Acts of material assets: download a blank form and sample

Document year: 2019

Document group: Acts

Type of document: Act

Download formats: DOC, EXCEL, PDF

Accounting, storage and write-off of an organization's material assets is carried out in accounting using special documentation. To determine the person responsible for inventory items, write off or transfer valuables for storage, special acts are drawn up.

These are primary accounting papers, which are drawn up in two or three copies (depending on the purpose of preparation) and signed by at least two participants: the one who transfers the goods and materials and those who accept.

Let's talk in more detail about the document flow regulating the accounting of material assets. A sample act can be downloaded at the end of the article.

Act of acceptance and transfer of material assets

To transfer valuables from one person to another, an act of acceptance and transfer of goods and materials is drawn up. This is the simplest example of document flow in the accounting of material assets.

In life, drawing up a deed form is required:

- when changing the financially responsible person. The act assigns financial responsibility to a certain employee: if he resigns and someone else is hired in his place, a transfer and acceptance certificate must be drawn up;

- when making transactions involving the purchase (or sale) of valuables;

- when transferring inventory items, temporary or safekeeping

The form of documentation is not fixed in law, so entities use their own developed templates. Samples and rules for accounting for inventory items are fixed in the accounting policy.

Regardless of the forms and templates, according to the Accounting Law, any primary document, including the acceptance certificate of goods and materials, contains:

- mandatory identification details (name, date of compilation, information about the company);

- information about the transferred valuables (description, size, quantity, cost, codes and numbers assigned in accounting);

- information about employees who transmit and receive values.

The employee who receives and the one who transmits must put a handwritten signature.

The act is drawn up in triplicate. In addition to the participants in the acceptance and transfer, the paper is signed by the head of the company (or an authorized person).

When changing the financially responsible person, acceptance and transfer can be carried out through the mediation of the organization itself:

- the replaced MOL transfers goods and materials to the company;

- the company assumes financial responsibility;

- When hiring a new employee, the organization transfers the goods and materials according to the act to him.

The act is drawn up in two copies:

- when issued to an employee who abdicates responsibility (upon dismissal, change of position or transfer to another branch);

- when issuing the act to the employee who accepts responsibility.

The documentation is used for accounting of inventory items.

The act of gratuitous transfer of material assets

The main task of the act of acceptance and transfer of valuables free of charge is to determine the complete list of goods and materials and the fact of their transfer. Often such a document is attached to a gift or donation agreement, and the recipients of the valuables are various budget organizations:

- hospital and various medical institutions;

- schools, kindergartens;

- social institutions;

- religious organizations;

- charitable foundations;

- other subjects.

Like a standard act of transfer of goods and materials, on a free basis, it is necessary to indicate on the paper the basic details:

- information about the document (date of signing and execution, name of the act and its number in the document flow);

- information about the parties;

- information about transferred values;

- signatures of the parties.

If organizations have seals, you can put them in the place for seals.

Act on write-off of material assets

Write-off of material assets in the accounting records of organizations is necessary:

| when used in the company's activities |

| in case of damage and detection of defects in which the asset cannot be used |

| when selling goods |

| when a shortage is identified after an inventory |

A specialized commission or the direct MOL, which is responsible for the asset, can initiate write-off. A write-off act is used to confirm the procedure.

https://www.youtube.com/watch?v=xYOfchPFVH8

There is no single form, so companies create their own templates, taking into account needs and regional requirements. At the same time, legislative acts establish some advisory models on write-offs. These forms include:

- f 0504230. Used to write off inventories. You can download form 0504230 at the end of the article for free;

- OKUD 0504143. Used for writing off household and soft equipment;

- sample from Order of the Ministry of Finance No. 52n. The form is prepared by budgetary organizations;

- TORG-12 and 16 – when selling or damaging goods;

- To write off fixed assets, use forms OS-4, 4a and 4b.

To write off material assets that have become unusable, not found during inventory and for other reasons, the company can develop its own sample and approve it with its accounting policy.

The write-off procedure itself is carried out by a commission that draws up an act. It, in addition to the document details and information about the organization, contains a list of assets to be written off and the reason for the write-off. A sample of filling out the act can be viewed for free on the Internet.

Inventory act of inventory items

The inventory procedure is carried out to record the safety of inventory items. The manager independently determines the need for an inventory, usually in the following cases:

- at the end of the year before the preparation and submission of the annual balance sheet and reports;

- when changing MOL;

- during reorganization and liquidation of the company;

- in case of damage to assets in case of emergency;

- when selling, buying or leasing.

Based on the results of the audit, an inventory act is drawn up, which is signed by members of the inventory commission.

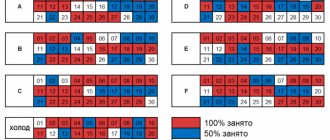

There are no unified forms, but there are reference templates. Companies are allowed to develop their own, but many use developed forms: INV 3, 4, 5 or 6 (depending on the situation).

In the standard act, you need to specify the number of the inventory order, members of the commission and a list or in tabular form indicate the available inventory items with quantity and units of measurement. At the end - calculate the total and sign.

The act of installing material assets

The final stage of installing material assets, which confirms that the installation work has been completed in full, is the act of installing material assets. A commission is hired to draw it up. The company’s own sample act is enshrined in the company’s accounting policies. Conventionally, any installation act is divided into three parts:

- introductory or identifying information (name and number of the document, date of preparation and signing, information about the company and members of the commission);

- main Describes the installed assets and the installation location. If several names are used, you can arrange this part in the form of a table;

- final. These are the signatures of the commission members and the head of the organization.

Like any act, the installation is drawn up in printed or written form on plain or branded paper.

Act of disposal of material assets

After the valuables are written off, they are disposed of. For this purpose, a commission is assembled that evaluates and analyzes the need for disposal, and with an act confirms the implementation of this procedure.

The recycling act is drawn up according to the template established by the company or in free form, handwritten or printed, on plain A4 paper or letterhead. The document must be signed by all members of the commission.

Important! Some categories of materiel must be disposed of in a certain order because they contain harmful substances. Then the disposal is carried out by a specialized company, and before that a disposal agreement is signed with it.

The main part of the act states:

- valuables that are subject to disposal, the cause of defects and malfunctions, the lack of feasibility of repairs;

- Based on the results, it is stated that the specified valuables have been disposed of and no valuables were capitalized during the procedure.

The act is signed by members of the commission and, if necessary, by the head of the company.

The act of registering material assets

The unified form M-35 is used to confirm the receipt of valuables that the company receives during the dismantling and dismantling of buildings and structures. Capitalization occurs if the materials obtained during disassembly are still suitable for use in the further activities of the organization.

https://youtu.be/GxbKsG2JkGg

The header of the act contains information about the organization, the customer and the contractor, as well as the appraisal organization (if involved).

By the way! The act is approved by the head.

Next, enter the date, the name of the structural unit and the type of activity.

The table states:

- correspondent accounts;

- information about material assets;

- what was obtained during analysis;

- which is transferred to the contractor for repeated work.

At the end, the paper is signed by the customer and the contractor.

Act on theft of material assets

The theft report is the final stage of the procedure for conducting an official investigation into the loss of valuables.

The documentation contains information about the members of the commission (there must be at least 2-3 people), then it indicates what was missing and in what quantity, and the damage caused is calculated. The following are the attachments: this is an explanatory note from the employee, an order to conduct an official investigation, an inventory and reconciliation act, economic calculations of the damage caused.

The theft report, together with the attached package of papers, is the evidence base for the judicial investigation of the case.

The act must be familiarized to the suspect (or thief), and also signed by all members of the commission. The theft report is drawn up in free form or according to the template established by the company.

If you have any questions, ask them to a lawyer in the chat. Don't forget to download sample acts for free.

Download documents

If you have not found the answer to your question or there are still misunderstandings, contact a lawyer for a free consultation in the chat on our website

| Transfer and acceptance certificate form |

| Form of write-off act |

| Equipment transfer acceptance certificate |

| Write-off act |

| Theft report |

| Act of gratuitous transfer |

Simplified sample act

A simplified act of acceptance and transfer of goods and materials, a sample of which will be presented below, is used when transferring assets in small quantities. This form is required to disclose information about the persons involved in this agreement. This section provides company details or passport data. The body of the document contains a table containing information about the assets being transferred and their value.

Any movement of goods within and outside the enterprise must be documented with appropriate documents

What is an act of acceptance and transfer of goods and materials (sample)

The need to transfer material assets for rent or storage arises both in organizations and in everyday life. In order for this action to be confirmed by law, it must be recorded using an act of acceptance of the transfer.

Below we will look in detail at how exactly it needs to be drawn up, in what cases it is necessary and we will see a sample act of acceptance and transfer of material assets.

The act of receiving and transferring valuables: what is it?

The act of transfer and acceptance of inventory items (TMT) is a special document that allows a company or individuals to control and record their movement.

What does the term “values movement” mean? This is the very moment of transfer of any object of value from one person to another.

Example. Let's consider a situation familiar to many. Two out-of-town students rent an apartment. In this case, the owner of the apartment is the person who transfers the value (apartment) to the students, who accepts responsibility for its safety and the safety of all things inside it. The process of renting an apartment itself is a “movement of material value” from its owner to student tenants.

The transfer and acceptance certificate always indicates in detail all transferred goods and materials with a clear indication of quantity and cost (for example, the same furniture from the example above). This is done to protect them and provide a refund if damaged or lost.

However, the document does not define liability for violating its terms. He only records the fact itself. Therefore, it is best to immediately draw up an addition to it with prescribed sanctions. In the case of the example with students, this is a fine or the purchase of a new thing.

The situation is more complicated when taking into account inventory items at enterprises. Since these organizations have high responsibility, they are forced to closely monitor all movements of inventory items within themselves. For them, drawing up acts is the ideal solution. Thanks to them, the enterprise creates a clear system by which it is possible to track the movement of any inventory items at a certain moment.

OGRNIP - decoding, what is it?

For even greater convenience, all things of the organization that have any material value are divided into categories. Each of them has its own article number, which is also indicated in the contract. The categories include:

- Packaging and storage containers;

- Fuel;

- Raw materials;

- The products themselves;

- Construction materials;

- Household equipment, etc.

Example. Office products (printing paper, pens, folders, staplers, hole punches, etc.) are inventory items in the office. In a company engaged in the construction of houses from solid timber, goods and materials are construction materials (logs, materials for foundations, corrugated sheets, metal tiles, etc.)

Procedure for drawing up the act

- First step. Before concluding an agreement, writing it and certifying it, organizations and individuals must carefully examine and recalculate inventory items. You need to understand that after the document comes into force, the party that accepted the values becomes fully responsible for them. Therefore, in order to avoid unpleasant situations, it is better to double-check everything.

- Second step.

Selecting the form of the act of acceptance and transfer of goods and materials. There is a small legal “incident”: at the legislative level there are no strict requirements for registration, but at the same time it is necessary to indicate the following data:

- Date of compilation;

- Positions of persons drawing up the act;

- Date of completion;

- Persons who executed the contract;

- The organization that compiled the form;

- The essence of the transfer of goods and materials;

- Signatures of all responsible persons with their subsequent decoding.

This version of the act is called simple. It can be issued on regular A4 sheets in double quantity (for the transmitting and receiving person). It does not require notarization, but must be signed by the head of the organization and have an official seal.

https://youtu.be/JoCCuNo4NuA

However, a better choice is to use the MX-1 fixed form, which includes the following fields:

- Codes and types of activities of the organization (OKPO, OKUD);

- Organization data;

- The person accepting responsibility for the transfer of values;

- Date of registration and serial number of the document;

- Type of operation performed with inventory items;

- Name, number of the cell in which the value will be stored, and its shelf life;

- List of goods and materials transferred for storage;

- Storage conditions for inventory materials;

- Special marks;

- Positions of persons participating in the agreement, their signatures and transcript.

Examples of completed acts

For clarity, below are completed samples of the transfer and reception of values of the MX-1 form.

Download a simple sample

simple act of acceptance and transfer of goods and materials

act of acceptance and transfer of goods and materials (form MX-1)

What is the essence of the form

This document is considered the primary documentation in accounting. The standard form of the form is not approved at the legislative level. Therefore, organizations compose it independently.

First of all, you need to make sure that officials on both sides have the authority to draw up this document.

The form is issued when someone starts working in a new position with a high level of responsibility for material assets.

The essence of this document is to draw up a contractual agreement that confirms the fact of transfer of property. The form also records that the valuables were transferred in a certain quantity.

The document can be used to formalize short-term transactions between individuals. and legal persons.

Many employers require their own employees to sign this document if this is consistent with their job responsibilities.

We invite you to familiarize yourself with: Sample donation agreement for an apartment to your son

The act of acceptance and transfer of goods, in fact, is considered a document that confirms the fact of the transfer and receipt of goods and materials.

This document protects the recipient if the product is defective. Using it, you can make a claim to the supplier about the condition of inventory items (defects, defects or other low-quality goods).

If the terms of the act are not observed, this entails criminal liability. If the case goes to court, the act is included in the evidence base.

Act of acceptance and transfer of material assets

Material assets are the main and important asset of the company. It is very important to organize clear control over inventory items in the company: this is ensured primarily by the preparation of documents.

For example, an act of acceptance of the transfer of material assets is drawn up.

Let's take a closer look at who, when and under what circumstances should draw up the act, whether there is a unified form of the act, and what the employer faces in its absence.

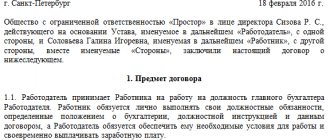

Form of the act of acceptance and transfer of material assets

The unified form of the form is not approved by law. Therefore, the company will have to develop the form itself.

Do not forget that the law establishes mandatory details that must be included in the primary document.

Thus, the form for the act of acceptance and transfer of material assets (and other documents), according to federal law, must contain the following details:

- document's name;

- the date the form was completed;

- the name of the company that compiled this document;

- content, the essence of a fact of economic life;

- the amount in which a fact of economic life is measured in physical or monetary terms (be sure to indicate the unit of measurement);

- the act of accepting the transfer of material assets must contain an indication of the positions of the persons between whom the transaction was made, the citizen who is responsible for its registration, or the name of the position of a citizen or several citizens responsible only for the registration of the accomplished event;

- personal signatures of all responsible persons with a transcript (indicating their surnames and initials or other details that allow the identification of these persons).

As an example of an act of acceptance of the transfer of material assets, you can use, for example, an act of acceptance and transfer of valuables for storage in form No. MX-1 or other documents. Unified forms can be supplemented with the necessary details or unnecessary ones can be removed. The developed form of the act must be consolidated in the company’s accounting policy.

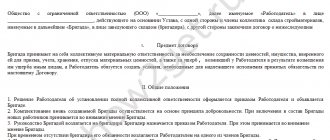

Act of acceptance of transfer of material assets upon dismissal

Financially responsible persons in a company may change or be absent for various reasons.

It must be remembered that the very concept of “material liability of an employee to the employer” means his obligation to compensate the employer for the actual damage caused.

Of course, an employee can be held liable, but, as a rule, employees bear limited liability (within the limits of average monthly earnings).

Therefore, the transfer of goods and materials when changing the MOL (materially responsible person) is necessarily accompanied by an inventory - that is, determining the real condition and quantity of material assets transferred under the responsibility of another employee.

This happens both in the event of dismissal of the responsible employee and in the event of his going on vacation. The transfer of goods and materials to the financially responsible person during inventory takes place with the participation of the “old” responsible employee and the “new” one - the one who will replace him.

The obligation to carry out an inventory in such cases does not depend on the taxation system applied.

If you do not correctly formalize the acceptance and transfer of inventory items, the employee’s liability statement (you will find a sample at the end of the article), the employer will have difficulty identifying the person at fault in the event of damage to property or its loss.

Yes, the agreement on full financial responsibility is also valid during the employee’s vacation; responsibility for the valuables continues to remain with him.

The transfer of fixed assets from one MOL to another must be formalized correctly, and this is not only in the interests of the employer, but also in the interests of the employee: if something happens during the employee’s vacation, he will be able to prove his absence and non-involvement in the loss. In this case, it will be very difficult for the employer to find and prove the involvement of the truly guilty person.

https://youtu.be/yD6lpq8wwp0

The employer must remember that in order to conclude an agreement with an employee on full financial responsibility, the employee’s position must be included in a special closed list approved by a special resolution of the Ministry of Labor dated December 31, 2002 No. 85. If the employee’s position is not indicated in the list, then it is impossible to conclude an agreement with him on full financial responsibility.

An act of financial responsibility (form), which will formalize the transfer of valuables from one employee to another employee, can be issued directly between financially responsible persons. To develop such a document, you can take, for example, the unified form No. OP-18 as a basis.

Inventory assets can also be transferred from one responsible person to another with the help of another party - directly the employing company, which in this case acts as an intermediary: the company takes the values back from the “old” responsible person and then gives them to the “new” one under responsibility. In this case, the act that formalizes the transfer of material assets is drawn up in at least two copies (one for the employer and one for the employee) and will confirm the transfer of property to the company and the absence of property claims against the employee who is resigning from the employing company. After this, in order to transfer the property to the “management” of the new MOL, 2 copies of the act for the transfer of valuables to the new financially responsible person are drawn up.

https://youtu.be/e7V8ywhkcp8

Inventory requirements

When a financially responsible person changes, the inventory is carried out with the participation of employees of the administrative apparatus, as well as employees of any divisions of the organization.

The absence of one of the commission members in the process of checking the safety of valuables is a reason for invalidating the audit results. It is also worth considering the need for the presence of a MOL.

The basis for convening the commission and organizing the inventory procedure is an order from management. To compile it, a single form INV-22 is used.

An order to change the financially responsible person can be found here.

To organize the audit, documents developed on the basis of methodological recommendations of the Ministry of Finance of the Russian Federation are used.

It is recommended to register the order in a special journal in the INV-23 , which will store information about the dates of all inventories performed.

The remaining documents reflecting the result of the audit are also drawn up on the basis of unified forms. These include:

- inventory of property INV-3;

- comparison inventory sheet INV-2b.

Form of the act of acceptance and transfer of material assets –

The acceptance certificate of inventory items (TMT) is written in a free form, in which all goods are scrupulously noted, displaying the quantity, valuation, parameters and defects. Today, existing legislation offers a unified template for the acceptance certificate of goods and materials. It is regulated by Resolution No. 66 of the State Statistics Committee of the Russian Federation dated August 9.

1999, which approved the form of the MX-1 form.

At the same time, each type of economic activity is documented in a primary accounting document, which is reflected in Article 9 of Law No. 402-FZ “On Accounting”. The provisions of the Law give institutions the right to draw up templates for primary accounting acts themselves.

In the life of enterprises, circumstances often arise when it is necessary to organize the transfer of products due to various reasons, for example, vacation, illness, business trip, dismissal of a financially responsible employee. This action must be documented in an acceptance certificate.

Why do you need an acceptance certificate for the transfer of goods and materials?

Let's consider under what circumstances an acceptance certificate is drawn up:

- Discrepancy in numbers and inventory parameters.

- Arrival of goods and materials without documents.

- Transfer of inventory items for safekeeping.

- Transfer of assets by agreement of the commission.

- Transfer of inventory items within an institution between departments or financially responsible employees.

- Transfer of inventory items into temporary storage.

- Title of the document.

- Date and place of completion.

- Information about the parties to the contract displaying details, addresses and contacts.

- Full names of responsible employees, details of their passports, powers of the represented parties.

- The contract number and the date of its signing, according to which the delivery is ensured.

- List of transferred goods and materials with display of quantity and price.

- Qualitative parameters of goods and materials.

- Final estimated amount.

- Presence/absence of product defects.

- List of identified discrepancies.

- Claims based on acceptance results.

The example document below can be used together with the acceptance certificate for storage (form MX-1).

Receipt of products against an invoice implies the possibility that the goods delivered do not correspond to the quantity displayed on the invoice. However, there are circumstances when the actual quantity of products does not coincide with the declared quantity.

To make a claim to the seller, it is necessary to reflect this circumstance in the acceptance certificate with recording of the identified discrepancies.

Acceptance of some types of goods and materials (for example, equipment) is carried out according to an act, since this is required by the procedure for its acceptance: inspection, determination of serviceability, etc. When sending inventory items for safekeeping, documents are drawn up describing the condition of inventory items, determining the conditions for their placement and appointing a materially responsible employee.

https://youtu.be/-CSj7srzAjE

When signing an agreement for the supply of goods, the parties can write into the agreement a clause on the need to draw up an act of acceptance of the products upon transfer to the buyer.

How to draw up an acceptance certificate of goods and materials

The acceptance certificate of goods and materials is usually attached to the supply contract and is considered an integral part of the agreement. The standard document structure includes the following information:

By agreement of the parties, other requirements may be displayed in the form, for example:

act

Who needs a simple sample act of acceptance of the transfer of material assets

The acceptance certificate, which states the fact of delivery of goods with violations, with quality claims, is the basis for filing a claim with the supplier with an offer to replace the product or provide monetary compensation for losses. The return of rejected goods to the supplier is carried out on the basis of a return certificate (form TORG-2) with a display of the reason for the return and a detailed display of the identified deficiencies.

If the cargo is lost or damaged during transportation, compensation for costs is carried out on the basis of an agreement, if such cases are provided for. Therefore, both parties need an act of acceptance and transfer of goods and materials.

Since the acceptance certificate is a mutual document, it must be signed by representatives of both parties (sender and recipient of the goods). Before starting the procedure for acceptance of goods and materials, it is required to check that there are representatives from each party with the appropriate authority to endorse the acceptance certificate.

Supporting documents of authority may be:

- Availability of a power of attorney signed by the management of the institution.

- Order to appoint a person with authority on behalf of the company

- A notarized document for an individual, on the contract side.

To document the fact of acceptance of goods under a contract, you must:

Inaccuracies, corrections and errors in acceptance documents are not permitted. If corrections are found in the acts, they must be rewritten before signing the documents.

Features of filling out the MX-1 form

In the previous section, we considered the situation when filling out the acceptance certificate was carried out during direct shipment of goods and materials from the supplier to the buyer at the warehouse of one of the representatives. However, there are circumstances where a third party is used in the shipping process.

At the same time, it turns into an interested representative. In such cases, papers for the transfer of goods and materials located in the warehouse of a third-party institution are written in three copies: for the seller, the recipient and the owner of the warehouse in which the goods are stored.

In addition, additional copies of documents may be needed by the road carrier, security agency, to ensure the integrity of the goods during transportation, etc. A separate situation is the transfer of cargo for storage.

Under such circumstances, the role of the acceptance certificate of goods and materials is a document filled out on the standard MX-1 form, signed by two parties: the owner of the goods and the receiving institution.

https://youtu.be/sE1rB3CyhmU

The basis for placing goods and materials in someone else's warehouse is an agreement of responsible storage, confirming the quantity of cargo being transferred and its price, the number of deliveries and various additional conditions.

If, under such circumstances, there is a consignment note for the cargo signed by representatives, then the legislation does not require the mandatory completion of the MX-1 form. At the same time, in the event of conflicting circumstances, the invoice has legal authority in court.

What is an acceptance certificate of goods and materials for storage (form MX-1 )? This is a primary accounting form filled out by representatives of the owner of the luggage and the custodian, both an institution and an independent businessman, on the basis of a contract for storage of products.

The template for the acceptance certificate of goods and materials for storage of MX-1 is regulated by Resolution of the State Statistics Committee of the Russian Federation dated August 9, 1999 No. 66.

According to the regulations, the MX-1 act can be used both for domestic storage of goods and for storage with the involvement of specialized organizations, which include banks, pawnshops, warehouses, hotels, as well as various commercial and non-commercial structures whose main activities , – ensuring storage of inventory items. A contract for the storage of inventory items with such companies is drawn up for a period specified in the agreement or “on demand”. Non-specialized custodians include institutions that store products free of charge.

Disputes that may arise during the acceptance and transfer of goods and materials for storage are regulated by Ch. 47 part 2 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation). Article 401 of the Civil Code of the Russian Federation (clause 1 of Article 901 of the Civil Code of the Russian Federation) states that the custodian company ensures full responsibility for goods and materials and, if the parameters of the goods deteriorate, is obliged to compensate the supplier for costs, unless otherwise reflected by the Law or agreement (Article 393, clause 1 Article 902 of the Civil Code of the Russian Federation).

The price of stored cargo for storage is indicated in column 8 of act MX-1 and is determined by agreement of the parties on the basis of a storage contract. The book price of inventory items of the institution sending the cargo for storage is not taken into account.

act of acceptance and transfer of material assets

Forms of the acceptance and transfer act can be downloaded from the following links: act (*.doc)Download form MX-1 (*.pdf)

Download form MX-1 (*.xls)

The act of acceptance of the transfer of material assets - a simple example

Inventory and materials, an act of acceptance and transfer of material assets, is a document (certificate) that confirms the transfer (transfer) of any valuable property compiled by an inventory in fact to another person (company, enterprise, etc.). This document may be supplemented by other certificates and documents that will secure the rights of the parties or determine the conditions of the parties to the agreement.

Why do you need an inventory transfer act?

This legal document is necessary and is drawn up to accurately record the transfer of transferred property and values, rights and obligations of the participants.

It is compiled upon complete or partial delivery and transfer of material (inventory) assets from one person to another. This is done in connection with a change in the responsible person, with a mandatory explanation of its quantity, value and name.

It may be necessary in case of sale, lease, pledge. Each organization can change the order, form and nature of the form in accordance with the necessary conditions.

It is made up upon complete or partial surrender and transfer of material (inventory) assets from one person to another. This is done in connection with a change in the person in charge, with a mandatory explanation of its quantity, cost and name.

It may be necessary in case of sale, lease, or mortgage.

Each organization can change the order, form and nature of the form in accordance with the necessary conditions.

The main points that a document on the acceptance and transfer of material assets should contain:

- title - title;

- full date of compilation, storage, approval;

- document serial number;

- place of its registration;

- detailed full details of the parties with names;

- Full name of the person responsible for compilation and the recipient to whom the MC (material value) is transferred, as well as information about the person donating;

- a complete identification list with complete data, units of measurement, names, quantity and cost of MC transferred for storage;

- list of additional documentation;

- conditions for storing material assets;

- signatures of all parties involved.

How to register and how long to store

It is more correct to transfer the purchased goods using the unified document TORG-12 - a unified form of consignment note. But if it is not possible to draw it up, and the terms of the contract allow or even insist on drawing up an act of transfer of material assets, then remember that it is the primary accounting document transferred to the accounting service.

- name and date of compilation;

- name of the organization and employee who compiles;

- content of the fact of economic life (what we convey, on what basis);

- units of measurement of transferred items, their quantity, price;

- job title, signature and transcript of the signature of the person receiving the goods and materials.

We invite you to familiarize yourself with the Vehicle Acceptance and Transfer Certificate sample free of charge.

It is drawn up in two copies, and then a copy is given to each of the parties to the transaction. Like other primary accounting documents, it is stored for five years after the reporting year.

Remember that such an act does not replace the contract, but is drawn up on its basis!