https://youtu.be/wYz00Cxgrvk

Methods for writing off production materials in accounting

Industry nuances of material write-off

At what cost estimate are depreciated inventories written off?

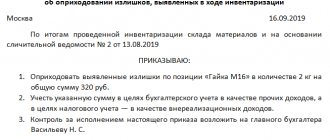

How to draw up an order to write off inventories - form and sample

What postings for write-off of materials look like for various reasons

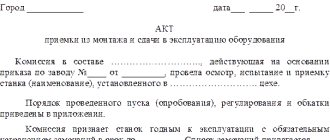

Act on write-off of inventories - sample form F-0504230 (OKUD)

Results

Organization of accounting

The principles of its maintenance are taken as the basis for the organization of accounting of inventories:

- at the place of storage;

- for each responsible person;

- assignment of materials to the appropriate group, depending on their type.

At the warehouse, the storekeeper is responsible for the materials, and he also makes records in the form No. M-17 of the accounting card. A separate document is opened for each number, entries in which are made on the basis of primary accounting registers. After entries are made on warehouse cards, the documentation is transferred to the accounting department.

https://youtu.be/myTRTgwZXAA

Materials accounting

Purpose of the lecture

: reveal the main provisions regarding the accounting of inventories.

General provisions

Inventories are everything that an organization uses in the production of products, as well as for other purposes. Materials are classified as current assets - that is, they, being released into production, are completely consumed.

The main document that regulates the accounting of inventories is PBU 5/01 “Accounting for inventories”.

In accordance with PBU, the following assets are accepted as inventory:

- used as raw materials, materials, etc. in the production of products intended for sale (performance of work, provision of services);

- intended for sale (finished products, goods);

- used for the management needs of the organization.

The item number is most often chosen as the unit of accounting for inventories. This is a fairly broad concept, the practical meaning of which is given by the organization itself. The main thing is that the item numbers allow, as stated in the PBU, to ensure the formation of complete and reliable information about these stocks, as well as proper control over their availability and movement. Let's assume our organization has introduced the following nomenclature numbers to account for different types of nails:

- Slate nails

- Nails 10 mm

- Nails 50 mm

- Nails 100 mm

- Dowels

For each of these numbers, you need to open a card, which indicates the name of the material being taken into account, units of measurement, incoming balance for the material, receipts, disposals, and final balance. Materials are accounted for in two dimensions. Firstly, this is a monetary measurement, and secondly, the units of measurement inherent in a given type of material: pieces, meters, liters, kilograms, square meters, cubic meters, etc.

To organize the primary accounting of materials, document forms approved in Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a are used.

In particular, in table. Table 6.1 provides a list of primary documents for material accounting Table 6.1. Primary documents for materials accounting

| Form number | Title of the document |

| M-2, M-2a | Power of attorney |

| M-4 | Receipt order |

| M-7 | Certificate of acceptance of materials |

| M-8 | Limit fence card |

| M-11 | Request-invoice |

| M-15 | Invoice for goods issue to the side |

| M-17 | Material accounting card |

| M-35 | Act on the recording of material assets received during the dismantling and dismantling of buildings and structures |

If an organization has materials, this means that it also has a warehouse for storing them before releasing them into production. The main feature of a warehouse is the presence of a financially responsible person who is responsible for the safety of valuables. Physically, a warehouse can be an ordinary room in an office building, a closet in which valuables are stored, a separate building, etc. The warehouse is subject to periodic inventory to reconcile accounting data with the actual state of affairs. The warehouse maintains inventory records of materials, usually in kind.

Let's look at the features of receiving materials into a warehouse.

Receipt of materials

Materials come into the organization from various sources, such as suppliers. Upon receipt, materials must be assessed. PBU 5/01 establishes that inventories are accepted for accounting at actual cost. That is, for an organization, the cost of materials is the sum of the expenses incurred by the organization when purchasing materials, delivering them, etc.

PBU says that the actual cost of inventories acquired for a fee is the amount of the organization's actual costs for the acquisition, with the exception of value added tax and other refundable taxes.

This point deserves special comment. The fact is that accounting for materials, goods, and many other accounting objects cannot be done without the need to simultaneously reflect in the accounting accounts information about taxes that “accompany” other types of accounting. One such tax is Value Added Tax, or VAT. In the next lecture we will talk in detail about this tax, and here we will consider a scheme for separate accounting of goods purchased with VAT and VAT amounts. VAT is called a refundable tax, since the VAT that an organization “purchased” along with materials, subject to proper compliance with legal requirements, is subject to refund.

To account for materials in accounting, account 10 “Materials” is used. This is an active account; a number of sub-accounts can be opened to it to account for certain types of materials.

When materials are received, the financially responsible person checks the compliance of the actual materials received with the accompanying documents. As a rule, materials are checked by the number of packages, the integrity of the packaging is assessed, and if necessary, materials can be checked more thoroughly.

If everything is in order, a receipt order (form No. M-4) is issued for the arrived materials and the materials are received at the warehouse. This transaction is reflected in the following accounting entry:

D10 K60 - Materials received from the supplier were received into the warehouse D19 K60: VAT on purchased materials is reflected

This accounting entry is made based on the invoice, where the VAT amount must be allocated.

Account 10 also includes other costs associated with the purchase of materials - for example, these may be transportation and procurement costs (payment to transport organizations for the delivery of materials), costs of loans for the purchase of materials, etc. Transportation and procurement costs (TPC) can be taken into account in a special subaccount to account 10 and distributed among written-off materials.

If the received materials for some indicators do not correspond to the contents of the documents, a materials acceptance certificate is filled out (Form No. M-7). The act must be drawn up in two copies, it must be signed by representatives of the purchasing organization and the supplier (or, in the absence of a representative of the supplier, representatives of the transport organization). One copy of the act is transferred to the supplier, the second - to the accounting department

Based on the act, the following accounting entry can be made:

D76-2 K60 - Materials that do not comply with the accompanying documents are accepted for accounting

Subaccount 76-2 is used for settlements of claims. After a decision is made on the materials for which calculations are listed in subaccount 76.2, other entries can be made. In particular, if the supplier has taken measures to replace low-quality goods and the buyer is ready to accept the goods, the following entry is made in accounting:

D10 K76-2 - Materials received

If, for example, the supplier returned the money for low-quality materials, the following entry is made:

D51 K76-2 - The supplier returned the money for low-quality materials

In accordance with the Chart of Accounts for accounting financial and economic activities and instructions for its application, depending on the accounting policy adopted by the organization, the receipt of materials can be reflected using accounts 15 “Procurement and acquisition of material assets” and 16 “Deviation in the cost of material assets” or without using them.

If an organization uses accounts 15 and 16, based on supplier settlement documents received by the organization, an entry is made in the debit of account 15 and the credit of accounts 60 “Settlements with suppliers and contractors”, 20 “Main production”, 23 “Auxiliary production”, 71 “Settlements with accountable persons", 76 "Settlements with various debtors and creditors", etc. depending on where certain values came from, and on the nature of the costs of procuring and delivering materials to the organization. In this case, the entry to the debit of account 15 and the credit of account 60 is made regardless of when the materials arrived at the organization - before or after receiving the supplier’s payment documents.

The receipt of materials actually received by the organization is reflected by an entry in the debit of account 10 and the credit of account 15.

When using accounts 15 and 16, the concept of discount prices is used. Accounting prices are the prices that are set in an organization to account for certain materials. Moreover, it is clear that accounting prices may not correspond to the actual costs of purchasing products. These accounts are used in order to keep records of the actual cost of materials and keep records at accounting prices.

Therefore, here we have the following record scheme.

As already mentioned, when materials are received, account 15 includes their actual cost, that is, funds paid to suppliers, delivery costs, etc. The following accounting entry is made:

D15 K60 - for the amount of debt to the supplier D19 K60 - for the amount of incoming VAT

Further, after actual receipt, materials are credited to the 10th account from the 15th account at accounting prices:

D10 K15 - cost of materials at discount prices

As a result of the previous operation on account 15, a balance was formed - that is, the difference between accounting prices and the actual cost of materials. This difference should be written off to account 16 using one of the following entries:

D16 K15 - Reflected overexpenditure (relative to the book price) D15 K16 - Reflected savings (relative to the book price)

As a result, account 15 is closed, on account 10 we have materials assessed at accounting prices, and on account 16 the deviation from the accounting price is stored. The accounting price and variance give us information about the actual cost of materials.

We discussed accounting for receipt of materials. Now let's look at the features of materials disposal.

Subaccounts

Basic materials in accounting are distributed into subaccounts. Basically, grouping is done by category of materials. For example, different types of transport fuels are combined into one category.

An organization can use the following accounting accounts “Materials”:

- 10.1 – for accounting for inventories that participate in the production process and their cost is included in the manufactured products;

- 10.2 – to collect information about components;

- 10.3 – to account for the fuel and lubricants used;

- 10.5 – to account for spare parts and materials needed for transport and production equipment;

- 10.6 – for accounting for other materials necessary for economic and administrative activities;

- 10.9 – for accounting of inventory items;

- 10.10 – to reflect information on the number of units of special clothing and equipment in the warehouse;

- 10.11 – to reflect data on the use of special. clothes and other equipment.

Additionally, other sub-accounts can be opened to group information about the movement of raw materials and materials.

The first method of turnover accounting

A separate analytical accounting card is opened for each type of material. It reflects expenditure and receipt transactions. Information is reflected both in the number of units of materials and in monetary terms.

At the end of the month, a turnover sheet is drawn up for each warehouse space. Amounts can be displayed separately for subaccounts, synthetic accounts, and groups of materials. The total amount for the warehouse in question must be indicated. The information is grouped into a consolidated turnover sheet, and then the collected data is compared with the indicators on synthetic accounts.

The second method of turnover accounting

Documents describing expenditure and receipt transactions for materials are collected into groups based on item numbers. At the end of the month, the final data is reflected in the turnover sheet in the context of the necessary synthetic and analytical accounts. Information is compiled in monetary and physical terms. Based on the data from the turnover sheets, free statements are compiled.

This option is less labor-intensive due to the absence of the need to maintain analytical materials accounting cards. Nevertheless, the reverse method of accounting for materials is cumbersome and irrational, even when using item numbers.

Balance accounting method

It is considered a more progressive way to account for the movement of materials. Accounting in this case does not re-reflect warehouse accounting, but uses its data. Within the time period established by the organization, an accounting employee checks the correctness of warehouse accounting and personally signs the cards.

At the end of the month the manager. the warehouse or the accountant himself records the data in quantitative terms in the balance sheet. Further processing of information is carried out only by the accounting department. The unit cost of the remaining materials is displayed at the accounting price set for each group separately, and in general for the warehouse. After which a consolidated balance sheet is prepared.

Accounting for the use of materials also involves filling out accumulative statements that reflect information about their movement. After calculating the results of monthly turnover, the data is transferred to the consolidated accumulative sheet. The indicators of material flow statements and balance sheet documents are checked monthly.

Evaluation of materials upon receipt at the warehouse

Accounting for the receipt of materials is most often carried out at their actual cost, which is the enterprise's purchase costs, excluding the amount of VAT and other taxes to be reimbursed.

The actual cost includes the following amounts:

- paid to the seller based on the contract;

- paid to intermediaries for the provided information and consulting services necessary for the acquisition of inventories;

- customs fees;

- non-refundable taxes;

- transport and procurement costs;

- other expenses associated with the purchase of materials.

The list of actual costs does not include administrative and general business expenses, except for cases in which the costs are directly related to the purchase of inventories.

The actual value of property received free of charge is calculated using market prices at the time of registration of the receipt. Inventory and equipment contributed to the authorized capital are subject to monetary valuation before being accepted for accounting.

Accounting for materials in accounting can also be done at the accounting price of each category of inventories. In this case, accounts 15 or 16 are used. Income is reflected in debit, and write-off is reflected in credit. The method of receiving materials at book value is usually used in cases where supplies of a certain type of materials are regular.

Accounting for the receipt of products at the warehouse

The receipt of goods is taken into account in account 41. Its debit reflects the receipt, and its credit reflects the disposal. There are several accounting methods:

- At cost of sale.

- At book value.

- At cost.

Cost accounting is relevant for wholesale and manufacturing entities. In retail companies, accounting is carried out either at cost or at cost of sales.

Accounting at actual cost

If accounting is kept at cost, you need to record the cost that is written down in the papers from the supplier. If the supplier has calculated VAT and presented an invoice, the amount of tax deductions is placed in a separate sub-account. Capitalization occurs at cost, which does not include VAT. However, the price may include transportation costs. Sometimes these expenses are separately accounted for on the debit of account 44. Let's consider the entries used:

- DT41 KT60 (76). Receipt of products to the warehouse.

- DT19 KT60 (76). Allocation of VAT.

- DT60 KT51. Transfer of funds to the supplier.

Products can be purchased using a loan. In this case, interest on the loan may be included in the cost. In this case, they are recorded on the debit of account 41.

Example of accounting at actual cost

The company took out a loan to purchase goods. Interest is charged on borrowed funds, which is included in the structure of operating expenses. The received goods were later sold. Let's look at the wiring used:

- DT51 KT66. Obtaining borrowed funds.

- DT41 KT60. Posting of goods.

- DT19 KT60. Allocation of tax.

- DT68 KT19. VAT tax deduction.

- DT91/2 KT66. Calculation of interest on the loan.

- DT90/2 KT41. Write-off of the cost of products for sale.

- DT62 KT90/1. Revenues from sales.

- DT90/3 KT68. VAT accrual on products sold.

- DT51 KT62. Receiving payment for goods sold.

The transaction for obtaining a loan must be confirmed by an agreement with the banking institution.

Accounting at cost of sales

If goods are accounted for at the cost of their sale, you will need invoice 42. The trade margin is recorded on it. It includes VAT. To fix the markup, this wiring is used: DT41 KT42. When the goods are sold, the markup is reversed, which is why this posting is needed: DT90/2 KT42.

The seller can discount his products. In this case, the amount of the markdown is written off against the markup. If the size of the markdown is greater than the markup, the difference is included in the structure of other expenses. In this case, this wiring is used: DT91/2 KT41.

If products are written off for the needs of the company, the markup must also be written off for needs. These wirings are required: DT44 KT41, DT44 KT42. If products are disposed of due to spoilage, this entry is used for write-off: DT94 KT41. The extra charge will be written off in DT account 94 . The corresponding account is KT42.

Example of accounting at cost of sales

The company purchased products in the amount of 12,000, the price included VAT in the amount of 2,000 rubles. The VAT rate on sales is 18%. The markup is 30%. Accounting is preceded by these calculations:

- (12,000 – 2,000) * 30% = 3,000 rubles (markup amount).

- (10,000 + 3,000) * 18% = 2,340 rubles (VAT on sales).

- 3,000 + 2,340 = 5,340 rubles (total markup).

The following entries are used in accounting:

- DT41 KT60. Capitalization in the amount of 10,000 rubles excluding VAT.

- DT19 KT60. Allocation of tax on purchased valuables in the amount of 2,000 rubles.

- DT68 KT19. Tax deduction for VAT in the amount of 2,000 rubles.

- DT60 KT51. Transfer of funds to the supplier in the amount of 12,000 rubles.

- DT41 KT42. Trade margin in the amount of 5340 rubles.

- DT90/2 KT41. Write-off of the value of valuables in the amount of 15,340 rubles.

- DT90/2 KT42. Reversal of the markup in the amount of minus 5,340 rubles.

- DT62 KT90/1. Proceeds from the sale in the amount of 15,340 rubles.

- DT90/3 KT68. VAT accrual on goods sold in the amount of 2,340 rubles.

- DT51 KT62. Transfer of payment for goods from the buyer.

Cost and sales value accounting are the most common accounting methods.

Valuation of inventories in tax accounting

Materials must be accepted for mandatory documentation upon admission. Accounting and tax accounting have some differences when reflecting the costs of purchasing materials, which constitute the actual cost. In general, the cost items are the same, but tax accounting does not recognize interest on loans that were accrued before the materials were accepted for expenses associated with the purchase of materials. You need to focus your attention on this and when maintaining tax records, do not include this item in the cost calculation.

Postings when registering inventories if a purchase was made

Accounting for the purchase of materials at actual cost is reflected by the posting: Dt “Materials” Ct “Settlements with suppliers”. This is the first operation in the chain. Next, the accountant will write:

- Dt “VAT” Ct “Settlements with suppliers” – for the amount of input VAT.

- Dt “Calculations for VAT” Ct “VAT” – for the amount of VAT to be deducted.

- DT “Settlements with suppliers” CT “Current account” - the amount of debt for the inventories has been paid to the supplier.

All expenses included in the actual cost items are collected in the production accounting account and then debited to account 10.

If an enterprise receives materials at accounting prices, the following transactions are made:

- Dt “Procurement and acquisition of mat. valuables" Ct "Settlements with suppliers" - materials have been received (the amount at which inventive goods are accepted is established by an agreement with the seller or other documents).

- Dt “Procurement and acquisition of mat. valuables" Ct "Settlements with suppliers" - the actual cost includes the cost of transportation costs;

- Dt “Materials” Kt “Procurement and acquisition of materials. valuables” – materials are capitalized at book value.

- Dt “Deviation in cost” Ct “Procurement and acquisition of materials. values” – the excess of the actual cost over the corresponding accounting value is shown.

- Dt “Procurement and acquisition of mat. values" Ct "Value deviation" - the excess difference between the accounting price and the actual cost is taken into account.

If the materials received are not the property of the enterprise, but were received temporarily, they are reflected in the debit of account 002.

At what cost to receive materials?

Materials must be received, that is, reflected in accounting, at actual cost. This requirement is expressly established in paragraph 5 of PBU 5/01. This rule always applies. Define cost as the amount of actual costs for purchasing or manufacturing materials. Therefore, for example, when you buy materials, you need to take into account not only the cost indicated by the supplier in the invoice, but also transportation and procurement costs.

Typically, materials are reflected in the debit of account 10 “Materials” at the actual cost of each accounting unit.

However, you have the right to apply a different procedure. In particular, you can reflect materials at accounting prices. Such, for example, as:

- planned prices. They are usually budgeted for a certain period;

- negotiable prices. When materials are purchased under a special contract that determines their possible cost;

- actual cost of materials for the previous reporting period. Namely month, quarter, year;

- average group price. When the planned price is set not for a specific item number, but for their group.

In this case, deviations from the actual cost must be recorded. Take into account differences with the actual cost on account 16 “Deviation in the cost of material assets.” Costs for the acquisition and procurement of materials must first be accumulated in account 15 “Procurement and acquisition of material assets.”

This procedure follows from the provisions of paragraph 5 of PBU 5/01, paragraph 80 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, and the Instructions for the chart of accounts (accounts 10, 15, 16).

Fix the selected option for accounting for the receipt of materials in the accounting policy for accounting purposes (clause 7 of PBU 1/2008).

In the actual cost of materials, do not take into account:

- general business and other similar expenses, except when they are directly related to the purchase of materials;

- refundable taxes – VAT and excise taxes. True, this rule does not always apply. Organizations and entrepreneurs that are exempt from paying these taxes can also include them in the cost of materials.

Such instructions are in paragraphs 6 and 7 of PBU 5/01.

A complete list of costs that are included in the cost of materials is given in the table.

Acceptance of inventories for registration in other cases

Materials can arrive at an organization’s warehouse not only through a transaction with a supplier.

Let's consider accounting for materials that were acquired in other ways: Account assignments for materials receipt

| Dt | CT | Characteristics of the operation |

| 10/15 | 98.2 | Materials received free of charge have been accepted for registration |

| 98.1 | 91.1 | The amount of income generated by materials received free of charge is reflected. |

| 10/15 | 91.1 | Materials arrived at the warehouse at market value as a result of liquidation of fixed assets |

| 10 | 75 | MPZ contributed as a contribution to the authorized capital |

It is worth noting that accounting for material consumption is always expressed by posting using account credit 10. It does not matter how the organization writes off inventories for production.

Accounting for materials at accounting prices using accounts 15, 16 (postings, example)

If to account for materials, not the actual cost price is used, but the accounting price, then the accounting department uses additional accounts 15 and 16. Inventory and materials are entered into the debit of account 15 at the actual cost, and into the debit of account 10 at the accounting price. The difference between the actual and accounting price is called a deviation and is reflected in account 16. The excess of the accounting price over the actual price is reflected in the credit of account 16, the excess of the actual price over the accounting price is reflected in the debit of account 16. The wiring is shown in the table below.

Postings for accounting materials at accounting prices

The table below shows the main entries for accounting for receipt of materials (materials and materials).

| Debit | Credit | Operation name |

| 60 | 51 | The cost of the supplier's goods and materials has been paid |

| 15 | 60 | The cost of inventory items is taken into account according to supplier documents excluding VAT |

| 19 | 60 | VAT allocated |

| 10 | 15 | Inventories are capitalized at the accounting price |

| 15 | 16 | The excess of the book price over the actual cost is written off |

| 16 | 15 | The excess of the actual price over the accounting cost is written off |

Let's consider this option for accounting for materials using a specific example.

Write-off of materials in accounting

Estimation of the cost of inventories when they are disposed of into the production process can be carried out using one of the following methods:

- according to the average cost value;

- by the cost of a unit of inventories;

- according to FIFO;

- by LIFO.

The cost of materials in accounting to be written off according to the average cost value is one of the usual methods.

During the period, inventories are written off at accounting production prices. At the end of the reporting month, the deviation of actual costs and accounting prices is calculated. The amount received is written off. Let's consider an example of a calculation based on the data indicated in the table. Information on the receipt/disposal of materials during the reporting period

| Registration price | Actual cost | Deviation | |

| Initial balance | 21600 | 22800 | +2400 |

| Received within a month | 41050 | 43100 | +3250 |

| The remainder arrived | 61450 | 64700 | +4450 |

| Spent during the reporting period | 46800 | 49262 |

Let's do the following:

- Let's determine the deviation coefficient: 4450 ÷ 61450 = 0.072.

- Let's calculate the deviation of the actual cost from the accounting prices: 46800 × 0.072 = 3370 rubles.

- Let's calculate the actual cost of materials spent: 46800 + 3370 = 50170 rubles.

The amount to be written off is RUB 3,370. as the difference between the actual cost of materials and the cost at which they were written off for production.

The valuation method based on the cost value of a unit of inventories is used for non-replaceable types of inventories, as well as when accounting for valuable materials (for example, precious ones).

Accounting for receipt of materials into production

If you, by the will of fate, find yourself as an accountant for a manufacturing company, or are simply planning to expand your qualifications, then you will be interested in the material presented below. Moreover, when speaking about production, I mean not only production in its pure form, such as, for example, the manufacture of furniture, plastic windows, spare parts, etc., but also a more expanded concept, such as: wood processing, tailoring , repair of household appliances, equipment, materials processing, bakery, coffee shop, etc. In a word, everything that the process of creating any final product implies. Naturally, a reasonable question immediately arises: what is necessary to produce any product?

Materials

– this is something that no manufacturing enterprise can do without, and one of the main components of production costs.

Therefore, the section will be devoted to accounting for materials in production. So, in order to start manufacturing products, you first need to purchase raw materials. Let's say it is purchased and brought to the warehouse - what are the actions of the accountant? Of course, the accounting employee should accept the materials for accounting...and, as they say, from now on, in more detail. Documents for accounting of materials in production

The basis for accepting inventories for accounting are primary documents

upon their arrival.

What do we pay attention to?

— Packing list

This can be either a unified document or a document independently developed by the supplier organization.

The main thing is to check whether all the required details are available and how correctly they are entered. The necessary information is specified in paragraph .

2 tbsp. 9 of the Law “On Accounting” - Invoice

It deserves especially close attention if you work on OSN. Without this document, it is impossible to accept VAT for deduction. It should also be carefully studied to ensure that all required fields are complete and correct. By the way, check out my article “Invoice”, it describes in detail how not to miss a single mistake when filling out and checking an invoice.

Alternatively, the set of documents from the supplier may include invoices, supply or sales agreements, and, if necessary, certificates.

Of course, if the above documents are available, the data in them should be comparable to the information in the primary documents.

Principles of accounting for the procurement and acquisition of materials

You have the right to accept materials for accounting in one of two possible ways:

1.

Upon receipt, materials are valued at the actual cost of acquisition (procurement).

See schematically what the actual cost

.

In short, these are all costs actually spent on purchasing or procuring your own materials.

2.

Received inventories are accounted for at discount prices.

Some large manufacturing companies use special prices

the actual cost

and

the accounting price

is adjusted . This option makes sense for large and frequent deliveries and an extensive range of inventories, when purchase prices for materials or transport services are variable.

Be sure to indicate in your company’s accounting policy the chosen method of recording the receipt of materials!

Postings by materials

Accounting and operational accounting of materials in production will depend on the chosen method. In particular, if the company reflects the receipt of inventories at actual cost

, then the accountant applies

account 10 “Materials”

.

Dt 10 Kt 60

— receipt of materials

at actual cost

from the supplier organization.

The picture looks somewhat different when initially organizing the receipt of materials at accounting prices. All expenses for the purchase of materials, including the purchase price of inventories, are recorded in the debit of account 15

.

Dt 15 Kt 60

— reflects the purchase price of inventories and other expenses associated with their acquisition.

And only after that the cost of inventories at discount prices

debited to

account 10

.

Dt 10 Kt 15

– Inventory and equipment are capitalized

at accounting prices

.

And then through account 16 “Deviation in the cost of material assets”

write off the discrepancy between

the accounting

and

actual cost

.

If the discount price is exceeded

:

Dt 15 Kt 16

If the actual cost is higher

, then reverse wiring:

Dt 16 Kt 15

Calculation part

And in order not to be unfounded, let's immediately see practically with numbers how it will look in accounting.

“OOO Tables and Chairs received production materials at the warehouse at a price of 35,400 rubles. (including VAT – 5,400 rubles). Delivery cost 5,900 rubles. (including VAT – 900 rubles).” The cost of consultations on the selection of materials amounted to 2,360 rubles (including VAT 360 rubles). Accounting for raw materials and materials in production is organized at actual cost"

Let's summarize the calculation:

37,000 rubles

- this is the actual cost of the inventories And now the same example, but the company uses

accounting prices

:

As you can see, the difference is still insignificant, with the exception of the posting of materials to account 15

instead of

invoice 10.

As in the previous example, the purchase cost of materials

is 37,000 rubles

.

However, further accounting entries are determined by the accounting prices

:

1)

The cost of purchased materials at the discount price is

30,000 rubles.

2)

The accounting price for received materials

is 40,000 rubles.

Obviously, the primary accounting of materials in production has its own nuances.

Unfortunately, the scope of the article does not allow us to reveal all the subtleties, structure and organization of accounting in production, but I would recommend enrolling in the workshop course “Accounting and taxation in a manufacturing enterprise + 1C 8.3”.

Everything is in the best traditions of the RUNO educational center: a combination of theory, practice, work in 1C using the example of a real operating manufacturing company.

I can assure you that we will teach you how to work.

Author of the article: Matasova T.V.

FIFO and LIFO methods

Writing off materials in FIFO accounting requires compliance with the rule: regardless of the batch released into production, it is accounted for at the cost of the first purchase. After the complete write-off of the quantity of materials of the first batch, the rest is written off at the cost of the second, third, etc. batches. On the contrary, the remaining materials in the warehouse are assessed based on the cost of the last delivery.

The method is often used when purchasing similar materials or raw materials. It is beneficial to the enterprise in cases where the market value of inventories becomes cheaper.

Let's consider an example: in the warehouse of an enterprise there are 400 tons of the same cement, which was purchased from different sellers. 200 tons of the first batch were purchased for 3200 rubles. per ton, and the remaining 200 tons - 3,300 rubles. per ton. If 30 tons of cement are written off, the accountant will take into account the cost of one ton at 3,200 rubles. until the entire volume of the first delivery of material is written off. In this case, it does not matter at all from which purchase the cement will be taken.

The LIFO method implies the use of the opposite rule: first, inventories are written off at the cost of the last batch, and so on in descending order. Warehouse balances are accounted for at initial delivery prices.

The amount of materials consumed, accounted for using the FIFO or LIFO method, is determined by the formula:

P = He + P – Ok, where:

It is the amount of the balance of materials at the beginning of the month;

P – cost of accepted materials;

Ok – the cost of the balance of materials at the end of the month.

Options for forming the actual cost of inventories

Using the situations described above, we have shown how materials can flow into an organization. Now let's look at the main options for increasing the actual cost of inventories in the 1C: Accounting 8 program:

- Reflection of customs expenses when purchasing imported materials.

- Reflection of transportation costs, insurance, loading and unloading operations and other expenses that increase the cost of materials.

- Collection of materials.

Reflection of customs expenses when purchasing imported materials

Above we demonstrated how imported materials can be entered into a warehouse. Now let's look at how we can reflect additional customs costs, thereby increasing the cost of materials received through the import of goods and materials. To do this, we will use the customs declaration document for import.

The header of the document indicates the counterparty and the agreement concluded with him. In our case, the counterparty is Zelenograd Customs. On the first tab Basic, the customs declaration number and the amount of customs duty are entered (see Fig. 10).

Rice. 10

The second tab Sections of the customs declaration is intended for the distribution of additional costs to the cost of received inventories. In order to do this, you must first fill out the tabular part itself with materials received for import, to which additional customs costs should be allocated. To do this, you can use the Fill button, as shown in Figure 11, and select Add from receipt. The tabular part will be filled with types of materials from the selected document Receipt of goods and services.

On the same tab, if necessary, other details are indicated: Customs value, Duty, VAT, etc., which will be distributed, after which you should click on the Distribute button.

Rice. eleven

When carrying out this document, additional costs will be distributed to all inventories of the tabular part and will increase the cost of inventories.

Reflection of transportation costs, insurance, loading and unloading operations and other expenses that increase the cost of materials

In addition to customs costs that increase the cost of imported materials, there are other costs that affect their cost. Moreover, they can be reflected both in relation to materials purchased in Russia and imported materials. These include transportation costs, insurance, excise taxes, payment for machine downtime, etc. All these costs can be reflected using the document Receipt of additional expenses. expenses.

An important feature of this document is that it allows you to distribute additional costs by cost both in proportion to the quantity of materials specified in the document and in proportion to their cost. It is also possible to manually enter the cost amount for each material separately.

Filling out the tabular part with materials occurs, as in the customs declaration document for import, by clicking the Fill button and selecting one of the filling options: either Add from receipt or Fill in upon receipt. These options for filling the tabular part with the necessary materials differ in that when you select the Add from receipt option, the tabular part will not be cleared, and the materials will only be added to existing ones, while with the Fill in upon receipt option, the tabular part will be cleared and the materials will be added to it. only the materials contained in the document you selected Receipt of goods and services (see Fig. 12).

Rice. 12

Collection of materials

Sometimes, in the process of work, an accountant is faced with a problem when it is necessary to assemble one material from several materials or, conversely, disassemble a certain inventory into several components. An example would be the purchase of computer components with further assembly of the system unit. To resolve this issue, you can use the document Assembling items.

Let's consider the option of assembling an MPZ. The Item Acquisition document has a fairly simple form and all the user needs is to indicate the resulting inventory in the Nomenclature field, and indicate its components and their quantity in the Components tabular section.

The picking or disassembling operation can be selected by the user using the Operation button in the upper left corner of the document (see Fig. 13).

Rice. 13

As a result of this document, the cost of the “Tables” MPZ will increase due to the screws and boards.

Inventory

Accounting for materials in accounting must be carried out continuously and reflect reliable information about the actual availability of materials in the warehouse. To check accounting data with real indicators, the enterprise conducts an inventory, during which authorized persons compare the data of accounting registers and count the number of corresponding units in the warehouse.

To reflect discrepancies in data between accounting and actual availability, the following procedure has been created:

- Surplus is taken into account at the market price on the date of the inventory. The amount is shown in the financial result.

- Shortages are written off from the materials accounting accounts to the debit of account 94. After identifying the reasons for the shortage and the perpetrators, the enterprise establishes the procedure for writing off the amount from account 94.

- Shortage of materials or their damage within the established limits of natural loss is written off as production costs.

- If it is determined that the shortage or damage to the goods occurred due to an identified person, the amount is debited from him.

- Amounts of shortages or damage due to unclear circumstances are written off in the financial result.

Correctly maintaining records of the receipt and delivery of materials allows you to reduce the amount of taxable profit.