Specifics of the audit

Inventory of goods is carried out in accordance with the Methodological Guidelines approved by Order of the Ministry of Finance No. 49 of 1995. Cases of mandatory audit are enshrined in Article 12 of Federal Law No. 129. Inventory of goods is carried out without fail:

- Before preparing annual reports.

- When changing the financially responsible person.

- If facts of damage/theft of property or other abuses are detected.

- After a natural disaster or other emergency.

- During liquidation/reorganization of an enterprise.

- In other cases established by law.

https://youtu.be/izaaugOflx0

Re-sorting of goods during inventory

As follows from the literal interpretation of the Methodological Recommendations approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 N 49, based on the results of the inventory the following can be established:

- compliance of actual inventories with accounting data;

- discrepancy between inventory indicators, or re-grading of goods. This occurs when property decreases beyond the natural loss or when surplus appears.

It is important to remember that in the accounting department of an enterprise, regrading should be done in accordance with paragraph 28 of the Regulations on accounting, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 N 34n.

For correct accounting of misgrading during inventory, the following circumstances are of decisive importance:

- surplus inventory items identified during inventory are included in the financial results of the enterprise;

- loss of property within the established norms is taken into account in costs;

- reduction of values in excess of limits is attributed to the persons responsible for the reduction of property.

Clause 5.3 of the Methodological Recommendations, put into effect by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 N 49, indicates that when conducting an inventory, misgrading is allowed.

However, in practice this action can only be performed as an exception to the rules and in the presence of the following circumstances:

- simultaneous identification of shortages and surpluses of goods and materials in one enterprise;

- the differences in quantity should be approximately identical;

- the property in respect of which inconsistencies are established must have the same name;

- a discrepancy between actual inventories and accounting data was discovered in the same period under review.

In the absence of any of the above circumstances, credit for re-grading of goods is not possible. This follows from the literal content of paragraph 5.3 of the Methodological Recommendations approved by the Ministry of Finance of Russia in Order No. 49 dated June 13, 1995.

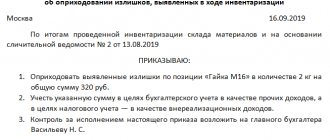

The provisions of paragraph 32 of the Instructions for accounting of inventories, put into effect by the Ministry of Finance of the Russian Federation by issuing Order No. 119n dated December 28, 2001, establish that the offset is carried out on the basis of a written order from the head of the enterprise.

In accordance with paragraph 34 of Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n, accounting for misgrading is carried out in the month the inventory is completed. If discrepancies in data on inventory items were identified as a result of an audit for a calendar year, then such deviations should be reflected in the accounting report for the corresponding period.

Documenting

The results of the audit are entered into a special form of a unified form - statement (form INV-3). In this document, the shortage of goods of one type is indicated in one line, and the surplus in another.

After filling out the form, it is sent to the accounting department, where a matching statement is generated (form INV-19). In this document, columns 18-23 are intended to reflect regrading. The information is also indicated in the INV-26 form.

Registration of re-grading of inventory items

The Ministry of Finance of the Russian Federation, in its regulatory guidelines mentioned above, directly provided for the obligation of responsible persons to give written explanations about the facts of misgrading. However, none of the above orders contains the answer to the question of how to issue a regrading.

The above-mentioned orders of the Russian Ministry of Finance do not provide for the form of the document used to formalize the regrading. The only indication of a discrepancy is contained in the comparison sheet No. INV-19, which reflects the discrepancies in the data.

However, Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88 approved form No. INV-3. The specified inventory list of goods and materials contains the columns:

- actual availability;

- according to accounting data.

This document can be used as a regrading report, since after filling it out and verifying the information contained in it, discrepancies are actually identified and documented.

Sheet 1 of form No. INV-3 must contain:

- name of the enterprise and its structural division;

- codes for OKPO and type of activity;

- the basis for the inspection;

- beginning and end of inventory;

- number and date of drawing up the act;

- the name and quantity of inventory items for which misgrading has been identified;

- receipt of the financially responsible person;

- date of removal of inventory balances.

After completing the first page, you should fill out sheets 2 and 3 of the form. The named sections of the document must be drawn up in accordance with their names using computers or black or blue ballpoint pens.

Having completed the execution of the specified form, information about the discrepancy in data should be reflected in the matching sheet No. INV-19.

When filling out the forms, you must follow the recommendations developed by the State Statistics Committee of the Russian Federation in the same Resolution.

As a conclusion, it should be noted that the current legislation of Russia allows for the execution of documents, the forms of which have not been approved. Consequently, each enterprise has the right to develop and fill out an independent regrading act form, which will be used along with the above documents.

sample regrading act

In what cases is misgrading possible?

The conditions for offset are given in the Guidelines approved by Order of the Ministry of Finance No. 49. Offset is allowed if:

- surpluses and shortages were identified in one audited period;

- one employee is responsible for the occurrence of misgrading;

- shortages and surpluses were identified for products of the same name and in equal quantities.

For example, if a surplus of red toys is found in warehouse No. 3, and a shortage of green toys is found in warehouse No. 4, then this will not be a re-grading of goods. Accordingly, offset is excluded. It cannot be carried out if there are shortages and surpluses of different products, and not identical, but of different types. The above conditions must be met simultaneously. If one of them is not met, the surplus is accounted for separately, and the deficiency is written off from the balance sheet.

Reflection of inventory results in accounting

However, officials limited themselves to pointing out: in accordance with the Methodological Instructions, proposals to regulate discrepancies in the actual availability of valuables and accounting data identified during the inventory are submitted for consideration to the head of the organization. And it is the manager who makes the final decision on the test (Letter dated March 31, 2011 N 03-03-06/1/195).

According to the author, to answer the question of what is the name of a food product, you can refer to GOST R 51740-2001 “Technical conditions for food products. General requirements for development and design" <1>. In Sect. 4.3 of this Standard provides requirements for the name of a food product. So, the name of a specific food product must comply with the requirements of GOST R 51074-2003 “Food Products. Information for the consumer. General requirements" <2>. The name of a food product must accurately and unambiguously characterize it. In this case, the name should be short, but allowing consumers to accurately identify the food product by belonging to a certain group of homogeneous products, characterized by a common purpose, composition (raw materials), condition, manufacturing method and (or) other factors. The product name may be supplemented by a trade name. Examples of names: frozen dumplings “Russian”, bitter porous chocolate “Air”. When forming the name of products, you should take into account the name of the corresponding classification group according to the All-Russian Classifier of Products OK 005-93 <3> at the type level, and in its absence - a subgroup or group. For example , OKP code 92 2200 corresponds to the group “Dairy products, except low-fat”, code 92 2260 - to the subgroup “Curd cheeses”, code 92 2261 - to the type “Curd cheeses without fillers”, code 92 2262 - to the type “Curd cheeses with fillers”. If a specific product is covered by a state standard, then the name of the product is formed taking into account the heading in the name of this standard. The product name should use standardized terms established in government and industry standards. Note that, according to clause 3.5.1.4 of GOST R 51074-2003, when flavorings are included in products that imitate the presence of food products (ingredients), their names indicate that these products are products with their taste and (or) aroma. For products with an aroma that is not inherent to a specific natural product, or with a complex aroma, indicate that they are flavored (without indicating a specific aroma).

<1> Approved by Decree of the State Standard of Russia dated April 25, 2001 N 191-st. <2> Approved by Decree of the State Standard of Russia dated December 29, 2003 N 401-st. <3> Approved by Decree of the State Standard of Russia dated December 30, 1993 N 301.

Taking into account the above, the author believes that in order to establish the identity of the product name, the All-Russian Product Classifier OK 005-93 should be used. The names of goods are the same if their OKP codes coincide at the type level, and in its absence, the subgroups or groups.

K.V. Timokhin

Journal expert

"Food industry:

Accounting

and taxation"

Document: Misgrading identified during inventory does not affect the tax accounting of the enterprise

The material was prepared by specialists from the editorial office of the newspaper “Accounting Week”

Misgrading identified during inventory does not affect the tax accounting of the enterprise

QUESTION: When conducting an inventory, a shortage of one product and a surplus of another was discovered. Is it possible to cover the shortage with an identified surplus of another product? Is it necessary to reflect the amount of discrepancies in tax accounting: the shortfall as part of gross expenses, and the surplus as part of gross income?

ANSWER: One of the ways to resolve discrepancies found during inventory is to offset shortages and surpluses as a result of re-grading of material assets.

Let us turn to the Instructions for the inventory of fixed assets, intangible assets, inventories, cash and documents and settlements, approved by order of the Ministry of Finance dated 08.11.94. No. 69 (hereinafter referred to as Instruction No. 69), which provides for the possibility of such offset.

According to clause 11.4 of Instruction No. 69, working inventory commissions, together with the accounting department, are developing proposals regarding the offset of shortages and surpluses by re-grading. Permanent inventory commissions check the validity of submitted proposals to offset misgrading in all places where valuables are stored. The decision to carry out a regrading test is reflected in the protocol of the inventory commission, which must be reviewed and approved by the head of the enterprise within 5 days.

This is about documentation. Now about the requirements put forward by Instruction No. 69 for the classification of misgraded students. Clause 11.12 of Instruction No. 69 allows mutual offset of surpluses and shortages as a result of regrading only in relation to inventory items of the same name and in the same quantity, provided that the surpluses and shortages occurred during the same audited period and from the same audited person. At the same time, government bodies in charge of enterprises (organizations) have the right to establish a procedure when such offset can be allowed in relation to the same group of goods and materials, if the values that are part of it are similar in appearance or packaged in the same container (when they are released without unpacking the container). In our opinion, ordinary “non-state enterprises” can make such an offset on this basis, but only with the permission of the head of the enterprise.

So, regrading is provided for those situations when, instead of one product (especially if this product is presented in an assortment and has similar external characteristics), another position of this product is sold. Or the operator (accountant), when preparing the invoice, mistakenly entered an incorrect item for the goods being sold, which led to discrepancies between the accounting data and the actual balance of goods in the warehouse. In this case, the person who made the mistake must give convincing and justified explanations of the reason for the formation of the misgrading.

The inventory results approved by the manager are reflected in the accounting records of the enterprise in the month in which the inventory is completed, but no later than December of the reporting year.

In accounting, the amount of credited regrading is reflected by the entries Dt 20 - Kt 20, Dt 22 - Kt 22, Dt 28 - Kt 28. In this case, the overidentified goods are reflected in the debit, and the cost of the missing goods is reflected in the credit. The offset of regrading does not affect the tax accounting of the enterprise (within the amount of offset, neither gross income nor gross expenses arise).

The amount of shortfall not covered by surpluses within the limits of natural loss norms is written off as expenses of the enterprise, and in excess of norms is attributed to the guilty persons. If, on the contrary, the values identified in the surplus exceed the value of the values identified in the shortage during re-grading, then the surplus is attributed to the increase in the balances of the corresponding inventory items and to the income of the enterprise.

The amount of identified shortages and the amount of surplus cannot be called re-grading if such values could not be confused in any way (they belong to different groups of goods and materials, have a dissimilar appearance, are located in different storage locations, etc.).

Explanatory note from the guilty employee

A commission is formed to identify all the circumstances of the incident. She is looking for the culprits. If misgrading is detected, the financially responsible employee (for example, a storekeeper) must provide an explanation.

It is addressed to the chairman of the commission. The financially responsible employee must indicate which goods were in surplus and which were in short supply, in what quantity, and the reasons why this situation arose. The head of the enterprise has the right to apply a disciplinary sanction to the person.

How to draw up an act on re-grading of goods

The presence of misgrading can be identified during the process of receiving goods or during inventory. If it was discovered upon receipt of the goods from the supplier, then the financially responsible person or the commission that was organized for the period of acceptance of the goods draws up a corresponding document.

The act of re-grading goods, the form of which, according to the unified form No. M-7, is called “Act of acceptance of goods,” must be approved by the head of the enterprise.

If misgrading is identified during the inventory period, then a special commission must draw up a protocol that reflects all identified deficiencies and surpluses of goods.

Before making a decision whether to offset or not, it is necessary to establish the nature of the shortage. If it was formed not due to the natural loss of reserves, but due to those financially responsible, then it should be established who these persons are.

After identifying the culprits, the protocol of the inventory commission describes the details of how the misgrading of goods occurred. This means that explanations must be taken from those responsible, which are attached to the protocol. Explanations are taken both from financially responsible persons and, if necessary, from members of the inventory commission.

Then the drawn up protocol must be reviewed and approved by the head of the enterprise within five days.

In addition to the compiled protocol, the regrading must be reflected in the accounting documents. They account for both surplus and shortage of goods. Such postings are made to account 28. If there is a surplus of goods, then this is recorded in the debit part of it. If there is a shortage, then entries are made in the credit area of the account.

Proposal for offset

It is drawn up by the chairman of the commission addressed to the head of the organization. It is advisable to make a proposal for offset if all the conditions given above are met. Otherwise, completing this document will only be a waste of time. The proposal provides information about the inventory, during which misgrading was identified, names, codes and quantities of products, shortages and surpluses of which were discovered, are indicated. The document also reflects information from the explanatory note of the financially responsible employee. If necessary, additional information from the technologist's conclusion is provided, confirming the possibility of mutual replacement of products and the identity of product codes according to OKP.

Collation statement

It records the inventory results and reflects data on regrading. The matching statement is drawn up in 2 copies. The first is to be transferred to the financially responsible employee, the second remains in the accounting department.

Information from the document is transferred to the statement according to f. INV-26. It, in fact, determines the method of eliminating discrepancies: by offset, write-off, or attribution to the culprit.

Features of reporting

When taking into account misgrading, many difficulties arise. For example, it happens that the total cost of different types of products, shortages and surpluses of which have been identified, differs. This situation may be due to differences in the prices of individual products. Meanwhile, this discrepancy does not prevent the regrading from being counted.

It happens that the shortage of products is greater than the surplus or vice versa. In this case, some of the products are counted as misgraded, and the rest are reflected according to the rules established for cases of compensation for damage to guilty parties. For example, if the total cost of products for which a shortage is identified is higher than the price of the surplus, then the responsible employee will compensate for the difference.

What are the reasons for the misgrading?

Regrading can occur both at the enterprise producing the product and in the process of preparing it for sale (in trade organizations). The buyer often associates re-grading with falsification and deception by replacing higher-grade goods with lower ones, but re-grading has not only subjective, but also objective components.

For example, misgrading of meat, sausages, flour, cereals, starch, coffee when sold in trade is often qualified as deception of the buyer by the manufacturer, since the quality of these goods is fully formed during their production and does not change during storage and sale by the seller. At the same time, there is a significant group of goods, the quality of which changes significantly during storage, and at the same time the quality indicators that determine their commercial grade are reduced. In this case, a re-grading occurs, which is of an objective nature, in which the seller who sells the expired product is to blame. Examples include dietary chicken eggs, Vologda butter, long tea, rennet cheeses, grape wines and other products, the grade of which is determined by direct tasting.

As a rule, misgrading occurs when there is insufficient control of goods released from the warehouse, data on the varieties and names of which differ from the information specified in the primary documents. This may occur due to the negligent attitude of financially responsible persons (storekeepers) to their duties or the lack of a clear procedure for the acceptance and storage of goods in the warehouse, or failure to comply with the established document flow schedule. Misgrading may occur as a result of staff abuse. At the same time, a shortage of some types of products and a surplus of others of the same name are discovered when conducting an inventory of products in the warehouse of a food industry enterprise.

Let's simulate the situation. The meat processing plant receives raw materials, which are transferred to primary processing. The processing act states: consumption (cow) - receipt (beef) (300 kg). The processed product is indicated in parts: beef tripe - 50 kg; beef meat (shoulder) - 67 kg; beef meat (butt) - 43 kg; beef of the 1st category - 90 kg; beef head - 30 kg; offal - 20 kg. The invoice for the release of products from the warehouse also describes everything in detail, but the assortment may be slightly different. The storekeeper may confuse the names of the parts of beef and indicate in the invoice for beef tripe in the amount of 67 kg instead of 50 kg, and beef shoulder in the amount of 50 kg instead of 67 kg. As a result, if you carry out an inventory, a shortage of 17 kg of beef tripe and a simultaneous surplus of beef shoulder will be discovered in the warehouse - the same 17 kg. Can we call this a re-grading? Let us remind you that the grade of a meat product is determined by the content of its main ingredient - meat. The higher the contribution of this component and the lower the contribution of veins and other tasteless components, the higher the grade. In the shoulder, tripe, head, butt, the content of tasty and tasteless components differs, so in principle these can be considered meat products (or rather, semi-finished products) of different grades (categories). If you separate the named parts into separate product names, then you won’t be able to call the identified discrepancies (shortages and surpluses) re-grading.

In any case, the main thing is to write off products in a timely manner so that the same amount of products is recorded as is actually in the enterprise’s warehouse. Complicating the situation is the fact that food industry enterprises account for tens of tons of products (beef, pork, lamb). Tracking kilograms of scars, shoulder blades, buttocks is quite a labor-intensive task. As a way out of the situation, it can be proposed to enlarge the listed accounting objects to beef (pork, lamb), the consumption of which in tons can be calculated taking into account all parts of the carcass sold. However, this method reduces control over the movement of finished products, especially when the company’s products are sold by intermediaries. By selling the most expensive cut of 1st category beef, they can record the sale of the cheapest cut of 1st category beef, and keep the difference in the markup for themselves. For example, a middleman who received 1st grade beef with 80% shoulder may report that only 20% was shoulder, and the rest was cheaper ingredients. To prevent such situations from arising, producers need to keep separate records of different meats with their costs. Of course, such accounting is not easy to organize. Let's highlight a few nuances.

Firstly, misgrading may arise due to differences in documents prepared by different employees. The receipt document (processing certificate) is drawn up by the head of the processing workshop, the expenditure document (issue invoice) is issued by the storekeeper. One of them entered one name, and the other listed the same product under a different name. How to eliminate discrepancies? It is necessary to automate the accounting process in the processing shop and warehouse so that those responsible for material assets work in the same program with an identical product range. The introduction of new types of products must be agreed upon and applied by all responsible persons filling out documents for the movement of finished products.

Secondly, even when working in an automated system, there may be discrepancies in income and consumption, for example, if income is reflected in aggregate (beef), and consumption is shown at the level of the next stage (shoulder, tripe, butt, head). This is only possible when raw materials are released into production, when one thing is released, and at the output (during processing, cutting) another is obtained. This shouldn't happen in a warehouse. Either incoming and outgoing items show beef, pork, and lamb (with integrated accounting), or incoming and outgoing items include shoulders, tripes, butts, and heads (when maintaining detailed accounting). Only when the level of redistribution of receipts at the warehouse corresponds to the level of redistribution of consumption, it is possible to offset the shortages and surpluses that arise during re-grading.

What to do if the culprit is not identified?

In this case, the difference is recognized as a shortage in excess of the norm of natural loss and, accordingly, is written off as costs. In such a situation, the head of the enterprise must document the absence of the culprit. The inventory commission, in turn, in its conclusion must justify the reasons why it is impossible to recover losses from the responsible persons.

As established in the Tax Code (Article 265, paragraph 2), losses can be attributed to non-operating expenses. If items in surplus are more expensive than those in short supply, the difference is written off as other income. It must be said that regrading is reflected differently in tax and accounting. In the first case, it is necessary to indicate the entire amount of detected deficiencies and surpluses. To put it simply, in taxation, regrading is the write-off of some products and the capitalization of others.

What is regrading

So, re-grading of goods is recognized as an excess of one type of product with a simultaneous shortage of another, necessarily within the name of the MC of one product group. For example, according to accounting data, there are 100 kg of premium rice and 50 kg of first-grade rice in the warehouse. The inventory commission established the actual availability of 80 kg of premium rice and 70 kg of first grade. The main reasons for the established misgrading may be:

- Initially, incorrect posting of goods by a warehouse employee;

- Markings on the product or in documents that do not correspond to the assortment;

- Errors when releasing goods from the warehouse;

- Cashier errors (in trading) when carrying out a purchase transaction through the cash register;

- Lack of proper control of warehouse document flow.

Thus, the person responsible for misgrading can be any of the warehouse personnel (loader, storekeeper) or an accountant who controls and takes into account the turnover of inventory items and their documentation. The detected misgrading of goods during inventory is dated on the day the misgrading was established, since it is often impossible to find out the real time of the confusion that arose.

Process automation

Let's look at how to reflect regrading in 1C. The procedure will be as follows:

- In the Menu you need to open “Warehouse and delivery”, then “Surplus, damage, shortages” and “Warehouse acts”.

- In the list of acts form, you must click the “Create” button.

- Among the items you should select “Regrading”.

- The new document indicates the enterprise to which the shortages will be written off and the surpluses resulting from the re-grading, the warehouse where it arose, and the division will be credited.

- On the item “Receive products at write-off cost” you need to check the box.

- The item of expenses to which the shortage will be attributed, the item of income to which the surplus will be transferred is indicated.

- In the “Products” tab, indicate information about the products for which you want to reflect the regrading, after which you should click the “Post” button.

Next, you need to select “Act of Regrading,” print it and submit it for approval.

When is offset possible?

Logic dictates that when regrading, the easiest way is to offset the missing and excess goods. But this can be done legally (according to the Methodological Instructions) only if a number of conditions are simultaneously met:

- discrepancies between goods of different grades were identified in the same accounting period (during the general inventory);

- responsibility for both shortages and surpluses is assigned to one person;

- the discrepancy between goods is identical in quantitative terms (surpluses cover shortages, and vice versa).

For example, if a surplus of “Bera” pears is found in one warehouse, and a shortage of “Duchess” pears is recorded in another, this cannot be recognized as misgrading and offset, since different people are responsible for different warehouses. It is also impossible to offset, for example, a shortage of tubes of toothpaste and the same excess of soap - these are goods of different names.

Postings for re-grading

Let's look at the features of reflecting discrepancies using an example. Let's say a company sells flour. Before the formation of annual reporting, an inventory was carried out, during which a shortage of premium products was revealed in the amount of 200 kg at a cost of 17.50 rubles and 150 kg of surplus first grade at a price of 13.20 rubles. The commission found that the storekeeper was to blame for the discrepancies. By order of the manager, a regrading test was carried out.

The accountant reflects transactions according to the following scheme:

- db sch. 94 CD count. 41 subconto “Premium flour” – 3500 rub. (200 x 17.50) – shows the shortage of premium products.

- db sch. 41 subconto “Flour p/s” CD count. sch. 94 – 1980 rub. (150 x 13.20) – reflects the surplus of first-grade products.

- db sch. 41 subconto “Premium flour” CD count. 41 subconto “Flour p/s” – 1980 rub. – product credit is shown.

The cost of deficiencies exceeds the total cost of surpluses by 645 rubles (150 x (17.50 - 13.20)). After the offset at the enterprise, the shortage of premium products remained in the amount of 50 kg. Its book value is 875 rubles. (50 x 17.50). As a result, after offset by misgrading, the amount of the shortage transferred to account 94 for premium products is equal to 1,520 rubles (875 + 645). Due to the fact that the storekeeper was responsible for the discrepancies, the specified amount will be withheld from his earnings.

Re-grading of goods

The appearance of misgrading is possible if the procedure for receiving and storing goods in a warehouse is violated and there is no proper internal control over the movement of goods. Sometimes the reason for misgrading is simply the inattention of the financially responsible person releasing the goods.

This is a scary word - inventory

When conducting an inventory, trade organizations are guided by the Methodological Guidelines for the Inventory of Property and Financial Liabilities, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49 (hereinafter referred to as the Guidelines for the Inventory). Mandatory inventory is carried out:

- when transferring property for rent, redemption, sale, as well as during the transformation of a state or municipal unitary enterprise;

- before preparing annual financial statements;

- when changing financially responsible persons;

- when facts of theft, abuse or damage to property are revealed;

- in the event of a natural disaster, fire or other emergency situations caused by extreme conditions;

- during reorganization or liquidation of the organization;

- during an audit (Federal Law of November 21, 1996 No. 129-FZ “On Accounting”).

Re-grading is identified on the basis of the Inventory inventory of inventory items (form No. INV-3), where the shortage of goods of one type is reflected in one line of the inventory, and the surplus in another. Next, form No. INV-3 is transferred to the accounting department of the trading company for the preparation of a Comparison Statement of the results of the inventory of inventory items (form No. INV-19), in which columns 18-23 are provided to reflect the misgrading. In addition, information about the regrading of goods is also indicated in the Statement of Accounting of Results Revealed by Inventory (Form No. INV-26).

it is important

Proposals for mutual offset of surpluses and shortages as a result of regrading are prepared by a permanent inventory commission and submitted for consideration to the head of the organization.

Is offset possible?

It is possible to offset the shortage of goods with surplus if the offset is carried out:

- for the same period;

- in relation to the same person being inspected;

- in relation to goods of the same name in equal quantities.

The decision to offset the shortage with surplus is made by the head of the trading company. The inventory commission submits proposals for consideration to regulate discrepancies between the actual availability of goods and accounting data. The financially responsible person being inspected must submit detailed explanations about the misgrading to the inventory commission. If, after offsetting the shortage with surplus by re-grading, the value of the missing goods exceeds the value of the goods found in surplus, the difference in their value is attributed to the guilty party. If the perpetrators are not identified, then the differences are considered as excess commodity losses and are written off as distribution costs of the trade organization.

In relation to the difference in value from re-grading, which did not cover the shortage of goods, which was not caused by the fault of the financially responsible person, the protocols of the inventory commission must provide comprehensive explanations about the reasons why such a difference is not attributed to the guilty persons.

Let's look at the procedure for reflecting the offset of shortages of goods with surpluses based on re-grading using examples.

Example 1

Organization “A” sells wholesale flour. Before preparing the annual reports, “A” carried out an inventory, as a result of which a shortage of premium flour in the amount of 200 kg was revealed at a price of 17.5 rubles. and surplus first-grade flour in the amount of 150 kg at a price of 13.2 rubles. The culprit of the allowed misgrading is the financially responsible person of the organization - the storekeeper.

By decision of the manager, organization “A” offset the shortage of premium flour with a surplus of first grade flour in the amount of 150 kg. The accountant of organization “A” made the following entries:

Debit 94 Credit 41 subaccount “Premium flour” - 3,500 rubles. — a shortage of 200 kg of premium flour is reflected (200 kg × 17.5 rubles);

Debit 41 subaccount “First grade flour” Credit 94 - 1980 rub. — surplus of first-grade flour is reflected in the amount of 150 kg × 13.2 rubles;

Debit 41 subaccount “Premium flour” Credit 41 subaccount “First grade flour” - 1980 rubles. - reflects the offset of the shortage of premium flour with a surplus of first grade flour.

When the shortage is offset by the surplus by re-grading, the cost of the missing flour exceeds the cost of the flour that is in surplus by 645 rubles. = 150 kg × (17.5 rubles - 13.2 rubles). Since the storekeeper is to blame for the mis-grading, this difference is attributed to the guilty party. In addition, after the offset, the accounting records of organization “A” continue to include a shortage of premium flour in the amount of 50 kg, the book value of which is 50 kg × 17.5 rubles. = 875 rub. After the offset, the amount of the shortage reflected in account 94 for premium flour amounted to 1,520 rubles. = (645 + 875). Since the storekeeper is to blame for the mis-grading of goods, the amount of the shortage is recovered from the guilty person, who agrees with the shortage.

Tax authorities, when writing off shortfalls, require the VAT payer to restore the amount of tax previously accepted for deduction. Note that this opinion is not indisputable, therefore, when writing off shortfalls, the organization must decide for itself whether it will restore the tax amount or not. Let’s assume that organization “A” has decided not to restore the tax amount.

Debit 73-2 Credit 94 - 1520 rub. - the amount of the deficiency is attributed to the guilty person.

In accordance with Article 246 of the Labor Code, the amount of damage caused to the employer is determined by actual losses, calculated from the market price of the goods in force in the area on the day the damage was caused, but not lower than the book value of the property.

The market price of premium flour on the day of damage is 17.6 rubles. The difference between the book value of premium flour and its market price is 200 kg × (17.6 rubles - 17.5 rubles) = 20 rubles.

Debit 73-2 Credit 98 - 20 rub. — the difference between the market price of flour and its book value is also attributed to the guilty party;

Debit 50 Credit 73-2 - 1540 rub. — the debt for the shortage has been added to the organization’s cash desk;

Debit 98 Credit 91-1 - 20 rubles. — the difference between the book value of flour and its market price is recognized as other income of the organization.

Let's consider a slightly different situation.

Example 2

Organization “A” sells wholesale flour. Before preparing the annual reports, “A” carried out an inventory, as a result of which a shortage of premium flour in the amount of 100 kg was revealed at a price of 17.5 rubles. and surplus first-grade flour in the amount of 150 kg at a price of 13.2 rubles.

The price of flour corresponds to the level of market prices.

The culprit of the allowed misgrading is the financially responsible person of the organization - the storekeeper.

By decision of the manager, organization “A” offset the shortage of premium flour with a surplus of first grade flour in the amount of 100 kg. The remaining surplus of first-grade flour is accepted by the organization for accounting. The accountant of organization “A” made the following entries:

Debit 94 Credit 41 subaccount “Premium flour” - 1,750 rubles. — a shortage of 100 kg of premium flour is reflected (100 kg × 17.5 rubles);

Debit 41 subaccount “First grade flour” Credit 94 - 1980 rub. — surplus of first-grade flour is reflected in the amount of 150 kg × 13.2 rubles;

Debit 41 subaccount “Premium flour” Credit 41 subaccount “First grade flour” - 1320 rubles. - reflects the offset of the shortage of premium flour with a surplus of first grade flour (100 kg × 13.2 rubles).

When the shortage is offset by the surplus by re-grading, the cost of the missing flour exceeds the cost of the flour that is in surplus by an amount of 430 rubles. = 100 kg × (17.5 rubles - 13.2 rubles). The difference is attributed to the person at fault.

Debit 73-2 Credit 94 - 430 rub. - the amount of the shortage of premium flour is attributed to the guilty person.

Debit 50 Credit 73-2 - 430 rub. — the amount of debt has been deposited into the organization’s cash desk.

If the market price of first-grade flour, prevailing on the day of the damage, was greater than in the example conditions, then in accounting, organization “A” would bring the final balance of first-grade flour to the market value using the following entry:

Debit 41 subaccount “First grade flour” Credit 91-1 - for the amount of the difference between the book value of flour and its market price.

note

Goods are part of inventories acquired or received from other legal entities or individuals and intended for sale. Amounts of shortages of goods are written off to account 94 “Shortages and losses from damage to valuables” at the actual cost, which consists of the contract price of the goods and the share of transportation and procurement costs (hereinafter referred to as TZR) related to this product (clause 29 of the Accounting Guidelines inventories approved by order of the Ministry of Finance of Russia dated December 28, 2002 No. 119n). Therefore, if a trade organization does not take into account TKR in the actual cost of goods, then the share of TKR recorded in account 44 “Expenses” should be added to the amount of the shortage written off as a debit to account 94 “Shortages and losses from damage to valuables” from account 41 “Goods”. for sale". The procedure for determining the share of consumer goods related to missing goods is determined by the organization independently and is fixed in the accounting policy of the organization.

V. Semenikhin , head of the Semenikhin Expert Bureau

Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe

Nuances

Based on Article 246 of the Labor Code, the amount of damage caused to the employer is established in accordance with the actual losses. They, in turn, are calculated at the market value in effect at the time of the damage in the area. However, it cannot be less than the book value of material assets.

Let’s assume that the market price of premium flour on the date of harm was 17.60 rubles. In this case, the discrepancy between it and the book value will be 20 rubles. (200 x (17.60 – 17.50)).

The accountant will make the following entries:

- db sch. 73 subaccounts 73.2 CD count. 98 – 20 rub. – reflects the difference between the book value and market value of the product, attributed to the guilty employee.

- db sch. 50 CD count. 73, subaccount. 73.2 – 1540 rub. – the debt for the shortage has been entered into the cash register.

- db sch. 98 CD count. 91, subaccount. 91.1 – 20 rub. – recognition of the difference between the book value and market value of flour as other income.

When recovering damages from the perpetrator, it is necessary to strictly comply with the requirements set out in the Labor Code.

If excess is detected

As a rule, regrading is carried out in order to reduce the amount of losses caused to the enterprise by the shortage (waste) of finished products and other material assets. But sometimes (though extremely rarely) as a result of an error in the production report or in the accounting department, more products end up in the warehouse than are listed in the accounting records. The following situation is also possible: identified shortages are quantitatively greater than surpluses, but in terms of value, on the contrary, there are more surpluses. In these cases, the accountant should reflect the excess of surpluses over deficits in accounting. Obviously, the traditional correspondence of accounts Debit 41 Credit 91-1 is suitable for this when identifying surpluses.

Example 2. Let’s change the conditions of the previous example: let’s assume that during the inventory, a shortage of beef tripe (70 kg) and a surplus of brisket (50 kg) was revealed for one financially responsible person and for one reporting period. The shortfall in value terms amounted to 4,200 rubles. (70 kg x 60 rubles/kg), and the surplus is 5000 rubles. (50 kg x 100 rub/kg). The market valuation of finished products corresponds to the accounting value.

In quantitative terms, the shortage is greater than the surplus, but in monetary terms, the surplus is greater than the shortage. The credit will be made for 50 kg, the difference in value terms will be 2000 rubles. (50 kg x 100 rubles/kg - 50 kg x 60 rubles/kg). The discrepancy will be included in other income. 20 kg of beef tripe will remain unaccounted for, the damage for the shortage will be 1200 rubles. (20 kg x 60 rub/kg). Therefore, despite the fact that according to accounting data there is a surplus, the employee will still be responsible for the shortage.

The following entries will be made in the organization's accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| Beef tripes and briskets were counted (50 kg) | 43-1 | 43-1 | 3000 |

| The cost excess of the surplus over the shortage is reflected | 43-1 | 91-1 | 2000 |

| Reflects a shortage that exceeds the surplus in quantity | 94-1 | 43-1 | 1200 |

| The difference between the shortage and surplus after regrading was attributed to the guilty parties | 73 | 94 | 1200 |

The first of the previously considered options for reflecting misgrading in accounting was selected.

Thus, no matter how high the estimate of the surplus is (if, for example, the market value is higher than the book value), the employee will still have to answer if the quantity of missing products is greater than that found in the surplus. Expensive surpluses will increase the organization's other income and will not reduce the employee's debt.