Register of information on income 2-NDFL

Who is responsible for compiling the register? There are two parties responsible in this matter:

- fiscal service inspectors;

- taxpayers generating a 2-NDFL certificate.

Issues with filling out the register do not arise for those employers who generate and send a 2-NDFL certificate via telecommunication channels. The register is created automatically by inspectors receiving reports. In this case, after receiving the 2-NDFL reports, the tax office is obliged to send the document to the enterprise’s accounting department by e-mail within 5 working days, and at the same time a protocol for receiving the information is sent.

When 2-NDFL is submitted to the fiscal authority on paper or on flash drives during a personal visit, the register of certificates is compiled by the tax agent himself.

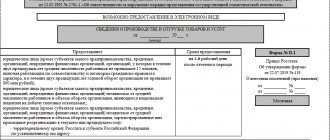

Those certificates that came to the fiscal authority with errors are deleted from the general register. Please note that a copy, which must remain with the employer, can be issued immediately by inspectors or by mail within 10 working days. How to fill out the document correctly? The summary document consists of a summary table with three columns:

- Certificate number 2-NDFL.

- Full name of employees (in full).

- Date of birth of employees.

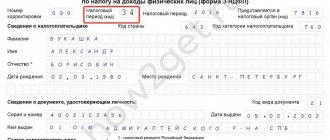

At the top of the pivot table there is a header where identification information is displayed:

- registration number and date;

- name of the electronic file;

- code of the tax authority where the tax agent is registered;

- full name of the employer;

- INN and OKTMO of the tax agent.

The register contains a line “information attribute”, where “1” or “2” is indicated.

This Register, in addition to information about the tax agent, reflects information on the number of 2-NDFL certificates submitted to the Federal Tax Service, as well as the numbers of the certificates, the full names of the individuals under whom these certificates are submitted, and their dates of birth.

Nuances of filling out form 2-NDFL in 2020

In this case, the enterprise issues a 2-NDFL (upon request), and the individual already submits the document to his Federal Tax Service.

This is also done as necessary, as many times a year as the individual needs. When it is necessary to notify the Federal Tax Service that personal income tax is not actually withheld at the source, see. The main innovation is that tax authorities and employees receive certificates on different forms:

- The form issued to employees has undergone mainly technical changes. For example, some fields have been removed.

- The form submitted to the Federal Tax Service has a completely different structure compared to the current form. It contains only 3 sections, instead of the usual 5, and consists of a main sheet, which has the format of the title page of any declaration, and an appendix, which displays information about the employee’s income in a monthly breakdown.

We recommend reading: Driver left work car unlocked

See details.

In 2020, form 2-NDFL, starting with reporting for 2020, has undergone significant changes.

Features of filling out documentation

The register of information is submitted to the Federal Tax Service in two copies (clause 15 of the Procedure). Moreover, it does not matter whether you submit the 2-NDFL certificates and the Register in person/through a representative or send them by mail - in any case there must be two copies of the Register.

Having received your 2-NDFL and Registry certificates, inspectors check the documents you submitted. And if any Certificate does not pass control (for example, the address of an individual is not indicated in the 2-NDFL certificate), then the tax authorities do not accept it and delete its data from the Register (clauses 16, 17 of the Procedure).

When all the Certificates have been checked, a Protocol for receiving information is drawn up (Appendix No. 3 to the Procedure) and if some 2-NDFL certificates were found to be erroneous, this information is recorded in the Protocol.

The tax authorities give you one copy of the Protocol and one copy of the Register on the day of submission of the 2-NDFL certificates, if the verification of the certificates is carried out in your presence (clause 19 of the Procedure). If you were not present when checking the certificates, then the Protocol and Register will be sent to you by mail within 10 working days from the date of receipt of the 2-NDFL certificates. True, in practice, if everything is in order with your 2-NDFL certificates, then the Federal Tax Service does not send the Protocol and the Register.

In this case, the tax authorities may try to refuse to accept the 2-NDFL certificates you submit and fine you 200 rubles. (clause 1 of article 126 of the Tax Code of the Russian Federation).

Despite the fact that the form of the 2-NDFL certificate itself has changed (approved by Order of the Federal Tax Service of Russia dated October 30, 2015 N ММВ-7-11 / [email protected] ), i.e. in 2016, reporting for 2020, you need to submit 2-NDFL certificates are in a new form, the form of the Register and the procedure for its submission remain the same.

- via telecommunication channels (TCS) You do not have to create a register of information on the income of individuals - it is formed by the tax authorities themselves after receiving your certificates (clause 29 of the Procedure);

- on electronic media (CDs, flash cards, etc.), then, as in the case of submitting paper 2-NDFL certificates, compiling the Register is your responsibility (clause 6 of the Procedure). In this case, the Register is compiled on paper in two copies for each file submitted to the Federal Tax Service.

- information about the employer (TIN/KPP, OKTMO);

- list of people for whom income tax information has been submitted indicating personal information - full name. and dates of birth;

- number of certificates sent to the Federal Tax Service.

- the tax payable is rounded to full rubles according to the general rules;

- All items are required to be filled in; if some values are missing, a dash is added.

When submitting reports to the Federal Tax Service in printed form, you must also attach the register of 2-NDFL certificates for 2020. This requirement is regulated by Federal Tax Service Order No. [email protected] Next, questions about what this document is, how to draw it up, etc. will be considered.

An example of such a registry is here (file 1).

In the absence of this consolidated act, tax authorities may refuse to accept 2-NDFL certificates and a fine of 200 rubles.

Tax inspectors, for their part, are required to return one copy of the protocol on acceptance and the register on the day of submission of documents, if the bearer came in person. If he was absent, then everything necessary is sent by registered mail to the company’s address within 10 days from the date of receipt.

Keep in mind: in practice, when 2-NDFL certificates are completed correctly and do not raise questions, the tax office does not send the protocol and the register itself.

In this case, the need to compile a register depends on the option of sending 2-NDFL certificates (see table).

The procedure defines the stage of formation and delivery of the register in each case, except for data transmission via a telecommunication channel.

If sending is done via Internet communication networks, then the register will be automatically created at the tax office. This makes it easier for tax agents to submit documents.

When submitting reports to the Federal Tax Service in printed form, you must also attach the register of 2-NDFL certificates for 2020. This requirement is regulated by Federal Tax Service Order No. Next, questions about what this document is, how to draw it up, etc. will be considered.

Please note that this year the form of the income certificate has changed, so for the previous and subsequent reporting periods, use its new form. It was approved by order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/ However, the type of register and the procedure for its submission remained unchanged.

The document in question is drawn up in two copies, regardless of the sending option:

- personally or through your employee - suitable for submitting reports in paper form or on electronic devices;

- the total values are written in the form of a fraction indicating rubles and separated by commas - kopecks;

Remember that income certificates must be prepared taking into account the rules established by law. Here are the main ones:

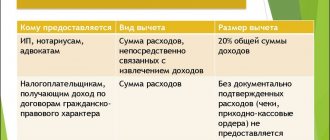

Package of documents for income tax refund

To receive any tax deduction for personal income tax, an individual submits the following documents to the inspectorate:

- Declaration of your income 3-NDFL. As of reporting for 2020, a new form is in effect, approved. by order of the Federal Tax Service of the Russian Federation dated December 24, 2014 No. ММВ-7-11/671 (as amended on October 25, 2017);

- an application for a tax refund containing the payment details of an individual for the transfer of a sum of money from the Federal Tax Service (attached if the tax for refund has already been calculated in 3-NDFL);

- employer's certificate 2-NDFL for the corresponding year.

What kind of document

The income register is a consolidated document that contains links to data on all income of individuals for a certain period of time. It is filled out once a year and submitted to the tax office along with 2-NDFL certificates before April 1 of the year following the reporting period. [Register of 2-NDFL certificates (2016) contains:

Papers for auxiliary writing

To ensure that no precedents or disputes arise in a tax organization, the paperwork for the declarant to generate 3-NDFL must be described in the letter (register) attached to it. This process can be carried out in free form, but it is necessary to indicate at what position the form is submitted, and the period for which the profit report is provided, the name of the tax organization and information about the applicant-applicant himself.

The main thing when drawing up an inventory of documents is to adhere to the purpose for which the application is being submitted. When checking all the papers, the tax office may require additional information certificates and documents.

Note! If the payment is made in cash, there must be supporting documentation: a receipt, a cash register receipt or a strict reporting form. Certificates that indicate timely payment or other types of confirmation are not acceptable.

We have sorted out the issue of the inventory for the declaration. Now filling out the register of supporting documents will not be so difficult.

To get back part of the previously paid income tax, the taxpayer only needs to submit to the Federal Tax Service an income tax return and all documents confirming the right to the deduction. We will tell you in this material what documents to attach to the 3-NDFL declaration, how to submit them to the Federal Tax Service, and whether they need to be accompanied by a register.

Filling rules

- When receiving 2-NDFL certificates and the register of information from them, inspectors carefully compare the documents. If an error is made in one of them, information about such a certificate is deleted from the register. It is impossible to receive her. After the inspection, a protocol is drawn up in which the results are recorded. A sample of such a protocol is here (file 2).

Tax inspectors, for their part, are required to return one copy of the protocol on acceptance and the register on the day of submission of documents, if the bearer came in person. If he was absent, then everything necessary is sent by registered mail to the company’s address within 10 days from the date of receipt.

Keep in mind: in practice, when 2-NDFL certificates are completed correctly and do not raise questions, the tax office does not send the protocol and the register itself.

What it is

This paper is represented by consolidated type documentation, which reflects the main links to information about debt obligations; they are indexed for a certain time period. The register must be completed once a year, and then given to the inspection together with the rest of the set of certificates and documents. It contains a basic list of information.

The specialists have an obligation to return one copy of the protocol stating that the papers were accepted. If documentation was missing, the necessary information is delivered by mail using a registered letter to the company's address.

Since 2020, there have been changes in the electronic form of the certificate evidencing income, so for the periods its form in a new form is used. The type of register and other data were not subject to major changes in 2020, so there should be no difficulties when filling out the information.

It is worth paying attention to the option through which certificates are sent. This will help you avoid common mistakes.

When submitting reports in printed format, it is necessary to attach a register of certificates 2 personal income tax 2020. This requirement is established within the framework of the relevant order given by the Federal Tax Service. It has several features that must be taken into account when submitting a set of documents to the Federal Tax Service.

If there is no consolidated documentation format, the tax service may refuse to accept certificates.

Document 2 Personal income tax register of information must be compiled in two versions, regardless of which method of sending it you prefer.

Reference information on income must be prepared taking into account the rules established by law. There are several pieces of information that must be taken into account.

In the process of receiving these certificates, tax specialists must carefully compare the documents and scan them for any erroneous values.

The register of information is an important document required to be submitted to the tax authorities for the reporting tax period. It is relevant for recording changes in budget revenues, as well as for conducting analytical work with this process. Competent preparation of this paper will help avoid problems with tax authorities and the likelihood of paying penalties.

If you find an error, please highlight a piece of text and press Ctrl Enter.

Related publications

At the end of the year, organizations and individual entrepreneurs paying wages or other income to their employees are required to report on these payments using form 2-NDFL. The register of information 2 personal income tax on the income of individuals for the reporting year is a mandatory attachment to the certificates. It is interesting that in some cases it is formed by the tax authorities themselves, but sometimes this responsibility falls on the shoulders of the person submitting information to the inspectorate, that is, the tax agent who made payments in favor of individuals during the reporting period.

How to apply for an income tax refund

The declaration along with the documents is submitted to the Federal Tax Service at the place of permanent registration of the individual. This can be done by coming to the inspection office and submitting the documents in person; in this case, you need to print out a second copy of the declaration for yourself, on which they will put a mark of acceptance.

You can send the entire set by valuable letter with an inventory. Please note that the register of attached documents to 3-NDFL, the form of which we discussed above, cannot be considered such an inventory - it is filled out on a special postal form, where a stamp with the date of dispatch and the signature of a postal employee are affixed.

It is possible to prepare documents for income tax refund and send a declaration electronically, which requires the taxpayer to have an electronic digital signature. The attached documents, pre-scanned, are uploaded as files and sent to the Federal Tax Service through the “Taxpayer Personal Account” on the Federal Tax Service website.

The deadline for filing a personal income tax deduction return is not limited - it can be submitted throughout the year for the previous 3 tax periods. If, in addition to the deduction, an individual declares his income, he needs to meet the deadline of April 30 (in 2020, the declaration for 2020 must be submitted no later than May 3).

Register of documents for 3-NDFL form (sample)

Reporting Form 3 Personal Income Tax is mandatory for individual entrepreneurs, lawyers and other persons who have additional income. In some situations, the tax return is supplemented with various documentation, which requires the creation of a separate register for 3 personal income taxes.

It allows inspection inspectors to gain a more complete understanding of the activities and profits of the enterprise. It must be taken into account that this is not considered mandatory for the taxpayer, but is his right.

For a report such as the register of supporting documents 3, the personal income tax form can be found in a separate Appendix under number 3. It is approved by order of the Federal Tax Service and is attached to the main Regulations.

The main task that the register performs for declaration 3 of personal income tax is to indicate the papers that provide data on the income and expenditure of funds of the entrepreneur. The document itself is a list of certificates and other papers attached to the main report. It includes:

- evidence that proves the resident’s position;

- certificates indicating registration of individual entrepreneurs;

- documents that show the amount of costs for training and treatment.

3-NDFL: due date

The register for the 3rd personal income tax year 2020 is drawn up in the form of a separate form. It is convenient if the report is submitted directly to the tax authorities. Then the office worker will be able to immediately check the entire list based on the list provided. The tax authorities require the taxpayer to personally prepare all the necessary forms. However, if there are additional documents and there is no register, the inspector can fill it out himself based on the information received.

Filling rules

- When receiving 2-NDFL certificates and the register of information from them, inspectors carefully compare the documents. If an error is made in one of them, information about such a certificate is deleted from the register. It is impossible to receive her. After the inspection, a protocol is drawn up in which the results are recorded. A sample of such a protocol is here (file 2).

Tax inspectors, for their part, are required to return one copy of the protocol on acceptance and the register on the day of submission of documents, if the bearer came in person. If he was absent, then everything necessary is sent by registered mail to the company’s address within 10 days from the date of receipt.

Keep in mind: in practice, when 2-NDFL certificates are completed correctly and do not raise questions, the tax office does not send the protocol and the register itself.

What it is

This paper is represented by consolidated type documentation, which reflects the main links to information about debt obligations; they are indexed for a certain time period. The register must be completed once a year, and then given to the inspection together with the rest of the set of certificates and documents. It contains a basic list of information.

The register can be prepared in the 1C 8.3-ZUP program.

The ability to automatically generate information for separate departments of a company is available only in the 1C 8.3 Accounting KORP software product. For them, you can reflect your OKTMO and checkpoint here. To do this, you need to accept workers into the unit and calculate earnings and withhold tax based on details. This option is not provided in the “Basic” and “PROF” configurations, however, the register can be created in them as well.

If the company has few employees, you need to do the following:

- Create personal income tax information for the tax office for the main organization (via the “Salaries and Personnel” menu).

- Fill out the form for all personnel of the organization. This means that the tax was calculated for all employees, including workers in departments, according to the main OKTMO and KPP.

- Delete all full names, except for persons working in separate units, or select them by selection.

For each file you need to prepare a separate set of registers. The register has a simple form and is easy to fill out. A sample design can be viewed on the Internet. Features of preparation and submission The electronic format of file 5.04 for submitting the 2-NDFL report is specified in the Federal Tax Service order No. ММВ-7-11/ dated 10.30.15.

- Click on the “New report, 2-NDFL” tab, select “Information on personal income.” persons."

- Specify the reporting organization and inspection where the documents are submitted, click “Next”.

- Using the “Add Employee” button, select the employee for whom the income data is generated.

- personally or through your employee - suitable for submitting reports in paper form or on electronic devices;

- by mail – the date of submission is considered to be the date of dispatch;

- via telecommunication channels using an electronic signature.

When receiving 2-NDFL certificates and the register of information from them, inspectors carefully compare the documents. If an error is made in one of them, information about such a certificate is deleted from the register. It is impossible to receive her. After the inspection, a protocol is drawn up in which the results are recorded. A sample of such a protocol is here (file 2).

Registry formation: whose area of responsibility?

If certificates of income paid to individuals, organizations or individual entrepreneurs - tax agents are submitted electronically via telecommunication channels, then they do not have to face the question of the need to compile a register of information on income. In this case, this document is automatically generated by the tax office.

If certificates of income paid to individuals, organizations or individual entrepreneurs - tax agents are submitted electronically via telecommunication channels, then they do not have to face the question of the need to compile a register of information on income. In this case, this document is automatically generated by the tax office.

Responsibility for filling out and submitting the register lies with either the tax agent or the inspector of the Federal Tax Service, depending on the method of submitting 2-NDFL information.

When sending information via TKS, the register is automatically created at the tax office. The inspector must send one copy of the document along with the control protocol to the company.

So, the register for the 2-NDFL report must be submitted to the Federal Tax Service along with certificates, with the exception of the case of data transfer via TKS. It is necessary to track and analyze changes in personal income tax amounts received into the budget.

In 2020, the register has the same form as in the previous reporting period. In order to avoid audits and sanctions from tax authorities, these reports should be prepared and submitted in accordance with the procedure approved by law.

How is 2-NDFL deciphered? - this is reporting in Form 2 for personal income tax.

What difficulties may arise when applying for a 2-personal income tax with zero income - read here.

Next, you can learn about the method of reflecting material assistance in the 2-NDFL certificate.

Attention!

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

How to print register 2 personal income tax in the taxpayer for 2020

A certificate of this form fully discloses information about income and taxes withheld from each employee of the enterprise in a certain period of time.

In addition, the document can be sent by mail in the form of a letter with a list of attachments. If the shipment is carried out by postal services, the authorized person making it receives a receipt with the date of departure, which is considered the date of reporting. To send an electronic certificate, an organization or individual entrepreneur must select an intermediary providing EDI services.

Submitting reports via the Internet is much more convenient, since company representatives do not need to waste time visiting the tax office or post office.

In addition, this method allows you to quickly verify that the document was accepted by the authorities and entered into the inspection database, which is also very important. Today, you can use the convenient “Taxpayer Online” service to prepare and submit reports.

What are the consequences of submitting 2-NDFL certificates without a register?

The fine for the absence of a register in cases where this document is required to be submitted is relatively small - only 200 rubles (clause 1 of Article 126 of the Tax Code of the Russian Federation). However, if a tax agent submits information about the income of individuals to the Federal Tax Service in paper form or on electronic media, but a mandatory register is not attached to it, then the 2-NDFL certificates may simply not be accepted. In this case, you will have to visit the Federal Tax Service again, and it’s good if this does not lead to delays in filing reports in general and to more significant fines.

How to do it right

The register is an A4 sheet.

At the top of it, general data is indicated:

- date and registration number. tax code;

- file name;

- name of the company, its INN, KPP, OKTMO;

- information sign;

- number of certificates.

If personal income tax is fully withheld and transferred, the indicator “1” is put in the line with the information attribute, otherwise - “2”.

How to obtain a 2-NDFL certificate through government services? Is such a possibility possible in principle? All the answers are in our article. Is Form 2-NFDL to be filled out during liquidation or reorganization - see this publication.

Below is a table with three columns.

They indicate:

- reference number;

- Full name of the employee;

- date of birth.

At the bottom is the signature of the head of the company, stamp and date of delivery. The corresponding columns are reserved for employees of the Federal Tax Service: places for signature and date of acceptance.

You can fill out 2-NDFL forms in the “Legal Taxpayer” program. You can download it for free on the GNIVC website: gnivc.ru. After filling out and uploading the certificates, a register is generated here in printed form.

Registry form for certificate 2-NDFL

Who forms?

Responsibility for drawing up the certificate depends on the form in which the certificates are submitted in Form 2NDFL.

Why do we need a register of documents?

The register of documents attached to the 3-NDFL declaration form is a kind of document that is an inventory of all documentary evidence submitted along with the 3-NDFL form.

The register may include such papers as:

- Various types of evidence.

- Document on registration of an Individual Entrepreneur.

- Certificates and checks from a bank or other institutions, including healthcare.

- Agreements on concluding loan obligations.

- Information about the cost of the apartment.

- Certificate of marriage registration, state registration of property.

- The act of acceptance and transfer of real estate.

- Account statements.

- Agreement for education or training and advanced training.

The register is used to control submitted papers. For example, when filing 3-NDFL in person, a tax specialist can check all documents submitted to the tax office for compliance with the list. This will also help avoid the loss of documents when sending them via postal parcel - postal workers will be able to check the list and, if any of the documents are lost, will respond personally.

This is interesting! The register of documents is a kind of guarantee for a citizen in case of loss of any of the documents. After all, if a document was listed in the register and then lost, tax workers will be held responsible for the loss. If the registry did not exist, then proving the fact of paper loss would be problematic.

Normative base

The fundamental document, which contains the rules for drawing up 2NDFL certificates and the accompanying list, was approved by Order of the Federal Tax Service of Russia dated September 16, 2011 No. ММВ-7-3/57.

Tax agents need to pay special attention to the deadlines for submitting documents so as not to be among the fined persons.

A paper register is required for those who submit income certificates for individuals, bypassing email. Therefore, everyone who sends information personally to the inspector without Internet technology should not forget about the register.

In its letter to the Federal Tax Service No. BS-4-11/5443 dated March 30, 2016. informed that if data under code “2” had already been submitted, then it must be submitted again, but with code “1”.

Some companies have won disputes in court regarding the issue of submitting such information twice.

The decisions stated that if all the necessary information was provided in the first report under code 2, then it was absolutely legal to submit it only once.

How many months is the personal income tax period? See here.

How to fill out a certificate for the new form 2-NDFL in 2020

New formats - new instructions.

Its structure is similar to tax returns, that is, it has a machine-oriented structure. It includes (clause 1.1 of the procedure for filling out the form): general part; section

Indeed, in addition to the two reporting forms, the tax authorities also adjusted the algorithm for their preparation. Current forms and detailed rules for the generation of reporting information are enshrined in the Order of the Federal Tax Service of Russia dated 10/02/2018 No. Please note that the document comes into force only from 01/01/2019, which means that information on employee income for 2020

will have to be formed on new forms. You can then download the new Form 2-NDFL for 2020 for free.

And if an employee requests a certificate for 2020, then prepare a report using the old form. There really aren't many changes. The structure has undergone minor changes.

We recommend reading: Where to find OPOAT by QR code

Fields and codes that were relevant for the Federal Tax Service are excluded. In general, the paper retained its general structure and appearance.

So, download form 2-NDFL for free for individuals in 2020 (for employees): The same cannot be said about the report submitted to the Federal Tax Service.