Topic: Shortages, surpluses of goods, their reflection in accounting

Shortages or surpluses identified as a result of the inventory of goods must be reflected in the accounting records of the organization. Let's consider typical transactions reflecting the results of inventory of goods.

Account Dt Account Kt Posting description Posting amount Base document

We reflect the results of the inventory

41 91.1 Surplus of goods identified Amount of surplus Inventory list according to the INV-3 form

Matching statement in form INV-19

Accounting certificate-calculation

94 41 Shortages of goods were identified Amount of shortages Inventory list according to the INV-3 form

Matching statement in form INV-19

Accounting certificate-calculation

We reflect the write-off of shortages within the norms

96 94 If the organization has a reserve for writing off normalized losses Amount of shortage within the norm Accounting certificate-calculation

44 94 If the organization does not have a reserve for writing off normalized losses, the amount of the shortage is within the norm Accounting certificate-calculation

We reflect the write-off of shortages in excess of norms at the expense of the guilty party

73.2 94 Write-off of shortage of goods at the expense of the guilty person within the limits of the book value of the missing property Amount of shortage in excess of the norm within the limits of the book value of the missing goods Accounting certificate-calculation

73.2 91.1 If the amount of recovery from the guilty parties is greater than the book value of the missing property The difference between the book value of the missing goods and the amount of recovery Accounting certificate-calculation

We reflect the write-off of shortages of goods in cases where the perpetrators have not been identified

91.2 94 Write-off of shortage of goods to the financial result Amount of shortage Accounting certificate-calculation

List of accounts involved in accounting entries:41 - Goods

44 – Selling expenses

73 — Settlements with personnel for other operations

73.2 - Calculations for compensation for material damage 91 - Other income and expenses

91.1 - Other income

91.2 — Other expenses

94 – Shortages and losses from damage to valuables

96 – Reserves for future expenses

Write-off of receivables and payables

In this article, we will consider the procedure for writing off doubtful (bad) receivables and payables identified as a result of an inventory of settlements in the organization’s accounting records, and we will determine typical accounting entries.

Write-off of overdue debts. Legal basis

Write-off of accounts receivable. Typical wiring

Write-off of overdue debts. Legal basis

Based on the results of the inventory of payments, doubtful and bad debts of buyers, customers, and personnel to the organization are identified.

According to clause 70 of the Regulations on Accounting and Accounting Reports in the Russian Federation, in accounting, doubtful debt is recognized as the receivables of an organization that are not repaid within the time limits established by the agreement and are not provided with appropriate guarantees. Thus, based on the results of the inventory, receivables (payables) for each obligation in accordance with the terms of the concluded agreements and taking into account the repayment period can be classified as follows:

debt for which the repayment period has not yet arrived;

debt for which the repayment period has already passed.

In addition, for overdue receivables and payables, the limitation period is determined, and the circumstances that interrupt this period are established.

According to Art. 196 of the Civil Code of the Russian Federation establishes a general limitation period of three years. In this case, the period calculated in years expires in the corresponding month and day of the last year of the term (Art.

https://youtu.be/QdDh5tAcqFk

Accounting for inventory results: postings

To carry out the inventory, a special inventory and a commission are created that will conduct the event. Inventory can be carried out in warehouses or inside any premises.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 94 | 10.01 | Identifying material shortages | Shortfall amount | Inventory list INV-3 Matching sheet INV-19 Accounting certificate-calculation |

Some finished products tend to decrease in weight or volume. For example, sausage has its own shrinkage number, which is taken into account when accounting. To compensate for such losses, some enterprises have special funds.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 96.09 | 94 | Write-off of shortages within the limits of norms when there is a reserve for write-off of losses | The amount of the shortage is within the norms | Accounting certificate-calculation |

| 20.01 | 94 | Write-off of shortages within the norms when there is no reserve for write-off of losses | The amount of the shortage is within the norms | Accounting certificate-calculation |

When storing goods, write-offs may occur as a result of scrap, loss or damage. Such loss is also subject to write-off, but subject to compensation by the person responsible.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 73.02 | 94 | Write-off of loss of materials at the expense of the guilty party in excess of the norm within the book value | The amount of shortage within the book value of materials | Accounting certificate-calculation |

| 73.02 | 91.01 | Postings for writing off shortages of materials at the expense of the guilty party in excess of the norm within the book value, when the amount to be recovered is greater than the market value of losses | Difference between recovery volume and balance sheet value | Accounting certificate-calculation |

When losses were caused, for example, by an emergency (fire, natural disasters), expenses are transferred to a future reporting period.

Postings

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 91.02 | 94 | Write-off of shortages with unknown culprits | Shortfall amount | Accounting certificate-calculation |

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10.01 | 91.01 | Capitalization of surplus materials | 18 | Inventory list, comparison sheet, record sheet of results identified by inventory |

Inventory results are reflected in accounting in the month in which the inventory ended. The results of the inventory for the year are indicated in the annual accounting report (clause 5.5 of the Guidelines for the inventory of property and financial obligations).

If surpluses are identified during the audit, the accountant will generate the following entry:

- Dt 08, 10, 41, 43, 50 Kt 91 - valuables discovered during inventory were capitalized.

If a shortage is detected, then you should first make a posting to the debit of the account. 94 in correspondence with the account of missing values. If this is a natural loss, then the following is the wiring:

- Dt 20, 23, 44 Kt 94 - the cost of inventory items was written off within the limits of natural loss norms.

If the amount of the shortage is greater than the norms for natural loss, or such norms have not been established for the object, and the culprit of the shortage works in the company, then the accountant makes an entry in accounting:

- Dt 73 Kt 94 - the shortage is attributed to the responsible person.

The loss can be withheld from the employee’s salary - but not more than 20% of the monthly salary (Article 138 of the Labor Code of the Russian Federation):

- Dt 70 Kt 73 - the shortage is withheld from the salary of the material person.

The guilty person can independently deposit money into the company’s cash desk to pay off the debt:

- Dt 50 Kt 73 - a financial person deposited money into the cash register to pay off a debt.

If the person responsible for the shortage is not found or the court does not allow the company to collect money from him, an entry is made:

- Dt 91-2 Kt 94 - loss from shortage is written off due to the absence of the guilty party or refusal to collect.

How to reflect a shortage in accounting

192 of the Civil Code of the Russian Federation). According to Art.

200 of the Civil Code of the Russian Federation, the limitation period begins from the day when the person learned or should have learned about the violation of his right. And it is interrupted, according to Art. 203 of the Civil Code of the Russian Federation when filing a claim in the prescribed manner, as well as when the obligated person performs actions indicating recognition of the debt (for example, signing a reconciliation report, a restructuring agreement, etc.). After a break, the limitation period begins anew and the time elapsed before the break is not counted towards the new period.

If an organization has created a reserve for doubtful debts, then the amounts of debt written off are credited to the reserve for doubtful debts, otherwise - to the financial results.

Recognizing a receivable as a loss due to the debtor's insolvency does not constitute cancellation of the debt. Write-off receivables must be accounted for for five years in off-balance sheet account 007 “Debt of insolvent debtors written off at a loss” in order to monitor changes in the debtor’s property status. Analytical accounting for account 007 is maintained for each counterparty whose debt is written off at a loss, and for each debt written off at a loss.

Write-off of accounts receivable. Typical wiring

Using the standard entries below, the results of the inventory of settlements with debtors are reflected in the organization’s accounting records.

Account Dt Account Kt Posting description Posting amount Base document

The procedure for reflecting the inventory of settlements with debtors if the organization has created a reserve for doubtful debts

63 62 We reflect the write-off of accounts receivable if the organization has a reserve for doubtful debts Amount of debt written off Accounting certificate-calculation

Reconciliation report with counterparty

We reflect the written-off receivables on an off-balance sheet account for further control Amount of written-off debts Accounting certificate-calculation

Reconciliation report with counterparty

The procedure for reflecting the inventory of settlements with debtors in the case when there is no provision for doubtful debts

91.2 62 We reflect the write-off of accounts receivable in the absence of a reserve for doubtful debts in the organization Amount of debt written off Accounting certificate-calculation

Reconciliation report with counterparty

We reflect the written-off receivables on an off-balance sheet account for further control Amount of written-off debts Accounting certificate-calculation

Reconciliation report with counterparty

The procedure for reflecting amounts received in the process of collecting debt previously written off at a loss

51 91.1 We reflect the receipt of collected debt to the current account Amount of collected debt Bank statement

007 We write off the received amount of debt from the off-balance sheet account Amount of collected debt Accounting certificate-calculation

List of accounts involved in accounting entries: 007 - Debt of insolvent debtors written off at a loss

51 — Current accounts

62 — Settlements with buyers and customers 63 — Provisions for doubtful debts

91 — Other income and expenses

91.1 - Other income

91.2 — Other expenses

Date: 2015-09-02; view: 274; Copyright infringement

| Did you like the page? Like for friends: |

Based on the inventory results, the commission draws up matching statements, inventory lists, and acts: We document the inventory results in postings. The final stage of the inventory is the reconciliation of accounting data, and there is often a need to write off shortages or, on the contrary, capitalize excess values. How to reflect in postings the identified shortage during inventory. The shortage must be reflected on account 94 in correspondence with the account for the property being written off:

Next, we act in one of two ways: 1) The perpetrators have not been identified (not found). You can write off the shortage within the approved norms of natural loss as expenses for the main activity.

Tax accounting: we write off shortages

If the culprits are not found , the amounts of shortfalls are included in costs not related to sales (non-operating expenses). Regardless of where the shortage of fixed assets will be attributed during the inventory, it is written off with a simultaneous reimbursement to the budget of the VAT previously accepted as a tax deduction.

Restoration and payment are carried out in accordance with the requirements of the Tax Code of Russia (Article 171), according to which VAT deductions are provided for goods purchased for the production needs of the organization. This case involves non-productive use of the lost object. For written-off damaged fixed assets, the amount of so-called input VAT is restored in proportion to the residual value.

| Didn't find the answer? Ask your question to lawyers |

Based on the inventory results, the commission draws up matching statements, inventory lists, and acts: We document the inventory results in postings. The final stage of the inventory is the reconciliation of accounting data, and there is often a need to write off shortages or, on the contrary, capitalize excess values.

Accounting for shortages of property in the warehouse (storage agreement)

- A company certificate compiled on the basis of an analysis of prices for similar property (invoices from suppliers, advertisements for the sale of similar objects in the media, a certificate from statistical authorities, etc.);

- A certificate prepared by an independent appraiser (more preferable).

Excess valuables at market prices are included in other income and capitalized using the following entry:

Re-grading If the audit reveals a shortage of one value and a surplus of another, this fact must also be reflected in accounting.

Order (instruction) for capitalization of surplus

To account for the identified “additional” objects, the manager issues a decree (order) to capitalize the surplus during the inventory. The form of such an order has not been approved by Resolution 88, so enterprises develop it independently. In order to reliably reflect data in accounting, the order (or an appendix to it in the case of a large number of positions) must contain the following information:

- Names of material assets by type.

- Cost per unit, quantity and total cost for each type (cost here means the market price determined in accordance with the previous section).

- For fixed assets and intangible assets - useful life. When determining it, the condition of the object (degree of wear) should be taken into account.

Based on the matching statements and the order, surpluses are reflected in accounting and tax accounting.

A sample order for the posting of surplus during inventory can be downloaded from the link below:

Inventory of goods and materials in safekeeping

Attention

The rules and procedure for carrying out this procedure are established by the Methodological Instructions (Order of the Ministry of Finance No. 49 of June 13, 1995), they list the composition of property and liabilities subject to audit, and the forms of documents that can be used to document the results. The main stages of conducting an inventory are given in the table: Stage Document Explanation Preparation Order of the manager to conduct an inventory The order indicates: the timing of the inventory, the reason for the inventory, the list of property being inventoried, the list of financially responsible persons and the composition of the commission Carrying out an inventory list Members of the commission keep an inventory (count) of property and its condition Comparison of data Matching statement Reconciliation of the data presented in the inventory with the data in the accounting records.

Drawing up comparison sheets to identify discrepancies.

Postings for surpluses and shortages during inventory

Info Formatting and approval of results Accounting reference Bringing accounting data into compliance with actual availability. Writing off shortages or capitalizing surpluses Reasons for conducting an inventory, in addition to the annual obligation, may be:

- Change of financially responsible person;

- Fact of theft or damage;

- Disaster;

- Organizational reasons (change of manager, reorganization, etc.):

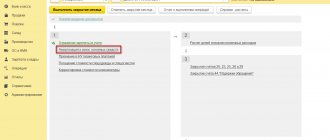

Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

The results of the inventory can be: To carry out the inventory, a commission consisting of at least three people is formed at the enterprise.

Reflection of goods in storage in accounting entries

Shortage during wiring inventory:

- Dt 20 (23,25,26,44) Kt 94

If natural loss rates for certain types of property are not established or the shortage exceeds them, then it is charged to other expenses and reflected by posting:

It is important to remember that in tax accounting it is impossible to recognize expenses in excess of the norms of natural loss (Article 254 of the Tax Code of the Russian Federation). 2) The perpetrators are identified, the damage is compensated at their expense. In this situation, an important role is played by the presence and content of an agreement on financial liability, as well as the norms of the Labor Code of the Russian Federation, which contain instructions on the maximum amount and procedure for deducting amounts from employees’ wages. If the guilty person is not an employee of the organization and agrees to compensate for the damage (it is better to draw up an agreement on voluntary compensation for damage), then you can deposit the money into the cash register or into a current account.

Reflection in accounting.

According to paragraphs. "b" pp.

Accounting entries for inventory

Postings based on inventory results are generated differently depending on what is revealed as a result - a surplus or a shortage. The procedure for reflecting discrepancies is regulated by Order No. 34n of July 29, 1998, paragraph 28):

- Surplus - objects are accounted for at the time of inventory at the current market price with the monetary value assigned to financial results (profit) as part of other income for ordinary enterprises or as income for non-profit organizations.

- Shortage within the framework of natural loss - the amounts are attributed to expenses or distribution costs.

- Shortages in excess of natural loss - amounts are written off to identified guilty parties. If for some reason the culprits of the shortage are not identified, and it is not possible to collect the debt in court, the debt is written off against the financial results (loss) of ordinary enterprises or for expenses of non-profit organizations.

Inventory surplus: postings

| Household contents inventory operations | Account by debit | Loan account |

| Surpluses of fixed assets identified | ||

| Excess inventory items identified | ||

| Surplus goods identified | 41, 43 | |

| Surplus detected in the cash register - posting |

The discovered surplus assets of the organization can be used by it in the process of future activities. When writing off production costs, accounts 20, 23, 25, 26, 29 are used. For accounting data, the cost of capitalizing surplus during inventory is taken.

Conclusion - if a surplus is detected, a posting is generated to the debit of the object’s capitalization account and the credit of the income attribution account.

Accounting for shortages and losses from damage to valuables

11.12 Instructions for the inventory of fixed assets, intangible assets, inventories, cash and documents and settlements, approved by order of the MFI dated August 11, 1994 No. 69 (hereinafter referred to as Instruction No. 69), when regulating inventory differences in the event of shortages, the latter must be attributed to the perpetrators. Moreover, if specific culprits are not identified, the amount differences in the form of excess amounts of shortages over surpluses are considered as a shortage of valuables in excess of the norms of natural loss with their inclusion in other operating expenses (paragraph 2, paragraph “b”, paragraph 11.12 of Instruction No. 69). Therefore, the amounts of identified shortfalls in accordance with the Instructions on the application of the Chart of Accounts for accounting assets, capital, liabilities and business operations of enterprises and organizations, approved by order of the MFI dated November 30, 1999 No. 291, are reflected in the accounting records by posting: Dt 947 “Shortages and losses from damage valuables" Kt 20, 28 - for the amount of the book value of missing goods. Simultaneously with the write-off of valuables, the culprits for the shortage of which have not been identified, the book value of the written-off assets is credited to off-balance sheet subaccount 072 “Uncompensated shortages and losses from damage to valuables.” If a decision is made in the future to compensate for damage, the amount to be compensated by the guilty party is reflected in other operating income by posting: Dt 375 “Calculations for compensation of losses caused” Kt 716 “Reimbursement of previously written off assets.” Accordingly, the book value of compensated losses is written off from off-balance sheet subaccount 072 “Uncompensated shortages and losses from damage to valuables.” Reflection in income tax accounting. In accordance with paragraphs. "and" pp. 138.8.5 NKU general production expenses include, in particular, shortages and losses from damage to material assets within the limits of natural loss rates in accordance with the standards approved by the central executive authorities. In addition, clause 140.3 of the Tax Code provides that when determining the object of taxation, expenses do not include the amount of actual losses of goods, except for losses within the limits of natural loss. The above norms of the Tax Code indicate that in the situation under consideration there are no grounds for reflecting the amounts of identified shortfalls in tax accounting. Reflection in VAT accounting. According to clause 198.3 of the Tax Code, the tax credit of the reporting period consists of the amounts of tax accrued (paid) by the payer in connection with the acquisition and production of goods and services for the purpose of their further use in taxable transactions within the framework of the economic activity of the tax payer. Consequently, when writing off inventory items for purposes not related to business activities, the taxpayer is obliged to adjust the tax credit for such previously acquired inventory items. The adjustment is made by issuing a tax invoice for a conditional sale based on the requirements of clause 189.1 of the Tax Code (delivery of goods within the balance of the taxpayer for non-productive use). Source: Vladimir Dymanov LLC AF "Profi-Audit"

Reflection of shortages in accounting

The cost of missing property recorded on the organization’s balance sheet is written off to the debit of account 94 “Shortages and losses from damage to valuables” (Instructions for using the Chart of Accounts).

The shortage of valuables within the limits of natural loss norms approved in the manner prescribed by law is written off by order of the head of the organization to the accounts of production costs (sales expenses) (paragraph 3, clause 5.1 of the Inventory Guidelines, clause 30 of the Accounting Guidelines inventories).

The loss of valuables within the established norms is determined after offsetting the shortages of valuables with surpluses based on re-grading. In the event that, after a regrading assessment carried out in the prescribed manner, a shortage of valuables is still discovered, then the norms of natural loss should be applied only for the name of the valuables for which the shortage was established. In the absence of norms, the loss is considered as a shortage in excess of the norms.

Shortages of material assets, cash and other property, as well as damage beyond the norms of natural loss are attributed to the perpetrators.

At the same time, in accounting, the book value of the missing property reflected in account 94 is debited to account 73 “Settlements with personnel for other operations”, subaccount 73-2 “Calculations for compensation of material damage” (if the culprit is an employee of the organization), or to account 76 “Settlements with various debtors and creditors”, subaccount 76-2 “Settlements for claims” (in other cases). The excess of the recovered amount (recognized by the guilty person or awarded by the court) over the amount of the shortfall is reflected in the debit of account 73, subaccount 73-2 (76, subaccount 76-2), and the credit of account 91, subaccount 91-1 “Other income” (clause p. .

Accounting for shortages and losses when receiving goods.

Lecture No. 9

Accounting for receipt of goods.

Plan:

1. Synthetic accounting of goods receipt.

2. Accounting for shortages and losses when accepting goods.

Synthetic accounting of goods receipt.

To account for the availability and movement of goods and packaging in accounting, account 41 “Goods” is used - an active balance sheet account. The debit reflects the receipt of goods, and the credit reflects their disposal. The debit balance shows the balance of goods as of the reporting date. The following subaccounts can be opened for account 41:

41.1 “Goods in warehouses”

41.2 “Retail goods”

41.3 “Containers under goods and empty” (for trade and catering establishments). Note: glass containers are counted along with the goods.

41.4 “Purchased products” (used by industrial and production enterprises, intended for completing finished products, presented to the buyer separately).

Retail trade accounts for goods at sales prices (with a markup), therefore it uses account 42 “Trade margin” - a passive, regulating account, not shown in the balance sheet (goods in the balance sheet are shown at actual cost). The credit reflects the trade margin on goods received, and the debit reflects the margin on disposed and sold goods. The credit balance shows the trade margin on the balance of goods in the enterprise.

Goods are accepted for accounting at their actual cost.

The actual cost of goods is the sum of the organization's actual costs for their acquisition, excluding VAT and other refundable taxes.

If an enterprise is exempt from VAT payer obligations, the amount of “input” tax is included in the cost of the purchased goods.

Example.

To expand the customer base, two new enterprises were organized, one of which is a VAT payer, and the second is not. In the reporting period, these enterprises received consignments of goods with the same value of 82,600 rubles, including VAT (18%) - 12,600 rubles. The following entries were made in the accounting of these trading enterprises.

In the accounting of an enterprise that pays VAT:

DT 41-KT 60 - 70,000 rub. – the goods are capitalized without taking into account the amounts of “input” VAT;

DT 19 -KT 60 - 12,600 rub. – VAT on purchased goods is taken into account separately;

DT 60 -KT 51 - 82,600 rub. – purchased goods have been paid for.

In the accounting of an enterprise that does not pay VAT:

DT 41-KT 60 - 82,600 rub. – the goods are capitalized taking into account the “input” VAT;

DT 60 -KT 51- 82,600 rub. – purchased goods have been paid for.

If an enterprise accounts for goods at sales prices, then when posting goods, the trade margin should be reflected.

Example.

The retail enterprise "Captain" received tracksuits from the supplier.

The supplier's invoice states:

selling price excluding VAT - 2,000 rubles.

VAT (18%) -360 rub.

Total payable - 2,360 rubles

The trade margin has been approved, according to the price register - 40%.

In the accounting of an enterprise that pays VAT:

DT41.2-KT60 - 2,000 rubles - the goods are capitalized without taking into account the amounts of “input” VAT;

DT 19 - CT 60 - 360 rub. – VAT on purchased goods is taken into account separately;

DT 60 - CT 51 - 2,360 rub. – purchased goods have been paid for.

DT41.2-KT42 - 800 rubles - the trade margin is reflected.

In the accounting of an enterprise that does not pay VAT:

DT 41-KT 60 — 2,360 rub. – the goods have been capitalized, taking into account “input” VAT;

DT 60 -KT 51- 2,360 rub. – purchased goods have been paid for.

DT41.2-KT42 - 944 rubles - the trade margin is reflected.

Accounting for shortages and losses when receiving goods.

During the acceptance of goods, shortages or any deficiencies may be identified.

If shortages are detected, a report is drawn up on the basis of which claims are made to the supplier.

The preparation of the act must be noted in the accompanying documents. One copy of the accompanying document is returned to the supplier. The act must be drawn up by a commission, which must include the financially responsible person of the trade organization and a representative of the supplier. The act can be drawn up unilaterally with the consent of the supplier or lack thereof. The act lists only inventory items for which discrepancies have been established.

The drawn up act serves as the basis for filing claims and lawsuits against the supplier and transport organization.

Example.

Vityaz LLC received a batch of women's shoes with defective locks. The cost of the batch according to the supplier’s documents is 24,230 rubles. (VAT – RUB 3,696.10), locks can be replaced. Replacing locks will cost RUR 1,770. (VAT – 270 rub.)

The management of Vityaz LLC decided not to return the goods and correct the defects, followed by filing a claim with the supplier to compensate for the costs incurred.

The accountant made the following entries in the accounting:

- DT 76 subaccount “Calculations for claims” KT 60- 1770 rub. – the amount of the store’s expenses to eliminate identified product defects is included in settlements for claims

- DT 41 CT 60 - 20,533.9 rubles (24,230 - 3696.1) - received goods are capitalized

- DT 19 CT 60 - 3696.1 rub. – VAT allocated

- DT 60 CT 51 - 22,460 rub. (24,230 – 1770) – the debt to the supplier for the received goods has been repaid minus the amount of expenses for eliminating the defects that are subject to compensation.

If the organization can eliminate the shortcomings, then the received goods should not arrive. In this case, it should be accounted for in off-balance sheet account 002 “Inventory and materials accepted for safekeeping” until the further fate of this product is clarified.

Speaking about losses identified during the acceptance of goods, losses are divided into losses in excess of established standards and within the limits of standards.

Currently, such division of losses has largely lost its meaning. The fact is that until January 1, 2002, until Chapter 25 of the Tax Code of the Russian Federation came into force, the rate of natural loss was applied in parallel for accounting purposes and for the purpose of calculating income tax. Actually, the EU norms in trade have not yet been approved. Therefore, for tax accounting purposes there are no EU regulations.

Before January 1, 2002 The following documents were valid for the calculation of EU standards:

Letter from the Ministry of Trade of the RSFSR dated May 21, 1987. No. 085 “On EU standards for food products in trade”

EU standards for fresh potatoes, vegetables and fruits for long-term and short-term storage in bases and warehouses of various types

EU standards for fresh potatoes, vegetables and fruits in the retail trade network, approved by order of the Ministry of Trade of the RSFSR dated February 22, 1988. No. 45 “On approval of EU standards for fresh potatoes, vegetables and fruits in urban and rural retail trade networks and instructions for their use.

Formally, a number of these documents have not lost their force to this day, i.e. an enterprise can still use the above and other valid documents for accounting purposes, although it cannot help but notice that such a fair approach in this case will be an irrational approach. Indeed, in this case, discrepancies will arise between the accounting and tax accounting data, which will have to be taken into account. At the same time, the applied EU norms will make it possible to reasonably withdraw from the MOL certain amounts of shortages or losses within the limits of the EU norms.

Example

.

The company received a consignment of goods worth 94,400 rubles. (without VAT). Upon acceptance of goods for which EU standards are established, a shortage in the amount of 826 rubles was discovered. These losses are losses within the EU standards.

- DT 41 CT 60 — 92,574 rub. (94 400-826) - capitalized based on the actual availability of purchased goods.

- DT 94 CT 60 — 826 rub. – a shortage was identified during the receipt of goods

- DT 44 CT 94 — 826 rub. – the shortage within the established norms is written off as expenses of the enterprise.

- DT 60 CT 51 - 94,400 rub. – the goods have been paid to the supplier.

Control questions:

- What accounts are used to record goods? Give them a description.

- What is the difference between accounting for the receipt of goods in wholesale and retail trade?

- How are shortages and losses reflected in the accounting when receiving goods?

Workshop:

Task No. 1

Reflect in your accounting the situation regarding the receipt of goods. The store has received goods from the supplier Vesta LLC. The invoice includes goods - 12,000 rubles, VAT 10%, packaging - 1,000 rubles. and transportation costs in the amount of 2000 rubles, VAT 18%.

The supplier's invoice has been paid in full from the current account.

Surpluses and shortages: nuances of accounting and tax accounting

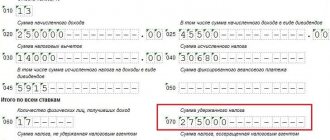

a shortage of 10 thousand rubles was identified. The accounting entries are shown in Table 3.

Table 2.3

| Contents of operation | Postings | Amount (rub.) | A document base |

| Cash was transferred from the cash register to collectors | Dt 57 Kt 50 | 650 000 | Account cash warrant. Receipt for the bag |

| Funds have been credited to the current account | Dt 51 Kt 57 | 640 000 | Bank account statement |

| Lack of funds | Dt 94 Kt 57 | 10 000 | Recount act |

The shortfall can be attributed to the guilty parties (account 73 “Settlements with personnel for other operations”, subaccount “Calculations for compensation of material damage”) or to other expenses (account 91.2 “Other expenses”), if the guilty persons are not identified or the court refuses recovery of damages. The guilty person is liable in the amount of average monthly earnings - by order of the head of the organization (Article 248 of the Labor Code of the Russian Federation), and above - by voluntary consent or by court decision.

The cashier of the organization is a financially responsible person and bears full individual financial responsibility for the safety of the valuables entrusted to him and the damage caused. According to the current legislation, when the fact of theft and shortage at the cash register is established, an audit is carried out.

Example 4 Using the data from example 3, assume that the shortage is attributed to the guilty person and deducted from wages.

Table 2.4

| Contents of operation | Postings | Amount (rub.) | A document base |

| Attribution of the shortage to the guilty person (cashier) | Dt 73 Kt 94 | 10 000 | Cash inventory report. Materials of the official investigation. Manager's order. Voluntary consent |

| Repayment of shortfalls (depositing cash into the cash register/deduction from salary) | Dt 50 Kt 73 or Dt 70 Kt 73 | 10 000 | Receipt cash order. Application for deduction from wages |

Example 5 Let's assume that when collecting cash in the amount of 430 thousand rubles. surpluses were identified and credited to the current account in the amount of 1 thousand rubles. Transactions in accounting will be reflected by postings.

Table 2.5

| Contents of operation | Postings | Amount (rub.) | A document base |

| Cash was transferred from the cash register to collectors | Dt 57 Kt 50 | 430 000 | Account cash warrant. Receipt for the bag |

| Funds have been credited to the current account | Dt 51 Kt 57 | 431 000 | Bank account statement |

| Excess cash | Dt 57 Kt 91.1 | Recount act |

The responsibility of organizations and officials for violation of the procedure for working with cash and the procedure for conducting cash transactions is provided for in Art. 15.1 Code of Administrative Offences. Regardless of whether this procedure was violated with direct intent or through negligence, the administrative fine for officials is from 4 to 5 thousand rubles, for organizations - from 40 to 50 thousand rubles.

Section PM3. The procedure for conducting cash transactions on cash registers and the conditions for working with cash

⇐ Previous1234

Date added: 2014-01-20; ; Copyright infringement?;

Recommended pages:

Is it possible to avoid liability for identified shortages during inventory?

Shortages identified during the inventory process are often discovered.

And people who are not directly involved in the disappearance of property (its damage), but who are financially responsible for this property, have to answer.

The employer usually explains to financially responsible employees their responsibilities, but not all citizens know their rights.

Therefore, if you discover a shortage (damage) of property, you must contact a lawyer before signing documents. Otherwise, the owner of the enterprise will shift all responsibility onto the shoulders of one responsible person, although many could have access to the values.

In addition, for ensuring the safety of property, for example, from the negative influence of the environment, those persons who are intangibly responsible, but whose responsibilities include providing conditions for the reliable storage of goods, should also bear responsibility.

How is inventory taken?

1. The results of the inventory are reviewed by the inventory commission. Her task:

- establish a measure of responsibility for each person when a shortage is identified;

- recover doubtful accounts receivable, deal with the possibility of debt transfer and barter transactions;

- draw up an inventory of objects that are unsuitable for use and cannot be restored;

- identify the causes of shortages (sometimes surpluses);

- receive explanations from financially responsible persons regarding the facts of the shortage.

2. The compiled protocol records:

- solutions;

- conclusions;

- offers.

3. If we are talking about industrial stocks that have become unusable, then the following must be indicated:

- reasons for damage;

- guilty persons.

4. Based on the available data, you will need to draw up and approve the final inventory act.

5. Inventory periods are as follows:

- annual inventory – reflected in the annual report;

- inventory for a certain period - indicating the month in which the latest data was recorded.

We invite you to familiarize yourself with Open a current account in Sberbank for individual entrepreneurs and LLCs

Shortfalls identified in accounting must be documented in accordance with the established procedure.

Natural decline

The shortage (damage) of property may be within the normal range, indicating natural loss. When producing or handling products, percentages of possible costs are usually indicated. When these standards are exceeded, the perpetrators bear responsibility.

Write-off of losses

Using reliable legal support, it will be possible to prove in court that the person accused of causing damage is not the guilty person.

Sometimes the guilty parties cannot be identified by the inventory commission, and the facts are manipulated. The case is then sent to court.

Missing (damaged) property is written off. Then this negative factor becomes one of the results of the organization’s financial activities.

In other situations, the company has to adjust its balance sheet, increasing unplanned expenses.

The decision must be made directly by the head of the organization.

Re-grading

The organization defines the limits within which natural loss of values is considered acceptable. However, the shortage of specific valuables can be compensated by surpluses due to re-sorting.

So the rate of natural loss is applied to them.

The perpetrators are being identified. They may answer:

- for lack of material assets (cash);

- for damage in excess of the natural loss rate.

When writing off valuables, please note:

- decision of the investigative authorities;

- decision of judicial authorities;

- conclusion on the issue of damage to valuables, drawn up by the technical control department.

This is not only a real opportunity to punish the guilty. These documents help:

- confirm the absence of perpetrators;

- deny the right to recover damages from persons allegedly responsible for the shortage.

Mutual offset of shortages arising from regrading is allowed if:

- shortages and surpluses arose at the same time (during a certain period);

- the person being checked did not change during this period;

- inventory items had the same name and identical quantities.

After legal advice, it will be easier for the responsible person to provide explanations to the inventory commission in order to relieve himself of unnecessary responsibility. The specific culprits of the misgrading may not be identified, and then the total difference is written off:

- in firms - on production and distribution costs;

- in budgetary organizations - to reduce funding (reduce funds).

Actual losses

When identifying the amount of damage, take into account the provisions of Art. 246 Labor Code of the Russian Federation. The actual loss suffered by the employer is the market price of the goods determined in the locality on the day the damage occurred.

The degree of wear and tear of the property is taken into account. Although the valuation of this property, taking into account the specified indicators, should not be lower than that indicated in the accounting data.

The provisions of the Federal Law of the Russian Federation also indicate the extent to which damage caused to the employer must be compensated:

- intentional damage;

- theft;

- shortage (loss) of certain types of valuables.

Sometimes the amount of damage actually caused exceeds the nominal amount indicated, and this should also be taken into account.

A practicing lawyer is well acquainted with all the basic norms of legislation (Order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000, clause 28 of the Accounting Regulations, and other provisions) and all innovations.

In court, he will recall precedent situations that will help solve the client’s problem.

Source

Natural decline

Write-off of losses

Re-grading

Actual losses

Source

Regular monitoring of the availability and condition of property, carried out through an inventory, helps the company’s management:

- promptly identify shortages and damage to property;

- deal with the culprits;

- take measures to recover shortfalls from those responsible;

- write off damaged and missing material assets from accounting accounts and generate reliable information in reporting on company property;

- take measures to strengthen control over the safety of assets, increase the level of responsibility of financially responsible persons, etc.

To understand the postings for writing off shortages during inventory, we will use the conditions of the example.

| Name | Quantity | price, rub. | Cost, rub. | ||

| Cement PC-500 | 5 bags | 290,00 | 1 450,00 | ||

| Shovel with wooden handle (rail steel) | 4 pieces | 525,00 | 2 100,00 | ||

| Rack jack | 1 piece | 5 080,00 | 5 080,00 | ||

| Total amount: | 8 630,00 | ||||

Storekeeper Zavyalov N.G. agreed to voluntarily compensate for the shortage.

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 94 | 10 | 8 630,00 | The cost of missing valuables is transferred to the shortage account |

| 73 | 94 | 8 630,00 | The shortage is attributed to the person at fault |

| 70 | 73 | 8 630,00 | The shortage is withheld from the salary of the financially responsible person at his request |

How the presence of natural loss norms affects the procedure for writing off shortages is described here.

Kazakhstan Taxpayer Forum

Other amounts, including transportation costs and VAT related to them, are not taken into account. If a shortage has been identified, then Dt 94 Kt 10 2) shortages and damage to materials in excess of the norms of natural loss are taken into account at actual cost. The actual cost includes: • the cost of missing and damaged materials, determined by multiplying their quantity by the contract (sale) price of the supplier (excluding VAT). If damaged materials can be used in the organization or sold (at a discount), they are accounted for at possible sale prices, with losses from damage to materials reduced by this amount; • the amount of transportation and procurement costs to be paid by the buyer, in the share related to missing and damaged materials. This share is determined by multiplying the cost of missing and damaged materials by the percentage of transportation costs prevailing at the time of write-off to the total cost of materials (at supplier sales prices) for a given delivery (excluding VAT); • the amount of VAT relating to the basic cost of missing and damaged materials and to transport costs associated with their acquisition. Subsequently, the amounts of shortages recorded on account 94 “Shortages and losses from damage to valuables” are written off in the following order: • shortages of materials and their damage are written off from account 94 “Shortages and losses from damage to valuables” within the limits of natural loss to cost accounts production and/or selling expenses; • above the norm - at the expense of the guilty persons. If the culprit is found, then Dt 73 Kt 94 Dt 70 Kt 73 - deduction from salary Dt 50 Kt 73 - the culprit deposited money into the cash register. If the employee refused the shortage, then we go to court. If the court decides that part needs to be covered from the income of the enterprise, and part from the income of the employee, then: Dt 70 Kt 73 Dt 91 Kt 73 In this case, the employee is charged the market value of the shortfall (Dt 73 Kt 91)

Accounting and write-off of shortages and damage to valuables

The fire inspection authorities issued a corresponding conclusion; those responsible for the fire were not identified.

Solution:

The following entries will be made in the accounting records of Premiere LLC:

Debit 94 “Shortages and losses from damage to valuables” - Credit 10 “Materials” - 54,740.00 - reflects the cost identified as a result of an inventory of materials warmed during the fire;

Debit 91 “Other income and expenses”, subaccount “Other expenses” - Credit 94 “Shortages and losses from damage to valuables” - 54,740.00 - the cost of materials burned in the fire is included in other expenses.

Example 34 As a result of a fire in warehouse No. 3 of Premiere LLC, building materials were destroyed. To assess the damage, an inventory of materials stored in the warehouse was carried out.

Members of the inventory commission found that the materials with a total value of 54,740.00 that were in the warehouse at the time of the fire had become completely unusable.

The fire inspection authorities issued a corresponding conclusion. The person responsible for causing the fire is the storekeeper A.S. Boev, who committed the arson. His guilt was established in accordance with current legislation.

Solution:

The following entries will be made in the accounting records of Premiere LLC:

Debit 94 “Shortages and losses from damage to valuables” - Credit 10 “Materials” - 54740.00 - reflects the cost identified as a result of an inventory of materials warmed during the fire;

Debit 73 “Settlements with personnel for other operations”, counterparty Boev A.S. - Credit 94 “Shortages and losses from damage to valuables” - 54,740.00 rubles - the amount of damage caused is attributed to the guilty party.

Date of publication: 2015-04-10; Read: 1729 | Page copyright infringement