The essence and purpose of the document

In the activities of any subject, there is an innumerable variety of different forms, types, forms of papers, without which the implementation of this very activity is not possible.

All this documentation has to be stored, and for quite a long time. The safety of papers in most cases is entrusted to a special structural department of the enterprise - the archive. Moreover, transferring forms and forms to the archives department for safekeeping is a whole ritual, which must also be documented with the appropriate documents.

The main form that is drawn up when accepting and transmitting papers is an inventory. A special form of the list, which names all types of documents transferred from one department to another or from one official to another. The key purpose is to organize order in the recording of documentation and ensure prompt search for the necessary information.

Formation of the acceptance certificate

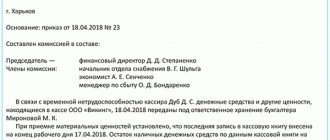

The format of the act is not unified, but contains a number of details that must be filled out, these are:

- Title of the act.

- The act is numbered and the date and place of execution are indicated.

- All documents ready for transfer to the archive are listed. In addition to the name, the list contains the number of sheets, the date and type of documents (original or copy).

- The act indicates the current parties to the act: name of the legal entity, full name of representatives.

- The document is certified by the seal and signatures of the transmitting/receiving parties.

The acts are drawn up in two copies if the documents are stored at the enterprise, and in four if the documents are submitted to the state. archive.

https://youtu.be/Ifj2h3AVvYM

The law regulates the drawing up of an act in the case where strict reporting forms/material assets are transferred. In other cases, for consideration by managers and stakeholders.

There are two options for storing documents:

- Option #1. Storage on site. In this case, simplified registration of cases is allowed, which are stored for up to ten years. It is not necessary to staple such bundles; storing them in binders is acceptable.

- Option #2. Storage in the state archive. Documents are grouped in a certain order, stapled, numbered and transferred to the state. archive. Storage of documents in the state. archive is paid, although documents relating to employees are state. the archive must accept it free of charge.

An approximate example of an act of acceptance and transfer of documents to the archive can be found here:

Document flow plays a vital role in the life cycle of an enterprise. Very often it is necessary to restore information stored in documents from previous years. Archives are able to organize the process of preserving, searching and providing the necessary papers in the shortest possible time. And the execution of the act will provide a guarantee to the transferring party that all documentation is in a safe place and its safety is ensured. Keep your documents in order!

Top

Write your question in the form below

Applicable forms

Depending on the situation, the responsible employee will have to fill out a special form. There are several of them. Thus, Order of the Ministry of Culture of Russia dated March 31, 2015 No. 526 approved the following forms of lists of cases (ML):

- permanent storage (Appendix 14);

- on personnel (Appendix 15);

- temporary (over 10 years) storage periods (Appendix 16);

- electronic documents for permanent storage (Appendix 17);

- electronic documents with temporary (over 10 years) storage periods (Appendix 18);

- structural unit (Appendix 23);

- electronic documents of the structural unit (Appendix 24).

The key requirements for filling out these types are set out in section 3.7 of the Basic Rules for the Operation of Archives of Organizations, approved by the decision of the Board of Rosarkhiv dated 02/06/2002.

Such a document is not just a folder with scattered tables and files. The form has its own individual structure:

- Title page.

- Content.

- Preface.

- List of abbreviations.

- Pointers.

Moreover, for each type they have unified forms that differ from each other. Let's look at the features of compilation and sample documentation samples.

https://youtu.be/IH4f3gbnG4A

In office work

In office work, an inventory should be made only of documents that require temporary or permanent storage. We are talking about personal, judicial or investigative matters.

You can carry out an inventory of documents, the loss of which threatens official trouble. For example, this applies to orders.

https://youtu.be/quJL8XdWBUE

Such an inventory simplifies the search for documents, because each individual document is assigned an individual number.

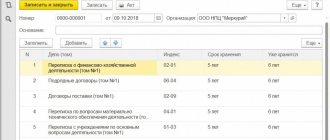

Inventory of permanent storage files

Such a list can be compiled in relation to securities that have a “Permanent” storage status. Inventory of permanent storage cases, sample filling differs from other forms in its structure. In the tabular part of the form there is no column “Storage period”, since it makes no sense to indicate this period.

Prepare a preface to the inventory of permanent storage cases; the sample should contain information about the main areas of activity, as well as information about the structure of the enterprise for the period of compilation of the form. Additionally, the precondition provides a brief description of the fund documentation included in this section. If there are cases that go beyond the boundaries of the period, they should also be listed in a separate order. You can also indicate in the preface whether this archival inventory contains additional information.

The preface must be signed by the responsible author. Moreover, you should not only sign, but also indicate the position of the compiler, full name, and date of registration. In addition to the compiler, the preface to the inventory of permanent storage files (example below) is signed by the head of the archive department or another responsible person (for example, the head of the archive).

opis_dokumentov_dlya_peredachi_v_nalogovuyu_obrazec.jpg

Related publications

We have already talked about how to submit a declaration of income to the tax authorities and draw up an inventory of documents for the tax office for 3-NDFL in one of our articles. The topic of forming a package of documents and an accompanying document - an inventory, for the subsequent transfer of documents requested by the Federal Tax Service remained untouched.

When submitting the requested documents, the taxpayer (company or individual entrepreneur) must attach to the package of documents a list of documents to the tax office, a sample of which may not always meet the established requirements. We will tell you in this article how to correctly draw up an inventory of investments in the tax office and what its content should be.

Inventory of personal matters

Personnel records must be organized in each institution. An inventory of personal files for personnel will also have to be compiled when transferring documentation to the archives department. This list must contain the following details:

- name of the institution or its structural divisions;

- numbers of funds and case indexes;

- documentation headers;

- dates of their compilation;

- number of pages in the case;

- additional notes.

Register personal files in the OD in chronological order. If during the census a case was identified that should have been indicated earlier, then it is permissible to make an entry with the letter, for example, 100/a, but it will have to be registered at the very end of the document.

At the bottom of the OA, summary records should be recorded that reflect the total number of cases, as well as the number of the first and last case. Then the information is endorsed by the head of the organization (structural unit), the responsible executive, as well as the head of the archives department. Provide information about the responsible persons in the following format: position, signature, full name. and date.

How to prepare an inventory for property deductions

Tax legislation provides for the possibility of obtaining a property deduction. One of the cases that falls under these conditions is the purchase of housing under an equity participation agreement.

In this case, the list will contain the names of the following documents:

- A copy of the agreement on participation in shared construction.

- A copy of the transfer deed.

- A copy of the order from the bank.

- Certificate in form 2-NDFL.

- Declaration in form 3-NDFL.

For each document, it is recommended to indicate the registration number of the form, the date of its signing and the number of sheets. It is worth noting that the list can be combined with a statement.

To summarize: the list of documents contains the names of all forms included in the package for transmission to the Federal Tax Service. It is recommended to include sufficiently detailed information in the list, including the number and date of compilation, and the number of sheets. Next, you can download a sample inventory from the link.

https://youtu.be/l6P2BCHNFqg

Sample inventory of property deductions

Sample list of social deductions

Post Views: 3,030

Content

There is no officially approved form that must be used when drawing up a cover letter. However, in practice, the requirements for the preparation of such documents have long been developed. Typically they should include the following items:

- Sender's name or official company stamp . If the letter is drawn up on a form approved by local regulations, you can do without this: the necessary information will be contained in the header of the document.

- Addressee details . They are usually indicated on the right side of the sheet.

- In the center below is the title: “Inventory of documents to be transferred under agreement number... from...”, “Covering letter”, etc. This is not a mandatory item; the letter can easily be formatted without a title.

- Addressing the recipient by name and patronymic . This is also an optional element.

- List of documents sent by letter .

It can be drawn up in the form of an ordinary numbered or bulleted list, or it can be made in the form of a table, where the name of the document, its summary, details and other information necessary for the case are entered in different columns. The strictest rules for formatting exist for inventories of archival or court cases, but for ordinary letters any form that comes to the mind of the sender is quite acceptable. - Sender's position and signature . Also, if he has a seal, its imprint is placed here.

A useful element is usually an indication of how many copies and on how many sheets the enclosed documents are transmitted by letter. However, with the exception of judicial or archival matters, this element is usually not required to be specified.

Inventory of documents for the tax office: form

When submitting documents at the request of tax authorities, the subject is obliged to provide the regional office of the Federal Tax Service with an established package of documents, the transfer of which is accompanied by a register (inventory).

The tax inventory is an accompanying document, the writing of which is imposed on the taxpayer by law. The document is a mandatory attachment to the documents specified in it. The standardized inventory form has not been approved by the tax office, so the taxpayer can use a free-form inventory or a form recommended for use at the tax office at the place where the declaration was submitted.

At the same time, the provided opportunity to compile an accompanying register in free form does not mean that the legislation does not impose any requirements on its content. The presence of an inventory (register) for transferring documents to the tax office is regulated by a number of regulations, including Appendix No. 18 to the Order of the Federal Tax Service of the Russian Federation No. MMV-7-2 / [email protected] dated November 7, 2018 “On approval of document forms...”. This order regulates the presence of an accompanying inventory as part of the documents submitted to the Federal Tax Service. This may be a separately attached form for an inventory of documents submitted to the tax office or an inventory given in the text of the cover letter.