What are personnel costs?

Personnel costs are a generally accepted indicator used in countries with market economies.

It should be noted that in such countries the concept of “human resources” (in English Human Resource – abbr. HR) has been used for more than 30 years, which replaced the concepts of “personnel” and “personnel” with the concept of “human resource management”. In our country, the costs associated with the use of human resources include:

- wage costs, including incentives and compensation payments included in the payroll (payroll fund);

- social and equivalent payments;

- costs not related to payroll and social benefits;

- deductions and payments for compulsory and voluntary insurance.

Similar indicators are established by various regulations of the Ministry of Finance of the Russian Federation (for example, PBU 10/99, approved by order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n), instructions for filling out federal statistical observation forms (for example, Rosstat order dated October 26, 2015 No. 498), numerous industry guidelines for determining the cost of products (works, services), the Tax Code of the Russian Federation, the Labor Code of the Russian Federation.

Wage costs are the main ones, as they make up the largest part of personnel costs. These include:

- payment for labor in accordance with the applicable wage system (time-based, piece-rate, etc.);

- additional payment in the form of surcharges and bonuses, incl. for high-quality fulfillment of production tasks (in kind and/or cash);

- compensation payments in connection with working conditions and working hours;

- other similar payments.

Social and equivalent payments include the organization’s expenses within the framework of its social policy, enshrined in the collective agreement. This:

- provision of sanatorium and tourist vouchers;

- pension supplements for employees of the enterprise;

- one-time benefits to retiring labor veterans;

- severance pay upon termination of an employment contract;

- financial assistance in connection with the employee’s family circumstances, etc.

Expenses not related to payroll and social payments can be made for training and advanced training of personnel, for the purchase of workwear and uniforms, for the maintenance of social infrastructure (children's holiday camps, holiday homes, etc.), costs for business trips, etc. d. In addition, this category also includes the payment of dividends on shares and the purchase by employees of preferential shares of their campaign.

Deductions and payments for various types of compulsory insurance are made by any employer organization on the basis (in 2020 conditions) of the requirements of Chapter 34 of the Tax Code of the Russian Federation, fed. Law of July 24, 1998 No. 125-FZ, fed. Law of December 29, 2006 No. 255-FZ, Labor Code of the Russian Federation, other regulations. In addition to the above, organizations are not prohibited from providing voluntary insurance for their employees within the framework and conditions of the current legislation of Russia. These expenses include payments for sick leave, expenses for the so-called. “maternity leave” for women, compensation for child care, compensation for harm caused to the health of employees, etc.

Theoretical aspects of budgeting

What is a “budget” and the “budgeting” process? A budget is a directive document that is a register of planned expenses and income distributed by item for the corresponding period of time. The budget is a document that defines the resource limitations of an enterprise, therefore, when managing cost, its cost component comes to the fore.

Let's assume that the annual business - personnel plan is a project. Then “budgeting is understood as determining the cost values of the work performed within the project and the project as a whole, the process of forming a project budget containing an established (approved) distribution of costs by type of work, cost items, by time of work, by cost centers or by another structure. The budget can be formed both within the framework of a traditional accounting chart of accounts, and using a special chart of accounts for management accounting" (Human Resources Management Handbook, No. 2, 2003).

The budgeting process covers four stages: drafting a budget, reviewing and approving it by an authorized person, budget execution and control, drawing up a report on budget execution and its analysis. The principles of the budget process are unity, independence, and the balance sheet method.

In essence, budgeting for HR professionals is the process of planning a budget for personnel costs, organizing costs, monitoring funds and analyzing their expenditure.

Pros and cons of having a business plan for personnel

Of course, before planning the budget for the personnel service, it is necessary to have a business plan for the company’s personnel. While at Zosia Gerchikova’s author’s seminar, my colleagues and I identified a number of reasons why the existence of a business plan is simply necessary, as well as the difficulties that arise when it is in place.

So, a business HR plan is needed for a company because it allows:

- competently build a strategy for working with personnel based on the company’s goals;

- determine the budget for personnel costs and defend it with management;

- predict the possibility of achieving the company's goals from the point of view of the development of the company's human resources;

- present the work plan of an HR specialist to other managers; priorities in working with personnel;

- develop several options for a plan depending on the existing business strategy, which spells out different scenarios for the company’s development;

- show “transparency” of work with personnel for the founders;

- to form the necessary level of relationships with the surrounding social environment, which is relevant for city-forming enterprises;

- assess the value of the company, etc.

Difficulties that may occur when you have a business plan for personnel:

- it is difficult to convince management to receive financial resources in the required amount and secure these expense items;

- there is no flexibility in budget management if the company’s strategic plan does not provide for a controlling and correction mechanism;

- it is difficult to foresee unexpected costs;

- with long-term planning, the cost of error is very high;

- HR specialists experience psychological resistance to a “more objective” assessment of the effectiveness of the HR service by the company’s management, etc.

Practical budgeting experience

At ZAO Santekhkomplekt - Ural, the budget planning system has existed almost from the first day. Each structural unit is a financial accounting center. All expenses at the enterprise are assigned to the responsible person. As a rule, managers make decisions and bear responsibility within the approved budget of their department.

I have been budgeting personnel costs in our company for about two years. Like most HR people, I do not have an economic education, only invaluable practical experience gained through my own mistakes and consultations with our financial director. The developments I have proposed on this topic are far from ideal, but they are working, which is their practical value.

Technology for developing a budget for personnel costs

When developing a budget for personnel costs, I adhere to the following technology:

Determination of personnel cost items

At different enterprises, HR directors have different powers and areas of responsibility. At our company, I, as Deputy General Director for Human Resources, have been delegated the authority to form and manage the following cost items:

- Payroll Fund (WF): fixed part of wages, bonuses, bonuses, overtime, remuneration of part-time workers;

- Social programs of the company: social package, financial assistance, intra-company events;

- The cost of attracting, dismissing, and rotating personnel;

- Equipment of new workplaces;

- Personnel training and development;

- Travel expenses in connection with training;

- Travel expenses in connection with the internship;

- Subscription, literature costs

Development of HR planning formats

To forecast expenses, it is convenient to rely on specific plans for working with personnel in the company. Such plans can have different formats, and each HR specialist develops his own forms that are convenient for him in planning. Of course, it's best to start with long-term planning.

I have developed the following formats for personnel planning (tables No. 1 - 5).

Table No. 1

Attracting new personnel in 2002

| Department | Job title | Qty | Hiring period | Selection costs | Costs for workplace equipment | Compensation package |

Table No. 2

Planned layoffs and relocations in 2002

| FULL NAME. employee | Position held | Salary amount + compensation | Timing of dismissal or relocation | Planned position | Salary amount + compensation (in new position) |

Table No. 3

Personnel training and development in 2002

| Employee category | Training topic | Form of study | Duration | Duration of training | Cost of education | Travel expenses | Availability already concluded contracts | Other costs and comments |

Table No. 4

Payroll fund

| Job title | Fixed salary | Salary variable (awards and bonuses) | Frequency of bonus payment | notes |

Table No. 5

Social programs of the company

| Types of social programs | Employee category | Number | Frequency of payments | notes |

Gathering information from managers

Having these or similar HR planning formats, you can offer them for completion to department heads, as well as top managers. This usually takes 7 – 10 days. When receiving these plans, it is important to clarify for what tasks managers recruit staff, what are the expectations from employees who have completed a particular training course, and how all this will affect the increase in labor productivity in the company as a whole.

Set of draft HR planning formats

Consolidating information from line managers and top managers is perhaps the most labor-intensive process in the technology of developing a budget for personnel costs. Often, the visions of middle and senior managers do not coincide. For example, when planning the number of personnel for the year, sometimes department heads seek to significantly relieve their employees by attracting additional labor. Such trends relate to the extensive way of increasing labor efficiency. When planning, top managers most often strive to increase the labor efficiency of existing employees in a different way, and therefore they plan to increase the number in smaller numbers. In such a situation, it is necessary to hold several meetings to agree on strategic objectives and ways to achieve them. When organizing such procedures, the HR manager is greatly helped by the skills of conducting group work and discussions.

Development of a budget for personnel costs

With consolidated draft personnel cost plans in hand, it is necessary to forecast the cost of hiring, training and other expenses. As a result, taking into account the time factor, type of payment (cash, non-cash), the budget for personnel costs can be summarized in the form presented in table No. 6.

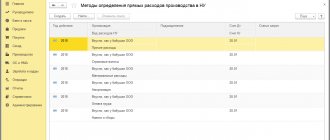

Table No. 6

Personnel cost planning

Personnel cost planning is carried out in order to identify the organization's reserves to increase its competitiveness in the market segment it occupies. To do this, appropriate planning and budgeting tools for personnel costs are used, which are applied sequentially in several stages.

1st stage

Preparation and analysis of the necessary data in order to compare the organization's performance with the activities of competitors. This takes into account the development prospects of the organization and the features of the local labor market as of the calculation date.

2nd stage

Performance indicators are determined - qualitative and quantitative, used to evaluate the planned budget.

Qualitative indicators include indicators of compliance of the level of education, qualifications, and production experience of employees with the requirements for the position held - for the subsequent calculation of costs for training and professional training.

Quantitative indicators are determined by comparing the actual and planned number of employees to calculate staffing levels.

The most important performance indicators determined at this planning stage are labor productivity, the standard number of administrative and managerial personnel (hereinafter referred to as AUP), the annual economic effect, financial savings, and staff turnover rate.

3rd stage

A planned budget is drawn up (with the definition of cost objects in the form of cost items).

4th stage

Adjustment of the obtained planned indicators from the point of view of economic efficiency, rationality, and compliance with the current financial capabilities of the organization. The results are reviewed taking into account the key condition that the increase in personnel costs cannot outpace the growth in labor productivity.

How to properly organize labor costs

These expenses are included in the employee cost budget, which is part of the overall budget of the enterprise. During the planning process, it is important to consider the relationship with other elements of the main budget (for example, profit and loss) so that the structure and level of employee costs are consistent with the capabilities of the organization.

In general, the process of organizing labor costs is as follows:

- Preparation and analysis of important information (assessment of the activities of the current stage and forecast of results). Analyze departmental plans and adjust them. This is done to ensure that the growth of employee costs does not outpace the rate of labor productivity. Budget limitations include a lack of funds for its implementation, a shortage of experienced personnel, the inability to purchase resources at an acceptable cost, and increased competition.

- Setting goals (key performance indicators, qualitative and quantitative, which will be used to evaluate the budget). For example, this could be the volume of products sold per ruble of labor costs, the ratio of growth rates of real wages and labor productivity, and more.

- Resource budgeting (identification of cost objects). For example, this could be determining the number of specialists who require advanced training.

- Converting the resource budget to the cash cost budget. For example, the number of employees who need advanced training is multiplied by the average cost of training per employee. In this case, the deviation should not be more than 8–10% of the fact.

- Analysis, control, making corrections.

- Budget approval.

- Organization of work to implement the budget.

- Budget execution.

It should be noted that the item of labor costs of all items of personnel costs requires more attention, since it is the most significant. Plan it taking into account the tax and labor legislation of the Russian Federation and ILO regulations.

The most important principles for organizing labor costs relate to:

- Coordination of labor productivity growth rates and real wages.

- Accounting and forecasting the impact of the labor market.

- Simplicity, accessibility and consistency for employees of the algorithm for generating labor costs.

Optimization of personnel costs

The need for optimization, and often, let’s put it bluntly, to reduce personnel costs, arises for many factors:

- lack of funds due to increased competition or deterioration of the current economic situation in the country;

- discrepancy between the payments made and the existing qualifications of employees;

- the emergence of new technical, technological, information capabilities that make it possible to increase labor efficiency and free up a certain number of workers;

- other factors.

In our country, personnel services (or HR departments) plan such optimization using one of two methods:

- direct counting method;

- factor planning method.

The first method allows you to calculate the potential reduction in personnel numbers in the event of the implementation of certain organizational and technical measures. To do this, calculate the planned number of personnel for individual categories, taking into account its possible reduction as a result of the implementation of these activities.

Then, based on the indicators of the planned number of personnel and planned production output, the level of labor productivity and its growth rate are determined in comparison with the base period.

The factor planning method allows you to present the economic impact on the organization’s performance in the form of groups of factors:

- external - not dependent on the work of the organization, such as: current inflation expectations, possible changes in tax, labor and other current legislation of the Russian Federation, fluctuations in supply and demand in the labor market, etc.;

- internal - factors that determine changes in the quantitative and qualitative parameters of product output, management systems, management and others.

A competent approach to personnel optimization is to prepare the most accurate forecast so that the organization can take the necessary measures in advance to adjust these costs.

Budgeting for personnel costs should also take into account the Labor Code of the Russian Federation: all planned activities must be within the framework of current legislation, otherwise the negative consequences may “overwhelm” all the expected savings.

Goals and general principles of HR budget planning

The key objective of planning is to provide adequate human resources to the management team to achieve the strategic goals and operational plans of the organization. In other words, bring in the right people with the right skills at the right time.

HR budgeting predicts future HR needs by analyzing the organization's current human resources, the external labor market, and the company's aspirations.

What information is required to prepare an HR budget:

1. Expected annual turnover of the company. 2. Estimated cost of employee benefit increases. 3. Number of employees planned to be hired in the next financial year. 4. Program plans for HR managers for the coming year (bonus programs, training, education, promotions, etc.). 5. Other changes in company policy, strategy, rules and regulations, which may, in turn, affect cash flows.

Cost efficiency, indicators

As noted above, the most important indicators of the effectiveness of personnel costs are:

- labor productivity;

- standard number of AUP;

- annual economic effect;

- financial savings;

- staff turnover rate.

Labor productivity

The effectiveness of an employee’s labor costs in producing products is determined by his ability to create a certain amount of this product per unit of time. Therefore, the most important indicator of personnel performance is labor productivity. It is determined by product output per unit of time and, at the organizational level, is calculated using the formula:

F = VP / CR

where: Et is an indicator of labor efficiency, VP is the cost of manufactured products, CR is the average annual number of workers employed at the enterprise.

In large industries, the efficiency of labor costs in the form of an indicator of labor productivity is calculated slightly differently:

Fri = Op / T

where: Pt is an indicator of labor productivity; Op - volume of products (works, services) produced during a certain period of time, rub.; T - labor costs (person/hour, person/day) or average number of employees.

AUP headcount standard

The need for management personnel can be calculated using the Rosencrantz formula:

where: n is the number of types of management work; mi is the average number of organizational actions performed within the i-th type of management work; ti is the time required to complete unit m within the i-th organizational and managerial type of work; Tpol - full working time, according to the employment contract with a specialist, for the estimated period of calendar time; Кнрв — coefficient of necessary time distribution; tр - additional actual time that could not be taken into account during planning; Kfrv is the coefficient of actual time distribution, determined by the ratio of the total working time to the total estimated time.

Annual economic effect

To compare the costs of carrying out optimization measures and the income received as a result of their implementation, you can apply the formula for the annual economic effect:

Eg = (C1 – C2) * B – En * Z

where Eg is the annual economic effect, C1 and C2 are the cost per unit of production before and after the event, B is the annual volume of work after implementation, En is the standard coefficient of comparative economic efficiency, Z is one-time costs associated with the development and implementation of the event.

Financial savings

Savings achieved by changing the structure and payroll of personnel can be calculated using the formula:

Ed = F1 – F2

where: Ed - savings achieved as a result of changes; F1 and F2 - annual payroll before and after the implementation of changes.

Staff turnover rate

An indirect indicator of the effectiveness of measures to optimize personnel costs can be the relative rate of staff turnover, which is determined as follows: