In June 2020, the Russian Government announced its intention to introduce a new formula for calculating insurance contributions to the Pension Fund of the Russian Federation for individual entrepreneurs making payments for themselves. At a meeting on entrepreneurship development on June 19, Finance Minister Anton Siluanov ordered the ministry to consider the possibility of making appropriate changes to the legislation. What does the proposed calculation method look like?

What contributions do individual entrepreneurs pay to the Pension Fund of the Russian Federation?

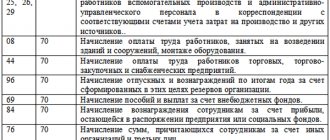

All individual entrepreneurs are required to strictly pay insurance contributions to the Pension Fund of the Russian Federation in order for their pension to be formed. After all, individual entrepreneurs are people who work for themselves; there is no one to make payments for them, so they do it on their own.

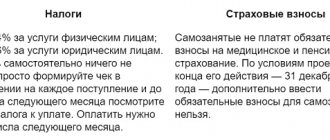

The legislation establishes two types of contributions to the Pension Fund:

- Required. This is a fixed payment that must be made to all entrepreneurs without exception. For 2020, its value is 29,354 rubles.

- From income. It is required to be paid only to those businessmen who make a profit of over 300 thousand per year. There was a special calculation formula for them:

contribution amount = (income - 300 thousand rubles) * 1%.

Now it is planned to make adjustments to this formula. The authorities decided that it would be better to take into account not only the profits, but also the expenses of an individual entrepreneur when calculating pension contributions. This change will affect those who use the simplified tax system.

What does it mean? The simplified tax scheme is the simplest taxation system, in which an individual entrepreneur pays only 6% of his revenue for the year under the “Income” scheme or 15% of profit under the “Income minus expenses” scheme. At the same time, he does not need to prepare any financial statements; he only needs to keep records of income and expenses in order to know from what amount to calculate the tax levy.

Insurance premiums and reduction of tax simplified tax system

An individual entrepreneur who has chosen the simplified tax system (simplified tax system) and the “income” tax regime can reduce the amount of income tax by the amount of insurance premiums paid. Individual entrepreneurs without employees can reduce tax by 100%, with employees - by 50%.

Both annual tax and quarterly advance payments can be reduced. To reduce advance payments, it is necessary to pay insurance premiums in quarterly installments.

If the object of taxation is “income reduced by the amount of expenses”, then paid insurance premiums can be included in expenses.

What else does an individual entrepreneur need to pay?

In addition to pension fees and taxes, people engaged in business also need to pay health insurance premiums. For 2020, their size is 6,884 rubles. This value is not calculated in any way; it is set by the authorities every year, so it can only change when a new year begins.

In addition to mandatory payments, there are also voluntary ones. All entrepreneurs have the right to make additional insurance contributions in order to insure themselves in case they lose their ability to work or go on maternity leave.

How to calculate insurance premiums in 2020 when rates decrease

Let's look at how to calculate insurance premium payments when rates are reduced using a practical example.