Accounting for the repair of fixed assets - accounting of the costs of restoring the operational characteristics of fixed assets (property). Fixed assets include: buildings, structures, machines, vehicles, tools, etc.

The organization's property can be partially restored through current (medium) repairs or completely through major repairs and reconstruction/modernization. Current repairs involve the replacement of functional parts of a fixed asset: parts, spare parts, mechanisms, etc. During a major overhaul, the technical indicators of the object in question change, which improves the production properties of the OS.

Cost accounting for each type is carried out differently. In order to avoid misunderstandings with the tax authorities regarding accounting for repairs of fixed assets, it is necessary to understand their differences. In the case of routine repairs, costs that are related in nature and are written off in the current period; in case of major repairs or reconstruction, expenses go towards increasing the value of the fixed asset (property).

The purpose of repairing fixed assets is to eliminate technical and functional faults, carry out planned preventive measures to prevent premature failure and maintain the performance of fixed assets.

To carry out repairs of a fixed asset, it is necessary to formulate a repair plan and calculate an estimate (costs by type of repair work). Completion of repair of a fixed asset - acceptance of a modernized or restored object for registration on the basis of an acceptance certificate for fixed assets.

How is repair different from reconstruction and modernization?

Since repairs, reconstruction and modernization are reflected differently in accounting and taxation, it is important to classify them correctly. The cost of restoration work does not matter to distinguish between such concepts. What matters here is the purpose for which such work is carried out (see table):

| Type of work | Target |

| Repair | Eliminate the malfunction that prevents the operation of the facility and restore functionality. At the same time, the properties of the object do not change (letter of the Ministry of Finance of Russia dated March 24, 2010 No. 03-03-06/4/29) |

| Modernization | Change the technological and service purpose of the object, improve some of the properties of the fixed asset. For example, in order to be able to work with it under increased loads (paragraph 2, paragraph 2, article 257 of the Tax Code of the Russian Federation) |

| Reconstruction | Rearrange the facility so that its capacity increases, the quality of products improves or its range becomes wider (paragraph 3, paragraph 2, article 257 of the Tax Code of the Russian Federation) |

To determine whether a property restoration is a renovation, renovation, or upgrade, refer to the following documents:

- Regulations on carrying out planned preventative repairs of industrial buildings and structures MDS 13-14.2000, approved by Decree of the USSR State Construction Committee dated December 29, 1973 No. 279;

- Departmental Construction Standards (VSN) No. 58-88 (R), approved by order of the State Committee for Architecture under the USSR State Construction Committee dated November 23, 1988 No. 312;

- by letter of the USSR Ministry of Finance dated May 29, 1984 No. 80.

This is stated in the letters of the Ministry of Finance of Russia dated March 24, 2010 No. 03-11-06/2/41, dated February 25, 2009 No. 03-03-06/1/87 and dated November 23, 2006 No. 03 -03-04/1/794.

Situation: can the work be considered a repair if, as a result, the characteristics of the fixed asset have improved? Before restoration, the main asset was faulty.

The answer to this question depends on the nature of the improvements.

In general, repairs are necessary precisely to restore the working condition of the property, and not to change its properties. If the characteristics of the fixed asset have improved, then the work may be considered reconstruction or modernization. That is why it is necessary to clearly define what the improvements are related to.

Work is recognized as repair work only if, as a result, properties change that are not related to the workload and technical and economic indicators of the object. In addition, it is important that such restoration does not affect the quality and range of products (works, services). Otherwise, the cost of restoration work will not meet the criteria for repair costs.

This conclusion follows from paragraph 2 of Article 257 of the Tax Code of the Russian Federation. A similar point of view is reflected in letters of the Ministry of Finance of Russia dated April 22, 2010 No. 03-03-06/1/289, dated December 29, 2009 No. 03-03-06/1/830, dated October 9, 2006 No. 03-03-04/4/156 and dated May 27, 2005 No. 03-03-01-04/4/67.

The courts share this position. Thus, if the work led to changes in the technical and economic indicators of the object and its purpose, then they cannot be considered repairs (see, for example, the determination of the Supreme Arbitration Court of the Russian Federation dated March 3, 2011 No. VAS-173/11).

By the way, there is an interesting position of the courts on replacing faulty parts of an object with more advanced or powerful ones. According to the arbitrators, this is not modernization. The main thing is that as a result of such a replacement, the technological or production purpose of the facility does not change. Even if performance characteristics improve, the costs of replacing faulty components and assemblies are recognized as repair costs. This position, for example, is expressed in resolutions of the Federal Antimonopoly Service of the Central District of February 9, 2010 No. A14-14803/2008/500/24, of the North-Western District of August 21, 2007 No. A56-20587/2006, of the Moscow District of August 14 2006 No. KA-A40/7489-06, Ural District dated June 7, 2006 No. F09-4680/06-S7).

Types of repairs

Repairs are classified as follows. Depending on who is doing the work: it can be repaired on its own (self-employed) or with the involvement of a contractor. And depending on the frequency and complexity, repairs can be current or major.

The first division is clear. And let's look at the second one in more detail. Typically, routine maintenance is the maintenance of fixed assets to keep facilities in working order. Major repairs involve replacing basic elements, parts, structures, etc.

You can determine which specific repairs are considered current and which major ones. In this case, you need to focus on documents developed by internal technical services (letter of the Ministry of Finance of Russia dated January 14, 2004 No. 16-00-14/10).

What documents need to be used to justify the need for repairs?

The need for repairs can be confirmed by a report on identified faults and defects of the fixed asset, or a defect sheet. For some industries, standardized forms of such documents are provided. For example, defects in the handling and transport equipment of sea trade ports can be documented using a defect sheet, which was approved by Decree of the Ministry of Transport of Russia dated January 9, 2004 No. 2. Defects in the main elements of pipelines of thermal power plants are reflected in the sheet of pipeline defects (approved by Decree of the State Mining and Technical Supervision of Russia dated June 18, 2003 No. 94).

If there is no unified form of a document confirming the detected defects, then you can develop a form yourself. For example, an act on identified faults (defects) of a fixed asset item. The main thing is that this form contains all the required details. The report indicates the faults of the fixed asset and proposals for their elimination.

How many copies of the report on identified faults, defects of fixed assets or statements should be prepared? It all depends on who owns the property and who will do the repairs:

- if you repair your own property using your own means, that is, on your own, then one copy “for yourself” will be enough;

- when the work will be performed by contractors, draw up a document according to the number of participants. Representatives of all parties involved must sign each copy.

If you are repairing new equipment, the defects of which were identified during installation, then you need to record them in a report on the detected equipment defects. For example, according to form No. OS-16. This should be done in relation to objects that have not yet been registered as fixed assets.

Results

OS overhaul is a step-by-step production process, each stage of which requires proper documentation.

When carrying out repair activities, it is important to justify the need for repairs, properly hand over and accept the object from repair and timely reflect the operations in accounting. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

How to register the transfer of a fixed asset for repairs

Document the transfer of the object for repair. This will not have to be done only when the main asset is being repaired on site. This procedure follows from the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

When you transfer a fixed asset for repair to a special division of the organization, draw up an invoice for internal movement, for example, according to form No. OS-2.

If the repairs are carried out by a third-party organization with which a contract has been concluded, then the transfer of the object for repair is formalized, for example, with an act of acceptance and transfer of the object for repair. It can be compiled in any form. If the contractor suddenly loses or damages a fixed asset, the signed act will allow him to demand compensation for losses. If there is no act, then it will be difficult to prove the transfer of fixed assets to the contractor, as well as to demand compensation. This follows from articles 15, 702 and 714 of the Civil Code of the Russian Federation.

Nuances of accounting for OS repairs

The specifics of accounting for the costs of repairing fixed assets must be reflected in the accounting policies of a particular enterprise and are formalized by an appropriate order. As a rule, these funds are included in the costs of production or circulation, for which one of the ways is chosen.

- Actual expenses are included in distribution costs. This method is used mainly for current repairs: expenses are written off in the same period in which they were incurred.

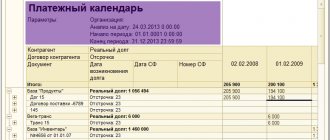

- A special repair financial reserve is created. The organization chooses the procedure for accruing reserve funds in relation to the special limits established in internal regulations for such deductions, the size of which depends on the group of fixed assets.

- Attributing repair costs to deferred expenses so that they can be written off evenly later. This method is more convenient if large-scale repair work is to be carried out, and a fund or reserve for this has not been created. If you write off a large amount for these expenses at once, the reflection of the cost of work will be disrupted.

What documents should I use to formalize the acceptance of a restored fixed asset?

Acceptance of the repaired object is formalized by a special act. For example, according to form No. OS-3. It is filled out regardless of whether the repairs were carried out internally or by contract. Only in the first case do they fill out the form in one copy, and in the second - in two (for themselves and for contractors).

The act is signed by:

- members of the selection committee created by the owner of the property;

- an employee responsible for the repair of fixed assets or a representative of the contractor;

- employee responsible for the safety of fixed assets after repairs.

After this, the act is approved by the head. Next, the document is handed over to the accountant.

After receiving the report, reflect the information about the repairs carried out in the inventory card for recording the fixed asset or in the inventory book (intended for small businesses). To do this, you can use standard forms No. OS-6, No. OS-6a or No. OS-6b. This is stated in the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

When accepting buildings, structures or premises after construction and installation work, additional paperwork must be completed. Namely, the acceptance certificate in form No. KS-2 and a certificate of the cost of work performed and expenses in form No. KS-3. These forms were approved by Decree of the State Statistics Committee of Russia dated November 11, 1999 No. 100.

By the way, if parts were changed during the repair process, then you will need to draw up an act for replacing spare parts of the fixed asset. There is no standard form for such a document, so it can be drawn up in any form (Part 1, Article 9 of Law No. 402-FZ of December 6, 2011).

Advice : to simplify document flow, acts on the replacement of spare parts in fixed assets can be drawn up at the end of the month for each performer of work.

Situation: is it necessary to draw up an act of acceptance and delivery of a fixed asset during self-repair, for example, according to form No. OS-3?

Answer: no, it is not necessary if the main asset was not transferred to other departments during repairs.

This is explained by the fact that it is necessary to draw up acceptance certificates only when moving fixed assets from the customer to the contractor and vice versa. For example, if the object was transferred for repair to a contractor or to the organization’s repair service.

If, during repairs, the location of the object does not change, when the repairs are carried out directly “on the spot,” then acceptance and transfer of the fixed asset does not occur.

Situation: is it necessary to indicate in the act in form No. OS-3 the cost of materials used by the contractor to repair the fixed asset? The organization handed over spare parts to the contractor for repairs.

Answer: no, it is not necessary.

Form No. OS-3 is used for the acceptance and delivery of fixed assets from repairs (instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7). Section 2 indicates the contractual cost of repairs. And the contractor must indicate the composition and cost of spare parts for the repair of fixed assets in the report on the materials consumed (Article 713 of the Civil Code of the Russian Federation).

DESCRIPTION OF THE PROBLEM

Enterprises of the machine-building complex incur significant costs associated with the overhaul of fixed assets. Timely repairs are one of the conditions for the normal functioning of a fixed asset facility. With a one-time write-off of the costs of major repairs to the cost of production, the enterprise is faced with the problem of a sharp increase in the costs of the current period. However, the fact of repairs, other things being equal, cannot be considered as an objective reason for the increase in the cost of products produced during the period of these activities, since these costs determine the receipt of economic benefits over a certain period in the future.

PBU 6/01 “Accounting for Fixed Assets” does not regulate the procedure for accounting for expenses for capital repairs of equipment: in accordance with paragraph 27 of PBU 6/01, costs for the restoration of fixed assets are reflected in the accounting records of the reporting period to which they relate. However, this document does not regulate approaches to the classification of these expenses - capital or current.

In domestic accounting practice, these expenses are included in the cost of finished products during the period of their implementation. This approach is traditional. In addition, in accordance with the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n, expenses for repairs, technical inspections and maintenance of fixed assets in working condition are subject to reflection as part of production costs.

On the other hand, expenses for major repairs made by organizations with a frequency of more than a year and being significant in cost meet the criterion for recognizing an asset, since they determine the flow of economic benefits to the organization during the period until the next major repair and technical inspection (clause 65 of the Regulations on Maintenance accounting and financial statements in the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n, clause 19 PBU 10/99).

In accordance with paragraph 2 of PBU 21/2008 “Change in estimated values,” a change in the estimated value is recognized as an adjustment to the value of an asset (liability) or a value reflecting the repayment of the value of an asset, due to the emergence of new information, which is made based on an assessment of the current state of affairs in the organization, expected future benefits and liabilities and is not a correction of an error in the financial statements.

Thus, if the period for writing off expenses for major repairs as expenses was determined incorrectly, it is subject to clarification, and the remaining amount of expenses or the amount of expenses to be written off as expenses is subject to adjustment.