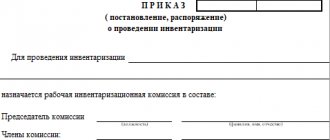

When drawing up an order relating to the issue of inventory, it is important for the office worker to remember that there is an established uniform template. It is they who must be guided. Information that must be reflected in the order:

- composition of the inventory commission;

- the subject of the inventory, that is, what exactly will be inventoried (property, documents, obligations);

- indicate the time frame within which the inventory must be carried out;

- an indication of the reason for the inventory, for example, revaluation or verification;

- within what time period materials on inventory results should be provided to the accounting department.

Let's look at a sample of this order using a specific example

LIMITED LIABILITY COMPANY "HORNS AND HOOVES"

Inventory: concept, types, frequency

Inventory is one of the accounting methods, which consists of comparing the actual availability of property and liabilities with the information contained in registers and documents, and identifying deviations (surpluses and shortages). Its purpose is to verify the completeness and accuracy of the accounting.

There are the following types of inventory:

- Planned.

- Unscheduled.

- Mandatory.

- By decision of management, full and partial.

During the planned one, the company’s property and its obligations are checked within the established time frame before the formation of annual reports. Unscheduled is carried out when facts of theft are detected, during emergency events, etc. Mandatory inventory is provided for by the relevant legislative acts (for example, when changing the MOL). Initiative is carried out by decision of the management of the enterprise. In case of complete inventory, all property of the enterprise and its sources of education are inventoried. With partial - only certain objects.

The frequency of inventory is determined at the enterprise by its management and chief accountant, and is recorded in the accounting policies of the organization, but at least once a year before drawing up annual reports. For fixed assets, it is allowed to be carried out once every three years. It also needs to be carried out when the composition of materially responsible warehouse workers changes; as a rule, this happens in the event of their dismissal, and one employee must transfer warehouse balances to another.

https://youtu.be/yJiAzwtov2Q

Inventory procedure

The company must have a permanent commission to carry out inventory.

In order to begin this inspection, it is necessary to issue an order to conduct it, which determines the objects of the inspection, the timing of the inspection, and the composition of the working commission. It is recorded in the journal for monitoring the execution of these orders.

Before conducting an inventory, all documents that may affect its results (receipts, expenses or reports, etc.) are transferred to the accounting department, and the MOL gives a receipt that they have submitted all available forms. After this, the inventory commission begins to work, which fills out inventory lists and acts in duplicate, indicating in them the actual data obtained by measuring, counting, etc.

Next, the inspection workers compare the information received with information from the accounting reports, after which statements of accounting for the inventory results are generated. It is also necessary to carry out a control check of this procedure and draw up appropriate acts, which are recorded in the control check logs.

How to submit inspection results

The results are compiled in accordance with the standard INV-18 form, which indicates the numerical characteristics of the company's fixed assets, operating assets, material objects, and also compares the data specified in the documents with the actual presence of certain components.

The results reflect the status of the following objects:

- Material objects used for more than one year

- Material objects that have been in use for less than a year and have changed their condition

- Operations with further preparation of an expense report (attached as evidence)

- The totality of cash and non-cash funds

- Calculations related to the purchase of goods and services

After creating the protocol and statement, the final determination of the results of the procedure occurs, and an order is signed containing data on the results of the event.

Upon completion of verification activities, the IC analyzes the information received and draws up an inventory (inventory act) based on it. The financially responsible persons must sign the acts, thereby confirming their presence and agreement with the results of the reconciliation process.

If during the audit, surpluses or shortages were identified that lead to discrepancies with accounting data, a matching statement is generated. For fixed assets, unified forms of final documentation will be recorded in the INV-1 inventory and the INV-18 statement.

After completing the process of analyzing the final information, a meeting of the inventory commission is held, at which the results of the assessment are recorded and possible options for correcting the detected violations are determined. After the meeting, a protocol and statement INV-26 are drawn up (Resolution of the Civil Code No. 26 of March 27, 2000), illustrating the absence (presence) of discrepancies and options for eliminating errors.

Documents drawn up at the meeting are sent to the head of the organization. Next, management reviews the initial materials of the assessment and makes decisions on the fact of control activities. The manager expresses his verdict by means of an order on the results of the reconciliation.

- details of the manager who signed the document.

After publication, the local act must be registered in a special journal to record control over the implementation of such decisions. Its recommended form can be taken from Goskomstat Resolution No. 88 (Form No. INV-23) or developed independently. All employees listed in it must be familiarized with the order.

They can sign the acquaintance directly on the form or on a separate sheet of acquaintance with the document, which is filed with the order. Step-by-step instructions for drawing up an order Step 1. Indicate the name of the document. Step 2. In the appropriate fields, enter the name of the organization (IP), indicate OKPO, and write the date of compilation.

Step 3. Fill out the main part of the order.

Important

Home → Accounting consultations → Inventory Updated: February 13, 2020 Inventory is one of the tools for an organization to control its values and obligations. Inventory is carried out at the enterprise annually to adjust accounting information.

Carrying out an inventory and recording its results are approved by orders of the head of the organization. The procedure for carrying out inventory The regulations for carrying out inventory are approved by the Methodological Instructions for Inventory (approved by Order of the Ministry of Finance No. 49 of June 13, 1995). The obligation to conduct an inventory annually is established by the Federal Law “On Accounting” No. 402-FZ dated December 6, 2011.

The rules for conducting an inventory and recording its results are established in each organization independently and are fixed by orders of the director.

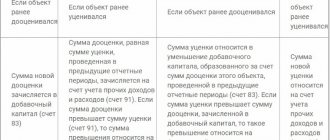

As a result of such a check, the following may be revealed:

- Full coincidence of actual balances with the data specified in the accounting documentation;

- Re-grade - property or goods of different grades, but with the same name, are both in short supply and in excess;

- Surplus - the actual quantity exceeds the accounting quantity;

- Shortage – the actual quantity is less than the accounting quantity.

The results of the inspection must be recorded in writing and submitted to management within the time limits specified in the order.

During the inventory, the commission carries out calculations, determination of weight, and measurement of inventory items.

Information about the results established during the inventory of inventory items is documented in the inventory list. The unified form of such an inventory (INV-3) was approved by the State Statistics Committee.

Based on the results of the inspection, the following are subject to reflection in the inventory list:

- productive reserves;

- finished products;

- goods;

- other supplies.

This information is specified by reflecting the following information:

- names of values;

- type, group of inventory items;

- the number of such values;

- varieties, etc.

The document in question consists of four pages.

The first page contains information about the organization, details of the order to conduct an inventory, as well as the signatures of officials bearing the corresponding financial responsibility.

The second and third pages contain a table with information about the values identified by the check.

The fourth page contains summary information and signatures confirming it.

Starting from 2013, organizations do not have to use unified forms. In order to take into account the results of the inventory, the organization has the right to develop and approve its own documentation forms indicating all the details necessary for this operation (this applies to both inventory forms and orders for inventory of material assets). Samples of such forms do not need to be approved by government departments.

We invite you to familiarize yourself with: Samples of a marriage contract for property

In the process of checking the actual existence of objects (obligations), control documents are drawn up, which differ depending on the object. The organization has the right to independently develop forms of control documents or use standardized forms approved by Resolution 88 of the State Statistics Committee.

The results are presented:

- inventory records, which reflect the actual availability and quantity;

- matching statements, where discrepancies between fact and accounting data are indicated.

Inventory order, sample filling

[ads-pc-2] [ads-mob-2]

An organization can apply an order drawn up in free form in compliance with the necessary details, and also use a unified document in the INV-22 form .

Specialized accounting programs include standardized documents.

At the top of the order the name of the organization, its OKPO code, as well as its structural unit (if any) are indicated. After this, the document is assigned a serial number, which can be viewed in the order log, and the date of its preparation is indicated.

In the preamble, you must fill in information about the type of inventory. Next, data is entered on the composition of the working commission with a breakdown of the positions and personal data of the workers who are included in it. The order must define specific objects to be inventoried, indicating their location (for example, spare parts that are located in the company's circulating warehouse).

After this, the document must determine the timing of this procedure, indicating the start and end dates. The line “Reason for inventory” indicates the event that required it to be carried out. If an annual inventory of inventory items is carried out, then “Planned” is filled in here.

Below you need to provide information about where the results are provided and within what time frame.

The order is signed by the head of the enterprise, filling out information about his position and personal data.

How to form a commission

The audit commission is approved by issuing an appropriate order. It may include:

- persons holding senior positions in the company;

- accounting department employees;

- financially responsible employees;

- employees of third-party audit organizations.

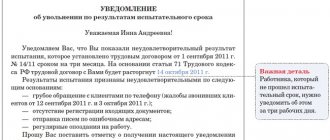

If, on the start date of the inventory, one of the approved members of the commission cannot begin to perform the assigned duties, for example, due to a business trip or temporary disability, then the manager is obliged to issue a document appointing a replacement for him. All other members of the commission must be familiarized with it and signed.

Sample order to create a commission

Sample order for the creation of an inventory commission:

After completing the main verification activities, the commission is obliged to prepare and document reports on the audit results. All detected inaccuracies, errors and violations must be indicated in a specialized accounting sheet. To maintain it, the resolution of the State Statistics Committee, issued number 26, provides for a universal standard form. It is recorded under the number INV-26 ().

Ultimately, after discussing the results and assigning penalties against the officials responsible for violations, the manager is obliged to issue an order on the results of the audit. It is compiled in free form. Typical sample document:

https://youtu.be/QdDh5tAcqFk

The nuances of drawing up an order to conduct an inventory

[ads-pc-4] [ads-mob-4]

When conducting a planned annual inventory of property and liabilities, either one general order can be issued, which contains as many subparagraphs on working commissions as there are objects of inspection, or several orders, one for each type property or liability.

To convey the contents of the order to employees, you can draw up introductory sheets in which they must sign and indicate their personal data. Members of the commission are allowed to sign next to their names in the order when the working commission is approved.

When drawing up an order to conduct an inventory in connection with the identification of facts of theft of property, it is advisable in the line “Reason for inventory..” to fill in not only the reason, but also the name and details of the document that prompted it (for example, based on a report from mechanic A.A. Ivanov dated December 1, 2015 about the theft of spare parts from a circulating warehouse).

https://youtu.be/ysJ9i7TG360