If the cashier in the institution is absent for good reasons (vacation, illness) or such a position is not provided at all, since the enterprise is still small, then the duties of this employee can be assigned to the accountant. To do this, a corresponding document must be prepared and signed. It is called “Order on assigning cashier duties to an accountant”

.

FILESDownload a blank form of an order on assigning cashier duties to an accountant .doc order on assigning cashier duties to an accountant .doc In addition to it, in order to comply with all the nuances, some changes will be required in the job description and employment contract

.

One or two papers must indicate the amount that the employee is entitled to for the additional workload

. Attention! It should not be less than the amount of additional payments prescribed in the Labor Code (in particular, Article 151).

How to replace a cashier during vacation?

Accounting and tax accounting for dummies Electronic journal, step-by-step free training This document is created during a cashier shift or when it is necessary to give the cash register to another person for a short period of time. What you should pay attention to? During the shift of the responsible person who works at the cash register, you need to draw up a special cash register inventory report and a document on the acceptance and transfer of finances to another person

.

Examples of filling out such documents can be found and downloaded from us. How is the act of transferring the cash register drawn up when changing the cashier? This process occurs in free form

.

A special authority of 3 people is formed. During acceptance and transfer, finances are recalculated, this fact is recorded in the act

. Certificate of acceptance and transfer of cash register when changing cashier.

Glavbukh-info

There is no special document according to which the process of transferring money from one cashier to another employee takes place. Therefore, it is important to carefully study the documents that provide accounting procedures, without ignoring a single detail.

.

Reception and transfer of cases by the cashier takes place in accordance with a specific order created by the head of the organization, documented by an act of checking the cash register. Since the cashier is a financially responsible person, when transferring the cash register to another employee, an inventory of the cash register must take place

.

Checking the availability of funds in the cash register must occur in the direct presence of the employee who hands it over. He must see this process with his own eyes and take an active part in it.

Order on assigning cashier duties to an accountant

Filling out the document It is necessary to pay attention to the following when filling out the document:

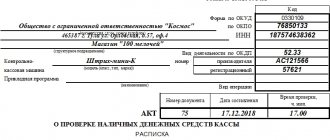

- The act must contain data - the name of the company.

- Name of the documentation - act.

- Information about the commission - initials, positions.

- Finances that are in the cash register.

- Cash according to accounting.

- Surplus data.

- Data on shortages.

- License plate number of recent warrants.

- Assurance from cashiers and commission.

Please note that there should be a couple of copies of the act: for cashiers and the accounting department. Download the form for the cashier Download the act of transferring the cash register when changing the cashier (form .doc) Rate the quality of the article.

Order for the appointment of a cashier (sample)

Acts An act of acceptance and transfer of funds from the cash register is drawn up when there is a change of cashier, and also, if necessary, to temporarily transfer the cash register to another person for a period of absence (vacation). the act of acceptance and transfer of money from the cash register when changing the cashier can be found at the end of the article in word format

.

When changing the financially responsible person working with the cash register and cash, it is necessary to draw up an inventory report for the cash register, as well as an act of acceptance and transfer of funds from one person to another

.

A sample act of inventory of cash at the cash desk can be downloaded from this link

.

Drawing up an act of acceptance and transfer of money does not eliminate the need to draw up an inventory act. You can draw up the act in any form

. It is necessary to create a commission consisting of at least three people: a chairman and members of the commission.

Rest and lunch breaks for cashiers

Then you need to draw up another document stating that the employee does not agree to talk about the reasons for the shortage (or excess money). You may also find samples of other transfer acts useful: The act of receiving and transferring funds from one cashier to another indicates, first of all, the information of the employees (full name, passport details, address) and the address of the organization where this procedure is taking place. The signing of the INV-15 act by the cashier who handed over the cash register and the cashier who accepted it means that the amount of money indicated in the act has been transferred from one to the other. Therefore, there is no need to draw up a separate act of acceptance and transfer of the cash register. Sample of filling out a cash inventory report when changing a cashier (Form N INV-15) See.

Certificate of acceptance and transfer of cash from the cash register when changing the cashier

This condition guarantees full compliance with labor laws. Is compilation necessary? Important! Even if the staffing table does not include the position of a cash register employee and there is a single job description indicating that all the cashier’s functionality is included in the accountant’s list, an order assigning duties is required.

.

This is due to the fact that the vast majority of banks licensed in the Russian Federation clearly state the terms of interaction with individual entrepreneurs, LLCs or other legal entities. Under these conditions, cash transactions cannot be carried out by anyone other than a cashier, who is selected from the existing staff or hired separately

. In large organizations If we are talking about individual entrepreneurs, then the employee’s written consent to assign duties is not required.

This is important to know: Who signs a 2-week vacation notice: sample 2020

There is no special document according to which the process of transferring money from one cashier to another employee takes place. Therefore, it is important to carefully study the documents that provide accounting procedures, without ignoring a single detail.

.

Reception and transfer of cases by the cashier takes place in accordance with a specific order created by the head of the organization, documented by an act of checking the cash register. Since the cashier is a financially responsible person, when transferring the cash register to another employee, an inventory of the cash register must take place

.

Checking the availability of funds in the cash register must occur in the direct presence of the employee who hands it over. He must see this process with his own eyes and take an active part in it.

In the act of acceptance and transfer of money between cashiers (indicating the details of the organization), the actual presence of property in the cash desk should be described in detail. If during the inspection a shortage or, conversely, a surplus of funds is revealed, it is necessary to obtain from the employee a written explanation of their occurrence.

. It happens that the cashier refuses to comply with this requirement. Then you need to draw up another document stating that the employee does not agree to talk about the reasons for the shortage (or excess money).

You may also find samples of other transfer deeds useful:

- funds under the contract - sample;

- documents - download;

- goods - download.

Registration of an act of transfer of money between cashiers

February 19, 2020 When changing the person financially responsible for the contents of the cash register, it is necessary to transfer the funds to a new person, and an act of acceptance and transfer of money is drawn up. The reason for this may be the dismissal of the old cashier, his going on vacation or another reason. A change of cashier is always accompanied by certain important procedures - taking an inventory of cash in the cash register and transferring its contents to the new cashier.

During the inventory, an act is drawn up in the prescribed form, which lists all the cash that is in the cash register at the time of acceptance and transfer.

Next, the procedure for transferring cash funds to a new financially responsible person is carried out. Both the old and the new cashier must be present.

This procedure is very responsible, therefore it is accompanied by a commission, the composition of which is appointed by the company’s management. The task of the commission members is to monitor the process of recalculating cash in the cash register, as well as to record the moment of acceptance and transfer of funds between cashiers by drawing up a transfer act. A sample of the act can be downloaded on our website at the bottom of the article.

You may also find other examples of transfer deeds useful:

- when transferring funds under an agreement - ,

- when transferring documents - ,

- when transferring goods - download.

The act of acceptance and transfer of money from one cashier to another is drawn up by members of the commission in the presence of both cashiers. The act form must list all participating persons - commission members and cashiers.

If there are discrepancies, then the cashier must provide a written explanation for this, but if he does not want to write such a document, then another document is drawn up about the refusal to provide an explanatory note about the cash discrepancies. The transfer deed form also indicates the number of the most recently issued incoming and outgoing cash order.

All members of the commission sign the document.

The cashier who handed over the cash register and the cashier who accepted it also put their signatures.

An example of an act can be downloaded from our website below. Download the act of acceptance and transfer of funds between cashiers sample - .

Your e-mail will not be published. Comment Name E-mail Website

Sample design

The act of receiving and transferring funds from one cashier to another indicates, first of all, the information of the employees (full name, passport details, address) and the address of the organization where this procedure is taking place.

Next, the exact amount of money is written down, which remains in the cash register and is transferred to the new cashier. Then it is said that a specific employee (No. 1) transferred the valuables to employee No. 2. At the end of the act of acceptance and transfer of money from the cash register, the signatures of both parties must be present

.

Do not forget about the presence of a specific date for the procedure itself

. This is necessary to avoid misunderstandings and controversial issues later.

Thus, the process of accepting and transferring money when changing a cashier is a responsible, serious event that requires the attention and interest of both parties (the one who hands over and accepts money). It is important that employees reflect the exact amount of the remaining balance in the document. The financial responsibility falling on the employee is a serious point that cannot be ignored.

You can get an answer to your question by calling the numbers ⇓

St. Petersburg, Leningrad region call:

Sample receipt and transfer of funds when changing cashier - download.

The transfer document is a mandatory document that allows you to confirm the procedure if necessary. At the same time, the transferring party relieves itself of the responsibility for controlling the cash of the enterprise and gives them to the receiving party at the time of signing the act.

Rate the quality of the article. We want to be better for you:

Accountant's Directory

Acts

When leaving work, the cashier must transfer the funds from the cash register to a new employee who will replace the cashier in this position. The acceptance and transfer of money between cashiers can be formalized by an acceptance certificate, which is drawn up at the time of acceptance and transfer of funds and signed by the transferring and receiving parties.

The act is drawn up in two copies, the transferring and receiving parties each receive a copy, mutually signed. A sample act of acceptance and transfer of cash from the cash register when changing the cashier can be downloaded below for free (word).

The act can be drawn up not only when a cashier is dismissed, but also when leaving, for example, on vacation, when matters are transferred to a replacement person. Before drawing up the transfer and acceptance certificate, you need to take an inventory of the cash register, recalculating its contents. To carry out the inventory, a commission is created; at least three people must be assembled into the commission.

In the presence of members of the commission, all cash in the cash register is recounted, after which members of the commission draw up an inventory report - a mandatory document when transferring money between cashiers. After the inventory report has been drawn up, you can proceed directly to changing the materially responsible persons.

An act of acceptance and transfer is drawn up, which states what is being transferred, from whom and to whom. The act is signed by both parties.

Also, an act of acceptance and transfer of money is drawn up at the time of payment under a purchase and sale agreement, provision of services, performance of work, or under a loan agreement -.

Sample design

The act of acceptance and transfer of funds between cashiers is drawn up in free form. It is necessary to indicate the name of the organization, the composition of the commission, as well as information about the transferring party (full name and position of cashier) and the receiving party (full name and position).

The old and new cashiers recalculate cash, after which the transfer and acceptance certificate states what the old cashier transfers to the new one:

- the amount of cash in the cash register according to accounting data;

- actual amount of cash on hand;

- the amount of surplus, if identified;

- the amount of the shortfall, if identified;

- numbers of incoming and outgoing cash orders issued last.

Both cashiers put their signatures as a sign that they agree with the given amounts and have no claims against each other.

If the transfer of funds between cashiers is carried out correctly, then subsequently the new cashier will not have any questions or problems. Documentation of the fact of acceptance and transfer is required.

Sample act of acceptance and transfer of funds from the cash register when changing the cashier -.

>The act of handing over the cash register when changing the cashier

This document is created during a cashier change or when it is necessary to give the cash register to another person for a short period of time.

The act of accepting the transfer of cash when changing the cashier

Conditions for storing the document The act, being an integral part of the agreement, must be stored together with it in a separate folder where there is no access to unauthorized persons. The storage period is established either by the legislation of the Russian Federation or by the internal regulations of the company.

Peculiarities of drawing up an act This document must necessarily contain the details of both parties (information from the registration papers of the organization or passport data of an individual) - without them, the document does not acquire legal status.

It is permissible to draw up an act not only personally, but also acting through a representative. However, in this case, it is important that the authorized person has a notarized power of attorney, a copy of which must be attached to the deed.

The act must necessarily satisfy the requirements of both parties.

- place and date of its compilation;

- if the document is an annex to an agreement, you must provide a reference to the number and date of the agreement.

- After this comes the main part. You must enter here:

- subjects who draw up the act (names of organizations and full names of its representatives, full names of individual entrepreneurs or citizens of the Russian Federation and their passport details);

- the amount that is transferred (necessarily in numbers and words);

- certify that the obligations are fulfilled in full and properly;

- indicate all other information that the parties consider necessary to include in this document (for example, about the form of transfer of money - bank transfer, online transfer, bills of exchange, “cash”, etc.).

If there are any attachments (checks, receipts and other documents), their originals or copies can also be attached to the act, noting their presence as a separate item.

Due to the direct dependence of the act on the previously concluded agreement, the document can be considered an annex to the main agreement between the parties. Difference from a receipt It is necessary to distinguish the act of acceptance from a receipt for receipt of money. The benefits of the act include:

- Signing of a document by both parties to the transaction, confirmation of the transfer by one party and receipt by the other party of the amount specified in the document.

- Evidence only of the transfer of funds without indicating any other obligations.

- Suitable as an annex to any type of contract, being part of it.

act of acceptance and transfer of funds Despite the fact that there are no strict requirements for this document, general rules for drawing up must be followed, otherwise there is a risk of the act being declared invalid.

However, perhaps, it will be much easier to draw it up yourself, since there is nothing complicated in this act.

The law does not contain mandatory requirements for this document, but in order to avoid possible claims it is necessary that it indicate:

- date, time and place where the act was drawn up;

- parties involved in its preparation: for citizens, the minimum will be the full name and passport data, for organizations - the full name and registration data (but the more complete the information that allows you to reliably identify the party, the better);

- basis for transfer: for citizens this is not necessary, but for commercial organizations it is extremely necessary, since they are prohibited from making donations in relations with each other; therefore, here it is necessary to refer to a paid agreement (purchase and sale, provision of services, etc.)

Drawing up an act of acceptance and transfer of money when changing a cashier in 2019

There is no special document according to which the process of transferring money from one cashier to another employee takes place. Therefore, it is important to carefully study the documents that provide accounting procedures, without ignoring a single detail.

Reception and transfer of cases by the cashier takes place in accordance with a specific order created by the head of the organization, documented by an act of checking the cash register.

Since the cashier is the financially responsible person, when transferring the cash register to another employee, an inventory of the cash register must occur.

Checking the availability of funds in the cash register must occur in the direct presence of the employee who hands it over. He must see this process with his own eyes and take an active part in it.

In the act of acceptance and transfer of money between cashiers (indicating the details of the organization), the actual presence of property in the cash desk should be described in detail.

If during the inspection a shortage or, conversely, a surplus of funds is revealed, it is necessary to obtain from the employee a written explanation of their occurrence. It happens that the cashier refuses to comply with this requirement.

Then you need to draw up another document stating that the employee does not agree to talk about the reasons for the shortage (or excess money).

You may also find samples of other transfer deeds useful:

- funds under the contract - sample;

- documents - ;

- goods - .

The act of receiving and transferring funds from one cashier to another indicates, first of all, the information of the employees (full name, passport details, address) and the address of the organization where this procedure is taking place.

Next, the exact amount of money is written down, which remains in the cash register and is transferred to the new cashier. Then it is said that a specific employee (No. 1) transferred the valuables to employee No. 2.

At the end of the act of acceptance and transfer of money from the cash register, the signatures of both parties must be present. Do not forget about the presence of a specific date for the procedure itself.

This is necessary to avoid misunderstandings and controversial issues later.

Thus, the process of accepting and transferring money when changing a cashier is a responsible, serious event that requires the attention and interest of both parties (the one who hands over and accepts money). It is important that employees reflect the exact amount of the remaining balance in the document. The financial responsibility falling on the employee is a serious point that cannot be ignored.

★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased

https://www.youtube.com/watch?v=xYOfchPFVH8

If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓Free legal consultation

Moscow, Moscow region call

One-click call

St. Petersburg, Leningrad region call: +7 (812) 317-60-16

One-click call

From other regions of the Russian Federation call

One-click call

Certificate of acceptance and transfer of funds when changing cashier sample - .

The transfer document is a mandatory document that allows you to confirm the procedure if necessary. At the same time, the transferring party relieves itself of the responsibility for controlling the cash of the enterprise and gives them to the receiving party at the time of signing the act.

Rate the quality of the article. We want to become better for you: Acts

There is no special document according to which the process of transferring money from one cashier to another employee takes place. Therefore, it is important to carefully study the documents that provide accounting procedures, without ignoring a single detail.

Reception and transfer of cases by the cashier takes place in accordance with a specific order created by the head of the organization, documented by an act of checking the cash register.

Since the cashier is the financially responsible person, when transferring the cash register to another employee, an inventory of the cash register must occur.

Checking the availability of funds in the cash register must occur in the direct presence of the employee who hands it over. He must see this process with his own eyes and take an active part in it.

In the act of acceptance and transfer of money between cashiers (indicating the details of the organization), the actual presence of property in the cash desk should be described in detail.

If during the inspection a shortage or, conversely, a surplus of funds is revealed, it is necessary to obtain from the employee a written explanation of their occurrence. It happens that the cashier refuses to comply with this requirement.

Then you need to draw up another document stating that the employee does not agree to talk about the reasons for the shortage (or excess money).

You may also find samples of other transfer deeds useful:

- funds under the contract - sample;

- documents - ;

- goods - .

The act of receiving and transferring funds from one cashier to another indicates, first of all, the information of the employees (full name, passport details, address) and the address of the organization where this procedure is taking place.

Next, the exact amount of money is written down, which remains in the cash register and is transferred to the new cashier. Then it is said that a specific employee (No. 1) transferred the valuables to employee No. 2.

At the end of the act of acceptance and transfer of money from the cash register, the signatures of both parties must be present. Do not forget about the presence of a specific date for the procedure itself.

This is necessary to avoid misunderstandings and controversial issues later.

Thus, the process of accepting and transferring money when changing a cashier is a responsible, serious event that requires the attention and interest of both parties (the one who hands over and accepts money). It is important that employees reflect the exact amount of the remaining balance in the document. The financial responsibility falling on the employee is a serious point that cannot be ignored.

★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased

Certificate of acceptance and transfer of funds when changing cashier sample - .

The transfer document is a mandatory document that allows you to confirm the procedure if necessary. At the same time, the transferring party relieves itself of the responsibility for controlling the cash of the enterprise and gives them to the receiving party at the time of signing the act.

Rate the quality of the article. We want to become better for you: Acts

First of all, we note that at present there is no special regulatory legal document that would regulate the transfer of cases from one cashier (employee performing his functions) to another.

In this regard, the relevant rules, including the rules for documenting the transfer of cases, must be developed independently by the organization, guided by the general requirements of regulations governing the procedure for maintaining accounting records in the territory of the Russian Federation.

An accountant goes on another vacation: How to properly transfer affairs to another accountant

In an organization, an accountant-cashier is going on another vacation. What is the procedure for transferring matters to another accountant?

First of all, we note that at present there is no special regulatory legal document that would regulate the transfer of cases from one cashier (employee performing his functions) to another. In this regard, the relevant rules, including the rules for documenting the transfer of cases, must be developed independently by the organization, guided by the general requirements of regulations governing the procedure for maintaining accounting records in the territory of the Russian Federation.

It is advisable to consolidate the developed procedure with an internal local act, for example, it could be “Instructions on the procedure for transferring cases when changing the cashier.” As a guide, you can use the Instructions on the procedure for accepting and submitting cases by chief accountants (senior accountants with the rights of chief accountants), centralized accounting departments (accounting departments), institutions, enterprises and organizations of the USSR Ministry of Health system, approved by the USSR Ministry of Health on May 28, 1979 N 25-12/ 38. For example, an organization may provide that the receipt and delivery of cases by the cashier is carried out on the basis of the corresponding order of the manager (indicating the deadline for the acceptance and delivery of cases) and is documented in a cash register inspection report (the form is arbitrary, it is desirable that it contains the details established by Article 9 of the Federal Law dated December 6, 2011 N 402-FZ “On Accounting” (hereinafter referred to as Law N 402-FZ)).

Let us repeat once again, the proposed procedure is an example of formalizing the transfer of cases; the organization is not at all obliged to follow it; moreover, even if the transfer of cases is not formalized with any documents at all, violations of the law will not arise.

It should also be taken into account that an employee performing the labor function of a cashier is a financially responsible person with whom an agreement on full financial liability can be concluded (Article 244 of the Labor Code of the Russian Federation and the List of positions and work replaced or performed by employees with whom the employer can enter into written agreements on full individual financial responsibility for the shortage of entrusted property, approved by Resolution of the Ministry of Labor of the Russian Federation of December 31, 2002 N 85). In this regard, we believe that when transferring cases from one cashier to another, it is advisable to conduct an inventory of the cash register.

Until January 1, 2013, Federal Law No. 129-FZ of November 21, 1996 “On Accounting” (hereinafter referred to as Law No. 129-FZ) established a requirement for mandatory inventory in the event of a change in financially responsible persons (clause 2 of Article 12 of the Law N 129-FZ). A similar requirement was contained in clause 37 of the Procedure for conducting cash transactions in the Russian Federation, approved by decision of the Board of Directors of the Central Bank of the Russian Federation on September 22, 1993 N 40 (hereinafter referred to as the Procedure for conducting cash transactions; no longer in force on January 1, 2012).

Since January 1, 2013, Law No. 129-FZ has lost force; the new Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Law No. 402-FZ) does not contain such a requirement. Part 3 of Art. 11 of Law N 402-FZ determines that the cases, timing and procedure for conducting an inventory, as well as the list of objects subject to inventory, are determined by the economic entity, with the exception of the mandatory inventory (cases of mandatory inventory are established by the legislation of the Russian Federation, federal and industry standards; cases of change financially responsible persons are not included here). The currently valid Regulation of the Bank of Russia dated October 12, 2011 N 373-P “On the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation” does not address cash inventory issues at all.

Thus, at present, a change of cashier is not a circumstance entailing the obligation to conduct an inventory. Nevertheless, we believe that in order to ensure the safety of cash and other valuables in the cash register, when transferring cases from one employee performing the functions of a cashier to another cashier, it is advisable to carry out an inventory of the cash register.

This is important to know: What to do if vacation pay is not paid before the start of the vacation

The procedure for taking inventory of funds at the organization's cash desk is regulated by the Methodological Guidelines for the Inventory of Property and Financial Liabilities, approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 N 49 (hereinafter referred to as the Guidelines). According to clause 3.39 of the Methodological Instructions, the inventory of funds in the cash desk is carried out in accordance with the Procedure for conducting cash transactions. However, since this procedure is not currently in effect, and the Regulation of the Bank of Russia dated October 12, 2011 N 373-P “On the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation” does not provide for any procedure for conducting an inventory of the cash register, We believe that an inventory of cash in the cash register must be carried out in accordance with section 2 “General rules for conducting an inventory” of the Methodological Instructions.

Let us recall that to carry out an inventory in an organization, a permanent inventory commission is created, which includes representatives of the organization’s administration, accounting service employees, representatives of the organization’s internal audit service, and other specialists (engineers, economists, technicians, etc.) (clause 2.2 and clause 2.3 of the Guidelines). The personnel of the permanent and working inventory commissions is approved by the head of the organization by order drawn up in form N INV-22 (approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88), or in any form indicating the mandatory details contained in Art. 9 of Law No. 402-FZ.

In addition to the composition of the commission, the order also indicates:

— the reason for the inventory (in this case, a change of cashier);

- property subject to audit (in the case under consideration - cash; note that, in accordance with clause 1.2 of the Methodological Instructions, cash is classified as property);

— start and end date of inventory.

The order is registered in the journal of accounting and control over the implementation of orders for inventory.

Based on clause 2.4 of the Methodological Instructions, before the start of the inspection, the inventory commission must obtain the latest receipts and expenditure documents or reports on the movement of material assets and funds at the time of the inventory. The chairman of the inventory commission endorses all incoming and outgoing documents attached to the registers (reports), indicating “before inventory on.” “(date)”, which should serve as the accounting department’s basis for determining the balance of property at the beginning of the inventory according to accounting data. The financially responsible person (cashier) gives a receipt stating that by the beginning of the inventory, all expenditure and receipt documents for the property were submitted to the accounting department or transferred to the commission and all valuables received under his responsibility were capitalized, and those disposed of were written off as expenses.

Checking the actual availability of property at the cash desk is carried out with the obligatory participation of the cashier handing over the files (clause 2.8 of the Methodological Instructions).

During the inventory, all documents related to the employee’s activities as a cashier are checked: cash book, cashier’s reports, receipts and expenditure orders, etc., as well as the actual availability of amounts of money in the cash register at the time of the check (reconciliation with the data is carried out cash book).

According to clause 2.5 of the Methodological Instructions, information about the actual availability of property (including cash) is recorded in inventory records or inventory reports (in this case, developed by the organization independently, indicating the details contained in Article 9 of Law N 402-FZ).

The results of the inventory are reflected in the cash inventory report (according to Form N INV-15, approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 N 88, or an independently developed form, indicating the details from Article 9 of Law N 402-FZ). A statement of the results identified by the inventory is also compiled (according to Form N INV-26, approved by Decree of the State Statistics Committee of Russia dated March 27, 2000 N 26, or an independently developed form indicating the details from Article 9 of Law N 402-FZ).

If surpluses or shortages are identified, you must obtain written explanations from the cashier about the reasons for their occurrence. If the cashier refuses to give appropriate comments, it is recommended to draw up a report on the employee’s refusal to provide an explanation. The cashier must be familiarized with the act against signature. If the employee refuses to sign the document, this fact should also be recorded.

Answer prepared by: Expert of the Legal Consulting Service GARANT, professional accountant Ekaterina Lazukova

Response quality control: Reviewer of the Legal Consulting Service GARANT Barseghyan Artem

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.

The act of transferring cash at the cash desk

The benefits of the act include:

Despite the fact that there are no strict requirements for this document, general drafting rules must be followed, otherwise there is a risk of the act being declared invalid. The mandatory details of the transfer and acceptance act include the following: The act is drawn up and signed directly when transferring money from one person to another.

The procedure is slightly different if the funds are received or transferred by a representative of the party acting as an individual. Before signing the act, a copy of the power of attorney to perform a specific action is attached to it.

For organizations, such a measure is not required, since the text of the document itself indicates

Act of acceptance and transfer of funds between cashiers

A change of cashier is accompanied by the transfer of the contents of the cash register from the old employee to the new one. Also on our website you may be interested in a sample transfer and acceptance certificate:

- funds under the contract - sample;

- transfer deed during reorganization - download.

The following information may be included in the act form: Certificate of acceptance and transfer of cash from the cash register when changing the cashier, sample - download.

Certificate of acceptance of cash transfer at the cash desk sample

For each person, a position, profession, and full name are written. The text of the act must confirm that money in a certain amount was transferred by one party to the other. At the same time, a list of cash in the cash desk is provided - accounting data, actually counted data, identified surpluses and shortages.

Members of the commission participating in the acceptance and transfer procedure sign the prepared form of the act. Also, the parties between whom the transfer procedure is being carried out must witness their signatures.

The act is drawn up in at least two copies, one copy must be received by the responsible persons between whom the acceptance and transfer procedure was carried out. An example of the document can be downloaded below. Sample receipt and transfer of funds when changing cashier - download.

A change of cashier is accompanied by the transfer of the contents of the cash register from the old employee to the new one.

When an employer pays for meals for employees, including through the buffet system, the “breadwinner” has the responsibilities of a tax agent for personal income tax.

The President of the Russian Federation considers it inappropriate to introduce a sales tax and a progressive scale of personal income tax. Amounts given to an employee going on a one-day business trip are not considered per diem for the purpose of calculating personal income tax and contributions.

The owners of a liquidated company cannot claim that the amount of taxes or contributions overpaid by the company will be returned to them.

If the general meeting of the founders of the Company decided to terminate the employment relationship with the director and appointed a new one, the demoted director cannot sign an order for his dismissal. Tax officials have compiled a “rating” of the most common errors in payment orders, due to which money is “stuck” as uncleared payments. Resolution of the State Statistics Committee No. 88:

- to the cashier who handed over the cash register;

- to the cashier who accepted the cash register;

- to the accounting department.

The signing of the INV-15 act by the cashier who handed over the cash register and the cashier who accepted it means that the amount of money indicated in the act has been transferred from one to the other.

Sample act of handing over the cash register during the cashier's vacation

The act is signed by both parties.

Also, an act of acceptance and transfer of money is drawn up at the time of payment under a purchase and sale agreement, provision of services, performance of work, or under a loan agreement -.

How to draw up an act of acceptance and transfer of funds?

- the act is signed by both parties, not just one;

- the act does not impose obligations on either party, but only records the fact of transfer, so it is easier to use it as an annex to the agreement.

The Internet is replete with offers to download various samples of various documents. If you need an act of acceptance and transfer of funds, you can use any of these offers.

However, perhaps, it will be much easier to draw it up yourself, since there is nothing complicated in this act. The law does not contain mandatory requirements for this document, but in order to avoid possible claims, it is necessary that it indicate: Finally, since the act is a bilateral document, it has features that are not obvious at first glance:

Certificate of acceptance and transfer of cash and strict reporting forms located at the cash desk of MGIMO (U) of the Ministry of Foreign Affairs of Russia

To the accounting policy for 2020 "______" __________20___ G.

8. inserts for work books ____ pcs.

9. new sample work book inserts ___ pcs. The last number of the receipt order No. ______ dated __________, the cash outgoing order No. ________ dated ___________. I confirm that I accepted the funds and strict reporting forms listed in the act for safekeeping.

Accepted by: _________ /______________/ Submitted by: _________ / _____________/ (signature) (transcript) (signature) (transcript) Chairman of the commission: _________ /_______________/ Members of the commission: _________ /______________/

Sample order for transfer of cash register during the cashier's vacation

If the cashier in the institution is absent for good reasons, vacation, illness, or such a position is not provided for at all, since the enterprise is still small, then the duties of this employee can be assigned to the accountant. To do this, a corresponding document must be prepared and signed. Open and download online. In addition, to comply with all the nuances, some changes will be required in the job description and employment contract.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

WATCH THE VIDEO ON THE TOPIC: Online cash register. Who can't use it?

What you should pay attention to

It is necessary to pay attention, first of all, to the features of the process:

- the inventory procedure is formalized in a special form of the INV-15 act

the act itself is formed only after the recount is completed and the relevant documentation is completed

- change of cash register employees, as well as documents prepared accordingly. This is a civil document that is drawn up by the participants as confirmation of the transfer of affairs by the parties to the agreement

- if the cashier is not on site (for a good reason), then money and other material assets must be transferred for reporting; for this, the employee, in the presence of the managers of the enterprise and the commission appointed by order, recalculate the values, funds

- It is necessary to conclude an agreement with the new cashier on responsibility for the safety of valuables and money accepted by him

The cashier is going on vacation, you need to entrust the cash register to another employee

The cashier is required to officially transfer his duties to another employee when he goes on vacation or is temporarily absent.

Otherwise, if there is a shortage of cash at the cash desk, it will be difficult to identify the culprit and return the money. The procedure is as follows. When transferring the functions of a cashier to another employee, new responsibilities must be assigned to him by order of combining positions. But this document is not enough. The employee is also required to agree to the combination. There are two possible options here. By the way, formally the chief accountant cannot perform duties related to direct financial responsibility for funds.

But there are no consequences for the combination either for the employee or for the company. The procedure for conducting cash transactions, approved by the Bank of Russia from However, an agreement is necessary. Otherwise, if there is a shortage, it will be impossible to recover money from the culprit.

The position of cashier is in the list of positions of employees with whom it is possible to conclude agreements on full financial responsibility, decree of the Ministry of Labor of Russia dated When changing financially responsible employees, cash inventory is required.

This means that on the day the cases are transferred from the cashier to another employee, a report must be drawn up. Its shape is arbitrary. We recommend drawing up the acts in triplicate - one for the cashier, one for the replacement employee, and the third remains in the accounting department. The same documents will be needed when the cashier returns to work after vacation.

The manager also has the right to conduct cash transactions. The cashier is financially responsible. When changing such employees, even temporary ones, it is necessary to carry out an inventory of items. What lies behind the requirements of the inspectors. Deadlines for submitting reports for the 2nd quarter of the year: table. Deadlines for submitting 6-NDFL for the 2nd quarter of the year. Deadlines for submitting 4-FSS for the 2nd quarter of the year. Form 4-FSS for the 2nd quarter of the year, new form.

This is important to know: When and how is it more profitable to quit: before or after the vacation?

Deadlines for submitting the DAM for the 2nd quarter of the year. Calculation of insurance premiums for the 2nd quarter of the year: sample form. Zero calculation for insurance premiums for the 2nd quarter of the year. UTII declaration for the 2nd quarter of the year: form. Deadlines for submitting the UTII declaration for the 2nd quarter of the year.

Advance payment under the simplified tax system for the 2nd quarter of the year due date. VAT return for the 1st quarter of the year, sample form. VAT declaration for the 2nd quarter of the year: form, sample filling. Deadlines for submitting the VAT return for the 2nd quarter of the year. Income tax return for the 2nd quarter of the year. Deadlines for filing income tax returns for the 2nd quarter of the year. Unified simplified tax return for the 2nd quarter of the year. Find tax risks on the company’s website before inspectors.

How to draw up new documents for tax audits. Ready-made sample documents that any company needs. How to work with cash registers according to the new rules. For which the chief accountant is responsible with personal money. New dangers in payments. How can a chief accountant protect a company from losses? The popular scheme for avoiding inspections is dangerous for the chief accountant. How they look for envelope circuits now. How can the chief accountant use the mistakes of tax authorities to the benefit of the company? Companies now have a way to get off the blacklist of bank clients.

We care about the quality of materials on the site and in order to protect the copyright of the editors, we are forced to place the best articles and services in closed access. Until the end of the year, subscription is free 8 Read in the electronic newspaper About the newspaper Advertising Enter the access code. Articles Cash order. How to transfer cashier duties to another employee.

Topics: Cash order. UNP investigation:. Legal basis. Tax Code Civil Code. Poll of the week. Did it become more difficult for you to work with contributions when they were handed over to the tax authorities? Yes, it's more difficult. No, it's easier. Nothing changed. Partner news. E-mail address.

I give my consent to the processing of my personal data. Reporting for the 2nd quarter of the year. News on the topic. Before July 1, you must register online and receive a deduction. Tax officials began to deregister cash registers. How to issue settlement documents to the buyer according to the new rules. Use the new form for deductions at online checkouts. From July 1 of this year, new rules for the use of cash registers are in effect. Articles on the topic. Online cash register for individual entrepreneurs. Cash discipline in the year: the procedure for conducting cash transactions.

Cash book: sample Cash book: form download Word, Excel Questions on the topic. Are there any peculiarities when using cash register systems when making an advance payment under a contract? Should a cash receipt contain the “advance” attribute? How to correct a paper cash book, what are the consequences of this violation for the company? Is it necessary to use cash register when issuing cash from the cash register to an entrepreneur for personal needs? How to maintain a cash book in a separate division.

Is it necessary for an individual entrepreneur to rent out any space of this cafe to an LLC, or is this not necessary? Articles on the topic in the newspaper “Accounting. Get demo access or subscribe immediately. Recommendations on the topic. Newspaper Editorial Board Advertising Contacts. Personal data processing policy. We are in social networks.

Sorry to interrupt reading:. I have a password. Password has been sent to your email Enter.

Is it necessary to compile

Important! Even if the staffing table does not include the position of a cash register employee and there is a single job description indicating that all cashier functionality is included in the accountant’s list, an order assigning duties is required.

This is due to the fact that the vast majority of banks licensed in the Russian Federation clearly state the terms of interaction with individual entrepreneurs, LLCs or other legal entities. Under these conditions, cash transactions cannot be carried out by anyone other than a cashier, who is selected from the existing staff or hired separately.

Order for the appointment of a cashier: sample filling, download form

A situation may also arise when the only cashier at the enterprise is temporarily absent.

In this case, the chief accountant or accountant has the right to replace him.

In this case, an order for the appointment of a cashier is also issued separately, which will provide for the full financial liability of such a person.

Important

This document has a standard form. Traditionally, it begins with the design of a header, which indicates the place, date and name of the organization in which it was issued, as well as the serial number.

The preamble should disclose the reason for its composition.

For example, the appointment of a new cashier due to production needs, illness, vacation or removal from the duties of the previous one.

After the preamble, the word “I ORDER” is written in the center in capital letters.

Attention

An employee applies for a pension: the role of the employer (part 1) The employee himself usually handles the application for a pension.

What is required from the employer? Is it necessary to submit to the Pension Fund in advance lists of future pensioners and documents necessary for assigning a pension? Or are the organization’s responsibilities limited to submitting the requested SZV-STAGE form to the Pension Fund for the future pensioner? Representatives of the Pension Fund Branch for Moscow and the Moscow Region told us what the role of the employer is in the process of applying for a pension by an employee.

However, for the application of this deferment there are a number of conditions (tax regime, type of activity, presence/absence of employees). So who has the right to work without a cash register until the middle of next year? → Accounting consultations When changing (including going on vacation, dismissal) cashier, proceed as follows. Take inventory of the cash register.

Draw up a cash inventory report (Form N INV-15) in triplicate and submit the Instructions, approved.

How to properly hand over a cash register when a cashier resigns

First of all, we note that at present there is no special regulatory legal document that would regulate the transfer of cases from one cashier (employee performing his functions) to another.

In this regard, the relevant rules, including the rules for documenting the transfer of cases, must be developed independently by the organization, guided by the general requirements of regulations governing the procedure for maintaining accounting records in the territory of the Russian Federation. It is advisable to consolidate the developed procedure with an internal local act, for example, it could be “Instructions on the procedure for transferring cases when changing the cashier.”

How to replace a cashier during vacation?

Site development:. Chief Editor:. Irina Zubova. Appoint a commission for the acceptance and transfer of the enterprise's cash register, consisting of: Thursday 08 August Home About the project Contacts Advertising on the website Forum. Home Accounting Order for acceptance and transfer of cash. Accounting Fixed assets Intangible assets Inventory assets Production costs Cash Payments to personnel Payments to the budget Finished products Financial results Capital and reserves Accounting policy Accounting and remuneration.

The act of handing over the cash register when changing the cashier

During the period of the next vacation, the cashier must officially transfer cases to another employee. Otherwise, there is a risk that if there is a shortage of cash at the till, it will be difficult to identify the culprit or return the money. The algorithm of actions is as follows. When transferring the functions of a cashier to another employee, it is necessary to apply the general norms of labor legislation, that is, assign the performance of duties by order of the manager on combining positions. The employee is required to agree to the combination, and he has the right to additional payment. The size can be specified in an additional agreement to the employment contract.