Which business entities are required to keep accounting records?

In accordance with the provisions of Art. 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, all types of business entities are required to maintain accounting records, except:

- Individual entrepreneurs (subject to accounting for their own income and expenses using other methods provided for by tax legislation);

- structural divisions of foreign companies operating in Russia (subject to keeping records of revenue and costs in accordance with tax legislation).

The organization must keep accounting records from the moment of state registration until the termination of its activities. Failure to fulfill this statutory obligation threatens the company with legal consequences in the form of measures established in Art. 120 of the Tax Code of the Russian Federation (fine) and Art. 15.11 Code of Administrative Offenses of the Russian Federation (fine or disqualification of officials).

It is in the interests of the company to maintain correct accounting. Who should be responsible for its organization?

https://youtu.be/dFcsKkyFUPE

Administrative responsibility

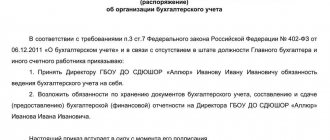

In accordance with Part 1 of Art. 7 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Law No. 402-FZ), accounting and storage of accounting documents is organized by the head of the economic entity (Part 1, Article 7 of Law No. 402-FZ) .

In this case, the manager is obliged:

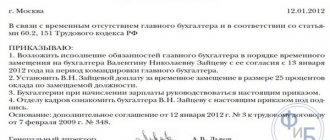

- or entrust accounting to the chief accountant or other official of the organization;

- or enter into an agreement for the provision of accounting services with a third-party organization (specialist);

- or take charge of accounting (if the organization is a small or medium-sized business) (Part 3, Article 7 of Law No. 402-FZ).

Thus, the responsibility for organizing accounting lies with the head of the organization.

The chief accountant reports directly to the head of the organization and is responsible for:

- for the formation of accounting policies;

- accounting;

- timely submission of complete and reliable financial statements.

The Code of Administrative Offenses of the Russian Federation provides for a number of articles establishing liability for violation of the requirements of the administrative legislation of the Russian Federation in the field of finance, taxes and fees.

Responsibility of the chief accountant

The chief accountant may be held administratively liable for committing, in particular, the following offenses:

1. Gross violation of accounting requirements, including accounting (financial) reporting, is punishable by an administrative fine in the amount of 5,000 to 10,000 rubles. Repeated commission of such an offense will result in a fine of 10,000 to 20,000 rubles. or disqualification for a period of one to two years (Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

Let us note that a gross violation of accounting requirements, including accounting (financial) reporting, means:

- understatement of taxes and fees by at least 10% due to distortion of accounting data;

- distortion of any indicator of accounting (financial) statements expressed in monetary terms by at least 10%;

- registration of a fact of economic life that has not taken place or an imaginary or feigned object of accounting in the accounting registers;

- maintaining accounting accounts outside the applicable accounting registers;

- preparation of accounting (financial) statements not based on data contained in accounting registers;

- the economic entity lacks primary accounting documents, and (or) accounting registers, and (or) accounting (financial) statements, and (or) an audit report on the accounting (financial) statements (if the audit of the accounting (financial) statements is mandatory) during the established storage periods for such documents.

2. Failure to submit within the period established by the legislation on taxes and fees or refusal to submit to the tax authorities, customs authorities documents and (or) other information necessary for the implementation of tax control, executed in the prescribed manner, as well as the submission of such information incompletely or distorted form - liability in the form of an administrative fine from 300 to 500 rubles. (15.6 Code of Administrative Offenses of the Russian Federation).

3. Failure to provide information and documents at the request of tax authorities or the provision of such information and documents in violation of the deadlines established by the legislation of the Russian Federation on the use of cash register equipment - liability in the form of a warning or the imposition of an administrative fine in the amount of 1,500 to 3,000 rubles. (Part 5 of Article 14.5 of the Code of Administrative Offenses of the Russian Federation).

4. Violation of the established deadlines for submitting a tax return (calculation of insurance premiums) to the tax authority at the place of registration - a warning or the imposition of an administrative fine in the amount of 300 to 500 rubles. (Article 15.5 of the Code of Administrative Offenses of the Russian Federation).

5. Violation of the established procedure and deadlines for submitting documents and (or) other information to the territorial bodies of the FSS of Russia - a fine in the amount of 300 to 500 rubles. (Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

6. Violation of cash discipline entails the imposition of an administrative fine in the amount of 4,000 to 5,000 rubles. (Part 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

Please note that ordinary accountants often make mistakes that the chief accountant only learns about at the stage of the tax audit. However, the blame for such mistakes still lies solely with the chief accountant, and not with his subordinates. After all, it is he who is responsible for the correct maintenance of accounting records and reliable reporting (clause 24 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated October 24, 2006 No. 18).

Manager's responsibility

Naturally, in a situation where the head of the organization has assigned the responsibility for keeping records to himself, he will be the subject of all the listed offenses.

In addition, the general director may be brought to administrative liability, in particular, if the following offenses are committed under the Code of Administrative Offenses of the Russian Federation:

1. Violation of the established deadline for filing an application for registration with the tax authority - liability in the form of a warning or the imposition of an administrative fine in the amount of 500 to 1000 rubles.

If this violation involves the conduct of activities without registration with the tax authority, it entails the imposition of an administrative fine in the amount of 2,000 to 3,000 rubles. (Article 15.3 of the Code of Administrative Offenses of the Russian Federation).

2. Violation of the deadline for submitting information about opening and closing an account in a bank or other credit organization (Article 15.4 of the Code of Administrative Offenses of the Russian Federation). This violation entails a warning or the imposition of an administrative fine in the amount of 1,000 to 2,000 rubles.

Disputed responsibility

As a general rule, a company is obliged to submit annual accounting (financial) statements to the inspectorate no later than three months after the end of the reporting year (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation).

As a rule, the responsibility for accounting and reporting is assigned to the chief accountant. This is stated in the employment contract and job description. Therefore, in case of untimely submission of financial statements, it is the accountant, and not the manager, who will be fined (Resolution of the Supreme Court of the Russian Federation dated September 22, 2014 No. 5-AD14-17).

But there is one nuance here. Currently, the signature of the chief accountant in financial reporting forms is not required (Order of the Ministry of Finance of Russia dated 04/06/2015 No. 57n “On Amendments to Regulatory Legal Acts on Accounting”). That is, the documents are signed only by the head of the company. Therefore, if the chief accountant does not put his signature on the reporting, responsibility for failure to submit it rests with the director. At the same time, the courts in a number of cases (see, for example, decisions of the Zheleznodorozhny District Court of Krasnoyarsk dated August 14, 2014 No. 12-2472014, Zhukovsky District Court of the Bryansk Region dated September 8, 2014 No. 12-26/2014, dated September 8, 2014 No. 12 -25/2014) believe that bringing the general director to justice under Part 1 of Art. 15.6 of the Code of Administrative Offenses of the Russian Federation for an organization’s untimely submission of financial statements to the Federal Tax Service without clarifying the official responsibilities of the chief accountant is unlawful, since the manager is responsible for the proper organization of accounting, and the chief accountant is responsible for maintaining accounting records and timely submission of complete and reliable financial statements.

Who is responsible for organizing accounting?

The legislator does not disclose the concept of “organization of accounting”, despite the fact that this phrase is given, in particular, in one of the main regulations governing accounting - order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.

The head of the business entity is responsible for organizing accounting (clause 6 of order No. 34n). From practical experience, it is legitimate to understand the organization of accounting as:

- legal registration of the accounting system (for example, the establishment of regulations on accounting, the issuance of orders on the inclusion of positions responsible for accounting in the staffing table, the registration of specialists for the corresponding positions);

- technical support for the accounting system (purchase of computers, accounting software and other infrastructure necessary for the work of specialists);

- organization of direct accounting.

Who is responsible for accounting?

The manager is also responsible for organizing accounting (Clause 1, Article 7 of Law No. 402-FZ). Unless otherwise provided by law, the head of the company is obliged to assign accounting functions to a competent person (clause 3 of article 7 of law No. 402-FZ). It could be:

- chief accountant or other competent employee of the company (in banking institutions - only chief accountant);

- a third-party organization or individual providing services under an outsourcing agreement.

Who is responsible for errors in accounting, tax accounting, and reporting if accounting and tax accounting is transferred to an outsourcer? ConsultantPlus experts are considering the answer to this question. If you don't already have access to the system, get a free trial online.

Accounting can be carried out by oneself, without the involvement of other persons, full-time or freelance, only by:

- the head of an economic entity who, by law, has the right to use simplified accounting methods;

- the head of an enterprise classified as a medium-sized business.

If a business entity is registered as a joint-stock company, has the status of a non-state pension fund, is a participant in trading or operates in the insurance business, its accounting must be carried out by a person who has a level of qualification, experience and competence determined by law.

What exactly is the chief accountant financially responsible for?

What is real damage? This:

- Damaged materials, equipment and other property of the company;

- Recorded shortages of funds or assets of the company;

- Costs of fines imposed;

- Expenses for forced absences or downtime of employees;

- Expenses for repairing company property.

Do not confuse real damage and lost profits. Lost profits consist of the loss of certain profits, for example due to unconcluded contracts due to the guilty actions of the chief accountant. The manager will not be able to compensate for lost profits at the expense of his employee.

According to Article 246 of the Labor Code of the Russian Federation, damage leads to loss of property; accordingly, the real damage that the chief accountant can cause is penalties, penalties, taxes accrued as a result of inspections.

Requirements for the person responsible for accounting

Qualification requirements for a person applying for a position involving the performance of accounting functions depend on the legal status and industry of the enterprise.

So, in accordance with paragraph 4 of Art. 7 of Law No. 402-FZ, a chief accountant applying for a job in a joint-stock company, an insurance company, a non-state pension fund, a financial management company and other companies that participate in tenders (but are not banks) must meet one of the following qualification requirements:

- availability of higher education in the field of accounting and auditing, as well as work experience in a position related to accounting, lasting at least 3 years out of 5 preceding appointment to the position of person responsible for accounting;

- availability of higher education in any specialization, as well as work experience related to accounting, lasting at least 5 years out of 7 preceding the appointment.

In addition, in both cases, the accountant should not have an unexpunged or unexpunged conviction for economic crimes.

Separate qualification requirements are established for the chief accountant of a banking organization (Clause 7, Article 7 of Law No. 402-FZ).

In general, the head of a company or HR manager applying for a job as a chief accountant should be guided by the qualification requirements established by the professional standard “Accountant”, approved by Order of the Ministry of Labor of the Russian Federation dated February 21, 2019 No. 103n.

For more details, see: “New professional standard for accountants - order No. 103n.”

Contents of the work of the person responsible for accounting

The chief accountant or other person responsible for accounting in the company, in the process of performing his work, solves such problems as:

- ensuring correct accounting (from the point of view of document flow, indication of reliable data in reporting);

- ensuring timely accounting (reporting);

- acceptance into circulation of primary and other documents certifying business transactions in accordance with the law;

- reconciliation of business settlements with counterparties;

- Conducting a timely inventory of the company's property;

- ensuring the safety of accounting documents.

The job responsibilities of the chief accountant are specified in the employment contract. What will happen if a person holding this position violates them?

Read more about the responsibilities of the chief accountant in our publications:

- “We are looking for extra responsibilities in the job description of the chief accountant”;

- “We are making changes to the job description.”

Is an agreement on full financial responsibility of the chief accountant necessary?

In an employment contract or agreement that is part of such a contract, it is possible to stipulate a condition on the full financial responsibility of the chief accountant. If such a condition is not specified in the employment contract, then the administration will not be able to recover damages from the chief accountant in excess of his average monthly earnings. If there are conditions in the agreement on the full financial responsibility of the chief accountant, then the manager, without the voluntary consent of the parties to the labor relationship, does not have the right to withhold damage caused from the employee’s salary. All conditions for payment of material damage to the company are specified in a separate agreement. Otherwise, you will have to recover money from the chief accountant through the court.

Conditions for the financial responsibility of the chief accountant:

- Failure to fulfill duties and committing actions (inaction) that lead to prosecution;

- The connection between actions (inaction) and consequences;

- The existence in the employment contract of conditions on the full financial responsibility of the chief accountant.

Read the agreement on the financial responsibility of the chief accountant.

Violation of work duties by an accountant: consequences

If the chief accountant violates his duties typical of his position, he may be held accountable in accordance with labor, administrative and criminal laws.

The chief accountant may be held liable under labor law on the basis of:

- Art. 192 of the Labor Code of the Russian Federation (possible sanctions - reprimand, reprimand, dismissal);

- clause 9 art. 81 of the Labor Code of the Russian Federation (possible sanction - dismissal);

- Art. 243 of the Labor Code of the Russian Federation (possible sanction - recovery of compensation by the company for material damage).

Provisions of Art. 192 of the Labor Code of the Russian Federation can be applied by the employer in the event of direct failure by the accountant to fulfill the duties established by the employment contract or his job description.

Norms of paragraph 9 of Art. 81 of the Labor Code of the Russian Federation, the employer has the right to apply if the accountant makes one or another decision that will entail damage to the company’s property or the unlawful use of this property.

Sanctions provided for in Art. 243 of the Labor Code of the Russian Federation, can be applied to the chief accountant if he:

- caused material damage to the company due to failure to fulfill obligations;

- allowed a shortage of material assets that were entrusted to him;

- intentionally caused damage to the company;

- caused damage in the company under the influence of alcohol or drugs;

- caused damage by committing a crime, administrative offense;

- allowed the disclosure of trade secrets;

- caused damage to the company outside the period of performance of labor duties.

In addition, the employment contract may establish other criteria for the occurrence of financial liability of the chief accountant.

IMPORTANT! Financial responsibility in full can be assigned to the chief accountant, provided that this is established by the employment contract. If the employment contract does not stipulate that the chief accountant bears financial responsibility in full in the event of damage, then liability for the damage caused can be recovered only in the amount of his average monthly earnings (clause 10 of the resolution of the Plenum of the Supreme Court dated November 16, 2006 No. 52).

If we talk about administrative liability, then, based on the provisions of Art. 15.11 of the Code of Administrative Offenses of the Russian Federation, an accountant as an official in the event of a gross violation of accounting (in accordance with the criteria established by clause 2 of Article 15.11 of the Code of Administrative Offenses of the Russian Federation) may be:

- fined 5,000–10,000 rubles;

- fined 10,000–20,000 rubles or disqualified for 1–2 years if the violation is repeated.

ATTENTION! In 2020 in Art. 15.11 of the Code of Administrative Offenses of the Russian Federation, changes were made to provide for the possibility of releasing an accountant from liability if he made accounting errors due to the fault of third parties. We talked about them in detail in this article.

The chief accountant may be brought to criminal liability on the basis of Art. 199, 199.1, 199.4 of the Criminal Code of the Russian Federation. The standards established by these articles apply if, due to the actions of an accountant, the company was found to have evaded paying taxes and insurance premiums. Possible sanctions:

- fine;

- arrest;

- deprivation of liberty.

The sanctions become more severe if it is proven that the crime was committed by several employees of the company by prior conspiracy, or if tax evasion on a particularly large scale is revealed.

Responsibility under Art. 199 of the Criminal Code of the Russian Federation, the chief accountant is liable only if fraud with large sums is proven, carried out intentionally or in conspiracy with the manager (paragraphs 7, 8 of the resolution of the plenum of the Armed Forces of the Russian Federation dated December 28, 2006 No. 64).

Does the chief accountant bear financial responsibility?

The term material liability is given by labor legislation, which interprets it as the obligation of one person to compensate for the harm another person has caused to him. The rules on financial liability are enshrined in the Labor Code and federal laws for certain categories of workers. So, according to the law of July 12, 1991 No. 161-FZ, you can find out about the financial liability of military personnel, etc.

The Labor Code of the Russian Federation establishes financial liability not only for a company employee, but also for his employer. The chief accountant bears full financial responsibility if his actions, namely incorrect accounting, cause material harm to the company.

According to Article 232 of the Labor Code of the Russian Federation, the one who caused it compensates for the damage. Financial liability is borne by the guilty party to the labor relationship as a result of actions or inactions of an illegal nature (Article 233 of the Labor Code of the Russian Federation).

For example, the chief accountant of one of the organizations, by a decision of the Moscow City Court dated February 26, 2012 in case No. 33-6435, was found guilty because, while receiving money according to cash and expense documents for the further purpose of crediting it to the company’s bank account, he did not hand it over to the bank money or transferred it partially. The chief accountant did not deny that it was his signature that was on the accounting documents. He also claimed that when he took money from the company's cash register, he handed it over to the general director. Through his illegal actions, the chief accountant caused damage to the company. The court decision indicated intentional harm to the company on the part of the chief accountant. The full amount of material damage was recovered from the employee.

Irregularities in accounting: responsibility of the manager or chief accountant

Of course, miscalculations in accounting can have consequences for the head of the company. In what cases can he be held accountable?

There are no rules in federal legislation yet on the basis of which it is possible to unambiguously distinguish between the responsibilities of the chief accountant and the head of the organization. The decisive role in this case is played by law enforcement practice, primarily judicial practice.

Thus, in the resolution of the plenum of the Armed Forces of the Russian Federation dated October 24, 2006 No. 18, a position was expressed according to which the division of responsibilities of an accountant and a manager should be carried out based on the difference in the obligations assigned to them: the manager is responsible for the organization of accounting, while the accountant is responsible for its correct conducting.

IMPORTANT! It can be concluded that the manager, in general, may be held responsible for the failure to carry out or incorrectly organize accounting. Such actions or, conversely, inaction of the head of the company can lead to the fact that it is he, and not the chief accountant, who will be fined or disqualified under Art. 15.11 Code of Administrative Offenses of the Russian Federation.

If mistakes are made directly in accounting, it is legitimate to say that the accountant and the director may be jointly responsible for the legal consequences of errors or deliberate actions.

In addition, the formulations of the RF Armed Forces allow us to conclude that only the manager will be responsible for the consequences of errors in accounting management if it turns out that the accountant was forced to carry out illegal actions as a result of a direct written order from the manager.

NOTE! In accordance with paragraph 8 of Art. 7 of Law No. 402-FZ, an accountant has the right to request a corresponding order on his own initiative. For example, if he considers that as a result of his signature on a particular financial document, the company cannot avoid unpleasant consequences.

One way or another, it should be recognized that the division of responsibilities between the chief accountant and the head of the company based on the law and law enforcement practice is an extremely controversial issue. Much depends on the circumstances of a particular precedent, the evidence base, the degree of seriousness of the offense, as well as the assessment of the facts relevant to the case by the competent executive or judicial authorities.

Does the head of the company face liability if the chief accountant fails to submit financial statements on time? Get trial access and find out the answer for free in an expert opinion from ConsultantPlus.

When does the chief accountant become financially responsible?

In order to establish the guilt of an employee, it is necessary to follow an algorithm of certain actions in accordance with the norms of the Labor Code of the Russian Federation.

Firstly , the administration must conduct its own investigation in order to establish the causes of the damage and evaluate it. For this purpose, a commission is created by order of the general director.

Secondly, the head of the organization must request an explanatory statement in writing from the chief accountant (Article 247 of the Labor Code of the Russian Federation). It is better for the chief accountant not to refuse to write an explanatory note, since through explanations an employee can try to justify himself in the eyes of management. If the manager does not make a decision to resolve the situation, he is not satisfied with the chief accountant’s explanations and the total cost of the damage caused exceeds the average monthly salary, then the employee’s guilt will be determined by the judicial authorities.

It is in the interests of the chief accountant to resolve the issue directly with the employer, since it is not always possible to achieve an acquittal in court. Let us take as an example case No. 33-1423 dated September 12, 2011 of the Kostroma Regional Court. The organization received a fine from the Pension Fund of the Russian Federation for the untimely submission of personalized accounting information by the chief accountant. This responsibility was enshrined in the job description, and the financial responsibility of the chief accountant was in the employment contract. Moreover, the agreement dealt with full financial responsibility. The manager filed a lawsuit against his chief accountant in order to collect a fine from the employee, and the case was won.

The head of the company must not forget that the deadline for filing a claim for liability is 1 year from the moment the commission signs the act on determining the damage. If the specified deadline is missed, the court will not restore it, and the employer will lose the case.

Results

Accounting is one of the most important areas of a company's activities from the point of view of business management. The head of the company is responsible for organizing accounting. The key accounting functions in the company are performed by an experienced and qualified specialist at the level of chief accountant. He is responsible for his work in accordance with the law, as well as the terms of the employment contract.

You can learn more about the features of accounting in the articles in the “Accounting (chart of accounts and principles)” section:

- "Accounting and analysis of financial results";

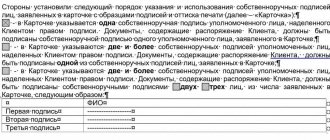

- “The right of the second signature of the chief accountant on documents”;

- “When is work to restore accounting carried out?” and etc.

Sources:

- Labor Code of the Russian Federation

- Law “On Accounting” dated December 6, 2011 N 402-FZ

- Code of Administrative Offenses

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Rights and obligations

The main rights and responsibilities of the chief accountant are spelled out in detail in the following regulations:

- Federal Law No. 402 “On Accounting” dated December 6, 2011;

- Decree of the Government of the Russian Federation No. 787 of October 31, 2002;

- Resolution of the Ministry of Labor of the Russian Federation No. 37 of August 21, 1998.

According to the latest resolution, the chief accountant performs the following duties according to his job description:

- organizes accounting for individual entrepreneurs;

- builds a general scheme for the financial activities of the enterprise and accounting;

- develops charts of accounts;

- controls the organizational document flow of accounting reports and monitors the inventory list;

- provides functional accounting;

- controls the use of available resources.

In addition to the above responsibilities, the official has certain rights. When using them, perform the following actions:

- create official requests to all branches of the company and for specific specialists;

- distribute specific responsibilities among employees of the accounting department;

- certify financial documents;

- create a new enterprise concept for maintaining accounting records.

If necessary, the director gives the chief accountant the authority to represent the company in tax and judicial authorities.

Federal Law of December 6, 2011 No. 402-FZ “On Accounting”

Decree of the Government of the Russian Federation of October 31, 2002 No. 787 “On the procedure for approving the Unified Tariff and Qualification Directory of Work and Professions of Workers, the Unified Qualification Directory of Positions of Managers, Specialists and Employees”

Resolution of the Ministry of Labor of the Russian Federation dated August 21, 1998 No. 37 “On approval of the Qualification Directory of Positions of Managers, Specialists and Other Employees”