Who does not have the right to apply the simplified tax system?

In the tax legislation of the Russian Federation today there are a number of restrictions in the simplified taxation system.

Let's look at some of them. 1. If the number of hired employees of an individual entrepreneur is more than one hundred people.

2. If in 2020 the maximum amount of income under the simplified tax system established by clause 4 of Art. 346.13 of the Tax Code of the Russian Federation in the amount of 150 million rubles will be exceeded. In 2020, the taxpayer is considered to have lost the right to apply the simplified taxation system from the beginning of the quarter in which his income exceeds 150 million rubles.

In 2020, the government of the Russian Federation developed bill No. 90556, which will allow you to remain on the simplified tax system if the maximum standards are exceeded. If it is adopted, then if income is received in excess of 150 million rubles, but not more than 200 million rubles, and (or) if the average number of employees is from 101 to 130 people, then the right to work on the simplified tax system will not be lost , subject to the payment by the entrepreneur of the simplified tax system at increased rates:

- under the simplified tax system “income” the increased rate will be equal to 8%;

- under the simplified tax system “income minus expenses” – 20%.

3. If the activity of an individual entrepreneur involves the production of excisable goods or the extraction of minerals.

4. The maximum residual value of fixed assets exceeds 150 million rubles.

In all other cases, an entrepreneur can choose the tax system most suitable for his type of activity.

For organizations, in addition to the above, there are additional restrictions when applying the simplified tax system. Organizations cannot apply the simplified tax system if:

- the share of participation of other organizations in it exceeds 25%;

- the organization has branches and (or) representative offices.

Registration of individual entrepreneurs: list of documents

An individual entrepreneur, according to the legislative acts of the Russian Federation, is an individual who is endowed with all the rights of a legal entity. Both a citizen of the Russian Federation and a foreigner can become a state of emergency in Russia by submitting the necessary package of documents.

In 2020, the list of required forms and forms for submission to tax control authorities has not changed. To do this, you need to prepare a list of documents, which looks like this:

- Copies of passport pages containing the data of an individual who wants to acquire emergency status. It is imperative to make a copy of the applicant’s residence permit and registration.

- A receipt recording the payment of the state fee for registering an entrepreneur.

- A copy of the document confirming the assignment of a tax number.

- An application, which is established by the regulations of the Russian Federation, for registration with correctly filled in fields.

- If you choose the simplified tax system, you must immediately submit an additional application to switch to the specified tax payment system.

If a state of emergency is opened by power of attorney, then it is necessary to take into account that all specified documents must be notarized. It is worth noting that this is also an additional item to the total amount of money required to open an individual entrepreneur.

Peculiarities

Information on how to create an individual entrepreneur and how much taxes you need to pay per quarter can be found in the Federal Tax Service. They will also tell you how to open your own business.

All individual entrepreneurs are recommended to pay taxes in non-cash form using a bank account, because the tax service can impose a tax on the net profit of individuals (13%) on the entrepreneur’s personal account without taking into account the tax collection system used by the entrepreneur.

The tax burden of individual entrepreneurs is formed from two indicators:

- taxes themselves (on property, etc.);

- mandatory insurance contributions;

For example, an individual entrepreneur may not pay any taxes if he is not yet engaged in business activities, but he is already obliged to transfer insurance premiums to the relevant authorities, since he is listed in the unified state register of individual entrepreneurs (USRIP).

Where should insurance amounts be transferred?

To state funds like:

- MHIF.

- Pension Fund.

- FSS.

An individual entrepreneur is required to make insurance contributions as long as he is a member of the Unified State Register of Individual Entrepreneurs.

Contributions of individual entrepreneurs to extra-budgetary funds for himself

From the moment an entrepreneur is registered with the Federal Tax Service, he automatically becomes a payer of mandatory insurance premiums for himself. The tax authority independently transmits all necessary information about the new individual entrepreneur to the Pension Fund of the Russian Federation.

It is noteworthy that a businessman is required to make deductions even if no activity was carried out during the reporting period.

How much should an individual entrepreneur pay for himself to compulsory insurance funds in 2020? A reliable answer to this question is contained on the official website of the Pension Fund of Russia www.pfrf.ru.

For 2020, an entrepreneur must list:

- 23,400 rubles for pension insurance in the Pension Fund of the Russian Federation;

- 4,590 rubles for health insurance through the Federal Compulsory Medical Insurance Fund.

These values are calculated for individual entrepreneurs whose annual income does not exceed the threshold of 300,000 rubles. If the income is higher, then contributions to the Pension Fund will increase by 1% of the amount exceeding the specified amount. The maximum possible amount of individual entrepreneur contributions for himself in 2020 to the Pension Fund is 187,200 rubles.

Transition of individual entrepreneurs to the simplified tax system

An individual entrepreneur can switch to a simplified taxation system based on the results of activities for 9 months in the following cases:

- if the number of employees is no more than one hundred people;

- if the residual value of fixed assets is no more than 150 million rubles;

- if the amount of income does not exceed 112.5 million rubles for nine months of the year in which the transition to the simplified tax system is planned (clause 2 of Article 346.12 of the Tax Code of the Russian Federation).

When you are just planning to open an individual entrepreneur, you have the opportunity to submit a notice of transition to the simplified tax system simultaneously with a package of registration documents. The second option is that after receiving documents on registration of an individual entrepreneur, it is possible to switch to the simplified tax system within 30 days.

If you do not submit an application to switch to the simplified tax system within the period specified by law, then the tax authority will automatically place you on the General System of Taxation (GTS).

Please note that the OSN presupposes a more complex tax payment system and reporting procedure.

Individual entrepreneurs who are not newly registered have the opportunity to switch to the simplified tax system no earlier than January 1 of the next year. It is advisable to submit a notification of the transition to the simplified tax system to the Federal Tax Service in the period from October 1 to December 31 of the current year.

The transition to the simplified tax system is possible only once a year. Notification of the transition to a simplified taxation system must be submitted in two copies.

Individual entrepreneurs are required to make advance payments (without reporting) no later than the 25th day of the month following the reporting period (quarter).

Three payments that an individual entrepreneur must make throughout the year:

- for the 1st quarter: from April 1 to April 25;

- for half a year: from July 1 to July 25;

- for 9 months: from October 1 to October 25.

Tax according to the simplified tax system (including advance payments) is paid next year (for the calendar year/tax period)

The deadline for paying the simplified tax system coincides with the deadline for filing a declaration. For individual entrepreneurs, this deadline is April 30 of the following year.

Individual entrepreneurs are obliged to pay mandatory insurance premiums from the wages of employees, if any, as well as fixed insurance premiums for themselves. The amount of fixed contributions increases annually.

For 2020, according to paragraph 1 of Art. 430 of the Tax Code, the amount of insurance contributions for compulsory pension insurance is 29,354 rubles, if the income of an individual entrepreneur does not exceed 300,000 rubles.

RUB 29,354 1% of the amount of income exceeding RUB 300,000.

Insurance premiums for compulsory medical insurance in a fixed amount in 2020 are 6,884 rubles.

In 2020, the amount of insurance fixed premiums for income less than 300,000 rubles increased by 4,636 rubles and amounted to:

- for pension insurance 32,448 rubles;

- for medical insurance 8,426 rubles.

For incomes over 300,000 rubles in 2020, an additional 1% is paid.

According to paragraphs. 3, 6 tbsp. 421 of the Tax Code of the Russian Federation, the maximum value of the base of insurance premiums is established annually by the Government of the Russian Federation. The established base shows the maximum limits of insurance premiums, above which premiums:

- no need to pay to calculate fixed contributions;

- pay at a reduced rate when paying contributions for employees.

In 2020, the base for calculating insurance premiums in case of temporary disability and in connection with maternity is set at RUB 865,000. (Resolution of the Government of the Russian Federation dated November 28, 2018 No. 1426).

The maximum base for calculating insurance premiums for compulsory health insurance is determined for 2020 in the amount of 1,150,000 rubles.

For 2020, the maximum base of insurance premiums is:

- for OPS - 1,292,000 rubles (12.3% higher than 2020).

- in case of temporary disability and in connection with maternity - 912,000 rubles (5.4% higher than in 2020).

For individual entrepreneurs using the simplified tax system in 2020, the following reporting is mandatory:

- declaration according to the simplified tax system (submitted to the Federal Tax Service once a year);

- KUDiR (Book of accounting of income and expenses without notarization). The KUDiR is not submitted to the tax authorities, but is kept by the individual entrepreneur in case of a tax audit.

In 2020, individual entrepreneurs on the simplified tax system had to maintain KUDiR, which was approved by order No. 135n of the Ministry of Finance dated October 22, 2012. From January 1, 2017, a new book for recording income and expenses of the simplified tax system was introduced. Compared to KUDiR 2020, another section has been added to KUDiR 2020 - the 6th. This section is completed by trade tax payers. Currently, the trade tax has been introduced in the city of Moscow, so this change applies only to the capital of the Russian Federation. In 2020, the trade tax was reflected only in the simplified taxation system declaration.

Also in the new KUDiR, starting from 2020, the signature to the “Seal” requisite has been changed: “M.P. individual entrepreneur - if available" was replaced by "M.P. individual entrepreneur (if there is a seal).” Those. If an individual entrepreneur has a seal, he is obliged to affix it to KUDiR. In 2020, the KUDiR form has not changed compared to 2020 and continues to operate in the format approved by Order of the Ministry of Finance dated December 7, 2016 No. 227n.

From 2020, the Government of the Russian Federation plans to cancel the provision of declarations for individual entrepreneurs using the simplified tax system with the object of taxation in the form of income, who use online cash registers and do without non-cash receipts. The tax office will independently monitor the amount of income received. The bill stipulates that such a rule will begin to work on July 1, 2020. To switch to the new regime, simplifiers will have to submit a special application to the tax office.

To switch to the simplified tax system, you must meet several requirements:

- The staff should not have more than 100 employees.

- Your income for 9 months of the current year should not exceed 112.5 million rubles.

- Your type of activity must be permitted under a simplified procedure.

Fill out and submit an application for the simplified tax system

Amounts payable upon registration in 2020

To calculate the costs of opening this form of running a small business in 2020, it is necessary to take into account all the constituent factors. Even the minimum costs during registration must be included in how much it costs to open a state of emergency status. It is better to consider them step by step:

- The first step of registering an individual entrepreneur is making copies of the necessary documents. The minimum cost to photocopy the required passport pages, as well as a certificate of TIN assignment, is 2 rubles each.

- The second step should be paying the state fee for opening an individual entrepreneur. Today it is 800 rubles. Its size has not changed for 5 years.

- Submitting documents to the tax office may be accompanied by additional travel expenses, and there are also cases when government officials voluntarily ask you to bring certain office supplies. The amount of these expenses ranges from 50 to 70 rubles. Although the last point does not happen to everyone who wants to register a business.

The average cost for the registration process will be about 900 rubles. This amount is how much it costs to open a state of emergency status if you collect all the documents and take them to the tax office yourself. But there are enterprises that are ready to take on all the hassle associated with registering as an entrepreneur. The cost of services of such companies is many times different from that at which you need to make a payment when starting a business on your own. The price for registering a small business representative is about 4,500 rubles. This is 5 times more than what you can pay for self-registration.

Many people are stopped from starting their own small business due to fear of bureaucratic procedures. Although in reality everything is quite simple and fast. And the costs are not that big. It takes about a week to start your business after submitting the documents.

It is worth noting that there are other optional items that can increase the final cost of expenses:

- Opening a current account in a bank. As a rule, from 0 to 2,000 rubles;

- Print production, from 500 to 1,500 rubles;

- Notarized power of attorney, from 800 to 1,500 rubles.

Insurance payments

How much should I pay per year for individual entrepreneurs in taxes on insurance and pension payments?

The Government of the Russian Federation has determined the amount of payments in favor of the Pension Fund: 26,545 rubles. in year. If the net profit of an individual entrepreneur exceeds 300,000 rubles, then the payment increases by 1% of the amount exceeding this limit. At the same time, insurance payments to the Pension Fund cannot exceed 212,360 rubles.

How much does an individual entrepreneur pay per year in taxes on insurance and pensions? With compulsory health insurance, the situation is much simpler. The annual payment is 5,840 and it cannot change.

If a businessman has a staff, he is obliged to pay insurance fees for him, including:

- 22% to the Pension Fund;

- 9% for social insurance;

- 1% for health insurance.

Accident insurance is paid separately at a percentage from 0.2% to 8.5%.

The law also provides for reduced tariffs for mandatory payments for employees. They depend mainly on the type of business the individual entrepreneur is engaged in and the given tax collection system (also on other conditions).

The main concept in the tax aspect of individual entrepreneurs’ activities is the taxation system, that is, a special procedure for calculating tax payments.

There are several such systems, and they differ in parameters:

- taxable object;

- the tax base;

- tax rate;

- tax payment period;

- calculation and payment of tax.

Very often, entrepreneurs switch to one of the tax regimes in order to get tax benefits. True, to do this they have to comply with some economic restrictions so as not to go beyond the requirements for a particular taxation system.

The legislation of the Russian Federation provides for such preferential tax regimes as:

- UTII (“imputation”);

- USN (“simplified”);

- PSN (patent);

- Unified agricultural tax (agricultural tax).

The tax collection system chosen by the entrepreneur determines how effective the tax optimization of his income/income and expenses will be. If a businessman has not expressed a desire to choose one or another preferential tax system, then he “by default” works on OSNO - the general tax collection system - one of the most complex and inconvenient from a reporting point of view.

Some preferential tax regimes prohibit a businessman from engaging in certain types of business. To find out exactly what types of business activities are allowed on PSN or UTII, for example, you need to use OKVED codes for individual entrepreneurs, which are freely available.

To determine the tax collection system, you can use auxiliary questions.

First, will the entrepreneur's income be constant or will its size constantly change?

Secondly, will the individual entrepreneur hire workers and if so, in what quantity?

On a patent (PSN), an entrepreneur is prohibited from employing more than 15 people. There are more than 100 people on “simplified” and UTII.

Also, the cost of a patent itself depends on the number of employees an individual entrepreneur has.

Why is staff size so important? Because thanks to it, an individual entrepreneur can reduce the amount of taxes paid due to insurance premiums for employees (does not apply to PSN).

Thirdly, what is the difference between income and expenses of an individual entrepreneur and can they be documented?

This question is mostly relevant when choosing a simplified tax system, since it is divided into two types:

- income 6%;

- the difference between income and expenses is 15%.

In the first case, a tax of 6% is paid on the profit received. In the second case, the amount of expenses is subtracted from the amount of profit and a 15 percent tax is paid on this difference.

If the situation is exactly the opposite, then an excellent option is “6% Income”.

Fourthly, what types of business in a given region are allowed under patent and imputation?

As noted above, not all types of entrepreneurial activity are permitted on a patent or imputation. Their list is compiled by federal and modified by regional authorities. The latter have the right to expand it (on a patent) and reduce it (on “imputation”).

Experienced entrepreneurs know that all individual entrepreneurs have the right to combine tax regimes, that is, you can choose several areas of activity for business development and determine a separate tax regime for each.

Moreover, it is possible to combine tax systems even if you have a single business. It just needs to be produced at different facilities.

Combination options:

- UTII/simplified;

- patent/simplified;

- UTII/patent;

- agricultural tax/UTII.

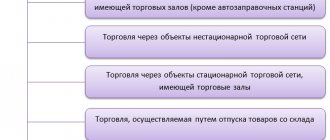

“Imputed” is a preferential tax regime, the types of activities for which are specified in Article 346.26 of the Tax Code of the Russian Federation. The list of “imputed” businesses established by the federal authorities may be reduced or completely abolished by regional authorities. For example, in the capital of the Russian Federation, entrepreneurs do not have the right to work on UTII.

A single tax is paid on UTII, which is calculated based on the following indicators:

- basic profitability (more details in Article 346.29 of the Tax Code of the Russian Federation);

- physical indicator (similar);

- regulatory coefficient 1, established by the Government of the country;

- regulatory coefficient 2, established by regional authorities.

BD x FP x RK1 x RK2 x 15%.

Moreover, the second coefficient is changed by the authorities of the constituent entity of the Russian Federation from 0.005 to 1, and the first for 2020 is set by the Government of the Russian Federation at the level of 1.868.

The single tax is paid for each quarter by the 25th of the reporting month.

The situation with reducing tax due to insurance payments on EBIT is completely similar to the simplified tax system - in this case it can also be reduced (sometimes to zero).

An entrepreneur is prohibited from employing more than a hundred people on UTII, and the area of his commercial premises cannot exceed 150 m2. From UTII you can switch to the simplified tax system.

The Unified Agricultural Tax was created specifically for people working with agricultural products: extraction, production, processing and sale. The fishing industry is also subject to this tax.

To switch to agricultural tax, two conditions must be met:

- An entrepreneur’s net profit is 70% or more derived from the sale of agricultural products.

- The businessman does not produce products subject to excise tax.

OSNO is a tax collection system on which all individual entrepreneurs are initially registered if they have not expressed a desire to switch to a preferential tax collection regime.

What taxes does an entrepreneur pay on OSNO:

- VAT (rate varies from zero to 18%);

- on the income of individuals;

Of course, taxes will also be levied on businesses. Moreover, it is possible to formally reduce income (and, accordingly, pay taxes on it) with the help of professional deductions - expenses that are confirmed by relevant documents and justified by expediency. If the last two conditions are not met, then income can only be reduced by 20%.

If an OSNO entrepreneur is a tax agent of Russia and conducts his activities for at least 183 days within 12 consecutive months in Russia, then his tax rate will be 13%.

If a businessman is not recognized as a participant in the country’s tax system and conducts his business from abroad, he pays taxes at a rate of 30% without the right to reduce them through deductions.

It is better for an individual entrepreneur to switch to the general tax regime if the majority of clients will work with VAT.

It will be profitable for partners to work, as it will be possible to take into account value added tax. It is only important to correctly calculate the entrepreneur’s income and expenses during the transaction.

General changes in the taxation system for individual entrepreneurs in 2020

- New reporting on form 6-NDFL.

Since April 2020, individual entrepreneurs with hired employees are required to provide monthly information to the tax authority on the amount of income tax withheld from the income of their employees. If the number of employees is more than 25 people, reporting can be submitted electronically. - New fines have been established.

- if the individual entrepreneur does not provide a 6-NDFL certificate, a fine of 1000 rubles is imposed for each overdue month (even if the month is not full). Failure to provide a 2-NDFL certificate, as before, is punishable by a fine of 200 rubles;

- if an individual entrepreneur has provided 2-NDFL and 6-NDFL certificates with false information, the fine for each document is 500 rubles;

- If the individual entrepreneur does not provide a 6-NDFL certificate within 10 days from the required deadline, the tax authority has the right to block the individual entrepreneur’s bank account.

- The deadlines for paying income taxes have been changed.

Income tax must be remitted no later than the next day after payment of income. Previously, it had to be transferred simultaneously with the transfer of income funds to the account of the employer or employee.Income tax on sick leave and vacation pay is paid no later than the last day of the month in which the funds were transferred.

- The deadlines for reporting information to the tax authority about the impossibility of withholding personal income tax from an employee’s income have been changed. Previously, such information had to be provided no later than January 1 of the next reporting year, and from 2020 - no later than March 1.

- The amount of property depreciation has been changed.

From 2020, property worth up to 100 thousand rubles will be considered depreciated (previously the amount was 40 thousand rubles). - The rates for calculating penalties have been changed.

The amount of penalties will be increased, since the Central Bank rate of 11% has been in effect since 2020 (previously the rate was 8.25%).

https://youtu.be/3CTd4CBNSqM

Thus, in 2020, individual entrepreneurs can carry out their activities under one of five tax regimes: general regime, simplified regime, UTII, Unified Agricultural Tax, PSN. Each taxation system has its own pros and cons, and the choice must be approached carefully so as not to pay extra taxes later. In 2020, the state introduced changes to the tax system, mainly related to the reduction of tax rates and the provision of tax holidays in order to support small businesses. At the same time, serious changes have been introduced regarding penalties for failure to provide information regarding hired employees. In particular, for better control, a new reporting form 6-NDFL has been introduced, which must be submitted monthly, and significant amounts of fines have been established for delays or evasion of providing relevant information. A beginning individual entrepreneur should carefully study the possibilities of each tax regime, taking into account innovations, and make the right choice.

Types of simplified tax system

The flexibility of the simplification lies in the fact that it allows an entrepreneur to independently assess the amount of expenses as part of his business and decide what his tax base will be. Two options are offered (Article 346.14 of the Tax Code of the Russian Federation):

- The simplified tax system “Income” (often synonymous with the simplified tax system 6) assumes all income of an entrepreneur as the tax base. The tax rate is 6%, but by decision of regional authorities it can be reduced for certain types of activities to 1%. For example, in the Voronezh region for activities in the field of health care and social services, the tax rate is 4%.

- The simplified tax system “Income minus expenses” (also known as simplified tax system 15) takes income reduced by the amount of expenses as the tax base. The tax rate is 15%, and regions can reduce it to 5%. In the Perm region, for example, for the activities of public catering enterprises the tax rate is 10%.

If with the first option everything is very clear (we count only income, remember the limit, apply the tax rate to the entire amount of income and pay), then the simplified tax system “Income minus expenses” has its own characteristics, which we will dwell on in more detail.

There are cases when the minimum tax is higher than the tax calculated using the standard formula (D-R) * 0.15. In this case, it is the minimum tax that must be paid, and the difference between it and the “standard” tax can be taken into account as expenses in the next tax period. Thus, even after working through the tax period at a loss, 1% of the income received must be given to the state.

Entrepreneurs often ask themselves: which option to choose? The “Income” option seems to be easier to account for, but there is no way to “write off” expenses for rent, communications, fuel and lubricants, utilities, etc. And with the second option, the tax rate plus is higher, you need to constantly check the list of expenses allowed for offset, and also keep all documentary evidence of payments made.

In total, there are five tax regimes for individual entrepreneurs (one general and four special):

- The general taxation system is OSN;

- Simplified taxation system - simplified tax system;

- Single tax on imputed income - UTII;

- Patent taxation system - PSN;

- Unified agricultural tax - Unified Agricultural Tax.

You can learn more about each tax regime in force in Russia on this page.

Under the simplified tax system for individual entrepreneurs in 2020, there are two objects of taxation:

- income (rate 6%);

- income reduced by the amount of expenses (rate 15%).

These are the sizes of the maximum tax rates of the simplified tax system. On July 13, 2020, the head of our state signed Law No. 232-FZ “On Amendments to Art. 12 parts I and part II of the Tax Code." These changes give regional governments the right to set simplified tax rates independently. With the simplified tax system for income, the tax rate can range from 6% to 1%; with the simplified tax system for income reduced by the amount of expenses, the tax rate can range from 15% to 5%.

Therefore, in the subsequent part of the article, the maximum simplified tax rates of 6% and 15% will be indicated, while in some regions they may be lower, but not higher.

The transition to a simplified taxation system is carried out by an individual entrepreneur independently choosing the object of taxation - income 6% or income minus expenses - 15%. It is possible to switch to a different taxation system only starting next year.

Let's take a closer look at each of the taxable objects.

This object of taxation requires individual entrepreneurs to pay a tax in the amount of 6% of the income received. Expenses in this case are not taken into account. The simplified tax system of 6% of income requires the maintenance of simple reporting. It is mandatory for an individual entrepreneur to submit an income declaration to the tax authority (once a year). The declaration is drawn up in a standard form.

When using the simplified tax system “income minus expenses 15%”, tax payment is calculated using the following formula: the amount of income minus the amount of expenses. 15% is calculated from this difference. This amount will be the payment amount.

This system is more suitable for entrepreneurs who have a high level of expenses.

The simplified taxation system for individual entrepreneurs “income minus expenses 15%” allows you to save, making paying taxes more profitable, taking into account expenses.

Minimum tax = Taxable income received during the tax period × 1%.

One of the “disadvantages” of this simplified tax system object is the complicated procedure for maintaining reporting documentation.

When working on the simplified tax system, income minus expenses, you must document all your expenses and income, and only those specified in Article 346.16 of the Tax Code can be included in expenses.

There is no need to keep track of expenses on the simplified tax system for income: they do not affect the tax base. It is enough to confirm only income.

On the simplified tax system, it is necessary to keep a book of income and expenses, entering into it all financial transactions carried out by the individual entrepreneur.

An individual entrepreneur can change the simplified tax system for income to the simplified tax system for income minus expenses on a voluntary basis, but only from the beginning of the new calendar year. To do this, it is necessary to submit to the Federal Tax Service a notification in form No. 26.2-6 “Notification of a change in the object of taxation” before December 31, in accordance with Appendix No. 6 of the Order of the Federal Tax Service of the Russian Federation No. MMV-7-3 / [email protected] dated November 2, 2012.

How can you open an individual entrepreneur?

Today in Russia there are several ways to start a business:

- on one's own;

- with the help of a trusted person;

- through an intermediary;

- by postal method;

- by online registration method.

Choosing one method or another confronts a novice businessman with various amounts of financial costs. How much it costs to register an individual entrepreneur in 2018 will be explained in step-by-step instructions that we have developed specifically for interested readers.

Back to contents

Open by yourself

The question of how much it costs to register an individual entrepreneur on their own is usually asked by people who want to save as much money as possible at the initial stage of their own business. The only cost in this case is the payment of the state duty - 800 rubles.

No other expense items are provided in this case.

A businessman saves his money and gains experience in communicating with government authorities by independently preparing all the necessary documents and personally submitting them to the tax service.

The only drawback of this method is the time that a citizen will spend to understand all the features of filling out the registration form, paying the fee and, in fact, submitting the papers itself.

Back to contents

Open through a trusted person

The next option for submitting documents for individual entrepreneur registration is to act through a proxy. In this case, the future entrepreneur delegates his powers and entrusts the process of starting a business to someone else.

This means that in addition to all the papers listed above, you will need notarization of the signature of the future businessman, which will allow a third party to submit documents to the tax authorities. Thus, notary services in the amount of approximately 1,500 rubles will be added to the cost of the state fee. The total cost of opening an individual entrepreneur through a proxy will be about 2,300 rubles.

Back to contents

Open with an intermediary

You can find out how much money you need to open an individual entrepreneur with the help of an intermediary by visiting the websites of such intermediaries - law firms that post price lists for their services online. This method of business registration is recommended for individuals who need advice on running a business.

Intermediaries can help fill out the registration form, explain the differences between existing tax regimes, and give tips on how to decide on the types of economic activity. The cost of such consultations will range from several hundred to a thousand rubles.

If the future entrepreneur entrusts the entire registration procedure to a law firm, then the price of services will increase significantly: 4,000-5,000 rubles for registration services, 3,000-4,000 rubles for issuing a power of attorney. Thus, taking into account the mandatory payment of a fee, the cost of registration through an intermediary will range from 1,300 (consultation and fee only) to 9,800 rubles.

Back to contents

Open an individual entrepreneur by mail

You can open an individual entrepreneur by using postal services, which will send documents by registered mail to the Federal Tax Service of Russia. The advantage of this type of registration is that it saves time in queues at the tax office; the disadvantage is the time spent on the direct movement of the letter from the post office to the Federal Tax Service.

When sending documents by post, a future businessman, in addition to the state fee, will have to pay for notarization of his own signature on the documents (1,500 rubles) and for the registered letter itself (several hundred). The Russian Post online calculator can help you calculate the cost of sending a registered letter. The total cost of the method will be about 2500 rubles.

Back to contents

Open an individual entrepreneur via the Internet

The question of how much it costs to create an individual entrepreneur via the Internet is usually asked by young businessmen who are familiar with technology. Using the World Wide Web, you can register a business at any time of the day and from any computer. Online registration saves time and money, ensuring high speed of case registration.

The online registration procedure can be completed on the official website of the Federal Tax Service of Russia, which provides a similar service. The cost of opening an individual entrepreneur via the Internet is equal to the cost of opening it yourself - 800 rubles for the state fee.

Back to contents

Benefits for paying insurance premiums

In 2013, a preferential regime for the payment of insurance premiums began to operate, thanks to which an individual entrepreneur may not make insurance payments if:

- is in conscription service;

- is on parental leave (up to 1.5 years);

- is disabled;

- his age exceeds 80 years;

- his spouse serves in the RF Armed Forces under a contract or is an employee of a diplomatic mission (hence, the individual entrepreneur cannot find a job).

In order for this tax benefit to be provided to an individual entrepreneur, it is necessary to write a corresponding application to the Federal Tax Service, as well as document any of the above reasons for the impossibility of carrying out business activities.

In other cases, an individual entrepreneur is not exempt from paying mandatory insurance contributions (SALT). If the entrepreneur’s data is excluded from the Unified State Register of Individual Entrepreneurs, then deductions of these contributions to various state funds can be stopped.

Why are the costs of running an individual entrepreneur and an LLC different?

Before moving on to specific calculations, a few words about why the costs of running an individual entrepreneur differ from the costs of an LLC. The fact is that these are different business entities.

A sole proprietor is an individual, while an LLC is an organization or legal entity. Individual entrepreneurs have their own specific benefits, for example, only entrepreneurs without employees who provide services have the right to work without a cash register until July 1, 2021.

The tax burden of individual entrepreneurs and LLCs for the same tax regime and the same type of activity is often calculated differently. Thus, under the general taxation system, an entrepreneur pays personal income tax at a rate of 13%, and an organization pays income tax at a higher rate of 20%.

Tax on dividends is withheld only from the owners of companies, and individual entrepreneurs take profits for their own needs without additional taxation. There are still many differences between individual entrepreneurs and LLCs that are worth knowing about if you are just choosing a format for running your business.

Taxes on a patent

PSN is a unique preferential tax regime for individuals. Legal entities cannot switch to it.

The patent applies to all types of activities that are listed in Article 346.43 of the Tax Code of the Russian Federation. There may be more, at the discretion of regional authorities. It is important that a patent has legal force only in the territory of the entity where it was issued.

To engage in the same business on a PSN in another constituent entity of the Russian Federation, you will have to buy a new document (and also make sure whether a patent is allowed for this type of business in another region). Although there is an exception: carriers have the right to issue one patent for their activities, extending to regions of the country. You just need to fulfill one condition: transactions will be concluded at the place of registration of the entrepreneur.

PSN has two important limitations:

- An entrepreneur has a staff of no more than 15 people.

- His annual income does not exceed 60 million.

The document is issued for a period of 1 to 12 months (valid for a full calendar year).

If a patent is issued for a period of up to 6 months, then its cost must be paid within the period of its validity.

If the validity period of the patent is longer, then a third of its cost is paid during the first 90 days, the rest - no later than the expiration date.

How much do you need to pay for IP taxes on a patent per year? Not at all. It is enough to pay the cost of the patent and insurance contributions to the funds.

It is impossible to reduce the price of a patent through insurance payments. True, there is a preferential rate on these contributions for the entrepreneur’s employees.

How much taxes does an individual entrepreneur pay on UTII?

Payers of the single tax on imputed income most often become businessmen operating in the field of retail trade, public catering, etc. The uniqueness of this tax regime is that the amount of deduction to the state treasury does not depend on the real income of the enterprise.

The tax is set at 15% of the imputed (potentially possible) income (I). For each type of individual entrepreneur activity permitted when using such a tax regime, there is its own FD, which is the product of a physical indicator and basic profitability.

Attention! How much an individual entrepreneur costs on UTII in 2020 also depends on special coefficients (K1 and K2), according to which the basic profitability of the individual entrepreneur is adjusted. These indicators are set for a period of 1 calendar year. In 2020, the K1 coefficient is 1.798. The K2 indicator may differ in different regions of the Russian Federation. To find out the exact value, it is recommended to contact the tax authority at your place of registration.

It should be noted that changes in tax legislation in 2020 affected not only payers using the simplified tax system.

Important! Amendments made to the Tax Code of the Russian Federation, which entered into force in 2020, provide for the ability of individual municipal authorities to influence the tax rate for individual entrepreneurs on UTII. Thus, the value of tax charges can vary from 7.5% to 15%.

New NAP regime

Since 2020, as an experiment, a new regime based on the payment of professional income tax (NPT) has been introduced in certain regions of Russia. It is designed for self-employed individuals and entrepreneurs.

The advantages of NPD are as follows:

- Low tax rates - 4% on income received from transactions with individuals, and 6% on transactions with legal entities and individual entrepreneurs. Expenses are not taken into account.

- This is the only regime that allows individual entrepreneurs not to pay their pension contributions. Medical contributions will be included in the tax amount. If an entrepreneur wants his insurance period to accumulate, he can pay contributions to the pension voluntarily.

- No need to purchase an online cash register. Receipts are generated through a special “My Tax” application.

- You don’t have to think about reporting and tax calculations. The Federal Tax Service itself will calculate everything and send you a monthly payment.

But there are also limitations:

- You can't hire workers.

- You can only engage in services or sell products of your own production, but you cannot resell goods.

- An entrepreneur's income is limited to 2.4 million rubles per year.

- This mode cannot be combined with others.

So far, the NAP operates in Moscow and the Moscow region, the Republic of Tatarstan and the Kaluga region. But starting from 2020, the list of regions will be expanded.

The use of NPD can be beneficial for those individual entrepreneurs who have small incomes and do not yet have plans for expansion. Their business is based on working with their hands or their heads, and their clients are predominantly individuals. However, it is quite possible that in this case, more benefits can be obtained from simplified taxation or UTII, which allow you to reduce the tax to zero through insurance contributions.

Comparison by example

To figure out which taxation system is better for an individual entrepreneur, let’s calculate how much taxes he needs to pay for them.

Let's take an entrepreneur from the town of Chekhov near Moscow with services for sewing curtains to order. With an average bill of 4.5 thousand rubles and 5 clients per day, the expected monthly income will be 675 thousand rubles. Number of employees - 5. Total cost per month in accordance with the business plan - 370 thousand rubles, including wages - 150 thousand, insurance premiums for employees - 45 thousand, for individual entrepreneurs - 3.02 thousand rubles .

Let's calculate the simplified tax system 6%. The tax will be: 675 * 6% = 40.5 thousand rubles. It can be reduced by contributions, but not by more than half, since the individual entrepreneur has employees. In total, on the “income” simplified tax system, the tax will be equal to 40.5 / 2 = 20.25 thousand rubles.

Let's calculate the simplified tax system of 15%. The tax base is: 675 - 370 = 305 thousand, tax amount: 305 * 15% = 45.75 thousand rubles.

Let's calculate UTII . Sewing curtains is classified as household services (OKVED 13.92.2). The physical indicator (FI) is the number of employees, including the individual entrepreneur himself, that is, 6. Basic profitability (BR) - 7.5 thousand rubles. The following coefficients are used for calculation:

K1 - 1.915 (deflator coefficient approved by the Ministry of Economic Development for UTII for 2020);

K2 - 0.8 (reducing factor established for other household services by Decision of the Chekhov Council of Deputies on November 9, 2012 No. 71/10).

UTII formula: FP * BD * K1 * K2 * 15%. The tax of our individual entrepreneur will be: 6 * 7.5 * 1.915 * 0.8 * 15% = 10.341 thousand rubles. It can be reduced by 50% due to contributions, so the payment due, taking into account rounding, will be 5,171 thousand rubles.

Let's calculate PSN . We will do the calculation using a calculator from the Federal Tax Service website. It turns out that in a year an individual entrepreneur must pay 67.729 thousand for a patent, or approximately 5.65 thousand per month.

We will not take into account other tax regimes, since our entrepreneur does not fit their conditions. It turns out that the most profitable is UTII. But do not forget that this is a special case with very approximate figures. If you slightly change the conditions of the problem, you may get completely different conclusions.