General information about ADV 1

The document is represented by a questionnaire, which is filled out for a hired specialist if he does not have SNILS during employment. The documentation is prepared personally by the citizen or employees of the enterprise’s personnel service.

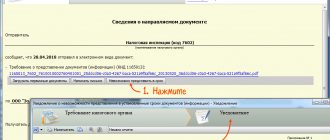

The application form is sent to the Pension Fund, so first a blank form is downloaded from the website of this organization, which can be obtained upon a personal visit to the institution’s branch.

The document includes personal information about the citizen who passed the interview and plans to work for the company. It is allowed to use a ballpoint pen while filling out, but only block letters are used. Most often, the questionnaire is generated on a computer.

Attention! The accuracy of the data is certified by the signature of the insured person, and if there is no possibility for personal certification, because the citizen is sick, sent on a business trip, or there are other reasons, then this reason is given in the questionnaire, and then the document is certified by the director of the company.

Why is the questionnaire needed?

If an employed citizen does not have an insurance certificate, then according to Federal Law No. 27, the employer is assigned an obligation to submit an application to obtain it. If a new specialist comes to the company who has not previously worked officially, and therefore has never had a SNILS issued, then personalized information about the citizen is sent to the PF representatives by the direct employer.

Based on the ADV-1 questionnaire, an insurance certificate is generated and issued. The legislation strictly stipulates the deadlines during which the head of the enterprise is obliged to transfer the questionnaire to PF employees for new specialists. This is given 14 days from the date of signing the contract.

It does not matter whether an employment agreement is signed between the director of the company and the employee, a GPC agreement, or whether the person will work for only a few days. Such requirements are given in Order of the Ministry of Health and Social Development No. 987n.

Important! If after the interview it is revealed that the citizen does not have SNILS, then before filling out the ADV-1 questionnaire, the person draws up an application in any form to receive a certificate.

SZV-STAZH - what kind of reporting is this?

You can find detailed instructions for filling out the SVZ-STAZH report form and the EDV-1 inventory on this page.

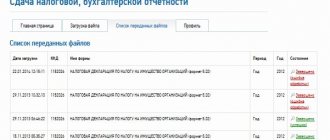

The SZV-STAZH report should be considered as a form that each business entity with employees must send to the Pension Fund of Russia in order to provide the fund with data on seniority. It replaced the previously used RSV-1 report, but only with regard to information about persons working in the organization, as well as those involved under contract agreements.

https://www.youtube.com/watch?v=ytcopyrightru

At first glance, this form resembles another new report for the Pension Fund - SZV-M. It was also introduced not long ago to transfer information about pensioners who are still performing work duties to the Pension Fund.

However, upon closer examination, it becomes clear that SZV-STAZH is a more extensive source of data than SZV-M. It contains not only personal information about the employee and his SNILS number, but also the dates of the beginning and end of work in the business entity.

This report also shows periods during which the employee’s job was retained, but during this time he did not actually work. Such periods include sick periods, unpaid leaves, periods of childcare, etc.

The law established the obligation of a business entity to issue a copy of this report to an employee upon dismissal of the latter. In such a situation, the form must be filled out for him alone, printed and submitted along with other mandatory documents on the final day of work.

Attention: when submitting a report, an attachment to it is the EDV-1 form, which includes data on contributions accrued and sent to the Federal Tax Service for a given period. The need to provide such data arises from the fact that reports on contributions in total terms during the year are provided only to the tax authority.

If an employee of an organization retires, the business entity must fill out and submit to the fund the SZV-STAZH form for the correct calculation of pension payments.

The report establishes that it is submitted to the Pension Fund in cases where a business entity has at least one concluded employment agreement. An entrepreneur without employees, as well as a lawyer or notary who works alone, has no obligation to submit this report.

It should be noted that the format of this report implies that the tabular part must contain at least one row of data. Otherwise, it will not be able to pass the entrance control for correct filling.

There is no clear answer for companies regarding the preparation of a zero report. This is due to the fact that this business entity has at least a director named in the Articles of Association.

Therefore, the need to submit a report can be twofold:

- The company does not have a single employment agreement, including with the director. This means there is no need to submit a report. But at the same time, the director must be a hired person from outside, and not the only founder.

- The report must be submitted if an agreement has been concluded with the manager. In addition, this will also have to be done if there is no agreement, but the director is the sole owner. In this case, according to the law, he is considered to be in an employment relationship, regardless of the actual conclusion of the agreement. The report will contain a single line with this person.

Attention: the report will not be considered zero if the organization has employees, but all of them are on vacation without pay. In this situation, they are all entered on the form, indicating the period code.

General rules of formation

Typically, the document is filled out by representatives of the enterprise’s personnel service. For this purpose, the points of Appendix No. 2 to the Pension Fund Resolution No. 2p are taken into account.

The basic rules of the procedure include:

- Only a strictly unified form is used, therefore the use of free form is prohibited;

- AVD-1, updated in 2020, can be found on the PF website;

- documentation is filled out by hand using a ballpoint pen or using a computer;

- if manual filling is selected, then it is allowed to use different colors, except red or green;

- information in the questionnaire is transferred from official documents belonging to the insured person, and these include a passport, as well as various statements or certificates;

- when sending a correctly completed application form to the Pension Fund, all personal accounting forms are grouped into separate packages, and one package should not contain more than 200 documents;

- For each package, an accompanying inventory is generated, for which the ADV-6-1 form is used.

Reference! When creating a special package of documents, only papers with the same format are selected.

Rules and sample for filling out form ADV-6-1

Filling out the form involves entering the following information:

| Specifying basic data | Among which:

|

| If the package of papers includes SZV-4-1/SZV-4-2 | In this case it is indicated:

|

If there is a need to make adjustments, fill out the following item. A check mark is placed next to “corrective” if changes are made to information about the employee that was provided earlier. In this case, it is assumed that the form will be filled out in its entirety, and not just those fields that require correction. If you check the box next to “cancelling”, this implies a complete cancellation of the data that was submitted earlier.

In specific cases, the “Territorial conditions” field must be filled in according to the classifier. In this case, it is mandatory to submit a form in the form SZV-4-2. Data about the amounts of contributions that have been accrued should be entered according to the rules that apply when drawing up the SZV-4-1 form.

When Form ADV-6-1 is ready, it and the rest of the papers are stitched and numbered. A list of insured persons for whom information is submitted is attached to the package of documents. The list is compiled in free form.

The inventory, which is drawn up in accordance with legal requirements, must also contain a certification inscription, which only the head of the enterprise or another person authorized by him has the right to put. With this inscription, the director assures that the contents of the papers included in the bundle, which includes the listed number of forms, are stated correctly.

Sample of filling out form ADV-6-1

Required details

Entering details when filling out the form has a number of features:

- the organization’s details are filled out in accordance with the rules for entering such information into the ADV-6 form;

- information about other incoming documents must be filled out if there are forms that could not be included in the list (the name of such a document should be indicated);

- when filling out the field “Number of persons who are insured,” you must indicate the number of completed forms in the SZV-4-2 form;

- The number of the bundle of papers provided is filled in only if the bundle of papers is accompanied by an electronic submission.

When filling out forms SZV-4-1/SZV-4-2, the following features should be taken into account:

- when the billing period is indicated, it is assumed that the year for which the information is provided is indicated (this field must be filled in if we are talking about providing data after the beginning of 2002);

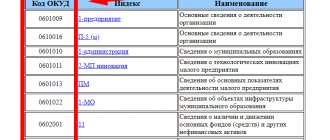

- the additional tariff code is filled in only for those individuals who are indicated in the classifier of the same name, for example, these are members of civil aviation flight crews;

- when a type of information is checked, you cannot check the box next to all values at once, only one should be selected;

- if a document is submitted to assign a pension, then when it is returned for revision by the Pension Fund employees, the next paper must be submitted with the same marking, namely “appointment of a pension”;

- the Territorial conditions field should not remain empty only when submitting SZV-4-2 (for other types of papers, filling it out is unacceptable, and information is entered by companies that have jobs in the Far North or areas equivalent to it, in the exclusion or resettlement zone and some others regions);

- data on the amounts of insurance premiums that were accrued are indicated in rubles, while the total value for all documents is taken into account.

Features of filling out forms SZV-1/SZV-3:

- must be completed for periods before January 2002;

- in the reporting period you must indicate the year for which the data is provided;

- information about income requires indicating the total values for the pack as a whole.

Step-by-step instructions for filling out and sample

If a representative of the enterprise’s personnel service is filling out the document, then he must understand the rules of this process.

To correctly form the ADV-1 form, the following steps are performed:

- personal information about the new employee is entered, for which his full name, date of birth and gender are indicated;

- information for filling out the form is taken exclusively from official documentation received from a specialist, so the data must match the information from the passport;

- the place of birth given in the passport is indicated, and not only the city is entered, but also the region, district and country;

- the citizenship of the new hired specialist is selected;

- the place of registration and the address of the citizen’s actual place of residence is indicated;

- indicate contact information represented by telephone number and email address;

- passport details are entered, and it is allowed to use other identification documents;

- a correctly formed application form of the insured person is signed by the direct employee, if there are no serious reasons for the director of the enterprise to carry out this process;

- at the end the date of compilation is indicated, after which the documentation is transferred to the representatives of the Pension Fund, and an accompanying inventory is attached to it.

Any hired specialist can understand the rules for creating the ADV-1 form. If false or incorrect information is entered, this will lead to negative consequences. Funds transferred in the form of insurance premiums for an employee will not accumulate in his individual account. Therefore, you will have to check and draw up a new questionnaire.

Inventory EDV-1

Along with completing the SZV-STAZH report, the responsible person must also fill out and submit an inventory in the EDV-1 form. It summarizes all the data that was included in the report.

The inventory can be compiled in one of three acceptable formats: “Initial”, “Correcting”, as well as “Cancelling”. The format is selected by marking o in the appropriate window.

Section 1 provides information about the organization. Filling out this information is carried out by analogy with section 1 of the SZV-STAZH form.

In section 2, the “Reporting period” column should always include “0”. The “Year” column records the number of the year for which the report and inventory were prepared.

Section 3 records the total number of employees included in the report.

Section 4 is completed only when the reports contain data in the SZV-ISH and SZV-KORR formats and marked “Special”. The data reflected here must be presented for the entire reporting period.

https://www.youtube.com/watch?v=ytdevru

Section 5 contains information if the report contains data in the SZV-STAZH or SZV-ISKH format for employees who are going to retire early due to special climatic conditions or harmful factors.