Monetary obligations of legal entities or individuals to an enterprise are classified as accounts receivable. Amounts arise due to delays in payment under the terms of contracts or debtors missing the payment deadline. To confirm accounting data on the existence of debt, its category, and repayment dates, an inventory is carried out. The procedure, document flow, and timing of the audit are approved by order in the accounting policy. In this article, we will look at how the inventory of accounts receivable takes place in organizations, what the timing and procedure are, which accounting accounts are audited and what documents need to be drawn up after the inventory.

Need for inventory

Information about the presence of outstanding debts is used in the formation of the annual balance sheet, drawing up an appendix to the statements and must meet the criterion of reliability. The practical benefit of carrying out an inventory is the use of data for the timely collection of funds used as part of working capital.

These accounts receivable status data are used by third parties when making decisions on granting a loan or joining an enterprise. Based on the comparability of receivables and payables, a liquidity analysis is carried out. The current liquidity ratio indicator indicates financial stability - the excess of current assets over liabilities or the opposite situation - the enterprise is in a crisis situation.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Order on inventory of receivables (payables)

An order for the inventory of receivables and payables is issued by the head of the enterprise before it is carried out.

It can be drawn up using the unified form INV-22 “Order (resolution, order) on conducting an inventory", approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Form INV-22 can be downloaded on our website:

Form of the unified form INV-22

The order contains the following information:

- the structural unit in which the inventory is carried out (in our case, this is the accounting and commercial department);

- members of the inventory commission and its chairman;

- the nature of the liabilities subject to recalculation;

- start and end dates of the inventory;

- its reasons and nature of implementation;

- deadline for transferring data to the accounting department.

Due to the fact that this form is not among the mandatory unified forms, the order can be issued on a form, the form of which was developed by the enterprise itself and approved by it in its accounting policies.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

Determination of receivables categories

As a result of the audit, the validity of the amounts reflected in the accounting accounts is confirmed. In addition to monitoring accounting data, it is necessary to analyze the status of the debt. The check reveals:

- Debts of counterparties are deferred under the terms of contracts for which the payment period has not yet arrived.

- Debt for which there is arrears, but there are guarantees of payment.

- Amounts for which there is a high probability of being overdue.

- Uncollectible debts for which it is necessary to create a reserve.

- Debt for which the statute of limitations has expired, subject to write-off and recording in an off-balance sheet account.

For the financial side of the company's activities, an important result of inventory is the creation of a reserve for bad debts and the identification of debt that needs to be recovered.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

How to write off bad receivables

The statute of limitations begins to run from the moment when a person learned or should have learned about a violation of his right (Article 200 of the Civil Code of the Russian Federation).

The limitation period is interrupted if the debtor takes actions indicating recognition of the debt (Article 203 of the Civil Code of the Russian Federation). After the break, the limitation period begins to run again, but it cannot exceed ten years (clause 2 of Article 196 of the Civil Code of the Russian Federation). 3. There is a resolution of the bailiff on the completion of enforcement proceedings, confirming the impossibility of collecting debts.

Deadlines for auditing accounts receivable

The head of the enterprise approves the timing of the inventory, except in cases where it is mandatory. Accounts receivable are subject to verification before the occurrence of new events and at the end of the reporting year (clause 23 of PBU 8/2010) .

The frequency of the inventory depends on the reasons for the inventory.

| Date | Date of issue of the act | Causes |

| Once a year | December 1 | Preparation for drawing up the annual balance sheet |

| Twice a year | June 1, December 1 | Control of account balance data and preparation for reporting |

| Several times a year - monthly or quarterly | Reporting date of reserve formation | Replenishment of the reserve for doubtful debts |

| If necessary and special circumstances arise | At the end of the inspection or the date specified in the order | Change of materially responsible person or official |

| Preparation for enterprise reorganization | ||

| Liquidation of a company | ||

| Identification of facts of theft at an enterprise |

The importance of the frequency of inventory calculations is due to the need to control the statute of limitations for debt collection (see → writing off accounts receivable with an expired statute of limitations in 2020).

Preparing for an inventory in an organization

To begin the inventory, an order is issued in the form INV-22 (→). The composition of the persons whose responsibilities are charged with carrying out the inventory is approved by order of the manager. Important aspects of document flow include:

- The commission must consist of at least 3 responsible persons. The commission is headed by the chairman responsible for conducting the audit.

- The permanent commission is reflected in the order of the beginning of the year, issued separately or included in the annex to the accounting policies.

- When forming the composition of a one-time convening of the commission (for special reasons for inventory), an order on the responsible persons is issued immediately before the audit.

Before starting the inventory, it is necessary to carry out reconciliations with counterparties who act as debtors of the enterprise. There is the added benefit of conducting a documented data reconciliation. It is possible to claim receivables only within the limitation period established by the Civil Code of the Russian Federation within 3 years.

The statute of limitations for debt confirmed by bilateral (or with a large number of parties to the agreement) reconciliation is recalculated from the date of signing the document. Resetting the period to zero must be taken into account when writing off uncollectible debt.

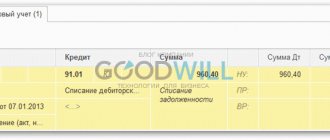

Accounts subject to verification

Inventory calculations differ from checking material assets. The audit is carried out on the basis of data from primary documents and reconciliations with counterparties. The amounts reflected in the accounts receivable accounts are subject to verification.

| Counterparties | Accounts |

| Suppliers in relation to listed advances or claims ordered by a court decision | 60, 76 |

| Buyers for payments for delivered goods, products, materials | 62 |

| Customers for payments for services rendered or work performed | 62 |

| Insurance companies regarding payments of compensations, premiums and other types of debts | 76 |

| Managers of budget funds in relation to overpaid taxes and contributions subject to refund | 68, 69 |

| Founders of the organization regarding unpaid shares of contributions to the management company | 75 |

| Employees of the enterprise for debts issued on account of the amounts of advances received from the company of loans, outstanding arrears for damage caused | 70, 71, 73, 76 |

Current accounting of an enterprise's receivables is carried out using analytical accounting in the context of counterparties and each debt obligation (agreement).

The procedure for accounting and analysis of receivables and payables

d. Accounts payable - obligations of the organization.

arising before third-party enterprises, individual entrepreneurs, employees and individuals during settlements related to supplied goods and materials, wages, payments to the budget, etc. For example, an enterprise bought goods on March 10, and the terms of the contract say that payment is possible until April 4 .

All the time from 10

The relevance of the chosen topic lies in the fact that an enterprise in a market economy has economic ties with other enterprises. A clear organization of payments helps accelerate the turnover of working capital, timely receipt of funds, and as a result contributes to the efficient operation of the enterprise. The purpose of my work is to become familiar with the concept of accounts receivable and payable, as well as to become familiar with the documents that regulate the accounting of settlements with buyers and customers, as well as to become familiar with documentation, synthetic and analytical accounting, and of course the forms of settlements with buyers and customers.

We recommend reading: Homeowners' association bankruptcy, what's next

Documentation of inventory results

At the end of the inspection, the results are documented in a certificate and act INV-17, drawn up in 2 copies. Filling out a certificate (standard form) precedes the drawing up of an act. Form No. INV-17 is accompanied by copies of primary accounting documents confirming the existence of debt: invoices, reconciliations, contracts, court decisions, and other forms.

During the inventory process, attention is paid to debt collection activities. The act specifies a list of measures taken by officials to collect debt amounts, including:

- Sending letters reminding about the need to repay the debt.

- Presentation of sanctions in accordance with the terms of contracts. If there is no corresponding provision in the document, sanctions are imposed at 1/300 of the refinancing rate accrued for each day of delay.

- Filing a claim with the courts.

Taking timely measures allows you to determine the debt as reclaimed, which allows you to write it off 3 years after the delinquency has occurred. With regard to employee debts, the commission establishes all cases of delay and makes proposals for its repayment.

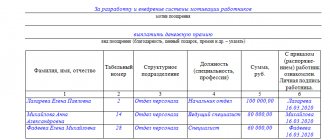

Example #1. Detection of employee debt after inventory

Let's consider the example of detecting an employee's debt. During the annual inventory of payments from November 1 to November 30, 2020, it was established that there was no report from employee K.M. Mironov on previously issued amounts. The report was issued on September 22 with a designated purpose for travel expenses.

During the audit, it was determined that the absence of an advance report was caused by the loss of documents. The commission decided: to oblige Mironov K.M. provide a report on the basis of a travel certificate with payment of the amounts due in case of loss of documents; deposit the difference into the cash register as the balance of funds received for the report.

The statements can be prepared manually or typewritten with the document certified by signatures and transcripts. The results of the audit are considered valid subject to the participation of all members specified in the order in the inventory.

Actions upon completion of the audit

The results of the inventory carried out before drawing up the balance sheet are reflected in the statements. For other cases, a procedure is provided for reflecting the identified results in the month of publication of the act. Based on the inventory results, the chief accountant of the enterprise groups accounts receivable and performs a number of actions:

| Debt category | Measures taken |

| Debt for which payment terms have not arrived | Actions to collect reliable debt are not taken |

| Debts of partners with overdue obligations, the repayment of amounts for which has a high probability of receipt | A letter is sent to the counterparty requesting payment of the debt amount. |

| A deferment (deferred payment) of debt repayment is made at the request of the partner | |

| Employees' debt for more than a month | The amount is recognized as the employee’s income and is included in the advance received |

| Debts recognized as doubtful for repayment | A reserve is created based on the amount of debt |

| The debt has been identified as uncollectible | Amounts are sent to be written off from the balance |

The classification of debt as bad is carried out by the enterprise independently. The grounds are:

- Doubts about the debtor's solvency.

- No additional guarantees.

- Bankruptcy proceedings initiated against a counterparty.

- Liquidation of a company - the presence of a notification submitted to the Federal Tax Service or the fact of exclusion from the register.

- A court decision to seize a person’s property or accounts.

Only debts in arrears under the terms of contracts after the expiration of the limitation period are subject to write-off. To write off the debt, an order from the manager is issued.

Documentation of accounts receivable

the amount of tax paid to suppliers reduces the organization's VAT obligations to the budget. This is reflected by the entry: Analytical accounting for account 60 “Settlements with suppliers and contractors” is maintained for each submitted invoice, and settlements in the order of scheduled payments are maintained for each supplier and contractor. At the same time, the construction of analytical accounting should ensure the possibility of obtaining the necessary data on: suppliers on accepted and other payment documents for which the payment period has not yet arrived; to suppliers for payment documents not paid on time; to suppliers for uninvoiced deliveries; advances issued; to suppliers on bills issued, the payment period of which has not yet arrived; to suppliers for overdue bills of exchange: to suppliers for received commercial loans, etc.

Using inventory results to create a reserve

A company that, based on the results of an inventory, has received data on the presence of doubtful debts for repayment of the company, forms a reserve in accordance with PBU 8/2010. The procedure for writing off amounts for taxation is defined in Art. 266 Tax Code of the Russian Federation.

Let's consider an example of creating a reserve for doubtful debts. Based on the results of an inventory of settlements with debtors at the Flazhok LLC enterprise, overdue debt was identified as of June 1, 2020. The debt amount of 45,800 rubles was formed as a result of late payment by the buyer for the shipped goods. The payment deadline under the agreement is February 1 (over 90 days).

Based on the results of the inventory, a reserve for doubtful debts was created at the enterprise: Dt 91/2 Kt 63 for the total amount of the debt of 45,800 rubles. In tax accounting, the debt is included in the reserve in full in accordance with Art. 266 Tax Code of the Russian Federation.