How can tax agents declare unwithheld personal income tax?

Important Tip: The accrual of penalties in cases where an organization could not withhold personal income tax, but did not send the corresponding notification to the inspectorate, can be challenged in court. If the tax agent was not able to withhold personal income tax, there are no grounds for charging penalties in principle. This conclusion is contained in the ruling of the Supreme Court of the Russian Federation dated March 19, 2020 No. 304-

Federal Tax Service of Russia dated October 19, 2020 No. BS-4-11/18217. Attention: failure to inform the tax inspectorate about the impossibility of withholding personal income tax is an offense (Article 106 of the Tax Code of the Russian Federation, Article 2.1 of the Code of Administrative Offenses of the Russian Federation), for which tax and administrative liability is provided. The fine will be:

- 200 rub. – for each case of failure to provide information (i.e. for each message that the tax agent should have sent to the inspectorate, but did not do so) under Article 126 of the Tax Code of the Russian Federation;

- from 300 to 500 rub. – in relation to officials of the organization, for example the manager (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

In addition, if during an on-site tax audit it is discovered that the organization did not report to the tax inspectorate about income from which personal income tax was not withheld, in addition to penalties, inspectors may charge penalties (letter of the Federal Tax Service of Russia dated November 22, 2013 No. BS- 4-11/20951).

Tax agent for personal income tax and his duties

One of the duties of tax agents provided for in paragraph 5 of Art. 226 of the Tax Code of the Russian Federation is a written message to the taxpayer and the tax authority about the impossibility of withholding tax. As noted in the Letter of the Federal Tax Service of the Russian Federation dated August 22, 2014 No. SA-4-7/16692 , the impossibility of withholding tax arises, for example, in the case of payment of income in kind or the occurrence of income in the form of material benefits.

This obligation should not be confused with the obligation provided for in paragraph 2 of Art. 230 of the Tax Code of the Russian Federation , namely with the obligation to submit to the tax authority at the place of registration information about the income of individuals for the expired tax period and the amounts of taxes accrued, withheld and transferred to the budget system of the Russian Federation for this tax period.

A notification about the impossibility of withholding tax is submitted no later than one month from the end of the tax period, that is, for income paid in 2014, no later than 01/31/2015. However, 01/31/2015 falls on a day off - Saturday, therefore, in accordance with clause 7 of Art. 6.1 of the Tax Code of the Russian Federation, the expiration date is considered to be the next working day following it, that is, 02/02/2015.

Information in accordance with paragraph 2 of Art. 230 of the Tax Code of the Russian Federation are submitted no later than April 1 of the year following the expired tax period, that is, for income paid in 2014 - no later than 04/01/2015.

Message about the impossibility of withholding personal income tax: who submits it?

Such reports must be submitted by organizations (their EP) and individual entrepreneurs who paid income subject to personal income tax to individuals in the reporting year, but did not withhold tax from these incomes and did not transfer it to the budget (clause 5 of Article 226 of the Tax Code of the Russian Federation). That is, reports of the impossibility of withholding personal income tax are submitted by tax agents who were unable to fulfill their agent duties.

The Personal Income Tax Virtual Assistant will help you understand whether your organization/individual entrepreneur/individual entrepreneur is a tax agent and whether you need to submit information on individuals to whom income was paid.

The main thing is to report.

By and large, if a tax agent cannot withhold personal income tax, then he does not have such an obligation. In particular, the judges of the Federal Antimonopoly Service of the Ural District came to this conclusion in Resolution No. F09-3923/09-S2 dated June 10, 2009. However, this does not mean that you can simply let go of the situation and not remember it.

According to paragraph 5 of Art. 226 of the Tax Code in the case under consideration, it is necessary to inform in writing the Federal Tax Service Inspectorate at the place of your registration, as well as the taxpayer himself, about the impossibility of withholding tax and the amount thereof (Letters of the Ministry of Finance of Russia dated August 29, 2011 N 03-04-05/3-611, dated August 19, 2011 N AS-4-3/13626, dated November 17, 2010 N 03-04-08/8-258, Federal Tax Service of Russia dated October 28, 2011 N ED-4-3/17996).

The form for reporting the impossibility of withholding tax and the amount of tax was approved by Order of the Federal Tax Service of Russia dated November 17, 2010 N ММВ-7-3 / [email protected] In fact, for this purpose the same 2-NDFL certificate is used, in the “Sign” field of which in this case, the number 2 is entered (Letter of the Ministry of Finance of Russia dated October 27, 2011 N 03-04-06/8-290). The deadline for its submission in the case under consideration is no later than one month from the end of the tax period in which the income was paid. This ends the obligation of the source of payment as a tax agent (Letters of the Ministry of Finance of Russia dated April 5, 2010 N 03-04-06/10-62, dated February 9, 2010 N 03-04-06/10-12). The only question that remains open is whether it is necessary to submit a general 2-NDFL certificate based on the results of the tax period in relation to an individual from whose income personal income tax could not be withheld.

Where to submit 2-NDFL

Messages about the impossibility of withholding personal income tax in form 2-NDFL are submitted to the Federal Tax Service (Clause 2 of Article 230 of the Tax Code of the Russian Federation):

- at the location of the organization (the largest taxpayers - at the place of registration as a “large enterprise”);

- at the location of the OP paying income to individuals;

- at the place of residence of the individual entrepreneur. True, if an individual entrepreneur uses UTII and/or PSN, then certificates for employees engaged in imputed activities and/or PSN activities must be submitted to the Federal Tax Service at the place of conduct of such activities.

Order of presentation of messages

The procedure for submitting messages to the tax authorities about the impossibility of withholding personal income tax and the amount of tax was approved by Order of the Federal Tax Service of Russia dated September 16, 2011 N ММВ-7-3/ [email protected] This regulatory act came into force on November 8, 2011.

Attention! Order of the Ministry of Taxes of Russia dated October 31, 2003 No. BG-3-04/583 “On approval of reporting forms for personal income tax for 2003” became invalid due to the entry into force of Order of the Federal Tax Service of Russia dated September 16, 2011 No. ММВ-7-3/ [email protected]

According to this Procedure, the messages under consideration may be:

- submitted by the tax agent to the tax authority personally or through a representative;

- sent in the form of a postal item with an inventory of the contents;

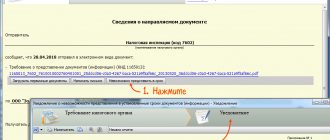

- transmitted electronically in established formats on electronic media or electronically via telecommunication channels (hereinafter referred to as TCS) using a qualified electronic signature of the tax agent or his representative.

Tax agents submit information to the tax authority in the form of a certificate in Form 2-NDFL, valid in the corresponding tax period.

Attention! Form 2-NDFL “Certificate of income of an individual for the year 20__” was approved by Order of the Federal Tax Service of Russia dated November 17, 2010 N ММВ-7-3/ [email protected]

The date of submission of messages is considered:

- when presented personally or by a representative of a tax agent to the tax authority - the date of their actual presentation;

- when sent by mail - the date of their sending by mail with a description of the attachment;

- when transmitted electronically on electronic media or via TKS - the date of their sending, recorded in the confirmation of the date of sending in electronic form via TKS of a specialized telecom operator or tax authority.

A new income certificate 2-NDFL has been approved

Form 2-NDFL

– this is a certificate of income of an individual. This certificate is generated by the employer (tax agent) for the employee (individual) who was paid a salary (or other income subject to personal income tax) during the year.

In addition, at the request of the employee, the employer is obliged to issue him a certificate of income in hand. Typically, an individual provides this certificate to the bank to receive a loan, to the tax office to receive deductions, to a new employer, etc.

The 2-NDFL certificate form is approved by the Federal Tax Service. This year, by order dated November 2, 2018 No. ММВ-7-11/ [email protected], the tax authorities not only changed the certificate form, but approved two forms at once.

- The first form

has a machine-readable format and is submitted to

the tax authority

. The abbreviated name of the form is 2-NDFL. - The second form

has a familiar appearance.

This certificate is issued to the employee

. The abbreviated name of the form is missing.

Download the new form 2-NDFL

Download a new form for a certificate of income for an individual

The new form has 3 sections and 1 application.

In the title

The form contains information about the employer: TIN, KPP, name of the organization / full name of the entrepreneur, OKTMO, etc.

In the “Sign” field the following should be entered: 1 for a regular certificate, 2 – for a certificate with information about the impossibility of withholding tax, 3 and 4 – to be filled in by legal successors during the reorganization of a legal entity.

The attribute of the certificate affects the deadline for submitting form 2-NDFL to the tax authority

In Section 1

The employee’s details are indicated: full name, tax identification number, date of birth, etc.

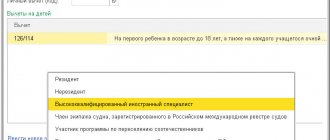

In the field “ Taxpayer Status”

» indicates: 1 – tax resident, 2 – non-resident, 3 – highly qualified foreign specialist, 4 – migrant, 5 – refugee, 6 – foreigner with a patent.

In Section 2

The total amount of income and tax is reflected.

In the “Tax Base” field, enter the amount of income from the Appendix, reduced by deductions from the Appendix and Section 3.

The indicator “Calculated tax amount” is the product of the tax base and the tax rate.

In Section 3

standard, social and property tax deductions are indicated, as well as data on notifications from the tax authority confirming the right to a tax reduction.

In the “Notification type code” field you need to put: 1 – for a property deduction, 2 – for a social deduction, 3 – for a tax reduction on fixed advance payments.

In the application

a breakdown of information on income and deductions (for specific income) by month according to the tax rate is reflected.

The certificate includes only income that is subject to personal income tax. For example, child care benefits for children under 1.5 years of age are not reflected in the certificate.

The amount of income is indicated in full, without reduction for taxes and deductions. Deductions provided for specific income, for example, 4,000 rubles. for gifts are indicated next to each other in the Appendix. Standard deductions, for example, 1400 rubles. per month per child, are reflected in the total amount in Section 3.

For income taxed at different rates, Sections 1-3 and the Appendix must be completed separately.

filling out a new form 2-NDFL

The procedure for filling out an income certificate for an employee

The form of the certificate has changed slightly. The new form does not contain fields that were needed only by tax authorities: certificate number, information about the notification from the tax authority about the right to reduce taxes, etc.

filling out a new income certificate for individuals

When to apply new certificates?

The order comes into force on January 1, 2020. Therefore, starting from 2019, you need to fill out 2‑NDFL for 2020 on new forms. Certificates for 2020 are filled out using the old form.

A new income certificate 2-NDFL has been approved

Form 2-NDFL

– this is a certificate of income of an individual. This certificate is generated by the employer (tax agent) for the employee (individual) who was paid a salary (or other income subject to personal income tax) during the year.

Tax agents annually submit 2-NDFL information for each employee to the tax office:

- until April 1

, regular certificates, - before March 1

, a certificate stating that the tax has not been withheld.

In addition, at the request of the employee, the employer is obliged to issue him a certificate of income in hand. Typically, an individual provides this certificate to the bank to receive a loan, to the tax office to receive deductions, to a new employer, etc.

- How can an employee obtain an income certificate?

New forms of certificate 2-NDFL

The 2-NDFL certificate form is approved by the Federal Tax Service. This year, by order dated November 2, 2018 No. ММВ-7-11/ [email protected], the tax authorities not only changed the certificate form, but approved two forms at once.

- The first form

has a machine-readable format and is submitted to

the tax authority

. The abbreviated name of the form is 2-NDFL. - The second form

has a familiar appearance.

This certificate is issued to the employee

. The abbreviated name of the form is missing.

Download the new form 2-NDFL

Download a new form for a certificate of income for an individual

An example of filling out a 2-NDFL certificate with sign 2

Alliance LLC in October 2020 rewarded former employee Petr Petrovich Ivanov (resident of the Russian Federation).

The price of the gift is 9,500 rubles. Income code – 2720. Deduction amount – 4,000 rubles. Deduction code – 501. Tax base: 5,500 rubles (9,500 rubles – 4,000 rubles).

Personal income tax: 715 rubles (5,500 rubles x 13 percent).

For the same person, you must also submit a 2-NDFL certificate with attribute “1” (letter of the Federal Tax Service of the Russian Federation dated March 30, 2016 No. BS-4-11/5443).

Certificate 2-NDFL will look like this: