What are the benefits of transferring accounting functions?

Outsourcing is the transfer of certain functions of an organization to a specialized company. By the way, this phenomenon is not domestic, but came to us from abroad.

In the United States, the services of accounting companies are used by about 92% of small and medium-sized businesses, in Western European countries - 86%. In Russia, the accounting outsourcing market is developing rapidly, but has not yet reached such figures.

Perhaps the main principle of outsourcing can be formulated as follows: trust us with what we can do better than others, and do what you can do better than others. In other words, the customer company, transferring accounting to an outsourcing company, can concentrate all its efforts on developing the main line of business. This saves time and money on organizing financial work, which is necessary if you have internal accounting.

Organization of internal control over accounting

Most often, accounting outsourcing is used in the following situations:

- a newly created enterprise or individual entrepreneur does not have the financial capacity to equip a workplace and pay a full-time accountant;

- the company does not have full-time specialists to perform one-time procedures (for example, audit) or certain functions (for example, payroll and personnel records);

- business requires multilateral expert support, for example, when collaborating with foreign companies, executing non-standard transactions;

- to relieve your own accounting department in case of unplanned absence of a full-time accountant (due to illness, force majeure);

- when the qualifications of internal employees do not meet the stated requirements of the organization;

- if there are conflict situations between the company’s management and the chief accountant/accounting department. By the way, we wrote about why it is better for two founder friends to outsource accounting.

It is important to understand that accounting must be carried out continuously and in full. Failure to comply with this principle is fraught with violation of the law, which leads to the imposition of fines and penalties from regulatory authorities. Restoration of “neglected” accounting and financial sanctions (often multimillion-dollar) from government agencies can jeopardize both the financial situation and the existence of the company as a whole.

Who is responsible for organizing accounting

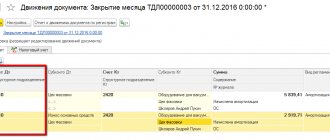

Execution of work: wiring

Let us give an example of the formation of accounting entries when the result has a material embodiment.

Example 3. Making custom furniture

Lira LLC, based on the customer’s sketches, manufactured a wardrobe costing 40,000 rubles. (NDS is not appearing):

- The customer made an advance payment of 10,000 rubles to the cash register;

- cost of materials – 20,000 rubles;

- salary – 5,000 rubles;

- insurance premiums for salary – 1,500 rubles.

Let's make the wiring:

| The essence of the operation | Debit | Credit | Amount, rub. |

| The customer made an advance payment to the cash desk of Lira LLC | 50 | 62 | 10 000 |

| Material costs | 20 | 10 | 20 000 |

| Salary | 20 | 70 | 5 000 |

| Insurance premiums | 20 | 69 | 1 500 |

| The actual cost of the wardrobe is taken into account | 43 | 20 | 26 500 (20 000 + 5 000 + 1 500) |

| The cost of work has been written off | 90.2 | 43 | 26 500 |

| Revenue is reflected (the work completion certificate is signed) by posting | 62 | 90.1 | 40 000 |

| Final settlement with the customer | 50 | 62 | 30 000 |

| Profit of Lira LLC | 90.9 | 99 | 13 500 (40 000 – 26 500) |

How to choose the right outsourcer

To outsource accounting services, you need to carefully evaluate the potential outsourcing company, which requires a responsible approach to the selection issue.

It is better to give preference to a large specialized company with extensive experience and a positive business reputation in the accounting services market.

Important!

When choosing an outsourcer, the following are important:

- employee qualifications;

- availability of specialized specialists on staff (tax experts and lawyers, auditors, lawyers, etc.);

- availability of a professional liability insurance policy;

- the amount of compensation in case of outsourcer errors specified in the contract;

- availability of diplomas and certificates, scope of services provided and price range.

To select a suitable outsourcing company, you need to study information on the websites of specialized organizations, compare the cost of services, consider the candidacies of experts, and reviews of other customers.

Why you shouldn’t trust an accountant you know too much

It is also necessary to verify the official activities of the selected organization by making a request on the website of the Federal Tax Service of Russia. Using the details, you can check whether the company is registered in the Unified State Register of Legal Entities (USRLE).

It is of no small importance that the outsourcer has a professional liability insurance policy, and you need to pay attention to the validity period of the document. It must be valid at the time of conclusion of the contract and, preferably, its term does not expire immediately after the start of cooperation.

When applying in person, it is recommended that you familiarize yourself with the title documentation of the accounting organization, as well as find out what methods the potential provider plans to use to solve the identified problems and issues of your business. In other words, you need to clearly understand that your company will not be drawn into any schemes, and that accounting and tax accounting will comply with the requirements of current legislation.

More details

Accounting for services from the customer

Services are expenses of the customer enterprise and are most often included in expense accounts 20 (23, 25, 26, 44).

Let's continue the example

However, some services may increase the cost of purchased goods or fixed assets (clause 6 of PBU 5/01, clause 8 of PBU /01), for example, transport or information services. In this case, they are reflected as follows:

- Dt 08 (10, 41) Kt 60 - the cost of fixed assets (inventory, goods and materials) has been increased by the amount of transport or other services to be included in the price.

For the procedure for forming the cost of fixed assets and inventory items, see the articles:

Agreement with an outsourcing company

A third-party organization maintains the company’s accounting records based on a signed agreement. Its content is one of the leading factors on which the quality of accounting and possible consequences in case of provider errors depend.

Our experts advise paying attention to the following conditions, which must be contained in the contract with the outsourcer:

- Terms and Definitions;

- subject of the contract;

- rights and obligations of the parties: specific functions of accounting support of the company;

- cost of services, payment procedure;

- responsibility of the customer and contractor, penalties;

- additional conditions: insurance, confidentiality, etc.;

- duration of the contract, terms of extension or termination;

- details of the parties.

This list of items can be supplemented at the discretion of the customer and the contractor.

The outsourcing company is interested in the final result of its activities, since, according to the contract, it bears financial responsibility for the omissions of its employees and assumes the associated risks.

Important!

Not all outsourcing companies are ready to bear financial responsibility. Many, on the contrary, limit it, for example, indicating that they only reimburse the fine for late submission of reports, as a rule, within the limits of the average monthly payment that the client transfers for services.

When choosing an accounting company, please note that everyone’s service process is organized differently; not every outsourcer has lawyers, experts in labor and tax law, or multi-level control, which, of course, affects the quality of the services provided. To maintain confidentiality of information, in addition to the contract, a non-disclosure agreement may be concluded. For example, in our company this is a mandatory document.

It is important that the outsourcing company is respected and proven in the field of accounting and inspires trust among clients.

Accounting for services from the contractor

The contractor's accounting directly depends on the type of activity and taxation regime. Most often, companies providing services in order to reduce the tax burden choose special regimes: UTII or simplified tax system. Along with them, OSNO can also be used.

Revenue from services provided is income from ordinary activities. The procedure for its accounting is regulated by clause 5 of PBU 9/99.

Postings from the contractor when selling services will be as follows:

- Dt 62 Kt 90.1 - reflects the sale of services.

- Dt 90.3 Kt 68 - VAT charged.

- Dt 90.2 Kt 20 (23, 25, 26, 43) - the cost of services provided is written off.

- Dt 50 (51) Kt 62 - services paid for by the customer.

- Cost accounting.

Consider, for example, training services. The main costs are salaries of employees, calculation of taxes and contributions, depreciation, etc. That is, to provide these services, the organization does not spend material assets on the production of any objects. At the end of the month, its costs are written off to the cost of sales by posting Dt 90.2 Kt 20.

Example

Materials in the amount of 17,342 rubles were spent on the production of the banner. (excluding VAT). The remuneration of employees amounted to 8,500 rubles, contributions from the payroll - 2,805 rubles.

- Dt 20 Kt 10 - 17,432 rub. — materials for making the banner were written off;

- Dt 20 Kt 70 - 8,500 rub. — wages accrued to employees;

- Dt 20 Kt 69 - 2,805 rub. — contributions from the payroll are calculated.

- Dt 43 Kt 20 - 28,737 rub. (17,432 + 8,500 + 2,805) - the banner was made at the actual cost.

- Dt 90.2 Kt 43 - 28,737 rub. — the cost of services is written off.

Advantages of outsourcing accounting services to 1C-WiseAdvice

- We provide comprehensive assistance in business accounting support; company experts help in resolving tax, personnel, and legal issues.

- The financial responsibility that we assume in the event of our errors extends to the next 3 years after submission of reports and amounts to 70 million rubles, which guarantees compensation for fines and penalties if they arise. And if the insurance policy does not cover the client’s losses, our company will compensate the entire amount from its own funds. In 1C-WiseAdvice, the amount of compensation is not limited.

- Deep automation of our processes allows us to create a multi-level accounting quality control system. And if the “machine” has questions and suspicions about a particular operation/document, the questionable area is rechecked manually by a specialized specialist.

Provision of transport services: wiring

Example 1. Provision of services by a transport company

Transimperio LLC provides services for the transportation and support of goods in Russia. The company entered into an agreement with Stankorem LLC for the transportation of a machine worth RUB 1,100,000. Contract price – 360,000 rubles, incl. VAT 20% – 60,000 rub. The price includes payment:

- for direct delivery of the machine;

- for forwarding.

The contract provides for payment upon delivery of the service.

The accountant of Transimperio LLC will generate the following entries:

| The essence of the operation | Debit | Credit | Amount, rub. |

| The machine is accepted for support (accounted for in the off-balance sheet account) | 002 | — | 1 100 000 |

| Contractor expenses - postings: | |||

| Car depreciation | 20 | 02 | 15 000 |

| Fuel | 20 | 10 | 20 000 |

| Delivery driver salary | 20 | 70 | 15 000 |

| Insurance premiums have been calculated for the driver's salary | 20 | 69 | 4 500 |

| Accommodation of the forwarding driver in a hotel | 20 | 71 | 3 000 |

| Total: | 57 500 | ||

| Dispatcher salary | 26 | 70 | 2 000 |

| Insurance premiums have been calculated for the dispatcher's salary | 26 | 69 | 600 |

| Total: | 2 600 | ||

| Income from the provision of transport services - postings: | |||

| Revenue according to the signed act | 62 | 90.1 | 360 000 |

| VAT 20% included | 90.3 | 68 | 60 000 |

| Funds have been credited from Stankorem LLC | 51 | 62 | 360 000 |

| The machine has been removed from safekeeping | — | 002 | 1 100 000 |

| Write-off of cost per month | 90.2 | 20 | 57 500 |

| 26 | 2 600 | ||

| Profit received from the transaction (360,000 – 60,000 – 57,500 – 2,600) | 90.9 | 99 | 239 900 |

Example 2. Provision of goods delivery services by the supplier

The supply agreement may provide for the delivery of goods by the supplier to the buyer's warehouse.

LLC "Avtotech" entered into an agreement for the supply of a large batch of spare parts for GAZ cars with LLC "Techcenter" in the amount of 480,000 rubles, incl. VAT 20% - 80,000 rub.

The cost of a batch of goods for Autotech LLC is 320,000 rubles. In this case, the supplier, at his own expense, is obliged to deliver spare parts to the address of the location of Tekhcenter LLC.

Supplier costs associated with delivery:

- fuel – 6,000 rubles;

- car depreciation – 4,000 rubles;

- driver’s salary – 10,000 rubles;

- insurance premiums for salary – 3,000 rubles;

Total expenses – 23,000 rubles.

Costs are included in sales expenses and are accumulated by the accountant on account 44:

| Delivery costs | Debit | Credit | Amount, rub. |

| Fuel | 44 | 10 | 6 000 |

| Car depreciation | 44 | 02 | 4 000 |

| Driver salary | 44 | 70 | 10 000 |

| Insurance premiums | 44 | 69 | 3 000 |

| Write off delivery costs as cost | 90.2 | 44 | 23 000 |

The financial result from the transaction for Autotech LLC will be:

480,000 (revenue) – 80,000 (VAT) – 320,000 (cost of spare parts) – 23,000 (delivery costs) = 57,000 rubles.

Interaction with third parties

Dear heads of repair, construction and construction organizations!

In order to ensure reliable energy supply to consumers in St. Petersburg and the Leningrad region, to carry out measures to prevent and eliminate accidents at the facilities of the electric power complex, PJSC Lenenergo invites you to cooperate in carrying out emergency restoration work.

The organization and execution of work will be carried out within the framework of the concluded Cooperation Agreements. The main areas of work are:

1. Emergency repair of overhead and cable power lines 0.4-110 kV, including clearing glades and cutting down threatening trees; 2. Emergency repair of 35-110 kV substation equipment, including power transformers up to 80 MVA, (factory and on-site), switching equipment, relay protection and automation, switchgear switchgear cells, etc. 3. Emergency repair of distribution network equipment, including including RP, TP; 4. Emergency repairs of buildings and structures; 5. Transportation of oversized cargo during emergency restoration work; 6. Etc.

Requirements for organizations:

- Availability of technical, human and material resources;

- Willingness, within no more than 12 hours, upon written notification of PJSC Lenenergo, to send fully equipped teams and special personnel. equipment to the work site;

- Availability (possibility of supplying your organizations in the shortest possible time) of necessary materials and equipment for the work.

You must inform us of your readiness to cooperate in writing.

on the official letterhead of the organization addressed to the first deputy general director - chief engineer Igor Anatolyevich Kuzmin.

The letter must indicate:

- Full name of the organization and its details (according to the format of the attached Agreement), territorial location of repair bases only in the Leningrad Region and St. Petersburg and possible areas of work (all districts of the Leningrad region or only certain ones, St. Petersburg or certain areas of the city);

- Type of work performed by the organization;

- The maximum possible number of teams (people) sent to work sites, but not less than two teams;

- Nomenclature of cars and specials. equipment sent with brigades;

- The range of tools, devices, equipment, etc. used;

- Contact coordinates of responsible persons and their replacements.

Attached to the letter, you must submit the Agreement drawn up on your part. The format of the Agreement was approved by Rosseti PJSC and cannot be changed.

For all questions, please contact the head of the Department of Maintenance and Repairs of PJSC Lenenergo, Denis Nikolaevich Konkov, by phone. Email

Draft agreement

Draft agreement

Regulations for the formation and approval of the cost of work when carrying out repair activities at PJSC Lenenergo

Full-time specialists

Many companies, even knowing about the possibility of providing accounting services by third parties, prefer to have their own in-house specialists. However, in-house accounting is quite expensive for an enterprise. The salary of a chief accountant in the modern labor market is now no less than $1000-1500 per month. Ordinary accountants with experience need to be paid at least 600-900 dollars.

The full-time accounting department also needs a courier - at least another $200 per month. In addition, it is necessary to take into account payments to the Federal Compulsory Medical Insurance Fund, pension and tax expenses. An accountant's workplace, along with a computer, furniture and software, costs about $1,500, and you also need to allocate a certain amount monthly for renting premises.

Another expense item is office supplies, maintenance services for copying and computer equipment. Full-time specialists will provide high-quality accounting services only taking into account their professional growth, which means it is necessary to pay for regular visits to accounting courses and seminars.

If you add up all these expenses, then even a small accounting department costs an enterprise from 8 to 30 thousand dollars per year. But these expenses are incurred regardless of the amount of work performed by your staff. What if the chief accountant, who has all the contacts and has all the information about the calculations, gets sick?