The chief accountant is one of the leading employees in any organization, since his work is closely related to solving financial issues.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-56-12 (Moscow)

+7 (812) 317-50-97 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The well-being of the company depends on the productive work of the person holding this position.

The chief accountant can leave the workplace either at his own request or at the insistence of the employer.

The dismissal of a chief accountant at the initiative of the employer usually occurs in cases where the employee ceases to perform his own duties efficiently.

In the process of dismissing the chief accountant, some difficulties may arise. This is because the person holding this position has access to all business transactions of the company.

When dismissing a person from this position, the management of the company must protect itself from possible risks, namely, make inquiries about the existence of existing debts to the Pension Fund and credit institutions.

Reasons

Since the chief accountant is the same employee as other personnel in the organization, there are no separate grounds for his dismissal.

Therefore, a person can leave this position and his workplace on the same grounds as other employees of the organization:

- in case of liquidation of the company;

- on their own initiative;

- in case of gross violation of the provisions of the employment contract;

- when making an unlawful decision, as a result of which the company suffered material losses;

- in case of inconsistency with the position held;

- in case of expiration of the fixed-term employment contract;

- when the owner of the organization changes, etc.

In addition, the dismissal of a person from the position of chief accountant can be carried out on the grounds specified in the company’s charter and employment contract.

Nuances and features of the procedure

The chief accountant is an official in an organization who carries out the main work of accounting for the financial flows of the enterprise. The process for terminating this official has some nuances and is slightly different from the procedure for terminating a regular employee.

The Labor Code in Article 59 indicates that it is permitted to conclude a fixed-term employment contract with this official. In accordance with Article 70, his probationary period is six months.

There are several types of dismissal of the chief accountant:

- by agreement of the parties;

- on their own initiative;

- at the initiative of the employer;

- due to circumstances that do not depend on the decision of the parties;

- due to the expiration of a fixed-term employment contract.

The employer has the right to dismiss this official due to the fact that he makes unreasonable financial decisions and conducts activities that bring losses. In accordance with paragraph 4 of Article 81 of the Labor Code, attention is drawn to the fact that when the owner of a company, enterprise or organization changes, the new manager has the right to dismiss not only his deputies, but also the chief accountant. In the job description, the director can prescribe with the employee the procedure for terminating the employment contract.

If the employee is not in a permanent job, but only on a probationary period, then his work is reduced to three days, and on the last working day he is required to be fully paid and issued a work book.

Dismissal of the chief accountant

The chief accountant reports directly to the head of the company.

He is responsible for the creation and maintenance of accounting records, as well as for the timely submission of reports.

It is not advisable for the company’s management to dismiss a person from this position until all the organization’s debts have been cleared. In addition, it makes sense to appoint an independent audit of the state of reporting.

At your own request

When leaving the organization of your own free will, you must write a letter of resignation addressed to the director. The document should be given to your superiors 2 weeks before the expected date of dismissal.

The management of the company, according to the law, does not have the right to keep the accountant at his place of work. However, in reality, everything can turn out differently.

In the case when the boss does not want to let go of the chief accountant, the latter must send a letter of resignation by mail with notification of receipt.

Alternatively, you can register the application at the office.

A sample application for voluntary resignation is here.

At the initiative of the employer

The dismissal of a chief accountant at the initiative of the employer due to personal hostility is considered illegal. Grounds for dismissal are required from the Labor Code.

Labor legislation includes an extensive list of grounds on which the chief accountant can be dismissed: from disciplinary violation to inadequacy for the position held.

If the grounds are applied unlawfully, the dismissed person has the right to appeal to the court.

If the court sides with the plaintiff, the person must be reinstated at the enterprise as chief accountant.

By agreement of the parties

When dismissing by agreement of the parties, the initiative can be taken by both the employer and the accountant himself.

In the latter case, the employee must submit a resignation letter, after which the parties can discuss the aspects and nuances of the process.

Once an agreement is reached, it is advisable to record the results on paper in the form of a document. It must indicate:

- the subject of the agreement;

- date of dismissal;

- the conditions under which the procedure will be performed;

- possible consequences of violating the agreement.

The document is maintained in free form. Its presence is not necessary, however, it will help to understand if any aspects of the agreement are violated by one of the parties.

A sample agreement to terminate an employment contract is here.

Upon change of owner

When there is a change of ownership, dismissal can be made if the accountant does not intend to cooperate with the new employer. In such a situation, he must write a letter of resignation, where the reasons will indicate the change of owner.

In this case, the employer does not have the right to refuse and must carry out the standard dismissal procedure.

Pensioner

Like other employees, an accountant can write a letter of resignation due to reaching retirement age. In this case, he receives the right to be released from service.

In addition, the local regulations of some companies additionally indicate the payments that an employee can receive in connection with leaving for this reason.

But it is worth noting that a citizen can submit an application for retirement due to retirement age only once.

This means that if a pensioner has already quit one job on this basis, then when leaving again, he cannot indicate the same reason.

Upon liquidation of an enterprise

In the event of liquidation of the company, accountants must be notified of the dismissal two months before it is carried out. This will allow workers to find new jobs.

At the same time, on the day of dismissal they must also receive the required compensation in the form of wages and payment for unused vacation days.

In addition to basic payments, all employees are entitled to additional severance pay in the amount of average monthly salaries.

Such payments are made in the first month after dismissal. In the second, they are received by those who have not yet found an official place of work.

You can receive payments in the third month, but to do this you need to contact the employment authorities and you cannot find a suitable job for this period.

Established terms of service upon dismissal of the chief accountant at his own request

The working time for the dismissal of the chief accountant under the Labor Code of the Russian Federation at his own request is standard - 2 weeks.

However, based on ab. 2 tbsp. 80 of the Law, the chief accountant and the head of the company can also agree to reduce the specified period.

You also won’t have to work out if:

- the chief accountant retires;

- or he is enrolled in an educational organization;

- or if the chief accountant wrote an application for leave with further dismissal (clause 2 of article 127 of the Law).

Dismissal procedure

The dismissal of an accountant is carried out according to the standard scheme with changes made to it in connection with the employee’s position.

The procedure is carried out in several stages:

- Submitting an application or drawing up an agreement.

- Registration of orders. The first will be responsible for transferring cases to a new employee, and the second will be responsible for the dismissal procedure.

- Transfer of cases from the old accountant to the new one.

- Receipt by the old employee of all documents, as well as payments due to him in accordance with the law.

Each stage has its own nuances and requires the necessary documents, so some of them can be examined in a little more detail.

Find out if dismissal is possible on the same day. How to issue notice of dismissal of an employee under a fixed-term contract? See here.

Submitting an application

An application is submitted on behalf of the employee in case of dismissal at his own request.

This document does not have a legal form, but there are still several rules for its preparation:

- the document is drawn up on A4 paper and can be printed or handwritten;

- the paper must be addressed directly to the head of the organization;

- the text with the reasons for dismissal should be as brief as possible and outline the essence of the decision;

- At the end there must be the date of completion and the signature of the employee.

The application is submitted to the manager or the human resources department. The paper must be accepted in any case.

The transfer of cases

In the event of the dismissal of an employee such as a chief accountant, the employer is obliged to carry out not only a standard dismissal scheme, but also issue an order.

It must indicate the transfer of all responsibilities and affairs from the resigning employee to a new person:

- the order in which all documentation will be completed, as well as the acceptance certificate for office work (the work can be performed jointly with a new employee);

- list of persons involved in the transfer of cases.

The document must also contain information about the date on which the transfer period will end. It is usually established based on the dates on which tax and accounting reporting documents are provided.

Since, when applying for a job, the chief accountant signs an agreement on financial liability, upon his dismissal it is necessary to additionally conduct an inventory of both the company’s cash registers and inventory items.

To carry out an inventory, it is necessary to issue another order, according to which a commission must be assembled.

After recounting all valuables, the inventory results must be entered into a special inventory of the organization’s property.

Order

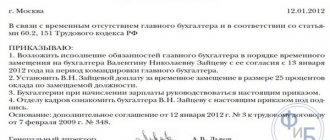

The dismissal order is drawn up on a standard form known as “T-8”. It is also used when dismissing regular employees.

The order specifies:

- information about the accountant;

- date of dismissal;

- the grounds on which he leaves his workplace.

The order must be signed by the manager and handed over to the accountant for review. If he agrees with its provisions, he must also leave his signature.

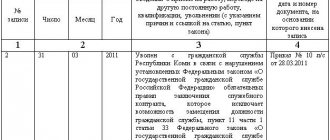

Entry in the work book

An entry in the accountant’s work book is left by an employee who has the right to do so, or by the employer himself. It must contain an article of dismissal with an exact repetition of the grounds specified in the act.

The entry must be certified by the seal of the company, as well as the signature of the person who entered it into the book.

The work book is issued to the accountant on the day of dismissal. If he agrees with the entry and has no complaints about its content, then he needs to put his signature under it.

If there are inaccuracies or errors, the entry must be rewritten to avoid problems with getting a job in the future.

How long must the chief accountant work upon dismissal?

If the chief accountant resigns at his own request, the duration of the service period does not differ from the standard one and is equal to 14 days.

The new law on accounting regulates that the chief accountant is responsible for the accuracy of information and the transfer of taxes on an equal basis with the head of the institution. Therefore, the chief accountant is interested in the timely delivery of all files and documents to the successor for signature. Considering the volume of work and responsibilities of the chief accountant, it is unrealistic to complete the assignments in such a time, therefore, in practice, the work may be delayed.

The receiver responsible for accepting cases in the accounting department needs to thoroughly study the situation at the company, understand the accounting system and work in the company. The duration of submission of cases can be delayed, sometimes even up to one month.

However, the legislation of the Russian Federation does not provide exceptions for this vacancy, therefore the resignation of the chief accountant at personal request must be carried out according to the same rules as for any ordinary employee.

Payments

In 2020, an accountant is entitled to standard payments in the form of compensation for unused vacation days, as well as wages.

In addition to them, there may be additional payments specified in local regulations or collective agreements of companies. Their presence may also be specified in the agreement of the parties.

It is possible to receive severance pay, but only in a few cases. These may include dismissal due to the liquidation of the company or due to a reduction in the number of its employees. In such cases, benefits will not go to only those who worked on the basis of a fixed-term contract.

The procedure for dismissal at the initiative of the employer is determined by current legislation. Is it possible to dismiss a civil servant due to loss of confidence? Information here.

What documents must an employer provide upon dismissal? Details in this article.

Responsibility after dismissal

The procedure for receiving and transferring cases is quite capacious and does not always fit within the two-week work period. Therefore, the accountant may be held liable even after the day of dismissal.

If such an employee does not submit the acceptance and transfer certificate, then the employer, within a year after the termination of the employment contract, has every right to file a lawsuit against such an accountant.

The management can file a claim even if there is an act, but in this case it will be very difficult to prove the guilt of the former employee, because the fact that he did his job efficiently will be documented.