 |

Changes in 2020 for individual entrepreneurs without employees

Individual entrepreneurs, like ordinary legal entities, pay taxes depending on the chosen tax system. In addition, they are required to participate in the compulsory insurance program of the Pension Fund of the Russian Federation, Social Insurance Fund and Compulsory Medical Insurance. In this case, deductions go both for yourself and for employees.

Let's consider what changes await individual entrepreneurs in 2020, which operate without the use of hired labor.

The basic rules for the payment of insurance premiums, which have been preserved for individual entrepreneurs without employees since 2020:

- payment of tax contributions for individual entrepreneurs is a mandatory element, regardless of the taxation system used, and even in the absence of activity. That is, if tax returns are submitted with zero values, then payment of contributions to insurance funds remains mandatory;

- The calculation of the amounts of contributions to the funds depends on the number of days of operation in the accounting year. That is, it begins from the moment of registration or from January 1, 2020 and ends with the closing date or December 31, 2020;

- Before January 1, 2020, the amount of payments depended on the size of the minimum wage, and from the beginning of 2020 this rule was changed. For 2020, the rules are still the same: the new calculation procedure is determined by Federal Law No. 335-FZ dated November 27, 2017.

What changed in 2020:

- the amount of insurance premiums increased for each fund.

The table presents data on changes in the amounts of contributions paid.

| Year | Compulsory medical insurance, rub. | PF, rub. | Total amount, rub. |

| 2020 | 5840 | 26545 | 32385 |

| 2020 | 6884 | 29354 | 36238 |

| 2020 | 8426 | 32448 | 40874 |

Thus, the amount of increase in contributions for individual entrepreneurs for themselves in 2020. is:

- according to compulsory medical insurance: 6884-5840 = 1044 rubles;

- according to OPF: 29354-26545 = 2809 rubles;

- the total tariff increase is: 1044 +2809 = 3853 rubles.

The due date for contributions is December 31, 2020.

If an individual entrepreneur receives income in excess of 300,000 rubles, the amount of deductions in excess of the amount also remained at the level of 1% for 2020.

Maximum amount of payments to funds in 2020 set within:

- 2020: 212,360 rubles;

- 2020: 234,832 rubles;

- increase in the maximum amount in 2020 amounted to: 22472 rubles.

Example No. 1. Individual entrepreneur without employees

Initial data:

- Individual entrepreneur without employees;

- taxation system – simplified tax system 6%

- income in 2020 will amount to 30,000,000 rubles;

Solution:

- the amount of insurance premiums is based on basic deductions: 29,354 rubles for general pension fund;

- Before July 1, 2020, you must pay an additional 1% to this amount:

(30,000,000 – 300,000)*1% = 297,000 rubles;

- the amount received exceeds the established maximum limit of 234,832 rubles;

- the amount of payments in the general public fund will be: 234,832 – 29,354 = 205,478 rubles.

Fixed contributions for individual entrepreneurs in 2020

Until 2020, insurance premiums for individual entrepreneurs were paid based on the cost of the insurance year. That is, the cost of the insurance year was calculated according to the formula: minimum wage X 12 months.

Since January 1, 2020, the minimum wage has increased by almost 30%. And in order to avoid excessive burden on individual entrepreneurs, from 2020 it was decided to decouple the amount of insurance premiums from the minimum wage and introduce fixed contributions for entrepreneurs.

Open an account with Kontur.Bank and use built-in accounting and reporting. Corporate card and electronic signature are free. Up to 5% on balance.

To learn more

For 2020, fixed contributions for individual entrepreneurs were:

- For compulsory pension insurance: if the income of an individual entrepreneur does not exceed 300,000 rubles, then the fixed amount is 29,354 rubles. (in 2018 - 26,545 rubles); if the income of an individual entrepreneur is more than 300,000 rubles, then the fixed amount is 29,354 rubles. + 1% of the amount of income exceeding 300,000 rubles, but not more than an eightfold increase in the fixed payment - 8 x 29,354 rubles. Thus, the maximum contribution for compulsory pension insurance in 2020 is RUB 234,832. (in 2020 - 212,360 rubles).

- For compulsory health insurance - 6,884 rubles. (in 2018 - 5,840 rubles).

Individual entrepreneurs, as before, are not required to transfer contributions in case of temporary disability and in connection with maternity “for themselves”.

Changes in 2020 for individual entrepreneurs with employees

In a situation where an individual entrepreneur has employees, in addition to the above-described payments for himself, the employer pays insurance premiums for his employees. He pays these contributions from the salaries of his employees.

From this perspective, when calculating for 2020. You also need to take into account a number of features and changes, especially with regard to bets.

The table shows data on insurance rates and their changes in 2020. (click to expand)

| Insurance | Rate 2020 | Rate 2020 | ||||

| Standard | Preferential | Exceeding the base | Standard | Preferential | Exceeding the base | |

| OPF | 22 | 20 | 10 | 22 | Canceled* | 10 |

| Compulsory medical insurance | 5,1 | 0 | – | 5,1 | Canceled* | – |

| Disability, pregnancy and childbirth insurance | 2,9 | No | 1,8 | 2,9 | Canceled* | 1,8 |

| Accident insurance | From 0.2 to 8.5 | No | – | From 0.2 to 8.5 | Canceled* | – |

*Cancellation of preferential rates from the table in 2020. is typical only for the following IPs:

- Individual entrepreneur on the simplified tax system for certain types of activities (clause 5, clause 1, clause 3, clause 2, article 427 of the Tax Code of the Russian Federation);

- IP on PSN (clause 9, clause 1, article 427 of the Tax Code of the Russian Federation);

- Individual entrepreneur on UTII for atpek.

All of the above categories lose the right to apply a preferential rate and for them insurance premiums increase from 20% to 30%.

Reduced rates

One of the most discussed topics regarding the calculation of insurance premiums was the topic of changing legislation regarding the application of reduced tariffs and determining the list of organizations and individual entrepreneurs that can apply this benefit.

Federal Law No. 303-FZ dated August 3, 2018 clearly regulates that the following categories of policyholders have the right to apply reduced insurance premium rates of 20% and maintain benefits in 2020:

- socially oriented non-profit organizations on the simplified tax system, carrying out activities in the field of social services for citizens, scientific research and development, education, healthcare, culture and art (activities of theaters, libraries, museums and archives) and sports;

- charitable organizations on the simplified tax system.

The Ministry of Finance also draws attention to the fact that 2020 is the last year of application of tariffs for organizations using the simplified tax system engaged in production and equivalent activities, as well as for pharmacists in pharmacies, non-profit organizations, charitable organizations and individual entrepreneurs applying a patent (clause 3 p. 2 Article 427 of the Tax Code of the Russian Federation). This must be taken into account when calculating and reporting insurance premiums. Accordingly, from January 1, 2019, these categories of beneficiaries must calculate contributions using general tariffs.