Common types of leave and the current legislative framework

The following types of annual leave are distinguished:

- standard - 28 days (Article 115);

- extended - depend on age, position, specifics of work (for example, this category of vacationers includes military personnel, teachers, etc.);

- additional - in the presence of dangerous, harmful working conditions, etc. (Art. 116).

Vacation can be divided (Labor Code, RF, Art. 125), and in some situations, postponed or extended (Labor Code of the Russian Federation, Art. 124). The next paid leave, which falls on different months or reporting periods, is called rolling (hereinafter referred to as PO). Calculation, features of payment of software, calculation of personal income tax, insurance premiums on it, as well as the application of preferential deductions are carried out in accordance with the generally accepted rules of the Labor Code of the Russian Federation. Read also the article: → “The procedure for dividing vacation into parts, calculating payments.”

Vacation pay - payment for work?

On the one hand, the amounts of accrued vacation pay are included in the wage system, are guaranteed by an employment contract, and from these positions can be classified as wages. This opinion is shared by some arbitration judges (Resolutions of the Federal Antimonopoly Service of the West Siberian District dated December 29, 2009 in case No. A46-11967/2009, the Federal Antimonopoly Service of the Ural District dated August 5, 2010 No. Ф09-9955/09-С3 and the Federal Antimonopoly Service of the Northwestern District dated September 30. 2010 in case No. A56-41465/2009). And if vacation pay is wages, then it is quite acceptable to apply the norm of paragraph 2 of Art. 223 of the Tax Code: the date of actual receipt of income by the taxpayer is the last day of the month for which the income was accrued to him.

Some principles for accounting for rolling leave

Calculated insurance premiums (or premiums), as well as taxes and other fees, are included in expenses for the period in which they were credited. FSSO, PFR, FFOMS contributions are calculated and paid for the software. Insurance fees are most often not distributed between months. For example, if an employee went on vacation in June and returned in July 2017, then insurance payments for vacation pay are taken into account in June 2020. Expenses are fully reflected in the declaration for the second quarter of 2017.

However, if, for example, the vacation began in December of one year and ended in the month of another year, accounting is kept differently. Vacation money is an expense included in wages. These software amounts are distributed in proportion to vacation days. They need to be included as expenses every month.

When calculating the single tax, expenses take into account: the software itself minus personal income tax (on the date this amount is issued to the vacationer), the insurance fee for the software (on the day of deduction to the funds).

Under the simplified tax system (Income), the single tax is reduced by the amount of insurance premiums in the period when they were transferred to the fund. However, there is a limit of no more than 50%. Vacation pay themselves do not affect the single tax, because no expenses are taken into account under such a taxation object.

Under the simplified tax system (income - expenses), the obligated person has the right to reduce his income by the amount of expenses for wages. Vacation pay (and in relation to software) is considered an expense at the time of issue. As for insurance premiums, they also reduce the tax base when paying a single tax on the date of payment.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Income tax

Organizations take into account the costs of paying the main annual leave established by law when calculating income tax and the simplified tax system with the object of taxation “income minus expenses” as labor costs. Since vacation pay is a labor expense, they are taken into account in the period to which they relate (Clause 7, Article 255 of the Tax Code of the Russian Federation). According to regulatory authorities, vacation pay should be taken into account in income tax expenses in the period to which they relate, regardless of when they were paid.

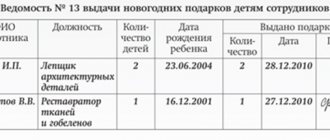

Benefits in the form of deductions applied during rolling leave

The software is subject to standard tax deductions for the vacationer and his children (Tax Code of the Russian Federation, Article 216). The only caveat is that this benefit applies only for one month, and not for both (that is, even when the vacation begins in one month and ends in another). This means that the deductions due to the vacationer are not distributed between months, but are recognized in the generally accepted manner for the current month. It is noteworthy that such benefits can be used both in vacation pay and wages.

| Deduction option | Conditions for providing benefits in the form of a deduction | Base |

| On your children | For each minor child, until the end of the year in which he turns 18; for full-time students up to 24 years of age | Tax Code of the Russian Federation, art. 218, clause 1, sub. 4; Letters of the Ministry of Finance No. 03-04-05/53291 dated October 22, 2014 and No. 03-04-05/8-1251 dated November 6, 2012 |

| To myself | The benefit is provided to participants and victims of the Chernobyl Nuclear Power Plant, participants and disabled people of the Second World War, former prisoners of concentration camps, heroes of the USSR and the Russian Federation, disabled people from childhood and groups 1 and 2, as well as other categories of persons specified in the Tax Code of the Russian Federation | Tax Code of the Russian Federation, art. 218 |

The legislation provides the opportunity for the hotel category of vacationers to receive a double deduction for their children (single parent, guardian, adoptive parent, etc.).

To exercise his right to a benefit, an employee must contact the employer (tax agent) with an application for the provision of this type of benefit and attach to it proper documentary evidence of the right to a deduction, such as: a copy of the certificate of a WWII veteran, a participant in the liquidation of the consequences of the Chernobyl nuclear power plant, etc.

Carrying holiday pay in section 1

Section 1 shows information (from the beginning of the year until the end of the reporting period on an accrual basis):

- about accrued income (in this case about accrued vacation pay) - in field 020;

- accrued personal income tax - in field 040;

- withheld personal income tax - in field 070.

Data for fields 020 and 040 are reflected at a certain rate, for example 13 or 30% (non-resident personal income tax). Data on field 070 - for all bets. Therefore, a direct correlation between this field and the previous ones is a special and irregular case.

Thus, vacation pay accrued in the reporting period is included in the calculation of the indicator in field 020. It is automatically necessary to reflect the accrual of personal income tax on vacation pay in field 040 (exception if they are covered by an unspent tax deduction issued by the employer, for example, property).

In turn, information about withheld personal income tax is shown in field 070 only if such withholding actually occurred within the time limits specified above. Until this happens, the amount of personal income tax is not included in the calculation of the indicator for field 070.

Do I need to fill out field 080 for unwithheld vacation pay? No no need. Field 080 is filled in only if the personal income tax withholding did not actually occur due to the impossibility of carrying it out. But in the case of vacation pay, such a scenario is not provided for by law, since personal income tax, as we already know, is withheld from them at the time of payment. Therefore, we don’t look at field 080 in terms of reflecting information on vacation pay at all.

At the same time, there is a direct correlation between the appearance of a reason to fill out field 070 and the need to fill out information in section 2.

The procedure for calculating the amount due and issuing money to the vacationer

Calculation of annual paid leave (and rolling over) is carried out taking into account the requirements of Government Decree of the Russian Federation No. 922 dated December 24, 2007. Vacation payment is made in advance. Regardless of when the period begins and ends, the employer must pay the amount due to the employee three days before the start of the vacation (Labor Code of the Russian Federation, Article 136, Part 9). In the month when the money was issued, personal income tax is calculated from it.

Calculation is made according to the formula: PO = GD / 12 (months) / 29.4 (days) * BH, where PO is rolling leave, GD is annual income, BH is the number of days of vacation. The billing period is the previous 12 calendar months (Government Decree No. 922 12/24/2007, clause 4). Calendar month is the period from the first to the last day of the month.

For example, a citizen of the Russian Federation has worked for 2 years and goes on another paid leave from August 21, 2020 for 14 calendar days. The vacation is rolling: it starts in August and ends in September. The employer is obliged to calculate and pay the amount due 3 days before 08/21/2017 (before the start of the program). The employee did not have sick leaves, swearing. assistance, bonuses and allowances were not accrued; the billing period was fully exhausted.

| Data for calculation | Sequential software counting | Calculation results |

| Salary 23,000 rub. for the previous 12 months; number of vacation days - 14; multiplier of the average number of days worked - 29.4 | Annual income: 23,000 * 12 = 276,000 rubles; PO without calculating personal income tax according to the formula GD/ 12/29.4* BH: 276,000/12/29.4 * 14 = 10,952 rubles; Personal income tax on vacation pay, formula - PO * 13%: 10952 * 13 / 100 = 1,424 rubles; Amount of software to be paid minus personal income tax (13%): 10952 - 1424 = 9,528 rubles. | Annual income - 276 rubles; Software - 10,962 rubles; Personal income tax - 1424 rubles. Payable - RUB 9,528. |

Based on the calculation results, the software is issued (9,528 rubles) three days before 08/21/2017, and the tax on personal income is transferred no later than 08/31/2017.

Simplified taxation system

The rules for calculating average wages for calculating vacation pay are determined by Art. 139 of the Labor Code of the Russian Federation and the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 (hereinafter referred to as Regulation No. 922). According to clause 4 of Regulation No. 922, the calculation period for calculating average earnings is 12 calendar months preceding the period during which the employee retains the average salary.

We invite you to read: Who pays for maternity leave, the company or the state?

If an employee goes on vacation in June 2020, then the calculation period will be the period from June 1, 2020 to May 31, 2020.

To calculate the average salary, all types of payments provided for by the remuneration system applied by the relevant employer are taken into account, regardless of the sources of these payments (clause 2 of Regulation No. 922). We are talking about the following amounts:

- wages accrued according to salary (tariff rates), as well as issued in non-monetary form;

- allowances and various additional payments to the salary (tariff rates) for professional skills, class, length of service, knowledge of a foreign language, combination of professions (positions);

- payments related to working conditions, including payments determined by regional regulation of wages (in the form of coefficients and percentage bonuses to wages), increased wages for hard work, work with harmful and (or) dangerous and other special working conditions , for night work, payment for work on weekends and non-working holidays, payment for overtime work;

- bonuses and remunerations provided for by the remuneration system of this employer.

Do not forget that only those bonuses that are paid to employees “for their work” can be included in the calculation of average earnings. Including a bonus on the occasion of, for example, an employee’s 55th birthday in the calculation of average earnings is paradoxical. A bonus on the occasion of an employee’s anniversary cannot be called a salary.

Thus, according to the letter of the Ministry of Finance of Russia dated March 22, 2012 No. 03-03-06/1/150, bonuses and rewards are included in the calculation of average earnings (including payments in connection with the celebration of professional holidays, anniversaries and memorable dates and based on work results), which are reflected in the provisions on payment (bonuses) for employees of the organization.

Let us also turn to the letter of Rostrud dated October 23, 2007 No. 4319-6-1: when calculating the average salary, the employer can take into account all bonuses accrued in the billing period, provided for by the remuneration system and enshrined in the wage regulations or bonus regulations. The exception is bonuses paid in an organization outside the remuneration system (one-time bonuses), for example, for anniversaries, holidays, for performing urgent work outside of official duties, etc. There is no reason to take them into account when calculating the average salary.

Based on different approaches regarding the inclusion of bonuses for anniversaries and holidays in the calculation of average earnings, the organization will have to make a choice.

Expenses in the form of average earnings retained by employees during vacation are classified as labor costs (Clause 7, Article 255 of the Tax Code of the Russian Federation).

Everything is extremely simple, if the organization operates on a cash basis, vacation pay and insurance contributions are taken into account at the time of their actual payment (subclauses 1 and 3 of clause 3 of Article 273 of the Tax Code of the Russian Federation). That is, there is actually no problem with how to write them off if the vacation covers days falling on different reporting periods.

Questions arise if the organization uses the accrual method, because in this case, expenses used for profit tax purposes are recognized as such in the reporting (tax) period to which they relate, regardless of the time of actual payment of funds and (or) other form of their payment (clause 1 of article 272 of the Tax Code of the Russian Federation). And in paragraph 4 of Art. 272 of the Tax Code of the Russian Federation states that these costs are recognized in tax accounting on a monthly basis.

And although financiers have repeatedly explained at different times what to do if vacations fall on different periods, taxpayers submitted requests to the department in both 2014 and 2015. The result was letters from the Ministry of Finance of Russia dated July 15, 2015 No. 03-03-06/40536, dated July 21, 2015 No. 03-03-06/1/41890, dated June 9.

In addition to the Ministry of Finance of Russia, the Federal Tax Service of Russia also spoke on this topic last year. In the letter of the Federal Tax Service of Russia dated 03/06/2015 No. 7-3-04 / [email protected], tax service specialists came to the conclusion that the costs of wages retained by employees during a vacation that lasts for several months are taken into account at a time in that reporting period, in which they are generated and paid.

The employee takes a vacation of 28 calendar days - from June 30, 2020 to July 27, 2020. On June 27, the employee was paid vacation pay in the amount of 45,000 rubles. Thus, 1 day of vacation falls in the second quarter of 2020, and 27 days in the third.

Let's assume that an organization reports income taxes quarterly. That is, she must take into account the amount of vacation pay paid in expenses in the following order:

- in the second quarter – 1607.14 rubles. (RUB 45,000 / 28 days × 1 day);

- in the third quarter – 43,392.86 rubles. (RUB 45,000 / 28 days × 27 days).

Obviously, the position of the Federal Tax Service of Russia is more favorable: already in the second quarter of 2020, the company will be able to take into account vacation pay in the amount of 46,000 rubles.

As for contributions to extra-budgetary funds that are accrued towards vacation pay, they are treated in accordance with sub-clause. 1 clause 1 art. 264 of the Tax Code of the Russian Federation to other expenses associated with production and sales. The date of such expenses is the date of their accrual (subclause 1, clause 7, article 272 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated December 27, 2013 No. 03-03-05/57806, dated December 23, 2010 No. 03-03-06/1/ 804, dated 06/01/2010 No. 03-03-06/1/362, etc.).

The rules for calculating the average salary for calculating vacation amounts are defined in Art. 139 of the Labor Code of the Russian Federation and the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 (hereinafter referred to as Regulation No. 922).

We invite you to familiarize yourself with: Tasks and incidents on the topic “Inheritance Law. Types of inheritance"

Thus, the average daily earnings for vacation pay and compensation for unused vacations are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and 29.3 (the average monthly number of calendar days). Before April 2, 2014, the indicated number was 29.4.

wages accrued according to salary (tariff rates), as well as issued in non-monetary form; allowances and various additional payments to salaries (tariff rates) for professional skills, class, length of service, knowledge of a foreign language, combination of professions (positions); payments related to working conditions, including those determined by regional regulation of wages (in the form of coefficients and percentage bonuses to wages), increased wages for heavy work, work with harmful and (or) dangerous and other special working conditions, for work at night, payment for overtime work and work on weekends and non-working holidays; bonuses and remunerations provided for by the remuneration system of this employer.

All named payments must relate specifically to the billing period in order to be included in the calculation of average earnings. Thus, if an annual bonus is accrued for indicators of those periods that are not included in the calculation period, this bonus is not taken into account in calculating average earnings. If the bonus based on the results of work for the year is accrued after the payment of vacation pay, the average daily earnings should be recalculated taking into account the bonus and an additional payment should be given to the employee (letter of Rostrud dated May 3, 2007 No. 1253-6-1).

Bonuses for professional holidays, anniversaries and memorable dates and based on work results can be taken into account when calculating vacation pay, if they are provided for by the remuneration system and accrued in the billing period (letter of the Ministry of Finance of Russia dated March 22, 2012 No. 03-03-06/1/150 , Ministry of Health and Social Development of Russia dated October 13, 2011, No. 22–2/377012–772).

Social payments and payments not related to wages are not taken into account when calculating the average salary. This applies to material assistance, payment of the cost of food, travel, training, utilities, recreation, etc. (clause 3 of Regulation No. 922).

Accounting object “income”

When using this accounting option, the amount of vacation pay will not affect the calculation of the single tax (clause 1 of Article 346.14 of the Tax Code of the Russian Federation). However, the tax itself can be reduced by the amount of contributions to pension (social, medical) insurance and contributions to insurance against accidents and occupational diseases paid from vacation pay.

Accrued contributions reduce the amount of advance payment and tax for the period in which contributions were transferred to the budget of the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund (clause 1, clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation), but by no more than 50%.

Standard 6-NDFL and display of software in it

6-NDFL is a model standard approved by Order of the Federal Tax Service N MMV-7-11/ [email protected] dated 10/14/2015. Valid from 2020, applied by all tax agents every quarter. The current form 6-NDFL consists of 2 sections. The first includes the latest income and personal income tax data for the organization as a whole. The second section contains detailed information on each individual transaction that appears when withholding income tax.

Carrying holiday pay is displayed in accordance with uniform rules, i.e. depending on the date of their payment and taking into account the deadline for payment of personal income tax. The deadline for making tax payments is the last day of the month. Therefore, in the appropriate column 6-NDFL, the date of the last working day of the month in which vacation pay was paid is entered. If the deadline falls on a weekend, then the first working day of the next month is entered in the form.

An example of reflecting rolling leave in 6-NDFL

Example 1. Deadline for transferring personal income tax from the rolling leave of employee P.N. Leonidova.

Vacation P.N. Leonidova lasts from 07/11/2017 to 08/3/2017. It starts in July and ends in August, which means it is a rolling vacation. The organization paid its employee the money for the software on time - 07/10/2017 (no later than 3 days before the start of the vacation period).

Tax deductions depend on the actual date of payment of money, i.e. taking into account the date 07/10/2017. From the above it follows that the deadline for transferring personal income tax from employee P.N. Leonidov’s vacation pay in this case will be on the deadline of July - 07/31/2017, Monday, working day.

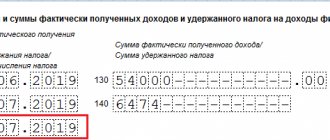

Example 2. Calculation of income tax for individuals with two employees and display of the appropriate amounts in 6-NDFL

The accounting department of Vasilek LLC paid vacation money to its employees I.A. Romashova (06/14/2017 - 23,000 rubles) and T.P. Lorina (06/30/2017 - 13,000 rubles) in June 2020. The tax calculation for the income of individuals (13% rate) is as follows:

- From vacation pay of employee I.A. Romashova: 23,000 * 13% = 2,990 rubles;

- From the vacation pay of employee T.P. Lorina: 13,000 * 13% = 1,690 rubles.

The tax was transferred in a single payment for both employees on June 30, 2017. Vacationers received money in their hands minus personal income tax. Standard 6-NDFL (six-year period) is filled out like this. The first section: information about vacations is entered in columns 020, 040, 070. In the second section, columns 100-140 are filled in:

- 100 14.06.17 130 23000;

- 110 14.06.17 140 2990;

- 120 30.06.17

- 100 30.06.17 130 13000;

- 110 30.06.17 140 1690;

- 120 30.06.17.

Expenses in accounting

Since 2011, companies (except small enterprises) have been required to create a reserve for upcoming vacation expenses. This follows from PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”. The monthly reserve must include vacation pay that has not yet been accrued, but most likely will be accrued this year. They need to be reflected in the debit of the “cost” account (20, 21, 26, 44) and the credit of account 96 “Reserves for future expenses.” When the time for rest comes, the amount of actually accrued vacation pay must be written off to the debit of account 96 (for more information on the formation of a reserve for upcoming vacation expenses, read the article “Reflecting vacation pay according to the new accounting rules”).

Due to the fact that vacation pay is reflected differently in tax accounting than in accounting, the organization has deductible temporary differences and deferred tax assets.

Example 1 Olga Stepanova works at the Jupiter manufacturing plant. This organization uses the accrual method for income tax purposes. In tax accounting, vacation pay is written off as an expense for the month in which the vacation falls. In accounting, the company creates a reserve for upcoming vacation expenses for each employee. Deductions for Stepanova amount to 5,000 rubles. monthly. Every month during the year, the accountant makes entries: DEBIT 20 CREDIT 96 - 5,000 rubles. – a reserve has been formed for upcoming expenses for employee Stepanova’s vacation pay; DEBIT 09 CREDIT 68 - 1,000 rub. (RUB 5,000 x 20%) – the deferred tax asset is shown. In 2012, Stepanova took another vacation, which began in June and ended in July. The vacation pay received by Stepanova amounted to 35,000 rubles. This value was distributed as follows: 12,500 rubles. – for the June part of the vacation and 22,500 rubles. – for the July part. The tax register for June reflects expenses in the amount of 12,500 rubles. In June, the accountant made the following entries: DEBIT 68 CREDIT 09 - 2,500 rubles. (RUB 12,500 x 20%) – the deferred tax asset was reduced; DEBIT 96 CREDIT 70 - 35,000 rub. – employee Stepanova’s vacation pay was issued from the reserve for future expenses. The tax register for July shows expenses in the amount of 22,500 rubles. In July, the accountant made the following entry: DEBIT 68 CREDIT 09 - 4,500 rubles. (RUB 22,500 x 20%) – the deferred tax asset was reduced.

Vacation is a time of rest, not work

Experts from the Russian Ministry of Finance believe that vacation is the time during which an employee is free from performing work duties and which he can use at his own discretion. Consequently, his payment is not payment for the performance of labor duties. For the purpose of calculating personal income tax in accordance with paragraphs. 1 clause 1 art. 223 of the Tax Code, the date of actual receipt of income in the form of vacation pay is the day of their payment (transfer to the employee’s bank account). In this case, the month for which vacation pay is accrued does not matter (Letters of the Ministry of Finance of Russia dated January 24, 2008 N 03-04-07-01/8, dated March 6, 2008 N 03-04-06-01/49 and dated November 15, 2011 N 03-04-06/8-306). The same position is set out in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02/07/2012 N 11709/11.

Transfer or compensation

The minimum duration of annual vacation time, regardless of the conditions of performance of duties and the form of the concluded individual agreement in accordance with Article 115 of the Labor Code of the Russian Federation, is equal to 28 calendar days for each fully worked year. The category of citizens, the presence of unfavorable production and climatic factors and the terms of the collective agreement can increase the rest time.

Extended main time is provided to the following persons in the following quantities:

- employees of preschool and educational institutions, social service enterprises and medical healthcare organizations – 42 (56);

- employees of state and municipal institutions – 30 (35);

- disabled people, regardless of group – 30;

- minors – 31.

Additional leaves in accordance with Articles 116-119 of the Labor Code of the Russian Federation are provided for irregular work, harmfulness and the special nature of the performance of duties in a quantitative equivalent determined by the degree of exposure to adverse factors, the category of employees and the insurance period in a particular segment.

Article 126 of the Labor Code of the Russian Federation allows for the replacement of a part exceeding the 28-day period with monetary compensation if the employee wishes. If this year a citizen has not taken advantage of his vacation right and has not received monetary compensation, then the next vacation is automatically transferred to the next year.

It is prohibited to replace any vacation interval with cash other than termination of the employment contract (Article 126 of the Labor Code of the Russian Federation) for the following persons:

- pregnant women;

- minors;

- engaged in work in hazardous conditions.

The employee has the right to choose whether the vacation can be postponed to the next year or replaced with monetary compensation in terms of exceeding the specified 28 days and not belonging to the above categories. For example, transferring the balance of vacation to the next year is mandatory for a minor if it is not used in the current year, and a disabled person is allowed not to transfer the amount of vacation exceeding 2 days, but to receive a compensation payment.

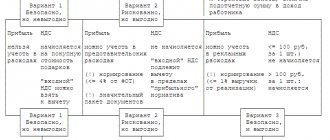

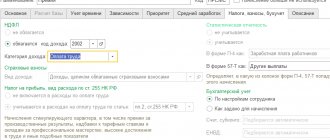

In the configuration "1C: Salary and Personnel 7.7"

To set up the reflection of vacation pay by payment period, you will have to specify a different personal income tax code for the vacation. We recommend the code “4800 – Other income”. It will not be possible to use code 2012 in this accounting option.

In all types of vacation accruals (including additional ones), on the “Tax Accounting” tab you will need to indicate income code 4800 (see Fig. 3 below).

Rice. 3 In the “1C: Accounting 7.7” configuration, only one option for calculating personal income tax is possible

Unlike the programs mentioned above, the configuration of “1C: Accounting 7.7” does not allow you to perform complex calculations of wages and vacation pay.

So, with its help it is impossible to distribute vacation over several months. Consequently, the amount of vacation pay will be taken into account in full in one month, and deductions will be applied once.

O.Ya.Leonova

Head of Department

automation of personnel records

and payroll

Terms of deduction and transfer of personal income tax from vacation pay amounts

The employer is obliged to withhold personal income tax from the amount of vacation pay at the time of its payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation), and transfer the amount of withheld tax within the following terms (clause 6 of article 226 of the Tax Code of the Russian Federation):

- when issuing vacation pay in cash from the organization's cash desk using funds withdrawn from a bank account specifically for the payment of vacation pay - no later than the day the cash is received from the bank;

- issuance of vacation pay in cash from the organization's cash desk at the expense of funds available in the cash register (from proceeds) - no later than the day following the day the employee receives vacation pay;

- transferring vacation pay from the organization's current account to the employee's bank account or, on his instructions, to the bank accounts of third parties - no later than the day the money is transferred from the organization's account.