What are excise taxes on cigarettes and why are they necessary?

Tobacco products are included in the group of goods that are subject to an additional indirect tax - excise tax. The tax is included in the total cost of goods and the buyer, when purchasing cigarettes or tobacco, simultaneously pays the cost of the excise tax.

For the first time, excise taxes on tobacco products were established in 2012. According to the definition specified in the Tax Code, an excise tax is an additional tax on goods and services that are in demand among buyers.

The state explains the need for this tax for several reasons:

- funds go to state revenue, thereby replenishing the federal budget;

- taxes are subsequently used to invest funds in the production of products to improve quality characteristics;

- excise taxes are considered an effective measure of influence on citizens who are addicted to smoking.

Excise taxes are imposed on goods sold by the manufacturer, confiscated by a court decision and exported within the Russian Federation. Payment must be made by legal entities - companies and individual entrepreneurs, as well as persons transporting goods. Wholesalers are exempt from paying excise duty.

Get 267 video lessons on 1C for free:

Excise tax rate on cigarettes and tobacco products

Bets can be of three types:

- specific, that is, fixed per unit of product;

- ad valorem, that is, common for the entire territory of the Russian Federation, in the form of a percentage of the total volume of production;

- There is also a combined bet, which includes features of both bets.

A complete list of excisable products, including tobacco and cigarettes, is given in Art. 193 Tax Code of the Russian Federation. The exception is the raw materials that are used for the direct manufacture of these products.

As an example, consider the rates that began to apply in January 2020:

| Name of product | Excise tax rate |

| cigars | 171 rub. for 1 piece |

| 4800 rub. for 1 kg. | |

| cigarillos, bidis | 2428 rub. for 1000 pcs. |

| 40 rub. for 1 piece | |

| 10 rub. for 1 piece | |

| cigarettes and cigarettes | 1562 rub. for 1000 pieces and an additional 14.5% of the cost based on the maximum retail price, but not less than 2123 rubles. for 1000 pcs. |

| 2520 rub. for 1 kg |

As can be seen from the table, cigars and tobacco are considered the most expensive goods. Cigarettes and cigarettes are less expensive products.

Forecast for increasing excise taxes on cigarettes in future periods

The issue of raising rates for future years is already being considered. While the planned figures are known, it is likely that excise tax rates will indeed be increased to this level.

For comparison, here are the forecast data for 2018-2019 on increasing excise taxes on tobacco products:

| Name of product | Excise tax rate in 2020 | Excise tax rate in 2020 |

| tobacco or tobacco products intended for smoking by heating | 5280 rub. for 1 kg | 5808 rub. for 1 kg |

| electronic nicotine systems | 44 rub. for 1 piece | 48 rub. for 1 piece |

| electronic fluid | 11 rub. for 1 piece | 12 rub. for 1 piece |

| cigarettes and cigarettes | 1718 rub. for 1000 pieces + 14.5% of the estimated cost, but not less than 2335 rubles. for 1000 pcs. | 1890 rub. for 1000 pieces + 14.5% of the estimated cost, but not less than 2568 rubles. for 1000 pcs. |

| chewing tobacco, smoking tobacco, pipe tobacco and other varieties | 2772 rub. for 1 kg | 3050 rub. for 1 kg |

Additionally, it is worth noting that, according to the Russian Ministry of Finance, the average cost of a pack of cigarettes in retail trade will increase by 10% in 2017 and by more than 27% over the next three years.

The State Duma has long been considering the issue of raising tobacco prices. Previously, increases in alcoholic beverages and fuel were repeatedly made; now the excise tax on cigarettes is expected to be raised in 2020.

Excise tax on cigarettes 2018-2019: tobacco excise stamp, responsibility, cost, calculation

Five years ago, a cheap pack of cigarettes cost 28 rubles, and an expensive one did not exceed 73 rubles. Today the average cost of one pack is 110 rubles. The price of nicotine increases every year due to an increase in indirect tax. Excise taxes on tobacco increased by 10 percent in 2020. There was a similar increase in 2020.

An increase in the tax burden of 10-15% has been in effect annually since 2013. The excise tax on cigarettes was introduced by the state in conjunction with a ban on smoking in public places and the fight against nicotine addiction of citizens throughout the country.

According to WHO (World Health Organization) research, a 10% increase in tax provokes a 5% decrease in nicotine consumption.

Excise goods of tobacco products

The tax does not only apply to filter cigarettes. The excise duty applies to types of tobacco, electronic smoking devices and smoking liquids. Tobacco for which tax is paid:

- Snuff.

- Chewing.

- Tubular.

- Smoking.

- Hookah bar.

- Cigarette.

- For cigarettes (with and without filter).

Manufacturers buy excise stamps for tobacco products at the stage of sales to retail chains. Tobacco as a raw material is not subject to tax burden. Electronic devices for permanent use and disposable items, together with nicotine liquids, have been subject to the law since 2020. At the moment when they began to be popular among smokers and young people.

The tax is established to replenish the budget from products sold that are not included in the list of necessary items for human life. Nicotine ruins people's health, and this fact is taken into account when determining government contributions. An indirect tax helps track the volume of nicotine products sold and observe annual sales dynamics.

Excise tax rates on cigarettes

Tariffs for contributions to the budget for tobacco and smoking products are established by current legislation. They are accepted and put into operation by the Government of the country.

Rates are updated annually and come into force on January 1 of the current year. Some tariffs are increased twice a year, some once, and some once every one and a half to two years.

Trade in tobacco products is less likely to remain without an increase.

Excise tax on tobacco products 2020:

- All varieties of tobacco at a price of 2,772 rubles per kilogram.

- One cigar 188 rubles.

- For a thousand cigarillos, kretek and bidis 2,671 rubles.

- Per kilogram of heating tobacco is 5,280 rubles.

- One smoking electronic device 44 rubles.

- Liquid refill for an electronic device for 11 rubles per milliliter.

- For a thousand cigarettes and cigarettes from January 1, 1,562 rubles, and from July 1, 1,718 rubles. With an interest rate of 14.5 calculated value. This type of excise tax is calculated at two rates simultaneously (flat and ad valorem).

The excise tax on cigarettes in Russia did not increase twice in 2020. The tax did not increase for a year and a half; the increase occurred only in the second half of the year. The rate has remained unchanged since January 2020.

Tariffs 2020:

- Ready-to-use varieties of tobacco: 3,050 rubles per kilo.

- One cigar 207 rubles.

- A thousand cigarillos, bidis and kretek 2,938 rubles.

- A kilogram of heating tobacco is 5,808 rubles.

- For one electronic smoking device 48 rubles.

- Smoking liquids for electronic devices: 12 rubles per milliliter.

- A thousand cigarettes and cigarettes are 1890 rubles and 14.5% of the estimated cost.

The increase in tariffs on nicotine products was 10 percentage points. The rate for electronic devices and liquids for them increased by 9%. The tax is not directly related to the pricing of tobacco products. However, an increase in rates entails an increase in prices in retail chains.

Excise stamp on cigarettes

The excise stamp for cigarettes is printed at the Goznak factory. It is needed for labeling tobacco products imported into the country and produced in the Russian Federation. An excise stamp with the name of the product is affixed to foreign goods, and a special one is affixed to products containing nicotine produced in Russia. The brand confirms the authenticity of the product through security features.

Excise stamps are printed on paper with a two-tone watermark. Indicating the country (Russia), coat of arms and signature excise stamp. The paper is permeated with two types of security fibers.

Chemical protection is applied that changes color in ultraviolet rays. The name of the product matches the contents of the package and the quantity or weight of the products.

The stamp contains an encapsulated phosphor - a reflective surface.

Special stamps are equipped with the same protective marks. They differ from excise taxes by the inscriptions Russian Federation, Tobacco products, Special stamp. A light watermark of one tone is printed. Not illuminated by ultraviolet light. The rank and number on the stamp are unique and never duplicated.

When comparing the listed protective characteristics when purchasing tobacco, remember how to check cigarettes for authenticity using the excise stamp.

A special device has been developed that helps verify the authenticity of the brand. Organizations use it when checking tobacco products. It's called Cassida Easy Check. Reads the presence of phosphor. When you point at the mark, it detects a protective element, the green indicator lights up and the sound signal turns on. If the indicator remains red, the stamp is fake.

Responsibility for the sale of cigarettes without excise duty

The law punishes the sale of cigarettes without excise tax. Responsibility for such a violation is determined by law enforcement agencies. This is an administrative or criminal penalty. An administrative fine is imposed on both sellers and companies that sell tobacco worth less than 100 thousand rubles. The organization will be charged up to 50 thousand rubles, and the seller up to 5 thousand.

https://youtu.be/SkVfkeedLDM

If a company or seller deliberately sells tobacco products worth more than 1 million rubles, criminal liability arises. The penalty for violating the law is up to 6 years in prison. Or a fine of up to 800 thousand rubles.

Procedure for paying excise tax

Contributions to the budget from nicotine products are paid by manufacturers, importers and distributors. Each taxpayer generates a tax return based on the quantity of goods handled during the reporting month. Payment must be made by the 25th of the next month. For manufacturers at the place of production of products.

The manufacturer pays tax based on the fact of transfer of products to another division or sale to a retail chain. Reports to the tax authority every month on transactions carried out with excisable tobacco products.

The importer carries out an excisable transaction of importing tobacco and the customs declaration is a report on the date of the transaction. This reporting act contains information about the quantity of excise goods on which tax is paid. If transactions occur monthly, the excise tax is paid every month. In one payment, because advance excise payments are not established for the importer.

For tobacco sellers, the reporting system includes an act of acceptance and transfer of tobacco products. Based on this, the distributor calculates the excise duty on a monthly basis. The seller purchases nicotine products from manufacturers or importers. Pays the tax, observing the accepted deadline, until the 25th of the next month.

Excise tax increase expected

As always, the New Year brings a lot of surprises to tobacco and alcohol consumers. The increase in excise tax on cigarettes in 2020 will affect the end buyer. There are about millions of smokers in the country, and it is at their expense that the state treasury will be replenished.

Tobacco prices will increase by at least 10%. Experts believe that increasing the excise tax on cigarettes will not be considered the most justified means of replenishing the budget.

Russians will not quit smoking; they will reduce expenses on purchasing other goods, for example, clothing, shoes, and food products. This will mean that the Russian budget will be replenished as experts have calculated.

Tax on “extra meters” of an apartment and rising prices for cigarettes: what “surprises” await Ukrainians

For more information about when and what taxes Ukrainians must pay from July 1, see the OBOZREVATEL material.

Property tax

From July 1, Ukrainians are required to pay taxes on their real estate if its area is larger than the “norm”. The amount of tax is determined by local authorities. The law limits them to a maximum rate of 1.5% of the minimum wage for each “extra” square meter. By decision of the city or village council, instead of 1.5%, they can, for example, charge 1% of the minimum wage.

It is also important to note that the minimum wage is taken into account as of January 1 of last year. Then the minimum wage was 3,723 UAH. That is, you will have to pay 37.2 UAH per square. So, for an apartment with an area of 100 square meters you will have to pay a tax of 1,488 UAH.

The tax is paid by Ukrainians who own houses and apartments with an area of 60 and 120 square meters. However, as in the case of rates, local authorities have the right to increase the rate. For example, collect tax only on apartments with an area of 80 square meters or more. But it’s impossible to reduce it to 50. Those who own luxury real estate will have to pay many times more. So, for an apartment of 300 sq. m and a house of 600 sq. m, in addition to the tax itself, you will also have to make a one-time payment of 25 thousand UAH. Moreover, they will count not only from the “extra” squares, but from the entire area.

Increased excise tax on cigarettes

In Ukraine, after July 1, a pack of cigarettes will rise in price by 2.2 UAH. Once stores run out of the old stock, smokers will have to pay significantly more for their bad habit.

Thus, cigarettes are becoming more expensive primarily due to an increase in excise tax. In most EU countries a pack costs about 5 euros. Ukrainians can still buy cigarettes for 1.2-1.5 euros. The Verkhovna Rada has committed itself to equalizing prices over time (until 2024).

As a result, the excise tax is increased annually by 20%. And this year it will be additionally raised to last year’s inflation level (9%). To understand how this will be reflected in the price, you first need to understand how much smokers pay for excise tax.

For example, at the end of last year, for every 1,000 cigarettes, suppliers had to pay UAH 577.98 in excise tax. This is approximately 11.5 UAH for each pack. Not all manufacturers adhere to this norm, but on average the share of excise tax should be about 60% of the total cost of the pack. Moreover, the Ministry of Finance even plans to oblige the market to strictly adhere to these proportions.

So, last year, taking into account this dependence, the minimum price for a pack of cigarettes should have been 19.1 UAH. In January, the excise tax was increased to UAH 693.5 (UAH 13.8 per pack), and from July 1 it will increase to UAH 756, or UAH 15.12 per pack.

Thus, the minimum price at the moment should be about 23 UAH, and from July 1 - 25.2 UAH. However, it is worth considering that for now there is no clear requirement for the share of excise tax in the total cost. Therefore, in Ukraine you can find cigarettes for less than 20 UAH. For example, the cheapest pack of “Kyiv” can be bought for 19.9 UAH.

New taxes on parcels

Until July 1, 2019, if the cost of the goods did not exceed 150 euros, there was no need to pay value added tax. This, the relevant parliamentary committee is confident, has created the opportunity for enterprising Ukrainians to engage in imports without paying VAT.

Only 1.4% of parcels have a declared value of 150 euros or more. At the same time, goods from the USA, EU countries, and China can be purchased on large Ukrainian online platforms and online stores. In fact, sellers earn on their markup, but do not pay VAT to the state.

To correct the situation, last year, when adopting the budget for 2019, parliamentarians considered two new norms. Firstly, you can only send three parcels per month. Secondly, if previously the value at which you did not have to pay tax was 150 euros, from July 1 - 100 euros.

Let us remind you that Zelensky abolished the fines with which tax authorities had been “a nightmare” for business for 26 years.

How much will cigarettes cost?

Of course, an increase in excise tax will also lead to an increase in the price of a pack of cigarettes. As predicted by the Ministry of Internal Affairs, the cost of a pack will be two hundred and twenty rubles. By increasing the excise tax rate to around 14.5%, it will come out to about 2,123 rubles. per thousand pieces, as a result, prices per pack will skyrocket.

At the moment, the price of cigarettes is around ninety rubles. This is based on the calculation of 1,680 per thousand pieces, as it was before 2019. The director of the largest tobacco corporation BAT emphasizes that consumers will face the biggest increase in cigarette prices in the new year.

The government revised excise taxes several times, and as a result, the established and ad valorem parts of the excise tax were increased, and the increase exceeded 30%. Due to taxes on tobacco, the cost of one pack will increase by approximately 14 rubles.

The Ministry of Finance claims that the excise tax on cigarettes in Russia in 2020 will be raised at the level of inflation and will be 10%, and by 2019 the increase is expected to be 27%. As experts predict, in 2019 a pack of cigarettes will cost on average 113-115 rubles.

An increase in tobacco prices will entail a flow of illegal products that will flow into Russia from the CIS countries. Belarusian cigarettes are already being sold illegally. In the countries of the Customs Union, cigarettes are sold 30% lower than in Russia.

At the moment, the volume of illegal products on the Russian market is 2%. But in 2020 it could increase significantly.

“Where there are money, there are cops”

In Apraksin Dvor, between the rows of trays filled with goods from China and neighboring countries, you can easily find numerous folding tables with blocks of cigarettes. The cheapest cigarettes are Belarusian. They refuse to sell them one pack at a time; you can only buy a block if you are an ordinary smoker, or several boxes if you are a small trader.

DP correspondents came up with a legend: there are plans to open a small point of sale of illegal cigarettes in the suburb of St. Petersburg, Sestroretsk, not far from the Tarkhovka station. Nearby there is Lenin's Hut, dachas and gardening, a bay and a beach, so there is a large flow of people, and the area has not yet been covered by merchants.

- Where do you say you will open it? — a dealer in illegal cigarettes at the Apraksin market asked a DP correspondent. — Tarkhovka, Sestroretsk. “Ah, a normal place, come in,” the merchant nodded approvingly. He spoke Russian poorly, but when he heard the words “buy” and “many,” he called a colleague named Azik for help. — Can I look at the product? — DP correspondents asked. “There’s a lot of everything,” the interlocutor pointed to the endless racks on which there were blocks either with Belarusian excise taxes or without them at all. - These are Belarusian, judging by excise taxes. And these? - These? These are without excise taxes. Also Belarusian. — Do you have a point closer to Sestroretsk? — There is one at Pionerskaya, there is one at Prosveshcheniya, there is one at Ozerki, there are metro stations “Narvskaya”, “Kirovskaya”, “Veteranov”, “Baltiyskaya”. Everything from here goes point by point. — How much do they usually charge? — There are those who take two boxes a day. This is 150 blocks. From 50 thousand rubles. The topic is normal. “I understand that there are good grandmothers here.” But where there are money, there are cops... - You can negotiate with the cops. They will come to you themselves. At the metro they pay about 30 thousand rubles. Per month. The metro has good prices, good trade, that’s why they pay so much. — Do you have a contact person who could help? - No, they just come on their own. — Doesn’t it happen that different people come twice? - No, you negotiate with one person, take his number. Another one comes, you call the first one, and they come to an agreement among themselves. Are you local? - Yes, locals. - Oh, well then you can easily agree. — Do you think we won’t have competition if something else opens in Sestroretsk? - No. You will come to an agreement with the cops. You immediately agree that only you will work. And what will you pay? - And who comes to you here, what kind of cops? - 27th department.

https://youtu.be/8f9wPoZ7pgA

At the next stall, seller Ruslan said that he controls two retail outlets at the Apraksin market, and also willingly agreed to cooperate.

— Do you need a very large batch? - Very big. Belarusian: “Fest”, “Optima”. — How many blocks do you need? - What if we want to order many boxes? How should we negotiate? We were told that we should definitely look here. — Cigarettes are delivered by truck to Salova. For large quantities, go to Salova, 52. We take it from there. - And just like that, come up and talk there? - Yes, sure.

Almost all traders at the Apraksin market sent DP correspondents to pick up a large batch of illegal cigarettes. There is a large wholesale market there. On it, as on Aprashka, you can see many trays of cigarettes without excise taxes.

There, DP correspondents met a man named Emin, whom local sellers presented as the head of the supply of smuggled cigarettes from Belarus. Emin confirmed that there is a large warehouse on the territory of the market and assured that he would sell the necessary products in any volume without any problems. He immediately shared the price list for the stamps he sells.

In addition, “DP” decided to see how the second link in this chain lives - traders who buy cigarettes on Salova or in Apraksin Dvor and then sell them in the areas where they themselves have settled. “DP” had at its disposal the telephone number of one of the sellers of smuggled cigarettes named Azar. He is responsible for trade in the area of the Narvskaya metro station. Azar, like all the other traders, agreed to sell a batch of illegal cigarettes without any problems.

At the exit from the Narvskaya metro station, the DP correspondent was met by Azar’s two nephews, selling blocks of cigarettes individually from trays. Azar himself, a little further away, sells smuggled cigarettes in boxes to wholesalers. He willingly told DP correspondents about the intricacies of the black market.

— Where will you stand in Sestroretsk? — At Shalash Lenin somewhere and where the train stops at Tarkhovka station. - Where there is an electric train, you can stand there. And where the hut is - it’s not worth it. Traffic there is bad. Listen to me. If you want to work and make a financial situation, I will help you. You need a larger assortment. If you buy four blocks of one type, you will stand, excuse the expression, like a piece of wood. You see what different, different cigarettes there are. The Russian ones are doing better than the Belarusian ones. But I don't know what your financial situation is. — How much do you need to spend to start successfully? What kind of money should I come with? - What do you need? Revenue? So that this is your income? We have a range of almost 94 brands. Now some are gone. You should have at least 40-45 types of stamps. If you constantly work with me, then Russian ones will cost you 40-42 rubles. I don’t have any Belarusian ones right now. - Why? - This is smuggling. Or do you think they took him for his beautiful eyes and transported him? No, Russia has its own factories. St. Petersburg has its own factories. — You say that it is possible to purchase from you. What is the difference compared to Aprashka? - If you work with me, I’ll give you a discount. I have regular clients. And it makes no difference to me whether you are Russian or Azerbaijani: if you want to earn money, I will help you. You will choose where it is cheaper. -Where do you buy? - You won't find this. - Aren’t you going to tell me a secret? - A man brings it to me. In boxes. - Where? From Belarus? - Yes. There are also fake cigarettes. Not only me, no one will tell you. They don't want to communicate with anyone. I advise you to make a small showcase first. And then it will go. Cigarettes are generally great in Vyborg. — In Vyborg? Is it possible to buy there? - You can sell it there. There is nothing like it there, you have to buy it here. And the Finns come there. The Finns buy because their cartons of cigarettes are expensive. But I’m telling you right away, there are a lot of problems with this. The cops are approaching. We need to negotiate.

Likely consequences of increasing tobacco excise taxes

First of all, increasing the excise tax on cigarettes will affect consumers. In Russia, about 60% of smokers choose economy-class cigarettes, so counterfeit products from Belarus and Kazakhstan will be an excellent alternative to Russian cigarettes.

Oddly enough, according to statistics, more than 80 percent of tobacco product consumers are people of middle and low income. Increasing the excise tax could not only lead to a significant increase in the cost of a pack of cigarettes, but also disrupt tax revenues, according to representatives of the largest tobacco factories.

Neighboring countries did not raise excise tax prices as rapidly as in Russia. And the prices for tobacco products in neighboring countries are surprising:

- Belarus – 60 rub.

- Kazakhstan – rub.

- Kyrgyzstan – 37 rubles.

- In Russia, the price until 2020 is 90 rubles.

Considering that currently a smoker spends 15 percent of his income on cigarettes, and very low-income buyers spend about a percent, this will push smokers to purchase cheaper products.

The Ministry of Finance comments that the increase in excise taxes on cigarettes in 2020 will not provoke a large increase in illegal cigarettes. Nevertheless, the Ministry of Internal Affairs will exercise increased control in border areas.

The increase in excise tax on tobacco is under the control of the Ministry of Finance and will be accompanied by a gradual increase over three years.

The gradual increase in prices will not hit the consumer's pockets too much and will be based on inflation. In 2020, the increase will be 10 percent, and then until 2020, the total increase for tobacco will be around 27 percent.

As you can see, expert opinions vary greatly. What Russians can expect after the excise tax on tobacco is raised remains to be seen.

However, judging by past increases, in 2020 the state received about 338 billion rubles. Experts predict that 2020 will greatly replenish the state treasury. This could be more than 500 billion rubles due to an increase in excise tax.

At the moment, the Russian Federation receives very little taxes from the tobacco industry, so an increase in the excise tax will significantly replenish the budget. The Ministry of Finance expects to receive exactly as much as planned. Therefore, the services of the Ministry of Internal Affairs will not sleep, and any illegal penetration of tobacco products into Russian markets will be strictly punished.

Information on how strongly excise tax rates on a number of goods will be indexed is contained in the materials for the government meeting, at which on Monday, September 18, the draft budget for the next three years was considered - from 2020 to 2020 (the document is available to Gazeta.Ru ). In particular, it talks about how these initiatives will affect federal budget revenues.

Top up your budget

According to the document, the increase in excise taxes on cigarettes and cigarettes will bring 20.816 billion rubles to the budget in 2020, 60.496 billion rubles in 2020, and 17.706 billion rubles in 2020.

Changes in excise tax rates on gasoline and diesel will allow the budget to receive an additional 25.267 billion rubles in 2018, 19.114 billion rubles in 2020, and 1.086 billion rubles in 2020.

Indexation of rates on ethyl and non-ethyl alcohol from food or non-food raw materials, among other factors (here the column also summarizes the impact of changes in excise taxes on alcohol products with a volume fraction of ethyl alcohol over 9%, standards for the distribution of excise taxes on petroleum products between regional budgets, etc. - "Gazeta.Ru") will give the budget 31.876 billion rubles in 2020. True, in 2020 the budget will miss 3.220 billion rubles, but already in 2020 an additional 18.564 billion rubles will be collected.

“The federal budget revenues projected for 2020 will exceed the revised estimate of revenue receipts for 2020 by 544.4 billion rubles,” the document notes. At the same time, in 2020 the budget will receive 366 billion rubles more than predicted, and in 2020 - by 732 billion rubles.

In general, as stated in the document, projected budget revenues in 2020 will amount to 15.182 trillion rubles, in 2020 - 15.548 trillion rubles, in 2020 - 16.280 trillion rubles.

Replenishment of the federal budget will affect the lives of ordinary Russians. The cost of gasoline, alcohol, and tobacco products will increase.

Smoking is more expensive for yourself

Thus, according to the materials for the government meeting, with regard to tobacco products, it is planned to establish a specific excise tax rate on cigarettes and cigarettes in the amount of 1,718 rubles per 1,000 pieces from July 1, 2020, and from January 1, 2020 - 1,966 rubles per 1,000 pieces.

Currently, the excise tax rate is 1,500 rubles per 1 thousand pieces.

It is also envisaged to establish a minimum specific rate for cigarettes and cigarettes from July 1, 2020 in the amount of 2,335 rubles. for 1000 pieces and from January 1, 2020 in the amount of 2,671 rubles. for 1000 pieces. Currently it is 2100 rubles.

Due to an increase in excise taxes, a pack of cigarettes may rise in price by 10% by 2020, estimates Finam Group analyst Alexey Korenev.

However, some in the tobacco industry believe that cigarette prices may rise by 10% as early as 2020.

In 2020, cigarettes in the low-price segment will rise in price by 10-12%, and cigarettes in the premium segment by 7%, Imperial Tobacco believes (the share of excise tax in the lower segment can exceed 60%, in the high segment it is about 40%).

The increase in the cost of this category of goods is in line with the policies pursued by the government. The strategy for promoting a healthy lifestyle (HLS) from the Ministry of Health states that health problems among Russians are mainly associated with bad habits, such as smoking and drinking alcohol. At the same time, it is because of smoking that 20% of Russians are exposed to health risks, the department notes.

Drink until 2020

An increase in excise taxes on alcohol products is planned only from 2020. From January 1, 2020, the specific rate for alcoholic products with a volume fraction of ethyl alcohol over 9% will be set at 544 rubles per 1 liter. Currently it is 523 rubles per liter. For products with a share of ethyl alcohol below 9%, from January 1, 2020, a rate of 435 rubles per liter will be established (currently 418). The excise tax rate on wine is set at 19 rubles per 1 liter (currently 18 rubles), on ethyl alcohol - 111 rubles per 1 liter of anhydrous ethyl alcohol against the current 107 rubles per 1 liter.

In 2020, it is precisely because of the increase in the excise tax rate that alcoholic beverages may rise in price by about 5%, however, retail prices for alcoholic beverages may also increase due to an increase in overhead costs, the cost of electricity and consumed resources,

says Vadim Drobiz, director of the Center for Research of Federal and Regional Alcohol Markets.

In 2020, Russians already had to deal with rising retail prices for alcoholic beverages. For example, from January 1 of this year, the excise tax on vodka and other strong alcohol was raised from 500 to 523 rubles. for 1 liter of anhydrous alcohol. The excise tax increased for the first time since 2014. According to the order of the Ministry of Finance, the minimum retail price for strong alcohol has increased in Russia since May 13. In particular, the minimum retail price for half a liter of cognac increased to 371 rubles (+15.2%).

Gasoline for the benefit of the regions

It will also be more expensive for Russians to drive a car. From January 1, 2020, the excise tax rate on motor gasoline that does not correspond to class 5 is set at 13,624 rubles per ton; for class 5 motor gasoline in the amount of 11,395 rubles per 1 ton; for diesel fuel - 7,649 rubles per 1 ton; for motor oils for diesel and (or) carburetor (injection) engines - 5,616 rubles per 1 ton; The excise tax rate on middle distillates from January 1, 2020 is set at 8,773 rubles per 1 ton.

At the same time, Russians will most likely feel a significant increase in gasoline prices in 2020. Excise tax rates on motor gasoline and diesel fuel are planned to be increased twice in 2020: by 50 kopecks per liter from January 1 and by the same amount from July 1.

According to officials' calculations, due to an increase in excise tax by 50 kopecks. 1 liter of fuel at retail may rise in price by 1.5%, or 60 kopecks.

Such indexation of tariffs will bring an additional 50-60 billion rubles to the budget, in addition to the 25 billion rubles that the planned tariff increase should bring.

However, officials believe that the increase in Russian spending can be offset by projects on which funds received from the federal budget are spent. In particular, the money received from increasing excise taxes on gasoline will be used to build new roads. “This money will be used to develop the road network, primarily in Crimea, Kaliningrad and throughout the Russian Federation as a whole,” Finance Minister Anton Siluanov promised on September 18.

On January 1 of this year, taxes on an impressive list of goods increased in Russia, especially affecting alcohol, cigarettes and even gasoline. The upcoming increase in taxes entailed changes in the laws on changes to the Tax Code of the country, which the State Duma approved in the third reading at the end of November last year.

Digitized tobacco: what will replace excise stamps on cigarette packs

What is CRPT

The Center for the Development of Advanced Technologies is the operator of a unified national system of traceable goods. Prime Minister Dmitry Medvedev ordered the development of a system that will cover most of the Russian commodity market by 2024. The company is 50% owned by the structures of Alisher Usmanov, 25% by the state corporation Rostec, and another 25% by the Elvis-Plus Group of Alexander Galitsky.

At the second stage of the experiment (July-December 2018), the number of participants expanded to include imported tobacco products. Packs of cigarettes were marked at the Philip Morris International factory in the Swiss city of Neuchâtel. In total, at the end of December 2020, 254 companies participated in the experiment. The number of labeled cigarette packages has exceeded 150 million, of which 50 million have already been put into circulation.

Mandatory stage of the program

The main purpose of introducing labeling is to combat illegal cigarette trafficking. Currently, the Russian budget is shorting about 60 billion rubles due to the illegal trade in cigarettes. per year, estimated the head of the Ministry of Industry and Trade Denis Manturov, with the main part being about 50 billion rubles. - These are underpayments of excise taxes. According to the analytical agency Nielsen, the share of illegal cigarettes, on the sale of which no excise tax was paid to the budget, almost doubled over the year and in 2018 amounted to 8.4% of the market compared to 4.5% in July-September 2017. The reasons for the growth of illegal turnover were the influx of cheap cigarettes from the EAEU countries and foreign countries, as well as the spread of illegal tobacco products in circulation without a tax stamp or with a suspicious excise stamp.

According to the government order, mandatory labeling of cigarettes will begin on March 1, 2019. From this date, manufacturers, importers and retailers of tobacco products will be required to register in the system. From July 1, 2019, labeling will be mandatory in production, and retailers will begin to record the withdrawal of cigarette packs from circulation at the time of sale to the end consumer. From July 1, 2020, full monitoring of the movement of tobacco products between all market participants will be introduced, and the circulation of unlabeled products will finally cease.

Barcode with excise tax

One of the objectives of the experiment, as stated in the report, is to find out whether the two-dimensional Data Matrix code used in marking can be used for fiscal purposes. Nowadays, cigarette manufacturers and importers apply marks produced by Goznak JSC to their products - in this way they report to the tax service on product turnover. To mark cigarettes produced in Russia for sale on its territory, a federal special stamp is provided, and for imported products - an excise stamp.

Photo: Artem Geodakyan / TASS

As part of the experiment, CRPT, together with the Federal Tax Service and tobacco producers (St. Petersburg enterprises of the international tobacco concerns BAT and JTI), assessed whether it is advisable and possible to move to mandatory Data Matrix labeling for the calculation and payment of excise taxes, as well as for monitoring the turnover of excisable goods. Manufacturers sent excise tax returns to the Federal Tax Service with calculations of the excise tax for marked packs of cigarettes, documents confirming their sale, and reports on the use of special brands. In turn, CRPT provided the Federal Tax Service with a report on the requested and used codes for labeling and sales of tobacco products.

The result of the experiment showed that labeling can perform a fiscal function: the system calculates the excise tax on tobacco products in real time and can replace the excise stamp, a source close to the project told RBC. From the report of the Ministry of Industry and Trade it follows that the system provides all the information necessary for the calculation and administration of excise tax. It also states that the Federal Tax Service is now reviewing the documents submitted by manufacturers and operators. The Federal Tax Service did not respond to RBC's request.

The tax office is interested in receiving information without errors in real time, notes RBC’s interlocutor. Manufacturers themselves, according to him, support such a transition: it is important for them that labeling solves as many problems as possible. Thus, at the suggestion of market participants, it has already been decided to include the maximum retail price for cigarettes in the labeling code “to reduce costs” for cigarette retailers - this proposal was supported by the federal executive authorities, the document says.

What do manufacturers think about the results of the experiment?

Representatives of the tobacco industry interviewed by RBC support replacing the paper excise stamp with a digital code. The results of the experiment on digital marking and tracking confirmed that the Data Matrix code has greater potential for strengthening state control over the production and circulation of tobacco products than paper special and excise stamps, says Sergei Golovko, JTI Vice President for Corporate Relations and Communications in Russia. “This concerns both the traceability of the movement of cigarettes from the manufacturer to the retail outlet, and the completeness of fiscal control over the payment of excise duty and VAT to the state budget,” he notes.

The tobacco industry is interested in having one label, says Andrei Mezhonov, general director of the Tabakprom association: labeling with Data Matrix codes, according to him, is more comprehensive. But no one is going to cancel the marking with special and excise stamps: the issue has not been resolved at the level of the concerned federal executive authorities, says Mezhonov. As a result, the industry now receives two labels instead of one, he laments.

Labeling cigarettes is an expensive project, notes Maxim Kurgansky, senior manager for government relations at BAT Russia. According to him, in 2020 the company invested more than 1 billion rubles. in the preparation and implementation of the system in production and plans to invest approximately the same amount this year. If the cost of one Data Matrix code is 50 kopecks, cigarette manufacturers will pay the CRPT about 6 billion rubles. per year, adds Kurgansky.

Representatives of PMI in Russia did not respond to RBC’s request.

What other products are labeled

The first labeled category was products made from natural fur; in 2020, it became mandatory in the countries of the Eurasian Economic Union. On February 1, 2020, a pilot project on drug labeling was launched. The Law on Labeling of Goods with Identification Means, which gave the government the right to determine the list of goods subject to labeling, was signed by Russian President Vladimir Putin on January 1, 2020. At the beginning of the year, labeling of tobacco products, jewelry and shoes was launched in test mode, and already in May, Prime Minister Dmitry Medvedev approved the list of goods that will be mandatory labeled starting from 2020. It included perfumery, tobacco products, cameras, clothing items - women's knitted blouses and blouses, coats, raincoats, jackets, windbreakers and windbreakers, shoes, as well as bed, table, kitchen and toilet linen.

Metamorphoses with alcohol

The government does not consider it necessary to reduce the level of excise taxes on alcohol. Already at the beginning of the year, excise taxes on champagne, which was made from imported products, reached 36 rubles per liter. Initially, the tax rate was going to be increased for products produced within the country, but as a result, this idea was rejected by law. The rate for champagne made from domestic grapes increased by only one ruble, although during the development of changes to the tax code legislation it was assumed that this figure would reach 14 rubles. We will consider the excise tax on tobacco below.

Excise taxes on popular foreign wines were raised from nine to 18 rubles per liter, while for wines made from Russian products the rate was kept at a low level of five rubles.

As expected, there were changes in the growth of excise taxes on strong alcoholic products. We are talking about those where the direct proportion of alcohol is over nine percent. The rate for anhydrous alcohol increased from the previous 500 to 523 rubles, and alcohol itself, with an average content of intoxicating concentrate (which is up to nine percent), increased in price by eighteen points. There is a constant increase in excise taxes on tobacco.

From the very beginning of the year, experts stated that the increase in prices in stores would certainly be several times higher than the increase in excise taxes. DIFFRA, which stands for “The Center for Research of the Federal and Regional Alcohol Markets, suggests that with the process of starting price increases, the most affordable bottle of wine will soon rise in price by 120 rubles. The minimum cost of champagne will not increase by such a dramatic amount as wine, but only by 19 rubles. As for a bottle of vodka, in the future it will not sell for less than 230 rubles.

How will prices increase?

Price increases will not occur abruptly and instantly. This is a long-term process, designed for a fairly long period of time. Typically, new prices reach their consumers by the time the producers completely run out of their previous products. In January of this year, retailers, as expected, lowered prices: incredible demand allowed them to sell a huge amount of spirits and champagne in a month and a half, which can be compared with revenue for a whole year. The excise tax on tobacco increased by an even larger amount.

It is noteworthy that at the end of September last year, the Ministry of Industry and Trade of the Russian Federation shared the following idea: it is desirable to reduce the lowest retail price of vodka in the country to ninety rubles per bottle. A number of experts readily supported this initiative and made a tentative forecast that such measures could undermine the activities of counterfeit counterfeit dealers.

But it was not there. Already in mid-December, Rospotrebnadzor made a statement that a reduction in the minimum retail price for alcoholic beverages should under no circumstances be allowed, as this could encourage Russian citizens to drink even more alcoholic beverages. The absence of plans to lower the level of excise taxes on alcohol was also approved by the government. Thus, Deputy Prime Minister Alexander Khloponin emphasized that it is contraindicated to make such a product publicly available.

The amount of excise taxes on alcohol and tobacco is of interest to many.

Excise tax on cigarettes

So, excisable tobacco products include tobacco:

Of course, when considering the issue of alcohol, Russian legislators did not ignore tobacco products. In the current 2017, the excise tax rate on cigarettes was 1,562 rubles per thousand pieces plus fifteen percent. The numbers are expected to rise higher as 2020 and 2020 approaches. Prices for the entire range of tobacco will increase, the same applies to heated products. Electronic cigarettes or, as they are commonly called, “vapes,” will also be subject to excise taxes, and we are talking about both the devices themselves and the liquids for refilling these substitutes. Many people are interested in how to obtain excise tax on tobacco.

Excise stamp on cigarettes

The excise stamp for cigarettes is printed at the Goznak factory. It is needed for labeling tobacco products imported into the country and produced in the Russian Federation. An excise stamp with the name of the product is affixed to foreign goods, and a special one is affixed to products containing nicotine produced in Russia. The brand confirms the authenticity of the product through security features.

Excise stamps are printed on paper with a two-tone watermark. Indicating the country (Russia), coat of arms and signature excise stamp. The paper is permeated with two types of security fibers. Chemical protection is applied that changes color in ultraviolet rays. The name of the product matches the contents of the package and the quantity or weight of the products. The stamp contains an encapsulated phosphor - a reflective surface.

Special stamps are equipped with the same protective marks. They differ from excise taxes by the inscriptions Russian Federation, Tobacco products, Special stamp. A light watermark of one tone is printed. Not illuminated by ultraviolet light. The rank and number on the stamp are unique and never duplicated.

When comparing the listed protective characteristics when purchasing tobacco, remember how to check cigarettes for authenticity using the excise stamp.

A special device has been developed that helps verify the authenticity of the brand. Organizations use it when checking tobacco products. It's called Cassida Easy Check. Reads the presence of phosphor. When you point at the mark, it detects a protective element, the green indicator lights up and the sound signal turns on. If the indicator remains red, the stamp is fake.

What do the calculations say?

The Ministry of Internal Affairs of the Russian Federation recently calculated that, taking into account the increase in the level of excise taxes this year, the average price for a pack of cigarettes will reach about 220 rubles.

The Budget Committee of the Federation Council hastened to cast distrust and doubt on such calculations of the Ministry of Internal Affairs. According to the head of the committee, Sergei Ryabukhin, with an increase in the excise tax on tobacco in 2020 by approximately 26%, one such pack of cigarettes will become more expensive by approximately eleven percent, which means by ten or even twelve rubles. The Ministry of Finance has more precisely outlined these figures and announced that the average retail price of one pack of cigarettes should increase by ten percent, and by 2020 by as much as 27%.

The excise tax on hookah tobacco is also becoming more expensive.

Anti-smoking

The World Health Organization reminds us that increasing the price of cigarettes is the most effective and efficient way to deal with the widespread problem of smoking among our citizens. Health workers once again emphasize that if such measures are taken, the effect and result will be much better than all kinds of anti-tobacco campaigns, as well as the ban on smoking in public places.

As for the interviewed experts on the essence of this issue, they believe that the cost of one cigarette pack can exceed one hundred rubles, and on average in the Russian market it will be 113-115 rubles. Citizens of the Russian Federation have already felt the rise in prices due to the introduction of excise taxes and, indeed, as expected, the current year has become one of the most sensitive in history in terms of prices for tobacco and alcohol.

Budget without billions

A similar scheme works in all regions of Russia. According to TNS Russia, as a result, the Russian budget loses more than 30 billion rubles in taxes per year.

“The problem is the lack of a single minimum price for cigarettes. Because of this, legal products cannot compete with smuggled goods,” says David Kapianidze, head of the tax practice at BMS Law Firm.

Among the main drivers of the black market are a decrease in household incomes and an imbalance of excise taxes in Russia and the countries of the Common Economic Space (Belarus, Kazakhstan, Kyrgyzstan), says Mikhail Burmistrov, general director of InfoLine-Analytics.

“Law enforcement agencies clearly do not carefully control the sale of illegal cigarettes, especially in spontaneous retail outlets such as stalls, markets, mobile trading and the like,” notes Mikhail Burmistrov.

Alcohol, tobacco, and now gasoline

Rates continue to rise by leaps and bounds. Experts predict that in 2020 it will also affect fifth-grade motor gasoline. It is expected that this will increase from the current 10,130 rubles per ton to 10,535, and in a year and a half, that is, already in 2019, this figure will grow to 10,957 rubles.

In addition to raising excise taxes on tobacco, Russian producers increased gasoline prices by four percent last fall. And in 2020, deputies set the rate for diesel fuel at 6,800 rubles. This figure is expected to rise to seven thousand next year and to seven and a half in 2020. Six months ago it was only five thousand. The Ministry of Finance of the Russian Federation previously assured that motor fuel of the fifth category should rise in price insignificantly, but in the end this hardly predictable figure resulted in a noticeable increase of almost two rubles.

According to the head of the Ministry of Energy of the Russian Federation, Alexander Novak, the increase in fuel prices in 2020 will not exceed the inflation limits. The Central Bank's target for the coming year is four percent. The head of the Federal Antimonopoly Service, Igor Artemyev, believes that the increase in gasoline prices within the framework of inflation will continue over the next ten years.

According to the words, Russian consumers will not face any major increases in the cost of petroleum products in the next ten years. He believes that they, as before, will remain at the level of inflation or even be slightly below it.

Forecasts

Forecasts from the Russian Fuel Union predict an increase in gasoline prices. They explain this by sanctions and all sorts of other factors that push this cost to creep up. Industry association workers are optimistic about the authorities' ability to maintain retail prices by all possible means.

President of the Russian Fuel Union Evgeny Arkusha explained that the cost of petroleum products has increased, and customs duties should decrease starting next year. This suggests that export parity should increase, as a result of which domestic prices will creep up, because for oil companies, equal profitability in fuel supplies, both to the foreign and domestic markets, plays a significant role.

Excise tax implies an indirect tax, established by law, on consumer goods. Legal entities and entrepreneurs who are direct producers of excisable goods are required to pay this tax. But since the excise tax is included in the price of the goods, an increase in the excise tax rate leads to an increase in the price of the goods. As a result, the payer is an ordinary buyer. Let's consider what rates are provided for calculating the amount of excise tax on tobacco in Russia, and whether an increase in excise taxes on tobacco is expected in 2017.

Excise tax rates on tobacco in Russia

To calculate excise tax payments, the state has developed several types of rates:

- fixed rate - calculated in rubles, depends on the quantity of goods sold;

- ad valorem rate – a percentage rate calculated as a percentage of the product;

- combined rate - involves calculation both in rubles and as a percentage:

In 2020, the excise tax on cigarettes, which is calculated from the MRP, is 1,562 rubles/1,000 pcs. plus 14.5% of the cost, but not less than RUB 2,123/1,000 pcs. According to the plan of the Ministry of Finance, in 2018 the rate will increase to 1,718 rubles. plus 14.5% (not less than 2,335 rubles), by 2020 – 1,890 rubles. plus 14.5% (not less than RUB 2,568).

The excise tax rate on other types of tobacco: pipe, smoking, chewing, sucking, snorting and hookah types in 2017 will be equal to 2,520 rubles/1 kg. By 2020 it is planned to increase to 2,772 rubles, and by 2020 – to 3,050 rubles.

Get 267 video lessons on 1C for free:

Since 2020, electronic cigarettes have been included in the list of goods for which excise duty is paid. The rate on them is 40 rubles/1 piece, it is planned to increase to 44 rubles. in 2020, and in 2020 – up to 48 rubles. The excise tax on liquids intended for electronic cigarettes in 2017 is calculated at a rate of 10 rubles/1 ml and in two years it is planned to increase it to 12 rubles/1 ml.

Also, from 2020, you will need to pay an excise tax on tobacco heated and used in electronic smoking devices. The rate for this type in 2020 is 4,800 rubles. per 1 kg and will increase by 2020 and 2019. up to 5,280 and 5,808 rubles. respectively.

According to preliminary calculations by the Russian Ministry of Finance, an increase in excise tax rates on tobacco will immediately provoke an increase in the retail price per unit of tobacco products and over 3 years prices will rise by 27%.

How does the state regulate the MRP for tobacco products? The price increase for cigarettes looks like this:

Enter the site

RSS Print

Category : Accounting Replies : 32

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev. 2 Next → Last (4) »

| Faith [email hidden] Belarus, Minsk Wrote 3716 messages Write a private message Reputation: 356 | #11[271484] February 9, 2011, 12:54 |

GreenBukh wrote:

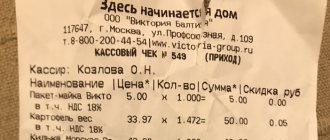

why is there such a strange VAT on the invoice: cigarettes price 1025, cost 512500, rate 16.67%,

VAT amount -6251

, fixed. price 1250.

It is as Pobeda wrote that the cigarettes were sold to you by a wholesaler who used the difference between the sales price and the purchase price of the goods as the tax base. Consequently, the seller presents you with the amount of VAT for payment, calculated on the basis of the trade discount remaining with the seller. If you do not use the calculated rate, then you cannot take anything as a deduction: 19. Value added tax amounts are not deductible: 19.8.

paid (to be paid) by the buyer upon acquisition and (or) importation of goods, the tax base for the sale of which is determined in accordance with paragraph 3 of Article 98 of this Code; a 3. The tax base for value added tax when sold at regulated retail prices, taking into account the value added tax of purchased (imported) goods (except for goods for which value added tax is calculated in accordance with paragraph 9 of Article 103 of this Code) is determined as the difference between the selling price and the acquisition price of these goods. In this case, purchase and sales prices are determined taking into account value added tax. That is, there are 2 options: 1) You use the difference between the sales price and the purchase price of these goods as the tax base. In this case, purchase and sales prices are determined taking into account value added tax. - THEN THERE ARE NO DEDUCTIONS (This means according to the tax bill for incoming cigarettes) 2) You use the calculated rate. - Then you have the right to take into account both the amount of VAT (Strange) allocated by the seller and the amount that you can allocate yourself

Notification is being sent...

| Faith [email hidden] Belarus, Minsk Wrote 3716 messages Write a private message Reputation: 356 | #12[271493] February 9, 2011, 12:57 |

GreenBukh wrote:

Stop!!! what if the products arrived at ten percent??????

Were they sold at 20%?

I want to draw the moderator's attention to this message because:Notification is being sent...

| dreamteam [email hidden] Belarus Wrote 1891 messages Write a private message Reputation: 166 | #13[271496] February 9, 2011, 13:00 |

Notification is being sent...

| dreamteam [email hidden] Belarus Wrote 1891 messages Write a private message Reputation: 166 | #14[271504] February 9, 2011, 13:06 |

Notification is being sent...

| Star [email hidden] Republic, Minsk Wrote 311 messages Write a private message Reputation: | #15[271505] February 9, 2011, 13:06 |

Notification is being sent...

| Faith [email hidden] Belarus, Minsk Wrote 3716 messages Write a private message Reputation: 356 | #16[271506] February 9, 2011, 13:06 |

Notification is being sent...

| Victory [email protected] Belarus Gomel Wrote 2454 messages Write a private message Reputation: 263 | #17[271510] February 9, 2011, 13:08 |

Notification is being sent...

"This is impossible!" - said the reason. "This is reckless!" - noted experience. "It's useless!" - Pride snapped. “Try...” whispered the dream.| Faith [email hidden] Belarus, Minsk Wrote 3716 messages Write a private message Reputation: 356 | #18[271514] February 9, 2011, 13:10 |

Notification is being sent...

| dreamteam [email hidden] Belarus Wrote 1891 messages Write a private message Reputation: 166 | #19[271517] February 9, 2011, 13:11 |

Notification is being sent...

| Faith [email hidden] Belarus, Minsk Wrote 3716 messages Write a private message Reputation: 356 | #20[271521] February 9, 2011, 13:12 |

Notification is being sent...

« First ← Prev. 2 Next → Last (4) »

In order to reply to this topic, you must log in or register.

Calculation of the amount of excise tax on tobacco

In the text of Art. 194 of the Tax Code of the Russian Federation spells out the formula by which the cost of excise duty is calculated:

Explanation of abbreviations:

- Ca – excise cost;

- ATS – excise tax with a fixed rate;

- Apns – excise tax with an ad valorem rate (in%);

- Ops – volume of cigarettes sold;

- FSN – fixed tax rate;

- Sps – retail cost of cigarettes;

- Otp – volume of tobacco products.

In order to avoid mistakes and problems with the Federal Tax Service and other inspection organizations, you need to carefully calculate the excise tax amounts.

When selling and selling tobacco products, violations may arise related to them: lack of labeling or illegal application of it, sale without excise tax, establishment of the fact of sale of tobacco products without labeling in especially large volumes, etc. Violations are subject to administrative or criminal liability:

Responsibility for the sale of cigarettes without excise duty

The law punishes the sale of cigarettes without excise tax. Responsibility for such a violation is determined by law enforcement agencies. This is an administrative or criminal penalty. An administrative fine is imposed on both sellers and companies that sell tobacco worth less than 100 thousand rubles. The organization will be charged up to 50 thousand rubles, and the seller up to 5 thousand.

If a company or seller deliberately sells tobacco products worth more than 1 million rubles, criminal liability arises. The penalty for violating the law is up to 6 years in prison. Or a fine of up to 800 thousand rubles.

Anti-tobacco concept

The anti-tobacco concept, the draft of which was developed by the Russian Ministry of Health for 2017-2022, addresses issues related to the gradual increase in the tax burden on organizations producing tobacco products. The tax is expected to be brought to the average level of European countries, and it is also planned to approve an environmental tax on cigarettes.

The document talks about the effectiveness of future measures and the benefits for the state, which consist of reducing the consumption of tobacco products, reducing the costs of eliminating the consequences of tobacco use and increasing tax payments to the budget.

Thus, it will be very difficult for most tobacco consumers to save money. Every day a smoker spends about 15% of his money on cigarettes, and if his income is equal to the minimum, then about 23%. The retail price of cigarettes consists of the following parts:

- cigarette manufacturer price – 42%;

- excise duty (tax) – 40%;

- VAT – 18%.

The price of one unit of tobacco product immediately increases if any of these parts increases. Experts suggest that the number of counterfeit products from the CIS countries will increase on the market, because the buyer will not give up the bad habit, but will start looking for a cheaper option, albeit of low quality.

Currently, more than 37% of the tobacco product market belongs to cheap brands of cigarettes. For Russia, this is a fairly high figure, given that there is a struggle for the health of the population and the promotion of a healthy lifestyle.